Headline confusion about mortgage rates stemmed from differences in reporting methods and timing. Weekly averages from reputable organizations like the Mortgage Bankers Association (MBA) and Freddie Mac showed small rate declines, but these figures reflected data collected before the Federal Reserve’s latest policy meeting.

In contrast, headlines indicating rising rates relied on daily tracking data, such as Investopedia’s real-time averages. These daily reports captured an immediate increase of 5 basis points after the Fed’s announcement, followed by another 13 basis point jump the next day.

Despite the Federal Reserve cutting its benchmark rate by 0.25%, mortgage rates actually rose. According to daily data, the average 30-year fixed rate climbed from about 6.45% to 6.63%, defying expectations that Fed rate cuts always reduce mortgage costs.

Mortgage rates do not directly follow the Fed’s rate because they are more closely linked to the 10-year Treasury yield and broader bond market trends. Factors such as inflation expectations, economic outlook, and housing demand play a larger role in determining mortgage rates than the Fed’s short-term benchmark.

A historical example illustrates this disconnect: between September and December last year, the Fed lowered rates by a full percentage point, yet mortgage rates increased by 1.25 percentage points by January.

Currently, uncertainty over the Fed’s future actions is driving rates higher. Although the Fed’s projections suggest more cuts may be possible, Chairman Powell emphasized that further easing is not guaranteed, leading to higher Treasury yields and, consequently, higher mortgage rates.

In summary, for homebuyers and observers, daily mortgage rate tracking offers a more accurate reflection of market movements than weekly averages during periods of volatility. Ultimately, Fed rate cuts do not automatically translate into lower mortgage rates.

The recent confusion over mortgage rate movements in the United States following Federal Reserve decisions offers valuable lessons for Singapore’s property market and banking sector. As the Monetary Authority of Singapore (MAS) navigates its own monetary policy challenges in 2025, similar dynamics are playing out in the Lion City’s sophisticated financial ecosystem, where DBS, OCBC, UOB, and other financial institutions operate in an increasingly complex rate environment.

The Singapore Context: A Unique Monetary Policy Framework

Unlike the U.S. Federal Reserve’s focus on interest rates, Singapore’s monetary policy operates through exchange rate management. MAS kept the Singapore dollar nominal effective exchange rate (S$NEER) policy band on a modest and gradual appreciation path, but reduced its slope slightly in its recent policy reviews. This fundamental difference means that mortgage rate movements in Singapore follow different patterns than their American counterparts.

The Singapore Overnight Rate Average (SORA), last recorded at 1.78 percent, serves as the key benchmark for most floating-rate mortgages. However, the 3 Month SORA rate is currently 1.50% as compared to the 1 Month SORA rate which is 1.30%, illustrating the term structure complexities that can confuse borrowers trying to understand rate movements.

The Big Three: How DBS, OCBC, and UOB Navigate Rate Volatility

DBS Bank’s Distinctive Approach

DBS has carved out a unique position in Singapore’s mortgage market with its fixed deposit rate-linked products. The fixed deposit rate housing loan option from DBS sets itself apart because it is currently the only bank, which has a floating rate pegged to a fixed deposit rate rather than a 3M SORA rate like the majority of other banks. This innovative approach provides borrowers with an alternative benchmark that may move differently from SORA-based rates.

Currently, DBS Bank offers four fixed-rate packages with terms ranging from two to five years, with the APR set at 4.25% for all packages. However, the bank’s floating rates tell a different story, highlighting the divergence between fixed and variable rate products that can create headline confusion similar to what occurred in the U.S. market.

OCBC’s Market Positioning

OCBC Home Loan Rates 2025 – From 1.76% represents the competitive landscape that characterizes Singapore’s mortgage market. OCBC has positioned itself aggressively in the floating rate segment, offering rates that compete directly with market leaders while maintaining profitability in Singapore mortgage market is vibrant and super-competitive evident from the razor-thin interest spreads and the final rate charged by mortgage banks which can go as low as 1% to 1.50% (all-in rate) during trough in cycles.

UOB’s Strategic Response

United Overseas Bank has taken a more measured approach, with fixed-rate offerings that reflect broader market conditions. The bank’s mortgage rates have moved in tandem with industry trends, demonstrating how even in Singapore’s competitive environment, systemic factors influence all major players.

Why Singapore Mortgage Headlines Can Be Just as Confusing

The SORA vs. Fixed Rate Disconnect

Singapore borrowers face the same challenges as their U.S. counterparts when interpreting mortgage rate news. When headlines report declining SORA rates, they may not reflect the actual rates available to new borrowers. Banks often adjust their mortgage pricing based on:

- Funding costs beyond SORA: Banks’ cost of funds includes deposits, wholesale funding, and regulatory capital requirements

- Credit risk assessments: Loan-to-value ratios, borrower profiles, and property types all influence final pricing

- Market competition: The intense rivalry among Singapore banks creates pricing dynamics that may not follow benchmark rates directly

- MAS cooling measures: Regulatory requirements like Total Debt Servicing Ratio (TDSR) affect lending capacity and pricing strategies

Weekly vs. Daily Rate Reporting

Singapore’s mortgage market faces similar reporting challenges. Banks typically update their published rates weekly or bi-weekly, but internal pricing adjustments happen daily based on:

- SGS (Singapore Government Securities) yield movements

- SORA fixings and forward curve expectations

- Global funding market conditions

- MAS monetary policy signals

This creates a lag between actual market conditions and published rates, potentially misleading borrowers about current pricing availability.

The Property Market Impact: When Rate Cuts Don’t Help Buyers

Historical Precedents

Singapore has experienced periods where declining policy rates didn’t translate to lower mortgage costs. During previous MAS policy adjustments, banks sometimes maintained or even increased mortgage spreads due to:

- Increased regulatory requirements

- Credit risk reassessments

- Funding cost volatility

- Competitive positioning changes

Current Market Dynamics

SORA is set to drop over the next 12 months as inflation is subdued, economic growth slows and interest rates drop, yet this doesn’t guarantee lower mortgage rates for property buyers. Several factors continue to pressure mortgage pricing upward:

Regulatory Environment: MAS cooling measures continue to influence lending practices, with banks maintaining conservative credit standards despite lower benchmark rates.

Global Funding Costs: Singapore banks’ reliance on wholesale funding markets means that global financial conditions significantly impact local mortgage pricing, sometimes overriding domestic rate movements.

Credit Risk Premiums: Banks may widen spreads over SORA to compensate for perceived increases in property market risks or economic uncertainty.

The Competitive Landscape: Beyond the Big Three

Smaller Banks and Financial Institutions

Singapore’s mortgage market extends beyond DBS, OCBC, and UOB. Smaller local banks, foreign bank branches, and financial institutions like Maybank, Standard Chartered, and HSBC add complexity to rate competition. These institutions often specialize in particular market segments or offer niche products that can create apparent rate disparities in market reports.

HDB Loan vs. Bank Loan Dynamics

The dual structure of Singapore’s housing finance—with HDB loans offering fixed 2.6% rates for public housing alongside competitive bank rates for private property—creates additional complexity in understanding overall mortgage market movements. Headlines might focus on one segment while missing broader market trends.

Strategic Implications for Singapore Banks

Funding Strategy Adaptations

Banks must navigate the challenges of:

- Deposit Competition: As SORA declines, banks face pressure on net interest margins, potentially leading to higher mortgage spreads to maintain profitability

- Wholesale Funding Diversification: Reliance on global funding markets requires sophisticated hedging strategies that may not align with local rate movements

- Regulatory Capital Optimization: Basel III requirements continue to influence pricing decisions independently of benchmark rate movements

Technology and Pricing Transparency

Leading Singapore banks are investing in real-time pricing systems and digital platforms that provide more accurate, up-to-date rate information. This technological advancement helps reduce the confusion caused by stale rate publications but requires borrowers to understand the complexity of modern mortgage pricing.

Looking Ahead: Navigating Singapore’s Mortgage Market in 2025

MAS Policy Implications

Since then, the SNEERhasstrengthenedtowardthetopofthepolicybandamidthebroad−baseddepreciationintheUSNEER has strengthened toward the top of the policy band amid the broad-based depreciation in the US NEERhasstrengthenedtowardthetopofthepolicybandamidthebroad−baseddepreciationintheUS. This currency strength provides MAS with policy flexibility, but also creates unique dynamics for mortgage rates that differ from interest rate-focused central bank policies.

Borrower Education and Market Transparency

Singapore’s sophisticated banking sector must balance competitive pressures with borrower education. Clear communication about:

- The difference between benchmark rates and actual mortgage pricing

- The factors that influence final rate offers

- The timing differences between policy changes and rate availability

- The impact of global markets on local lending costs

Strategic Recommendations for Market Participants

For Banks:

- Enhance real-time pricing capabilities

- Improve transparency in rate communication

- Develop sophisticated hedging strategies for funding cost volatility

- Invest in borrower education initiatives

For Borrowers:

- Focus on daily rate monitoring rather than weekly averages during volatile periods

- Understand the multiple factors beyond SORA that influence mortgage pricing

- Consider the total cost of borrowing, including fees and lock-in periods

- Maintain relationships with multiple banks for rate comparison

For Policymakers:

- Continue monitoring the effectiveness of cooling measures in conjunction with monetary policy

- Ensure adequate market transparency and consumer protection

- Consider the global interconnectedness of Singapore’s financial system in policy decisions

Conclusion

Singapore’s mortgage market demonstrates that the relationship between central bank policy and consumer borrowing costs is complex and multifaceted. While the recent U.S. experience of rising mortgage rates despite Fed cuts provides a cautionary tale, Singapore’s unique monetary policy framework, competitive banking sector, and regulatory environment create their own set of dynamics.

Singapore mortgage market is vibrant and super-competitive, but this competition operates within constraints that can sometimes override benchmark rate movements. For borrowers, the key lesson is that headline rates—whether rising or falling—require careful interpretation within the broader context of funding markets, regulatory requirements, and competitive dynamics.

As Singapore navigates 2025’s evolving economic landscape, understanding these complexities becomes crucial for all market participants. The most successful borrowers and industry players will be those who look beyond simple rate headlines to understand the underlying forces shaping Singapore’s dynamic mortgage market.

Singapore Mortgage Market: Why Rate Headlines Can Mislead in a Complex Banking Landscape

The recent confusion over mortgage rate movements in the United States following Federal Reserve decisions offers valuable lessons for Singapore’s property market and banking sector. As the Monetary Authority of Singapore (MAS) navigates its own monetary policy challenges in 2025, similar dynamics are playing out in the Lion City’s sophisticated financial ecosystem, where DBS, OCBC, UOB, and other financial institutions operate in an increasingly complex rate environment.

The Singapore Context: A Unique Monetary Policy Framework

Unlike the U.S. Federal Reserve’s focus on interest rates, Singapore’s monetary policy operates through exchange rate management. MAS kept the Singapore dollar nominal effective exchange rate (S$NEER) policy band on a modest and gradual appreciation path, but reduced its slope slightly in its recent policy reviews. This fundamental difference means that mortgage rate movements in Singapore follow different patterns than their American counterparts.

The Singapore Overnight Rate Average (SORA), last recorded at 1.78 percent, serves as the key benchmark for most floating-rate mortgages. However, the 3 Month SORA rate is currently 1.50% as compared to the 1 Month SORA rate which is 1.30%, illustrating the term structure complexities that can confuse borrowers trying to understand rate movements.

The Big Three: How DBS, OCBC, and UOB Navigate Rate Volatility

DBS Bank’s Distinctive Approach

DBS has carved out a unique position in Singapore’s mortgage market with its fixed deposit rate-linked products. The fixed deposit rate housing loan option from DBS sets itself apart because it is currently the only bank, which has a floating rate pegged to a fixed deposit rate rather than a 3M SORA rate like the majority of other banks. This innovative approach provides borrowers with an alternative benchmark that may move differently from SORA-based rates.

Currently, DBS Bank offers four fixed-rate packages with terms ranging from two to five years, with the APR set at 4.25% for all packages. However, the bank’s floating rates tell a different story, highlighting the divergence between fixed and variable rate products that can create headline confusion similar to what occurred in the U.S. market.

OCBC’s Market Positioning

OCBC Home Loan Rates 2025 – From 1.76% represents the competitive landscape that characterizes Singapore’s mortgage market. OCBC has positioned itself aggressively in the floating rate segment, offering rates that compete directly with market leaders while maintaining profitability in Singapore mortgage market is vibrant and super-competitive evident from the razor-thin interest spreads and the final rate charged by mortgage banks which can go as low as 1% to 1.50% (all-in rate) during trough in cycles.

UOB’s Strategic Response

United Overseas Bank has taken a more measured approach, with fixed-rate offerings that reflect broader market conditions. The bank’s mortgage rates have moved in tandem with industry trends, demonstrating how even in Singapore’s competitive environment, systemic factors influence all major players.

Why Singapore Mortgage Headlines Can Be Just as Confusing

The SORA vs. Fixed Rate Disconnect

Singapore borrowers face the same challenges as their U.S. counterparts when interpreting mortgage rate news. When headlines report declining SORA rates, they may not reflect the actual rates available to new borrowers. Banks often adjust their mortgage pricing based on:

- Funding costs beyond SORA: Banks’ cost of funds includes deposits, wholesale funding, and regulatory capital requirements

- Credit risk assessments: Loan-to-value ratios, borrower profiles, and property types all influence final pricing

- Market competition: The intense rivalry among Singapore banks creates pricing dynamics that may not follow benchmark rates directly

- MAS cooling measures: Regulatory requirements like Total Debt Servicing Ratio (TDSR) affect lending capacity and pricing strategies

Weekly vs. Daily Rate Reporting

Singapore’s mortgage market faces similar reporting challenges. Banks typically update their published rates weekly or bi-weekly, but internal pricing adjustments happen daily based on:

- SGS (Singapore Government Securities) yield movements

- SORA fixings and forward curve expectations

- Global funding market conditions

- MAS monetary policy signals

This creates a lag between actual market conditions and published rates, potentially misleading borrowers about current pricing availability.

The Property Market Impact: When Rate Cuts Don’t Help Buyers

Historical Precedents

Singapore has experienced periods where declining policy rates didn’t translate to lower mortgage costs. During previous MAS policy adjustments, banks sometimes maintained or even increased mortgage spreads due to:

- Increased regulatory requirements

- Credit risk reassessments

- Funding cost volatility

- Competitive positioning changes

Current Market Dynamics

SORA is set to drop over the next 12 months as inflation is subdued, economic growth slows and interest rates drop, yet this doesn’t guarantee lower mortgage rates for property buyers. Several factors continue to pressure mortgage pricing upward:

Regulatory Environment: MAS cooling measures continue to influence lending practices, with banks maintaining conservative credit standards despite lower benchmark rates.

Global Funding Costs: Singapore banks’ reliance on wholesale funding markets means that global financial conditions significantly impact local mortgage pricing, sometimes overriding domestic rate movements.

Credit Risk Premiums: Banks may widen spreads over SORA to compensate for perceived increases in property market risks or economic uncertainty.

The Competitive Landscape: Beyond the Big Three

Smaller Banks and Financial Institutions

Singapore’s mortgage market extends beyond DBS, OCBC, and UOB. Smaller local banks, foreign bank branches, and financial institutions like Maybank, Standard Chartered, and HSBC add complexity to rate competition. These institutions often specialize in particular market segments or offer niche products that can create apparent rate disparities in market reports.

HDB Loan vs. Bank Loan Dynamics

The dual structure of Singapore’s housing finance—with HDB loans offering fixed 2.6% rates for public housing alongside competitive bank rates for private property—creates additional complexity in understanding overall mortgage market movements. Headlines might focus on one segment while missing broader market trends.

Real-World HDB Buyer Scenarios: When Rate Headlines Don’t Tell the Full Story

Scenario 1: The First-Time BTO Buyer Dilemma

Meet Sarah and Marcus Chen: A young couple earning a combined monthly income of S$8,000, purchasing their first 4-room BTO flat in Tampines for S$450,000.

The Rate Headline Confusion: In September 2025, headlines proclaimed “SORA Rates Expected to Drop Further” while simultaneously reporting “Bank Mortgage Rates Rise Despite Policy Signals.” The Chens were confused about whether to take an HDB loan or bank financing.

HDB Loan Option:

- Loan amount: S$360,000 (80% financing)

- Interest rate: Fixed 2.6% throughout the loan tenure

- Monthly payment: ~S$1,430 (25-year tenure)

- Total interest: ~S$69,000

Bank Loan Option (DBS example):

- Loan amount: S$360,000

- Current floating rate: 3.25% (1.50% SORA + 1.75% spread)

- Monthly payment: ~S$1,520 (25-year tenure, initial rate)

- Risk: Rate volatility could push payments to S$1,650+ if SORA rises to 3%

The Decision Reality: Despite headlines suggesting rates would fall, the Chens discovered that:

- Banks required higher income documentation and credit assessments

- Bank rates included fees (processing, valuation, legal) totaling ~S$3,000

- HDB loan processing was more straightforward with lower requirements

- The fixed 2.6% HDB rate provided payment certainty regardless of SORA movements

Outcome: They chose the HDB loan, saving ~S$90 monthly initially and avoiding rate volatility risk.

Scenario 2: The Resale Flat Buyer’s Timing Challenge

Meet David Lim: A 35-year-old professional earning S$7,500 monthly, buying a 5-room resale flat in Bishan for S$650,000.

The Rate Environment: Headlines in early September showed “Mortgage Rates Hit 18-Month Lows” based on weekly averages, but daily rates were already climbing.

HDB Loan Constraints:

- Loan amount limited to S$520,000 (80% of flat value)

- Shortfall: S$130,000 (deposit + renovations + costs)

- Fixed 2.6% rate available

Bank Loan Evaluation (OCBC):

- Could finance up to S$585,000 (90% LTV)

- Initial rate: 2.85% (promotional for first 2 years)

- Subsequent rate: 3.50% (1.75% SORA + 1.75% spread)

- Lower cash outlay: S$65,000 vs. S$130,000

The Headlines vs. Reality:

- Headlines suggested rates were falling when David started shopping

- By approval time (3 weeks later), OCBC’s rates had increased to 3.15% initial, 3.75% subsequent

- HDB rate remained unchanged at 2.6%

Outcome: David chose the bank loan for cash flow reasons, despite higher long-term costs, but locked in a 3-year fixed rate to hedge against volatility.

Scenario 3: The Upgrader’s Complex Decision Matrix

Meet The Tan Family: Combined income S$15,000, selling their HDB flat to buy a S$1.2 million condominium in Clementi.

The Rate Timing Challenge: September 2025 headlines showed conflicting signals about rate direction, complicating their refinancing strategy.

Multiple Loan Options:

Option 1 – UOB Floating Package:

- Rate: 1.88% (first year), then 3M SORA + 1.30%

- Current all-in rate: ~2.80%

- Lock-in: 2 years minimum

Option 2 – DBS Fixed Deposit Rate Package:

- Rate: 2.25% (tied to 12-month FD rahttps://encrypted-tbn0.gstatic.com/images?q=tbn:ANd9GcTqXNaM03DLeyhK_pJXlyQ4B0JlKWC_kMJzCg&ste)

- More stable than SORA-based pricing

- Lock-in: 3 years

Option 3 – OCBC Fixed Rate:

- Rate: 3.85% for 5 years

- Payment certainty but higher initial cost

- No early redemption penalties after year 3

The Headlines’ Impact:

- “SORA Set to Fall” headlines made floating rates seem attractive

- “Global Rate Uncertainty” reports raised concerns about volatility

- “Singapore Banks Tighten Lending” articles worried them about approval odds

The Reality Check: When the Tans applied in mid-September:

- UOB’s initial teaser rate had increased from 1.88% to 2.15%

- The SORA spread had widened from 1.30% to 1.45%

- Processing times had extended due to increased applications

Outcome: They chose DBS’s fixed deposit package for rate stability while maintaining some sensitivity to declining rates, avoiding the uncertainty created by conflicting headlines.

Scenario 4: The HDB-to-Private Investor Strategy

Meet Jennifer Wu: A 40-year-old entrepreneur planning to retain her paid-off HDB flat and purchase a private condo for investment.

Regulatory Complexity: Since she’s keeping the HDB flat, she faces:

- Additional Buyer’s Stamp Duty (ABSD) of 17% for second property

- Total Debt Servicing Ratio (TDSR) calculations including potential HDB rental

- Higher scrutiny from banks due to investment intent

The Rate Headlines Confusion: Headlines showed “Mortgage Rates Decline for Owner-Occupiers” but didn’t clarify that investment property rates follow different trajectories.

Bank Options Discovered:

Standard Chartered Investment Property Package:

- Rate: 4.25% (significantly higher than owner-occupier rates)

- Maximum LTV: 75% (vs. 80% for owner-occupiers)

- Stricter income documentation requirements

DBS Investor Package:

- Rate: 3.95% (first 2 years), then 4.50%

- Required minimum liquid assets of S$500,000

- Shorter lock-in period but higher penalties

The Reality: Investment property rates remained elevated despite headlines about declining residential mortgage rates, because:

- Banks price investment loans as higher risk

- MAS cooling measures specifically target investors

- Global funding costs affect investment lending more than owner-occupier loans

Outcome: Jennifer discovered that rate headlines focused on owner-occupier loans don’t reflect investment property pricing, leading her to restructure her investment timeline.

Scenario 5: The CPF-Cash Optimization Strategy

Meet The Kumar Family: Both spouses aged 45, upgrading from HDB to S$800,000 private property, with substantial CPF balances.

The CPF Complication: With S$300,000 combined CPF Ordinary Account balance, they faced decisions about:

- Using CPF vs. cash for down payment

- CPF interest rate of 2.5% vs. mortgage rates

- Accrued interest implications for CPF usage

Rate Environment Analysis:

- Headlines: “Bank Rates Fall Below 3%” (based on weekly averages)

- Reality: Daily rates for their profile showed 3.15-3.35% range

- CPF OA rate: Fixed 2.5%

Financial Strategy Matrix:

Option A – Maximize CPF Usage:

- Use S$240,000 CPF for purchase (leave S$60,000 for retirement)

- Bank loan: S$400,000 at 3.25%

- Opportunity cost: Losing 2.5% CPF interest on S$240,000

Option B – Cash-Heavy Approach:

- Use S$100,000 CPF, S$300,000 cash

- Bank loan: S$400,000 at 3.25%

- Keep S$200,000 CPF growing at 2.5%

Option C – Minimal Down Payment:

- Use S$80,000 cash only (10% down payment)

- Bank loan: S$720,000 at 3.45% (higher rate for 90% LTV)

- Preserve maximum CPF and cash

The Headlines’ Misleading Impact: Rate decline headlines made Option C seem attractive, but the reality was:

- 90% LTV loans carried 20-30 basis points premium

- Banks were tightening high-LTV lending criteria

- Processing times for 90% loans had increased

Outcome: They chose Option B, balancing CPF preservation with borrowing costs, after discovering that headline rates didn’t reflect high-LTV pricing.

Key Insights from HDB Buyer Scenarios

These real-world scenarios highlight several critical points:

- Rate Headlines Often Exclude HDB Context: Most mortgage rate reports focus on private property financing, overlooking the HDB loan alternative that affects 80% of Singaporeans.

- Timing Gaps: The delay between rate shopping and loan approval can render headline rates irrelevant, especially during volatile periods.

- Regulatory Overlay: TDSR, ABSD, and CPF rules create complexity that simple rate comparisons don’t capture.

- Product-Specific Pricing: Investment properties, high-LTV loans, and different bank packages carry premiums not reflected in general rate headlines.

- Total Cost vs. Interest Rate: Processing fees, lock-in penalties, and opportunity costs significantly impact the real cost of borrowing beyond advertised rates.

Strategic Implications for Singapore Banks

Funding Strategy Adaptations

Banks must navigate the challenges of:

- Deposit Competition: As SORA declines, banks face pressure on net interest margins, potentially leading to higher mortgage spreads to maintain profitability

- Wholesale Funding Diversification: Reliance on global funding markets requires sophisticated hedging strategies that may not align with local rate movements

- Regulatory Capital Optimization: Basel III requirements continue to influence pricing decisions independently of benchmark rate movements

Technology and Pricing Transparency

Leading Singapore banks are investing in real-time pricing systems and digital platforms that provide more accurate, up-to-date rate information. This technological advancement helps reduce the confusion caused by stale rate publications but requires borrowers to understand the complexity of modern mortgage pricing.

Looking Ahead: Navigating Singapore’s Mortgage Market in 2025

MAS Policy Implications

Since then, the SNEERhasstrengthenedtowardthetopofthepolicybandamidthebroad−baseddepreciationintheUSNEER has strengthened toward the top of the policy band amid the broad-based depreciation in the US NEERhasstrengthenedtowardthetopofthepolicybandamidthebroad−baseddepreciationintheUS. This currency strength provides MAS with policy flexibility, but also creates unique dynamics for mortgage rates that differ from interest rate-focused central bank policies.

Borrower Education and Market Transparency

Singapore’s sophisticated banking sector must balance competitive pressures with borrower education. Clear communication about:

- The difference between benchmark rates and actual mortgage pricing

- The factors that influence final rate offers

- The timing differences between policy changes and rate availability

- The impact of global markets on local lending costs

Strategic Recommendations for Market Participants

For Banks:

- Enhance real-time pricing capabilities

- Improve transparency in rate communication

- Develop sophisticated hedging strategies for funding cost volatility

- Invest in borrower education initiatives

For Borrowers:

- Focus on daily rate monitoring rather than weekly averages during volatile periods

- Understand the multiple factors beyond SORA that influence mortgage pricing

- Consider the total cost of borrowing, including fees and lock-in periods

- Maintain relationships with multiple banks for rate comparison

For Policymakers:

- Continue monitoring the effectiveness of cooling measures in conjunction with monetary policy

- Ensure adequate market transparency and consumer protection

- Consider the global interconnectedness of Singapore’s financial system in policy decisions

Conclusion

Singapore’s mortgage market demonstrates that the relationship between central bank policy and consumer borrowing costs is complex and multifaceted. While the recent U.S. experience of rising mortgage rates despite Fed cuts provides a cautionary tale, Singapore’s unique monetary policy framework, competitive banking sector, and regulatory environment create their own set of dynamics.

Singapore mortgage market is vibrant and super-competitive, but this competition operates within constraints that can sometimes override benchmark rate movements. For borrowers, the key lesson is that headline rates—whether rising or falling—require careful interpretation within the broader context of funding markets, regulatory requirements, and competitive dynamics.

As Singapore navigates 2025’s evolving economic landscape, understanding these complexities becomes crucial for all market participants. The most successful borrowers and industry players will be those who look beyond simple rate headlines to understand the underlying forces shaping Singapore’s dynamic mortgage market.

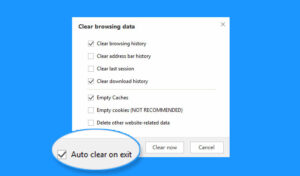

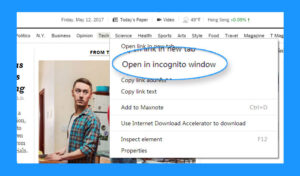

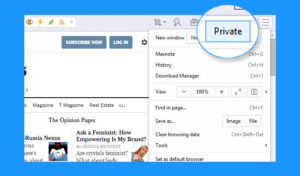

Instructions for Enabling and Disabling Private Browsing Mode in Maxthon Browser

1. Open Maxthon Browser: Launch the Maxthon browser on your device. Ensure you are running the latest version for optimal features and security.

2. Access the Menu: Click on the menu icon located at the top-right corner of the browser window. Three horizontal lines or dots usually represent this.

3. Select Private Browsing: In the dropdown menu, look for the Private Browsing option. Click on it to activate private mode.

4. Confirm Activation: A new window should appear, indicating that you are now in private browsing mode. You may notice a different colour scheme or an icon indicating this status.

5. Browse Privately: While in this mode, your browsing history, cookies, and site data will not be saved once you close the session. Feel free to explore securely.

6. Exit Private Browsing Mode: To return to regular browsing, click again on the menu icon and select Exit Private Browsing from the list of options.

7. Confirm Exit: Once you exit, a message may confirm that you have returned to normal browsing mode.

8. Resume Normal Usage: Continue surfing the internet without any restrictions while your activity is logged as usual again.

9. Check Settings if Needed: If you do not see these options, verify that your browser settings have not turned off private browsing functionality or consult the help section for troubleshooting advice.

Follow these steps carefully to navigate between standard and private modes seamlessly!