Singapore’s Current Inflation Context (2025)

Singapore’s inflation landscape presents unique opportunities and challenges:

- Current Rate: 1.6% (December 2024), down from 2.4% average in 2024

- MAS Forecast: 1.5-2.5% for 2025 (headline), 1-2% (core inflation)

- Key Spending Categories: Housing & Utilities (29.4%), Food (20.4%), Transport (13.1%)

- Historical Context: Peak of 6.12% in 2022, now moderating but still impacting purchasing power

SHORT-TERM TACTICAL STRATEGIES

1. Housing Cost Optimisation (29.4% of CPI)

HDB Mortgage Strategy

- Leverage HDB Loan Advantage: At 2.6% fixed rate (April-June 2025), HDB loans remain below market rates

- CPF-Cash Balance: Strategic decision between using CPF OA (earning 2.5%) vs cash for downpayment

- Refinancing Window: With rates potentially peaking, lock in fixed rates for private property mortgages

Rental Market Navigation

- Location Arbitrage: Consider Sengkang’s connectivity advantages – MRT access reduces transport costs while maintaining lower rental premiums vs central locations

- Co-living Arrangements: Shared housing becoming more acceptable, can reduce individual housing burden by 20-40%

- Utility Management: With energy comprising significant portion, implement smart home solutions for 10-15% utility savings

2. Food Inflation Mitigation (20.4% of CPI)

Strategic Food Sourcing

- Wet Market Revival: 15-25% savings vs supermarkets, especially for fresh produce

- Bulk Purchasing Cooperatives: Organize with neighbors for wholesale pricing on non-perishables

- Cross-Border Shopping: Johor weekend trips for specific items (factor transport costs)

- Seasonal Eating: Align consumption with local harvest seasons and import cycles

Singapore-Specific Food Strategies

- Hawker Center Optimization: Identify value hawkers in non-tourist areas

- NTUC Plus! Membership: Maximize rebates on regular purchases

- Community Gardens: Participate in HDB rooftop gardens or community plots

- Meal Planning: Singapore’s diverse food scene tempts impulse spending – structured meal planning prevents 20-30% food waste

3. Transport Cost Management (13.1% of CPI)

Public Transport Maximization

- Distance-Based Pricing Advantage: Singapore’s efficient MRT system often cheaper than driving for most journeys

- Off-Peak Travel: Flexible work arrangements to avoid peak pricing

- Integrated Transport: Combine walking/cycling with MRT for first/last mile efficiency

Private Transport Efficiency

- COE Timing: If car ownership necessary, time COE bidding cycles strategically

- Car-Sharing Economics: Evaluate BlueSG, Car Club vs ownership for occasional use

- ERP Avoidance: Route optimisation using apps to minimise Electronic Road Pricing charges

LONG-TERM STRATEGIC POSITIONING

4. CPF Optimization Framework

Account Allocation Strategy

- OA vs SA Trade-offs: Understanding when to maintain OA balance (2.5%) vs topping up SA (4% guaranteed)

- Voluntary Contributions: Tax-efficient way to boost retirement savings while earning guaranteed returns above inflation

- CPF LIFE Optimization: Early planning for CPF LIFE scheme selection based on risk tolerance

Investment Integration

- CPFIS Navigation: Using CPF Investment Scheme for higher returns while managing risks

- Property-CPF Balance: Strategic use of CPF for property vs leaving for retirement

5. Singapore-Specific Investment Strategies

Local Market Advantages

- REITs Dominance: Singapore REITs offer 4-6% yields, often exceeding inflation

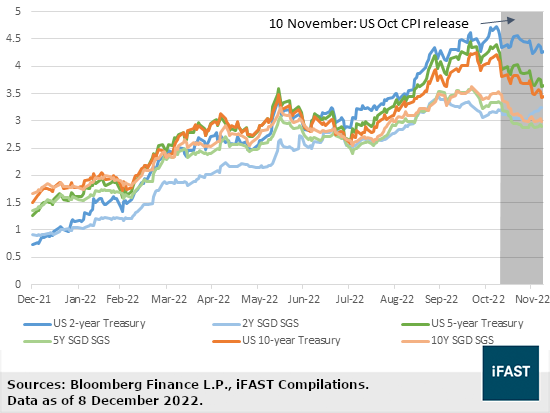

- SGS Bonds: Singapore Government Securities provide inflation-protected baseline

- STI ETF: Broad market exposure with dividend yields typically above inflation

- SSGS (Singapore Savings Bonds): Flexible, government-backed bonds with step-up interest rates

Currency Hedging

- Multi-Currency Deposits: Leverage Singapore’s banking hub status for foreign currency exposure

- Regional Investment: Access to Asian growth markets through Singapore’s financial infrastructure

6. Income Enhancement Strategies

Singapore’s Gig Economy

- Platform Economy: Food delivery, ride-hailing optimized for high population density

- Professional Services: Leverage Singapore’s role as regional hub for consulting/freelancing

- Cross-Border Opportunities: Remote work for international clients using Singapore’s connectivity

Skill Development Investment

- SkillsFuture Credits: Government-subsidized training for career advancement

- Industry Transformation Maps: Align skills with government-identified growth sectors

- Language Premium: Capitalize on Singapore’s multilingual environment for international roles

ADVANCED INFLATION-HEDGING TECHNIQUES

7. Real Asset Accumulation

Property Strategy

- HDB Appreciation: Despite cooling measures, HDB flats historically track inflation over long term

- REIT vs Direct Property: REITs offer liquidity and professional management vs direct ownership complexity

- Commercial Property Exposure: Through REITs or small business premises

Alternative Assets

- Precious Metals: Gold savings accounts offered by local banks

- Collectibles: Singapore’s position as art/luxury hub creates markets for alternative investments

8. Debt Management in Rising Rate Environment

Fixed vs Variable Rate Strategy

- Mortgage Refinancing: Lock in favorable fixed rates while available

- Credit Card Optimization: Singapore’s competitive banking sector offers attractive balance transfer rates

- Personal Loan Consolidation: Streamline high-interest debt during moderate inflation period

9. Tax-Efficient Wealth Building

Singapore Tax Advantages

- No Capital Gains Tax: Investment profits not taxed (except for trading business)

- SRS Contributions: Supplementary Retirement Scheme offers tax deferral benefits

- Insurance Wrappers: Investment-linked policies for tax-efficient wealth accumulation

MONITORING AND ADJUSTMENT FRAMEWORK

Economic Indicators to Track

- MAS Policy Statements: Singapore’s unique currency-based monetary policy affects import prices

- Regional Inflation Trends: Singapore’s inflation is closely tied to regional food/energy costs

- Property Market Cycles: Government cooling measures impact housing costs and investment returns

Personal Metrics Dashboard

- Real Income Growth: Salary increases vs inflation rate

- Asset Allocation Drift: Rebalancing frequency in volatile periods

- Expense Category Analysis: Monthly tracking of the big three: housing, food, transport

Contingency Planning

- Job Market Flexibility: Singapore’s dynamic economy requires adaptability

- Emergency Fund Sizing: 12 months’ expenses given Singapore’s high fixed costs

- Insurance Optimisation: Health, disability, and life insurance as an inflation hedge

SINGAPORE-SPECIFIC CONSIDERATIONS

Regulatory Environment

- Government Intervention: Singapore’s active government creates both opportunities (subsidies, grants) and constraints (cooling measures, regulations)

- Policy Predictability: Long-term planning benefits from Singapore’s stable policy environment

Social Safety Net Integration

- Healthcare Costs: Medisave requirements and healthcare inflation planning

- Education Investment: Children’s education costs and inflation protection strategies

- Elderly Care: Sandwich generation planning for ageing parents

Regional Economic Integration

- ASEAN Opportunities: Singapore as gateway for regional investment diversification

- Global City Advantages: Access to international financial products and services

This comprehensive framework recognizes that Singapore’s unique economic structure – small open economy, government intervention, regional hub status – requires tailored inflation-fighting strategies that leverage local advantages while mitigating specific vulnerabilities.

Comprehensive Analysis: Countering Inflation in Singapore

Executive Summary

Singapore’s inflation landscape in 2025 presents both challenges and opportunities. With headline inflation moderating to approximately 1.5-2.5% (MAS forecast) and current T-bill yields around 2%, Singaporeans face a complex environment where traditional savings vehicles barely keep pace with price increases. This comprehensive analysis provides actionable strategies leveraging Singapore’s unique economic infrastructure, regulatory environment, and investment ecosystem to not only counter inflation but also build long-term wealth resilience.

Section 1: Understanding Singapore’s Inflation Dynamics

Current Inflation Context (2025)

Singapore’s inflation structure differs significantly from other developed economies due to its unique position as a small, open, trade-dependent city-state:

Key Metrics:

- Headline inflation: 1.5-2.5% (2025 MAS forecast)

- Core inflation: 1-2% (2025 MAS forecast)

- Previous peaks: 6.12% (2022), 4.82% (2023)

- Current moderation reflects global supply chain normalisation and MAS monetary policy effectiveness

Expenditure Weightings in CPI:

- Housing: 25% of total weight

- Food: 22% of total weight

- Transport: 16% of total weight

- Education: 7% of total weight

- Healthcare: 6% of total weight

- Communication: 5% of total weight

- Clothing & Footwear: 3% of total weight

Singapore’s Unique Inflation Drivers

Singapore imports over 90% of its food and energy needs, making it particularly vulnerable to global commodity price fluctuations. This creates both vulnerability and opportunity—while external price pressures are unavoidable, Singapore’s efficient markets and government intervention often moderate impacts compared to other small nations.

Housing Market Dynamics. Unlike most countries, where housing inflation reflects market forces alone, Singapore’s dual-track system (HDB public housing vs private property) creates unique dynamics:

- HDB prices are subject to government cooling measures and affordability constraints

- Private property is more responsive to global capital flows and speculation

- Rental markets are influenced by foreign worker policies and property regulations

Government Intervention Capacity Singapore’s substantial fiscal reserves and policy tools (GST vouchers, utility rebates, transport subsidies) can offset inflation impacts for lower-income households. Still, these measures don’t eliminate the underlying price pressures for middle and upper-income groups.

Inflation Impact by Income Segment

Lower-Income Households (Bottom 20%)

- Disproportionately affected by food and transport inflation

- Benefit most from government assistance schemes

- Limited investment options to hedge against inflation

Middle-Income Households (21st-80th percentile)

- Face full inflation impact with minimal government assistance

- Have access to investment vehicles but often lack sophistication

- Most at risk of lifestyle degradation without a strategic response

High-Income Households (Top 20%)

- Better positioned with investment access and financial literacy

- Face inflation on discretionary spending, but basics remain affordable

- Can leverage Singapore’s investment ecosystem most effectively

Section 2: Housing – The 25% Solution

Housing represents the most significant component of Singapore’s Consumer Price Index (CPI), making it the most critical area for mitigating inflation. Singapore’s unique housing ecosystem provides both challenges and opportunities.

HDB Housing Strategy

Leveraging the HDB Loan Advantage. Current HDB loan rates at 2.6% per annum represent one of Singapore’s most significant inflation-hedging opportunities. With inflation at 1.5-2.5%, HDB borrowers effectively access near-zero or negative real interest rates.

Strategic Considerations:

- New HDB Purchases: Maximize loan quantum rather than using cash/CPF for down payment

- Existing HDB Owners: Avoid early repayment; invest excess cash in higher-yielding instruments

- Refinancing Strategy: Private property owners should consider refinancing to fixed rates while available

CPF-Housing Integration The interaction between CPF usage and housing creates complex optimization scenarios:

- CPF OA for Housing: Earns 2.5% but foregoes potential 4% in CPF SA

- Cash for Housing: Preserves CPF earning potential but reduces liquidity

- Optimal Strategy: Use HDB loan maximally, preserve CPF OA for eventual transfer to SA

Private Property Considerations

Investment vs Residence Decision Matrix Private property in Singapore serves multiple functions—residence, investment, and inflation hedge. The decision framework involves:

Factors Favouring Purchase:

- Access to rental income (3-4% gross yields in most segments)

- Long-term capital appreciation potential

- Fixed-rate mortgage availability

- Portfolio diversification beyond financial assets

Factors Against Purchase:

- High transaction costs (buyer’s stamp duty, seller’s stamp duty)

- Additional Buyer’s Stamp Duty (ABSD) for non-citizens and multiple properties

- Property tax implications

- Illiquidity compared to REITs

Rental Market Navigation

For Tenants: Strategic Rental Decisions

- Location Arbitrage: Consider emerging areas with strong transport connectivity

- Lease Timing: Negotiate longer leases during high inflation periods

- Shared Accommodation: Mature professionals increasingly open to co-living arrangements

For Landlords: Rental Income Optimization

- Inflation Escalation Clauses: Include annual rent reviews tied to CPI

- Property Upgrading: Strategic renovations to justify premium pricing

- Market Timing: List properties during peak demand periods (January-March, July-August)

Utilities and Energy Costs

Strategic Energy Management Singapore’s electricity market liberalization provides opportunities for cost management:

- Retailer Switching: Compare fixed vs variable rate plans

- Solar Installation: For landed properties, evaluate rooftop solar economics

- Energy Efficiency Investments: Smart home systems, efficient appliances, insulation improvements

Section 3: Food Inflation Mitigation – The 22% Challenge

Food represents 22% of Singapore’s CPI, making it the second-largest inflation exposure. Singapore’s food security initiatives and diverse import sources create opportunities for strategic consumers.

Strategic Food Sourcing

Market Diversification Strategy Singapore’s food ecosystem ranges from high-cost imported premium products to subsidized local options:

Wet Markets Revival

- Cost Savings: 15-25% savings compared to supermarkets

- Quality Advantages: Fresher produce, seasonal availability

- Timing Strategy: Late morning purchases for best prices

- Relationship Building: Regular customer discounts and priority access

Bulk Purchasing Cooperatives

- Community Organization: Neighborhood groups for wholesale access

- Storage Solutions: Shared freezer space, dry goods rotation

- Product Focus: Non-perishables, frozen goods, household items

- Digital Coordination: WhatsApp groups, shared spreadsheets for orders

Cross-Border Food Arbitrage

Johor Bahru Shopping Strategy For residents near the Causeway, cross-border shopping provides significant savings:

- Target Products: Processed foods, personal care items, household goods

- Cost-Benefit Analysis: Factor transport time, queue time, currency fluctuation

- Bulk Strategy: Monthly trips for non-perishables rather than frequent small purchases

- Group Coordination: Family/friend groups to maximize car space and minimize per-person transport costs

Urban Agriculture Participation

Community Gardens Singapore’s urban farming initiatives provide both cost savings and food security:

- HDB Void Deck Gardens: Small-scale herb and vegetable production

- Allotment Participation: Community gardens in various estates

- Rooftop Gardens: Building-level initiatives for residents

- Hydroponics Systems: Individual apartment solutions

Vertical Farming Partnerships Direct relationships with local vertical farms:

- Subscription Models: Weekly produce boxes at wholesale prices

- Seasonal Planning: Align consumption with local harvest cycles

- Quality Premium: Pesticide-free, locally grown produce

Food Waste Minimization

Economic Impact of Food Waste Singapore households waste approximately $342 million worth of food annually. Systematic waste reduction represents immediate inflation mitigation:

Strategic Meal Planning

- Weekly Menu Planning: Reduce impulse purchases and ensure ingredient utilization

- Batch Cooking: Economies of scale in home food preparation

- Preservation Techniques: Proper storage, freezing, and preservation methods

- Leftover Integration: Creative recipes for food repurposing

Section 4: Transport Optimization – The 16% Efficiency Gain

Transport represents 16% of Singapore’s CPI, but offers significant optimization opportunities due to the city-state’s excellent public transport infrastructure and compact geography.

Public Transport Maximization

MRT/Bus System Economics Singapore’s distance-based pricing creates opportunities for strategic transport planning:

- Route Optimization: Multiple route analysis for cost minimization

- Peak/Off-Peak Arbitrage: Flexible work arrangements to avoid peak pricing

- Multi-Modal Integration: Walking/cycling combinations with public transport

- Corporate Transport Benefits: Maximize employer transport allowances

Transport Subscription Analysis

- Monthly Concession Passes: Break-even analysis for regular commuters

- Tourist Pass Arbitrage: Visitors and occasional users benefit from day passes

- Senior/Student Concessions: Maximize available discounts

Private Transport Strategy

Car Ownership Economics Singapore’s Certificate of Entitlement (COE) system creates unique car ownership dynamics:

COE Timing Strategy

- Market Cycle Analysis: COE prices fluctuate based on supply/demand cycles

- Economic Timing: Purchase during economic downturns for lower COE costs

- Category Strategy: Choose COE category based on intended usage pattern

Alternative Transport Models

- Car-Sharing Economics: BlueSG, Car Club evaluation vs ownership

- Ride-Hailing Optimization: Grab vs taxi vs private hire strategic usage

- Motorcycle/Scooter Options: Cost-effective personal transport for specific use cases

Electric Vehicle Transition

EV Cost-Benefit Analysis Singapore’s push toward electric mobility creates new economic considerations:

- Purchase Incentives: Government rebates and tax advantages

- Operating Cost Savings: Electricity vs petrol cost comparison

- Charging Infrastructure: Home vs public charging economics

- Resale Value Projections: Technology advancement impact on depreciation

Section 5: CPF Optimization – The Guaranteed Return Foundation

Singapore’s Central Provident Fund system provides unique inflation-hedging opportunities through guaranteed returns that often exceed inflation rates.

CPF Account Strategy

Current Interest Rate Environment (2025)

- Ordinary Account (OA): 2.5% per annum

- Special Account (SA): 4% per annum (guaranteed floor rate)

- MediSave Account (MA): 4% per annum

- Retirement Account (RA): 4% per annum

Strategic Account Management

OA to SA Transfer Strategy. The most powerful CPF optimisation involves transferring excess OA funds to SA:

- Guaranteed Return Differential: 1.5% annual advantage (4% vs 2.5%)

- Tax Benefits: CPF top-ups are eligible for tax relief up to $37,740 annually

- Compounding Effect: Over 20 years, $10,000 transferred grows to an additional $3,207

- Timing Considerations: Transfer before age 55 to maximise compounding

Voluntary Contribution Strategy

- Cash Top-Up: Direct cash contributions to SA/MA for tax relief

- Employer Coordination: Maximize employer matching contributions where available

- Age-Based Strategy: Earlier voluntary contributions have a higher compounding impact

CPF Investment Scheme (CPFIS) Navigation

Risk-Return Optimisation CPFIS allows CPF OA and SA funds to be invested in approved instruments:

Conservative Strategy

- Bond Funds: Singapore government bonds, corporate bonds

- Fixed Deposits: Higher returns than CPF OA rate

- Target: Beat CPF OA rate (2.5%) with minimal risk

Moderate Strategy

- Balanced Funds: Mix of bonds and equities

- Singapore Blue Chip Stocks: DBS, OCBC, UOB, Singapore Telecommunications

- Target: 4-6% annual returns with moderate volatility

Aggressive Strategy

- Growth Funds: Higher equity allocation

- Regional/Global Funds: Broader market exposure

- Individual Stock Selection: High-conviction investments

- Target: 6-8% annual returns with higher volatility acceptance

CPFIS Risk Management

- Minimum Sum Assurance: Ensure CPF Minimum Sum requirements are met regardless of investment performance

- Diversification Imperative: Avoid concentration in single assets or sectors

- Regular Review: Quarterly portfolio assessment and rebalancing

Section 6: Investment Strategies – Beating Inflation Through Asset Allocation

Singapore’s position as a financial hub provides access to diverse investment opportunities for inflation hedging.

Singapore REITs (S-REITs) – The Inflation Hedge Champion

Current REIT Market Dynamics (2025) Singapore REITs offer compelling inflation-hedging characteristics:

- Average Yield: 6.9% across 41 listed S-REITs

- Yield Comparison: Significantly higher than 1-year T-bills at 2.12%

- Historical Performance: 6% compound annual growth rate over the past 10 years

Strategic REIT Selection

Defensive REITs (Lower Risk)

- CapitaLand Integrated Commercial Trust: 5.2% yield, diversified retail portfolio

- Mapletree Commercial Trust: Office properties with stable tenancies

- Ascendas REIT: Industrial properties with long lease terms

Growth REITs (Higher Risk/Return)

- Mapletree Logistics Trust: E-commerce beneficiary with regional exposure

- Digital Core REIT: Data centre properties with inflation-linked contracts

- Healthcare REITs: Ageing population demographics support

REIT Investment Strategy

- Dollar-Cost Averaging: Monthly REIT purchases to smooth volatility

- Dividend Reinvestment: Compound growth through DRIP programs

- Sector Diversification: Spread across retail, office, industrial, and healthcare

- Geographic Diversification: Local Singapore properties vs regional exposure

Singapore Blue Chip Equity Strategy

Inflation-Resistant Singapore Stocks: Companies with pricing power and essential services:

Banking Sector

- DBS Group: Regional banking leader, benefits from rising interest rates

- OCBC Bank: Strong regional presence, diversified revenue streams

- UOB: Conservative banking model, consistent dividend payments

Telecommunications & Utilities

- Singapore Telecommunications: Essential services with regulated returns

- SPH REIT: Media and property combination

- Keppel Corporation: Infrastructure and renewable energy exposure

Consumer Staples

- Dairy Farm International: Regional food retail chains

- Wilmar International: Agricultural commodities processing

- Thai Beverage: Regional beverage market leader

Government Securities and Bonds

Singapore Government Securities (SGS)

- 10-Year SGS: Benchmark rate around 2.5-3% provides inflation baseline

- Singapore Savings Bonds (SSB): Step-up interest structure, early redemption flexibility

- Inflation-Linked Bonds: Direct inflation protection through principal adjustment

Corporate Bond Strategy

- High-Grade Corporate Bonds: 3-5% yields from established Singapore companies

- Perpetual Securities: Higher yields but higher risk from financial institutions

- Foreign Currency Bonds: Currency diversification for portfolio protection

International Diversification

Regional Growth Exposure Singapore’s geographic position provides access to high-growth Asian markets:

- China A-Shares: Through Hong Kong connect programs

- ASEAN Markets: Indonesia, Thailand, Malaysia growth opportunities

- India Market Access: Through Singapore-listed Indian companies and funds

Currency Diversification

- Multi-Currency Deposits: USD, EUR exposure through Singapore banks

- Foreign Currency Bond Funds: Professional currency management

- Commodity Currency Exposure: AUD, CAD through ETFs and funds

Section 7: Alternative Investment Strategies

Precious Metals and Commodities

Gold Investment in Singapore

- UOB Gold Savings Account: No storage concerns, easy liquidity

- Physical Gold: Singapore’s tax-free gold market advantages

- Gold ETFs: Professional management, lower transaction costs

- Strategic Allocation: 5-10% portfolio allocation for inflation hedge

Silver and Platinum

- Industrial Demand: Higher volatility but potential for greater returns

- Physical vs Paper: Storage considerations for physical metals

- Market Timing: Cyclical nature requires strategic entry/exit

Real Estate Investment Beyond REITs

Private Property Investment

- Residential Properties: Rental income and capital appreciation

- Commercial Properties: Higher yields but larger capital requirements

- Industrial Properties: Stable returns from logistics/manufacturing tenants

Property Crowdfunding

- REIT Alternative: Access to private properties with lower minimums

- Development Projects: Higher risk/return property development investments

- International Property: Global real estate exposure through Singapore platforms

Business and Entrepreneurship

Inflation-Resistant Business Models

- Essential Services: Healthcare, education, food services

- Technology Platforms: Scalable businesses with pricing power

- Import/Export: Leverage Singapore’s trade hub position

Franchise Opportunities

- Established Brands: Proven business models with inflation-resistant pricing

- Regional Expansion: ASEAN market access through Singapore base

- Government Support: Various grants and programs for business development

Section 8: Tax Optimisation Strategies

Singapore Tax Advantages

No Capital Gains Tax Singapore’s lack of capital gains tax provides significant advantages:

- Investment Profits: All capital gains tax-free for individual investors

- Trading vs Investment: Careful documentation to maintain investment status

- International Comparison: Significant advantage over most developed countries

Supplementary Retirement Scheme (SRS)

- Tax Deferral: Contributions reduce current year taxable income

- Investment Growth: Tax-free growth within SRS account

- Withdrawal Strategy: 50% of withdrawals taxable at retirement (lower tax rates)

Corporate Structure Optimization

Investment Holding Companies

- Tax Efficiency: Corporate structure for significant investment portfolios

- Estate Planning: Succession planning advantages

- International Investment: Access to tax treaties for global investments

Family Office Structures

- High Net Worth: S$20 million minimum for family office incentives

- Tax Benefits: Reduced tax rates on investment income

- Professional Management: Access to institutional investment opportunities

Section 9: Risk Management and Insurance

Inflation-Adjusted Insurance Planning

Life Insurance Strategies

- Whole Life Policies: Cash value growth as an inflation hedge

- Investment-Linked Policies: Equity exposure within an insurance wrapper

- Term Life Optimisation: Lower cost, higher coverage, invest the difference strategy

Health Insurance Evolution

- Medical Inflation: Healthcare costs rising faster than general inflation

- Integrated Shield Plans: Comprehensive coverage against medical cost inflation

- Critical Illness Coverage: Lump sum protection against major medical expenses

Asset Protection Strategies

Emergency Fund Optimisation

- Liquidity Requirements: 6-12 months’ expenses in high-yield savings

- Currency Diversification: Partial emergency funds in foreign currencies

- Access Mechanisms: Multiple banking relationships for crisis access

Estate Planning Considerations

- Will and Trust Structures: Protection against inflation erosion over time

- Beneficiary Designations: Regular updates for changing family circumstances

- Cross-Border Assets: International estate planning for global portfolios

Section 10: Implementation Framework

Phase 1: Foundation Building (Months 1-3)

Immediate Actions

- CPF Optimisation: Transfer excess OA to SA, plan voluntary contributions

- Banking Setup: High-yield savings accounts, multi-currency capabilities

- Budget Analysis: Detailed expense tracking, identify inflation impact areas

- Insurance Review: Ensure adequate coverage, consider inflation escalation clauses

Investment Account Setup

- Brokerage Account: SGX-listed securities, REITs, bonds

- CPFIS Activation: If pursuing CPF investment strategy

- Robo-Advisor Evaluation: For passive investment management

- International Access: Global market access through Singapore brokers

Phase 2: Strategic Implementation (Months 4-12)

Investment Portfolio Construction

- Asset Allocation: Based on risk tolerance, time horizon, inflation protection needs

- Dollar-Cost Averaging: Systematic investment to reduce timing risk

- Diversification: Across asset classes, sectors, geographic regions

- Tax Optimization: Utilize SRS, maximize tax-efficient investments

Lifestyle Adjustments

- Housing Strategy: Optimise housing costs, consider location arbitrage

- Transport Optimisation: Implement public transport, consider car ownership economics

- Food Cost Management: Bulk buying, market diversification, waste reduction

Phase 3: Advanced Optimisation

(Year 2+)

Sophisticated Strategies

- Alternative Investments: REITs, precious metals, private equity access

- Business Development: Inflation-resistant business models, franchise opportunities

- International Diversification: Regional growth exposure, currency hedging

- Estate Planning: Long-term wealth preservation structures

Performance Monitoring

- Inflation-Adjusted Returns: Track real returns across all investments

- Lifestyle Quality Metrics: Ensure strategies don’t compromise quality of life

- Strategy Refinement: Regular review and adjustment based on economic conditions

Section 11: Economic Scenario Planning

Base Case Scenario (60% probability)

- Inflation: 1.5-2.5% range through 2025-2027

- Interest Rates: Gradual normalisation, CPF rates stable

- Economic Growth: 2-3% GDP growth, stable employment

- Strategy Focus: Balanced approach, REITs, blue chip equities, CPF optimisation

High Inflation Scenario (25% probability)

- Inflation: 3-5% due to external shocks, supply disruptions

- Interest Rates: Rising rates, higher bond yields

- Economic Impact: Reduced consumer spending, potential recession risk

- Strategy Adjustment: Increase REIT allocation, reduce duration risk, accelerate debt paydown

Low Inflation/Deflation Scenario (15% probability)

- Inflation: Below 1%, potential deflationary pressures

- Interest Rates: Lower for longer, potential negative rates

- Economic Impact: Economic stagnation, high unemployment risk

- Strategy Adjustment: Increase government bond allocation, focus on dividend-paying stocks, and maintain cash reserves

Black Swan Scenario Planning

- Currency Crisis: SGD devaluation scenario preparation

- Financial System Disruption: Alternative banking and payment systems

- Geopolitical Shock: Supply chain disruption, trade route impacts

- Climate Crisis: Physical and transition risks to investments

Section 12: Monitoring and Review Framework

Key Performance Indicators (KPIs)

Financial Metrics

- Real Return Achievement: Portfolio returns vs inflation rate

- Expense Ratio Tracking: Investment costs as percentage of portfolio

- Debt Service Ratio: Debt payments as percentage of income

- Emergency Fund Adequacy: Months of expenses covered

Lifestyle Metrics

- Quality of Life Index: Subjective assessment of lifestyle maintenance

- Financial Stress Level: Regular assessment of financial anxiety

- Goal Achievement Rate: Progress toward financial independence

- Flexibility Maintenance: Ability to adapt to changing circumstances

Review Schedule

Monthly Reviews

- Expense Tracking: Detailed analysis of spending patterns

- Investment Performance: Portfolio returns, dividend income

- Market Conditions: Economic indicators, inflation data

- Strategy Adjustments: Minor tactical adjustments

Quarterly Reviews

- Asset Allocation Rebalancing: Restore target allocations

- Tax Planning: Optimize tax strategies, SRS contributions

- Insurance Needs: Coverage adequacy, premium optimization

- Goal Progress: Track toward financial independence targets

Annual Reviews

- Comprehensive Strategy Assessment: Full portfolio review

- Economic Assumption Updates: Inflation expectations, growth projections

- Life Stage Adjustments: Career changes, family evolution

- Estate Planning Updates: Will, beneficiaries, trust structures

Technology Integration

Financial Management Tools

- Expense Tracking Apps: Automated categorization, trend analysis

- Investment Platforms: Portfolio management, performance tracking

- Tax Software: Optimize tax planning, maximize deductions

- Economic Data Sources: Real-time inflation data, market indicators

Automation Strategies

- Dollar-Cost Averaging: Automated investment contributions

- Bill Payments: Optimize autopay to avoid late fees

- Savings Transfers: Automatic emergency fund building

- Rebalancing Triggers: Systematic portfolio maintenance

Conclusion: The Singapore Advantage

Singapore’s unique economic structure provides both challenges and exceptional opportunities for inflation mitigation. The combination of government stability, financial market access, favorable tax treatment, and regional growth exposure creates a powerful framework for wealth preservation and growth.

Key Success Factors:

- Leverage Singapore’s Institutional Advantages: CPF system, government securities, tax efficiency

- Utilize Geographic Position: Regional investment access, cross-border opportunities

- Maintain Diversification: Across assets, currencies, and geographic regions

- Stay Disciplined: Systematic implementation, regular review, long-term perspective

- Remain Adaptive: Economic conditions change, strategies must evolve

Long-Term Wealth Building Philosophy: The most effective inflation-fighting strategy combines Singapore’s unique advantages with disciplined financial management and strategic risk-taking. Success requires understanding that inflation is not just an economic phenomenon but a long-term wealth erosion force that demands proactive, sophisticated responses.

Singapore residents have access to tools and opportunities that most of the world lacks. The question is not whether inflation can be beaten, but whether individuals will take advantage of Singapore’s exceptional financial ecosystem to build lasting wealth resilience.

The strategies outlined in this analysis provide a comprehensive framework for not just surviving inflation, but thriving despite it. Implementation requires commitment, education, and adaptation, but the potential rewards—true financial independence and intergenerational wealth building—justify the effort required.

Final Recommendation: Begin with CPF optimization and REIT investments as the foundation, expand into comprehensive asset allocation and alternative strategies as knowledge and capital grow, and maintain the discipline to stick with long-term strategies despite short-term market volatility. Singapore’s residents have the tools to win the inflation fight—the only question is whether they’ll use them effectively.

The Sengkang Inflation Warriors

Chapter 1: The Reckoning

The notification pinged on Wei Ming’s phone just as he was boarding the NEL at Sengkang MRT station. His DBS banking app cheerfully informed him that his monthly expenses had increased by 18% compared to last year. He stared at the screen, watching the familiar stations blur past—Buangkok, Hougang, Serangoon—each stop a reminder of rising costs that seemed to chase him everywhere.

At 34, Wei Ming had thought he had it figured out. Software engineer at a multinational, decent salary, 4-room HDB flat in Sengkang purchased three years ago. But inflation had arrived like a silent thief, picking his pockets one grocery receipt at a time.

“Another price increase?” asked his seat neighbor, a middle-aged woman who’d been observing his frowning face.

“Everything’s going up, auntie. Even my regular cai png is now $4.50.”

Mdm Lim, as she introduced herself, worked as a part-time administrative assistant after her retrenchment last year. “You know what ah, young man? My generation survived the Asian Financial Crisis, SARS, circuit breaker. This inflation thing, we’ve seen worse. Question is—are you going to just complain, or are you going to fight back?”

Chapter 2: The Alliance Forms

That evening, Wei Ming couldn’t shake Mdm Lim’s words. He found himself in the void deck of Block 312, where his neighbors were engaged in their usual evening routines. The chess uncles were deep in concentration, the yoga group was winding down, and children were cycling in diminishing circles.

“Eh, everyone also feeling the pinch hor?” Wei Ming ventured to the group.

Uncle Raj looked up from his chess game. “My taxi earnings same-same, but petrol, maintenance, everything up. Lucky I got my HDB loan at 2.6%, otherwise I’d be sleeping in my car.”

Sarah, a marketing manager and single mother, overheard from the yoga mat. “Don’t talk about it. My 8-year-old son’s enrichment classes, groceries, even his school shoes—everything more expensive. I’m considering moving back with my parents.”

“Wah, don’t need to be so drastic,” said Mdm Lim, who had just returned from the nearby market. “Why don’t we help each other? My husband always say, when life gives you expensive lemons, make lemonade and sell it.”

And so, the Sengkang Inflation Warriors were born—not through grand proclamations, but through a simple recognition that their neighbors were their greatest asset in uncertain times.

Chapter 3: The Battle Plan

Operation Grocery Solidarity

Mdm Lim had spent forty years navigating Singapore’s markets. She became their strategic advisor, teaching them that inflation was not just about rising prices, but also about information asymmetry.

“Every Tuesday, 4pm, Sengkang Grand Mall wet market,” she announced. “Vegetable uncle always mark down prices. But more importantly, we buy together, we get bulk discount.”

Wei Ming volunteered to create a WhatsApp group. Within days, they had coordinated purchases: Sarah handled baby products and household items from her Shopee expertise, Uncle Raj leveraged his taxi driver network for wholesale contacts, and Wei Ming managed the group’s digital coupon strategy.

Their first group purchase saved each family an average of $127 per month on groceries alone.

The Great Energy Audit

Uncle Raj, despite his humble exterior, had been an electrical technician before becoming a taxi driver. He offered to audit everyone’s homes for energy efficiency.

“Wei Ming, your aircon running 18 degrees whole night? In Singapore weather, 24 degrees is good enough. And Sarah, your water heater on 24/7? Switch to timer mode.”

Through simple adjustments—LED bulbs, timer switches, strategic appliance usage—the group reduced their electricity bills by 15-20%. Uncle Raj refused payment, saying the knowledge sharing was “just neighbors helping neighbors.”

The Skills Exchange Network

The beauty of their alliance lay in its organic evolution. Sarah, with her marketing background, helped Uncle Raj create a simple website advertising his electrical services. Wei Ming taught Mdm Lim’s grandson basic coding, potentially opening doors to future tech careers. Mdm Lim became the group’s financial advisor, sharing her knowledge of CPF optimization and government schemes.

“You know hor, my CPF Special Account earning 4% guaranteed?” Mdm Lim explained during one of their monthly void deck meetings. “While bank giving you 0.5% for savings, government giving you 4%. Some of you young people, got spare cash, consider top up your CPF SA. Tax relief some more.”

Chapter 4: The Innovation Wave

The Sengkang Food Revolution

Month three brought their most ambitious project. Inspired by the success of their bulk buying, they decided to tackle Singapore’s notorious food costs through a community-supported agriculture initiative.

Sarah’s research had revealed that Singapore was pushing urban farming. They partnered with a local vertical farm in Sengkang to receive weekly produce boxes at wholesale prices. Each family contributed $40 monthly for fresh vegetables that would have cost $80 at the supermarket.

But the real genius was Mdm Lim’s suggestion: “Why don’t we also start small garden at void deck?”

With approval from their town council, they transformed unused space into a small herb garden. Coriander, spring onions, chili plants—nothing massive, but enough to supplement their cooking and foster community spirit.

The Investment Club

Wei Ming had always been intimidated by investments, but Uncle Raj surprised everyone with his savvy.

“Drive a taxi for 20 years, you pick up many bankers, fund managers. They all say the same thing: time in market beats timing the market.”

Together, they formed an informal investment club. Each member contributed $200 monthly to a shared STI ETF investment, with Wei Ming managing the digital platform. They also explored Singapore Savings Bonds, utilising the group’s collective knowledge to gain a deeper understanding of the products.

Mdm Lim, with her experience, guided them on REITs. Singapore REITs, not bad. Can get a 4-5% dividend yield. Better than putting money in a fixed deposit.”

Chapter 5: The Ripple Effect

The Network Expands

Their success became the talk of Sengkang. Other blocks began forming similar groups. The original Warriors became mentors, sharing their strategies and lessons learned.

Sarah started a blog documenting their journey, which gained thousands of views from Singaporeans facing similar challenges. Uncle Raj was featured in a Lianhe Zaobao article about community resilience. Wei Ming was invited to speak at his company’s employee resource group about financial wellness.

The Unexpected Windfall

Uncle Raj’s electrical services business, boosted by Sarah’s marketing and the group’s word-of-mouth recommendations, grew significantly. Instead of keeping all profits, he proposed a community fund.

“When we help each other, prosperity comes back to us,” he said. The fund helped families during emergencies—when Sarah’s son needed urgent medical treatment, when Wei Ming’s air conditioner broke during a heatwave, when Mdm Lim’s husband required expensive medication.

The Next Generation

The children, initially peripheral to their parents’ activities, became active participants. Wei Ming’s teenager started a small business selling plants to other residents. Sarah’s son learned basic financial literacy from Mdm Lim. The kids formed their own “Junior Warriors” group, tackling school expense inflation through textbook sharing and group tuition arrangements.

Chapter 6: The Philosophy Emerges

Beyond the Numbers

Twelve months after their first meeting, the Sengkang Inflation Warriors had achieved measurable success:

- Average household savings: $300-400 monthly

- Investment portfolio growth: 8% annually

- Community network: 200+ families across Sengkang

- Side business income: $500-1500 monthly per participating family

But the real victory was philosophical. They had transformed from inflation victims to inflation strategists.

“We realised,” Wei Ming reflected during their anniversary gathering, “that inflation isn’t just an economic problem—it’s a social problem. When communities are disconnected, everyone suffers alone. When we’re connected, we pool resources, knowledge, and resilience.”

The Singapore Advantage

Mdm Lim, now recognised as the group’s unofficial wisdom keeper, offered her perspective: “Singapore has a good foundation—stable government, strong CPF system, excellent infrastructure. But the foundation alone is not enough. We need to build community on top of that foundation.”

Their model leveraged Singapore’s unique advantages:

- A high-trust society enables resource sharing

- Excellent digital infrastructure for coordination

- Government transparency allows strategic planning

- A multicultural environment fosters diverse skills and perspectives

- Compact geography enables face-to-face community building

Epilogue: The Continuing Story

Two Years Later

The Sengkang Inflation Warriors had evolved into something neither governmental nor purely private—a hybrid community institution that adapted to changing economic conditions while maintaining human connections.

Wei Ming had received a promotion, partly due to leadership skills developed through community organising. Sarah launched a successful consultancy helping other communities replicate their model. Uncle Raj expanded his business and hired two assistants. Mdm Lim became a certified financial counsellor, helping seniors optimise their CPF and investment strategies.

The Model Spreads

Their approach influenced policy discussions about community resilience. Several government agencies consulted with them about bottom-up approaches to economic challenges. Universities invited them to speak about social innovation.

But perhaps the most significant impact was personal. In a society often criticised for its competitive individualism, the Sengkang Inflation Warriors had demonstrated that mutual aid and collective action could thrive even in modern urban Singapore.

The Next Challenge

As inflation moderated in 2025, new challenges emerged—climate change costs, ageing population pressures, and technological disruption. But the Warriors faced these with confidence, knowing they had built something more valuable than any individual inflation-hedging strategy: a resilient community capable of adapting to whatever economic storms lay ahead.

“We started fighting inflation,” Sarah said during a recent community gathering. “But we ended up building something much bigger—we built a neighbourhood where everyone looks out for everyone else. That’s the best insurance policy against any economic uncertainty.”

The story of the Sengkang Inflation Warriors became a testament to a simple truth: in Singapore’s complex modern economy, the most sophisticated financial strategies could not replace the fundamental human resource of community solidarity. When neighbors became allies, inflation became not just bearable, but beatable.

“In the end, we didn’t just survive inflation—we used it as an opportunity to rediscover what makes a community strong. Singapore’s greatest asset isn’t its GDP or its financial sector—it’s its people, when they choose to support each other.”

— Wei Ming, Sengkang Inflation Warriors

Maxthon

In an age where the digital world is in constant flux and our interactions online are ever-evolving, the importance of prioritising individuals as they navigate the expansive internet cannot be overstated. The myriad of elements that shape our online experiences calls for a thoughtful approach to selecting web browsers—one that places a premium on security and user privacy. Amidst the multitude of browsers vying for users’ loyalty, Maxthon emerges as a standout choice, providing a trustworthy solution to these pressing concerns, all without any cost to the user.

Maxthon browser Windows 11 support

Maxthon, with its advanced features, boasts a comprehensive suite of built-in tools designed to enhance your online privacy. Among these tools are a highly effective ad blocker and a range of anti-tracking mechanisms, each meticulously crafted to fortify your digital sanctuary. This browser has carved out a niche for itself, particularly with its seamless compatibility with Windows 11, further solidifying its reputation in an increasingly competitive market.

In a crowded landscape of web browsers, Maxthon has carved out a distinct identity through its unwavering commitment to providing a secure and private browsing experience. Fully aware of the myriad threats lurking in the vast expanse of cyberspace, Maxthon works tirelessly to safeguard your personal information. Utilising state-of-the-art encryption technology, it ensures that your sensitive data remains protected and confidential throughout your online adventures.

What truly sets Maxthon apart is its commitment to enhancing user privacy during every moment spent online. Each feature of this browser has been meticulously designed with the user’s privacy in mind. Its powerful ad-blocking capabilities work diligently to eliminate unwanted advertisements, while its comprehensive anti-tracking measures effectively reduce the presence of invasive scripts that could disrupt your browsing enjoyment. As a result, users can traverse the web with newfound confidence and safety.

Moreover, Maxthon’s incognito mode provides an extra layer of security, granting users enhanced anonymity while engaging in their online pursuits. This specialised mode not only conceals your browsing habits but also ensures that your digital footprint remains minimal, allowing for an unobtrusive and liberating internet experience. With Maxthon as your ally in the digital realm, you can explore the vastness of the internet with peace of mind, knowing that your privacy is being prioritised every step of the way.