Core Mechanisms Protecting Customer Funds

Primary Protection: Banker’s Blanket Bond

The article clearly states that, contrary to popular belief, FDIC insurance (which is US-specific) doesn’t cover bank robberies. Instead, banks rely on a “banker’s blanket bond” – comprehensive insurance that protects banks from various losses, including robberies, employee theft, fires, floods, and other disasters.

This means that when physical cash is stolen during a robbery:

- The bank absorbs the loss

- Customer account balances remain intact

- Customers don’t need to take any action

Security Measures Preventing Loss

Banks employ multiple layers of security to minimise robbery losses:

- Sophisticated surveillance systems to identify perpetrators

- Exploding dye packs attached to cash that activate when removed from the bank premises

- Staff training on robbery protocols

- Alarm systems and other deterrents

- Limited cash kept in the teller drawers

Singapore-Specific Considerations

While the article doesn’t mention Singapore directly, here’s how Singapore’s banking system would handle robberies:

Deposit Insurance in Singapore

Unlike the US FDIC, Singapore has the Singapore Deposit Insurance Corporation (SDIC), which protects deposits up to S$75,000 per depositor per member bank. Similar to the US system, this protection is for bank failure, not robbery.

Singapore’s Banking Security Context

Singapore has several advantages regarding bank security:

- Extremely low robbery rates: Singapore has one of the lowest crime rates globally

- Stringent banking regulations: The Monetary Authority of Singapore (MAS) enforces strict security standards

- Advanced surveillance: Singapore banks have state-of-the-art security systems

- Cashless trend: Singapore’s push toward cashless transactions reduces physical cash vulnerability

Notable Singapore Bank Robbery History

Physical bank robberies are exceptionally rare in Singapore:

- The 2016 Standard Chartered Bank robbery was Singapore’s first in over a decade

- The perpetrator was caught within 24 hours

- Customer funds remained completely protected

The Shifting Nature of Bank Theft Risk

Physical vs. Digital Threats

The article correctly identifies that the absolute risk has shifted from physical robberies to cybersecurity threats. As Angelo Crocco stated, “The real battlefield is cyber, not cash drawers.”

For Singapore, this is particularly relevant as the nation:

- Has one of the highest digital banking adoption rates globally

- It is a significant financial hub with a sophisticated cybersecurity infrastructure

- Faces targeted attacks due to its wealthy financial ecosystem

Detailed Solutions for Protection

For Banks

- Enhanced Physical Security

- Advanced biometric access controls

- AI-powered surveillance systems

- Cash recyclers that limit exposed currency

- Protective barriers between customers and tellers

- Cybersecurity Infrastructure

- End-to-end encryption for all transactions

- Multi-factor authentication requirements

- Regular penetration testing

- Advanced threat detection systems

- Staff Preparedness

- Regular security drills and training

- Clear protocols for robbery situations

- Psychological support for affected staff

- Reward systems for security compliance

- Insurance Coverage

- Comprehensive banker’s blanket bonds

- Specific cyber insurance policies

- Clearly defined coverage terms

- Regular policy reviews and updates

For Customers

- Digital Protection

- Enable all available security features on banking apps

- Use strong, unique passwords for financial accounts

- Enable two-factor authentication

- Monitor accounts regularly for suspicious activity

- Personal Safety During Robberies

- Comply with robber demands (safety first)

- Avoid confrontation or heroics

- Be observant but discreet

- Cooperate with the authorities afterwards

- Financial Management

- Maintain accounts at multiple institutions when managing large sums

- Utilise bank safe deposit boxes for valuables rather than keeping them at home

- Keep digital records of essential transactions

- Understand your bank’s security protocols

Conclusion

The fear of losing money due to bank robberies is largely unfounded in modern banking systems. The banker’s blanket bond provides comprehensive protection that ensures customer account balances remain unaffected regardless of physical theft. In Singapore specifically, with its advanced security infrastructure and strong regulatory environment, the risk of both physical robberies and associated customer losses is minimal.

The true area of concern has shifted to cybersecurity threats, which require different protective measures from both banks and customers. By understanding these protections and taking appropriate digital security precautions, customers can feel confident that their funds remain secure, even in the unlikely event of a bank robbery.

Banking Scams in Singapore: Analysis and Countermeasures

Current Landscape of Banking Scams in Singapore

Despite Singapore’s robust banking infrastructure and low physical robbery rates, the nation faces a significant and growing banking scam problem:

Scale and Impact

- Alarming Growth Trajectory

- Scam cases increased dramatically in recent years, with over S$660 million lost to scams in 2023 alone

- Banking-related scams represent the largest category of financial fraud in Singapore

- Average loss per victim has increased year-over-year, with some victims losing life savings

- Prevalent Scam Types

- Phishing scams: Fake bank websites/emails requesting verification of account details

- SMS impersonation: Messages appearing to be from banks requesting urgent action

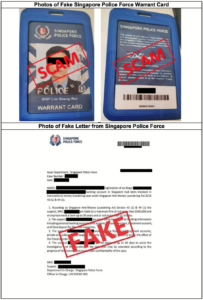

- Phone scams: Callers impersonating bank staff to extract information

- Investment scams: Fraudulent investment platforms promising high returns

- Malware attacks: Banking trojans targeting mobile banking applications

- Job scams: Fraudulent employment offers requiring victims to perform “money transfers”

- Vulnerability Factors

- High digital banking adoption rate (over 94% of Singaporeans use digital banking)

- Affluent population making Singapore an attractive target

- Trust in institutions making people susceptible to authority-based scams

- Language barriers affecting some residents’ ability to detect suspicious communications

Why Singapore Faces Unique Challenges

Cultural and Socioeconomic Factors

- Trust in Institutions

- Singapore’s reputation for safety and institutional reliability creates a false sense of security

- Many victims believe communications claiming to be from banks without sufficient verification

- “Kiasu” Culture

- Fear of missing out on opportunities makes investment scams particularly effective

- Desire to avoid problems makes threatening bank scams more effective

- Digital Transformation Speed

- Rapid adoption of digital banking outpaced digital literacy and security awareness

- Older Singaporeans particularly vulnerable during forced digital transition during COVID-19

Regulatory Environment

- Cross-Border Jurisdiction Issues

- Many scams originate outside Singapore, complicating investigation and prosecution

- Funds often quickly transferred across multiple jurisdictions

- Limited ability to recover funds once transferred overseas

- Adaptation Gap

- Regulatory frameworks struggling to keep pace with evolving scam techniques

- Historic focus on physical banking security rather than digital threats

Comprehensive Solutions Framework

Regulatory Enhancements

- Delayed Transaction Processing

- Implementation of mandatory cooling-off periods for large or unusual transfers

- “Delay and verify” protocols requiring secondary confirmation for high-risk transactions

- Financial Institution Liability

- Expanded bank responsibility for scam losses where reasonable security was not provided

- The recent MAS framework requiring banks to share responsibility for losses in certain scam scenarios

- Enhanced KYC (Know Your Customer)

- Stricter verification processes for new payees and cross-border transactions

- AI-based behavioral analysis to identify unusual transaction patterns

Technological Solutions

- Advanced Authentication

- Biometric verification requirements for high-risk transactions

- Device binding to prevent unauthorized access from new devices

- AI-powered fraud detection systems that analyze transaction patterns

- Scam Detection Infrastructure

- Centralized scam detection system across financial institutions

- Real-time database of known scam accounts and techniques

- Integration with international fraud prevention networks

- Secure Communication Channels

- Verified communication pathways between banks and customers

- Clear identification protocols for legitimate bank communications

- In-app notifications rather than SMS/email for sensitive communications

Educational Initiatives

- Targeted Awareness Programs

- Customised education for vulnerable demographics (elderly, new migrants)

- Regular updates on emerging scam techniques

- Integration of scam awareness into school curricula

- Public-Private Partnerships

- Collaboration between banks, telecommunications companies, and the government

- Joint funding for anti-scam technology and awareness campaigns

- Shared intelligence on emerging threats

- Peer Support Networks

- Community-based education where scam survivors share their experiences

- Neighbourhood watch programs focused on financial crimes

- Support groups for scam victims

Crisis Response

- Rapid Response Teams

- Specialised police units dedicated to scam investigation

- 24/7 hotlines for reporting suspicious activity

- Fast-tracking of cross-border investigations

- Recovery Mechanisms

- Fund recovery protocols to freeze and return stolen funds, where possible

- Insurance products specifically covering scam losses

- Victim support services, including counselling and financial assistance

Implementation Strategies

Immediate Actions

- Transaction Safeguards

- Mandatory confirmation callbacks for first-time large transfers

- Automatic flagging of transactions to new recipients or high-risk countries

- Temporary limits on digital transaction amounts for new accounts

- Communication Protocols

- Standardised bank communication templates that customers can verify

- Clear guidance on information banks will never be requested

- Dedicated secure channels for sensitive communications

Medium-Term Strategies

- Technological Integration

- Unified banking security framework across all Singapore financial institutions

- Advanced AI monitoring systems analyzing transaction patterns

- Blockchain-based verification for high-value transactions

- Legislative Framework

- Updated digital crime laws addressing modern scam techniques

- Increased penalties for scam facilitators (money mules, account providers)

- Expanded cross-border enforcement agreements

Long-Term Vision

- Digital Resilience

- Banking system designed with scam prevention as a primary architecture consideration

- Continuous monitoring and adaptation to emerging threats

- Self-healing systems that can identify and block new scam patterns

- Cultural Shift

- Moving from reactive to proactive scam prevention

- Creating a society where verification is normalised rather than considered rude

- Establishing Singapore as a global leader in financial crime prevention

Conclusion

While Singapore has exceptionally low rates of physical bank robberies, the nation faces a serious and growing threat from sophisticated banking scams. These scams represent a significant evolution in financial crime, targeting the digital infrastructure that makes Singapore’s banking system efficient and convenient.

Addressing this challenge requires a multi-faceted approach combining regulatory reform, technological innovation, and comprehensive education. By implementing the recommendations outlined above, Singapore can leverage its existing strengths in governance, technology adoption, and social cohesion to dramatically reduce the effectiveness of banking scams while preserving the convenience of its digital banking ecosystem.

Thus, the protection of customer funds in Singapore extends far beyond the physical security measures traditionally associated with bank robberies, focusing instead on the complex and evolving landscape of digital financial crime.

In an increasingly interconnected and digital world, the threat of scams has become a pervasive challenge, demanding innovative and collaborative solutions. Recognizing this urgent need, the Singapore Police Force’s (SPF) Anti-Scam Centre (ASC) has forged a powerful alliance with four major banks – DBS Bank, OCBC Bank, Standard Chartered Bank, and UOB Bank – resulting in the successful disruption of over 900 ongoing scams. This concerted effort, spanning the beginning of 2025, targeted a diverse range of fraudulent activities, including enticing job scams, high-pressure investment scams, emotionally manipulative fake-friend call scams, and deceptive e-commerce scams. The tangible outcome of this partnership is the prevention of significant financial losses, highlighting the effectiveness of proactive collaboration in the fight against cybercrime.

A key element underpinning the success of this partnership lies in the strategic implementation of Robotic Process Automation (RPA) technology. This innovative approach has fundamentally altered the speed and efficiency of information sharing between the ASC and the participating banks. RPA allows for the rapid and automated exchange of critical data related to potentially fraudulent transactions and suspicious activities. This, in turn, enables the swift identification of potential scam victims, providing a crucial window of opportunity for timely intervention and the prevention of further financial losses. The real-time intelligence provided by RPA empowers both the ASC and the banks to act decisively and proactively, staying one step ahead of the ever-evolving tactics of scammers.

Between January 1, 2025, and February 28, 2025, the collaborative efforts of the ASC and its banking partners manifested in a proactive communication strategy. Over 9,000 targeted SMS messages were dispatched to more than 7,000 bank customers who had been identified as potential scam victims. These messages served as crucial warnings, alerting individuals to suspicious activity and prompting them to take immediate action to protect their accounts. This proactive measure proved remarkably effective, averting over $58 million in potential losses. These were funds that would have otherwise been siphoned off by malicious actors, underscoring the significant impact of the collaborative and technology-driven approach. The sheer magnitude of the averted losses serves as a stark reminder of the financial devastation that scams can inflict on individuals and the importance of preventative measures.

Beyond the direct intervention efforts, the Singapore Police Force recognizes the critical role of public awareness and education in preventing scams. The SPF urges the public to adopt a proactive approach to scam prevention by remembering to “ACT” against scams, an easily memorable acronym that encapsulates key preventive steps.

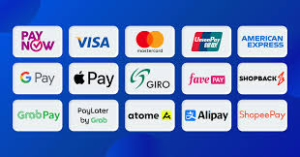

ADD: This component emphasizes the importance of enhancing digital security. Individuals are encouraged to bolster their online defenses by adding security features such as the ScamShield application, which helps to identify and block scam calls and messages. Enabling two-factor authentication (2FA) for personal accounts, including bank accounts, social media profiles, and Singpass accounts, adds an extra layer of protection, making it significantly more difficult for scammers to gain unauthorized access. Furthermore, setting transaction limits for internet banking, including PayNow, can help limit potential losses in the event that an account is compromised. These measures act as a digital shield, minimizing vulnerability to scam tactics.

CHECK: Vigilance is paramount in the fight against scams. This component encourages individuals to be observant and carefully check for potential signs of a scam. This includes asking probing questions, verifying requests for personal information or money transfers, and meticulously confirming the legitimacy of online listings and reviews. The SPF emphasizes the importance of pausing and checking before acting impulsively on any request or offer. This critical pause allows individuals to assess the situation rationally and identify potential red flags. A key principle to remember is that if an offer seems too good to be true, it likely is a scam. This healthy skepticism can be a powerful tool in avoiding falling victim to fraudulent schemes.

TELL: Reporting scam encounters is crucial not only for personal protection but also for contributing to the broader fight against cybercrime. This component encourages individuals to report scam encounters to the authorities, providing valuable information that can help to track down and apprehend scammers. Reporting scams to the bank, ScamShield, or by filing a police report allows law enforcement to investigate and disrupt ongoing scam operations. Additionally, sharing information about ongoing scams and preventive steps with friends and family helps to raise awareness and protect others from falling victim to similar schemes. Reporting fraudulent pages and accounts to the relevant platforms helps to remove them from circulation, preventing further harm. By sharing information and reporting suspicious activity, individuals can actively contribute to a safer online environment.

The Singapore Police Force’s commitment to combating scams extends beyond reactive measures and focuses on fostering a culture of awareness and proactive prevention. By empowering the public with the knowledge and tools to “ACT” against scams, the SPF aims to create a more resilient and secure society.

For more information on scams, individuals are encouraged to visit www.scamshield.gov.sg or call the ScamShield Helpline at 1799. Anyone with information on scams can call the Police Hotline at 1800-255-0000 or submit information online at www.police.gov.sg/iwitness. All information will be kept strictly confidential, ensuring that individuals can report suspicious activity without fear of reprisal.

The successful collaboration between the Singapore Police Force, the Anti-Scam Centre, and partner banks serves as a powerful example of how proactive partnerships, technological innovation, and public awareness can effectively combat the growing threat of scams in the digital age. By remaining vigilant, informed, and proactive, individuals and organizations alike can contribute to creating a safer and more secure online environment for all.

Analysis of Singapore’s Scam Prevention Approach

Government and Institutional Measures

Based on the article, Singapore has implemented several institutional approaches to combat scams:

- Monetary Authority of Singapore (MAS) Initiatives:

- Working directly with banks to enhance digital banking security

- Implementing new protective measures like eliminating clickable links in official emails/SMSes

- Requiring a minimum 12-hour delay before activating new soft tokens on mobile devices

- Providing specific guidance to banking customers on safe practices

- Police Force Involvement:

- The Singapore Police Force (SPF) actively tracks and reports on scam statistics

- Conduct investigations of scammers and money mules (as evidenced by the case involving 170 men and 89 women)

- Shares examples and screenshots of scams to raise public awareness

- Banking Sector Protections (specifically highlighted for DBS):

- Stopping non-essential SMSes with links

- Sending only essential communications like security notifications and OTP authentication

- Implementing default transaction notification thresholds (S$100)

- Providing in-app security features like card locking and customizable spending limits

- Offering digital tokens with enhanced encryption

Effectiveness Analysis

The approach appears to be multi-faceted, combining:

- Technical barriers: Implementing security features that make scamming more difficult

- Public education: Raising awareness about standard scam techniques

- Enforcement: Actively investigating scam cases

However, the rising scam statistics mentioned (16% increase in cases, with amounts cheated rising from S$63.5M to S$168M) suggest these measures may be struggling to keep pace with evolving scam techniques.

Strengths of Singapore’s Approach

- Coordinated response: Collaboration between regulatory bodies (MAS), law enforcement (SPF), and financial institutions

- Customer-focused solutions: Tools that give customers more control over their security

- Practical implementation: Specific, actionable measures rather than just general advice

Potential Gaps and Recommendations

- Technology gap: The article doesn’t mention advanced detection technologies like AI for identifying unusual transaction patterns

- Demographic considerations: No specific mention of tailored approaches for vulnerable groups like seniors

- Private sector cooperation: Limited discussion of how businesses beyond banks are involved in prevention

- International coordination: No mention of cooperation with other countries to address overseas-based scammers

Singapore’s approach appears to be comprehensive but could potentially benefit from more advanced technological solutions and broader cooperation across sectors and borders to address the evolving nature of scams.

Social Engineering: Anatomy of Manipulation and Defense

Social Engineering Techniques

Psychological Manipulation Strategies

- Authority Impersonation

- Scammers pose as official representatives (e.g., bank officers, government officials)

- Exploit victims’ respect for authority and tendency to comply with perceived authoritative figures.

- Use official-sounding language, titles, and fabricated credentials.

- Fear and Urgency Tactics

- Create artificial time pressures to prevent critical thinking

- Trigger emotional responses like panic or anxiety

- Common threats include:

- Legal consequences

- Financial penalties

- Account suspension

- Potential criminal investigations

- Trust Building and Rapport

- Develop a seemingly genuine conversational flow

- Use personal details to appear credible

- Gradually escalate requests, starting with minor, seemingly innocuous asks

- Exploit human tendency to be helpful and avoid confrontation

- Information Harvesting

- Collect fragmentary personal information from multiple sources

- Use social media, public databases, and previous data breaches

- Craft highly personalized, convincing narratives

Technical Manipulation Methods

- Phishing Techniques

- Spoofed communication channels

- Lookalike websites and email addresses

- Malicious links and attachments

- Screen sharing and remote access exploitation

- Multi-Stage Scam Progression

- Complex narratives involving multiple fake personas

- Gradual erosion of victim’s skepticism

- Continuous redirection and technical jargon

Prevention Strategies

Personal Awareness and Education

- Critical Thinking Development

- Always verify unsolicited communications independently

- Use official contact methods from verified sources

- Never click links or download attachments from unknown sources

- Recognize and resist emotional manipulation

- Communication Red Flags

- Unsolicited contact requesting personal information

- Pressure to act immediately

- Requests for financial transfers

- Communication via unofficial channels

- Threats or aggressive language

Technical Protective Measures

- Digital Security Practices

- Use multi-factor authentication

- Regularly update software and security systems

- Install reputable antivirus and anti-malware solutions

- Use dedicated communication and banking apps

- Enable transaction notifications

- Information Protection

- Minimize public personal information sharing

- Use privacy settings on social platforms

- Create complex, unique passwords

- Regularly monitor financial statements

- Use virtual credit cards for online transactions

Institutional and Technological Interventions

- Technological Defenses

- Implement AI-driven fraud detection systems

- Develop advanced caller ID and communication verification tools

- Create comprehensive scam reporting mechanisms

- Educational Initiatives

- Regular public awareness campaigns

- School and workplace training programs

- Clear, accessible resources on emerging scam techniques

- Collaborative efforts between government, tech companies, and financial institutions

Psychological Resilience

- Emotional Intelligence

- Recognize personal emotional triggers

- Practice calm, methodical responses to unexpected communications

- Develop healthy skepticism without becoming paranoid

- Community Awareness

- Share scam experiences

- Supporting vulnerable community members

- Create support networks for scam victims

Emerging Trends

- Increasing sophistication of AI in social engineering

- Cross-platform information integration

- More personalized, contextually relevant scam attempts

Conclusion

Social engineering exploits fundamental human psychological vulnerabilities. Comprehensive defense requires a multi-layered approach combining technological solutions, personal awareness, and continuous education.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

Maxthon private browser for online privacyThis meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.