Key Findings from “Intelligent Banking: The Future Ahead” Study

https://finance.yahoo.com/news/future-banking-intelligent-riskier-ever-123800799.html

The report, based on insights from 1,700 senior executives across six continents, highlights that banks are at a critical juncture where they must adapt to AI-driven transformation or risk becoming irrelevant.

Significant Challenges Facing Banks:

- Economic volatility with interest rate fluctuations and liquidity stresses

- Accelerated technological disruption, particularly from Genai

- Rising digital competitors (fintech, BigTech, digital-only banks)

- Increased cybersecurity threats and fraud risks

Key Statistics:

- 99% of surveyed executives report some level of Genai implementation

- Over 50% indicate limited or no financial returns from early Genai initiatives

- Nearly 80% expect cyberattacks, fraud, and financial crimes to have significant operational impacts in the coming decade

- 68% view emerging regulations on AI, open banking, and blockchain as innovation enablers, not constraints

Five Strategic Imperatives for Banks:

- Strengthen data and AI governance for ethical innovation

- Build customer trust through transparency and data protection

- Streamline compliance processes through automation

- Pursue strategic partnerships with fintech and Big Tech firms

- Accelerate enterprise innovation by upskilling talent and modernising infrastructure

The report emphasises that while AI offers tremendous opportunities, it also introduces significant risks that require robust governance frameworks. Banks that balance innovation with responsible practices will be best positioned to thrive in this “Digital Intelligence Era.”

The Future of Banking: An In-Depth Analysis with Asian Focus

Based on the SAS-Economist Impact study and broader industry trends, I’ll analyse the future of banking with particular emphasis on Singapore, ASEAN, and the broader Asian context.

Global Banking Transformation: Core Drivers

1. The AI Revolution in Banking

The near-universal adoption of generative AI (99% implementation rate) signals a fundamental shift in how banking operates. However, the disconnect between adoption and tangible returns highlights a crucial implementation gap that institutions must address.

Asian banks, particularly in Singapore, have been aggressive in AI deployment. For example, DBS Bank’s implementation of dedicated AI governance models places it at the forefront of balancing innovation with responsible practices.

2. Evolving Risk Landscape

The report identifies a complex risk environment characterised by:

- Macroeconomic volatility affects liquidity

- Interest rate fluctuations impacting asset values

- Intensified cyber threats and sophisticated fraud schemes

- Regulatory fragmentation across jurisdictions

For Asian banks, regional diversity in regulatory approaches, economic development stages, and digital infrastructure maturity compounds these risks.

3. Competitive Disruption

Traditional banks face intensifying competition from:

- Digital-only banks (particularly strong in Asia)

- Fintech disruptors

- Significant Tech expansion into financial services

- Central Bank Digital Currencies (CBDCS)

Asian Banking Context: Regional Dynamics

Singapore: Digital Banking Pioneer

Singapore has positioned itself as a fintech hub with supportive regulatory frameworks:

- MAS (Monetary Authority of Singapore) has created sandbox environments encouraging innovation

- The issuance of digital banking licenses to non-traditional players

- Advanced data infrastructure supporting AI implementation

- Leadership in establishing ethical AI governance (referenced indirectly through DBS)

Singapore’s banks are likely to focus on leveraging their advanced technological infrastructure to develop sophisticated AI-powered financial services while maintaining robust governance standards.

ASEAN: Diverse Digital Transformation Journeys

The ASEAN region presents a heterogeneous banking landscape:

- Advanced markets (Singapore, Malaysia): Emphasising sophisticated AI applications and regulatory refinement

- Developing markets (Indonesia, Philippines, Vietnam): Focusing on digital inclusion and fundamental financial service modernisation

- Emerging markets (Cambodia, Laos, Myanmar): Building digital infrastructure foundations

Digital banking penetration varies significantly across ASEAN, creating both challenges and opportunities for cross-border banking services.

Broader Asian Context

Within the broader Asian context:

- China and India: Leading in scale of digital payment adoption and fintech innovation

- Japan and South Korea: Focusing on AI-powered premium banking experiences

- Hong Kong: Competing with Singapore as a fintech hub with its virtual banking licenses

Five Transformative Implications for Asian Banking

1. Rise of Super-Regional Banking Platforms

The need for scale in AI development and implementation will likely drive consolidation among Asian banks, creating influential regional players able to compete with global institutions and tech giants.

2. Embedded Finance Acceleration

Asian markets, with their high mobile penetration and e-commerce adoption, are prime for embedded finance growth. Banks that can integrate their services into popular platforms and ecosystems will capture significant market share.

3. Regulatory Technology (RegTech) Imperative

The complex regulatory landscape across Asian jurisdictions creates a powerful incentive for advanced regulatory technology solutions. Banks will increasingly automate compliance through AI to navigate fragmented regulatory frameworks efficiently.

4. Trust as Competitive Differentiator

As noted in the report, building customer trust through transparency, data protection, and ethical AI practices will be crucial. This is particularly important in Asian markets where financial data privacy concerns are growing amid rapid digitalisation.

5. Talent and Infrastructure Modernisation

The imperative to upskill talent and modernise infrastructure will be particularly challenging in diverse Asian markets, creating potential competitive advantages for institutions that manage this transition effectively.

Strategic Imperatives for Asian Banking Leaders

For Singapore-Based Institutions:

- Leverage existing technological advantages to pioneer responsible AI banking applications

- Export governance frameworks and compliance solutions to regional markets

- Focus on high-value, knowledge-intensive financial services enhanced by AI

For ASEAN Regional Players:

- Develop a scalable technological infrastructure adaptable to varying market conditions

- Create tiered service offerings addressing different digital maturity levels

- Invest in cross-border payment and banking solutions that reduce friction in regional trade

For Pan-Asian Banking Groups:

- Implement flexible, modular technology stacks that accommodate regulatory diversity

- Develop targeted partnership strategies for different market segments

- Balance standardisation benefits with local market customisation

Conclusion: Asia’s Pivotal Role in Banking’s Future

As outlined in the SAS-Economist Impact study, Asian institutions and markets will significantly shape the future of banking. With their combination of technological readiness, large underbanked populations, and diverse regulatory approaches, Asian markets provide both a testing ground and scaling opportunity for the next generation of intelligent banking solutions.

The five imperatives identified in the report—strengthening governance, building trust, streamlining compliance, pursuing strategic partnerships, and accelerating innovation—will manifest uniquely in Asian contexts, likely leading to distinctive banking models that blend cutting-edge technology with regional values and needs.

As economic power continues shifting eastward, how Asian banking institutions navigate this digital intelligence transformation will not just determine regional winners and losers but potentially establish new global standards for intelligent banking.

The Diminishing Role of Labour in Banking’s Future

The banking industry is undergoing a profound transformation away from its historically labour-intensive model. This shift isn’t merely incremental but represents a fundamental restructuring of how financial services are created and delivered. Drawing insights from the SAS-Economist Impact study and broader industry trends, I’ll analyse why banking is moving decisively away from being labour-driven.

The End of Banking as a Labour-Intensive Industry

1. AI-Driven Process Automation

The near-universal adoption of generative AI (99% implementation) highlighted in the report signals a watershed moment for the industry. Unlike previous technological advances that primarily enhanced human capabilities, generative AI and related technologies are increasingly capable of:

- Executing complex financial analysis previously requiring specialised analysts

- Conducting risk assessments with greater accuracy than human underwriters

- Handling customer inquiries through sophisticated conversational interfaces

- Detecting fraud patterns at scales impossible for human monitoring

This represents a fundamental shift from technology supporting human labour to technology replacing human decision-making in core banking functions.

2. Economics of Digital Scale vs. Human Scale

Banking operations face a pivotal economic reality: digital systems scale differently than the human workforce.:

- Digital systems: Once built, they can serve millions of additional customers with minimal marginal cost

- Human workforces: Each additional customer segment traditionally required proportional staffing increases

The economics increasingly favour building sophisticated technological infrastructure over expanding traditional branch networks and relationship management teams. The SAS report’s emphasis on infrastructure modernisation reflects this fundamental economic calculus.

3. Shift from Service Delivery to Platform Orchestration

Banking is transitioning from a service delivery model (requiring substantial human intermediation) to a platform orchestration model where:

- Core banking functions operate as automated, API-accessible services

- Value creation comes from connecting and configuring these services

- Human role shifts from service provision to exception handling and relationship management in only the most complex scenarios.

This architectural transformation fundamentally changes the labour requirements of the industry.

Evidence from Banking’s Technological Evolution

Changing Nature of Banking Employment

The industry has already begun this transformation:

- Traditional teller positions have declined by over 40% in many markets

- Middle management roles in operations have been consolidated through workflow automation

- Even sophisticated functions like wealth management are being automated through robo-advisory platforms

The report’s emphasis on “upskilling talent” rather than expanding the workforce reflects this reality – the future requires different skills, not necessarily more banking employees.

The Rise of Banking-as-a-Service (Baas)

The embedded finance trend mentioned in the report accelerates the move away from labour intensity:

- Financial products increasingly exist as programmable APIS rather than services delivered by personnel

- Non-bank entities can embed banking functionality without building banking teams

- The value chain disaggregates, with technology rather than labour becoming the connective tissue

Data as the New Core Asset

Banking is shifting from relationship-based to data-driven decision-making:

- Customer insights previously gathered through personal relationships are now algorithmically derived.

- Credit decisions increasingly rely on sophisticated scoring models rather than loan officer judgment

- Investment advice leverages quantitative analysis over personal expertise

This represents a fundamental shift in how value is created in banking – from human judgment to data processing capability.

Structural Forces Accelerating the Shift

1. Regulatory Technology Automation

The report highlights streamlining compliance as a key imperative. This reflects how even regulatory compliance, traditionally highly labour-intensive, is becoming automated:

- AI systems can monitor transactions for suspicious patterns more effectively than human reviewers

- Regulatory reporting is increasingly automated and real-time

- Policy implementation can be encoded into smart contracts and automated workflows

2. Customer Expectations and Digital Preferences

Modern banking customers, particularly in digitally advanced Asian markets, increasingly prefer:

- 24/7 service availability is impossible to provide cost-effectively with human staff

- Instant decision-making on lending and other services

- Seamless digital experiences with minimal friction

These expectations can only be met through highly automated systems, not by adding more banking personnel.

3. Competitive Pressure from Digital-Native Challengers

Traditional banks face existential competition from:

- Digital-only banks operating with 1/3 or fewer employees per customer

- Fintech firms are leveraging automation to deliver specialised services at lower costs

- Tech giants whose banking forays rely on algorithmic rather than human intelligence

This competitive landscape forces even traditional institutions to reduce reliance on human labour to remain viable.

Strategic Implications for Banking Leadership

1. Value Creation Through Intelligence, Not Service Delivery

Future banking value will derive primarily from:

- The sophistication of algorithmic decision systems

- The depth and integration of data assets

- The seamlessness of automated customer journeys

This requires fundamentally different organisational capabilities than traditional banking’s relationship-based model.

2. Human Capital Strategy Reimagined

Banking institutions must now focus on:

- Cultivating a much smaller workforce with significantly different skills

- Developing expertise in designing and governing automated systems

- Creating organisational structures that combine technological and financial expertise

This represents not just a reduction in workforce size but a fundamental reimagining of the banking employment model.

3. Risk Management in an Automated Environment

Banks must develop new approaches to:

- Managing algorithm-driven risk when human oversight is reduced

- Ensuring ethical outcomes from automated decisions

- Maintaining regulatory compliance through technological rather than procedural controls

Conclusion: From Labour-Intensity to Intelligence-Intensity

Banking’s future will not be labour-driven because the fundamental value creation model has shifted from service delivery to intelligence deployment. The SAS-Economist Impact study’s emphasis on “digital intelligence” rather than service excellence captures this transformation.

The institutions that will thrive are those that successfully navigate this transition, not by incrementally reducing headcount while maintaining the same operating model, but by fundamentally reimagining banking as an intelligence-driven rather than thalabour-drivenen industry.

This doesn’t mean humans will disappear from banking entirely. Still, their roles will be concentrated in areas where human judgment, creativity, and empathy create distinctive value that automated systems cannot yet replicate. Meanwhile, the core functions that have traditionally defined banking will increasingly operate through sophisticated technological systems with minimal human intervention.

The Urgency of AI and Intelligent Banking: A Critical Imperative

The SAS-Economist Impact study frames intelligent banking not merely as a strategic opportunity but as an urgent necessity. This urgency stems from several converging forces creating an existential imperative for financial institutions to embrace AI-powered transformation immediately. Let’s analyse why waiting is no longer an option for banks.

Existential Competitive Threats

1. The Accelerating Disintermediation Crisis

Traditional banks face unprecedented disintermediation pressure from multiple directions:

- Digital-native challengers: Digital-only banks operate with fundamentally different cost structures and agility, targeting banks’ most profitable segments without legacy technology burdens.

- Big Tech encroachment: As noted in the report, tech giants with massive customer bases and advanced AI capabilities are steadily expanding into financial services, leveraging their technological superiority and customer relationships.

- Embedded finance revolution: Financial services are increasingly embedded into non-financial platforms and experiences, threatening to relegate traditional banks to invisible utilities rather than customer-facing brands.

Without intelligent banking capabilities, traditional institutions risk being reduced to regulated commodity providers while more agile competitors capture the customer relationship and associated value.

2. The Widening Technology Gap

The report’s finding that 99% of surveyed executives report Genai implementation but with limited returns reveals a critical reality: mere adoption is insufficient. The technology gap is rapidly widening between:

- Leaders who have integrated AI into their operational fabric and decision systems

- Followers who have implemented surface-level AI applications without fundamental transformation

This gap compounds over time due to data network effects—AI systems improve with more data, creating a virtuous cycle for early successful implementers that becomes increasingly difficult for laggards to overcome.

Escalating Risk Environment

1. AI-Powered Financial Crime

The report highlights that nearly 80% of executives expect significant operational impacts from cyberattacks, fraud, and financial crimes. This reflects the reality that criminal enterprises are rapidly deploying AI capabilities to:

- Create sophisticated deepfakes that bypass traditional identity verification

- Generate synthetic identities undetectable by conventional means

- Execute market manipulation schemes at machine speed

- Develop novel attack vectors targeting algorithmic vulnerabilities

Banks without equally advanced defensive AI capabilities face asymmetric vulnerability, creating an urgent need to deploy countermeasures that can only function at machine speed and scale.

2. Systemic Risk Acceleration

Modern financial markets operate at speeds and complexities beyond human comprehension:

- Market movements propagate globally in milliseconds

- Complex derivative instruments create intricate risk interconnections

- Algorithmic trading systems can amplify volatility

The report highlights macroeconomic volatility, compounding these challenges. Only AI systems can monitor and respond to these dynamics at the necessary speed, making intelligent risk management not optional but essential for institutional survival.

Economic Sustainability Crisis

1. Margin Compression in Traditional Models

Traditional banking faces severe economic pressures:

- Persistently low net interest margins in many markets

- Rising compliance costs (estimated at 5-10% of operating expenses)

- Technology debt requires a amassiveinvestment

The report’s finding that many Genai initiatives have yielded limited financial benefits underscores that superficial implementation isn’t enough—banks need transformative AI applications that fundamentally alter their economics.

2. Operational Efficiency Imperative

Legacy banking operations typically operate at efficiency ratios (cost-to-income) of 50-70%. In contrast:

- Digital challengers achieve ratios of 30-40%

- Brilliant banking models could potentially operate below 30%

This efficiency gap creates an unsustainable competitive disadvantage that erodes profitability and ultimately threatens viability. Intelligence-driven automation isn’t merely about cost-cutting—it’s about fundamental business model viability.

Customer Expectation Revolution

1. The Personalisation Mandate

Modern customers increasingly expect:

- Hyper-personalised offerings based on their specific financial situations

- Proactive recommendations rather than reactive service

- Instantaneous decision-making on credit and other services

These expectations cannot be met at scale without advanced AI capabilities that can process vast amounts of customer data and generate personalised insights and offers in real-time.

2. Experience Parity with Digital Leaders

Customers now benchmark their banking experience not against other banks but against digital experience leaders:

- The seamlessness of technology platforms

- The predictive capabilities of streaming services

- The convenience of e-commerce giants

This creates an urgent need for banks to deploy comparable intelligence in their customer interfaces or face increasing irrelevance, particularly among younger demographics who represent future value.

Regulatory and Compliance Pressures

1. The Expanding Compliance Burden

Financial regulation continues to expand in scope and complexity:

- Enhanced KYC/AML requirements

- Consumer protection frameworks

- Data privacy regulations

- Emerging AI governance standards

The report’s emphasis on streamlining compliance through automation reflects the reality that traditional manual compliance approaches are becoming economically unsustainable, creating urgent pressure to implement intelligent compliance solutions.

2. Regulatory Technology Arms Race

Advanced regtech capabilities are becoming a competitive differentiator:

- Reducing compliance costs through automation

- Enabling faster entry into new markets

- Minimising regulatory penalties

Institutions lacking these capabilities face not only higher operational costs but also strategic limitations on their business development.

Strategic Window of Opportunity

1. The Data Advantage at Risk

Traditional banks still possess valuable data advantages:

- Rich transaction histories

- Established customer relationships

- Comprehensive financial profiles

However, this advantage erodes daily as alternative data sources proliferate and digital competitors build their own data repositories. The window to leverage this historical advantage through intelligent banking applications is rapidly closing.

2. The Trust Transition Period

The report emphasises building customer trust through transparency and ethical AI practices. We are currently in a transition period where:

- Customers still associate greater trust with established banking brands

- This trust advantage can facilitate the adoption of AI-powered offerings

- This advantage will diminish if digital competitors establish their own trust credentials

This creates urgency for established institutions to leverage their trust advantage while it still exists.

Conclusion: Beyond Innovation to Survival

The urgency of intelligent banking transcends normal innovation cycles—it represents a fundamental survival requirement in a rapidly transforming industry. The report’s warning that “banks must act now or risk irrelevance” isn’t hyperbole but recognition of the compression of traditional transformation timeframes.

Financial institutions now face a stark reality: the adoption of intelligent banking isn’t merely about competitive advantage but about maintaining relevance in an industry undergoing perhaps its most profound transformation since the introduction of computerised banking systems. Those who delay comprehensive AI transformation aren’t merely postponing benefits—they’re potentially signing their own extinction warrants in an increasingly intelligence-driven financial ecosystem.

As the report reemphasises, sises this requires not piecemeal AI projects but a comprehensive approach addressing governance, trust, compliance, partnerships, and talent—all simultaneously and with urgency that acknowledges the existential nature of the challenge.

AI Transformations in Singapore’s Banking Sector

Based on the article’s insights, here’s how AI transformations and algorithmic functions could specifically apply to Singapore’s banking landscape:

Strategic Relevance for Singapore

Singapore is uniquely positioned to benefit from AI in banking due to:

- Its status as a global financial hub

- Strong regulatory framework under MAS (Monetary Authority of Singapore)

- Advanced digital infrastructure

- High technology adoption rates

- Position as an APAC financial technology leader

Key Applications for Singapore Banks

Enhanced Financial Intelligence

- AML/KYC Compliance: AI algorithms could strengthen Singapore’s already robust anti-money laundering frameworks

- Cross-border Transaction Monitoring: Critical for Singapore as an international banking hub

- Real-time Fraud Detection: Particularly valuable for Singapore’s high-volume payment systems

Treasury and Liquidity Management

- Regional Treasury Operations: AI optimization for banks managing liquidity across ASEAN markets

- SGD Currency Flow Prediction: Specialized models for Singapore’s currency movements

- MAS Regulatory Compliance: Automated adherence to Singapore-specific banking regulations

Personalized Banking Services

- Multi-Language Customer Service: AI-powered solutions catering to Singapore’s multilingual population

- Customized Wealth Management: Algorithmic solutions for Singapore’s growing wealth management sector

- SME Banking Solutions: Tailored AI applications for Singapore’s vital SME sector

Regional Financial Analysis

- ASEAN Market Intelligence: Generative AI producing insights on regional market movements

- Geopolitical Risk Assessment: Analyzing impacts of regional tensions on Singapore’s financial position

- Trade Finance Optimization: Algorithmic improvements to Singapore’s significant trade finance operations

Implementation Considerations for Singapore

Data Protection Compliance

- AI systems would need to comply with Singapore’s Personal Data Protection Act (PDPA)

- Adherence to MAS Technology Risk Management Guidelines

Talent Development

- Leverage Singapore’s educational institutions for AI talent development

- Potential partnerships with government initiatives like AI Singapore

Cross-Border Collaboration

- AI systems that facilitate Singapore’s role as a connector between Western and Asian financial markets

- Standardized protocols for data sharing with international banking partners

Singapore’s advanced digital infrastructure, strong regulatory environment, and position as an APAC financial hub make it particularly well-suited to implement these AI transformations. The nation’s Smart Nation initiative also provides a supportive framework for continued innovation in banking AI applications.

Comprehensive Approach

The guide correctly emphasizes that no single method provides complete protection. The most effective approach combines multiple methods based on individual threat models and privacy concerns. The recommended combination of tools addresses different aspects of privacy:

- Data in transit (VPNs, secure email)

- Data at rest (antivirus, updates, backups)

- Authentication (password managers)

- Behavioural practices (mindful sharing)

- Existing data exposure (data removal tools)

This layered approach is consistent with cybersecurity best practices and provides defense in depth against various privacy threats.

How Encryption Works

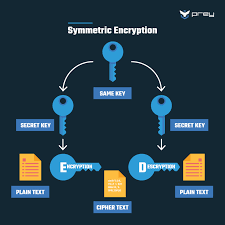

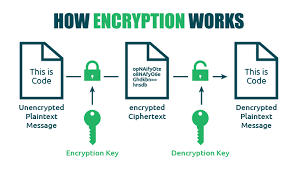

Encryption uses mathematical algorithms to convert plaintext (readable data) into ciphertext (scrambled data). Only those with the decryption key can convert the ciphertext back into usable information. There are two main types:

- Symmetric Encryption: Uses the same key for both encryption and decryption. It’s efficient but requires a secure key exchange.

- Asymmetric Encryption uses a pair of keys—a public key for encryption and a private key for decryption—to allow secure communication without prior key exchange.

Key Encryption Applications for Privacy

Device Encryption

- Full-disk encryption: Protects all data on your computer or smartphone (BitLocker for Windows, FileVault for Mac, and built-in encryption for iOS and Android)

- File-level encryption: Protects individual files and folders

Communication Encryption

- HTTPS: Secures website connections (look for the padlock icon in your browser)

- End-to-end encryption: Used in messaging apps like Signal, WhatsApp, and others to ensure only you and your recipient can read messages

- Email encryption: Options include PGP (Pretty Good Privacy), S/MIME, or encrypted email services

Network Encryption

- VPNs: Create an encrypted tunnel for all your internet traffic

- Wi-Fi encryption: WPA3 is the current most substantial standard for wireless networks

Cloud Storage Encryption

- At-rest encryption: Protects stored data

- Zero-knowledge encryption: The provider has no access to your encryption keys

- Client-side encryption: Data is encrypted before leaving your device

Implementing Encryption in Your Digital Life

- Enable device encryption on all your computers and mobile devices

- Use encrypted messaging apps for sensitive communications

- Verify HTTPS connections when sharing personal or financial information

- Consider encrypted email for sensitive communications

- Choose cloud services with strong encryption policies

- Use a VPN when connecting to public Wi-Fi networks

- Password-protect and encrypt sensitive files and backups

Limitations to Consider

- Encryption can’t protect against malware already on your device

- Weak passwords can undermine even the strongest encryption

- Encryption doesn’t hide metadata (who you’re communicating with, when, how often)

- Some countries have laws limiting encryption use or requiring backdoors

Encryption is a fundamental aspect of digital privacy that works best as part of a comprehensive security strategy. By understanding and implementing appropriate encryption methods, you can significantly enhance your online privacy protection.

.

Identity Theft

Identity theft is a pervasive form of fraud that can have devastating consequences for victims. In this crime, the perpetrator steals an individual’s personal information to assume their identity. This stolen information can often be gathered from discarded documents such as bank statements, utility bills, or even phishing scams.

Once armed with this data, the criminal may choose to open accounts in the victim’s name, a process known as application fraud. They might apply for credit cards, loans, or utility services under pretences, leaving the unsuspecting victim to deal with the aftermath.

The emotional toll of identity theft can be immense. Victims often face financial losses and damage to their credit scores, which can take years. In today’s digital age, account takeovers have become a prevalent threat to unsuspecting victims. Criminals typically employ tactics such as phishing, vishing, or smishing to manipulate individuals into revealing their personal information.

Phishing often involves deceptive emails that appear to come from legitimate sources. These emails may prompt the victim to click on malicious links or provide sensitive details under the guise of verifying their identity.

Vishing, or voice phishing, involves phone calls in which scammers impersonate bank representatives or trusted entities to extract confidential information directly from the victim. Similarly, smishing involves text messages that lure individuals into divulging critical data.

Once armed with this personal information, the criminal can easily convince a bank to change the account holder’s address. This deception allows them full access to the victim’s financial accounts and resources.

Additionally, some criminals are skilled enough to bypass bank interaction altogether. They can use the obtained credentials to log into online accounts directly, executing unauthorised transactions without needing any further verification.

The consequences for victims can be devastating, leading not only to financial loss but also to emotional distress as they recover their stolen identities and secure their accounts. Consequently, individuals must remain vigilant and understand these risks to protect themselves against potential account takeovers for repair. Additionally, they may find themselves tangled in legal disputes as they try to prove their innocence.

Recovering from such a violation requires diligence and time, making it crucial for individuals to safeguard their personal information vigilantly. Implementing measures like shredding sensitive documents and monitoring credit reports can help prevent these types of crimes before they occur.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.