Overview of GXS Group

GXS Group is a digital bank established as a 60:40 joint venture between Grab Holdings and SingTel. In approximately 2021, it will be one of the first fully digital banks licensed by the Monetary Authority of Singapore. The bank currently operates in three Southeast Asian markets: Singapore, Malaysia, and Indonesia.

Target Audience

GXS targets explicitly the “underserved” segments of the banking population:

- The “Bottom 40” demographic:

- In Malaysia, over 50% of their customers fall into the “B40” (Bottom 40) demographic

- In Singapore, about 20% of customers are from this segment

- Gig workers and non-traditional earners who may be disadvantaged by traditional banking requirements, like salary crediting

- Small business owners and sole proprietors who may not qualify for financial products from larger banks

- Individuals without substantial credit histories who are overlooked by traditional banking institutions

- Regular consumers seeking higher interest rates on savings with fewer restrictions

Key Benefits

- Higher interest rates on deposits:

- Interest rates tend to be higher than those offered by traditional banks

- Interest is credited daily rather than monthly or quarterly

- Simplified banking experience:

- Fully digital with no physical branches to visit

- Accessible entirely through smartphones

- Emphasis on “gamification” to make banking more engaging

- Flexible account structure:

- Ability to create labelled sub-accounts (called “pockets”) for different purposes

- Customizable savings goals

- Alternative credit assessment:

- Leveraging ecosystem data from Grab and SingTel to assess creditworthiness

- Provides access to lending for those without traditional credit histories

- Uses metrics like a driver’s average daily earnings or a small supplier’s monthly sales figures

- Growing product suite:

- Currently expanding into SME banking services

- Developing investment products with personal accident insurance

How to Use GXS

- Eligibility: Available to Singaporeans, Permanent Residents, and Employment Pass holders

- Account opening:

- Requires only a smartphone and SingPass identity

- No physical documentation or branch visits needed

- Key features:

- Daily interest crediting on deposits

- Total deposits in Singapore amount to about $1.3 billion

- Current loan products with individual loans up to $120,000

- Upcoming services (expected by the end of 2025):

- Full-fledged SME banking services including:

- Business Banking operating accounts

- GXS FlexiLoan Biz (unsecured business loans for sole proprietors)

- Investment products with personal accident insurance coverage

- Potential credit card offerings in the future

- Full-fledged SME banking services including:

- Integration with parent companies:

- Likely offers enhanced services for Grab and SingTel customers

- Uses data from these ecosystem partners for credit assessment

Financial Position and Growth Strategy

- Currently has approximately 250,000+ customers in Singapore

- Total customer base of 4.5 million across all three markets

- Still in “cash-burn” stage with a net loss of $214 million for fiscal year 2024

- Expects to break even in Singapore by the end of 2026

- Project customer base growth to 10 million by 2027

- Potential IPO or other funding options once $1.5 billion capital is drawn down by ethe nd of 2026

GXS positions itself not as a competitor to traditional banks like DBS or UOB, but as a complementary service focusing on demographics that may be underserved by larger institutions, while offering innovative digital-first banking solutions.

Comprehensive Analysis of GXS Features and Benefits

Core Account Features

1. GXS Savings Account

- Daily Interest Accrual: Unlike traditional banks that calculate interest monthly or quarterly, GXS credits interest on a daily basis, maximising returns

- Competitive Interest Rates: Offers higher interest rates than traditional banks’ basic savings accounts without complex requirements

- No Minimum Balance Requirements: Accessible to customers regardless of financial standing

- Zero Fees Structure: Eliminates standard banking fees that disproportionately affect lower-income customers

- Pockets Feature: Allows users to create labelled sub-accounts (like “JB” or children’s names, as mentioned by Ms. Lai) for different savings goals without opening multiple accounts

2. Digital-First Infrastructure

- Smartphone-Based Banking: Complete banking experience througa h mobile app without needing branch visits

- SingPass Integration: Streamlined identity verification and account setup using Singapore’s national digital identity system

- Paperless Operations: Environmental benefits and convenience through fully digital documentation

- 24/7 Accessibility: Banking services are available at any time, not limited by operating hours

Lending Products

1. Personal Loans

- Alternative Credit Assessment: Uses non-traditional data from Grab and SingTel ecosystems to evaluate creditworthiness

- Accessibility for Thin-File Customers: Available to individuals without extensive credit bureau histories

- Loan Amounts: Current maximum personal loan of $120,000

- Competitive Interest Rates: Structured to be accessible to underserved segments

2. Upcoming SME Banking Services

- Business Banking Operating Account: A Digital account specifically designed for small business needs

- GXS FlexiLoan Biz: Unsecured business loans for sole proprietors without requiring collateral

- Validus Capital Integration: Enhanced capabilities from the acquisition of Validus Capital’s Singapore operations, which have disbursed over US$1 billion in SME financing

- Supply Chain Financing: Solutions for businesses to manage cash flow through their supply chains

- Working Capital Loans: Short-term financing to help businesses manage day-to-day operations

Wealth Management (Upcoming)

1. Investment Products

- Simplified Investment Solutions: Entry-level investment products designed for first-time investors

- Integrated Insurance: Personal accident insurance bundled with investment products for added security

- Accessibility Focus: Lower minimum investment thresholds than traditional wealth management services

- Educational Components: Likely to include financial literacy elements to help underserved customers understand investments

User Experience Features

1. Gamification Elements

- Engaging Interface: Banking tasks transformed into more enjoyable experiences through game-like elements

- Achievement Systems: Likely rewards for reaching financial goals or consistently saving

- Educational Gamification: Making financial literacy more accessible through interactive elements

- Behaviourall Incentives: Using game mechanics to encourage positive financial habits

2. Simplified User Interface

- Intuitive Design: Banking functions as accessible without financial or technical expertise

- Streamlined Processes: Account management and transactions are designed for maximum simplicity

- Personalisation: The Interface likely adapts to user behaviour patterns

- Financial Visualisation Tools: Graphical representations of spending, saving and financial progress

Integration Benefits

1. Grab Ecosystem Integration

- Seamless Connection: Likely integration with Grab’s ride-hailing, food delivery, and payment services

- Enhanced Data Utilisation: Financial behaviour insights from Grab usage informing banking services

- Reward Systems: Potential for cross-platform rewards between GXS and Grab services

- Targeted Financial Products: Services tailored to specific Grab user segments (drivers, merchants, etc.)

2. SingTel Ecosystem Integration

- Telecommunications Data: Utilising bill payment history and telecom usage for credit assessment

- Bundled Services: Potential for combined offerings with telecommunications services

- Enhanced Digital Security: Leveraging SingTel’s telecommunications security expertise

- Cross-Platform Authentication: Simplified verification across SingTel and GXS services

Regional Expansion Features

1. Cross-Border Capabilities

- Multi-Country Presence: Operations in Singapore, Malaysia, and Indonesia with a unified technology backbone

- Scalable Platform: Infrastructure designed to handle up to 20 million customers without significant additional costs

- Standardised Experience: Consistent banking interface across different markets

- Regional Financial Services: Potential for simplified cross-border transactions between operating countries

Special Benefits for Underserved Segments

1. For Gig Economy Workers

- Flexible Banking Requirements: No need for regular salary credits to access better rates

- Income Volatility Accommodation: Banking services designed for irregular income patterns

- Grab Driver-Specific Services: Specialised financial products for drivers using their earnings data.

- Microloans and Short-Term Credit: Accessible financing options during income gaps

2. For Small Business Owners

- Simplified Business Banking: Reduced bureaucracy compared to traditional banks

- Startup-Friendly Services: Financial services accessible to new businesses without an extensive history

- Supplier-Chain Integration: Specialised services for businesses in the Grab supply ecosystem

- Digital-First Operations: All business banking needs are manageable through the mobile app

3. For Lower-Income Individuals

- Financial Inclusion Focus: Services designed explicitly for the Bottom 40% demographic

- Accessible Minimum Requirements: Low or no minimum balances to maintain accounts

- Fee Avoidance: Structure eliminates standard fees that disproportionately impact lower-income users

- Building Credit History: Opportunity to establish banking history for future financial access

Security Features

- Digital-Native Security: Built with modern cybersecurity principles from the ground up

- Regulatory Compliance: Full adherence to the Monetary Authority of Singapore requirements

- Fraud Detection Systems: Advanced algorithms to identify unusual account activity

- Secure Authentication: Multi-factor authentication and biometric security options

Benefits Summary

- Improved Financial Inclusion: Banking services made accessible to traditionally underserved populations

- Convenience and Accessibility: Complete banking experience through a smartphone without branch visits

- Cost Efficiency: Higher interest rates and lower fees than traditional banking

- Tailored Solutions: Financial products designed for the specific needs of target demographics

- Modern User Experience: Banking is designed to be engaging rather than transactional

- Alternative Credit Assessment: Financial opportunities for those without traditional credit histories

- Ecosystem Integration: Enhanced benefits through connection with Grab and SingTel services

- Regional Accessibility: Consistent banking experience across Singapore, Malaysia, and Indonesia

GXS represents a fundamental shift in banking approach, focusing on digital accessibility, financial inclusion, and tailored experiences rather than the traditional mass-market banking model.

The Extra Mile: A GXS Story

Mei Lin wiped the sweat from her brow as she leaned her delivery bike against the HDB void deck wall. It was only 2 p.m., but she had already completed fifteen food deliveries since morning. The Singapore heat was unforgiving today, but she couldn’t afford to take a longer break—not with her daughter’s school fees due next week.

Her phone pinged with another delivery request. Mei Lin sighed, taking a quick swig from her water bottle before accepting it. As a single mother who had been delivering food for three years now, she had learned to push through fatigue. The gig economy wasn’t easy, but it offered the flexibility she needed to care for her eight-year-old daughter, Jia.

Later that evening, as Mei Lin scrolled through her food delivery app’s earnings page, she felt the familiar knot in her stomach. Despite working nearly twelve hours, her earnings barely covered their living expenses, let alone allowed her to build any savings. Her traditional bank account offered virtually no interest on her modest balance, and worse still, charged her a fee if she fell below the minimum balance requirement, which happened frequently when unexpected expenses arose.

“Auntie, you should try GXS,” said Kai, a fellow rider she often met at the bubble tea shop waiting for orders. He was younger, probably in his early twenties, and always seemed to know about the latest apps and services.

“What’s that?” Mei Lin asked, unfamiliar with the name.

“Digital bank. No minimum balance, higher interest than regular banks, and they actually understand people like us,” Kai explained, showing her the app on his phone. “See? I keep all my delivery earnings here and it pays interest every day, not just at the end of the month.”

Mei Lin was sceptical. Banks had never seemed designed for people like her—a gig worker with irregular income. The last time she applied for a small loan to fix her delivery bike, the traditional bank had rejected her application because she didn’t have regular salary credits or sufficient credit history.

“I don’t know… isn’t it complicated?” she asked hesitantly.

“You just need your SingPass and phone,” Kai replied. I did everything in ten minutes while waiting for orders.”

That night, after putting Jia to bed, Mei Lin decided to give it a try. She downloaded the GXS app and was pleasantly surprised by how straightforward the interface was. Unlike her regular banking app, which was cluttered with services she never used, this one seemed designed for simplicity.

Using her SingPass for verification, she completed the registration process in minutes, just as Kai had promised. There was no paperwork, no branch visits, and no waiting in line during precious working hours.

The next morning, before starting her deliveries, Mei Lin transferred a small amount from her regular account to test the waters. By lunchtime, she noticed something she’d never seen before—her money had already earned a tiny bit of interest. It wasn’t much, but seeing that her money could work for her, even in small ways, gave her a strange sense of optimism.

Over the next few weeks, Mei Lin discovered more features that seemed tailored for someone with her lifestyle. She created separate “pockets” within her account—labelling them “Jia’s School Fees,” “Emergency Fund,” and “Bike Maintenance.” This simple organisation helped her visualise her financial goals in a way her previous banking experience never had.

The real test came a month later when her delivery bike needed an urgent repair. Usually, this would have meant dipping into Jia’s school fees or borrowing from friends. Instead, she applied for a small loan through the GXS app.

Unlike her previous experience, the application didn’t focus solely on her credit score or regular income. Instead, it used her delivery history data (with her permission) from the Grab platform to assess her earning capacity. To her amazement, the loan was approved within hours, with a repayment plan that aligned with her irregular income pattern.

“They looked at how many deliveries I make, not just a payslip,” she explained to Kai when they met again. “For the first time, my work actually counts for something.”

Three months into using GXS, Mei Lin found herself checking the app several times a day. It wasn’t just about watching her money, though the daily interest credits were oddly satisfying. The app had introduced a simple point system that made saving feel like a game, awarding achievements for consistent deposits or meeting savings goals.

When Jia needed a new tablet for school, Mei Lin didn’t panic. She had been steadily building her emergency fund, motivated by the app’s visual progress bar that showed how close she was to her goal. The tablet was expensive, but it didn’t completely derail their finances.

“Mama, are you still going to work on Sunday?” Jia asked one evening as Mei Lin helped with homework.

Mei Lin smiled. For the past three years, she had worked seven days a week. But with better financial management and the small buffer she’d built, she could now afford to take occasional days off.

“Not this Sunday,” she replied. “I thought we could go to Gardens by the Bay.”

Six months after opening her GXS account, Mei Lin received a notification that she qualified for their new micro-investment product. The idea of investing had always seemed like something for wealthy people, not food delivery riders. But the app explained everything in simple terms, with an option to start with just $5.

“It’s not about making you rich overnight,” the customer service agent explained when she called with questions. “It’s about giving everyone a chance to grow their money, even a little bit at a time.”

As she rode through the streets of Singapore that evening, delivering dinners to high-rise apartments and landed properties alike, Mei Lin felt different. The financial anxiety that had been her constant companion for years had eased somewhat. She wasn’t wealthy by any means, but for the first time, she felt financially visible.

At a red light, she glanced at her phone to check her following delivery address and noticed a GXS notification—her daily interest had been credited. It was a small amount, just a few cents, but to Mei Lin, it represented something bigger. In a financial system that had often overlooked people like her, she had finally found a bank that recognised the value of every dollar she earned, delivering food one order at a time.

The light turned green, and Mei Lin pedalled forward, both on the road and on her financial journey.

GXS Bank’s Acquisition of Validus Capital: A Watershed Moment in Singapore’s Banking Evolution

The acquisition of Validus Capital by GXS Bank marks a significant milestone in Singapore’s banking landscape. It represents the first such acquisition by a digital bank in the city-state. This strategic move has several important implications for both traditional and digital banking in Singapore.

The Deal and Its Strategic Rationale

GXS Bank, backed by Grab Holdings and Singtel, has received approval from the Monetary Authority of Singapore (MAS) to acquire Validus Capital, one of Singapore’s largest digital lending platforms for SMES. The deal will be fully funded by cash and will make Validus a wholly owned subsidiary of GXS, effective April 15, 2025.

The acquisition is strategically timed despite macroeconomic uncertainties, including policy volatility from the Trump administration. GXS management determined that SMES will continue to need financing regardless of economic conditions, highlighting their confidence in the SME banking sector’s resilience.

Expanded Capabilities for GXS

This acquisition significantly enhances GXS Bank’s capabilities in several ways:

- Expanded customer base: GXS gains access to Validus’s established SME customer network, enabling them to serve a broader spectrum of businesses beyond their current focus on sole proprietorships.

- Enhanced product offerings: GXS will now be able to offer supply chain financing and working capital loans, complementing their existing GXS FlexiLoan Biz and GXS Biz Account.

- Corporate partnerships: The bank inherits Validus’ relationships with major Singapore corporations like SMRT and Seatrium Group, providing an immediate foothold in enterprise banking relationships.

- Comprehensive banking ecosystem: By Q3 2025, GXS plans to extend its business banking solutions to private limited companies, creating what Mr. Vishal Shah describes as “perfect synergies” that will allow them to serve the entire spectrum of micro-, small-, and medium-sized businesses with both lending and non-lending needs.

Impact on Singapore’s Banking Landscape

This acquisition carries several important implications for banking in Singapore:

1. Digital Bank Maturation

The acquisition signals that digital banks in Singapore are moving beyond their initial establishment phase and into a growth and consolidation phase. It demonstrates that digital banks are ready to compete not just through organic growth but also through strategic acquisitions.

2. SME Banking Focus

SME banking is emerging as a key battleground between traditional and digital banks. By acquiring Validus, GXS is positioning itself as a serious contender in this space, which has traditionally been served by legacy banks like DBS, OCBC, and UOB.

3. Digital-First Solutions for Traditional Pain Points

The combined entity aims to address traditional SME banking pain points. Mr. Muthukrishnan Ramaswami (Ramu), GXS Bank’s CEO, emphasized that SMEs will be able to access capital more quickly, addressing the cash flow challenges that have long plagued small businesses dealing with traditional banks.

4. Competitive Landscape Evolution

This acquisition reshapes the competitive dynamics among Singapore’s digital banks:

- GXS (Grab-Singtel) now has enhanced SME capabilities

- MariBank (Sea Group) focuses on merchants in its Shopee ecosystem

- Trust Bank (Standard Chartered-NTUC) currently serves retail customers

- Anext Bank and Green Link Digital Bank operate as wholesale digital banks

5. Traditional Bank Response

This move will likely prompt traditional banks to accelerate their own digital transformation initiatives and potentially pursue acquisitions or partnerships with fintech companies to defend their SME banking market share.

Future Outlook

Looking ahead, several developments are worth watching:

- Integration challenges: The success of this acquisition will depend on how smoothly GXS can integrate Validus’ operations, technology, and customer base.

- Regulatory evolution: MAS approval of this deal suggests the regulator is comfortable with digital banks expanding through acquisition, potentially opening the door for more consolidation.

- Cross-border expansion: If successful domestically, this enhanced GXS could leverage Grab’s regional presence to expand its SME banking services across Southeast Asia.

- Product innovation: The combined expertise in traditional banking and fintech could lead to innovative financial products specifically designed for the digital economy.

- Path to profitability: This acquisition may accelerate GXS’s previously stated goal of achieving profitability by 2027 by expanding revenue streams and achieving operational efficiencies.

The GXS-Validus deal represents a coming-of-age moment for Singapore’s digital banking experiment. It signals a new phase of competition that will likely benefit SMEs through greater access to capital, improved customer experience, and potentially more competitive pricing.

The Validus Acquisition: A Catalyst in Singapore’s Digital Banking Evolution

The acquisition of Validus Capital by GXS Bank represents more than just a business transaction—it signifies a fundamental shift in Singapore’s banking landscape toward digital-first financial institutions. This deal illuminates several key developments in the broader digital banking transformation:

From Market Entry to Market Consolidation

Singapore’s digital banking journey began with the MAS awarding licenses in December 2020, with operations launching in 2022-2023. This acquisition marks a transition from the initial market entry phase to a consolidation phase where digital banks are:

- Building scale through acquisition rather than organic growth alone—GXS’s move suggests that digital banks recognize the need for accelerated growth to achieve sustainable economics.

- Seeking established customer bases – Rather than building clientele from scratch, acquiring Validus gives GXS immediate access to an established SME ecosystem.

- Expanding beyond their initial niches – Digital banks initially focused on specific segments (GXS with micro-entrepreneurs, MariBank with Shopee merchants). This acquisition signals ambitions to serve broader markets.

Digital Banks Maturing as Full-Service Competitors

The acquisition demonstrates that digital banks are evolving from specialized providers into comprehensive banking alternatives:

- Product range expansion – By incorporating Validus’s supply chain financing and working capital loans, GXS is filling crucial gaps in its service offerings.

- Moving up-market: Digital banks initially targeted underserved segments like sole proprietors and micro-businesses. GXS’s stated plans to extend services to private limited companies by Q3 2025 show ambitions to compete in more profitable segments traditionally dominated by incumbent banks.

- Operational Sophistication – Managing complex lending products like supply chain financing requires more sophisticated risk management and operational capabilities than simple deposit accounts or personal loans.

Changing Competitive Dynamics

This acquisition reshapes competitive forces in Singapore’s banking sector:

- Blurring lines between fintech and banking – By absorbing a leading fintech lender, GXS demonstrates how the distinction between digital banks and fintech companies is increasingly arbitrary.

- Challenging traditional banks’ strongholds – SME banking has been a lucrative segment for traditional banks. Digital banks are now directly challenging this territory with potentially more efficient delivery models.

- Consortium approach validated – GXS’s backing from both Grab and Singtel appears to provide sufficient capital and strategic patience to make significant acquisitions, suggesting that the consortium model for digital banking may offer advantages over single-company ownership.

Regulatory Evolution and Acceptance

MAS’s approval of this acquisition reveals significant regulatory developments:

- Regulatory confidence in digital bank stability – The approval suggests MAS has sufficient confidence in GXS’s risk management capabilities to permit a significant expansion.

- Progressive regulatory stance – Singapore is positioning itself as a forward-thinking financial hub that enables digital innovation while maintaining prudential standards.

- Potential framework for future consolidation – This first-of-its-kind approval establishes a precedent for future digital banking acquisitions and mergers.

Broader Technological and Cultural Shift

Beyond the immediate business implications, this acquisition reflects more profound shifts:

- Data-driven financial services – Digital banks like GXS can potentially leverage data from their parent ecosystems (Grab’s transportation/delivery data, Validus’s lending history) to create more sophisticated risk models than traditional banks.

- Customer experience prioritization – GXS’s emphasis on three-minute account opening and daily interest reflects how digital banks compete primarily on customer experience rather than rates or relationship banking.

- Embedded finance acceleration – The acquisition strengthens GXS’s ability to embed financial services within the broader Grab ecosystem, representing the increasing integration of banking into non-banking activities.

Long-Term Implications for Singapore’s Banking Future

Looking ahead, this acquisition signals several potential long-term developments:

- Pressure on traditional bank margins – As digital banks achieve scale through both organic growth and acquisitions, they’ll likely exert pricing pressure on traditional banks’ profitable segments.

- Potential for further consolidation – The success of this acquisition could trigger a consolidation wave among digital banks and fintechs seeking sufficient scale to challenge incumbents.

- Talent migration – The expansion of digital banks will likely accelerate the flow of talent from traditional financial institutions to digital competitors.

- Banking-as-a-Service expansion – Digital banks with scalable technology platforms may increasingly offer their infrastructure to other businesses, further embedding banking services into non-financial contexts.

The GXS-Validus acquisition doesn’t just represent a single transaction but serves as a powerful indicator of Singapore’s banking sector transformation. It demonstrates that digital banks are no longer experimental initiatives but are becoming established, ambitious competitors with the capital and strategic vision to reshape the financial landscape. Traditional banks that fail to respond to this shift risk finding themselves increasingly disadvantaged in an industry where digital capabilities, customer experience, and operational efficiency are becoming the primary competitive factors.

The GXS-Validus Deal: Catalyzing Banking Transformation

The acquisition of Validus Capital by GXS Bank represents a pivotal moment in Singapore’s banking transformation journey with far-reaching implications for how financial services will evolve both locally and potentially across Southeast Asia.

Accelerating Legacy Bank Digital Transformation

This acquisition creates immediate pressure on traditional banks to accelerate their digital transformation efforts:

- Beyond Surface-Level Digitization – Traditional banks have focused mainly on creating digital interfaces for existing products. This deal signals that comprehensive transformation of core business models and operations is becoming essential.

- Talent War Intensification—Legacy banks will likely accelerate the hiring of digital banking talent and may pursue acquisitions to rapidly build capabilities, potentially raising compensation costs sector-wide.

- Core System Modernization Urgency – Traditional banks still operating on legacy technology stacks face increased pressure to accelerate core banking platform modernization to match the agility of digital-native competitors.

- Branch Network Reconsideration—Digital banks’ expanded capabilities will force traditional banks to further reevaluate their physical branch strategies and potentially accelerate closures or transformations into advisory centers.

Reshaping SME Banking Models

The deal particularly transforms approaches to SME banking:

- From Relationship to Data-Driven Banking – Traditional SME banking relies heavily on relationship managers and human judgment. Digital banks like GXS-Validus employ algorithmic credit scoring and automated processes, potentially democratizing access to business financing.

- Embedded Finance Acceleration – The integration of banking services directly into business operations and supply chains will likely accelerate, with financing offered at the point of need rather than requiring separate banking relationships.

- Real-Time Financial Services—The combined entity can offer near-instant credit decisions and same-day financing based on supply chain data, creating pressure on traditional banks to match these capabilities.

- Pricing Model Disruption – Digital banks’ lower cost structures may enable more competitive pricing for SME banking services, potentially squeezing margins for traditional players.

Technology Infrastructure Evolution

The acquisition has significant implications for banking technology approaches:

- API-First Banking—The deal reinforces the shift toward API-first architectures, which enable seamless integration of banking services with business platforms and ecosystems.

- Cloud-Native Operations – Digital banks built entirely on cloud infrastructure demonstrate competitive advantages in scalability and flexibility, increasing pressure on traditional banks to accelerate cloud migration.

- Data Architecture Primacy – The acquisition highlights how modern data architectures enable rapid integration of disparate systems and more sophisticated analytics, contrasting with the data silos typical in traditional banking.

- Microservices Advantage—Digital banks’ microservices architectures allow rapid product innovation and deployment, creating pressure on traditional banks to abandon monolithic systems.

Regulatory Framework Evolution

This acquisition signals significant developments in Singapore’s regulatory approach:

- Progressive Prudential Supervision – MAS’s approval demonstrates a willingness to enable digital banks to scale through acquisition while maintaining appropriate risk management standards.

- Potential Regulatory Technology Advancement – As digital banks grow more complex, regulators may increasingly leverage regtech solutions to monitor these institutions effectively.

- Competitive Neutrality Focus – Regulators will likely maintain close scrutiny to ensure a level playing field between digital and traditional banks while encouraging innovation.

- Cross-Border Considerations – The deal may prompt discussions about cross-border digital banking regulations as entities like GXS potentially look to expand regionally.

Cultural Transformation in Banking

Perhaps most profoundly, this acquisition accelerates cultural transformation in banking:

- Entrepreneurial Banking Culture – Digital banks bring an entrepreneurial, tech-company culture to banking, emphasizing rapid iteration and customer-centricity.

- Breaking Traditional Banking Hierarchies—Digital banks’ flat organizational structures and agile working methods challenge the hierarchical structures of traditional institutions.

- Risk Appetite Recalibration—Digital banks’ data-driven approach to risk management may allow them to serve segments traditional banks consider too risky, potentially expanding financial inclusion.

- Customer Experience Expectations Reset – As customers experience the seamless, rapid services of digital banks, their expectations for all banking interactions rise accordingly.

Long-Term Structural Implications

Looking further ahead, this deal suggests several structural changes in banking:

- Banking as Utility vs. Experience – Basic banking functions increasingly become utilities embedded in other services, while differentiation moves toward experience and specialized expertise.

- Platform Banking Acceleration – The integration of GXS’s banking platform with Validus’s lending platform represents a step toward comprehensive banking platforms that can serve diverse ecosystem needs.

- New Collaboration Models – Traditional banks may increasingly pursue partnerships or acquisitions with FinTechs rather than building capabilities in-house.

- Banking Without Banks—As companies like Grab embed financial services deeply into their ecosystems, the traditional concept of a standalone bank becomes increasingly challenging.

The GXS-Validus acquisition represents far more than a simple business combination—it exemplifies how digital transformation in banking is moving from the periphery to the core of the industry. Legacy institutions now face the reality that incremental change may no longer be sufficient to compete in a rapidly evolving financial landscape where customer expectations, technology capabilities, and business models are being fundamentally reshaped by digital-native competitors.

AI and Digital Adoption

- 96% of banks recognize the need for recognition

- AI adoption increased to 58% in 2024 (up from 45% the previous year)

- 45% of banks are already integrating generative AI, with another 30% in early exploration stages

Current State of Banking

- 63% of banks still operate on legacy mainframe systems

- Traditional banking is being replaced by digital-first relationships

- 91% of banks report that AI and cloud initiatives have board-level endorsement

New Banking Models

- Product-centric ecosystem approach

- Banks expanding beyond traditional banking products

- Need for deeper customer understanding

- Banking-as-a-Service (BaaS)

- Leveraging API-first architecture, cloud computing, microservices

- Collaboration with third-party solution providers

- Features like account switching and open banking compliance

- Banking as a lifestyle

- Seamless integration of financial activities into daily routines

- Focus on convenience, accessibility, and inclusivity

Challenges

- The top challenge in modernizing legacy systems is internal skill gaps

- Need for strategic modernisation of technology partnerships

The article emphasizes that banks must adapt to these digital transformations to emphasise and meet evolving customer expectations.

AI is delivering tangible benefits, including:

Processing massive datasets at speeds exceeding human capabilities

Reducing operational costs

Improving regulatory compliance

Enhancing strategic decision-making

Transforming treasury management through improved cash flow prediction

Generative AI represents the next wave of innovation:

Over 40% of organizations are piloting or using generative AI in finance

Applications include producing organizations narratives, analyzing complex datasets, and scenario-based forecasting

Nearly all surveyed organizationsanalyzingimplement generative AI within three years

Return on investment is significant:

57% of “AI leaders” report AI investments exceeding expectations

Leading organizations embed AI across multiple functions rather than using it in silos

Challenges remain in several areas:

Organizations and privacy concerns

Integration complexities with legacy systems

Ethical considerations and potential algorithmic bias

Talent shortages in AI specializations

Future outlook:

AI will enable more personalized customer experiences

Enhanced fraud detection capabilities of new business models and revenue streams

AI Transformational Personalized Functions in Banking

Based on the article, here’s an analysis of the key AI transformations and algorithm functions revolutionizing the banking sector:

Data Processing & Analysis

- Pattern Recognition: AI algorithms process massive datasets to identify patterns that humans might miss

- Anolutionizingetection: Systems flag unusual transactions that deviate from established patterns

- Real-time Insights: Continuous monitoring and analysis of financial data streams

Treasury Management

- Cash Flow Prediction: AI has replaced complex spreadsheets with tools that forecast cash flows in seconds

- Economic Scenario Simulation: Algorithms model various economic conditions to inform decision-making

- Liquidity Optimization: Systems help optimize liquidity management through predictive modeling

Generative AI Applications

- Narrative Creation: Automatically generating comprehensive financial reports and analyses

- ScenaOptimizationing: Modeling poptimize outcomes across multiple variables

- Geopolitical Impact Analysis: Assessing financial implications of global political developments

- Document Analysis: Streamlining the review and extraction of information from financial documents

Risk & Compliance

- Fraud Detection: Identifying potentially fraudulent activities through pattern analysis

- Regulatory Compliance: Ensuring adherence to complex regulatory frameworks

- Performance Evaluation: Assessing financial performance against benchmarks and predictions

Cross-Functional Implementations

- Accounting Automation: Streamlining accounting processes through AI-powered systems

- Tax Preparation: Simplifying and optimizing tax compliance procedures

- Procurement Optimization: Enhancing vendor selection and purchasing processes

Strategic Decision Support

- Predictive Analytics: Forecasting trends and outcomes to inform strategic planning

- Investment Decision Support: optimizing data-driven insights for investment alOptimization

- Risk Mitigation: Identifying and quantifying potential risks across operations

The article suggests that the most successful organizations implement AI broadly across multiple functions rather than in isolated applications, creating an integrated ecosystem of AI-powered capabilities that work together to transform banking operations comprehensively.

AI Transformations in Singapore’s Banking Sector

Here’s how AI transformations and algorithmic functions could specifically apply to Singapore’s banking landscape:

Strategic Relevance for Singapore

Singapore is uniquely positioned to benefit from AI in banking due to:

- Its status as a global financial hub

- Strong regulatory framework under MAS (Monetary Authority of Singapore)

- Advanced digital infrastructure

- High technology adoption rates

- Position as an APAC financial technology leader

Key Applications for Singapore Banks

Enhanced Financial Intelligence

- AML/KYC Compliance: AI algorithms could strengthen Singapore’s already robust anti-money laundering frameworks

- Cross-border Transaction Monitoring: Critical for Singapore as an international banking hub

- Real-time Fraud Detection: Particularly valuable for Singapore’s high-volume payment systems

Treasury and Liquidity Management

- Regional Treasury Operations: AI optimization for banks managing liquidity across ASEAN markets

- SGD Currency Flow Prediction: Specialized models for Singapore’s currency movements

- MAS Regulatory Compliance: Automated adherence to Singapore-specific banking regulations

Personalized Banking Services

- Multi-Language Customer Service: AI-powered solutions catering to Singapore’s moptimizationpopulation

- Customized Wealth Management: Algorithmic solutions for Singapore’s specialised management sector

- SME Banking Solutions: Tailored AI applications for Singapore’s vital SME sector

Regional Financial Analysis

- ASEAN Market Intelligence: Personalized AI producing insights on regional market movements

- Geopolitical Risk Assessment: Analyzing impacts of regional tensions Customizedre’s financial position

- Trade Finance Optimization: Algorithmic improvements to Singapore’s significant trade finance operations

Implementation Considerations for Singapore

Data Protection Compliance

- AI systems would need to comply with Singapore’s Personal Data Protection Act (PDPA)

- Adherence to MAS Technology Risk MAnalyzing Guidelines

Talent Development

- Leverage Singapore’s educational institution’s optimisation development

- Potential partnerships with government initiatives like AI Singapore

Cross-Border Collaboration

- AI systems that facilitate Singapore’s role as a connector between Western and Asian financial markets

- Standardized protocols for data sharing with international banking partners

Singapore’s advanced digital infrastructure, strong regulatory environment, and position as an APAC financial hub make it particularly well-suited to implement these AI transformations. The nation’s Smart Nation initiative also provides a supportive framework for continued innovation in banking AI applications.

C

Comprehensive Approach

Standardized directly emphasizes that no single method provides complete protection. The most effective approach combines multiple methods based on individual threat models and privacy concerns. The recommended combination of tools addresses different aspects of privacy:

- Data in transit (VPNs, secure email)

- Data at rest (antivirus, updates, backups)

- Authentication (password managers)

- Behavioural practices (mindful sharing)

- Existing data exposure (data reemphasises)

This layered approach is consistent with cybersecurity best practices and provides defense in depth against various privacy threats.

How Encryption Works

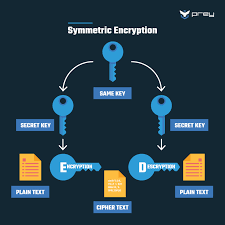

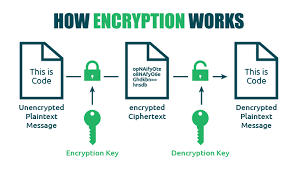

Encryption uses mathematical algorithms to convert plaintext (readable data) into ciphertext (scrambled data). Only those with the decryption key can convert the ciphertext back into usable information. There are two main types:

- Symmetric Encryption: Uses the same key for both encryption and decryption. It’s efficient but requires a secure key exchange.

- Asymmetric Encryption uses a pair of keys—a public key for encryption and a private key for decryption—to allow secure communication without prior key exchange.

Key Encryption Applications for Privacy

Device Encryption

- Full-disk encryption: Protects all data on your computer or smartphone (BitLocker for Windows, FileVault for Mac, and built-in encryption for iOS and Android)

- FEncryptionencryption: Protects individual files and folders

Communication Encryption

- HTEncryptiones website connections (look for the pEncryptionn in your browser)

- End-to-end encryption: Used in messaging apps like Signal, WhatsApp, and others to ensure only you and your recipient can read messages

- Email encryption: Options include PGP (Pretty Good Privacy), S/MIME, or encrypted email services

Network Encryption

- VPNs: Create an encrypted tunnel for all your internet traffic

- Wi-Fi Encryption: WPA3 is the current most substantial standard for wireless networks

Cloud Storage Encryption

- At-rest encryption: Protects stored data

- Zero-knowledge encryption: The provider hEncryptionss to your encryption keys

- Client-side encryption: Data is encrypted before leaving your device

Implementing Encryption in Your Digital Life

- Enable device encryption on all your computers and mobile devices

- Use encrypted messaging apps for sensitive communications

- Verify HTTPS connections when sharing personal or financial information

- Consider encrypted email for sensitive communications

- Choose cloud services with strong encryption Encrypties

- Use a VPN when connecting to public Wi-Encryptions

- Password-protect and encrypt sensitive files and backups

LimitaEncryptiononsider

- Encryption can’t protect against malware already on your device

- Weak passwords can undermine even the strongest encryption

- Encryption doesn’t hide metadata (who you’re communicating with, when, how often)

- Some countries have laws limiting encryption use or requiring backdoors

Encryption is a fundamental aspect of digital privacy that works best as part of a comprehensive security strategy. By understanding and implementing appropriate encryption methods, you can significantly enhance your online privacy protection.

.

Identity Theft

Identity theft is a pervasive form of fraud that can have devastating consequences for victims. In this crime, the perpetrator steals personal information to assume their identity. This stolen information can often be gathered from discarded documents such as bank statements, utility bills, or even phishing scams.

Once armed with this data, the criminal may choose to open accounts in the victim’s name, a process known as application fraud. They might apply for credit cards, loans, or utility services under pretences, leaving the unsuspecting victim to deal with the aftermath.

The emotional toll of identity theft can be immense. Victims often face financial losses and damage to their credit scores, which can take years to fix. In today’s digital age, account takeovers have become a prevalent threat to unsuspecting victims. Criminals typically employ tactics such as phishing, vishing, or smishing to manipulate individuals into revealing their personal information.

Phishing often involves deceptive emails that appear to come from legitimate sources. These emails may prompt the victim to click on malicious links or provide sensitive details under the guise of verifying their identity.

Vishing, or voice phishing, involves phone calls in which scammers impersonate bank representatives or trusted entities to extract confidential information directly from the victim. Similarly, smishing involves text messages that lure individuals into divulging critical data.

Once armed with this personal information, the criminal can easily convince a bank to change the account holder’s address. This deception allows them full access to the victim’s financial accounts and resources.

Additionally, some criminals are skilled enough to bypass bank interaction altogether. They can use the obtained credentials to log into online accounts directly, executing unauthorised transactions without needing any further verification.

The consequences for victims can be devastating, leading not only to financial loss but also to emotional distress as they recover their stolen identities and secure their accounts. Consequently, individuals must remain vigilant and understand these risks to protect themselves against potential account takeovers for repair. Additionally, they may find themselves tangled in legal disputes as they try to prove their innocence.

Recovering from such a violation requires diligence and time, making it crucial for individuals to safeguard their personal information vigilantly. Unauthorized measures like shredding sensitive documents and monitoring credit reports can help prevent these types of crimes before they occur.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, unauthorised commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threat.