- AI tools on both sides of hiring are creating problems:

- Employers initially adopted AI recruitment tools for efficiency and to reduce bias

- Job seekers are now using AI to mass-apply and prepare for automated assessments

- This has created an “arms race” situation benefiting neither side

- Employer perspective:

- HR departments are frustrated by AI-generated job applications

- Many large employers have a “zero-tolerance attitude” toward AI use by applicants

- Employers are overwhelmed by application volume and struggle to identify qualified candidates

- Job seeker perspective:

- Applicants have endured automated hiring systems for years

- Many feel “confused, dehumanised, and exhausted” by tools like asynchronous video interviews

- They’re responding by using AI to navigate a process that already feels impersonal

- Emerging inequalities:

- Data suggests uneven access to practical AI tools (31% of men vs. 18% of women use paid AI tools)

- Relative underperformance among Black individuals, women, and those from lower socioeconomic backgrounds is growing

- Potential solutions:

- Game-based assessments that are currently less vulnerable to AI

- Return to in-person test centres for skills assessment

- Reintroducing human interaction earlier in the hiring process

- Multi-stage workflows that include live interviews

The article concludes that technology can’t eliminate fundamental trade-offs in hiring processes, and seemingly simple technological solutions often create new complications over time.

AI Arms Race in Hiring: In-Depth Analysis

The Evolution of the AI Arms Race in Hiring

Phase 1: Employer-Led Automation (2010s)

The article describes how employers first introduced automated recruitment tools in the 2010s with dual goals:

- Efficiency – Processing more candidates with fewer resources

- Fairness – Reducing human bias in candidate selection

Key technologies implemented included:

- Asynchronous video interviews (no human interviewer)

- AI-powered candidate assessment systems

- Automated resume screening tools

Phase 2: Applicant Adaptation (Early 2020s)

Job seekers responded to automation by developing their own strategies:

- Using AI tools like Chatgptpt to generate applications

- Optimising resumes for Applicant Tracking Systems (ATS)

- “Gaming” assessment systems with AI assistance

- Some candidates are even using AI to provide answers during video interviews

Phase 3: Mutual Frustration (Present – 2025)

The article highlights a situation where both parties are dissatisfied:

- Employers are overwhelmed by the volume of AI-enhanced applications

- Candidates feel dehumanised by automated processes

- Diminishing returns on both sides as the technology race escalates

- Emerging inequalities in access to practical AI tools

Proposed Resolutions

The article suggests several potential solutions:

1. Return to Human-Centred Processes

- Reintroducing human interaction earlier in hiring

- Multi-stage workflows combining technology and human judgment

- HireVue (a vendor of asynchronous interviews) aacknowledgesthe importance of live interviews

2. Technology Adaptations

- Adopting game-based assessments less vulnerable to AI manipulation

- Return to in-person test cecentresor skills verification

- Development of “AI-proof” assessment methods

3. Implicit Suggestion: Better Alignment

While not explicitly stated, the article implies a need for:

- Greater transparency about AI use on both sides

- Establishing norms and boundaries for appropriate AI use

- Designing processes that leverage AI while preserving human dignity

Impact on Singapore’s Labour Market

While the article doesn’t specifically address Singapore, we cananalysee potential implications:

Singapore’s Context

- Tech-Forward Environment

- Singapore has embraced digital transformation in multiple sectors

- Government initiatives like Smart Nation promote technology adoption

- Sophisticated AI infrastructure already exists in many organisations

- Highly Competitive Job Market

- Limited labour pool withspecialisedd skills

- Strong presence of multinational corporations with standardised hiring practices

- An education system that emphasises measurable performance metrics

Specific Impacts

For Employers in Singapore

- Talent Identification Challenges: Similar to global trends, Singapore employers may struggle to identify genuinely skilled candidates amid AI-enhanced applications.

- Regulatory Considerations: Singapore’s Personal Data Protection Act (PDPA) and fair employment practices may require transparency about AI use in hiring

- SME Disadvantage: Smaller companies with fewer resources may be disadvantaged if unable to implement sophisticated screening systems

For Job Seekers in Singapore

- Skills Polarization: Those with access to advanced AI tools and the skills to use them effectively may gain advantages

- Impact on Foreign Talent: International applicants may face additional challenges navigating Singapore-specific hiring AI systems

- Cultural Factors: Singapore’s emphasis on educational credentials may interact with AI screening in ways that either reinforce or challenge traditional hiring preferences

For Policymakers

- Need to consider regulations around AI in hiring to ensure fairness

- Potential to establish national standards for ethical AI use in recruitment

- Opportunity to develop public resources, ensuring equitable access to AI tools

Long-term Considerations

The hiring AI arms race reflects broader questions about technology’s role in labour markets:

- Trust Erosion: The mutual escalation damages trust between employers and candidates

- Skill Validation: As AI can simulate specific skills, determining authentic capability becomes more complex

- Equity Concerns: The article highlights disparities in AI tool access that could exacerbate existing inequalities

- Balance of Power: The dynamic between job seekers and employers shifts as technology evolves

The article’s central lesson applies globally, including to Singapore: technological solutions to complex social processes like hiring often create new problems that require thoughtful, balanced approaches incorporating both human judgment and appropriate technology use.

Long-Term Labour Market Implications of the AI Hiring Arms Race

Structural Market Transformations

1. Credential Inflation and Skills Verification Crisis

The proliferation of AI tools that help candidates present themselves more effectively will likely trigger:

- CredentiScepticismism: Employers are becoming increasingly suspicious of traditional qualifications and resume claims

- Alternative Verification Systems: Rise of blockchain-verified credentials, continuous assessment portfolios, and work product demonstrations

- Skills-Based Hiring: Acceleration toward performance-based hiring rather than credential-based filtering

Over time, this may fundamentally restructure how skills are signalled in labour markets, potentially diminishing the value of traditional degrees while elevating demonstrable skills and authenticated work history.

2. Labour Market Segmentation

The uneven access to advanced AI tools noted in the article (31% of men vs. 18% of women using paid AI tools) indicates early signs of a broader segmentation:

- AI-Augmented Workers: Those with access to and proficiency with advanced AI tools form a privileged labour class

- Non-Augmented Workers: Workers without such access face systematic disadvantages in hiring processes

- Verification-Privileged Workers: Those who can easily verify their skills through networks or educational pedigree, maintaining advantages

This segmentation could harden existing socioeconomic divisions while creating new ones based on technological access and literacy.

Changes to Employment Relationships

1. Shifting Power Dynamics

The ongoing technological escalation will continually reshape power balances:

- Initial Employer Advantage: Early AI adoption gave employers significant screening power

- Current Rebalancing: Candidate AI use has partiallyneutralisedd this advantage

- Future Oscillations: Expect ongoing shifts as each side develops new technological countermeasures

These fluctuations may increase market uncertainty and friction costs for both employers and job seekers.

2. Trust Erosion and Relationship Models

Deepening scepticism about the authenticity of candidate representations could transform employment structures:

- Probationary Employment: Extended trial periods are becoming standard to verify candidate capabilities

- Project-Based Evaluation: Increase in gig-style trial projects before permanent hiring

- Reputation Systems: Development of trusted third-party reputation verification platforms

- Network-Based Hiring: Greater reliance on verified personal connections as AI makes stranger credentials less trustworthy

3. Hiring Timelines and Processes

The article mentions employers considering the reintroduction of in-person testing centres and earlier human interaction. These trends suggest:

- Longer Hiring Cycles: More complex, multi-stage verification processes extend time-to-hire

- Higher Hiring Costs: Additional verification steps increase the expense of recruitment

- Hybridised Approaches: AI used for initial sorting, with increased human oversight for final decisions

Labour Market Efficiency and Economic Impact

1. Matching Efficiency Paradox

The AI arms race creates a paradox for labour market efficiency:

- Theory: Better information should improve employer-employee matching

- Reality: When both sides use AI strategically, information quality may deteriorate

- Outcome: Potentially worse matching efficiency despite more sophisticated technology

This could lead to higher turnover rates, longer job vacancies, and increased friction ilabouror markets, potentially reducing economic productivity.

2. Skills Development Incentives

How workers invest in skills development may change dramatically:

- Verifiable Skills Premium: Skills that can be objectively demonstrated, gaining value

- Certification Evolution: Rise of micro-credentials and continuous assessment models

- “AI-Proof” Skills: Greater investment in capabilities that AI cannot easily simulate

- Meta-Skills Focus: Increased value for adaptability, learning capacity, and technological literacy

3. Labour Market Participation Effects

Different demographic groups may respond differently to these developments:

- Digital Natives: Younger workers are potentially adapting more readily to AI-mediated hiring

- Mid-Career Transitions: Workers changing fields face additional verification barriers

- Re-Entry Challenges: Those returning to the workforce after gaps are finding increased difficulty

Systemic and Policy Implications

1. Regulatory Responses

Expect increasing regulatory attention to AI in hiring:

- Transparency Requirements: Mandates for disclosing AI use in hiring processes

- Algorithmic Auditing: Requirements to test hiring systems for bias

- Data Rights: Expanded candidate rights regarding their application data

- AI Licensing: Potential certification requirements for hiring AI systems

2. Educational System Adaptation

Education providers will need to respond to changing verification needs:

- Continuous Assessment: Moving away from point-in-time examinations

- Authenticated Portfolios: Building verifiable work product collections throughout education

- Skills Demonstration: Greater emphasis on provable capabilities versus abstract knowledge

- AI Literacy: Including AI interaction as a core educational component

3. Labor Market Infrastructure

New institutions and platforms will likely emerge:

- Verification Platforms: Third-party services specializing in skills authentication

- AI-Resistant Assessment Centres: Specialised facilities for verified in-person testing

- Candidate Representation Services: Professional services helping navigate complex hiring processes

- Recruitment Process Redesign: Consulting specializing in balanced human-AI hiring systems

Conclusion: Toward a New Equilibrium

The AI arms race in hiring represents a classic technological disruption that initially creates inefficiency and uncertainty before potentially reaching a more productive equilibrium. The labour market is likely entering a multi-year adjustment period characterised by:

- Experimentation: Organisations testing various combinations of human and AI involvement

- Standardisation: Gradual emergence of new norms and best practices

- Infrastructure Development: Creation of supporting systems for the new hiring paradigm

The ultimate resolution will likely involve neither complete AI dominance nor rejection, but instead thoughtfully designed processes that leverage technology while preserving human judgment and dignity in employment relationships.

The most successful labour market participants—both individuals and organisations—will be those who approach these changes reflectively, adapting strategies while maintaining focus on authentic skill development and meaningful work relationships.

Several important insights:

Key Takeaways:

- Job Disruption at DBS Bank

- DBS plans to cut approximately 4,000 contract and temporary jobs over the next three years

- Permanent staff will not be affected

- AI is expected to take over many repetitive tasks

- Roles Most at Risk

- Customer service roles

- Compliance jobs

- Risk management positions

- Data entry clerks

- Some bank teller functions

- Marketing and sales roles involving fundamental data analysis

- Why Banking is Primed for AI Adoption

- Banks have massive amounts of data

- Financial institutions have resources to invest in AI technologies

- Consumers are willing to share data for more efficient services

- Sophisticated risk modeling and regulatory requirements support AI integration

- Opportunities and Worker Adaptation

- 79% of financial sector employers struggle to find talent

- New roles emerging in AI system development and management

- Workers need to:

- Develop coding and software skills

- Enhance critical thinking and communication abilities

- Learn to work alongside and interpret AI systems

- Government and Industry Response

- Singapore is investing in upskilling initiatives

- Emphasis on preparing employees for an AI-driven future

The overall message is that while AI will significantly transform banking jobs, human professionals remain crucial, especially for complex decision-making and strategic roles.

AI Disruption in Banking: A Comprehensive Analysis

Technological Foundations of Disruption

Data-Driven Transformation

The banking sector is uniquely positioned for AI integration due to:

- Massive volumes of transactional and historical data

- Sophisticated risk modeling capabilities

- Established digital infrastructure

- High computational resources

- Stringent regulatory frameworks that require precise data management

Specific Areas of AI Implementation

1. Customer Service Transformation

- Current State: Chatbots and virtual assistants replacing human representatives

- Key Impacts:

- 24/7 customer support

- Instant response times

- Reduced operational costs

- Standardized communication

- Potential loss of personalized human touch

2. Compliance and Risk Management

- AI Applications:

- Automated surveillance systems

- Real-time credit risk assessment

- Fraud detection algorithms

- Regulatory reporting optimization

3. Operational Efficiency

- Automation Targets:

- Data entry processes

- Routine administrative tasks

- Basic financial analysis

- Transaction processing

- Document verification

Employment Landscape Shift

Job Displacement Projections

- High-Risk Roles:

- Customer service representatives

- Data entry clerks

- Compliance specialists

- Entry-level analysts

- Basic marketing roles

Emerging Job Opportunities

- New Role Categories:

- AI system developers

- Machine learning engineers

- AI ethics specialists

- Data interpretation experts

- AI-human interface managers

Skill Evolution Requirements

Technical Skills

- Advanced coding capabilities

- Data analytics proficiency

- AI system management

- Software engineering

- Programming languages relevant to financial technologies

Soft Skills Enhancement

- Critical thinking

- Strategic decision-making

- Complex problem-solving

- Emotional intelligence

- Cross-functional communication

- Adaptability to technological changes

Institutional Responses

Corporate Strategies

- Gradual AI integration

- Workforce reskilling programs

- Selective job reduction

- Investment in AI technologies

- Maintaining human oversight in critical decision-making

Government and Industry Initiatives

- Upskilling programs

- Professional development funding

- Technology adaptation workshops

- Collaborative industry-education partnerships

Potential Challenges

Implementation Barriers

- Initial high investment costs

- Complex integration with legacy systems

- Data privacy concerns

- Potential algorithmic bias

- Employee resistance to change

Ethical Considerations

- Maintaining human judgment in complex scenarios

- Ensuring fair and transparent AI decisions

- Protecting employee rights during technological transitions

Future Outlook

Predicted Trajectory

- Gradual, not sudden displacement

- Augmentation of human capabilities

- Continuous skill adaptation

- Collaborative human-AI work environments

Long-Term Vision

- Enhanced operational efficiency

- More strategic human roles

- Personalized financial services

- Increased innovation potential

Conclusion

AI disruption in banking is inevitable but not catastrophic. The key to success lies in proactive adaptation, continuous learning, and maintaining a balance between technological efficiency and human expertise.

How Encryption Works

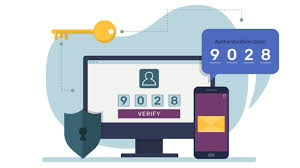

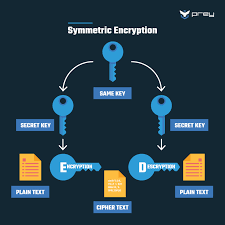

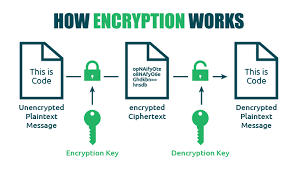

Encryption uses mathematical algorithms to convert plaintext (readable data) into ciphertext (scrambled data). Only those with the decryption key can convert the ciphertext back into usable information. There are two main types:

- Symmetric Encryption: Uses the same key for both encryption and decryption. It’s efficient but requires secure key exchange.

- Asymmetric Encryption uses a pair of keys—a public key for encryption and a private key for decryption—to allow secure communication without prior key exchange.

Key Encryption Applications for Privacy

Device Encryption

- Full-disk encryption: Protects all data on your computer or smartphone (BitLocker for Windows, FileVault for Mac, built-in encryption for iOS and Android)

- File-level encryption: Protects individual files and folders

Communication Encryption

- HTTPS: Secures website connections (look for the padlock icon in your browser)

- End-to-end encryption: Used in messaging apps like Signal, WhatsApp, and others to ensure only you and your recipient can read messages

- Email encryption: Options include PGP (Pretty Good Privacy), S/MIME, or encrypted email services

Network Encryption

- VPNs: Create an encrypted tunnel for all your internet traffic

- Wi-Fi encryption: WPA3 is the current most substantial standard for wireless networks

Cloud Storage Encryption

- At-rest encryption: Protects stored data

- Zero-knowledge encryption: The provider has no access to your encryption keys

- Client-side encryption: Data is encrypted before leaving your device

Implementing Encryption in Your Digital Life

- Enable device encryption on all your computers and mobile devices

- Use encrypted messaging apps for sensitive communications

- Verify HTTPS connections when sharing personal or financial information

- Consider encrypted email for sensitive communications

- Choose cloud services with strong encryption policies

- Use a VPN when connecting to public Wi-Fi networks

- Password-protect and encrypt sensitive files and backups

Limitations to Consider

- Encryption can’t protect against malware already on your device

- Weak passwords can undermine even the strongest encryption

- Encryption doesn’t hide metadata (who you’re communicating with, when, how often)

- Some countries have laws limiting encryption use or requiring backdoors

Encryption is a fundamental aspect of digital privacy that works best as part of a comprehensive security strategy. By understanding and implementing appropriate encryption methods, you can significantly enhance your privacy protection online.

.

Identity Theft

Identity theft is a pervasive form of fraud that can have devastating consequences for victims. In this crime, the perpetrator steals an individual’s personal information to assume their identity. This stolen information can often be gathered from discarded documents such as bank statements, utility bills, or even phishing scams.

Once armed with this data, the criminal may choose to open accounts in the victim’s name, a process known as application fraud. They might apply for credit cards, loans, or utility services under pretences, leaving the unsuspecting victim to deal with the aftermath.

The emotional toll of identity theft can be immense. Victims often face financial losses and damage to their credit scores, which can take years. In today’s digital age, account takeovers have become a prevalent threat to unsuspecting victims. Criminals typically employ tactics such as phishing, vishing, or smishing to manipulate individuals into revealing their personal information.

Phishing often involves deceptive emails that appear to come from legitimate sources. These emails may prompt the victim to click on malicious links or provide sensitive details under the guise of verifying their identity.

Vishing, or voice phishing, involves phone calls in which scammers impersonate bank representatives or trusted entities to extract confidential information directly from the victim. Similarly, smishing involves text messages that lure individuals into divulging critical data.

Once armed with this personal information, the criminal can easily convince a bank to change the account holder’s address. This deception allows them full access to the victim’s financial accounts and resources.

Additionally, some criminals are skilled enough to bypass bank interaction altogether. They can use the obtained credentials to log into online accounts directly, executing unauthorised transactions without needing any further verification.

The consequences for victims can be devastating, leading not only to financial loss but also emotional distress as they recover their stolen identities and secure their accounts. Consequently, individuals must remain vigilant and understand these risks to protect themselves against potential account takeovers for repair. Additionally, they may find themselves tangled in legal disputes as they try to prove their innocence.

Recovering from such a violation requires diligence and time, making it crucial for individuals to safeguard their personal information vigilantly. Implementing measures like shredding sensitive documents and monitoring credit reports can help prevent these types of crimes before they occur.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.