- There’s an increasing number of scam victims in Singapore who not only lose their savings but also fall into debt by taking out loans to pay scammers.

- Singapore saw record scam losses of $1.1 billion in 2024.

- Credit Counselling Singapore (CCS) has seen over 200 scam victims since it started recording such cases in 2023, with numbers rising:

- 106 cases in 2024

- 33 cases in Q1 2025 alone (projecting to 130+ for the year)

- The Financial Industry Disputes Resolution Centre (FIDREC) reported a significant increase in scam-related disputes, from 325 cases in 2022 to 879 in 2024.

- The article profiles a victim named “Ali” who fell for a combination of romance and a job scam:

- Lost his $6,000 savings

- Borrowed $9,000 from a colleague

- Got $11,000 in cash advances from banks

- Borrowed $6,000 from licensed moneylenders

- Now struggling to repay with only $500 monthly from his $2,500 income

- Another victim, “Mr. V.J.,” accumulated $650,000 in debt after an investment scam:

- $200,000 borrowed from friends

- $450,000 borrowed from banks

- Had to sell his house in India

- Now spends half his salary on loan repayments

- Organisations like CCS and AMP Singapore’s Debt Advisory Centre (DAC) offer help to victims through:

- Counseling

- Debt management planning

- Support groups

- Negotiating with creditors

- Fidrec can help mediate between victims and financial institutions, with successful mediation rates improving from 27% in 2022 to 67% in 2024.

The article highlights how scammers often combine emotional manipulation (romance in Ali’s case) with fraudulent investment or job opportunities, leaving victims with devastating financial consequences.

The Debt Crisis From Scams: Analysis and Solutions

The Deepening Problem of Scam-Induced Debt in Singapore

The rise in scam-related debt represents a particularly damaging dimension of the scam crisis. When victims not only lose their savings but also accumulate significant debt, the financial damage becomes exponentially worse and longer-lasting. Let me analyse this issue in depth:

Why Scam Victims Fall Into Debt

- Desperation to Recover Losses: As seen with Ali in the article, victims often borrow money, hoping to recoup their initial losses, which can create a debt spiral.

- Psychological Manipulation: Scammers exploit emotional connections (romance scams) or create artificial urgency, clouding victims’ judgment about making financial decisions.

- Sunk Cost Fallacy: Victims continue to invest borrowed money because they’ve already lost so much, believing that one more investment will allow them to recoup their losses.

- Shame and Secrecy: Victims often hide their situation from family and friends, turning to loans rather than seeking help, which delays intervention.

- Multiple Forms of Borrowing: The pattern typically involves:

- Depleting personal savings first

- Borrowing from friends/family (often under false pretences)

- Taking bank loans or cash advances

- Resorting to moneylenders with high interest rates

Long-Term Consequences

- Extended Financial Recovery: While direct scam losses are immediate, debt repayment can span years or even decades.

- Accumulating Interest: High-interest loans, especially from moneylenders, multiply the original loss.

- Credit Score Damage: Defaults or late payments can significantly impact victims’ ability to secure housing, employment, or access legitimate financial services in the future.

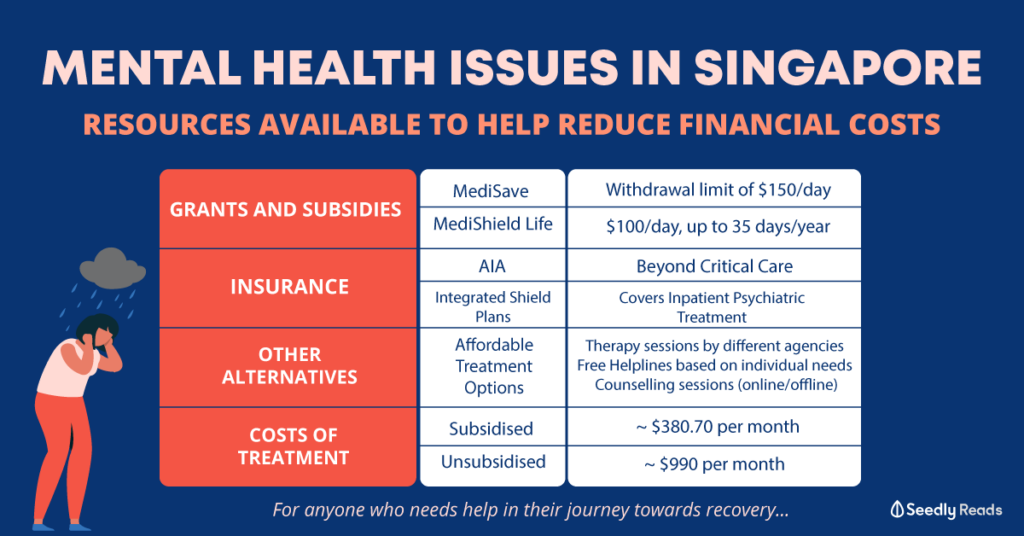

- Mental Health Impact: The combination of being scammed and subsequently falling into debt creates compounding trauma, anxiety, and depression.

- Relationship Strain: Unpaid debts to friends and family can permanently damage relationships.

Solutions and Interventions

Credit Counselling Services

Organizations like Credit Counselling Singapore (CCS) provide crucial help through:

- Debt Assessment: Creating a comprehensive picture of all outstanding debts and interest rates.

- Budget Restructuring: Helping victims identify necessary spending cuts to allocate more towards debt repayment.

- Creditor Negotiation: Mediating with creditors to:

- Extend loan periods (as seen with Mr. V.J.’s case)

- Potentially reduce interest rates

- Create manageable repayment schedules

- Sometimes negotiate partial debt forgiveness

- Financial Education: Teaching victims better financial management to prevent future vulnerability.

Anti-Scam Support

Beyond debt management, specialized anti-scam help is crucial:

- Psychological Support: Groups like AMP Singapore’s Debt Advisory Centre recognize that scam victims need emotional counseling to process guilt, shame, and trauma.

- Legal Guidance: Helping victims understand their rights and the proper procedures for reporting scams.

- Peer Support Networks: Connecting victims with others who have experienced similar situations reduces isolation and provides practical advice from those who’ve navigated recovery.

- Dispute Resolution: Services like Fidrec can mediate between victims and financial institutions, with increasingly successful outcomes (67% successful mediation in 2024).

Banking and Legislative Solutions

More systematic approaches could include:

- Scam-Specific Debt Relief Programs: Financial institutions could develop specialised repayment plans for verified scam victims.

- Temporary Interest Freezes: Implementing cooling-off periods where interest accumulation pauses while victims work with counselling services.

- Enhanced Bank Security: Implementing additional verification steps for massive transfers or new recipients.

- Moneylender Regulations: Stricter rules for high-interest lenders, especially regarding vulnerable individuals with sudden borrowing patterns.

- Financial Institution Liability: Exploring shared responsibility frameworks where banks bear some responsibility if they fail to flag suspicious transaction patterns.

Prevention Strategies

To reduce the number of people falling into scam-related debt:

- Early Warning Systems: Financial institutions could implement AI systems to detect potential scam-related transaction patterns before victims empty their accounts or take loans.

- Public Education: Targeted campaigns about how scammers specifically encourage victims to take on debt.

- Mandatory Cooling-Off Periods: For large loans or transfers, especially for first-time borrowers.

- Transaction Friction: Deliberately slowing down large money movements to allow for reflection.

The combination of scam victimisation and debt represents a particularly devastating financial trauma. While credit counselling and anti-scam support services provide crucial help, more systematic preventative measures and debt relief programs may be necessary as the problem continues to grow.

Detailed Examples of Common Scams

Romance Scams

Example: The Foreign “Contractor” Romance

- Initial Contact: A victim receives a friend request from an attractive person, often claiming to be a foreign professional, engineer, military contractor, or doctor working abroad.

- Relationship Building: Over the course of 1-3 months, the scammer sends daily messages, shares fake photos, and creates an elaborate backstory. They may send small gifts or flowers as “proof” of affection.

- First Crisis: The scammer claims they’re stuck in a foreign country with frozen assets due to a banking issue or contract dispute.

- Small Test: They request a small amount ($200-$ 500) to “test the relationship,” which they may even repay to establish trust.

- Major Crisis: A larger emergency arises, such as medical bills following an accident, legal fees for detained equipment, or bribes required to release contract payments.

- Escalation: When the victim hesitates, the scammer creates a sense of urgency, using phrases such as “I’ll lose everything,” “I might go to jail,” or “I can’t get medical treatment.”

- Compound Requests: Initial payments rarely solve the problem; new complications always arise, requiring additional funds.

- Ghosting: Once the victim runs out of funds or becomes suspicious, the scammer disappears or creates an excuse for not meeting in person.

Investment Scams

Example: The Crypto Trading Platform Scam

- Advertisement: The Victim sees a targeted social media ad featuring testimonials from people who have achieved huge returns through a specialised trading platform.

- Initial Registration: The platform requires a small deposit of $250-$ 500 to begin.

- Early Success: The victim’s dashboard shows immediate profits (completely fabricated), creating excitement.

- Personal “Advisor”: A “senior investment manager” contacts the victim directly, offering personalised guidance to “maximise returns.”

- Graduated Investments: The advisor encourages increasingly larger deposits, showing projections of potential earnings.

- False Trading Activity: The platform displays sophisticated-looking charts and trade histories, all fabricated.

- Difficulty Withdrawing: When attempting small withdrawals, victims encounter “verification fees,” “tax clearances,” or “minimum balance requirements.”

- Account Freezing: Eventually, the account is flagged for suspicious activity, requiring a hefty security deposit to verify funds.

- Regulatory Impersonation: Sometimes, victims receive messages from fake “financial authorities” claiming they need to pay taxes or fines before funds can be released.

- Vanishing Act: Eventually, the website disappears, or login credentials stop working.

Job Scams

Example: The Remote Processing Position

- Attractive Listing: A too-good-to-be-true job offer appears online: high pay, flexible hours, remote work, minimal qualifications.

- Quick Hiring: After a brief text-based “interview,” the victim is immediately “hired.”

- Equipment Setup: The scammer sends a fake check to “purchase necessary equipment” from “approved vendors” (actually the scammers).

- Processing Tasks: The victim’s job involves receiving funds into their personal account and transferring them elsewhere, unknowingly laundering money.

- Fake Check Scam: The initial check bounces after the victim has already sent real money to the “vendors.”

- Identity Theft: The employment paperwork collects sensitive personal information, including banking details and Social Security/identification numbers.

- Legal Entanglement: The victim may face legal consequences for participating in money laundering or fraud.

Government Impersonation Scams

Example: The Tax Authority Scam

- Official Contact: Victim receives a call, email, or text claiming to be from tax authorities with caller ID spoofed to show an official number.

- Fabricated Problem: The caller claims the victim has unpaid taxes or incorrect filings that will result in immediate arrest, property seizure, or passport cancellation.

- Verification Process: To seem legitimate, the scammer may recite personal information they’ve gathered from data breaches or social media.

- Urgency and Isolation: The victim is told not to hang up or tell anyone about the call “for privacy reasons” or “to avoid complications.”

- Unusual Payment Methods: Payment must be made immediately via gift cards, cryptocurrency, wire transfers, or prepaid debit cards.

- Multi-Person Approach: If the victim expresses doubt, they’re transferred to a “supervisor” (another scammer) who reinforces the threat.

- Follow-up Scam: After paying, victims may receive additional calls claiming the payment wasn’t completed or that new issues have been discovered.

Tech Support Scams

Example: The Virus Alert Scam

- Warning Trigger: A pop-up appears on the victim’s device, displaying alarming messages about viruses, complete with countdown timers and loud sounds.

- Helpline Contact: The alert provides a “support number” to call immediately.

- “Diagnosis”: The scammer requests remote access to the victim’s computer to “investigate the issue.”

- Fabricated Evidence: Once inside, they run fake diagnostic tools showing numerous “critical issues.”

- Service Fees: The victim is required to pay hundreds or thousands for immediate “protection services.”

- Maintenance Plan: After initial payment, victims are sold unnecessary ongoing service plans.

- Banking Details: In some cases, scammers access banking websites while they have remote access.

- Backdoor Installation: Malware may be installed to allow future access to the device.

Rental Scams

Example: The Phantom Apartment Scam

- Attractive Listing: A scammer posts a property at significantly below market rates with stolen photos from legitimate listings.

- Unavailable for Viewing: When contacted, the “landlord” has a reason why the property can’t be shown – they’re out of town, it’s currently occupied, or COVID restrictions apply.

- Virtual Tour: They may offer a video walkthrough (using footage from the original listing).

- Application Process: The victim is asked to complete a detailed application with personal and financial information.

- Securing the Property: To “hold” the apartment, the victim must send a deposit immediately via wire transfer or payment app.

- Additional Fees: Once the first payment is made, additional requests follow for security deposits, first month’s rent, or application fees.

- Disappearance: After payment, the “landlord” becomes unreachable, or the listing disappears.

Package Delivery Scams

Example: The “Missed Delivery” Scam

- Notification: Victim receives a text or email appearing to be from a legitimate delivery service about a failed delivery attempt.

- Tracking Link: The message contains a link to “reschedule delivery” or “track package.”

- Phishing Site: The link leads to a convincing replica of a delivery company’s website.

- Small Fee: To reschedule delivery, the victim must pay a small “processing fee” ($2-5).

- Credit Card Theft: The payment form captures complete credit card information.

- Additional Information: The site may also request additional personal details for “verification.”

- Immediate Card Use: Within hours, the scammers make purchases using the stolen card information.

Banking Scams

Example: The Bank Security Team Scam

- Alert Message: The victim receives an urgent text about “suspicious activity” on their account, requesting that they verify a transaction.

- Immediate Call: Whether they reply “yes” or “no” to the text, they quickly receive a call from the “bank’s security team.”

- Verification Process: The caller may have the victim’s name and possibly their address, making them appear legitimate.

- Account Protection: The caller claims they need to move the victim’s money to a new “secure account” to protect it from fraud.

- Security Codes: The victim is asked to share authentication codes sent to their phone (actually, authorisation codes for transactions the scammer is initiating).

- Fund Transfer: The victim is guided through transferring money to “temporary secure accounts”, which are actually the scammer’s accounts.

- Secret Operation: The victim is instructed not to visit their local branch or discuss this matter with anyone, as it could compromise the investigation.

- Multiple Accounts: Sometimes, victims are asked to withdraw from multiple accounts or take cash advances on credit cards as part of the “security protocol.”

Grant/Relief Fund Scams

Example: The Government Relief Program Scam

- Program Announcement: The Victim sees social media posts or receives messages about a special government program offering grants or relief payments.

- Pre-Qualification: The victim is told they’ve been “pre-selected” or meet all qualifications for significant funds ($5,000-$50,000).

- Application Fee: To process their application, applicants must pay a small fee ($50-$ 200).

- Document Requirements: They’re asked to provide copies of ID, banking information, and sometimes their social security numbers for verification purposes.

- Processing Delays: After payment, they’re informed that there are processing backlogs or additional verification is required.

- Escalating Fees: Additional fees for “expediting,” “insurance,” or “tax clearance” are requested.

- Official-Looking Documents: The scammers provide fake award letters, certificates, or ID badges to appear legitimate.

- Wire Transfer Requirements: Finally, they’re asked to wire money for final “release fees” before they can receive their grant.

Each of these scams relies on creating a sense of urgency, exploiting emotional vulnerabilities, and establishing a false sense of legitimacy. Scammers continually adapt their techniques as awareness spreads, making ongoing education about these tactics essential for effective prevention.

- Emotional and psychological effects: Stress that can be both intense (from the amount lost) and chronic (during recovery), potentially leading to depression, anxiety, sleep issues, and panic attacks

- Social impact: Victims often experience shame and may withdraw socially, depriving themselves of needed support

- Work consequences: Mental health impacts can affect performance and information retention at work

- Trauma symptoms: Some victims develop paranoia, like fear of answering phone calls or handling money

Recovery Recommendations

The article offers these suggestions for victims:

- Don’t isolate yourself: Seek social support from family and friends

- Be kind to yourself: Recognize negative emotions but avoid dwelling on shame

- Manage grief: Move from denial and anger to acceptance and active recovery planning

- Practice self-care: Engage in enjoyable activities to relax

- Seek professional help: Consider counseling if symptoms persist and interfere with daily functioning

It also provides advice for supporting someone who’s been scammed:

- Be sensitive with language (avoid terms like “falling prey” that suggest gullibility)

- Focus on emotional support first before offering preventative advice

Analysis of Scam-Related Psychological Trauma in Singapore

Psychological Trauma from Scams

Based on the article, scam victims often experience significant psychological trauma that manifests in multiple ways:

- Financial trauma: The sudden loss of substantial sums creates both acute and chronic stress

- Identity trauma: Victims question their judgment and intelligence, experiencing shame and self-blame

- Trust trauma: The betrayal can lead to difficulty trusting others or systems (financial, communication)

- Secondary trauma: Social isolation and stigma can compound the initial trauma

Common Symptoms

The article identifies several psychological symptoms experienced by scam victims:

- Depression: Persistent low mood and negative self-perception

- Anxiety: Heightened state of worry and fear

- Sleep disturbances: Difficulty falling or staying asleep

- Cognitive impairments: Trouble concentrating and retaining information

- Paranoia: Excessive fear around similar situations (e.g., avoiding phone calls)

- Performance issues: Reduced effectiveness at work or daily tasks

- Social withdrawal: Isolation due to shame or fear of judgment

Coping Mechanisms

The article recommends several coping strategies:

- Social reconnection: Actively maintaining connections instead of withdrawing

- Self-compassion: Practicing kindness toward oneself rather than self-blame

- Grief processing: Working through stages from denial to acceptance

- Active recovery planning: Taking concrete steps toward financial and emotional recovery

- Engaging in pleasurable activities: Using enjoyable activities as emotional respite

Counseling Avenues in Singapore

While the article mentions explicitly TOUCHline (1800 377 2252) as a counseling resource in Singapore, here are other potential avenues for support:

- TOUCH Mental Wellness: Offers personalized therapy and counseling programs

- Helplines: TOUCHline operates Monday to Friday, 9am to 6pm

- Corporate support: The article mentions that TOUCH works with corporations on mental wellness programs

- Professional counseling: Recommended if symptoms persist and interfere with daily functioning

Cultural Context in Singapore

The article hints at particular challenges in the Singaporean context:

- Rising scam cases: The article notes over 990 cases in just two weeks of April 2022

- Financial focus: Singapore’s achievement-oriented culture may intensify shame around financial losses

- Stigma concerns: Careful language is emphasized, suggesting stigma around being scammed exists

The article emphasizes the importance of destigmatizing scam victimhood by recognizing that anyone can become a victim, regardless of intelligence or education level, which is particularly important in addressing mental health recovery in the Singaporean context.

Coping with Scam Trauma: Treatment Avenues in Singapore

Specialized Counseling Services

- TOUCH Mental Wellness

- Offers personalized therapy and counseling specifically addressing scam trauma

- Contact via TOUCHline: 1800 377 2252 (Monday-Friday, 9am-6pm)

- Specializes in building resilience and stress management

- Credit Counselling Singapore (CCS)

- Provides both financial and emotional support for victims of financial fraud

- Helps create recovery plans that address both financial and psychological aspects

- Silver Ribbon Singapore

- Mental health services with experience supporting elderly scam victims

- Offers educational workshops on scam prevention and recovery

Clinical Treatment Options

- Trauma-Focused Cognitive Behavioral Therapy (TF-CBT)

- Available through Singapore’s mental health clinics and hospitals

- Addresses negative thought patterns common after scams (“I’m stupid,” “I can’t trust anyone”)

- Helps develop practical coping strategies

- Institute of Mental Health (IMH)

- Offers comprehensive assessment and treatment for severe trauma reactions

- Provides both outpatient and inpatient services if needed

- Private Psychological Services

- Many private psychologists in Singapore now specialize in financial trauma

- May offer more flexible scheduling than public institutions

Community Support Networks

- Scam Support Groups

- Peer support groups where victims can share experiences

- Reduces isolation and provides validation from others with similar experiences

- Family Service Centres

- Over 40 centers across Singapore offering counseling and support

- Can help mediate family tensions that might arise from financial losses

- Religious Organizations

- Many temples, churches, and mosques in Singapore offer counseling services

- Can provide spiritual perspective on forgiveness and moving forward

Self-Help Approaches

- Mindfulness and Stress Reduction

- Practices like mindfulness meditation help manage anxiety symptoms

- Available through community centers and health promotion programs

- Financial Recovery Planning

- Working with financial advisors who understand trauma

- Creating concrete steps helps restore a sense of control

- Education and Prevention

- Learning about scams can help restore confidence

- National Crime Prevention Council offers resources

Practical First Steps

- File a police report – Important for closure and may help with financial recovery.

- Contact TOUCHline at 1800 377 2252 for immediate emotional support

- Visit a Family Service Centre in your neighborhood for local support

- Consider a mental health screening if experiencing persistent symptoms

Remember that recovery is a process, and early intervention can significantly improve outcomes for scam trauma victims.

Prevention Measures

The article outlines several approaches to improving scam readiness:

Educational Framework (SGScamWISE)

- Well-Informed, Secured, and Empowered program supported by Google.org

- Empathy-Led Education: Understanding both the tactics and psychological techniques of scammers

- Real-World Learning: Though details were incomplete, this suggests practical, experience-based training

- Community Empowerment: Building collective defense mechanisms within communities

Technological Countermeasures

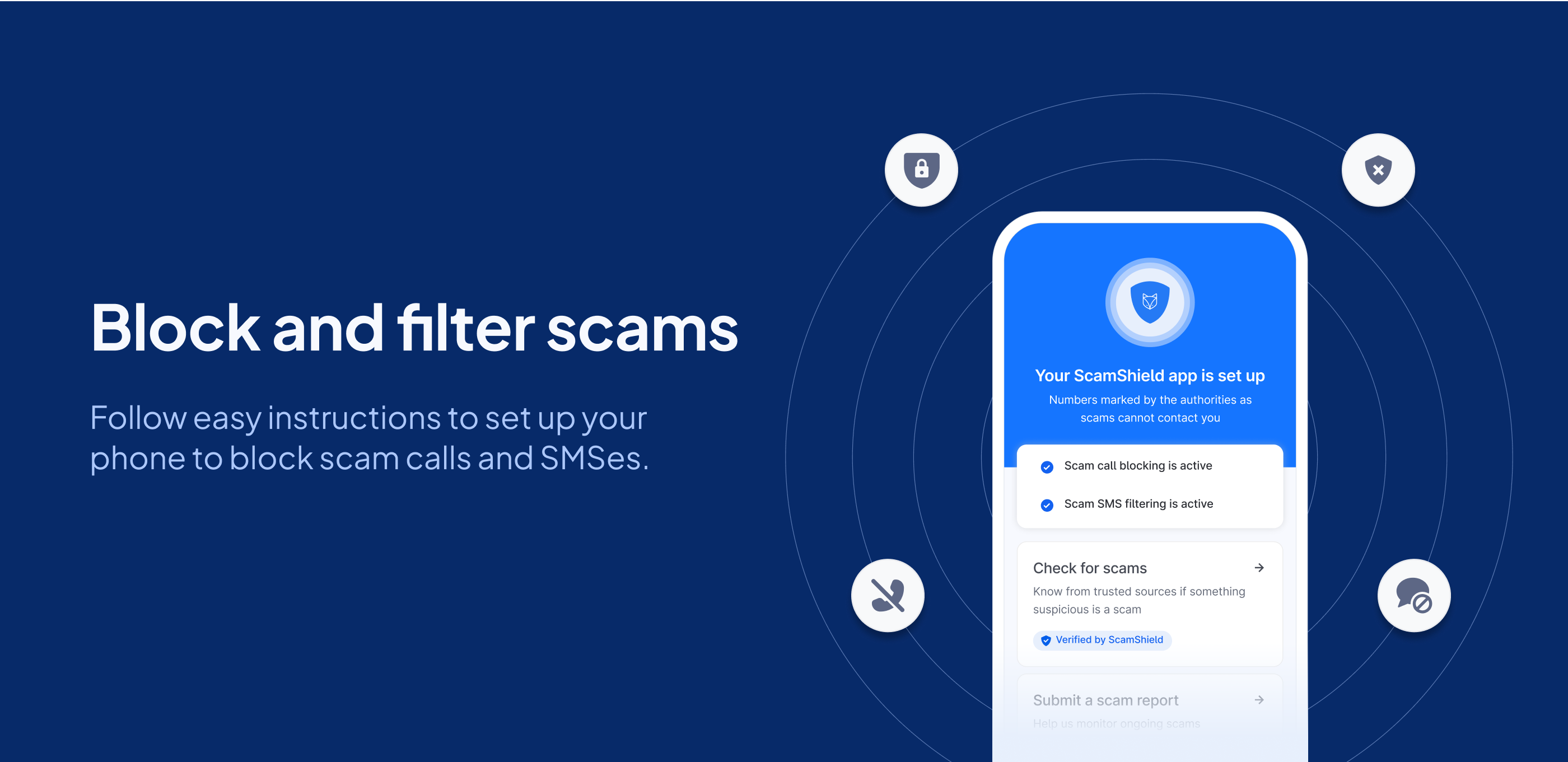

- SATIS (Scam Analytics and Tactical Intervention System): Developed by GovTech to identify and neutralize malicious websites

- Leveraging AI as a protective tool rather than just viewing it as a threat

Collaborative Approach

- Partnerships between social enterprises (like Bamboo Builders), government agencies (Singapore Police Force, IMDA), and community organizations

- Support from the national Digital for Life movement

- Emphasis on a whole-of-society response rather than individual solutions

Legal Aspects

While the article doesn’t delve deeply into legal frameworks, it mentions:

- Government agencies’ involvement suggests regulatory oversight

- The collaborative approach indicates a coordinated response between public and private sectors

- The emphasis on response preparedness suggests that legal reporting mechanisms exist but may be underutilized

Emotional Impact and Psychology

The emotional dimensions of scams receive significant attention:

Psychological Vulnerability

- Scammers exploit fundamental human psychology, not just technological gaps

- Overconfidence creates vulnerability (84% believe they can spot scams; only 40% actually can)

- Social trust is leveraged when scammers mimic trusted relationships

Emotional Support Gaps

- Two in three citizens lack effective response strategies, creating anxiety and helplessness.

- Parents feel particularly vulnerable regarding protecting their children

- Reliance on family and friends for information creates emotional dependencies that may spread misinformation

Empathy as a Solution

- Understanding both victims’ and scammers’ psychology is emphasized as critical.

- Community support frameworks are positioned as emotional safeguards

- Building resilience is framed as not just technical but emotional preparation

Gaps in the Current Approach

Reading between the lines, several challenges remain:

- Measurement Gap: How to objectively assess scam resilience beyond self-reporting

- Technology-Psychology Intersection: Need for a deeper understanding of how AI exploits human psychology

- Educational Effectiveness: Ensuring that empathy-led education translates to behavioral change

- Demographic Customization: Different approaches are needed for various vulnerable populations

The article presents scam resilience not just as technical knowledge but as a holistic capability involving emotional intelligence, community support, and practical response strategies, suggesting that effective prevention requires simultaneously addressing technological and human factors.

How Empathy Deters Scams

Based on the article, empathy functions as a scam deterrent in several sophisticated ways:

Understanding the Psychology of Scammers

The article suggests that empathy-led education helps potential victims understand not just the tactical aspects of scams but also the psychological techniques scammers employ. This deeper understanding works as a deterrent by:

- Recognizing Manipulation Patterns: When people understand the emotional triggers scammers use (urgency, fear, greed, trust), they become less susceptible to these tactics.

- Anticipating Psychological Pressure: Empathy allows potential victims to recognize when they’re being pushed into emotional states that compromise rational decision-making.

Creating Community Resilience

The empathy approach extends beyond individual protection to building community defenses:

- Collective Vigilance: The article states, ” We can build a collective shield through education and empathy,” suggesting that empathy creates shared responsibility for scam prevention.

- Reducing Stigma: When communities approach scam victimization with empathy rather than judgment, victims are more likely to report incidents quickly, helping authorities respond faster.

Improving Response Effectiveness

The SGScamWISE program emphasizes being “Well-Informed, Secured, and Empowered,” with empathy playing a crucial role in the response phase:

- Faster Recovery: The article identifies that two-thirds of Singaporeans wouldn’t know how to respond effectively to scams. Empathy-based education addresses this by helping people understand appropriate emotional and practical responses.

- Breaking Isolation: Scam victims often feel shame and isolation. Empathetic community responses help break this cycle, potentially preventing repeat victimization.

Countering Overconfidence

One of the most interesting aspects is how empathy might address the overconfidence problem:

- Self-awareness: Understanding one’s own psychological vulnerabilities (through empathy for oneself) helps counter the dangerous overconfidence the article identifies (84% believing they can spot scams when only 40% actually can).

- Realistic Risk Assessment: Empathy for victims helps others recognize that “it could happen to me too,” countering the false security that makes digital natives especially vulnerable.

The article frames empathy not as a soft skill but as a practical defensive tool that helps people better understand scammers’ psychological tactics and their own vulnerabilities. Thus, empathy creates a more comprehensive and practical approach to scam prevention than purely technical solutions.

Mental Health Impact on Scam Victims

- Victims often experience shame, fear, guilt, and severe emotional trauma

- Some develop serious conditions like depression or anxiety disorders

- Sleep problems, paranoia, loss of trust, and low self-esteem are common

- The psychological recovery process can take weeks to six months

Case Examples

- Ms. Lie, 52, lost approximately S$111,000 in a malware scam after downloading a third-party app that she thought was for a tour ticket.

- She experienced insomnia, emotional distress, and severe self-blame (“I ask myself why I’m so stupid”)

- Ms. Khoo, 58, lost S$44,487 in a similar malware scam and became extremely distrustful and fearful afterwards.

Mental Health Expert Insights

- Dr. Lim Boon Leng notes victims typically go through stages including denial, anger, and “bargaining” (trying to recover losses)

- Dr. Annabelle Chow points out that older victims may particularly struggle with “loss of face” in Asian cultures.

- Experts emphasize that recovery requires time to grieve, acceptance, and moving forward.

How to Support Scam Victims

- Listen without judgment and validate their emotions

- Help with practical matters like reporting to authorities

- Avoid telling them to “just move on” or downplaying their experience

- Never blame or shame the victim, as they’re already suffering

The article concludes with helpline resources for those experiencing mental health challenges.

Analysis of Scams and Their Impact

Types of Scams Mentioned

- Malware Scams: The primary scam highlighted in the article involves victims downloading third-party apps that give scammers control over financial accounts. Both Ms. Lie and Ms. Khoo fell victim to this type of scam.

- Social Media Advertisement Scams: Ms. Lie was initially lured by a Facebook advertisement for an inexpensive durian day-tour ticket to Malaysia (S$28), which turned out to be fraudulent.

Scale and Impact

Financial Impact

- Over 1,400 victims fell prey to malware scams between January and August

- Total losses amounted to at least S$20.6 million

- Individual losses were substantial:

- Ms. Lie: US$81,000 (approximately S$111,000)

- Ms. Khoo: S$44,487 from multiple credit cards and bank accounts

Psychological Impact

- Emotional Trauma: Shame, fear, guilt, and self-blame

- Sleep Disturbances: Insomnia and irregular sleep patterns

- Trust Issues: Paranoia and difficulty trusting others

- Self-Esteem: Severe decline in self-worth and confidence

- Long-term Conditions: Potential development of depression and anxiety disorders

- Social Withdrawal: Victims become wary of everyday activities (like using social media or answering phone calls)

- Family Burden: Family members take turns to provide care and supervision

Prevention Strategies

Individual Protection Measures

- Verify Sources: Be skeptical of unusually low-priced offers or deals, especially on social media.

- App Downloads: Only download apps from official app stores (Google Play, Apple App Store)

- Link Verification: Never click on suspicious links, mainly those promising deals or requiring immediate action

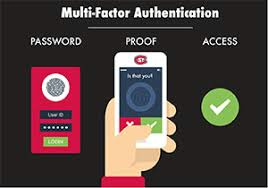

- Two-factor authentication: Enable this for all financial accounts

- Regular Monitoring: Check bank statements and credit card transactions frequently

- Credit Limits: Keep default credit limits lower and only increase them temporarily when needed

- Secure Banking: Use banking apps that have additional security features

- App Permissions: Review what permissions you grant to apps, especially financial access

Systemic Prevention

- Education Campaigns: Target vulnerable populations with awareness programs

- Financial Institution Safeguards: Banks could implement additional verification for unusual transactions

- Rapid Response Systems: Improve mechanisms for quickly freezing accounts when scams are reported

- Social Media Platform Responsibility: Stricter verification of advertisers and monitoring of potential scam content

Recovery Support

- Financial Counseling: Help victims manage the aftermath of financial losses

- Mental Health Services: Specialized psychological support for scam victims

- Community Support Groups: Create spaces where victims can share experiences and healing strategies

- Legal Aid: Assistance in navigating reporting procedures and potential recovery options

Cultural Considerations

The article specifically mentions that in Asian cultures, the concept of “loss of face” can make recovery particularly challenging. Prevention and support strategies should be culturally sensitive, acknowledging that shame may prevent victims from seeking help promptly.

Implementing these preventative measures could significantly reduce the likelihood of falling victim to such scams, while improving support systems would help mitigate the long-term psychological impact on those who do become victims.

Steps to Prevent Sophisticated Scams

Before Any Potential Scam Occurs

1. Develop a verification protocol

Create your personal verification procedure for any unexpected financial communication. This could include hanging up and calling the official number, checking through official apps, or visiting a physical branch. Make this your non-negotiable habit for all financial matters.

2. Familiarize yourself with official communication channels

Know precisely how legitimate organizations like banks, government agencies, and financial institutions typically contact you. Most will never call from mobile numbers, use video calls, or transfer you directly to other agencies.

3. Establish personal security questions

For your accounts that allow it, set up personalised security questions that only you and the institution would know. If a caller can’t verify these, it’s likely fraudulent.

4. Enable two-factor authentication

Activate this security feature on all your important accounts, particularly those connected to financial services and digital identity systems like Singpass.

5. Register for scam alerts

Subscribe to official scam alert services from police, financial authorities, and banks to stay informed about current scam techniques being used in your area.

During a Suspicious Call

6. Pause and breathe

When receiving unexpected calls about security issues, take a moment to calm yourself. Scammers rely on creating a panic that clouds judgment.

7. Question the context

Ask yourself: “Was I expecting this call?” “Have I recently applied for this service?” “Does this situation make logical sense?”

8. Verify the caller independently

If someone claims to represent an organization, tell them you’ll call back through official channels. Never use the number they provide – look up the official contact information yourself.

9. Be wary of pressure tactics

Legitimate organizations will not pressure you into making immediate decisions. If you feel pressured with artificial urgency, it’s likely a scam.

10. Watch for information asymmetry

Be suspicious when someone has extensive information about you but you know very little about them. Request their full name, employee ID, and department – details you can verify later.

11. Notice technical inconsistencies

Pay attention to call quality, background noises, or switching between different “representatives” on the same phone number. These often indicate scam operations.

Red Flags to Remember

12. Be alert to emotional manipulation

Recognize when someone is trying to provoke fear, urgency, or excitement – these emotional states make critical thinking difficult.

13. Question unusual procedures

Be highly suspicious if asked to transfer money to “safe accounts,” purchase gift cards, or download unfamiliar software for “verification.”

14. Guard against authority imposters

Government agencies and banks never demand immediate payments or transfers during the first point of contact.

15. Beware of the “hanging question”

Scammers often ask if you’ve recently clicked suspicious links or been involved in unusual activity – designed to make you feel vulnerable and reactive rather than analytical.

Long-term Protection Strategies

16. Regularly monitor your accounts

Schedule weekly checks of your financial accounts to catch unauthorized activity early.

17. Use credit monitoring services

Consider services that alert you to changes in your credit report or when your personal information appears in unusual places.

18. Limit your digital footprint

Regularly audit what personal information is publicly available about you online and take steps to minimize it.

19. Keep learning about new scam techniques

Scammers constantly evolve their approaches. Stay informed about new tactics through official sources.

20. Share knowledge with vulnerable networks

Discuss scam prevention with family members, especially those who might be more susceptible, like elderly relatives or those less familiar with technology.

Remember that even the most vigilant person can be caught off guard by sophisticated scams. The key is creating systems and habits that protect you even when your emotional defences might be compromised.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

By utilising the Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser is a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.