As the Federal Reserve signals likely interest rate cuts, locking in a high-yield bank account becomes increasingly valuable. Connexus Credit Union’s Xtraordinary Checking Account stands out by offering both a market-leading 5.00% APY on balances up to $25,000 and a cash bonus of up to $300 — a combination rarely seen in today’s banking landscape.

To qualify for the 5% APY, account holders must complete either 15 debit card transactions or $500 in monthly spending, plus receive at least $500 in electronic deposits each month. The cash bonus is structured according to your average balance: maintain $10,000 or more for two months within the first four months to earn the full $300; lower balances yield smaller bonuses.

This offer is particularly timely, as Bankrate and other financial sources confirm that savings rates typically fall following Fed rate cuts. By meeting Connexus’s requirements now, consumers can secure a robust return even as rates elsewhere are expected to decline.

For those unable to meet the debit card usage criteria, alternatives exist. High-yield savings accounts currently offer APYs between 4.31% and 5.00%, while money market accounts reach up to 4.80%. Certificates of Deposit (CDs), including those from Connexus, provide locked rates as high as 4.60%.

Ultimately, Connexus’s Xtraordinary Checking Account offers an exceptional blend of yield and bonus, making it a compelling choice for eligible customers seeking to maximize returns in a changing rate environment.

Singapore Banking Context Analysis

The US banking rates mentioned in the article are significantly higher than what’s available in Singapore. Here’s the stark comparison:

Rate Comparison: US vs Singapore

US Rates (from article):

- High-yield checking: 5.00% APY

- High-yield savings: 4.31-5.00% APY

- Money market accounts: up to 4.80% APY

- CDs: up to 4.60% APY

Singapore Rates (September 2025):

- Digital banks (best fuss-free): MariBank 2.28% p.a., GXS 1.58% p.a. BeansproutSingSaver

- Traditional banks (with conditions): UOB One up to 3.30% p.a. Best Online Savings Accounts with High Interest Rates to Park Your Money in Singapore – SingSaver

- DBS Multiplier: up to 2.5% p.a. (promotional rate) Best savings accounts in Singapore with highest interest rates [September 2025] – Growbeansprout.com

- Fixed deposits: up to 1.60% p.a. Singapore Best Fixed Deposit Rates [September 2025] | StashAway Singapore

Key Differences for Singapore Context:

1. Much Lower Base Rates Singapore’s highest rates are roughly half of what’s offered in the US. This reflects different monetary policies between the Federal Reserve and Monetary Authority of Singapore (MAS).

2. Limited High-Yield Options

- Digital banks offer 2.38% to 3.50% p.a., but options are limited as GXS Bank isn’t accepting new sign-ups Best Digital Bank Savings Accounts: Trust Bank vs GXS Bank vs MariBank

- Traditional bank accounts require multiple conditions (salary crediting, credit card spending, etc.)

3. No Equivalent “Bonus” Culture Singapore banks rarely offer large cash bonuses like the $300 mentioned in the US article. Promotions typically focus on waived fees or small cashback amounts.

4. Singapore Alternatives to Consider:

- Fuss-free option: MariBank at 2.28% p.a. with zero conditions MariBank Review: How Does It Compare Against GXS And Trust Bank? – SingSaver

- Higher rates with conditions: UOB One Account at 3.30% p.a. (requires spending and salary crediting) Best Online Savings Accounts with High Interest Rates to Park Your Money in Singapore – SingSaver

- Fixed income: Singapore Government Securities (SGS bonds/T-bills) often offer competitive risk-free returns

Bottom Line: While the US 5% checking account with $300 bonus sounds attractive, Singapore residents face a more constrained environment where even the best accounts offer roughly half those returns, making careful comparison of local options more crucial.

Singapore’s banking landscape offers far lower interest rates compared to those available in the United States, reflecting differences in monetary policy and market structure. While US consumers can access high-yield checking accounts at 5.00% APY and savings rates up to 5.00%, the best Singapore digital banks, like MariBank, offer only 2.28% p.a., with traditional options such as UOB One reaching up to 3.30% p.a. — but only with multiple qualifying conditions (SingSaver, Growbeansprout.com).

A key distinction is that Singapore’s base rates are consistently about half those in the US. This disparity arises from the Monetary Authority of Singapore’s tight control over interest rates to manage currency stability, compared to the Federal Reserve’s focus on stimulating domestic lending. Furthermore, the variety of high-yield accounts is limited locally; for example, GXS Bank, a popular digital option, frequently pauses new sign-ups.

Unlike American banks, Singaporean institutions seldom offer substantial cash bonuses for new accounts. Promotions are typically limited to modest cashback or fee waivers, lacking the $300 incentives seen in US marketing campaigns. Moreover, maximizing returns from traditional banks usually requires customers to meet several requirements, such as monthly salary crediting and minimum card spending.

For those seeking risk-free alternatives, Singapore Government Securities like T-bills and SGS bonds may provide competitive yields relative to fixed deposits, which currently cap around 1.60% p.a. Ultimately, Singapore residents must navigate a more conservative banking environment, where even the most attractive accounts deliver only half the returns found in the US, making thorough comparison and strategic selection essential for optimizing savings.

Banking Reality Check: Why Singapore Savers Face a Different Game Than US Counterparts

An in-depth analysis of the stark differences between US and Singapore banking landscapes

When headlines tout US banks offering 5% annual returns with $300 cash bonuses, it’s easy for Singapore residents to feel they’re missing out on lucrative opportunities. However, the reality is that Singapore’s banking environment operates under fundamentally different conditions that make direct comparisons misleading. Understanding these differences is crucial for making informed financial decisions in the local context.

The Great Rate Divide: Numbers Don’t Tell the Whole Story

The disparity between US and Singapore banking rates is immediately striking:

United States (September 2025):

- Premium checking accounts: 5.00% APY

- High-yield savings: 4.31-5.00% APY

- Money market accounts: up to 4.80% APY

- Certificates of deposit: up to 4.60% APY

Singapore (September 2025):

- Best digital bank rates: 2.28% p.a. (MariBank)

- Traditional bank conditional rates: up to 3.30% p.a. (UOB One)

- Fixed deposits: typically 1.60% p.a. or lower

- Government securities: varying based on tenure

At first glance, US rates appear roughly double Singapore’s offerings. However, this numerical comparison masks deeper structural and economic factors that shape each market differently.

Understanding the Monetary Policy Foundation

The rate differential stems primarily from divergent monetary policies between the Federal Reserve and Singapore’s Monetary Authority (MAS).

The US Federal Reserve’s Approach: The Federal Reserve uses interest rates as its primary monetary policy tool, raising or lowering the federal funds rate to control inflation and economic growth. When the Fed maintains higher rates to combat inflation, this creates room for banks to offer competitive consumer rates while maintaining profitable spreads.

Singapore’s Currency-Based System: Singapore operates under a unique exchange rate-centered monetary policy. Instead of adjusting interest rates, MAS manages the Singapore dollar’s trade-weighted exchange rate against a basket of currencies. This system has historically kept Singapore’s interest rates relatively lower and more stable, as the focus is on exchange rate management rather than interest rate manipulation.

This fundamental difference explains why Singapore rarely sees the dramatic rate swings—both up and down—that characterize US banking markets.

The Structural Banking Landscape: Oligopoly vs. Competition

Singapore’s Banking Concentration: Singapore’s banking sector is dominated by three major local banks (DBS, OCBC, UOB) that collectively control the vast majority of deposits and lending. This concentration, while providing stability, reduces competitive pressure to offer aggressive rates. The recent entry of digital banks (GXS, Trust Bank, MariBank) has introduced some competition, but their market share remains relatively small.

US Banking Fragmentation: The US banking system includes thousands of institutions—from mega-banks to community credit unions—creating intense competition for deposits. Smaller institutions like Connexus Credit Union (mentioned in the original article) often compete by offering premium rates to attract deposits from larger, less agile competitors.

This competitive dynamic in the US enables niche players to offer attractive rates that would be unsustainable for larger institutions, while Singapore’s concentrated market tends toward more uniform, conservative pricing.

The True Cost of Money: Looking Beyond Headline Rates

When evaluating these rate differences, several hidden factors must be considered:

Inflation Environment:

- US inflation has been running higher, making nominal interest rates less attractive in real terms

- Singapore’s typically lower inflation environment means lower nominal rates may preserve purchasing power more effectively

- Real returns (after inflation) may be more comparable than headline rates suggest

Currency Risk: For Singapore residents, US dollar deposits introduce exchange rate risk. The SGD’s strength against the USD over certain periods could erode returns from US accounts, while MAS’s exchange rate policy provides some stability for SGD-denominated savings.

Regulatory and Tax Implications:

- US accounts may subject Singapore residents to foreign tax obligations

- Singapore’s lack of capital gains tax on most investments provides advantages not reflected in deposit rates

- Regulatory protections differ significantly between jurisdictions

Digital Banking Revolution: Singapore’s Unique Opportunity

While Singapore’s traditional banks offer modest returns, the digital banking licenses granted in recent years have created new opportunities:

MariBank’s Simplicity: At 2.28% p.a. with zero conditions, MariBank offers Singapore’s most straightforward high-yield option. No minimum balance, no spending requirements, no salary crediting needed—just park your money and earn.

Trust Bank’s Integration: Trust Bank’s ecosystem approach, backed by Standard Chartered, provides competitive rates while integrating with Singapore’s digital payment infrastructure.

The GXS Situation: GXS Bank’s temporary halt on new customer acquisition highlights both the demand for better rates and the challenges digital banks face in scaling operations profitably.

These digital entrants represent Singapore’s best hope for improved deposit rates, though they’re still constrained by the broader monetary policy environment.

Strategic Approaches for Singapore Savers

Given these constraints, Singapore residents need different strategies than their US counterparts:

1. Maximize Conditional Rates Strategically Traditional banks’ conditional accounts (like UOB One’s 3.30% rate) can be worthwhile if you’re already meeting the requirements through normal spending patterns. The key is ensuring the conditions align with your natural financial behavior.

2. Embrace the Digital Banking Premium Digital banks currently offer the best risk-free returns available to Singapore residents. Their fuss-free approach makes them ideal for emergency funds and short-term savings.

3. Consider Government Securities Singapore Government Securities (SGS) and Treasury Bills often provide competitive, government-backed returns that can exceed bank deposits, especially for longer-term funds.

4. Diversify Beyond Deposits Singapore’s favorable tax environment makes it attractive to consider investment options beyond traditional deposits. The absence of capital gains tax on many investments can potentially generate better after-tax returns than higher-rate deposits elsewhere.

5. Currency Diversification Thoughtfully For those considering US dollar deposits, treat them as part of a broader currency diversification strategy rather than purely return-seeking, and understand the exchange rate risks involved.

The Innovation Pipeline: What’s Coming

Several trends suggest Singapore’s deposit rate environment may evolve:

Increased Digital Bank Competition: As digital banks establish their footing and potentially gain larger market shares, competitive pressure on traditional banks may increase.

Regulatory Evolution: MAS continues to encourage innovation in financial services, potentially creating new products and competitive dynamics.

Regional Integration: Singapore’s role as a regional financial hub may create opportunities for innovative cross-border products that offer better returns while maintaining regulatory compliance.

Making Peace with the Rate Reality

The fundamental lesson for Singapore residents is that chasing headline rates from other jurisdictions often misses the bigger picture. Singapore’s lower deposit rates are part of a broader economic framework that includes:

- Greater economic stability

- Favorable tax treatment of investments

- Strong currency management

- Robust regulatory protection

- Access to diverse investment opportunities

Rather than lamenting the absence of 5% checking accounts, Singapore savers are better served by:

- Maximizing available local opportunities through digital banks and strategic use of conditional accounts

- Understanding that lower nominal rates may provide better real returns in Singapore’s lower-inflation environment

- Taking advantage of Singapore’s investment-friendly tax structure to seek returns beyond traditional deposits

- Appreciating the stability and predictability that comes with Singapore’s monetary policy approach

The Long-Term Perspective

While US banking headlines may seem enticing, Singapore’s approach to monetary policy and financial regulation has delivered consistent economic growth and stability over decades. The trade-off for lower deposit rates is often greater overall economic predictability and access to diverse investment opportunities.

For Singapore residents, the focus should shift from envying overseas rates to optimizing within the local framework. This means making thoughtful choices about digital banks, understanding when conditional accounts make sense, considering government securities, and leveraging Singapore’s investment advantages.

The grass may seem greener on the other side of the Pacific, but Singapore’s financial landscape offers its own advantages for those who understand how to navigate it effectively. The key is playing the game that’s actually available, rather than wishing for a different set of rules.

This analysis reflects market conditions as of September 2025. Banking products and rates are subject to change, and readers should verify current offerings before making financial decisions.

Real-World Examples: Playing Singapore’s Financial Game Smart

Example 1: The Emergency Fund Optimizer Sarah, a marketing manager, needs S$50,000 in emergency funds

Instead of chasing the mythical 5% US account, Sarah optimizes locally:

- Parks S$30,000 in MariBank at 2.28% p.a. (no conditions, instant access)

- Places S$20,000 in UOB One Account at 3.30% p.a. (she already credits her S$6,000 salary monthly and spends S$500 on the UOB card for regular expenses)

- Result: Blended return of ~2.68% on emergency funds vs. 0.05% at traditional banks

Example 2: The Government Securities Ladder David, a civil servant, has S$100,000 to invest for 1-2 years

Rather than lamenting US CD rates at 4.60%, David builds a T-bill ladder:

- Invests S$50,000 in 6-month T-bills at 1.59% cut-off yield

- Invests S$50,000 in 1-year T-bills at 1.68% cut-off yield

- When the 6-month bills mature, reinvests in new 1-year bills

- Result: Government-guaranteed returns with liquidity every 6 months, plus protection against rising rates

Example 3: The Tax-Advantage Maximizer Linda, a finance director, has S$200,000 for long-term wealth building

Instead of envying US rates, Linda leverages Singapore’s tax advantages:

- Invests S$100,000 in SGX-listed REITs with no dividend withholding tax, earning 100% of dividend payouts

- Average S-REIT dividend yield: 6.9% (as of February 2025) vs. 10-year government bond at 2.7%

- Invests S$100,000 in growth stocks with no capital gains tax on eventual sale

- Benefits from Singapore not taxing foreign-sourced dividends for individual investors

- Result: Potentially 6%+ annual returns with no capital gains tax vs. US investors paying 15-20% capital gains tax

Example 4: The Conditional Account Strategist Mark runs a small business and needs working capital flexibility

Mark strategically uses conditional accounts:

- Sets up DBS Multiplier for business banking (salary + business credit card spending naturally meets requirements)

- Earns up to 2.5% on business funds vs. 0.05% in basic business accounts

- Uses the higher returns to offset business loan interest or reinvest

- Result: Turns routine business banking into a profit center

Example 5: The Digital Bank Portfolio Jenny, a recent graduate, starts with S$10,000

Jenny builds a simple but effective digital bank strategy:

- S$5,000 in MariBank at 2.28% (emergency fund)

- S$3,000 in Trust Bank at competitive rates (short-term goals)

- S$2,000 starts regular investing in broadly diversified ETFs

- Result: 2%+ risk-free returns plus long-term growth potential, all tax-efficient

Example 6: The Cross-Border Tax Optimizer James, an expat, manages multi-currency wealth

James leverages Singapore’s favorable tax environment:

- Maintains SGD deposits for local expenses and stability

- Invests in Ireland-domiciled ETFs for global exposure (better tax treaties than US ETFs)

- Uses Singapore as base for tax-efficient investing across Asia-Pacific markets

- Result: Global diversification with Singapore’s tax advantages vs. being tied to one country’s deposit rates

The Compound Effect of Smart Local Optimization

These examples illustrate how Singapore residents can achieve competitive returns by:

- Stacking Benefits: Combining digital bank rates with conditional account benefits where natural spending patterns align

- Tax Optimization: Leveraging zero capital gains tax and favorable dividend treatment

- Government Backing: Using SGS securities for guaranteed, government-backed returns

- Strategic Timing: Building T-bill ladders for liquidity while capturing rate movements

- Diversification: Using multiple account types and investment vehicles rather than seeking one “perfect” solution

While a US 5% checking account sounds attractive, Sarah’s optimized emergency fund strategy, Linda’s tax-advantaged REIT portfolio yielding 6.9%, and James’s cross-border tax optimization demonstrate that Singapore’s framework can deliver competitive, often superior, after-tax returns for those who understand the local game.

This analysis reflects market conditions as of September 2025. Banking products and rates are subject to change, and readers should verify current offerings before making financial decisions.

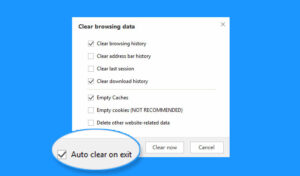

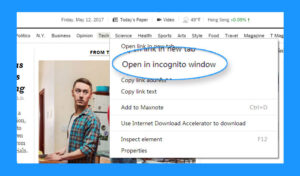

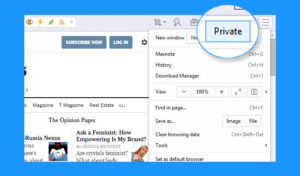

Instructions for Enabling and Disabling Private Browsing Mode in Maxthon Browser

1. Open Maxthon Browser: Launch the Maxthon browser on your device. Ensure you are running the latest version for optimal features and security.

2. Access the Menu: Click on the menu icon located at the top-right corner of the browser window. Three horizontal lines or dots usually represent this.

3. Select Private Browsing: In the dropdown menu, look for the Private Browsing option. Click on it to activate private mode.

4. Confirm Activation: A new window should appear, indicating that you are now in private browsing mode. You may notice a different colour scheme or an icon indicating this status.

5. Browse Privately: While in this mode, your browsing history, cookies, and site data will not be saved once you close the session. Feel free to explore securely.

6. Exit Private Browsing Mode: To return to regular browsing, click again on the menu icon and select Exit Private Browsing from the list of options.

7. Confirm Exit: Once you exit, a message may confirm that you have returned to normal browsing mode.

8. Resume Normal Usage: Continue surfing the internet without any restrictions while your activity is logged as usual again.

9. Check Settings if Needed: If you do not see these options, verify that your browser settings have not turned off private browsing functionality or consult the help section for troubleshooting advice.

Follow these steps carefully to navigate between standard and