Key Points from FIS’s Money Movement Hub Announcement

FIS (a global financial technology company) has launched a new product called the “Money Movement Hub” on May 1, 2025. This is a unified payments solution with several notable features:

- Purpose: Simplifies back-end infrastructure for financial institutions by connecting multiple payment networks in one place

- Key Capabilities:

- Cloud-native platform hosted on AWS

- Universal API and orchestration capability

- Integrates with major US payment networks (instant, ACH, wires)

- Built-in fraud controls and OFAC monitoring

- Real-time transaction monitoring and risk scoring

- Target Market: Range of financial institutions from super regional banks to community banks

- Business Model: “Pay-as-you-grow”, allowing institutions to start with needed payment types and expand later

- Problem Being Addressed: According to FIS’s Harmony Gap survey, 57% of organisations experience friction in payments processing at least weekly

This solution appears to be responding to increasing consumer demands for faster, more efficient payments, as well as the need for financial institutions to modernise their payments infrastructure. According to an analyst quoted in the release, 45% of U.S. banks have major payment modernisation plans over the next 18 months.

Analysis of FIS’s Money Movement Hub: Impact on Singapore Banks and Commerce

1. In-Depth Analysis of the Money Movement Hub

Technical Architecture

FIS’s Money Movement Hub represents a significant advancement in payment infrastructure design with its:

- Cloud-native architecture: Built on AWS, providing scalability advantages over legacy on-premises systems

- Universal API approach: Simplifies integration across multiple payment networks through a single connection point

- Network agnostic design: Supports instant payments, ACH, and wire transfers through one platform

- Built-in fraud controls: Embedded security rather than bolt-on solutions, including real-time transaction monitoring, OFAC screening, and risk scoring

Business Model Innovation

The “pay-as-you-grow” model introduces flexibility that traditional payment solutions typically lack:

- Allows financial institutions to start with specific payment types and expand

- Reduces upfront capital investment requirements

- Enables more gradual, strategic modernisation pathways

Competitive Positioning

FIS is positioning this solution to address specific market pain points:

- 57% of organisations report weekly payment friction issues

- Responds to growing customer expectations for faster payments

- Targets institutions from super-regional to community banks, filling a gap where smaller players often struggle with fragmented systems

2. Impact on Singapore Banks

Modernization Opportunities

Singapore banks face unique modernisation challenges that the Money Movement Hub could address:

- Integration with FAST: Singapore’s Fast And Secure Transfers system could potentially integrate with FIS’s hub, expanding cross-border capabilities

- MAS Payment Roadmap alignment: The solution could help banks meet the Monetary Authority of Singapore’s payment modernisation guidelines

- PayNow enhancement: Potential to strengthen Singapore’s PayNow infrastructure for both retail and corporate users

Competitive Considerations

For Singapore banks, this solution presents both opportunities and challenges:

- DBS, OCBC, UOB advantage: Singapore’s largest banks with established digital transformation programs could leverage this to further accelerate their payment capabilities

- Smaller banks’ opportunity: Provides smaller Singapore financial institutions a path to compete with larger banks’ payment capabilities

- International banks operating in Singapore: Could use this to standardise payment operations across their global network, including Singapore operations

Regulatory Considerations

Singapore’s unique regulatory environment creates specific considerations:

- MAS compliance: Any implementation would need to satisfy Singapore’s strict financial regulatory requirements

- Cross-border payment regulations: Singapore’s position as a financial hub makes cross-border capabilities particularly important

- Data residency requirements: Singapore’s data localisation rules may require specific implementation approaches for the cloud-native solution

3. Impact on Commerce

Merchant Ecosystem Effects

The solution could significantly impact merchants operating in Singapore:

- Settlement time improvements: Faster, more reliable settlement could improve cash flow management

- Cross-border commerce enablement: Enhanced payment infrastructure could reduce friction in international transactions

- Embedded finance opportunities: The API-first approach could enable new embedded payment experiences within merchant applications

Consumer Experience Implications

End customers would likely experience:

- Reduced payment friction: Fewer failed or delayed transactions

- Enhanced payment options: More flexible payment methods across channels

- Improved security: Better fraud detection with fewer false positives

Economic Impact

The broader economic implications include:

- Financial inclusion: Potentially lower costs could extend digital payment access

- Business efficiency: Reduced payment friction could improve overall business efficiency and economic productivity

- Innovation ecosystem: API-first approach could spark new fintech innovations leveraging the payment infrastructure

4. Strategic Considerations for Singapore Implementation

For successful adoption in Singapore, financial institutions should consider:

- Integration with existing Singapore payment rails: Ensuring compatibility with FAST, PayNow, NETS, and other local systems

- Cross-border capabilities: Leveraging Singapore’s position as a financial hub to enable seamless ASEAN and global payments

- Cultural customisation: Adapting the solution to meet local business practices and consumer preferences

The Money Movement Hub represents a significant development in payment infrastructure that could enhance Singapore’s already advanced financial ecosystem while addressing remaining friction points in cross-border and business payments.

Analysis: Impact of FIS Money Movement Hub on Digital Payments in Singapore

Current State of Singapore’s Digital Payments Landscape

Singapore has already established itself as one of Asia’s most advanced digital payment ecosystems with:

- High digital payment adoption: 85% of Singaporeans regularly use digital payment methods

- Advanced infrastructure: FAST, PayNow, SGQR, and NETS form a robust foundation

- Strong government support: MAS and government initiatives like the Singapore Payment Roadmap

- Diverse ecosystem: Mix of traditional banks, neobanks (Grab, Sea), and international players

Potential Transformative Impacts

1. Payment System Integration and Interoperability

The FIS Money Movement Hub could significantly enhance Singapore’s payment integration:

- Unified API approach: Could reduce the current fragmentation between PayNow, FAST, NETS, and card networks

- Cross-scheme reconciliation: Simplifies the back-end for financial institutions managing multiple payment schemes

- Holistic transaction visibility: Provides institutions consolidated view of payment flows across channels

2. Real-Time Payment Enhancement

Singapore’s FAST system would potentially see improvement through:

- Enhanced orchestration: Better routing and management of real-time payment flows

- Fraud prevention in real-time: More sophisticated real-time monitoring without adding latency

- 24/7 operational resilience: Cloud-native architecture supporting actual always-on operations

- Volume scaling: Better handling of peak transaction periods (e.g., holiday shopping, CNY)

3. Cross-Border Payment Evolution

For Singapore as a regional hub, the solution could drive cross-border advancement:

- ASEAN payment corridor enhancement: Potentially streamlines payments within ASEAN through a hub-based approach

- Integration with Project Ubin: Could complement MAS blockchain-based cross-border payment initiatives

- Multi-currency optimisation: Improved handling of SGD alongside regional currencies

- Settlement efficiency: Reduced friction in cross-border settlement processes

4. SME Digital Payment Empowerment

Singapore’s SME segment would likely benefit significantly:

- Lower integration barriers: Simplified API connections make digital payment adoption more accessible

- Reduced implementation costs: “Pay-as-you-grow” model aligns with SME resource constraints

- Multiple payment type support: Allows SMES to offer more payment options with a single integration

- Cash flow improvements: Faster settlement and better visibility improve working capital management

5. Financial Inclusion and Digital Banking

The solution could support broader financial inclusion initiatives:

- Digital banking acceleration: Support for Singapore’s new digital bank licensees (Grab-Singtel, Sea Group)

- Lower cost structure: Potentially reduces transaction costs, making digital payments more accessible

- Alternative payment method support: Better integration of non-traditional payment methods

- Reduced technical barriers: Simplifies payment infrastructure for smaller players

Industry-Specific Impacts

E-commerce and Retail

- Checkout optimisation: Reduced payment friction at checkout, improving conversion rates

- Refund process improvement: Faster, more reliable refund processing

- Omnichannel integration: Better connection between online and offline payment experiences

- Marketplace settlement: Enhanced capabilities for complex marketplace money movement

Financial Services

- Wealth management: Improved payment infrastructure for investment movements

- Insurance: Faster claims disbursement and premium collection

- Lending: Enhanced loan disbursement and repayment processes

- Remittance providers: Potential disruption to traditional remittance models

Platform Businesses

- Super-apps: Enhanced payment capabilities for Singapore’s growing super-app ecosystem

- Gig economy platforms: More efficient worker payments and customer collections

- Subscription services: Better handling of recurring payments and failed payment recovery

Challenges and Considerations

Regulatory Alignment

- PSA compliance: Any implementation must comply with Singapore’s Payment Services Act

- Data sovereignty: Managing cloud-native implementation with Singapore’s data governance requirements

- Consumer protection: Ensuring robust consumer protection while enhancing payment speed

Market Dynamics

- Incumbent resistance: Potential pushback from established payment providers

- Integration complexity: Despite a unified API, legacy systems may still present challenges

- ROI justification: Financial institutions need a clear business case for implementation

Consumer Behavior

- Education needs: Consumer awareness of new payment capabilities

- Trust building: Ensuring consumer confidence in new payment infrastructure

- User experience design: Frontend experience must match backend capabilities

Strategic Recommendations for Singapore Payment Ecosystem

- Public-private collaboration: MAS engagement with FIS to ensure alignment with the Singapore Payment Roadmap

- Industry standardisation: Develop common standards for implementation across Singapore’s financial sector

- Cross-border coordination: Leverage ASEAN connections to expand regional payment capabilities

- SME enablement program: Targeted initiative to help SMES benefit from enhanced infrastructure

- Consumer education campaign: Coordinated effort to build awareness of new payment capabilities

The FIS Money Movement Hub represents a significant opportunity to further advance Singapore’s already sophisticated digital payment ecosystem, particularly in addressing remaining friction points in cross-border transactions, enterprise payments, and system interoperability. Its success will depend on thoughtful implementation that respects Singapore’s unique regulatory environment while leveraging its position as a regional financial hub.

Industry Approach to AI:

- Initial excitement about AI has evolved into a more cautious approach

- Recognizes that AI isn’t a universal solution but needs targeted implementation

- Many clients lack clear AI strategies or struggle with integration

Endava’s Philosophy:

- Promotes thoughtful, careful implementation of AI technologies

- Investing in understanding AI while

- maintaining caution

- Develops practical tools to simplify tasks like coding

- Learns from real-world applications

AI’s Potential in Banking:

- Most significant potential is in fraud management, shifting from reactive to predictive approaches

- AI can process large data sets to recognize patterns and predict potential fraud

- Human oversight remains essential for proper decision-making

Broader Context:

- Compares AI’s potential impact to the early internet, suggesting transformative effects across industries

AI in Global Payments: Key Trends Analysis

Based on the article about Matt Williamson’s insights and broader industry knowledge, here’s an analysis of AI trends in global payments:

Current Implementation Stage

- The industry has moved from initial AI hype to a more measured, practical approach

- Many financial institutions are in an exploratory phase rather than full implementation

- Organizations are struggling with integration challenges despite investing in AI technologies

Primary Use Cases

- Fraud Detection & Prevention:

- Shifting from reactive to predictive fraud management

- Pattern recognition across large datasets to identify potential threats

- Real-time analysis of transactions for immediate intervention

- Process Automation:

- Streamlining backend operations like reconciliation and settlements

- Reducing manual processing in compliance workflows

- Automating coding and development processes

- Customer Experience:

- Personalized payment experiences and recommendations

- Conversational interfaces for customer service

- Improved authentication methods balancing security and convenience

Implementation Challenges

- Integration with legacy banking infrastructure

- Regulatory compliance and risk management

- Need for human oversight to ensure appropriate decision-making

- Difficulty measuring ROI on AI investments

Strategic Approaches

- More organizations adopting cautious, targeted implementation strategies

- Focus on specific business problems rather than broad AI adoption

- Growing emphasis on partner ecosystems rather than building everything in-house

- Testing and learning from real-world applications

Future Outlook

- Potential for transformative impact similar to the internet revolution

- Increasing focus on explainable AI for regulatory compliance

- Greater integration of AI across the payment lifecycle

- Emergence of new business models powered by AI capabilities

Applying AI in Singapore’s Payment Ecosystem

Singapore offers unique opportunities for AI application in payments due to its advanced financial infrastructure and progressive regulatory environment. Here’s how AI trends in global payments specifically apply to Singapore:

Singapore’s Advantages for AI in Payments

- Strong Digital Infrastructure:

- High smartphone penetration (approximately 92%)

- Advanced 5G network deployment

- Tech-savvy population comfortable with digital payments

- Progressive Regulatory Framework:

- MAS (Monetary Authority of Singapore) supports fintech innovation through regulatory sandboxes

- AI Governance Framework provides ethical guidelines for AI deployment

- Singapore’s Fairness, Ethics, Accountability and Transparency (FEAT) principles for AI

- Government Initiatives:

- Smart Nation initiative promoting digital transformation

- National AI Strategy with a significant focus on financial services

- Public-private partnerships supporting AI development

Specific AI Applications in Singapore’s Payment Landscape

- Fraud Prevention:

- Real-time transaction monitoring leveraging Singapore’s centralized data infrastructure

- Multi-layered authentication systems using behavioral biometrics

- Cross-border transaction analysis through Singapore’s position as a regional hub

- Integration with National Systems:

- Enhancement of PayNow and SGQR unified payment systems using AI

- Potential AI augmentation of Singapore’s national digital identity system (SingPass)

- Optimization of FAST (Fast And Secure Transfers) system

- Customer Experience Innovation:

- Multilingual AI assistants catering to Singapore’s diverse population

- Personalized recommendations based on spending patterns in local context

- Seamless integration between payment methods and loyalty programs

Implementation Strategies for the Singapore Market

- Partnership Approach:

- Collaborate with local banks (DBS, OCBC, UOB) for distribution and trust

- Engage with government initiatives like IMDA’s AI and Data programs

- Join industry consortiums such as the Singapore Fintech Association

- Regulatory Compliance Focus:

- Ensure adherence to MAS guidelines on technology risk management

- Implement PDPA (Personal Data Protection Act) compliant data handling

- Develop explainable AI models that satisfy local regulatory requirements

- Localization Considerations:

- Account for Singapore’s unique multi-cultural context in AI training

- Address local payment preferences and behaviors

- Consider regional expansion opportunities using Singapore as a hub

AI Implementation for Banks in Singapore’s Payment Ecosystem

Singapore’s banks are uniquely positioned to leverage AI in payments due to their technological readiness and strong regulatory support. Here’s how banks in Singapore can effectively implement AI payment solutions:

Strategic Implementation Approach

- Phased Deployment Strategy:

- Begin with targeted AI use cases that address specific pain points

- Establish clear metrics for measuring success and ROI

- Scale successful implementations across other banking functions

- Create a centralized AI governance structure for consistency

- Integration with Existing Systems:

- Identify key integration points with core banking platforms

- Leverage APIs to enable AI functionality without significant system overhauls

- Ensure compatibility with national payment infrastructure (FAST, PayNow)

- Address data silos that could limit AI effectiveness

- Skills Development:

- Build internal AI competencies through training and hiring

- Establish centers of excellence for AI implementation

- Partner with local universities for talent pipeline development

- Create cross-functional teams combining banking and AI expertise

Priority AI Applications for Singapore Banks

- Customer-Facing Solutions:

- Intelligent chatbots supporting multiple languages (English, Mandarin, Malay, Tamil)

- Personalized financial insights and spending analysis

- Voice-enabled payment authorizations

- Real-time transaction categorization and budget recommendations

- Risk Management & Security:

- Advanced fraud detection using behavioral analytics

- Credit risk assessment incorporating alternative data sources

- Anti-money laundering pattern detection

- Enhanced customer authentication combining biometrics and behavior

- Operational Efficiency:

- Automated payment reconciliation and exception handling

- Intelligent document processing for payment-related forms

- Smart routing of payments for cost optimization

- Predictive maintenance of payment infrastructure

Regulatory Considerations

- MAS Compliance Strategy:

- Implement “explainable AI” approaches that satisfy MAS requirements

- Maintain detailed model risk management documentation

- Conduct regular bias testing to ensure fair outcomes

- Establish clear human oversight mechanisms for AI decisions

- Data Governance:

- Create comprehensive data management policies compliant with PDPA

- Implement data minimization and purpose limitation principles

- Ensure appropriate consent mechanisms for AI data processing

- Establish robust data security protocols

Competitive Differentiation Opportunities

- SME Banking Innovation:

- AI-powered cash flow forecasting for small businesses

- Automated invoice processing and payment recommendation

- Integration with accounting software for seamless payment operations

- Intelligent credit decision-making for faster financing

- Cross-Border Payment Enhancement:

- AI-driven optimization of international payment routing

- Real-time currency conversion rate optimization

- Enhanced compliance screening for international transactions

- Predictive analytics for foreign exchange management

Payment Fraud Landscape in Singapore:

- 49% of respondents have experienced payment fraud

- 33% of consumers feel less safe shopping compared to ten years ago

- 52% of businesses reported an increase in fraud attempts in the past year

Top Types of Payment Fraud in 2025:

- Phishing

- Social engineering attacks to steal personal information

- Increasingly sophisticated, using synthetic identities

- In 2024, victims lost S$59.4 million to phishing scams

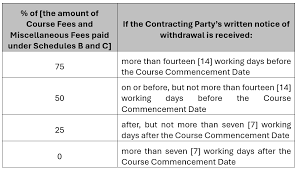

- Refund Fraud / Policy Abuse

- Exploiting business return, refund, and promotion policies

- It can be conducted by professional fraudsters and every day consumers

- Experienced by nearly half of online merchants worldwide

- Card Testing

- Testing stolen cards to verify their active status

- Active cards can be sold at higher prices on the dark web

- Friendly Fraud / First-Party Fraud

- Consumers making purchases and then requesting chargebacks

- Accounts for up to 70% of credit card fraud

- Costs the industry over US$132 billion annually

Business Response to Fraud:

- 66% considering partnerships with providers offering chargeback liability guarantees

- 62% using AI to prevent fraudulent transactions

- 60% recognize fraud increases during peak shopping periods

Additional Payment Trends:

- 31% of Singaporeans don’t carry wallets

- 48% used mobile wallets in the past year

- QR code payments grew 31% year-on-year

- 51% shopped via social media platforms

The report highlights the growing sophistication of payment fraud and the need for robust security measures in Singapore’s digital payment ecosystem.

Payment Fraud Versions and Prevention Strategies:

- Phishing Characteristics:

- Sophisticated social engineering attacks

- Aim to steal Personal Identifiable Information (PII)

- Advanced tactics include creating synthetic identities

- In 2024, caused S$59.4 million in losses in Singapore

Prevention Methods:

- Implement robust second-factor authentication (2FA)

- Educate consumers about identifying suspicious communications

- Use AI-powered fraud detection systems

- Develop advanced identity verification technologies

- Regularly update security protocols to counter emerging tactics

- Refund Fraud / Policy Abuse Characteristics:

- Exploiting business return and refund policies

- Conducted by both professional fraudsters and opportunistic consumers

- Difficult to detect

- Affects nearly 50% of online merchants globally

Prevention Methods:

- Develop clear and strict refund policies.

- Implement sophisticated tracking systems for returns

- Use AI to identify suspicious return patterns

- Set reasonable time limits for returns

- Create detailed documentation requirements for refunds

- Monitor customer behaviour and flag unusual return activities

- Card Testing Characteristics:

- Fraudsters test stolen credit card details

- Aim to verify card validity

- Successful cards sold at higher prices on the dark web

Prevention Methods:

- Use advanced payment gateway fraud detection

- Implement real-time transaction monitoring

- Utilize machine learning algorithms to detect unusual transaction patterns

- Set up velocity checks to limit multiple quick transactions

- Use device fingerprinting technology

- Implement CAPTCHA and additional verification for suspicious transactions

- Friendly Fraud / First-Party Fraud Characteristics:

- Consumers make legitimate purchases, then request chargebacks

- Accounts for 70% of credit card fraud

- Costs the industry over US$132 billion annually

Prevention Methods:

- Maintain detailed transaction and delivery records

- Implement clear communication channels with customers

- Use chargeback management software

- Provide excellent customer service to resolve issues proactively

- Develop comprehensive documentation for each transaction

- Create transparent return and refund policies

Advanced Prevention Strategies:

- Technology Integration

- 62% of businesses now use AI for fraud prevention

- Leverage machine learning and predictive analytics

- Implement real-time fraud detection systems

- Use blockchain for secure, transparent transactions

- Authentication Techniques

- Encourage second-factor authentication (2fa)

- Biometric verification

- Tokenisation of payment information

- Continuous authentication during transactions

- Consumer Education

- Raise awareness about fraud tactics

- Provide guidelines for safe online shopping

- Encourage vigilance and reporting of suspicious activities

- Collaborative Approaches

- 66% of businesses are considering partnerships with secure payment providers

- Share fraud intelligence across industries

- Develop cross-platform fraud detection networks

The evolving landscape of payment fraud requires a multi-layered, adaptive approach. Businesses must continuously update their prevention strategies, leverage advanced technologies, and maintain a proactive stance against emerging fraud tactics.

Maxthon

Maxthon has embarked on an ambitious journey to significantly enhance the security of web applications, driven by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—whether it involves sharing passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, knowing that their information is continuously safeguarded against emerging threats in cyberspace.