Recession survival guide tips

The five main things to avoid:

- Co-signing loans – Higher risk of both parties facing job loss or income decline

- Adjustable-rate mortgages (ARMs) – Rates typically fall early in recessions but rise during recovery

- Taking on new debt – Increased risk of job loss makes debt payments harder to manage

- Taking your job for granted – Job security decreases significantly during economic downturns

- Making risky business investments – Better to wait for clear signs of recovery before expanding

The underlying theme concerns managing increased financial risk during uncertain economic times. During recessions, the probability of job loss, business failure, and income reduction increases, making previously manageable financial commitments potentially dangerous.

The article also provides some constructive alternatives, like helping families with down payments instead of co-signing, considering fixed-rate mortgages during low-rate periods, and focusing on building emergency funds rather than taking on new obligations.

Recession Survival Guide: Singapore Context & Impact Analysis

Singapore’s Economic Vulnerability Profile

Structural Sensitivities

Singapore’s economy faces unique recession vulnerabilities due to its:

Trade Dependency: As a central global trade hub, Singapore is highly sensitive to international economic fluctuations. The country’s trade-to-GDP ratio exceeds 300%, making it one of the most trade-dependent economies globally.

Financial Services Exposure: With financial services contributing ~14% of GDP, Singapore is vulnerable to global financial market volatility and capital flight during downturns.

Manufacturing Base: Electronics, chemicals, and biomedical manufacturing sectors are cyclical and sensitive to global demand shifts.

Tourism Reliance: Pre-2020, tourism contributed significantly to GDP through Hospitality, retail, and related services.

Historical Recession Impacts in Singapore

Asian Financial Crisis (1997-1998)

- GDP contracted by 0.1% in 1998

- Unemployment peaked at 4.5%

- Property prices fell 40-50%

- The government implemented a central fiscal stimulus

Global Financial Crisis (2008-2009)

- GDP contracted by 0.6% in 2009

- Unemployment rose to 4.3%

- Manufacturing output fell sharply

- The government used reserves for economic support

COVID-19 Recession (2020)

- GDP contracted by 3.9% – the worst recession since independence

- Unemployment peaked at 3.5%

- The government deployed SGD 100 billion in support measures

Sector-Specific Recession Impacts

Most Vulnerable Sectors

- Aviation & Aerospace – Changi Airport ecosystem, airlines, maintenance

- Tourism & Hospitality – Hotels, F&B, retail, entertainment

- Trade & Logistics – Shipping, warehousing, freight forwarding

- Construction – Property development, infrastructure projects

- Discretionary Retail – Non-essential goods and services

Resilient Sectors

- Healthcare – The ageing population drives consistent demand

- Technology – Digital transformation accelerates during downturns

- Government Services – Counter-cyclical Employment

- Essential Services – Utilities, telecommunications, food

- Financial Services – Though volatile, remains structurally important

Personal Financial Survival Strategies

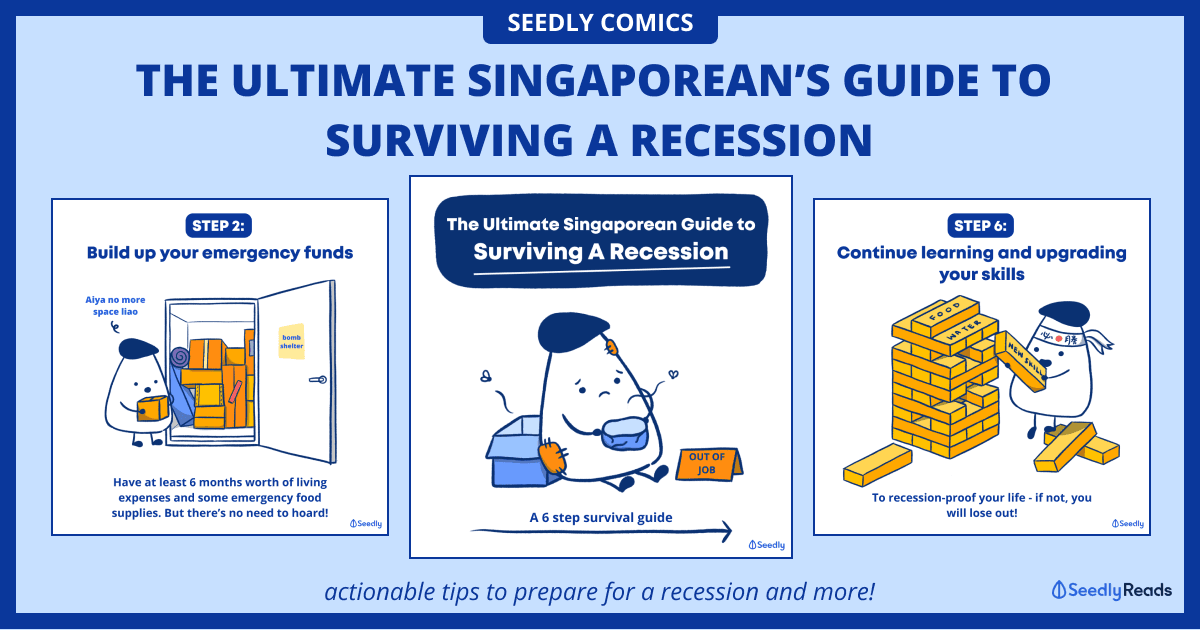

Emergency Fund Optimization

Singapore-Specific Considerations:

- Target 8-12 months of expenses (higher than the global average due to job market concentration)

- Keep funds in SGD to avoid currency risk

- Utilize high-yield savings accounts from local banks

- Consider Singapore Savings Bonds (SSB) for capital preservation

Employment Security Tactics

Skill Development Priorities:

- Digital literacy and data analytics

- Healthcare and eldercare services

- Green technology and sustainability

- Cross-cultural communication (for regional roles)

Network Building:

- Leverage Singapore’s compact professional networks

- Engage with industry associations and government bodies

- Maintain connections across the ASEAN region

- Participate in SkillsFuture programs proactively

Housing Strategy Adjustments

HDB Considerations:

- Understand mortgage moratorium options

- Consider rental Income from spare rooms (with approval)

- Evaluate resale vs rental market timing

- Monitor cooling measures on property values

Private Property:

- Assess Additional Buyer’s Stamp Duty implications

- Consider foreign buyer market dynamics

- Evaluate rental yield sustainability

- Monitor interest rate sensitivity

Investment Portfolio Adaptation

Singapore-Focused Strategies:

- REITs: Singapore REITs offer steady dividends, focus on essential property types

- Blue-chip STI stocks: DBS, OCBC, and UOB provide stability and dividends

- CPF optimization: Maximize voluntary contributions for guaranteed returns

- Government bonds: SSB and SGS for capital preservation

- Regional diversification: Balanced exposure to ASEAN growth markets

Cost Management Tactics

Singapore Cost Optimisation:

- Transportation: Maximize public transport, consider a car-lite lifestyle

- Food: Balance hawker centres with home cooking, bulk buying

- Utilities: Optimize energy consumption, consider solar programs

- Healthcare: Leverage subsidized options, maintain adequate Insurance

- Education: Utilize free/subsidized programs and online alternatives

Business Survival Strategies

SME Resilience Building

Government Support Utilization:

- Enterprise Singapore grants and loans

- Productivity solutions grants

- Market development assistance

- SkillsFuture Enterprise Credit

Operational Efficiency:

- Digital transformation acceleration

- Supply chain diversification

- Cash flow optimization

- Overhead reduction without compromising core capabilities

Sector Pivoting Opportunities

- Food services → Delivery and ghost kitchens

- Retail → E-commerce and omnichannel

- Tourism → Domestic experiences and virtual services

- Manufacturing → Automation and higher-value production

Government Safety Net Understanding

Automatic Stabilizers

- Progressive taxation reduces the burden during income decline

- GST vouchers provide targeted relief

- U-Save rebates offset utility costs

- ComCare assistance for lower-income households

Crisis Response Mechanisms

- Job support schemes for salary supplementation

- Training subsidies for skill upgrading

- SME financing through DBS, OCBC, and UOB partnerships

- Rental relief for commercial properties

Regional Economic Integration Impact

ASEAN Dynamics

Singapore’s recession experience is influenced by:

- Regional supply chain disruptions

- Cross-border investment flows

- Tourism and business travel patterns

- Currency stability relative to regional peers

China-US Trade Relations

As a neutral hub, Singapore benefits from:

- Trade diversion effects

- Safe-haven capital flows

- Increased importance as a neutral meeting ground

- Technology transfer opportunities

Long-term Structural Preparations

Demographic Transition Management

- An ageing workforce requires skill upgrading and health planning

- Immigration policy impacts labour market dynamics

- Healthcare costs will increase significantly

- Housing needs will shift toward smaller, accessible units

Climate Resilience Planning

- Sea level rise impacts property values and Insurance

- Temperature increases affect energy costs

- Supply chain disruptions from regional climate events

- Green transition creates new opportunities and risks

Recession Recovery Indicators for Singapore

Leading Indicators to Monitor

- PMI manufacturing index – Early signal of industrial recovery

- Container throughput – Trade activity gauge

- Tourist arrivals – Service sector recovery

- Property transaction volumes – Wealth effect and confidence

- Credit growth – Business investment appetite

Policy Response Effectiveness

- Fiscal multiplier of government spending

- Monetary transmission through the banking system

- LaLabour market flexibility in wage and employment adjustment

- International coordination with trading partners

Action Plan Framework

Immediate Actions (0-3 months)

- Audit personal/business cash flow

- Identify expenditure reduction opportunities

- Strengthen professional networks

- Review insurance coverage adequacy

- Assess emergency fund sufficiency

Medium-term Strategies (3-12 months)

- Implement skill development programs

- Diversify income sources

- Optimize investment portfolio allocation

- Explore government support schemes

- Build strategic partnerships

Long-term Positioning (1-3 years)

- Develop recession-resilient career skills

- Build diversified income streams

- Create flexible living arrangements

- Establish regional business connections

- Invest in sustainable growth sectors

Conclusion

Singapore’s unique position as a global financial and trade hub creates vulnerabilities and opportunities during recessions. Success requires understanding the economy’s interconnected nature, leveraging government support systems, and maintaining flexibility to adapt to rapid changes.

The key to Singapore’s recession survival lies in balancing the country’s external dependencies with its internal strengths—strong institutions, skilled workforce, strategic location, and proactive government policies. Individual and business strategies must align with these macro realities while maintaining the agility to capitalize on opportunities that emerge from economic disruption.

The Complete Singapore Recession Survival Guide: Strategy, Impact & Real Stories

Table of Contents

- Understanding Singapore’s Recession Landscape

- The Anatomy of Economic Crisis in the Lion City

- Personal Survival Strategies

- Business Resilience Framework

- Investment & Wealth Protection

- Government Safety Nets & Support Systems

- A Singaporean’s Recession Journey: The Story of Marcus Lim

- Recovery Roadmap

Understanding Singapore’s Recession Landscape

The Unique Singapore Economic DNA

Singapore’s economy operates like a finely tuned Swiss watch – precise, interconnected, and vulnerable to external shocks. Unlike continental economies that can rely on domestic consumption, Singapore’s survival hinges on its ability to serve as Asia’s premier hub for trade, finance, and services.

The Numbers That Matter:

- Trade-to-GDP ratio: 320% (compared to 27% for the US)

- Foreign workforce: 38% of total Employment

- Manufacturing exports: 60% of total exports

- Financial services: 14% of GDP

- Tourism pre-COVID: 8% of GDP

This interconnectedness means that when global trade sneezes, Singapore catches pneumonia. However, it also means that Singapore often recovers faster than other economies once global conditions improve.

Historical Recession Patterns in Singapore

The Asian Financial Crisis (1997-1998): The First Modern Test

Singapore’s baptism by fire came during the Asian Financial Crisis. The economy contracted by 0.1% in 1998, but the real damage was psychological and structural:

- Property Prices: Plummeted 40-50% from peak

- Unemployment: Rose from 1.8% to 4.5%

- Currency: SGD weakened 15% against USD

- Banking Sector: Non-performing loans spiked to 8%

- Consumer Confidence: Collapsed to historic lows

Key Lesson: Singaporeans learned that external crises could devastate local prosperity overnight.

The Dot-Com Bust (2001-2002): The Tech Reality Check

- Manufacturing: Electronics sector contracted 20%

- GDP Growth: Fell to -2.4% in 2001

- Employment: Tech and manufacturing layoffs are widespread

- Property: Secondary correction of 15-20%

Key Lesson: Sector concentration risk became apparent – too many eggs in the tech basket.

Global Financial Crisis (2008-2009): The Great Recession

Singapore experienced its worst post-independence recession until COVID-19:

- GDP Contraction: -0.6% for the year, -9.5% in Q1 2009 alone

- Trade Collapse: Exports fell 20% year-on-year

- Manufacturing Devastation: Industrial production dropped 29%

- Employment: 23,000 jobs lost in manufacturing

- Property Market: Prices fell 25-30% in prime districts

Key Lesson: Global financial contagion could paralyze Singapore’s economy within quarters.

COVID-19 Recession (2020): The Perfect Storm

- GDP Collapse: -3.9% for 2020, worst since independence

- Tourism Annihilation: Visitor arrivals fell 99%

- Aviation Crisis: Changi passenger traffic dropped 96%

- Circuit Breaker: 8-week lockdown Devastated SMEs

- Job Losses: Unemployment peaked at 4.1%

Key Lesson: Even Singapore’s best-laid plans couldn’t prevent external shocks from causing severe domestic pain.

The Anatomy of Economic Crisis in the Lion City

How Recessions Cascade Through Singapore

Stage 1: External Shock (Weeks 1-4)

- Global demand falls, or financial markets freeze

- Singapore’s trade-dependent sectors feel an immediate impact

- Export orders are cancelled, and shipping volumes plummet

- MNCs initiate hiring freezes

Stage 2: LaboLabouret Transmission (Months 2-6)

- Manufacturing and logistics companies begin layoffs

- Service sectors (F&B, retail, tourism) follow

- Work permit holders repatriated first

- Singaporean unemployment begins to risee

- Spending falls as confidence evaporates

Stage 3: Domestic Amplification (Months 6-12)

- Property market weakens as demand falls

- Construction projects delayed or cancelled

- Domestic banks tighten lending standards

- SMEs struggle with cash flow and credit access

- Government revenues fall, requiring a fiscal response

Stage 4: Policy Response (Throughout)

- The Monetary Authority of Singapore adjusts currency policy

- The government deploys fiscal stimulus and job support

- Public sector hiring increases to offset private sector losses

- Social safety nets activated

Sector Vulnerability Matrix

HIGH RISK (First to fall, most brutal hit):

Aviation & Aerospace Ecosystem

- Changi Airport operations

- Singapore Airlines and subsidiaries

- Aircraft maintenance, repair, and overhaul (MRO)

- Aerospace manufacturing

- Airport ground services and retail

Tourism & Hospitality Complex

- Hotels and resorts

- Integrated resorts (casinos)

- Food & beverage outlets

- Retail and entertainment

- Tour operators and travel agencies

Trade & Logistics Network

- Shipping and port operations

- Freight forwarding and logistics

- Warehouse operations

- Trade financing

- Maritime services

Manufacturing Base

- Electronics and semiconductors

- Chemicals and petrochemicals

- Precision engineering

- Biomedical manufacturing

MEDIUM RISK (Cyclical but resilient):

Financial Services

- Investment banking and capital markets

- Insurance (except life/health)

- Asset management

- Private banking

- Fintech and digital payments

Construction & Real Estate

- Property development

- Construction contractors

- Architecture and engineering

- Property agents and valuers

- Building materials

Professional Services

- Legal services

- Consulting and advisory

- Accounting and audit

- Human resources

- Marketing and advertising

LOW RISK (Defensive characteristics):

Essential Services

- Utilities (water, electricity, gas)

- Telecommunications

- Public transportation

- Waste management

- Security services

Healthcare & Social Services

- Hospitals and clinics

- Pharmaceutical companies

- Eldercare and nursing homes

- Educational institutions

- Government services

Technology & Innovation

- Software development

- Cybersecurity

- Cloud computing services

- E-commerce platforms

- Digital media and content

Personal Survival Strategies

The Singapore Emergency Fund Formula

Unlike other countries where 3-6 months of expenses suffice, Singapore’s unique characteristics demand a more robust approach:

Base Emergency Fund: 12 months of expenses

- The high cost of living requires a larger buffer

- Job market concentration increases search time

- Limited social safety net compared to welfare states

- High fixed costs (housing, Insurance, education)

Enhanced Fund Calculation:

Monthly Expenses × 12 + (Annual Insurance Premiums + Property Tax + Major Medical Reserve) = Target Emergency Fund

Example for Middle-Income Family:

Monthly Expenses: $6,000

Annual Insurance: $12,000

Property Tax: $3,000

Medical Reserve: $15,000

Total Target: $102,000

Optimal Fund Allocation:

- 40% in high-yield savings accounts (current rate ~2.5%)

- 30% in Singapore Savings Bonds (guaranteed capital, ~2.8% yield)

- 20% in money market funds or short-term deposits

- 10% in CPF Voluntary Contributions (guaranteed 2.5-4% returns)

Career Recession-Proofing Strategies

The Singapore Skills Pyramid

Tier 1: Recession-Proof Foundation Skills

- Digital literacy and data analysis

- Cross-cultural communication (English, Mandarin, Malay)

- Project management and process improvement

- Financial literacy and business acumen

- Crisis management and Adaptability

Tier 2: Growth Sector Specialisations

- Healthcare and eldercare (ageing)

- Green technology and sustainability

- Fintech and digital transformation

- Cybersecurity and data protection

- ASEAN market expertise

Tier 3: Unique Value Propositions

- Government relations and regulatory knowledge

- Regional business development

- Cultural bridging (East-West, intra-ASEAN)

- Crisis leadership and turnaround management

- Innovation and entrepreneurship

The Portfolio Career Approach

Singapore’s compact economy enables multiple income streams:

Primary Employment (60-70% of Income)

- Full-time Income in the recession-resilient sector

- Focus on essential functions within the organization

- Build strong internal networks and institutional knowledge

Secondary Income (20-30Incomencome)

- ConsuIncome or freelancing in the area of expertise

- Part-time teaching or training

- E-commerce or online business

- Property rental Income (applicable)

Passive Income (10-15Incomencome)

- DividIncomeying Singapore stocks

- REIT distributions

- Interest from savings and bonds

- CPF returns and government schemes

Housing Strategy During Recession

HDB Flat Owners: Optimisation Tactics

Mortgage Management

- Switch to a floating rate if fixed rates are high

- Consider partial prepayment to reduce monthly servicing

- Understand HDB mortgage moratorium options

- Explore renting out spare rooms (with HDB approval)

Resale Market Navigation

- Monitor transaction volumes, not just prices

- Consider upgrading during market lows

- Evaluate rental income potential before selling

- Understand cash-over-valuation implications

Private Property Owners: Advanced Strategies

Investment Property Optimization

- Focus on rental yield rather than capital appreciation

- Target essential worker housing (healthcare, education)

- Consider short-term rentals if regulations permit

- Evaluate refinancing options during low-interest periods

Primary Residence Decisions

- Assess downgrade opportunities to release capital

- Consider relocation to areas with better value

- Evaluate foreign buyer market dynamics for resale

- Plan for potential Additional buyers ‘ stamp duty changes

Cost Optimization: The Singapore Way

Transportation Revolution

- Embrace a car-lite lifestyle: sell cars, use car-sharing

- Maximize public transport concessions and passes

- Consider cycling for short distances

- Negotiate work-from-home arrangements

Food Strategy Overhaul

- Master Hawker Centre dining: quality meals under $5

- Bulk purchase of non-perishables during promotions

- Learn basic cooking to reduce outside dining

- Grow herbs and vegetables in HDB-approved containers

Utility Optimization

- Switch to time-of-use electricity plans

- Invest in energy-efficient appliances during sales

- Consider solar panel installation with government rebates

- Implement water-saving measures for utility rebates

Healthcare Cost Management

- Maximize the use of polyclinics and subsidized healthcare

- Maintain adequate Medisave balances

- Consider upgrading health insurance during healthy periods

- Utilize preventive care programs and screenings

Education Investment

- Leverage free SkillsFuture credits for professional development

- Use public library resources for children’s enrichment

- Consider local universities over overseas options

- Explore scholarship and bursary opportunities

Business Resilience Framework

SME Survival Blueprint

Cash Flow Fortress Strategy

The 90-Day Cash Flow Buffer Singapore SMEs should maintain cash reserves covering 90 days of fixed expenses due to:

- Rapid economic transmission of external shocks

- Limited access to emergency credit during crises

- High fixed costs (rent labour regulations)

Cash Flow Optimization Tactics

- Negotiate extended payment terms with suppliers

- Offer early payment discounts to customers

- Implement dynamic pricing based on demand

- Consider invoice factoring for immediate cash

Operational Resilience Engineering

Supply Chain Diversification

- Reduce dependency on single-country suppliers

- Develop ASEAN supplier networks

- Maintain 30-day safety stock for critical components

- Establish alternative logistics routes

Workforce Flexibility

- Cross-train employees for multiple functions

- Develop partnerships with temp staffing agencies

- Implement variable compensation structures

- Create remote work capabilities

Digital Transformation Acceleration

- Migrate to cloud-based systems for scalability

- Implement e-commerce capabilities

- Develop digital marketing competencies

- Automate routine processes

Government Support Navigation

Enterprise Singapore Grant Ecosystem

Productivity Solutions Grant (PSG)

- Up to 80% funding for pre-approved solutions

- Focus on digital transformation projects

- Quick approval process during economic downturns

- Covers software, hardware, and training

Market Readiness Assistance (MRA)

- Up to 70% funding for overseas expansion

- Particularly relevant for ASEAN markets

- Include market research and business development

- It can be combined with other schemes

Enterprise Development Grant (EDG)

- Up to 80% funding for capability building

- Covers innovation, productivity, and market expansion

- Higher support rates during crisis periods

- Suitable for medium to large projects

:max_bytes(150000):strip_icc()/great_depression.asp-Final-8258581e56b6472fb8e1f12c3766187e.jpg)

Crisis-Specific Support Mechanisms

Jobs Support Scheme (JSS)

- Salary co-funding during economic difficulties

- Higher support rates for severely affected sectors

- Automatic eligibility for qualifying businesses

- Designed to prevent mass layoffs

SME Working Capital Loan

- Government-backed loans at concessionary rates

- Faster approval processes during crises

- Lower collateral requirements

- Extended repayment periods

Investment & Wealth Protection

The Singapore Defensive Portfolio Strategy

Core Holdings (60% of Portfolio)

Singapore Blue Chips – The STI Foundation

- DBS Group: Dominant local bank with ASEAN exposure

- OCBC Bank: Strong regional presence and wealth management

- UOB: Conservative banking with a growing regional footprint

- Singapore Telecom: Essential services with dividend yield

- Keppel Corporation: Infrastructure and utilities focus

Singapore REITs – Income Generation

- CapitaLand Integrated Commercial Trust: Prime retail and office

- Mapletree Logistics Trust: Essential logistics properties

- Ascendas REIT: Industrial and business park properties

- Keppel REIT: Premium office buildings

- Mapletree Commercial Trust: Diversified commercial properties

Growth Allocation (25% of Portfolio)

Technology and Innovation

- Sea Limited: Southeast Asian digital platform

- Grab Holdings: Regional mobility and delivery

- Singtel’s tech investments and digital services

- Local fintech and health tech companies

- Clean energy and sustainability play

Regional Exposure

- ASEAN market ETFs and index funds

- Chinese technology and consumer companies

- Indian growth stocks through Singapore listings

- Healthcare and infrastructure across Asia

Defensive Allocation (15% of Portfolio)

Government Bonds and Fixed Income

- Singapore Savings Bonds: Guaranteed returns, no risk

- Singapore Government Securities: Benchmark risk-free rate

- High-grade corporate bonds from local companies

- Asia Development Bank bonds

Alternative Investments

- Gold through local dealers or ETFs

- Commodities exposure through REITs or ETFs

- Foreign currency deposits (USD, EUR) for diversification

CPF Optimisation During Recession

Strategic CPF Management

Voluntary Contributions

- Maximize annual limit: $37,740 (2024)

- Guaranteed returns: 2.5% (Ordinary), 4% (Special/Medisave)

- Tax relief on contributions

- Build retirement security during market volatility

CPF Investment Scheme (CPFIS)

- Reduce equity exposure during market peaks

- Focus on blue-chip Singapore stocks and REITs

- Avoid speculative investments

- Consider bond funds for stability

Housing and CPF Integration

- Use CPF for property down payments during market lows

- Understand the accrued interest implications

- Plan for CPF minimum sum requirements

- Consider cash vs CPF payment trade-offs

Government Safety Nets & Support Systems

Understanding Singapore’s Social Compact

Singapore’s approach to economic support differs fundamentally from Western welfare states. The system emphasizes:

- Self-reliance with government support as a last resort

- Targeted assistance rather than universal benefits

- Temporary support to help people get back on their feet

- Family responsibility before state intervention

Comprehensive Support Ecosystem

Employment Support

Career Guidance and Job Matching

- Workforce Singapore (WSG) career centres

- NTUC’s e2i (Employment and Employability Institute)

- Sector-specific job placement programs

- Mid-career guidance and counselling

Skills Training and Development

- SkillsFuture credits: $600 every five years for citizens 40+

- SkillsFuture Mid-Career Enhanced Subsidies: Up to 90% course fee support

- Company training grants and subsidies

- Professional conversion programs

Job Placement and Transition

- P-Max (Professional Conversion Programme)

- SGUnited Jobs and Skills Package

- Career trial and attachment programs

- Industry-specific reskilling initiatives

Financial Assistance Framework

ComCare Assistance

- Short-term relief: Up to $1,800 per month for 3-6 months

- Long-term assistance: Ongoing support for chronic issues

- Medical assistance for healthcare costs

- Service and conservancy charges assistance

GST Vouchers and U-Save

- Annual GST voucher payments based on Income

- U-SaveIncomety bill rebates

- Additional cash payouts during economic difficulties

- Grocery vouchers for lower-income households

Emergency Financial Support

- CDC Emergency Relief Fund

- Community Foundation of Singapore grants

- Religious and community organization assistance

- Temporary financial assistance for specific crises

Healthcare Support Systems

Medifund

- Safety net for medical expenses

- Covers subsidized bills at public hospitals

- Automatic assessment for eligible patients

- Additional support during economic hardship

Community Health Assist Scheme (CHAS)

- Subsidized healthcare at private clinics

- Dental and specialist care support

- Medicine and chronic disease management

- Enhanced support for vulnerable populations

A Singaporean’s Recession Journey: The Story of Marcus Lim

Chapter 1: The Storm Clouds Gather (January 2020)

Marcus Lim woke up on January 15th, 2020, to his usual routine. At 38, he was the regional sales director for a German aerospace components company, earning $12,000 monthly. His wife Jessica worked as a marketing manager at a luxury hotel, bringing home $7,500. Together, they were the epitome of Singapore’s middle-class success story.

Their Bukit Timah condo was worth $1.8 million, with a remaining mortgage of $800,000. Their two children, ages 8 and 6, attended an international school at $2,500 per month each. The family drove a BMW X3, vacationed twice yearly, and had $80,000 in savings – what they considered a comfortable buffer.

“Did you see the news about this virus in China?” Jessica asked over breakfast, scrolling through her phone.

Marcus barely looked up from his laptop, reviewing quarterly sales projections. “It’ll blow over. Remember SARS? Singapore handled it fine.”

Neither could have imagined that within three months, their carefully constructed life would begin unravelling.

Chapter 2: The First Tremors (February-March 2020)

By February, Marcus noticed his first warning sign – orders from Chinese aerospace manufacturers were being delayed. “Supply chain issues,” his German headquarters explained. “Temporary disruption.”

But Marcus had lived through enough economic cycles to recognize patterns. He called an emergency family meeting.

“We need to talk about money,” he announced, spreading their financial statements across the dining table.

The Lim Family Financial Snapshot (February 2020):

- Combined monthly Income: $19,500

- Monthly expenses: $16,800

- Savings: $80,000

- Investments: $150,000 (mostly in tech stocks)

- Outstanding loans: $850,000 (mortgage + car loan)

- Insurance premiums: $18,000 annually

“I think we should cut some expenses,” Marcus said. “Just temporarily.”

Jessica resisted. “The kids’ education, Marcus. We can’t compromise their future.”

“I’m not saying stop their schooling. Let’s postpone the Bali trip. I’ll take the MRT more often.

It was their first serious discussion about money in years. Within weeks, it would become a daily conversation.

Chapter 3: The Cascade Begins (March-April 2020)

March 23rd, 2020: Circuit Breaker announced.

Marcus’s company immediately implemented a hiring freeze. Jessica’s hotel closed for two months, and their monthly Income dropped from $19,500 to $12,000 overnight.

“It’s only eight weeks,” Jessica said, trying to stay positive. “The hotel will reopen.”

But Marcus had spent the weekend analyzing their sector exposure. Aviation, tourism, Hospitality – they were in the eye of the storm.

Immediate Actions Taken:

Week 1: Emergency Expense Audit

- Cancelled Bali vacation: $8,000 saved

- Reduced grocery budget by 40%

- Cancelled gym memberships: $200/month saved

- Negotiated payment deferrals on utilities

Week 2: Income Stabilization

- Marcus negotiated a work-from-home arrangement

- Jessica applied for the hotel’s retention scheme

- Both researched government support schemes

- Started freelance projects in my spare time

Week 3: Investment Portfolio Review

- Tech stocks have fallen 35% since February

- Decided to hold rather than crystallize losses

- Moved $20,000 from stocks to high-yield savings

- Applied for CPF voluntary contribution tax relief

Week 4: Long-term Planning

- Researched public school options for children

- Consider downsizing housing options

- Started exploring alternative careers

- Built a spreadsheet for different income scenarios

Chapter 4: The Deep Dive (May-August 2020)

By May, the full scale of the crisis became clear. Marcus’s company announced a 30% reduction in the Singapore office. Jessica’s hotel remained closed with no reopening date.

The family’s financial situation:

- Marcus’s salary: $12,000 (reduced to $8,400 after company pay cut)

- Jessica’s Income: $0 Income closed)

- Government support: $1,200/month (various schemes)

- Total monthly Income: $9,600

- Monthly expenses (reduced): $12,000

- Monthly deficit: $2,400

“We’re burning through our savings,” Marcus told Jessica one evening. “At this rate, we have eight months before we’re in real trouble.”

Strategic Decisions Made:

Education Pivot

- Transferred children to local public schools

- Monthly savings: $5,000

- Used saved funds for tuition and enrichment

- Applied for school financial assistance schemes

Transportation Revolution

- Sold the BMW: $45,000 cash injection

- Bought a secondhand car for $15,000

- Reduced monthly transport costs by $800

Housing Consideration

- Evaluated downsizing options

- Decided to stay but rent out a spare room

- Found a tenant paying $1,500/month

- Navigated HDB rental regulations

Income Diversification

- Marcus started consulting on weekends: $2,000/month

- Jessica launched online marketing services: $1,500/month

- Both took on SkillsFuture courses

- Applied for various government training grants

Chapter 5: The Learning Curve (September-December 2020)

By September, the Lim family had achieved a new equilibrium:

Revised Monthly Budget:

- Marc” salary: $8,400

- Jessica’s freelance Income: $1,500

- Income consulting: $2,000

- Room rental: $1,500

- Government support: $600

- Total monthly Income: $14,000

- Moncomely expenses: $11,500

- Monthly surplus: $2,500

“We’re actually saving more money than before,” Jessica realized one day. “How is that possible?”

Marcus had been meticulously tracking every expense. “We were spending money without thinking. Now, every dollar has a purpose.”

Key Learnings:

Financial Resilience

- Emergency fund increased from 4 months to 12 months of expenses

- Diversified income streams reduce vulnerability

- Lower fixed costs provided more flexibility

- Regular financial reviews became a monthly habit

Career Adaptability

- Marcus’s consulting revealed new opportunities

- Jessica discovered a passion for digital marketing

- Both developed recession-proof skills

- Network expansion through community involvement

Family Priorities

- Children adapted well to local schools

- Family relationships strengthened during the crisis

- Developed an appreciation for simple pleasures

- Built stronger connections with neighbours and the community

Chapter 6: The Plot Twist (January-June 2021)

Just as life seemed to stabilize, Marcus received unexpected news. His German employer was shutting down the Singapore office entirely. After 12 years with the company, he would receive a retrenchment package of $60,000.

“Maybe this is our chance,” he told Jessica. “To do something completely different.”

Jessica’s freelance business had grown steadily. She was earning $4,000 monthly and had waiting lists for her services. “What if we both went full-time entrepreneurial?”

It was a terrifying and exhilarating prospect.

The Entrepreneurial Leap:

Marcus’s New Venture

- Started an aerospace consulting firm

- Leveraged 15 years of industry experience

- Focused on helping companies pivot during the crisis

- Initial clients: former colleagues and competitors

Jessica’s Business Expansion

- Registered proper marketing consultancy

- Hired two part-time assistants

- Specialized in crisis communications

- Developed online courses and workshops

Joint Financial Strategy

- Used retrenchment package as business capital

- Maintained ultra-low personal expenses

- Reinvested all profits for the first year

- Built separate emergency funds for personal and business needs

Chapter 7: The Unexpected Recovery (July 2021- December 2022)

The couple’s businesses grew faster than anticipated. By mid-2021, their combined Income exceeded iIncome-pandemic levels, but they maintained their recession-era lifestyle.

Financial Transformation:

Income Growth

- Marcus’s consulting: $15,000/month by end-2021

- Jessica’s agency: $8,000/month by end-2021

- Combined Income: $23,000/month

- Pre-recession Income: $19,500/month

Expense Discipline

- Maintained monthly expenses at $12,000

- The savings rate increased to 48% of Income

- The emergeIncomend grew to 18 months of expenses

- The investment portfolio diversified and grew

Investment Evolution

- Reduced tech stock exposure after the painful lesson

- Increased Singapore REIT allocation

- Added gold and government bonds

- Started investing in their business expansion

Chapter 8: The New Normal (2023-Present)

By 2023, Marcus and Jessica had not only survived the recession but also emerged stronger. Their businesses were thriving, their finances more robust than ever, and their family closer than before.

Current Financial Position:

- Combined business income: $35,000/month

- Monthly expenses: $15,000 (including higher business costs)

- Emergency fund: $300,000 (20 months of expenses)

- Investment portfolio: $400,000

- Business assets: $150,000

- Outstanding debt: $600,000 (mortgage only)

- Net worth: $1.25 million (vs $1.1 million pre-recession)

But the numbers tell only part of the story.

Lifestyle Changes That Stuck:

- Continued using public transport and car-sharing

- Maintained focus on hawker centres and home cooking

- Children remained in local schools and thrived

- Annual vacations became local staycations and regional trips

- Spending decisions always included a “necessity check.”

Business Philosophy:

- Always maintain a 12-month expense buffer

- Diversify client base across sectors and geographies

- Invest in employee training and retention

- Build recession-resistant service offerings

- Maintain strong relationships with former colleagues and clients

Chapter 9: Lessons Learned and Wisdom Gained

Looking back, Marcus reflects on the experience: “The recession didn’t just change our bank account. It changed who we are.”

Key Insights from Marcus and Jessica’s Journey:

Financial Resilience Principles

- Expense Flexibility: Fixed costs are the enemy during downturns

- Income Diversification: Multiple income streams provide security

- Emergency Funds: Larger than conventional wisdom suggests

- Investment Patience: Don’t panic-sell during market crashes

- Government Support: Understand and utilize available programs

Career Evolution Strategies

- Skill Development: Continuous learning prevents obsolescence

- Network Building: Relationships become opportunities during a crisis

- Adaptability: Rigid career plans break down during economic storms

- Entrepreneurial Mindset: Crisis creates opportunities for those prepared

- Industry Diversification: Don’t put all career eggs in one sector basket

Family and Lifestyle Wisdom

- Value Clarification: Crisis reveals what truly matters

- Resilience Building: Children adapt better than parents expect

- Community Connection: Strong local networks provide support

- Simplicity Benefits: Lower maintenance lifestyle reduces stress

- Gratitude Practice: Appreciate what remains during a loss

Marcus’s Advice to Other Singaporeans:

“Don’t wait for the recession to start preparing. Singapore’s economy moves fast, bottom-up and up. The families and businesses that survive are those that build resilience during good times.

Start with your emergency fund – not 3-6 months like financial advisors say, but 12-18 months for Singapore. Our economy is too connected to global markets for smaller buffers.

Develop skills that work across industries and economic cycles. Learn to sell, manage projects, and work with people from different cultures. These skills transfer anywhere.

Most importantly, don’t let pride prevent you from adapting. We almost destroyed our finances because we couldn’t imagine living differently. The moment we let go of our pre-recession lifestyle, we found freedom.”

Jessica’s Perspective:

“The recession taught me that security doesn’t come from a job or a paycheck – it comes from your ability to create value for others, no matter what the economic environment looks like.

I also learned that Singapore has incredible support systems, but you have to know how to access them. Don’t be ashamed to use government programs – that’s what they’re there for.

Finally, teach your children about money and resilience early. Our kids learned more about economics, budgeting, and Adaptability during the recession than they ever would have in an international school.”

Epilogue: Building Anti-Fragile Lives

Today, Marcus and Jessica run successful businesses, maintain robust personal finances, and have become informal mentors to other families navigating economic uncertainty. They’ve learned that proper security doesn’t come from avoiding downturns but from building systems and mindsets that not only survive but thrive during the chaos.

Their story illustrates a crucial principle: in Singapore’s interconnected economy, recession survival isn’t about weathering the storm – it’s about learning to dance in the rain.

The Lim family’s transformation from recession victims to recession victors demonstrates that with the right strategies, mindset, and execution, economic crisis can become the catalyst for building a more resilient and fulfilling life.

Their experience offers a roadmap for other Singaporeans: prepare extensively, adapt quickly, learn continuously, and never waste a good crisis.

Recovery Roadmap

Recognising Recovery Signals

Leading Indicators for Singapore:

- Manufacturing PMI consistently above 50

- Container throughput at Singapore ports is increasing

- Tourist arrival numbers are recovering

- Property transaction volumes are rising

- Credit growth to businesses expanding

Sector Recovery Sequence:

- Manufacturing and Trade (0-6 months into recovery)

- Financial Services (3-9 months)

- Construction and Property (6-12 months)

- Tourism and Hospitality (12-24 months)

- Discretionary Services (12-24 months)

Positioning for Recovery

Personal Strategy:

- Maintain a defensive posture until recovery is confirmed

- Begin skill development for growth sectors

- Network actively as opportunities emerge

- Consider calculated risks after 6 months of consistent growth

- Resist lifestyle inflation during early recovery

Business Strategy:

- Invest in capability building during early recovery

- Hire talent that competitors are releasing

- Expand market share while competitors are weak

- Build strategic partnerships with struggling competitors

- Prepare for rapid scaling once demand returns

Investment Strategy:

- Begin increasing equity allocation as markets stabilize

- Focus on Singapore and regional recovery plays

- Avoid speculative investments until late in recovery

- Maintain significant cash reserves for opportunities

- Rebalance portfolio as sectors recover at different rates

The complete Singapore recession survival guide demonstrates that while economic downturns are inevitable, financial destruction is not. With proper preparation, strategic thinking, and disciplined execution, Singaporeans can not only survive recessions but also emerge stronger, wiser, and more prosperous than before.

The key is to start preparing today because, as Marcus Lim learned, “The best time to fix the roof is when the sun is shining.”

Maxthon

In an age where the digital world is in constant flux and our interactions online are ever-evolving, the importance of prioritising individuals as they navigate the expansive internet cannot be overstated. The myriad of elements that shape our online experiences calls for a thoughtful approach to selecting web browsers—one that places a premium on security and user privacy. Amidst the multitude of browsers vying for users’ loyalty, Maxthon emerges as a standout choice, providing a trustworthy solution to these pressing concerns, all without any cost to the user.

Maxthon, with its advanced features, boasts a comprehensive suite of built-in tools designed to enhance your online privacy. Among these tools are a highly effective ad blocker and a range of anti-tracking mechanisms, each meticulously crafted to fortify your digital sanctuary. This browser has carved out a niche for itself, particularly with its seamless compatibility with Windows 11, further solidifying its reputation in an increasingly competitive market.

In a crowded landscape of web browsers, Maxthon has forged a distinct identity through its unwavering dedication to offering a secure and private browsing experience. Fully aware of the myriad threats lurking in the vast expanse of cyberspace, Maxthon works tirelessly to safeguard your personal information. Utilising state-of-the-art encryption technology, it ensures that your sensitive data remains protected and confidential throughout your online adventures.

What truly sets Maxthon apart is its commitment to enhancing user privacy during every moment spent online. Each feature of this browser has been meticulously designed with the user’s privacy in mind. Its powerful ad-blocking capabilities work diligently to eliminate unwanted advertisements, while its comprehensive anti-tracking measures effectively reduce the presence of invasive scripts that could disrupt your browsing enjoyment. As a result, users can traverse the web with newfound confidence and safety.

Moreover, Maxthon’s incognito mode provides an extra layer of security, granting users enhanced anonymity while engaging in their online pursuits. This specialised mode not only conceals your browsing habits but also ensures that your digital footprint remains minimal, allowing for an unobtrusive and liberating internet experience. With Maxthon as your ally in the digital realm, you can explore the vastness of the internet with peace of mind, knowing that your privacy is being prioritised every step of the way.