Mechanics of These Phishing Scams

Entry Points

- Social media platforms, including Facebook, TikTok, and Instagram, are being leveraged as primary channels for distributing these scams.

- Deceptive Promotions: Scammers use enticing but unrealistic offers such as “$1.99 for unlimited travel” or “$6 for unlimited travel” to lure victims.

- Brand Impersonation: Scammers impersonate trusted entities, including EZ-Link, SimplyGo, and the Land Transport Authority (LTA).

Technical Execution

- Redirect Chain: Victims click on advertisements that redirect them to sophisticated phishing websites, which resemble official sites.

- Data Harvesting: These sites prompt users for sensitive information, including:

- Credit/debit card details

- Banking credentials

- One-time passwords (OTPS)

- Psychological Manipulation: Some variations include interactive elements, such as online games or questionnaires, to increase engagement and perceived legitimacy.

Monetization Methods

- Direct Bank Withdrawals: Unauthorised transactions from victims’ bank accounts.

- Credit Card Fraud: Unauthorised charges to victims’ credit cards.

- Digital Wallet Exploitation: Unauthorised access to Grab or GrabPay wallets.

Impact on Singapore

Financial Damage

- At least $35,000 in losses from 36 victims (April 2025)

- At least $156,000 in losses from 97 victims (March 2025)

- This suggests an average loss of approximately $1,000 to $1,600 per victim.

Broader Scam Context

- Part of Singapore’s $1.1 billion in scam losses during 2024

- Phishing scams were the third most common scam type in 2024

- $59.4 million lost to phishing in 2024 (quadruple the 2023 amount)

Social Impact

- Trust Erosion: Diminishes public trust in legitimate digital payment systems and public transport payment methods.

- Digital Adoption Barriers: May create hesitancy among users to adopt cashless payment systems.

- Public Transportation Economy: Potential Adverse Effect on Singapore’s Highly Digitised Transport Payment Ecosystem.

Anti-Scam Centre Assistance

Scam Prevention Measures

- Public Advisories: The Anti-Scam Centre (ASC) issues alerts about emerging scam patterns.

- Educational Campaigns: Distributes information about legitimate transaction channels and warning signs.

- Verification Channels: Provides resources for the public to verify legitimate promotions.

Intervention Capabilities

- Scam Report Hotline: Dedicated channels for reporting suspected scams.

- Fund Recovery: Works with banks to freeze accounts and attempt to recover stolen funds.

- Digital Forensics: Analysis of phishing websites and advertisement trails.

Collaboration Framework

- Financial Institution Partnerships: Collaborates with banks to facilitate a rapid response to suspicious transactions.

- Platform Coordination: Works with social media platforms to remove fraudulent advertisements.

- International Cooperation: Engages with overseas law enforcement when scammers operate internationally.

Protection Recommendations

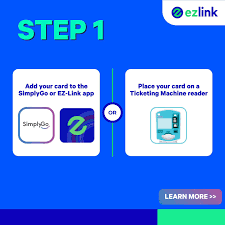

- Official Channels Only: All legitimate promotions are conducted exclusively on SimplyGo and Nets websites and their official social media pages.

- Verify Offers: Be sceptical of desirable promotions; “too good to be true” offers usually are.

- URL Verification: Check website URLS carefully before entering any personal information.

- Direct Navigation: Instead of clicking links, directly navigate to official websites.

- Multifactor Authentication: Enhance security on financial accounts with additional layers.

The persistent and evolving nature of these scams indicates sophisticated operations targeting Singapore’s highly digitised society, requiring ongoing vigilance from both authorities and the public.

The Singapore Police Force (SPF) is warning the public about a recent surge in online scams involving fraudulent promotions related to EZ-Link and SimplyGo cards. These deceptive campaigns have already resulted in substantial financial losses for victims, with Singaporeans reportedly losing a total of S$156,000. This alarming trend highlights the increasing sophistication of online scammers and underscores the urgent need for heightened public awareness and vigilance.

The premise of these scams typically involves enticing advertisements or social media posts promising attractive discounts, rebates, or complimentary credits for EZ-Link or SimplyGo users. These promotions often appear on seemingly legitimate platforms, mimicking the branding and visual elements of official EZ-Link or Land Transport Authority (LTA) marketing materials. Victims, drawn in by the allure of saving money on their daily commutes, are then directed to phishing websites that closely resemble the official EZ-Link or SimplyGo portals.

Once on these fake websites, victims are prompted to enter their personal and financial information, including their EZ-Link card details, credit card numbers, and even One-Time Passwords (OTPS). Unbeknownst to them, the scammers harvest this information and use it to make unauthorised transactions, drain bank accounts, or commit other forms of identity theft. The speed and efficiency with which these scammers operate mean that victims often don’t realise they’ve been targeted until significant financial damage has already been done.

The success of these scams hinges on several factors. Firstly, the perceived legitimacy of the promotions, often cleverly designed to mirror authentic marketing campaigns, lulls victims into a false sense of security. Secondly, the promise of financial gain, even if seemingly modest, taps into people’s desire to save money, making them more susceptible to impulsive clicks without thoroughly verifying the source. Thirdly, the use of social media and online advertising platforms allows scammers to reach a broad audience quickly and efficiently, making it difficult to track and shut down these fraudulent schemes.

The consequences of falling victim to these scams can be devastating. Beyond the immediate financial losses, victims may also experience significant emotional distress, including feelings of shame, anger, and vulnerability. The compromise of personal information can also lead to long-term problems, such as identity theft, damaged credit scores, and difficulty accessing financial services in the future.

In response to this escalating threat, the SPF has issued a series of advisories urging the public to exercise extreme caution when encountering online promotions related to EZ-Link or SimplyGo. They emphasize the importance of verifying the authenticity of any offer directly with the official EZ-Link or LTA websites or customer service channels. They also strongly advise against clicking on suspicious links or providing personal or financial information on unverified websites.

Furthermore, the SPF is working closely with banks and other financial institutions to enhance security measures and detect fraudulent transactions more effectively. They are also collaborating with social media platforms and online advertising networks to identify and remove scam advertisements and accounts. The police are also actively investigating these scams and pursuing the perpetrators to bring them to justice.

Beyond the efforts of law enforcement and financial institutions, individuals must take proactive steps to protect themselves from these scams. This includes practising good cybersecurity hygiene, such as using strong and unique passwords, enabling two-factor authentication, and regularly updating software and security patches. It also involves being critical of online content and learning to identify the red flags of phishing scams, such as poor grammar, suspicious links, and requests for sensitive information.

Education and awareness are key to preventing these scams from spreading further. Public awareness campaigns, workshops, and online resources can help educate Singaporeans about the latest scam tactics and provide them with the knowledge and tools they need to protect themselves. By fostering a culture of vigilance and critical thinking, we can collectively make it more difficult for scammers to exploit unsuspecting individuals.

The prevalence of these EZ-Link/SimplyGo scams serves as a stark reminder of the ever-present danger of online fraud. As technology continues to evolve, so too will the tactics of scammers. It is, therefore, imperative that we remain vigilant, informed, and proactive in protecting ourselves and our loved ones from these insidious threats. The loss of S$156,000 is a significant blow. Still, it should also serve as a wake-up call, urging us to prioritize online safety and adopt a more cautious approach to navigating the digital world. By working together, we can create a safer online environment for all Singaporeans.

\

Maxthon

Maxthon has embarked on an ambitious journey to significantly enhance the security of web applications, driven by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—whether it involves sharing passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to protecting its users. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, knowing that their information is continuously safeguarded against emerging threats in cyberspace.