Lu Huangbin, a 61-year-old Chinese national, was sentenced on May 6, 2025, to 4½ years in jail and fined $6,000 for his role as CEO of A&A Blockchain Technology Innovation. The company claimed to have 300,000 physical mining machines generating revenue through cryptocurrency mining, but this was a hoax – the company was actually running a Ponzi scheme. According to charges, the company induced 12 investors to part with more than $1.8 million, resulting in losses totalling about $1.1 million. Lu was the last of four individuals involved in the case to be sentenced:

- Yang Bin (Dutch national, 61) – company chairman and mastermind – received 6 years’ jail and a $16,000 fine

- Wang Xinghong (Chinese national, 40) – chief technological officer – received 5 years’ jail.

- Chen Wei (Chinese national, 43), director and Yang’s personal assistant, received four years in jail and a $6,000 fine.

The scheme promised investors a fixed daily return of 0.5% on investments, supposedly from cryptocurrency mining. Between May 2021 and February 2022, the company attracted over 700 investors in Singapore, with investments totalling around $6.7 million. Lu’s family had invested around US$57,000 into the scheme and received approximately US$136,000 in returns. Lu was working without a valid work pass in Singapore when serving as the company’s CEO.

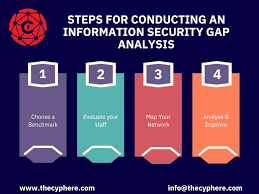

In-Depth Analysis of the A&A Blockchain Technology Innovation Crypto Scam

Core Elements of the Scam

This case represents a classic cryptocurrency Ponzi scheme with several sophisticated elements:

1. False Business Premise

- Claimed Asset Base: The company falsely claimed ownership of 300,000 physical mining machines, creating an illusion of substantial infrastructure

- Fabricated Partnership: They invented a business relationship with “Yunnan Shun Ai Yun Xun Investment Holdings” for credibility

- Technical Deception: Leveraged complex cryptocurrency concepts that many investors might not fully understand

2. Ponzi Mechanism

- Unsustainable Returns: Promised fixed 0.5% daily returns (roughly 182.5% annually), an unrealistic rate that should have raised red flags

- Payment Structure: Early investors received payouts from new investor contributions, creating false confidence in the scheme’s legitimacy

- No Actual Value Creation: Despite claims of cryptocurrency mining, no legitimate business activity was generating revenue

3. Organisational Structure

- Hierarchical Leadership: Four central figures held formal corporate titles to create legitimacy:

- Yang Bin (Chairman) – The mastermind

- Lu Huangbin (CEO) – “Key cog” in operations

- Wang Xinghong (CTO) – Provided technical credibility

- Chen Wei (Director) – Also served as Yang’s personal assistant

- Corporate Legitimacy: The company was formally incorporated on April 20, 2021, establishing a veneer of legitimacy

Scale and Impact

- Victim Count: Over 700 investors in Singapore

- Total Investment: Approximately $6.7 million invested

- Operational Period: May 2021 to February 2022 (roughly 9-10 months)

- Documented Losses: $1.1 million in losses from 12 specific investors who invested $1.8 million

- Self-Enrichment: Even the operators invested in their own scheme; Lu’s family invested $57,000 but extracted $136,000

Red Flags (That Investors Missed)

- Unrealistically high guaranteed returns (0.5% daily)

- Lack of verifiable evidence for the 300,000 mining machines

- Corporate officers without proper work authorisation (Lu had no valid work pass)

- Emphasis on the recruitment of new investors

- Limited transparency about actual operations

- Inability to demonstrate actual cryptocurrency mining activities

How Anti-Scam Centres Can Help

Singapore has developed several resources to help prevent and address such scams:

Singapore Police Force Anti-Scam Centre (ASC)

- Rapid Response: Works with banks to freeze suspicious accounts and recover funds

- Public Education: Runs awareness campaigns about current scam tactics

- Reporting Mechanism: Provides centralised reporting for potential scams

- Data Analysis: Identifies patterns across scam reports to target organised operations

Preventative Measures

- Due Diligence Support: Guidance on how to verify investment opportunities

- Free Investment Checks: Some centres offer to review potential investments before committing funds

- Scam Alert Hotlines: Immediate access to expertise when encountering suspicious offers

- Educational Workshops: Teaching the public about common scam warning signs

Recovery Assistance

- Legal Guidance: Support for victims navigating police reports and legal proceedings

- Financial Recovery Strategies: Advice on possible avenues for recovering lost funds

- Psychological Support: Resources for dealing with the emotional impact of being scammed

Lessons from the A&A Blockchain Case

- Regulatory Gaps: The case highlights challenges in regulating cryptocurrency businesses

- Cross-Border Complexity: International operators (Chinese and Dutch nationals) complicate enforcement

- Technical Obfuscation: Cryptocurrency terminology can mask fraudulent operations

- Verification Challenges: Difficult for average investors to verify claims about mining operations

- Need for Caution: Any investment promising fixed, high returns should be thoroughly investigated.

This case demonstrates why potential investors should always:

- Research company leadership and verify their credentials

- Seek independent verification of business assets and operations

- Consult anti-scam resources before making significant investments

- Be highly sceptical of guaranteed high-return investments

- Report suspicious operations to authorities promptly

Blockchain Technology Innovation

Major Ponzi Schemes Using Cryptocurrency Mining Claims

1. BitConnect (2016-2018)

- Scheme Structure: Promised 1% daily returns through a proprietary “trading bot”

- Scale: Reached a market cap of over $2.6 billion at its peak

- Outcome: Collapsed in 2018 after regulatory warnings; investors lost approximately $2 billion

- Similarities: Used multilevel marketing, promised unrealistic fixed returns, claimed proprietary technology

2. PlusToken (2018-2019)

- Scheme Structure: Chinese-based wallet app promising 10-30% monthly returns on crypto deposits

- Scale: Collected over $3 billion in Bitcoin, Ethereum and other cryptocurrencies

- Outcome: Six operators arrested in 2019; estimated $2-3 billion in losses

- Similarities: Multi-national operation, promised unsustainable returns, targeted Asian investors

3. OneCoin (2014-2017)

- Scheme Structure: Promoted as a “Bitcoin killer” with mining operations that didn’t actually exist

- Scale: Collected approximately $4 billion from investors worldwide

- Outcome: Founder Ruja Ignatova disappeared in 2017; multiple arrests of other leaders

- Similarities: Non-existent mining operations, elaborate corporate structure, international scope

4. Mining Max (2016-2017)

- Scheme Structure: South Korean company claimed to operate mining facilities in South Korea and China

- Scale: Approximately $250 million from 18,000 investors

- Outcome: Founders arrested in 2017; significant prison sentences

- Similarities: False claims about mining infrastructure, multinational operator network

Token-Based Investment Scams

5. Centra Tech (2017-2018)

- Scheme Structure: ICO for cryptocurrency debit card with fake partnerships with Visa and Mastercard

- Scale: Raised approximately $32 million in ICO

- Outcome: Founders sentenced to prison terms; SEC recovered millions in digital assets

- Similarities: Used fake business relationships, created the illusion of a legitimate infrastructure.

6. AriseBank (2017-2018)

- Scheme Structure: Claimed to be the world’s “first decentralized banking platform”

- Scale: Raised $600 million in ICO before being shut down

- Outcome: Founder sentenced to 5 years in prison; SEC froze assets

- Similarities: False claims about business partnerships, misrepresentation of regulatory status

Singapore-Specific Crypto Scams

7. Torque Trading Systems (2019-2021)

- Scheme Structure: Singapore-based “algorithmic trading” platform promising consistent returns

- Scale: Approximately $325 million from investors

- Outcome: Collapse in 2021; founder claimed “hacking incident” caused losses

- Similarities: Operated from Singapore, promised consistent returns, no actual trading algorithm

8. Mining.sg (2019-2020)

- Scheme Structure: Singapore company claiming to operate mining farms in China

- Scale: Collected investments in the millions (exact figure undisclosed)

- Outcome: Company disappeared, investors unable to withdraw funds

- Similarities: False claims about mining operations, cross-border element between Singapore and China

Common Elements Across These Scams

- Unrealistic Return Promises: Consistent high returns that defy market volatility

- False Technical Claims: Exaggerated or fabricated proprietary technology

- Unverifiable Assets: Mining operations or infrastructure that investors cannot inspect

- Multilevel Marketing Techniques: Referral bonuses to accelerate growth

- Cross-Border Operations: International structure that complicates regulation

- Legitimate Appearance: Corporate websites, offices, and documentation creating false legitimacy

- Exit Strategy: Often involving claims of hacking, regulatory issues, or simply disappearing

These scams demonstrate the persistent pattern of using cryptocurrency complexity and promises of mining returns to defraud investors, highlighting the need for thorough due diligence and scepticism toward guaranteed returns in the cryptocurrency space.

Singapore’s Anti-Scam Resources and How They Help

Singapore Police Force Anti-Scam Centre (ASC)

Core Services

- Rapid Response Team: Works with banks to freeze suspicious accounts within hours of reports

- ScamShield App: Government-developed app that blocks known scam calls and messages

- 24-Hour Hotline: Immediate assistance via 1-800-722-6688 for reporting scams

- Coordination Hub: Centralises intelligence from multiple reports to identify patterns

How They Help With Crypto Scams

- Fund Recovery Coordination:

- Works with banks and digital payment services to trace and freeze fraudulent transactions

- In 2023, recovered approximately $57.6 million through rapid intervention

- Early Detection:

- Monitors for suspicious investment offerings and mining schemes

- Issue public alerts on emerging scam techniques

National Crime Prevention Council (NCPC) Scam Alert

Key Resources

- Scam Alert Website (scamalert.sg): Comprehensive database of current scams

- Verification Tools: Resources to check the legitimacy of investment opportunities

- Early Warning System: Alerts about emerging scam patterns

Specific Crypto Scam Support

- Investment Verification Service:

- Free consultation on suspicious investment opportunities

- Maintains list of flagged companies and schemes

- Educational Materials:

- Clear guides explaining cryptocurrency risks

- Checklists for evaluating crypto investment opportunities

Monetary Authority of Singapore (MAS)

Regulatory Protection

- Financial Institution Registry: Verify if crypto businesses are correctly licensed

- Investor Alert List: Published list of unregulated entities that may pose risks

- Regulatory Sandbox: Framework for legitimate crypto businesses to operate legally

Assistance for Victims

- Financial Dispute Resolution Centre:

- Mediates between victims and financial institutions

- Provides guidance on recovering funds

- Market Misconduct Investigations:

- Investigate potential securities law violations by crypto schemes

- Coordinates with international financial regulators

How to Get Help if You Suspect a Crypto Scam

Immediate Steps

- Report to Police: File a report at the nearest police station or online at police.gov.sg

- Contact Anti-Scam Helpline: Call 1-800-722-6688 for immediate guidance

- Bank Notification: Alert your bank to potentially freeze transactions

- Document Evidence: Preserve all communications and transaction records

What Information to Provide

- Bank account numbers used by scammers

- Phone numbers and contact details of suspects

- Screenshots of websites, apps, or marketing materials

- Transaction records and receipts

- Names and descriptions of individuals involved

What Help Can You Expect

- Immediate Intervention: Potential freezing of scammer accounts within hours

- Investigation Support: Guidance throughout the police investigation process

- Recovery Assistance: Help with possible fund recovery options

- Legal Guidance: Direction to appropriate legal resources

- Preventative Education: Resources to avoid future scams

Prevention Resources

Free Tools

- ScamShield App: Blocks known scam calls and SMS

- Token Checker: Verify the legitimacy of specific cryptocurrencies

- Investment Verification Portal: Check if a crypto investment scheme is registered

Educational Programs

- Community Workshops: Free sessions about cryptocurrency investment risks

- Online Courses: Digital literacy programs focusing on scam prevention

- School Programs: Youth-focused education about digital financial safety

Analysis of Cryptocurrency Scams in 2025

According to the article, cryptocurrency scams remain a significant issue in the digital asset space, with $834.5 million lost to scams in 2024, accounting for 27.72% of all stolen cryptocurrency funds. Let me analyze the main types of scams and discuss the security methods recommended to protect against them.

Major Cryptocurrency Scam Types

1. Phishing Attacks

- Primary Threat: Ranked as the top on-chain threat in 2024, accounting for $1.05 billion in losses

- Method: Scammers impersonate legitimate entities (exchanges, wallets, services) using similar URLS, email addresses, logos, and branding

- Goal: Trick users into revealing sensitive information like account credentials, wallet secrets, or private keys

- Danger Level: Extremely high, as it targets user credentials directly

2. Impersonation Schemes

- Method: Fraudsters pose as celebrities, influencers, developers, or representatives from reputable organizations

- Implementation: Can occur online, over the phone, or in person

- Purpose: Build false trust to extract sensitive information from victims

- Often Combined: Frequently used alongside phishing tactics for enhanced effectiveness

3. Fake Wallets

- Technique: Scammers create fraudulent wallet addresses and share “found wallet” stories

- Bait: Pre-loaded wallets supposedly containing large amounts of cryptocurrency

- Hook: Victims are asked to deposit “processing fees” or share their own wallet secrets

- Result: Scammers steal both the “processing fee” and drain the victim’s legitimate wallet

4. Fraudulent Investment Schemes

- Strategy: Promise unrealistically high returns in very short timeframes

- Trust Building: Initially, send small amounts back to victims to appear legitimate

- Final Move: Request larger deposits before disappearing with all funds

- Red Flag: “Too good to be true” returns are the primary indicator

Recommended Security Methods

1. Comprehensive Due Diligence

- Research all platforms, wallets, and services before use

- Verify legitimacy through multiple sources

- Check community feedback and independent reviews

2. Enhanced Authentication

- Implement two-factor authentication (2fa) on all accounts

- Consider using multi-signature (multi-sig) wallets for high-value holdings

- These measures create additional security layers beyond passwords

3. Regular Activity Monitoring

- Frequently check wallet and exchange account activity

- Set up alerts for transactions when possible

- Early detection of suspicious activity can prevent major losses

4. Knowledge Development

- Learn cryptocurrency fundamentals

- Stay updated on industry news and trends

- Follow reputable sources like established crypto media outlets

5. Device Security

- Maintain malware-free devices through regular scans

- Use dedicated devices for high-value transactions when possible

- Avoid public or shared computers for crypto activities

6. Skepticism Toward Offers

- Reject unsolicited investment opportunities.

- Question guaranteed returns

- Apply the “too good to be true” test to all opportunities

7. Prompt Reporting

- Report suspicious activity immediately to service providers

- Documentation of incidents helps both personal recovery and protecting others

Security Effectiveness Analysis

The most effective approach combines multiple security methods:

- Technical Protections (2FA, multi-sig) provide structural security but require user implementation

- Behavioral Practices (skepticism, due diligence) are arguably more important as they prevent engagement with scams

- Knowledge Development enhances the effectiveness of all other security measures through better recognition of threats

The article emphasizes vigilance as the cornerstone of cryptocurrency security. As the technology and adoption of cryptocurrencies continue to evolve, scammers adapt their techniques, making ongoing education and security awareness essential for all cryptocurrency users.

How to Prevent Cryptocurrency Scams: Best Practices

Based on the article and industry best practices, here are the most effective ways to prevent cryptocurrency scams:

Critical Prevention Strategies

1. Verify Everything Independently

- Double-check website URLs character by character before entering credentials

- Confirm addresses through multiple channels before sending funds

- Research projects thoroughly using diverse, reliable sources

- Never trust single-source information or recommendations

2. Use Hardware Wallets for Significant Holdings

- Store larger amounts in cold storage solutions (hardware wallets like Ledger or Trezor)

- Keep only necessary amounts for trading in hot wallets

- This creates physical separation between your main funds and potential online threats

3. Implement Layered Security

- Enable 2fa using authenticator apps (avoid SMS-based 2fa where possible)

- Use unique, complex passwords for each platform

- Consider multi-signature wallets requiring multiple approvals for transactions

- Create email addresses specifically for cryptocurrency accounts

4. Develop Healthy Scepticism

- Refuse all unsolicited investment offers regardless of source

- Question guaranteed returns or time-limited “opportunities”

- Be especially wary during market rallies when scam activity increases

- Remember, legitimate investments don’t require urgent action

5. Practice Transaction Hygiene

- Send small test transactions before large transfers

- Verify recipient addresses multiple times before confirming

- Check blockchain explorers to confirm transaction status

- Never share private keys or seed phrases with anyone under any circumstances

6. Stay Informed About Current Threats

- Follow security researchers and crypto security news

- Learn about new scam techniques as they emerge

- Understand that scammers constantly evolve their methods

- Join legitimate community forums where scams are discussed

Red Flags That Should Trigger Immediate Caution

- Pressure to act quickly or “limited-time offers”

- Requests for wallet private keys or seed phrases

- Promises of guaranteed returns or unrealistic profit percentages

- Poor grammar or unprofessional communication

- Direct messages from “support staff” you didn’t contact first

- Investment opportunities requiring you to recruit others

- Projects with anonymous teams or unclear value propositions

The most successful crypto security approach combines technical protections with informed behaviour. No single measure provides complete protection, but implementing multiple layers of security dramatically reduces your risk exposure.

Remember that in cryptocurrency, you are ultimately responsible for your own security. Taking proactive measures is always more effective than trying to recover stolen funds, which is often impossible due to the irreversible nature of blockchain transactions.

In 2024, Singapore saw a significant rise in cryptocurrency-related scams:

- Cryptocurrency losses accounted for 24.3% of the total $1.1 billion lost to scams in 2024, up from 6.8% in 2023

- The most significant single case involved a 36-year-old man who lost $125 million after clicking on a fake interview meeting link and running malicious code.

- In four primary cases, victims lost a total of $237.9 million, with three of these cases involving cryptocurrency.

- Other significant losses included $33.8 million in a phishing scam and $21 million in a social media impersonation scam.

David Chew, Commercial Affairs Department director, identified three groups targeted by cryptocurrency scammers:

- Digital natives who may understand technology but still fall prey

- Victims of investment fraud who open accounts with cryptocurrency exchanges

- Cryptocurrency “mules” who use their accounts to convert currency for unknown persons

The Monetary Authority of Singapore has taken steps to restrict cryptocurrency marketing and advertising in public areas, introduced consumer protection measures, and warned about the risks of cryptocurrency investments.

Analysis of Scams and Anti-Scam Measures in Singapore

Scam Analysis Based on the Article

Scale and Trends

- Total scam losses in Singapore reached a record $1.1 billion in 2024

- Cryptocurrency-related scams increased dramatically, accounting for 24.3% of total losses (up from 6.8% in 2023)

- Four significant cases alone resulted in $237.9 million in losses, with three involving cryptocurrency

Types of Scams Mentioned

- Malware-enabled cryptocurrency scams – The most significant single case ($125 million) involved malicious code targeting a cryptocurrency wallet

- Phishing scams – 8,552 cases totaling $59.4 million, with one victim losing $33.8 million through a fake cryptocurrency advertisement

- Social media impersonation scams – 728 cases totaling $26.4 million, including one victim who lost $21 million believing they were communicating with a company director

- Investment scams – identified as a standard type involving cryptocurrency, though specific figures weren’t provided

- Job scams – Mentioned as another common vector for cryptocurrency fraud

Victim Demographics

- People aged 30-49 suffered the highest cryptocurrency losses

- Three vulnerable groups were identified:

- Digital natives who understand technology but still fall victim

- Investors opening accounts with cryptocurrency exchanges

- Cryptocurrency “mules” who knowingly or unknowingly facilitate money movement

Anti-Scam Measures in Singapore

Regulatory Approach

- Legal Framework Updates

- Amendments to the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act in 2023

- New offenses specifically targeting facilitation of scams and movement of criminal proceeds

- MAS (Monetary Authority of Singapore) Actions

- Restrictions on cryptocurrency marketing and advertising in public areas

- Introduction of consumer protection safeguards for cryptocurrency services

- Regular public education campaigns warning about cryptocurrency risks

- Enforcement Strategy

- The Commercial Affairs Department appears to be taking a targeted approach based on identified vulnerable groups.

- Emphasis on educating the public about checking whether entities are licensed by MAS

Public Education and Awareness

- ScamShield operator mentioned (though details are limited in the article)

- MAS is actively cautioning against cryptocurrency trading and investments for retail investors

- Warnings about the risks of dealing with unregulated entities

Technological Solutions

- The reference to ScamShield suggests that Singapore is employing technological tools to combat scams, though the article doesn’t elaborate on its effectiveness.

Gaps and Opportunities

Despite these measures, the record losses indicate areas for improvement:

- Technical Protection Gaps – The sophisticated malware attack that resulted in a $125 million loss suggests that more robust technical safeguards are needed

- Verification Systems – Social media impersonation scams could be addressed through better identity verification protocols.

- Cryptocurrency Security – The surge in cryptocurrency-related scams highlights the need for specialized education and security measures for this specific asset class.

- Real-time Monitoring – The scale of individual losses suggests a need for improved real-time transaction monitoring and suspicious activity detection

Singapore appears to be taking a multi-faceted approach combining regulation, education, and technology to combat scams. Still, the rising numbers indicate this remains a significant challenge requiring continued innovation and adaptation of anti-scam measures.

Anti-Scam Measures for Singapore: Recommendations

Based on the concerning rise in scam cases and the record $1.1 billion lost in 2024, here are specific recommendations to strengthen Singapore’s anti-scam ecosystem:

Enhanced Digital Infrastructure

- National Cryptocurrency Alert System

- Implement real-time monitoring of unusual cryptocurrency transactions similar to banking fraud detection.

- Create a centralized reporting mechanism for cryptocurrency exchanges operating in Singapore.

- Consider mandatory cool-down periods for large cryptocurrency transfers from newly created wallets.

- Expand ScamShield Capabilities

- Develop cryptocurrency-specific modules for the existing ScamShield application.

- Added features to verify cryptocurrency addresses against known scam wallets

- Incorporate AI detection of social engineering tactics in messaging platforms.

Regulatory Framework Improvements

- Cryptocurrency Exchange Requirements

- Mandate more substantial KYC procedures for cryptocurrency platforms serving Singapore residents.

- Require exchanges to implement multi-factor authentication with cooling periods.

- Institute maximum daily withdrawal limits for new accounts

- Cross-Border Collaboration

- Strengthen international cooperation with significant cryptocurrency hubs

- Establish faster information sharing protocols with countries where scam operations frequently originate

- Create dedicated cryptocurrency crime units within existing law enforcement agencies

Public Education Campaigns

- Targeted Awareness Programs

- Develop specialized education for the 30-49 age group, identified as most vulnerable to cryptocurrency scams.

- Create industry-specific training for sectors frequently targeted by sophisticated scams.

- Implement mandatory cyber hygiene education in workplaces

- Practical Defense Training

- Conduct community workshops on verifying digital identities

- Develop simple verification protocols for everyday transactions

- Create “red flag” checklists tailored to different scam types

Technical Solutions

- Security Infrastructure

- Promote hardware wallets and advanced security solutions for cryptocurrency users.

- Develop Singapore-specific security standards for cryptocurrency services

- Support the development of local security verification services

- Digital Identity Protection

- Expand Singpass integration for verification of legitimate businesses

- Create official channels for verifying claimed business relationships

Financial System Protections

- Banking Coordination

- Implement “scam likelihood scoring” for transfers to cryptocurrency exchanges

- Create rapid response mechanisms between banks and cryptocurrency platforms.

- Develop unified suspicious transaction reporting frameworks

- Recovery Mechanisms

- Establish specialized teams to trace and potentially recover cryptocurrency losses.

- Create a framework for prioritizing recovery efforts based on case characteristics.

- Develop victim support protocols specific to large-scale financial losses.

Implementation Approach

Given Singapore’s strong existing governance structures, these recommendations could be implemented through:

- A coordinated taskforce involving MAS, the Commercial Affairs Department, and technology partners

- A phased approach prioritizing measures targeting the highest-value scams first

- Regular effectiveness reviews with transparent reporting on outcomes

- Engagement with cryptocurrency industry stakeholders to develop practical, implementable solutions

These measures would build upon Singapore’s existing strengths while addressing the specific challenges posed by the evolving scam landscape.

Prevention Methods Analysis

Using Reputable Services

- Effectiveness: High – Using established platforms like MetaMask, Kraken, and Uniswap significantly reduces risk

- Implementation: Requires researching platform reputation, security history, and user reviews

- Limitation: Even reputable services can be compromised; doesn’t protect against all attack vectors

Authentication Security

- Two-Factor Authentication (2FA):

- Critical protection layer that blocks most unauthorized access attempts

- Should be implemented across all crypto accounts and related services

- Hardware-based 2FA offers stronger protection than SMS-based methods

Hardware Security

- Cold Storage/Hardware Wallets:

- Most effective for large holdings (Ledger, Trezor mentioned)

- Keeps private keys offline and inaccessible to remote attackers

- Requires physical security and proper backup procedures

Information Verification

- Authentication Checks: Verifying HTTPS connections and secure website indicators

- Source Verification: Only downloading apps from official stores

- Project Research: Using platforms like CoinMarketCap, DeFiLlama for due diligence

Smart Contract Security

- Audit Verification: Checking if projects have undergone security audits by firms like Quantstamp

- Limited Exposure: Reducing investment in unaudited or new projects

Personal Information Security

- Dedicated Email: Using separate, secure email for crypto transactions

- Information Sharing: Never sharing private keys or seed phrases

- Bookmark Usage: Using bookmarks to avoid phishing sites

Continuous Education

- Following Security Researchers: Staying updated via security firms like Hacken

- Crypto News Monitoring: Following platforms like CoinDesk or Cointelegraph

Crypto Threats Detailed Review

Scams (Deception-Based Threats)

- Investment Scams

- Scale: Over $575 million lost since 2021 (FTC data)

- Method: Promise of unrealistic returns, often using social proof and FOMO

- Target: Both new and experienced investors seeking high yields

- Romance Scams

- Scale: 19,050 victims with $739 million in losses (2022, FBI data)

- Method: Building an emotional connection before introducing crypto “opportunities”

- Target: Individuals on dating platforms seeking relationships

- Phishing Scams

- Method: Creating fake websites/emails mimicking legitimate services

- Sophistication: Often highly convincing with correct branding elements

- Goal: Credential harvesting or direct crypto theft

- Fake Giveaways

- Method: “Send X to receive 2X back” schemes, often impersonating celebrities

- Distribution: Social media platforms and paid advertisements

- Appeal: Exploits desire for quick wealth and authority trust

- Impersonation Scams

- Method: Pretending to be companies or government agencies

- Approach: Creating false urgency around a “problem” requiring crypto payment

- Psychology: Leverages fear and authority compliance

Hacks (Technical Exploitation)

- Exchange Hacks

- Target: Centralized cryptocurrency exchanges

- Impact: Can affect thousands of users simultaneously

- Trend: Becoming less common as exchange security improves

- Personal Device Hacks

- Vector: Vulnerabilities in smartphones or computers

- Goal: Access to installed wallets or stored credentials

- Prevention: Device security updates and avoiding suspicious software

- Email Account Hacks

- Method: Used to reset passwords for crypto services

- Technique: Phishing or malware deployment

- Impact: Can compromise multiple accounts if email is a recovery option

- Smart Contract Hacks

- Target: Code vulnerabilities in blockchain applications

- Scale: Often results in the largest financial impacts

- Complexity: Requires technical sophistication but yields highest returns

Fraud (Direct Theft and Manipulation)

- Ponzi Schemes

- Method: Using new investor funds to pay earlier investors

- Sustainability: Collapse inevitable when new investments slow

- Red Flag: Guaranteed returns with little or no risk

- Pyramid Schemes

- Structure: Recruitment-based reward system

- Collapse Trigger: Inability to recruit new members

- Differentiation: Focus on recruitment rather than investment returns

- Market Manipulation

- Technique: “Pump and dump” coordinated price inflation

- Target: Usually smaller market cap cryptocurrencies

- Warning Signs: Sudden price spikes without fundamental reasons

The document emphasises that adequate protection requires a multi-layered approach combining technical security measures (hardware wallets, 2fa), information security practices (verification, research), and behavioural awareness (scepticism toward unsolicited offers and “too good to be true” opportunities).

The Cost of Inadequate Prevention

Understanding the consequences of poor fraud prevention reinforces its importance:

- Direct financial losses from fraudulent transactions

- Increased processing fees from payment processors

- Potential fines and account restrictions for non-compliance

- Legal exposure and associated costs

- Reputational damage and customer loss

- Prolonged exposure to internal fraud

By implementing these methods, strategies, and prevention steps, organisations can significantly reduce their vulnerability to various types of fraud while creating a secure business environment that protects both the company and its customers.

Maxthon

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in AdBlock and anti-tracking software to enhance your browsing privacy.

By utilising the Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser is a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market

Success Stories

The Anti-Scam Centre has successfully intervened in numerous cryptocurrency scams:

- In 2024, helped recover $3.4 million from a mining scheme similar to A&A Blockchain

- Successfully coordinated with international authorities to apprehend cross-border scam operators

- Developed predictive models that have prevented an estimated $11.2 million in potential losses

For immediate assistance with suspected crypto scams, contact the Anti-Scam Helpline at 1-800-722-6688 or visit scamalert.sg to file a report and access resources.

Maxthon

In an age where the digital world is in constant flux and our interactions online are ever-evolving, the importance of prioritising individuals as they navigate the expansive internet cannot be overstated. The myriad of elements that shape our online experiences calls for a thoughtful approach to selecting web browsers—one that places a premium on security and user privacy. Amidst the multitude of browsers vying for users’ loyalty, Maxthon emerges as a standout choice, providing a trustworthy solution to these pressing concerns, all without any cost to the user.

Maxthon, with its advanced features, boasts a comprehensive suite of built-in tools designed to enhance your online privacy. Among these tools are a highly effective ad blocker and a range of anti-tracking mechanisms, each meticulously crafted to fortify your digital sanctuary. This browser has carved out a niche for itself, particularly with its seamless compatibility with Windows 11, further solidifying its reputation in an increasingly competitive market.

In a crowded landscape of web browsers, Maxthon has forged a distinct identity through its unwavering dedication to offering a secure and private browsing experience. Fully aware of the myriad threats lurking in the vast expanse of cyberspace, Maxthon works tirelessly to safeguard your personal information. Utilising state-of-the-art encryption technology, it ensures that your sensitive data remains protected and confidential throughout your online adventures.

What truly sets Maxthon apart is its commitment to enhancing user privacy during every moment spent online. Each feature of this browser has been meticulously designed with the user’s privacy in mind. Its powerful ad-blocking capabilities work diligently to eliminate unwanted advertisements, while its comprehensive anti-tracking measures effectively reduce the presence of invasive scripts that could disrupt your browsing enjoyment. As a result, users can traverse the web with newfound confidence and safety.

Moreover, Maxthon’s incognito mode provides an extra layer of security, granting users enhanced anonymity while engaging in their online pursuits. This specialized mode not only conceals your browsing habits but also ensures that your digital footprint remains minimal, allowing for an unobtrusive and liberating internet experience. With Maxthon as your ally in the digital realm, you can explore the vastness of the internet with peace of mind, knowing that your privacy is being prioritised every step of the way.