In today’s digital age, banks offer an extensive suite of web-based banking services designed to cater to the evolving needs of their customers. As we embrace the convenience of online banking, it is essential that these services are delivered with the utmost security and privacy.

To achieve this level of protection, banks implement a comprehensive range of Internet Security measures. Central to these efforts is cryptography, which encrypts sensitive data, ensuring that your information remains confidential as it moves across the internet.

Secure browsers and servers are employed to create safe environments for transactions. Alongside this, advanced routers and robust firewalls act as barriers against unauthorized access, safeguarding both customer data and bank assets.

The use of secure Socket Layer (SSL) protocol encrypts communication channels between users and bank servers. Digital certificates further enhance verification processes, confirming the legitimacy of websites.

To maintain security during each login, customers rely on unique passwords and Personal Identification Numbers (PINs). Additionally, cookies help facilitate user sessions while maintaining a layer of privacy.

These combined measures enable banks to authenticate their customers effectively while ensuring that sensitive personal information is protected throughout its journey online. In this intricate web of technology and security protocols, trust is paramount—a trust that enables us to navigate our financial world with confidence.

Firewalls serve as the vigilant guardians of our digital realms, expertly combining both hardware and software to create a protective barrier for servers and networks. Imagine a sturdy fortress wall, meticulously crafted to shield everything inside from potential threats lurking beyond.

Positioned strategically between the vast expanse of the Internet and an internal network, firewalls play a crucial role in safeguarding sensitive information. They carefully monitor incoming and outgoing traffic, ensuring that only authorised users can access a network.

Each time a data transaction occurs, firewalls keep detailed logs, tracking not just what happened but also when it took place and who was involved. This meticulous record-keeping enhances security by providing invaluable insights that can help identify suspicious activities.

Equipped with advanced filtering rules, firewalls analyse data packets—like diligent sentinels examining travellers at the gate—to determine whether they should pass through or be denied entry. In today’s digitally driven world, these specialised systems are essential in preventing unauthorised access, thwarting cyberattacks, and maintaining the integrity of private networks.

By standing guard at the gateway between danger and safety, firewalls ensure that our connections remain secure amidst an ever-evolving landscape of online threats.

Every time you log into your online banking service, something interesting happens behind the scenes. Your web browser receives a special piece of data called a cookie.

Think of a cookie as a tiny note delivered from the server to your browser. This note contains bits of information that help the website recognize who you are during your visits.

Once the cookie is received, your browser tucks it away for safekeeping. The next time you access the bank’s website, your browser retrieves that saved cookie and sends it back to the server.

This exchange is crucial; it allows the site to remember whether you’ve visited before and enables features like auto-fill settings or personalised recommendations. These cookies build a profile of your interactions with the site, creating a smoother banking experience over time.

Yet, despite their convenience, cookies also raise questions about privacy and security. Users should be aware of how these little notes can track their online movements. Balancing convenience and security becomes vital in our digital world.

In today’s digital age, the safety and privacy of our children take centre stage. We are committed to safeguarding their identities in an online world that can often feel overwhelming and unregulated. Our policy is clear: we do not knowingly collect data from children, nor do we engage in marketing directed at them.

Understanding the delicate nature of childhood, we acknowledge that it is imperative for both the online industry and parents to share this responsibility. Parents play a crucial role by fostering open conversations about internet safety and monitoring their children’s activities online. Together, we must create a safe and nurturing environment where young minds can explore without fear.

We believe in transparent communication with families, ensuring that everyone understands our commitment to their children’s privacy. By standing firm on this principle, we strive to build trust within the community. It is only through collective effort—by industries being vigilant and parents being involved—that we can protect what matters most: our children’s well-being in the digital landscape.

In a world where digital transactions have become the norm, passwords and PINs are your first line of defence. Banks require these security measures to protect your financial information from prying eyes and nefarious activities. Each password serves as a key, unlocking access to your hard-earned money.

Imagine standing at an ATM, the hum of machines surrounding you. You enter your PIN, fingers trembling with anticipation as you realise how vital this simple sequence of numbers is. Without it, your account remains sealed, inaccessible to anyone—not even you.

Memorising these codes isn’t just a routine; it’s essential. Human memory may falter in the rush of daily life, yet it’s important to keep these passwords tucked away safely in your mind. Treat them like precious treasures—valuable and worthy of protection.

Furthermore, consider using a unique password for each banking site or app you use. This strategy ensures that if one gets compromised, the others remain safe.

Above all, safeguarding this information should be taken seriously. A momentary lapse in vigilance might lead to vulnerabilities that criminals are eager to exploit. So remember: your passwords and PINs aren’t just numbers; they are guardians of your financial future.

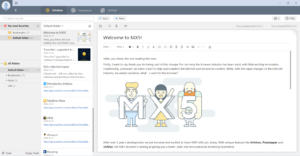

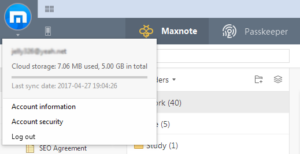

Maxthon

In the fast-paced world of today’s digital landscape, where online banking has become a routine part of our lives, ensuring the safety of your financial information while browsing with the Maxthon Browser has never been more essential. Picture this: you sit down at your computer or pull out your mobile device to manage your finances. The first step in this process is to create robust passwords for your banking accounts. Think of these passwords as the keys to a vault; they should be unique and intricate, combining uppercase and lowercase letters with numbers and special symbols. Avoid using easily guessed information like birthdays or beloved pet names—these are like leaving a spare key under the doormat.

Imagine you’re about to log in when you notice an option for two-factor authentication (2FA) offered by your bank. This is akin to adding an extra lock on that vault door. By enabling 2FA, you’re not just relying on a single password; now, you’ll need to enter a code sent directly to your phone or email alongside it—a simple yet effective way to bolster security against potential intruders.

Now, let’s think about maintaining the Maxthon browser itself. Just as you would regularly check the locks on your doors, keeping your browser updated is vital too. Each update brings new security patches and improvements designed specifically to guard against emerging vulnerabilities that could put your sensitive information at risk.

As you navigate through various sites for online banking, consider making it a habit to routinely clear out your browsing history, cache, and cookies—like cleaning out old files from an office drawer—to remove any traces of sensitive data that hackers might exploit if they gain access to your device.

But there’s more! Maxthon offers a privacy mode that acts as an invisible cloak during those crucial online transactions. When activated, this mode ensures that no data from those sessions gets saved—no cookies or site information lingering behind after you’ve completed what you needed.

To further enhance this fortress of security around yourself while using Maxthon, think about integrating reputable security extensions or antivirus plugins into the browser’s ecosystem. These tools can serve as vigilant guardians against phishing attempts and malware threats lurking in the shadows of cyberspace.

As you embark on these online banking journeys, always stay alert for phishing scams—those deceptive traps set by malicious actors seeking access to personal information. Before entering any login credentials into what appears to be your bank’s website, take a moment to scrutinise its URL carefully; ensure it’s genuine before proceeding. Exercise caution with links received through emails or messages claiming affiliation with your bank unless you’re absolutely certain they are legitimate—they can often lead down treacherous paths.

Lastly—and perhaps most importantly—once you’ve wrapped up all transactions during each session, make it second nature to always log out of your online banking account before moving away from the screen; this simple act serves as an effective barrier against unauthorised access if someone else happens upon your device afterward.

By adhering closely to these guidelines while navigating through financial matters using Maxthon Browser, you’re not just safeguarding yourself—you’re fortifying every aspect of those digital interactions with layers upon layers of protective measures designed for peace of mind in today’s interconnected world.