The Core Warning The Bank for International Settlements (BIS) is warning about potential instability in the massive $113 trillion foreign exchange swap market. The concern centres on non-bank financial firms holding over $80 trillion in FX swaps, which are essentially short-term dollar borrowing arrangements that exist “off-balance sheet” and aren’t subject to regulatory capital requirements.

The Scramble Scenario BIS official Hyun-Song Shin outlined a concerning feedback loop: if investors rush to unwind these swap positions simultaneously, it could trigger a “scramble for dollars” as firms with euro or yen holdings still face dollar repayment obligations. This rush could cause the dollar to spike rapidly in value, potentially creating broader market disruption.

Current Context The warning comes amid significant US market volatility, including:

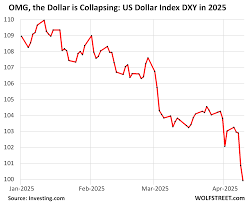

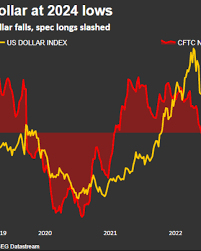

- Trade war tensions under President Trump weakened the dollar to its worst year-start performance in over 35 years

- Moody’s recent decision to strip the US of its last remaining AAA credit rating, citing concerns about mounting government debt

- The unusual phenomenon of US stocks, bonds, and the dollar all declining together

Broader Implications The article touches on whether “US exceptionalism” – the traditional investor preference for US assets – might be weakening. While Shin notes it’s too early to determine if major investors are actually divesting from US assets or just hedging, the combination of factors suggests they’re at least reconsidering their strategic positioning.

This represents a classic example of how interconnected global finance has become, where problems in one primary market can cascade through hidden channels like the swap market.

Global Market Instability and the Evolving Dollar System: Implications for Singapore’s Financial Sector

Executive Summary

The Bank for International Settlements’ recent warning about potential dollar market instability signals a critical juncture in global finance. With over $80 trillion in foreign exchange swaps held by non-bank financial institutions and mounting pressures on US economic fundamentals, the international monetary system faces unprecedented stress tests. For Singapore, a nation whose prosperity is intrinsically linked to global financial stability, these developments present both immediate risks and strategic opportunities that will reshape the financial landscape for decades to come.

The Architecture of Dollar Dominance Under Stress

Structural Foundations and Vulnerabilities

The US dollar’s hegemonic position in global finance rests on several pillars: its role as the primary reserve currency (approximately 59% of global foreign exchange reserves), the benchmark for international trade pricing, and the foundation of the $7.5 trillion daily foreign exchange market. This dominance has created what economists term “dollar privilege” – the ability for the United States to finance deficits at preferential rates while exporting monetary policy globally.

However, this system’s apparent strength masks profound vulnerabilities. The $113 trillion FX swap market, larger than global GDP, represents a hidden web of dollar dependencies. These instruments, predominantly held off-balance sheet, create what the BIS characterises as “phantom debt”—dollar obligations that remain invisible to regulators until crisis conditions force their recognition.

The mechanics of this vulnerability are straightforward yet dangerous. Non-US entities, from European pension funds to Asian corporations, routinely hedge currency exposures through FX swaps. When market stress emerges, these entities face simultaneous pressures: their non-dollar assets decline in value while their dollar repayment obligations remain fixed. This asymmetry can trigger what BIS official Hyun-Song Shin describes as a “scramble for dollars,” creating self-reinforcing feedback loops that amplify market volatility.

Signs of Systemic Stress

Recent market behaviour suggests this theoretical risk may be materialising. The simultaneous decline of US stocks, bonds, and the dollar – a historically rare occurrence – challenges the fundamental assumption of US asset exceptionalism. Traditional safe-haven flows, which typically strengthen the dollar during global uncertainty, appear to be disrupted.

The Moody’s decision to strip the United States of its final AAA credit rating represents more than symbolic damage. It reflects genuine concerns about fiscal sustainability, with US debt-to-GDP ratios approaching levels historically associated with crisis conditions in other economies. The rating action coincides with trade policy uncertainties that have weakened the dollar to its poorest year-to-date performance in over three decades.

These developments occur against a backdrop of changing geopolitical dynamics. China, Russia, and other nations’ efforts to reduce dollar dependence through alternative payment systems, bilateral trade agreements in local currencies, and central bank digital currency initiatives signal a gradual but potentially transformative shift in global monetary architecture.

Singapore’s Financial Ecosystem: Exposure and Resilience

Banking Sector Vulnerabilities

Singapore’s three major banks – DBS Group, Oversea-Chinese Banking Corporation (OCBC), and United Overseas Bank (UOB) – represent the frontline of potential dollar market stress. These institutions, while among Asia’s strongest, maintain significant dollar funding requirements to support their regional operations across Southeast Asia, Greater China, and beyond.

DBS Group, Southeast Asia’s largest bank by assets, exemplifies both the opportunities and risks inherent in dollar dependence. The bank’s expansion across Asian markets has necessitated substantial dollar funding to support trade finance, corporate lending, and treasury operations. While DBS maintains robust capital ratios and sophisticated risk management systems, a sudden tightening of dollar liquidity could pressure net interest margins and constrain lending capacity.

OCBC’s substantial insurance operations through Great Eastern add another layer of complexity. Insurance companies typically hold long-duration assets to match policy liabilities, often involving cross-currency exposures that require active hedging through FX derivatives. In a dollar scramble scenario, the cost of maintaining these hedges could increase dramatically, potentially affecting profitability and solvency ratios.

UOB’s focus on Southeast Asian markets, particularly in commodity-dependent economies, creates indirect dollar exposure through its corporate clients. Many of the bank’s borrowers depend on dollar-denominated commodity revenues to service local currency loans, creating credit risk that could manifest during periods of dollar strength and commodity price volatility.

Market Infrastructure and Trading Operations

Singapore’s role as a global financial centre amplifies both its exposure and its strategic importance during periods of dollar stress. The city-state handles approximately 7.6% of global foreign exchange trading volume, making it the third-largest FX centre after London and New York. This position provides significant revenue streams for local banks and international institutions, but also creates systemic exposure to market volatility.

The Singapore Exchange (SGX) operates derivatives markets that facilitate hedging activities across Asia-Pacific. During periods of dollar stress, trading volumes typically increase as market participants seek to manage currency exposures, potentially boosting exchange revenues. However, increased volatility also raises counterparty risks and may require additional margin requirements that could strain market liquidity.

Singapore’s emergence as a central fintech hub adds another dimension to dollar market dynamics. Payment service providers, digital asset exchanges, and blockchain-based financial services operating from Singapore often rely on dollar-denominated settlement systems. Disruptions to these systems could affect the competitiveness of Singapore’s fintech ecosystem relative to other regional centres.

Monetary Authority of Singapore: Policy Challenges and Strategic Responses

The NEER Framework Under Stress

The Monetary Authority of Singapore’s unique approach to monetary policy, based on managing the Singapore dollar’s nominal effective exchange rate (NEER) rather than interest rates, faces unprecedented testing during periods of global currency volatility. This system, praised for its effectiveness in maintaining price stability while supporting economic growth, may require adaptation as traditional currency relationships become more volatile.

The NEER system’s effectiveness depends partly on the stability of significant currency relationships, particularly between the US dollar, euro, and Japanese yen – the primary components of Singapore’s trade-weighted basket. Extreme volatility in any of these relationships could complicate policy implementation and reduce the framework’s precision.

MAS maintains one of the world’s most sophisticated monetary policy operations, with deep expertise in foreign exchange markets and quantitative analysis. The authority’s research capabilities, demonstrated through initiatives like Project Ubin, which explores digital currencies and distributed ledger technology, position Singapore well for potential transitions in global monetary architecture.

Regulatory and Supervisory Adaptations

The hidden nature of FX swap exposures highlighted by the BIS presents particular challenges for financial supervision. Traditional regulatory frameworks focus on on-balance-sheet risks, potentially missing the systemic vulnerabilities created by derivative positions. MAS has begun addressing these gaps through enhanced reporting requirements and stress testing that incorporates cross-currency funding scenarios.

Singapore’s regulatory approach emphasises proportionality and risk-based supervision, principles that become crucial when addressing complex, interconnected risks. The authority’s willingness to experiment with regulatory sandboxes and innovative supervisory technologies provides tools for monitoring emerging risks in real-time.

The development of macroprudential policy tools represents another area where MAS has shown leadership. Countercyclical capital buffers, liquidity coverage requirements, and sector-specific measures could help mitigate the systemic effects of dollar market stress on Singapore’s financial system.

International Cooperation and Contingency Planning

Singapore’s small, open economy makes international policy coordination essential during periods of global financial stress. MAS participates actively in multilateral forums, including the Bank for International Settlements, the Financial Stability Board, and ASEAN+3 financial cooperation initiatives.

The authority maintains bilateral swap arrangements with major central banks, providing access to foreign currency liquidity during stressed conditions. These arrangements, tested during the 2008 financial crisis and the 2020 pandemic, represent crucial backstops for maintaining financial stability.

MAS has also pioneered innovative approaches to cross-border payments and settlements through initiatives like linking domestic payment systems with regional partners. These efforts could prove strategically important if traditional dollar-based settlement systems face disruption.

Strategic Implications and Future Scenarios

Scenario Planning and Risk Assessment

Multiple scenarios could emerge from current global monetary tensions, each with distinct implications for Singapore’s financial sector:

Gradual Multipolarity: A slow transition toward a more balanced international monetary system, with increased roles for the euro, renminbi, and potentially digital currencies. This scenario would provide time for adaptation but might reduce Singapore’s advantages as a dollar-based financial centre.

Dollar Renewal: Successful US policy adjustments that restore confidence in dollar assets and reinforce the current system. This outcome would benefit Singapore’s existing financial infrastructure but might delay necessary diversification efforts.

Abrupt Transition: A sharp loss of confidence in dollar assets triggers rapid shifts in global financial flows. This scenario presents the highest near-term risks but could also create opportunities for Singapore to emerge as a bridge between different monetary systems.

Fragmented System: The emergence of competing monetary blocs with limited interoperability, potentially requiring Singapore to navigate multiple, partially incompatible financial systems.

Long-term Strategic Positioning

Singapore’s response to these challenges will likely determine its role in the global financial system for decades to come. The city-state’s historical success in adapting to changing global conditions suggests several strategic priorities:

Technology Leadership: Continued investment in financial technology, particularly in areas like central bank digital currencies, blockchain-based settlements, and artificial intelligence-driven risk management, could provide competitive advantages regardless of which monetary system emerges.

Regulatory Innovation: Singapore’s reputation for balanced, innovative regulation becomes more valuable as traditional regulatory frameworks struggle to address new risks and opportunities in global finance.

Regional Integration: Deeper financial integration with Southeast Asian partners could reduce dollar dependence while strengthening Singapore’s role as the region’s financial hub.

Talent and Infrastructure: Maintaining Singapore’s position as a preferred location for international financial institutions requires continued investment in human capital and physical infrastructure.

Recommendations and Conclusions

The current period of dollar system stress presents Singapore with challenges that require immediate attention and strategic opportunities that could shape its future prosperity. Success will depend on MAS’s ability to maintain financial stability while positioning Singapore for potential transitions in global monetary architecture.

Immediate priorities should include enhanced monitoring of cross-currency funding risks, stress testing of major financial institutions under extreme dollar volatility scenarios, and strengthening international policy coordination mechanisms. Longer-term strategic initiatives might encompass expanding local currency financial markets, developing alternative payment and settlement systems, and deepening regional financial integration.

Singapore’s unique combination of regulatory sophistication, technological innovation, and strategic positioning provides tools to navigate this transition successfully. However, the magnitude of potential changes in the global monetary system requires sustained attention and adaptive policymaking to ensure that Singapore remains a leading global financial centre regardless of how the current tensions resolve.

The path forward requires balancing immediate stability concerns with longer-term strategic positioning, a challenge that Singapore has successfully navigated throughout its history as an independent nation. While the current monetary system tensions present significant risks, they also offer opportunities for Singapore to strengthen its role in an evolving global financial architecture.

NEW YORK – The US dollar experienced a significant boost at the start of the week, driven by renewed speculation regarding potential trade agreements. This development led to an unexpected surge in Taiwan’s currency, causing ripples across global foreign exchange markets.

The greenback has been under continuous pressure, mainly due to President Donald Trump’s economic policies, which have cast doubt on the attractiveness of American assets. Consequently, the US dollar weakened further on May 5, losing ground against most major currencies.

By 1:20 PM in New York, a Bloomberg index tracking the dollar showed a decline of approximately 0.2 per cent. This downturn highlighted growing concerns among investors about the future trajectory of the US economy amid evolving trade discussions.

Market analysts noted that the currency movements underscored the fragile sentiment surrounding the US dollar in international markets. As trade negotiations continue to unfold, traders remain cautious, closely monitoring developments for any signs of lasting impact on currency valuations.

The Taiwanese dollar surged significantly, marking its most significant intraday jump in over 30 years. This made it the leading performer among 16 major currencies tracked by Bloomberg. Meanwhile, the yen experienced a rally, appreciating by approximately 0.6%, which placed it at the forefront of gains within the Group of 10 nations. The euro also showed strength, surpassing the US$1.13 threshold.

In contrast, China’s financial markets were inactive due to a public holiday, creating a quiet backdrop for regional trading activities.

Since taking office in January, Mr. Trump’s assertive trade rhetoric has caused turbulence in macroeconomic markets. His approach has undermined the US dollar’s status as a haven during periods of uncertainty. As a result, investors have been shifting their focus away from American assets, seeking opportunities elsewhere.

In recent days, investors have been keenly focused on the potential trade and tariff deals that the Trump administration might negotiate with key international partners. There is particular interest in understanding the scope and nature of these agreements and how they might impact global markets. A significant point of discussion is whether these negotiations will include a coordinated strategy among global policymakers to weaken the U.S. dollar intentionally.

Such a move could have far-reaching implications for international trade and currency markets. A weaker dollar might boost U.S. exports by making them cheaper on the global market, but could also lead to increased volatility in foreign exchange rates.

Mr. Arindam Sandilya, a Singapore-based global forex strategist at JPMorgan Chase & Co., shared his insights on this evolving situation during a podcast. He noted that there is a palpable sense of uncertainty and caution in Asia regarding these developments. “We’re all feeling a little shell-shocked in this part of the world,” he remarked, emphasising the apprehension among investors and policymakers in the region.

The recent fluctuations in Asian currencies reflect this unease, as markets adjust to the potential economic shifts. The outcomes of these trade negotiations could significantly influence global financial stability and investor confidence in the coming months.

“The substantial and coordinated appreciation of currencies across the region is sparking discussions about the possibility of a currency accord among central banks,” he remarked. This speculation arises as financial leaders contemplate strategies to manage the rapidly shifting exchange rates.

Despite a slowdown in selling during May, the Bloomberg Dollar Spot Index remains significantly impacted. It has experienced a decline of nearly 7 per cent in 2025, marking the most significant drop since the index was established two decades ago. This notable decrease underscores the challenges faced by the U.S. dollar in maintaining its value against other major currencies.

In parallel, traders in the speculative derivatives market are exhibiting unprecedented bearish sentiments towards the dollar. According to the most recent data from the Commodity Futures Trading Commission, this level of pessimism hasn’t been observed since September. Such sentiment reflects growing concerns over the dollar’s future performance amid global economic uncertainties.

The combination of these factors is contributing to heightened volatility in currency markets. Central banks are under increasing pressure to respond, potentially leading to coordinated efforts to stabilise the situation. As discussions continue, market participants are closely watching for any signs of an official agreement that could influence currency dynamics worldwide. Since May 2, the Taiwan dollar has experienced a significant surge. This rise is partly fueled by speculation, though unconfirmed, that a potential trade deal with the United States might include adjustments to exchange rates. This situation exemplifies the complex challenges global policymakers face as investors increasingly withdraw from American assets due to uncertainties in trade policies.

Brad Bechtel, the global head of forex at Jefferies, has commented on the situation. He suggests that the rally in Taiwan’s currency could have broader implications, potentially extending to other developing nations.

Bechtel also speculates about a possible currency agreement involving the US and China, or perhaps the entire region. Such an agreement could strengthen all Asian currencies. This scenario underscores the interconnectedness of global markets and the far-reaching effects of policy decisions. On May 5, in California, US Treasury Secretary Scott Bessent addressed concerns about the impact of the Trump administration’s economic policies on investor behaviour. Speaking at the Milken Institute Global Conference, Bessent dismissed claims that investors are divesting from American assets. He emphasised the United States’ status as the “premier destination” for global capital, underscoring its enduring appeal to international investors.\

Bessent also touched upon the complex nature of trade negotiations under the current administration. He acknowledged that securing better terms of trade can be challenging and sometimes uncomfortable. Despite these challenges, he expressed optimism about the future of America’s trading relationships.

According to Bessent, the long-term outcome will be stronger trading partnerships. He assured that these efforts would not undermine the existing security and values-based ties with international partners. His remarks aimed to reassure both domestic and global audiences about the stability and resilience of US economic strategies.

Central banks and financial officials are actively addressing the rapid appreciation of local currencies. This surge in currency value has prompted swift responses to stabilise markets and mitigate potential economic disruptions.

The situation has become urgent in Taiwan. On May 5, the governor of the central bank held an emergency briefing. He highlighted that market commentary had sparked “excessive” buying of the Taiwan dollar by exporters and foreign investors. This sudden influx is causing concern among financial authorities.

Simultaneously, Taiwan’s markets regulator is taking action. They have convened with life insurers who hold US dollar-based bonds. These insurers are particularly vulnerable to the strengthening domestic currency, which could impact their investments.

On a broader scale, economic indicators are influencing currency dynamics. Ms. Skylar Montgomery Koning, a currency analyst at Barclays in New York, noted that lower tariff rates and progress on trade deals are significant factors. These developments alleviate fears about disruptions to the US economy. Moreover, they could bolster Asian economies and boost their previously lagging currencies.

Maxthon

In an era where the internet weaves itself into the very fabric of our everyday existence, safeguarding our online identities has never been more crucial. Imagine setting forth on an exhilarating journey through the expansive and mysterious realms of the web, where each click unveils a treasure trove of knowledge and thrilling adventures. However, hidden within this vast digital expanse are lurking threats that can jeopardise our personal information and safety. To navigate this intricate online world successfully, it is vital to choose a browser that prioritises user security. Enter Maxthon Browser—your steadfast companion on this expedition, and the most delightful aspect? It won’t cost you a dime.

Maxthon Browser: Tailored for Windows 11 Adventurers

For those who have adopted Windows 11, Maxthon Browser stands out from conventional web browsers due to its unwavering commitment to online privacy. Think of it as a vigilant guardian, always on alert against the myriad dangers that inhabit the digital sphere. Armed with a suite of built-in features like ad blockers and anti-tracking capabilities, Maxthon tirelessly endeavours to protect your online identity. As users navigate the internet on their Windows 11 devices, these protective measures form a strong shield against disruptive advertisements and prevent websites from tracking their browsing habits.

As individuals chart their course through the ever-evolving digital landscape on their Windows 11 systems, the importance of Maxthon’s dedication to privacy becomes increasingly apparent. By harnessing advanced encryption technologies, it ensures that sensitive information remains safeguarded throughout your online escapades. Thus, as users plunge into the uncharted waters of cyberspace, they can embark on their digital quests with confidence, knowing that their personal data is secure and well-guarded.