The synchronized monetary policy actions taken by the Federal Reserve and the Bank of England in September 2025 represent a significant turning point for Singapore’s economic outlook.

The Federal Reserve reduced its benchmark interest rate by 25 basis points, setting the federal funds rate at a target range of 4% to 4.25%, while the Bank of England opted to maintain its rate at 4% (Federal Reserve, 2025; Bank of England, 2025).

These decisions signal a shift towards more accommodative global financial conditions after several years of tightening.

Singapore, as a small and highly open economy, is particularly sensitive to changes in international monetary policy. Lower U.S. rates tend to encourage capital inflows into Asian markets, potentially strengthening the Singapore dollar and affecting export competitiveness. At the same time, stable rates in the UK provide some predictability in trade and investment relations with Europe.

Financial institutions in Singapore must now adjust their strategies to account for these evolving external conditions. Easing cycles typically lead to lower borrowing costs and increased liquidity, which could stimulate domestic investment and consumer spending. However, they also heighten the risk of asset bubbles and financial instability if not carefully managed.

The Monetary Authority of Singapore (MAS) has indicated it will closely monitor these global developments to ensure local monetary and exchange rate policies remain aligned with economic fundamentals (MAS, 2025). Singapore’s robust regulatory framework positions it well to navigate potential volatility stemming from divergent policy moves among major central banks.

In conclusion, the recent policy shifts by the Federal Reserve and Bank of England underscore the interconnectedness of global financial markets and their direct impact on Singapore’s economy. As global central banks move towards easing, Singapore must balance the opportunities for growth with prudent risk management to safeguard its economic stability.

Immediate Market Impact on Singapore

Financial Markets Response

Singapore’s financial markets have responded with characteristic sensitivity to global rate movements. The Straits Times Index has shown resilience, with several key sectors experiencing divergent impacts:

Winners:

- REITs (Real Estate Investment Trusts): REITs like CICT could gain fresh momentum as financing costs ease

- Property Developers: Lower global rates reduce borrowing costs for development projects

- Consumer-focused stocks: Benefiting from potential increased consumer spending due to lower borrowing costs

Under Pressure:

- Banking Sector: Singapore’s largest banks are likely to face pressure on margins as the global interest rate cycle eases

- Export-oriented companies: Facing headwinds from potential SGD strengthening

Currency and Capital Flows

The Singapore Dollar has shown mixed signals against major currencies. While the Fed’s dovish stance typically weakens the USD, exporters (from stronger SGD) face cautionary headwinds as capital flows potentially favor Singapore’s stable economic environment.

SORA Rate Dynamics and Domestic Impact

Current SORA Landscape

Singapore’s benchmark SORA rates reflect the global monetary environment shifts:

- The 3 Month SORA rate is currently 1.50% as compared to the 1 Month SORA rate which is 1.30% with rates accurate as of September 2025

- Singapore – Overnight Rate Average (SORA) 2025-09-18 · 1.12 %

Trajectory and Implications

SORA is set to drop over the next 12 months as inflation is subdued, economic growth slows and interest rates drop. This downward trajectory has several implications:

For Borrowers:

- Borrowers should look for floating interest rate loans to take advantage of lower mortgage rates

- Reduced financing costs for businesses expanding operations

- Lower personal loan and credit facility rates

For Property Market: While the Fed drives the narrative, Singapore applies its own tools to shape outcomes for homeowners. Interest rates may be falling, but home prices are holding steady. The housing market is experiencing:

- Sustained demand due to lower borrowing costs

- Government cooling measures continuing to moderate price appreciation

- Singapore’s housing market is entering a phase of cautious optimism

Sectoral Deep Dive

Banking Sector: Navigating Margin Compression

Singapore’s banking giants—DBS, OCBC, and UOB—face a challenging environment:

Challenges:

- Net Interest Margin (NIM) compression as rates decline

- banks such as DBS, OCBC, and UOB brace for margin pressure

- Competition for deposits intensifying

Opportunities:

- they are poised to sustain steady net incomes as the country continues to attract global capital

- Increased lending volumes as demand for credit rises

- Wealth management services benefiting from capital inflows

Real Estate and REITs: The New Frontier

The real estate sector emerges as a primary beneficiary of the rate environment:

REITs Advantages:

- Lower financing costs improving distribution yields

- Increased attractiveness relative to fixed-income instruments

- Foreign capital seeking yield in Singapore’s stable market

Commercial Real Estate:

- Office and retail spaces benefiting from lower cap rates

- Industrial properties supporting Singapore’s manufacturing renaissance

- Data centers and logistics facilities riding the digital economy wave

Manufacturing and Trade: Export Dynamics

Singapore’s trade-dependent economy faces mixed signals:

Research Findings: Singapore’s total imports and average overnight rate are significantly affected by the federal funds rate, but there is no obvious relationship between the federal funds rate and the exchange rates of US dollars and Singapore dollars

Implications:

- Import costs potentially declining with global rate cuts

- Export competitiveness depending on SGD strength

- Re-export trade benefiting from improved regional liquidity

Monetary Authority of Singapore’s Response Strategy

Exchange Rate Policy Focus

Unlike traditional central banks, MAS uses exchange rate policy as its primary monetary tool. The current environment presents unique considerations:

Policy Calibration:

- Balancing imported inflation concerns with growth support

- SGD NEER (Nominal Effective Exchange Rate) adjustments to maintain price stability

- Coordination with global monetary trends while maintaining policy independence

Inflation Management: Given the current state of inflation in Singapore, which appears to be under control, MAS has room for accommodative policies if needed.

Economic Growth Outlook

2025 Growth Projections

Economists more bullish on Singapore’s 2025 GDP in MAS’s September survey; economy expected to expand by 2.4% y-o-y

Growth Drivers:

- Financial services expansion due to regional capital flows

- Technology sector benefiting from AI and digital transformation investments

- Tourism recovery reaching pre-pandemic levels

- Green economy initiatives positioning Singapore as a sustainability hub

Risk Factors:

- Global economic slowdown affecting trade volumes

- Geopolitical tensions impacting supply chains

- Climate change costs requiring increased adaptation investments

Investment Strategy Implications

For Individual Investors

Anticipated rate cuts are likely to normalize the yield curve, transitioning it from its current inverted state to a more positive slope. This adjustment could create a more favorable environment for investors

Strategic Positioning:

- Fixed Income: Longer-duration bonds may outperform as rates decline

- Equities: Focus on dividend-paying stocks and growth companies benefiting from lower financing costs

- REITs: Industrial and data center REITs offering stable yields

- Alternative Investments: Private equity and infrastructure plays

For Corporate Treasurers

Funding Strategy:

- Refinancing existing debt at lower rates

- Extending debt maturities while rates are declining

- If SORA aligns with global rate trends and short-term rates decline, positioning for variable rate facilities

Global Context and Regional Positioning

Singapore’s Competitive Advantage

The current rate environment reinforces Singapore’s position as:

- Regional Financial Hub: Attracting capital seeking stability and yield

- Wealth Management Center: High-net-worth individuals diversifying into Asian assets

- Corporate Treasury Center: Multinational corporations centralizing cash management operations

ASEAN Integration Benefits

Lower global rates facilitate:

- Increased intra-ASEAN investment flows

- Infrastructure project financing across the region

- Currency cooperation initiatives gaining momentum

Risk Assessment and Scenario Planning

Upside Scenarios

Goldilocks Economy (40% probability):

- Moderate global growth with controlled inflation

- Singapore GDP growth exceeding 3%

- Stable currency and strong capital inflows

- Corporate earnings growth of 8-10%

Base Case (45% probability)

Managed Slowdown:

- Singapore GDP growth of 2-2.5%

- SORA rates declining to 0.8-1.0% by end-2025

- Selective sector performance with banking underperforming

- Property market stabilization

Downside Risks (15% probability)

Global Recession:

- Trade volumes declining significantly

- Forced aggressive monetary easing

- Asset price corrections across markets

- Corporate earnings downgrades

Strategic Recommendations

For Policymakers

- Maintain Policy Flexibility: Keep exchange rate policy responsive to changing global conditions

- Support Transition Industries: Facilitate movement toward higher-value activities

- Infrastructure Investment: Accelerate digital and green infrastructure development

- Financial Innovation: Support fintech and sustainable finance initiatives

For Businesses

- Capital Structure Optimization: Take advantage of lower borrowing costs for expansion

- Technology Investment: Accelerate digital transformation initiatives

- Regional Expansion: Leverage Singapore’s hub status for ASEAN growth

- Sustainability Integration: Position for the green economy transition

For Investors

- Sector Rotation: Move toward rate-sensitive beneficiaries like REITs and utilities

- Duration Strategy: Consider longer-term fixed income investments

- Currency Hedging: Evaluate SGD exposure in global portfolios

- Alternative Assets: Explore private markets and infrastructure investments

Conclusion: Navigating the New Paradigm

The September 2025 central bank actions mark a significant inflection point for Singapore’s economy. While challenges exist—particularly for the banking sector facing margin compression—the overall environment presents more opportunities than threats.

As 2025 unfolds, Singapore’s housing market is entering a phase of cautious optimism, which reflects the broader economic sentiment. The key to success in this environment lies in understanding that Singapore’s unique position as a global financial center, combined with its policy flexibility and strong institutions, provides resilience against external shocks while maximizing benefits from global monetary accommodation.

The path forward requires careful navigation between supporting domestic growth and maintaining price stability, between embracing global capital flows and preserving financial system integrity. For Singapore, the current environment represents not just a cyclical opportunity, but a chance to solidify its position as Asia’s premier financial and business hub for the next decade.

Key Takeaway: After holding steady through most of 2025, the Fed signalled a shift in September when Chair Jerome Powell suggested that rate cuts could be on the table. Singapore’s response to this shift will determine whether the city-state emerges stronger from this global monetary transition or faces headwinds that could slow its growth trajectory. The early signs suggest cautious optimism is warranted, but vigilant policy management remains essential.

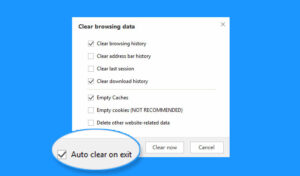

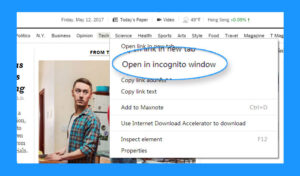

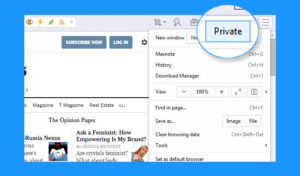

Instructions for Enabling and Disabling Private Browsing Mode in Maxthon Browser

1. Open Maxthon Browser: Launch the Maxthon browser on your device. Ensure you are running the latest version for optimal features and security.

2. Access the Menu: Click on the menu icon located at the top-right corner of the browser window. Three horizontal lines or dots usually represent this.

3. Select Private Browsing: In the dropdown menu, look for the Private Browsing option. Click on it to activate private mode.

4. Confirm Activation: A new window should appear, indicating that you are now in private browsing mode. You may notice a different colour scheme or an icon indicating this status.

5. Browse Privately: While in this mode, your browsing history, cookies, and site data will not be saved once you close the session. Feel free to explore securely.

6. Exit Private Browsing Mode: To return to regular browsing, click again on the menu icon and select Exit Private Browsing from the list of options.

7. Confirm Exit: Once you exit, a message may confirm that you have returned to normal browsing mode.

8. Resume Normal Usage: Continue surfing the internet without any restrictions while your activity is logged as usual again.

9. Check Settings if Needed: If you do not see these options, verify that your browser settings have not turned off private browsing functionality or consult the help section for troubleshooting advice.

Follow these steps carefully to navigate between standard and private modes seamlessly!