Analysis: Why Trump’s Tariffs Alone Won’t Revitalise US Manufacturing

The article by Vikram Khanna presents a compelling case that tariffs alone are insufficient to restore American manufacturing strength. Here’s an analysis of why a more comprehensive approach is needed:

The Limitations of Tariffs

Trump’s tariff-focused strategy falls short because:

- Historical precedent: Successful manufacturing nations, such as Japan, South Korea, and Taiwan, have used tariffs only as temporary, selective measures within broader industrial strategies.

- Economic backlash: The article notes that “empty shelves, a bond market crisis, and stagflation” have already led to a moderation of Trump’s tariff approach.

- Incomplete solution: Tariffs create a protective environment but don’t address fundamental manufacturing capacity issues, workforce development, or technological advancement.

Industrial Policy: The Missing Cornerstone

A robust industrial policy requires:

- Strategic investment: The Biden administration’s initiatives (CHIPS Act, Inflation Reduction Act, Infrastructure Investment and Jobs Act) provided targeted funding for critical sectors and infrastructure. The uncertain future of these programs under Trump creates major gaps:

- Semiconductor manufacturing support is in limbo

- Green technology development is being ceded to China and Europe

- Critical infrastructure modernization is stalled

- Capital accessibility: Countries like Japan and South Korea ensured manufacturers had access to affordable capital – a component missing from current US policy.

- Performance metrics: South Korea tied protection to export performance, creating accountability that’s absent in the current US approach.

Education Funding: The Foundation for Innovation

The article highlights serious concerns in education policy:

- Department of Education: Proposed closure would harm disadvantaged students and reduce access to higher education.

- Research funding cuts: Slashed support for the National Science Foundation, NIH, and other research bodies weakens America’s innovation ecosystem.

- Brain drain risk: Without strong educational and research institutions, top talent will seek opportunities elsewhere.

- Workforce development: Unlike successful industrial nations, the United States lacks comprehensive technical education and vocational training programs to develop manufacturing skills.

International Partnerships: A Collaborative Approach

The most innovative suggestion in the article involves reimagining trade relationships:

- Beyond market access: Instead of just demanding lower barriers, the US should cultivate genuine partnerships.

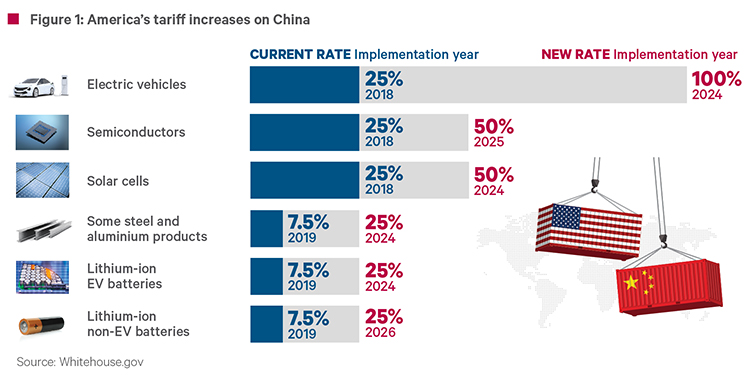

- Foreign direct investment: The US could welcome targeted foreign direct investment (FDI) in strategic sectors such as electric vehicles (EVS), semiconductors, and green technology.

- Technology transfer reversal: After decades of US companies transferring technology abroad, countries such as China, Japan, and South Korea are now bringing their manufacturing expertise to American shores.

- Collaborative ventures: Specific opportunities include:

- Chinese investment in EV ecosystems and infrastructure

- South Korean, Taiwanese and Japanese participation in semiconductor supply chains

- European partnerships in pharmaceuticals and biotech

Conclusion

The article correctly identifies that manufacturing revival requires a comprehensive strategy where tariffs are just one component. Without addressing education, research, infrastructure, and international collaboration, tariffs alone risk raising consumer prices without meaningfully rebuilding American industrial capacity.

The most promising path forward would combine selective tariff protection with strategic investments in education, research, infrastructure, and manufacturing capacity, while fostering mutually beneficial international partnerships rather than pursuing economic isolation.

Why Tariffs Alone Are Insufficient to Save US Manufacturing

Fundamental Limitations of Tariff-Only Approaches

- Narrow Scope of Impact

- Tariffs only address the price competitiveness of imports

- They don’t build domestic productive capacity, technological know-how, or workforce skills

- As the article states: “Cheaper prices are a poor substitute for an expansion of productive capacity and technological upgrading”

- Historical Precedent Shows Tariffs as Supporting Tools Only

- The article highlights that Japan, South Korea, Taiwan, and China used tariffs successfully, but only as:

- Selective and temporary measures

- One component within comprehensive industrial strategies

- “Scaffolding” for more critical policies

- The article highlights that Japan, South Korea, Taiwan, and China used tariffs successfully, but only as:

- Missing Complementary Elements

- Countries that successfully industrialised paired tariffs with:

- Access to cheap capital for domestic manufacturers

- Performance requirements (export targets)

- Targeted technology acquisition strategies

- Massive investments in technical education and training

- Infrastructure development (ports, roads, industrial parks)

- Countries that successfully industrialised paired tariffs with:

Specific US Manufacturing Vulnerabilities Not Addressed by Tariffs

- Innovation Ecosystem Decay

- Research funding cuts to the NSF, NIH, DOE Office of Science, and other agencies.

- This weakens “industries that depend on foundational science such as semiconductors, biotechnology, medicine, energy technology, defence and quantum computing”

- No tariff can compensate for falling behind in core technologies

- Deteriorating Infrastructure

- Frozen infrastructure investment prevents upgrading of “roads, bridges, ports, airports, railways, public transit systems and power grids”

- Manufacturing competitiveness depends on efficient logistics networks

- Skills and Workforce Development Gaps

- Department of Education funding threats impact educational access

- Lack of investment in technical education and vocational training

- Manufacturing requires skilled workers that tariffs don’t produce

- Supply Chain Integration

- Modern manufacturing depends on complex global supply chains

- Tariffs can disrupt access to components, materials, and equipment needed by US manufacturers

- They don’t create domestic alternatives to these inputs

- Export Competitiveness

- The article notes that the US “does not have policies in place to promote exports”

- Manufacturing scale and efficiency depend on access to global markets

- Tariffs can trigger retaliatory measures that limit US export opportunities

Economic Consequences of Tariff-Heavy Policies

- Consumer Impacts

- “Empty shelves on US stores” suggests supply disruptions

- Higher prices for consumers with no corresponding improvement in domestic options

- Financial Market Disruption

- The article mentions “bond market crisis” as a consequence of aggressive tariffs.

- Financial instability undermines manufacturing investment

- Macroeconomic Threats

- “Stagflation” (stagnant growth with inflation) is highlighted as a risk

- This economic environment makes manufacturing investment less attractive

The article concludes that without “substantive policies behind its tariff wall to help its manufacturing sector, the US will be in a weak position to benefit from its tariffs.” A tariff merely creates potential space for domestic manufacturing to develop, but without the supporting ecosystem of skills, technology, infrastructure, and investment, that potential cannot be realised.

The Missing Blueprint: Analysis of America’s Incomplete Manufacturing Revitalisation Strategy

Introduction

Despite rhetoric about restoring American manufacturing dominance, the United States lacks a coherent, comprehensive strategy for industrial revival. Drawing from the article by Vikram Khanna, this analysis examines the critical gaps in current US policy that prevent meaningful manufacturing revitalisation, contrasting the American approach with successful models from other nations.

1. Fragmented and Inconsistent Policy Framework

Disrupted Industrial Initiatives

The article highlights how promising industrial policies have been undermined:

- CHIPS Act: Initially designed to provide $50 billion for semiconductor manufacturing, now “mired in confusion and uncertainty” after being “rebranded” under the Investment Accelerator

- Inflation Reduction Act: $370 billion clean energy initiative now suspended, with “disbursements frozen” and EV mandates revoked

- Infrastructure Investment and Jobs Act: $1.2 trillion package for critical infrastructure now facing frozen disbursements

This policy inconsistency creates an environment where manufacturers cannot make long-term investment decisions due to regulatory unpredictability.

Missing Integration Between Trade and Industrial Policy

The article notes the absence of coordination between tariff policy and domestic capacity building:

- Tariffs implemented without corresponding policies to develop domestic alternatives

- No strategy to connect protected industries with global supply chains

- Absence of mechanisms to ensure tariff benefits translate to manufacturing investment rather than price increases

2. Neglect of Knowledge Infrastructure

Educational System Deterioration

The foundation of manufacturing competitiveness—a skilled workforce—is being undermined:

- Proposed closure of the Department of Education threatens funding for disadvantaged students

- Reduced support for higher education limits access to technical training

- Focus shifted away from academic standards to ideological concerns

Research Ecosystem Damage

The article explicitly warns about “this assault on knowledge” through:

- Slashed funding for National Science Foundation, National Institute of Health, and Department of Energy’s Office of Science

- Frozen or canceled research grants to universities

- Weakening of the innovation pipeline that feeds advanced manufacturing

The consequences include “a profound impact on the US technology and innovation ecosystem” and will “result in the weakening of industries that depend on foundational science.”

3. Absence of Workforce Development Strategy

Unlike prosperous manufacturing nations, the US lacks:

- Comprehensive technical education programs aligned with industry needs

- Apprenticeship systems that develop specialised manufacturing skills

- Retraining programs for workers displaced by automation or trade

- Immigration policies to attract specialised talent

The article warns this will “not help to build a future-ready workforce and will instead lower productivity and economic growth.”

4. Missing Export Promotion Mechanisms

Manufacturing scale and efficiency depend on global market access, yet:

- The article observes that the US “does not have policies in place to promote exports”

- Currency devaluation is proposed as a substitute but deemed “a poor substitute for an expansion of productive capacity”

- No parallel to successful export-oriented industrial policies in East Asia

- Absence of export targets or incentives to drive manufacturing competitiveness

5. Adversarial Rather Than Collaborative International Approach

Instead of leveraging global expertise, current policy:

- Treats trade partners primarily as rivals rather than potential collaborators

- Fails to facilitate beneficial technology transfer from advanced manufacturing nations

- Overlooks opportunities for joint ventures in critical industries

- Does not strategically direct foreign direct investment toward manufacturing gaps

The article suggests that a comprehensive approach would require a change in mindset —a shift to working with other economies rather than against them.

6. Infrastructure Deficiencies

Modern manufacturing requires robust physical infrastructure, yet

- Frozen infrastructure spending prevents modernisation of “roads, bridges, ports, airports, railways, public transit systems and power grids”

- No coordinated development of industrial zones or manufacturing hubs

- Energy infrastructure modernisation stalled with green energy project suspensions

- Digital infrastructure gaps unaddressed

Conclusion: Learning from Successful Models

Countries that successfully developed manufacturing strength implemented comprehensive strategies where protectionist measures served as temporary scaffolding while building robust industrial ecosystems. America’s current approach lacks:

- Strategic coherence – policies work at cross purposes rather than in coordination

- Long-term vision – political shifts disrupt industrial development that requires decades

- Knowledge infrastructure – underinvestment in education and research undermines innovation

- Global integration – insularity rather than strategic international collaboration

- Workforce preparation – absence of skills development aligned with manufacturing needs

Without addressing these fundamental gaps, manufacturing revitalisation will likely remain an unfulfilled promise, regardless of tariff levels. As the article concludes, what happens “behind the US tariff wall will be more important to watch” than the tariffs themselves.

I’ll analyse the article about tariff impacts on K-beauty products in the US market.

Key Points from the Article

The article discusses how US tariffs are affecting Korean beauty products, particularly:

- Panic buying by US consumers before price increases hit, with many stocking up on products like Korean sunscreens

- Tariff specifics: South Korea was hit with a 25% reciprocal tariff rate, though these are currently paused for 90 days until July 8

- Market significance: K-beauty exports reached a record $10.2 billion in 2024, with the US being the second-largest market after China

- Industry responses:

- Large companies (LG, Amorepacific) are monitoring the situation before making price adjustments

- Korean manufacturers (Kolmar Korea, Cosmax) are ramping up production at US factories to avoid tariffs

- Smaller brands like KraveBeauty express significant concerns about affordability

- Complex supply chains: Even Korean brands may be affected by China tariffs since many source packaging from China

- Economic impact: An economist suggests costs will be distributed between Korean manufacturers, US distributors, and US consumers, with consumers likely bearing much of the burden due to the unique qualities of K-beauty products

The article effectively illustrates how global trade policies create ripple effects across industries and consumer behaviours, with both immediate responses (panic buying) and potential long-term structural changes (shifting production to the US).

Analysis of K-Beauty Panic Buying: The Irony of Demand Despite Tariffs

The panic buying of Korean beauty products demonstrates a fascinating economic and cultural contradiction at the heart of US-Korea trade relations. This phenomenon reveals several layers of irony:

The Demand-Tariff Paradox

The most obvious irony is that US consumers are rushing to stockpile products that their own government is attempting to make less accessible through tariffs. This creates a situation where:

- Presidential policy aims to discourage foreign imports

- Yet consumer behaviour demonstrates an unwavering commitment to these very products

- The tariffs may actually boost short-term sales through panic buying

Cultural Contradictions

There’s a more profound cultural irony at play:

- The US has positioned itself as promoting domestic manufacturing (“America First”)

- Yet American consumers clearly believe Korean beauty products are superior and irreplaceable

- As the article notes, Korean sunscreens are “prized for their lightweight formulas and efficacy that users believe US-made sunscreens cannot match”

This reveals a disconnect between nationalist economic policies and the reality of global consumer preferences that have been shaped by quality and innovation rather than country of origin.

Market Adaptations

The industry response highlights another layer of irony:

- Korean manufacturers are now accelerating plans to build US factories

- This means “Korean” products will technically become “American-made”

- The tariffs may ultimately succeed in creating US manufacturing jobs, but for Korean companies

- The intellectual property, formulations, and profits will still primarily flow back to Korea

Economic Consequences

The most significant irony may be in the economic outcomes:

- Tariffs are ostensibly designed to protect American consumers and businesses

- Yet as economist Lee Mun-seob predicts, “American consumers will likely end up absorbing much of the cost”

- Rather than spurring competitive American alternatives, the unique qualities of K-beauty products mean consumers will simply pay more.

The Snail Mucin Metaphor

The Atlantic’s article title, “My Snail Mucin is Caught in a Trade War,” perfectly encapsulates the absurdity of the situation—an exotic Korean skincare ingredient becoming collateral damage in international trade politics. It symbolises how deeply integrated global consumer preferences have become, defying simplistic nationalist economic approaches.

This whole scenario demonstrates how globalised consumer culture has become more potent than trade policy. Despite government attempts to reshape buying habits through economic levers, consumers have developed such strong preferences for certain global products that they’ll go to extraordinary lengths – including panic buying and paying premium prices – to maintain access to them.

K-Beauty vs. Lancôme and L’Oréal: A Comparative Analysis

When comparing K-Beauty with established French beauty conglomerates like Lancôme and L’Oréal, several key differences emerge in philosophy, formulation, marketing approach, and pricing:

Product Philosophy & Innovation

K-Beauty:

- Emphasises multi-step skincare routines (often 7-10 steps)

- Prevention-focused rather than correction-focused

- Known for innovative ingredients (snail mucin, centella asiatica, rice water)

- Rapid product development cycles with quicker response to trends

- Often incorporates traditional Asian medicinal ingredients

Lancôme/L’Oréal:

- More traditional approach with simpler routines

- Greater emphasis on anti-ageing treatments

- Longer development cycles but with significant R&D investment

- Historically stronger in makeup than skincare (though this has evolved)

- Often leverages patented technologies and compounds

Formulation & Texture

K-Beauty:

- Lightweight, hydration-focused formulations

- Innovative textures (essences, ampoules, cushion foundations)

- Often fragrance-free or naturally scented

- Typically offers higher SPF protection in everyday products

Lancôme/L’Oréal:

- Richer, more emollient formulations traditionally

- More likely to contain heavier perfumes

- Often includes signature scent profiles associated with luxury

- Historically lower SPF values (though changing)

Marketing & Branding

K-Beauty:

- Playful, often whimsical packaging

- Accessible price points with premium lines available

- Heavy emphasis on visible results and before/after imagery

- Social media and viral marketing-driven

- Often uses cute or food-inspired packaging

Lancôme/L’Oréal:

- More traditional luxury marketing (especially Lancôme)

- Celebrity endorsements and high-fashion associations

- Heritage and history as selling points

- Emphasis on scientific credibility and patents

- More understated, elegant packaging

Price Points

K-Beauty:

- Generally more affordable ($10-30 for most items)

- Value-oriented with accessible entry points

- Premium lines are still typically less expensive than Western luxury

Lancôme/L’Oréal:

- Broader price spectrum (L’Oréal has mass market to luxury)

- Lancôme positions itself as prestige ($50-200+ for skincare)

- Price often reflects brand positioning rather than just ingredient costs

Market Position & Consumer Perception

K-Beauty has disrupted the traditional beauty market by offering innovative formulations at accessible prices, challenging established players like L’Oréal and Lancôme to respond with their own innovations. Interestingly, L’Oréal has recognised this threat by acquiring Korean beauty brands and incorporating K-Beauty inspirations into their own product lines.

The irony in the tariff situation is particularly apparent when considering that L’Oréal Group (which owns Lancôme) has been actively trying to capture the essence of K-Beauty’s appeal—yet American consumers are still willing to pay premium prices and stockpile authentic Korean products rather than switch to Western alternatives trying to emulate the K-Beauty approach.

Maxthon: Your Dependable Companion in the Digital Odyssey

As we set forth on our expedition through the ever-changing terrain of the internet, entering this vast online universe often feels akin to embarking on a thrilling adventure into untamed and unexplored lands. To navigate this expansive digital domain with confidence and security, a reliable web browser is essential.

This is where Maxthon makes its grand entrance. Tailored specifically for users of Windows 11, this exceptional browser seamlessly blends with the cutting-edge features of this advanced operating system, providing a treasure trove of innovative tools that enhance your online interactions.

At the heart of Maxthon’s purpose lies an unwavering dedication to safeguarding user privacy and security. Boasting an impressive suite of privacy-centric features, this browser enables users to browse the internet freely while protecting their personal information from prying eyes.

What truly sets Maxthon apart in the bustling ecosystem of web browsers is its steadfast commitment to delivering robust functionalities at no cost to users. With an intuitive design crafted for everyone, it ensures easy access to the vital tools necessary for navigating the intricate web of information and connections that the online world presents.

With Maxthon by your side during this digital journey, you’re not just browsing; you’re embarking on a secure and enriching exploration through the boundless realms of cyberspace. Each click unveils new insights as you navigate a landscape where information flows like a mighty river and connections emerge like bridges spanning vast chasms. Throughout this adventure, Maxthon stands as your loyal guide, steering you safely through every twist and turn of your exploration in this digital universe.