A top US group that watches over kids’ ads claims MrBeast’s chocolate promotions tricked young fans. The Children’s Advertising Review Unit, or CARU, stepped in to review YouTuber MrBeast’s Feastables bars. They spotted problems in his videos and contests that could break rules meant to shield children’s privacy online.

MrBeast, whose real name is Jimmy Donaldson, draws millions of young viewers to his channel. His Feastables line hit stores in 2022, blending candy with his huge online fame. But CARU found issues that might confuse kids. For one, a video showed a blind taste test of the bars. It looked like fun content, not an ad. The team failed to add clear labels saying it promoted products. Viewers under 13 could easily think it was just entertainment. That clip has vanished from YouTube now.

Then there were the sweepstakes. MrBeast ran contests where fans entered to win prizes like cash or gadgets. To boost odds, kids might buy up to 10 bars a day. CARU worried this pushed children to spend money without parents knowing. Worse, the entry forms did not block users under 13. That meant the site could grab personal details from kids, like names or emails. US law, called COPPA, bans collecting such data from children without strict parental okay. Breaking it risks big fines and hurts trust.

Experts say these slip-ups matter a lot. Kids trust stars like MrBeast. Ads hidden in videos can sway them to buy without thinking. CARU’s director, Cynthia Montgomery, noted in their report that clear disclosures build fair play. Without them, young fans face pressure to act fast on impulse.

MrBeast’s team worked with CARU to fix things. They added ad labels to future videos and tightened contest rules to keep kids out. Still, the group disagrees with some of CARU’s full findings. This case highlights how big influencers must handle kid audiences with care. It reminds creators that fun content crosses into ads, and privacy laws apply no matter the platform. Parents, keep an eye on what your children watch and enter online.

How the world’s most popular YouTuber’s relentless pursuit of viral content and commercial success has sparked a growing chorus of ethical concerns

The Golden Boy’s Tarnished Crown

James Donaldson, better known as MrBeast, has built an empire on the simple premise of giving away money and creating increasingly elaborate stunts. With 437 million subscribers across his channels, he’s become YouTube’s undisputed king, generating hundreds of millions of views and wielding influence that extends far beyond the platform. But as his empire has grown, so too have the controversies surrounding his methods, ethics, and impact on both participants and viewers.

The latest blow came this week when the Children’s Advertising Review Unit (CARU) concluded that MrBeast’s marketing of his Feastables chocolate bars potentially misled child viewers and violated industry guidelines designed to protect minors. While the YouTuber’s team has cooperated with implementing recommendations, the incident represents just the tip of an iceberg of mounting concerns about the MrBeast phenomenon.

A Pattern of Problematic Practices

The Chocolate Controversy: More Than Sweet Deception

CARU’s investigation revealed several troubling practices in MrBeast’s chocolate marketing campaign. A now-deleted “blind taste test” video purported to show unbiased tasters preferring Feastables chocolate over competitors, without adequately disclosing the promotional nature of the content. This type of native advertising—where promotional content is disguised as entertainment—is particularly problematic when targeting children, who lack the cognitive development to recognize marketing bias.

“Kids see marketing as another source of information, like parents or teachers,” explains Dr. Jennifer Harris, a research adviser at the University of Connecticut who studies food marketing to children. This vulnerability makes the blurred lines between entertainment and advertising in MrBeast’s content especially concerning.

Perhaps most alarming was a sweepstakes promotion that could have encouraged children to purchase up to 10 chocolate bars daily to maximize their chances of winning. Such practices raise serious questions about promoting unhealthy consumption patterns to impressionable young audiences.

Privacy Violations and Data Collection

The CARU review also found that MrBeast’s sweepstakes failed to adequately filter out children under 13, potentially collecting their personal information in violation of the Children’s Online Privacy Protection Act (COPPA). This represents not just a regulatory misstep but a fundamental failure to protect the privacy of the channel’s youngest and most vulnerable viewers.

The incident highlights broader questions about how YouTube’s biggest creators handle data collection and privacy compliance, particularly given the platform’s massive reach among minors.

The Broader Controversies: A Growing List

Exploitation Concerns and Participant Welfare

MrBeast’s content often involves putting participants through challenging, sometimes degrading situations for cash prizes. Critics have raised concerns about the psychological impact on participants, particularly given the power dynamics at play when large sums of money are involved.

Former participants and critics have described scenarios where:

- Contestants are subjected to psychological pressure and manipulation

- Participants are encouraged to endure uncomfortable or potentially harmful situations

- The line between entertainment and exploitation becomes dangerously blurred

The YouTube star’s “Squid Game” recreation, while popular, drew criticism for potentially trivializing the original work’s commentary on exploitation and economic desperation.

Labor Practices and Workplace Culture

Reports have emerged about demanding working conditions within MrBeast’s production company, with former employees describing:

- Extremely long working hours and unrealistic deadlines

- High-pressure environment focused on viral content at any cost

- Limited regard for employee wellbeing in pursuit of content creation

These allegations raise questions about how the pursuit of viral content impacts not just viewers but also the army of workers required to produce MrBeast’s increasingly elaborate videos.

Environmental and Social Impact

MrBeast’s content often involves massive waste and consumption, from destroying expensive items for entertainment to elaborate stunts that generate significant environmental impact. While he has undertaken some environmental initiatives, critics argue that these don’t offset the overall message of excess and waste promoted through his main content.

Influence on Young Creators

The MrBeast model—expensive stunts, cash giveaways, and increasingly extreme content—has influenced countless aspiring YouTubers, many of whom lack the resources to safely replicate such content. This has led to:

- Dangerous copycat behavior among young creators

- Unrealistic expectations about content creation success

- Potential financial ruin for creators attempting expensive stunts

The Psychology of MrBeast’s Appeal

Exploiting Psychological Triggers

MrBeast’s content is masterfully designed to exploit psychological triggers that keep viewers engaged:

Intermittent Reinforcement: The unpredictable nature of his giveaways creates a gambling-like psychological response, particularly problematic for young viewers who may not understand these manipulation techniques.

Social Proof and FOMO: His videos create artificial scarcity and social pressure, encouraging viewers to engage with his content and products to avoid missing out.

Parasocial Relationships: MrBeast cultivates a carefully crafted persona that makes viewers feel personally connected, increasing their likelihood of purchasing his products and supporting his content.

Impact on Child Development

Child psychology experts have raised concerns about the potential impact of MrBeast’s content on developing minds:

- Materialism and Values: His content often equates worth with monetary value, potentially distorting young viewers’ understanding of success and happiness

- Attention and Reward Systems: The high-stimulation format may contribute to shortened attention spans and unrealistic expectations for immediate gratification

- Risk-Taking Behavior: The glorification of extreme challenges may encourage dangerous behavior among impressionable viewers

The Regulatory Response: Too Little, Too Late?

Current Oversight Gaps

The CARU action highlights significant gaps in current regulatory oversight of digital content creators. Unlike traditional media, YouTube creators operate with minimal regulatory oversight, despite reaching audiences that rival major television networks.

Key regulatory challenges include:

- Cross-Border Jurisdiction: Creators can operate globally while avoiding local regulations

- Platform Responsibility: Unclear accountability for platforms versus individual creators

- Rapid Content Evolution: Regulations struggle to keep pace with new content formats and marketing techniques

International Regulatory Differences

Different countries are taking varying approaches to regulating content creators:

- European Union: Implementing stricter advertising disclosure requirements and data protection measures

- United Kingdom: Considering specific regulations for content creators and influencer marketing

- Australia: Developing guidelines for digital content and consumer protection

- United States: Relying primarily on industry self-regulation, which critics argue is insufficient

Industry Impact and Precedent

The MrBeast Effect on YouTube Culture

MrBeast’s success has fundamentally changed YouTube culture, creating what critics call an “arms race” of increasingly expensive and extreme content. This has led to:

- Unsustainable Production Costs: Creators feel pressure to spend enormous sums to compete for attention

- Content Homogenization: The success of the MrBeast formula has led to countless imitators, reducing content diversity

- Commercialization Creep: The line between entertainment and advertising has become increasingly blurred across the platform

Platform Responsibility

YouTube’s role in enabling and profiting from potentially problematic content has come under scrutiny. Critics argue that the platform’s algorithm and monetization structure incentivize increasingly extreme content without adequate safeguards for viewer welfare.

The Financial Empire: Following the Money

Revenue Streams and Business Model

MrBeast’s empire extends far beyond YouTube ad revenue:

- Feastables: His chocolate brand, now under scrutiny for marketing practices

- MrBeast Burger: Virtual restaurant chain with mixed reviews and operational challenges

- Merchandise: Extensive product lines marketed to his young fanbase

- Sponsorships and Partnerships: High-value brand deals that may lack adequate disclosure

Financial Transparency Concerns

Unlike traditional media companies, MrBeast’s financial operations lack transparency, raising questions about:

- How prize money is actually distributed

- Tax implications for participants and viewers

- The true cost and funding sources of his elaborate productions

Global Reach, Local Impact

International Expansion and Cultural Sensitivity

MrBeast’s global expansion has raised questions about cultural sensitivity and local impact:

- Content that may be inappropriate or insensitive in different cultural contexts

- Economic disparities that make cash prizes particularly coercive in developing countries

- Limited understanding of local regulations and ethical standards

Educational System Impact

Teachers and educators report challenges with students who have unrealistic expectations about money, success, and attention spans influenced by MrBeast-style content.

The Path Forward: Accountability and Reform

Industry Self-Regulation vs. Government Oversight

The CARU action represents industry self-regulation at work, but critics argue it’s insufficient given the scale and influence of creators like MrBeast. Potential reforms include:

Enhanced Disclosure Requirements: Clearer, more prominent advertising disclosures in video content

Child Protection Measures: Stricter age verification and content restrictions for channels with significant minor viewership

Financial Transparency: Requirements for clearer disclosure of how contests, giveaways, and prizes actually work

Platform Accountability: Greater responsibility for platforms to monitor and regulate content

Possible Solutions and Safeguards

Experts suggest several approaches to address the concerns raised by the MrBeast phenomenon:

Educational Initiatives: Media literacy programs to help young viewers understand and critically evaluate online content

Industry Standards: Development of comprehensive ethical guidelines for content creators, particularly those targeting younger audiences

Regulatory Framework: Creation of specific regulations governing digital content creators, similar to those governing traditional media

Platform Policy Changes: Algorithm and policy changes to reduce incentives for increasingly extreme or manipulative content

Conclusion: The Cost of Viral Fame

The MrBeast phenomenon represents both the incredible potential and serious risks of the digital content creation economy. While his charitable giving and entertainment value cannot be dismissed, the mounting controversies raise fundamental questions about the responsibility that comes with such massive influence, particularly over young audiences.

The CARU action may be a watershed moment, signaling growing recognition that the world’s biggest content creators cannot operate without accountability. As regulatory bodies, platforms, and society grapple with these challenges, the outcome will likely determine not just MrBeast’s future, but the entire trajectory of digital content creation.

The stakes are high: the decisions made now will shape how hundreds of millions of young people understand success, consumption, and their relationship with media. Whether MrBeast can evolve his empire to address these concerns—or whether external forces will compel change—remains to be seen. What’s clear is that the golden age of unregulated viral content may be coming to an end.

As the dust settles from this latest controversy, one thing is certain: the world will be watching how the king of YouTube responds to growing calls for accountability. The future of digital entertainment may depend on it.

MAS Digital Advertising Guidelines

The Monetary Authority of Singapore, or MAS, has stepped up its efforts to clean up online financial ads. On September 25, 2025, it issued fresh guidelines for banks, insurance firms, and capital market providers. These rules target misleading content on digital platforms. The goal is to protect consumers from false promises in financial promotions.

This news comes at a key time. Singapore’s financial sector relies heavily on online tools to reach people. Yet, issues like shortened posts on social media often skip vital risk details. For instance, an insurance ad might highlight big payouts but leave out fine print on exclusions. Such gaps can trick users into poor choices.

MAS developed these guidelines over two years. The process started in April 2023 with public input. Experts and industry groups weighed in to shape fair rules. The guidelines kick in on March 25, 2026. This gives firms time to adjust their digital strategies.

At the core, the rules demand that financial institutions check their online content. It must stay clear, fair, and free of tricks, even in tight spaces like tweet limits. Standalone views matter most—ads can’t rely on follow-ups to explain risks.

Five main safeguards stand out. First, platform assessment. Institutions must review sites before posting ads. They look at the platform’s reputation and any risks, such as exposure to fake news. A bank, for example, might avoid a forum known for scams.

Second, clear content. Ads need to spell out facts without confusion. If a character cap cuts details, firms must rework the message. This prevents half-truths that mislead at first glance.

Third, digital marketer selection. Companies set up ways to pick reliable partners. They check qualifications and past work. Say an agency has a history of shady ads; firms would drop them to avoid fines.

Fourth, monitoring. Active checks form a big part. Tools track ads in real time. Mystery shoppers test how promotions play out. This catches problems early, like an unauthorized post slipping through.

Fifth, disciplinary action. If a marketer strays, institutions act fast. This could mean ending ties or reporting to MAS. It builds accountability across the board.

These steps address real problems. Social media’s fast pace often omits risks. Agents have used dating apps to pitch insurance, blurring lines between personal chats and sales. Worse, ads spread without firm approval, reaching wide audiences unchecked.

MAS data shows the need. In recent years, complaints about misleading finance ads rose by over 20 percent on digital channels. Consumers lost money on bad investments pitched as sure wins. The guidelines balance outreach benefits—like easy education on savings plans—with strong guards against harm.

Financial experts praise the move. One analyst noted, “These rules help build trust in Singapore’s markets.” They tackle doubts readers might have: Will this stifle innovation? No, it focuses on safety without banning digital tools. Firms can still educate on topics like retirement funds, as long as info stays honest.

In short, the guidelines push for smarter digital practices. They shield everyday users while keeping Singapore a top spot for finance. As platforms grow, these rules ensure ads inform, not deceive.

MAS Digital Advertising Guidelines: A Comprehensive Analysis of Singapore’s Financial Content Regulation

Executive Summary

The Monetary Authority of Singapore (MAS) has introduced comprehensive guidelines for financial institutions regarding digital advertising and online content sharing, marking a pivotal moment in financial services regulation. These guidelines, effective March 25, 2026, represent a sophisticated regulatory response to the digital transformation of financial marketing and the proliferation of misleading content on social media platforms.

The Regulatory Context: Why Now?

Digital Transformation Catalyst

The guidelines emerge from a two-year consultation process initiated in April 2023, reflecting MAS’s methodical approach to regulation in an rapidly evolving digital landscape. The timing is strategic, addressing several convergent trends:

- Exponential growth in digital financial services adoption

- Rise of “finfluencers” and social media financial advice

- Platform constraints leading to incomplete information disclosure

- Increasing consumer reliance on social media for financial decisions

Observed Market Failures

MAS has documented specific instances of market dysfunction that necessitated intervention:

- Deceptive Lead Generation: Insurance agents exploiting dating applications like Tinder to solicit potential clients under false pretenses

- Incomplete Risk Disclosure: Character limits on platforms leading to promotion of benefits without corresponding risk warnings

- Unauthorized Content Distribution: Non-compliant advertisements circulating without institutional oversight

- Platform Misalignment: Use of entertainment-focused platforms for serious financial product promotion

Deep Dive: The Five Safeguards Framework

Safeguard 1: Digital Platform Assessment

Requirement: Financial institutions must evaluate the appropriateness of digital platforms before use.

Analysis: This safeguard acknowledges that not all digital platforms are suitable vehicles for financial product promotion. The regulation requires institutions to conduct due diligence on:

- Platform reputation and track record

- User demographics and behavior patterns

- Platform policies regarding financial content

- Historical incidents of misleading content

- Alignment with institutional brand values

Implementation Challenge: The dynamic nature of digital platforms means assessments must be ongoing rather than one-time evaluations.

Safeguard 2: Content Clarity Despite Format Constraints

Requirement: Ensure clear, fair, and non-misleading content within platform limitations.

Analysis: This represents the most technically challenging aspect of compliance. Social media platforms impose various constraints:

- Character Limits: Twitter’s 280 characters, Instagram caption limits

- Video Duration: TikTok’s short-form content requirements

- Visual Emphasis: Instagram’s image-centric format

The “Standalone Test”: Each advertisement must be non-misleading when viewed in isolation, preventing the practice of highlighting benefits in one post while relegating risks to separate, less visible content.

Safeguards 3-5: Digital Marketer Management

The remaining safeguards focus on human capital management in digital marketing:

- Selection Framework: Establishing criteria for digital marketer qualifications

- Active Monitoring: Implementing surveillance and oversight systems

- Disciplinary Mechanisms: Creating accountability structures for non-compliance

Sector-Specific Impact Analysis

Banking Sector

Challenges:

- Complex product structures (derivatives, structured products) difficult to explain in short formats

- Regulatory capital requirements and risk disclosures mandated by Basel III framework

- Consumer protection requirements under the Financial Advisory Act

Opportunities:

- Enhanced customer education through multimedia content

- Broader reach to previously underserved demographics

- Real-time customer feedback and engagement

Insurance Industry

Particular Vulnerabilities:

- High-pressure sales tactics historically associated with insurance

- Complex policy terms and conditions

- Long-term commitment nature of insurance products

Regulatory Focus: The guidelines specifically address insurance agent behavior on social platforms, suggesting MAS has observed significant issues in this sector.

Capital Markets

Unique Considerations:

- Investment risks and market volatility disclosures

- Suitability assessments for retail investors

- Compliance with Securities and Futures Act requirements

Implementation Challenges and Solutions

Challenge 1: Platform Diversity and Evolution

Problem: The rapid evolution of digital platforms creates a moving target for compliance.

Solution: Establish a dynamic assessment framework with regular review cycles. Financial institutions should:

- Create cross-functional teams combining legal, marketing, and technology expertise

- Develop platform-specific compliance templates

- Implement automated monitoring systems with regular manual reviews

Challenge 2: Content Quality at Scale

Problem: Ensuring compliance across potentially thousands of posts and content pieces.

Solution: Implement a three-tiered approach:

- Pre-publication Review: All content must pass compliance screening

- Real-time Monitoring: Automated systems flag potential issues

- Post-publication Audit: Regular sampling and review of published content

Challenge 3: Third-Party Management

Problem: Managing external digital marketers and influencers who may not understand financial services regulations.

Solution: Comprehensive third-party management framework:

- Enhanced Due Diligence: Background checks, qualification verification, and track record analysis

- Contractual Controls: Clear compliance obligations and penalty structures

- Training Programs: Regular education on financial services regulations

- Performance Monitoring: Continuous assessment of third-party compliance

Technology Solutions and Infrastructure

Automated Compliance Systems

Content Analysis Tools: AI-powered systems that can:

- Scan content for compliance keywords and phrases

- Identify missing risk disclosures

- Flag potentially misleading claims

- Ensure consistent messaging across platforms

Social Media Listening: Advanced monitoring tools that:

- Track brand mentions across platforms

- Identify unauthorized content

- Monitor competitor practices

- Measure consumer sentiment and feedback

Governance Technology (GovTech)

Regulatory Reporting: Automated systems for:

- Compliance documentation

- Incident reporting to MAS

- Performance metrics tracking

- Audit trail maintenance

International Comparative Analysis

United States: SEC Social Media Guidance

The U.S. Securities and Exchange Commission has issued guidance on social media use by financial professionals, emphasizing:

- Record-keeping requirements

- Supervision obligations

- Content approval processes

Key Difference: Singapore’s guidelines are more prescriptive in their safeguard structure.

United Kingdom: FCA Social Media Rules

The Financial Conduct Authority requires:

- Clear and prominent risk warnings

- Balanced presentation of information

- Approval processes for financial promotions

Similarity: Both jurisdictions emphasize the “standalone” principle for social media content.

European Union: MiFID II Digital Requirements

EU regulations focus on:

- Investor protection in digital channels

- Suitability assessments for online advice

- Cross-border digital services compliance

Economic Impact Assessment

Compliance Costs

Direct Costs:

- Technology infrastructure investment: S$500,000 – S$2 million per major institution

- Personnel training and certification: S$100,000 – S$500,000 annually

- Third-party monitoring services: S$50,000 – S$200,000 annually

Indirect Costs:

- Reduced marketing agility and speed-to-market

- Potential limitation on creative marketing approaches

- Increased legal and compliance overhead

Market Benefits

Consumer Protection: Enhanced disclosure quality should lead to better-informed financial decisions.

Market Integrity: Reduced misleading content should improve overall market confidence.

Competitive Fairness: Level playing field for all financial institutions regarding digital marketing practices.

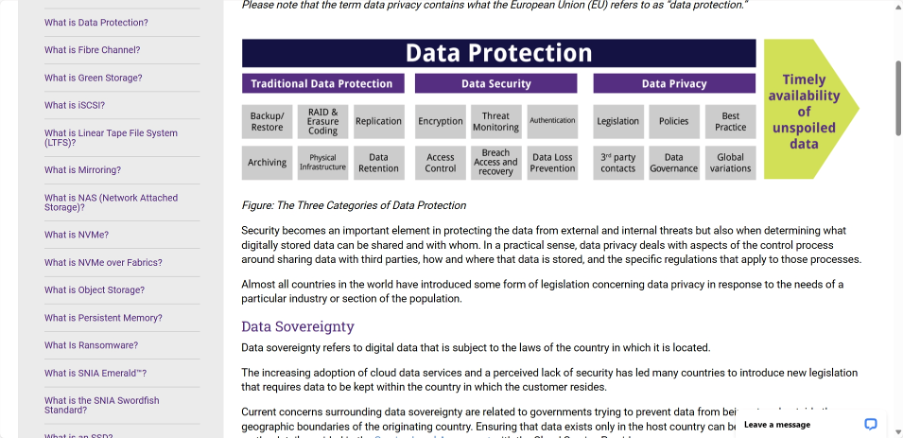

Ever wondered why you see advertisement on items or companies you search for on the search engine on multiple platforms? The reason is because companies are able to use data collected related to you to push advertisements to you, these are called behaviour-based advertising. Every step taken by you on the digital world can be tracked and the data can be used to develop intrusive ads on different platforms in different formats.

What is intrusive target advertising?

Understanding and addressing data privacy concerns is essential. Marketers collect customer data, such as demographical and behavioural information, as you engage with their brand. This information is collected via cookies, location information and search data. With this information, marketers can identify their target segment and create personalised marketing messages and visuals to interact and engage.

Intrusive target ads occur when your digital footprint is collected without your permission or unknowingly. Google, one of the world’s most used search engine giant, has been in multiple lawsuits related to unethical methods of data collection of their user’s information.

As a consumer, intrusive advertisement can negatively impact your online experience when advertisements are bombarded at you on different platforms.

How to avoid intrusive advertising?

Unethical data collection has been a hot topic as information collected can expose individuals to dangerous scenarios. As a result, different parties have gotten involved to ensure data collected complies with laws and regulation or allow users to have the option to opt out of having their data collected.

1. Government

Data privacy involves protecting and responsibly using an individual’s personal information, preferences, and activities. With the increase in online customer data, measures have been implemented to safeguard personally identifiable information (PII) like names, dates of birth, email addresses, financial details, and browsing history.

Governments and organisations worldwide are implementing measures to protect personal information, and marketers must comply with data collection regulations. Stay informed about these regulations to ensure compliance.

GDPR privacy laws

GDPR, a data privacy law, has changed how marketers work. It gives people more control over their data and requires businesses to ask for explicit permission before using it. Marketers must now be transparent about data collection and update their privacy policies to comply.

One challenge is explaining how data is used and giving people the choice to opt in or out. This complicates targeting and personalisation efforts, as marketers need permission to use data. GDPR also requires companies to respond to requests from customers to access or delete their data promptly and correctly. Marketers must be prepared to handle these requests to follow the law.

Privacy laws are changing in the US as data privacy becomes more important worldwide. While the US doesn’t have a national privacy law like the EU’s GDPR, individual states are taking steps to protect people’s privacy. California has the California Consumer Privacy Act (CCPA) since January 2020.

This law lets Californians know what data companies collect about them and who they share it with and allows them to delete it. People can also choose not to have their information sold to others. Other states, like Virginia, are following California’s example. Virginia passed the Virginia Consumer Data Protection Act (VCDPA) in March 2021, giving its residents more control over their data, including the right to transparency, access, deletion, and opting out.

2. Private businesses

Apple’s privacy updates are causing challenges for marketers. One example is the Mail Privacy Protection (MPP) feature, which opens incoming emails to protect user privacy. This feature hides IP addresses and prevents tracking of the recipient’s location and online activity. Apple’s recent iOS 17 updates also focus on protecting user data and privacy, making it harder for marketers to track engagement.

For instance, Link Tracking Protection in iOS 17 removes tracking parameters from messages, mail, and links, making it difficult to link interactions to specific users. Despite these challenges, link tracking remains a helpful metric, with only certain link types being affected.

Ensuring ethical data collection practices is essential for fostering trust with customers. When customers are hesitant to share their data, it can hinder their overall experience.

3. Yourself

You can also play a part to protect your own online data privacy through methods such as using private browsers such as Maxthon that prioritises data privacy of their users. Maxthon browser prioritizes data privacy by incorporating advanced encryption measures to protect users’ personal information. It ensures that user data is anonymized and not shared with third parties without consent.

By minimizing data collection, Maxthon reduces the risk of potential security breaches or privacy violations. Additionally, the browser offers robust privacy settings that allow users to control what information is collected and stored.

Maxthon takes a proactive approach to enhancing security and protecting user privacy by minimizing the collection of unnecessary data. By reducing the amount of personal information gathered, the risk of potential security breaches or privacy violations is significantly lowered. Additionally, Maxthon provides users with robust privacy settings that allow for greater control over their online activities.

These privacy settings include options to block unwanted tracking cookies, enable private browsing mode, and customize cookie permissions on a site-by-site basis. Users can also choose to opt-out of personalized advertisements and prevent websites from accessing their location or webcam without permission. With these features in place, Maxthon ensures that users can browse the internet securely and with peace of mind knowing their data is protected.

Maxthon, as a leading web browser, understands the importance of protecting user data. To ensure the highest level of security, the company conducts regular audits to assess its data protection measures. These audits help identify any potential vulnerabilities and ensure compliance with industry standards. Additionally, Maxthon focuses on implementing timely security updates to address any emerging threats or issues.

By staying proactive in evaluating its data protection practices, Maxthon demonstrates a commitment to safeguarding user information. The company prioritizes staying informed about the latest security trends and technologies to enhance its defenses against cyber threats. Through these continuous efforts, Maxthon aims to provide users with a secure browsing experience that instills trust and confidence in their data privacy.

Through regular audits and security updates, Maxthon constantly evaluates its data protection practices to adhere to the latest industry standards. Users can also benefit from features like built-in ad blockers and anti-tracking tools for a more secure browsing experience. Overall, Maxthon puts an emphasis on maintaining user trust through transparent data handling policies and proactive measures to safeguard sensitive information.