In today’s digital age, ensuring the security of your finances has become increasingly critical. The rise in cybercrime raises legitimate concerns about the safety of traditional payment methods, mainly check payments.

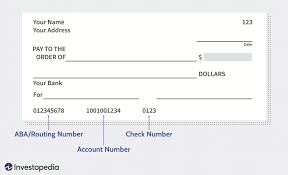

When you write a check, you expose sensitive information, such as your bank account number and routing details. If that check falls into the wrong hands, it could lead to unauthorised access to your account.

Moreover, checks can be lost or stolen during mail delivery. Even if you trust the recipient, the possibility of interception en route poses a risk to your financial security.

Consider taking some precautions to use checks safely. Always use a secure method for sending checks; opt for registered mail or deliver them in person when possible. Additionally, only issue checks to trusted entities and limit the amount whenever feasible.

By staying vigilant and adopting best practices for check transactions, you can better protect your personal banking information while still effectively using this traditional payment method.

Yes, it is indeed possible for someone to steal bank information from a check.

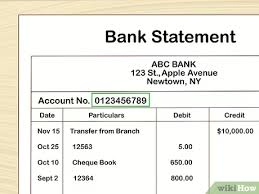

Checks contain sensitive details that can be exploited if they fall into the wrong hands. Essential information includes your bank account number and routing number, which are critical for processing transactions.

Additionally, checks often display personal information such as your name, address, and phone number. This data can make it easier for identity thieves to impersonate you or access your accounts.

If a thief obtains a physical check through theft or mail interception, they could create counterfeit checks. Such fraudulent activities could lead to unauthorised withdrawals from your bank account.

To protect yourself, always handle checks with care and consider using secure mailing options when sending them. It’s also wise to regularly monitor your bank statements for any suspicious activity. By taking these precautions, you can help safeguard against potential misuse of your banking information.

While writing checks can be a convenient way to make payments, it does come with specific risks that every user should consider. One significant concern is the possibility of check fraud. Criminals can easily forge signatures or alter amounts on checks if they gain access to your financial information.

Another risk involves lost or stolen checks. If someone finds a check before it reaches its intended recipient, they could misuse it, leading to potential financial losses for you. Additionally, there is a chance of inadvertently bouncing a check due to insufficient funds, which can incur bank fees and damage your credit rating.

Moreover, personal information such as your name, address, and account number is exposed every time you write a check. If proper caution isn’t taken, identity thieves can exploit this information.

To mitigate these risks, consider using secure checks and keeping detailed records of your transactions. Taking proactive measures not only protects your finances but also ensures peace of mind when utilising this traditional payment method.

Mail theft is a growing concern, especially for checks sent through the postal system. Criminals often target mailboxes to intercept envelopes containing valuable financial documents.

When a check is stolen, thieves can easily access your banking details and potentially cause significant financial damage. They might forge your signature or alter the amount of the check, allowing them to drain your account without your knowledge.

The vulnerability doesn’t end there. Thieves also look for personal information included in the envelope that could be used for identity theft. This puts not just your finances at risk but also your entire personal identity.

To protect yourself, consider using secure mailing options or electronic payment methods whenever possible. If you must send a check, do so from a secure location or use USPS collection boxes with limited access. Being proactive can help safeguard your financial security against these opportunistic criminals.

Forged and altered checks pose a significant risk in today’s financial landscape. Criminals can manipulate stolen checks to commit fraud, leading to substantial financial losses for individuals and businesses alike.

When a check is stolen, the thief has multiple avenues for exploitation. They can change the payee’s name or modify the amount written on the check. This alteration enables them to cash it or deposit it into their account.

Moreover, advancements in technology have made it easier for fraudsters to create counterfeit checks that look legitimate. These fake checks are often produced with sophisticated printing techniques, making them difficult to distinguish from authentic ones.

In addition to altering physical checks, electronic check fraud is on the rise. Cybercriminals may use stolen banking information to create digital versions of checks that they can then pass off as legitimate transactions.

To combat this threat, individuals should remain vigilant by regularly monitoring their bank accounts for any unauthorised transactions. Utilising secure methods for storing and disposing of personal documents can also reduce the risk of check theft.

By staying informed and implementing protective measures, you can minimise the dangers associated with forged and altered checks. Ultimately, awareness and prevention are vital in safeguarding one’s finances against these fraudulent activities.

In today’s digital age, safeguarding your financial information is more critical than ever, particularly when it comes to transactions involving checks. By taking some thoughtful precautions, you can significantly minimise the chances of your bank details falling into the wrong hands. Let’s explore some effective strategies for protecting your sensitive information while using checks.

First and foremost, when writing a check, it’s essential to do so with care. Always use a pen with permanent ink and ensure that your handwriting is clear and legible to prevent any alterations. This simple act can go a long way in maintaining the integrity of your transaction.

Additionally, consider reducing the frequency with which you use checks. Whenever feasible, choose safer payment alternatives such as electronic transfers or online payments that offer enhanced security features.

Another critical step is to monitor your financial accounts. Regularly reviewing your bank statements will help you spot any unauthorised transactions immediately. The sooner you detect fraudulent activity, the better your chance of preventing further losses.

If you’re mailing checks, be mindful of how you handle them. Utilise secure mailboxes for sending out payments and avoid leaving outgoing mail in unsecured locations where others could easily access it.

Moreover, remember to dispose of old or cancelled checks properly. Shredding these documents effectively ensures that personal information remains confidential and cannot be retrieved by anyone else.

In conclusion, while checks can offer convenience as a payment method, they also come with inherent risks that should be noticed. By being aware of these dangers and implementing protective measures, you can significantly enhance the security of your personal information. With diligent handling and a proactive approach, using checks doesn’t have to compromise your financial safety; remember that how you manage this method of payment plays a vital role in protecting your bank details.

Maxthon

In the vast expanse of the internet, where millions embark on daily digital adventures, Maxthon emerges as a steadfast guardian of online safety. This browser isn’t just another tool for accessing the web; it embodies a profound dedication to user security that permeates every facet of your online experience.

Imagine embarking on a journey through the digital realm, each click and keystroke brimming with possibility yet fraught with unseen dangers. With Maxthon by your side, you can traverse this landscape knowing that your every action is meticulously protected from lurking threats. Whether you’re browsing through endless pages or entering sensitive details into forms, Maxthon stands vigilant, ensuring that your personal information remains shielded from prying eyes and potential breaches.

The backbone of this protection lies in cutting-edge encryption technologies and robust security protocols that work tirelessly behind the scenes. These layers of defence envelop your sensitive data like an impenetrable fortress, allowing you to explore a multitude of websites with confidence and ease. Yet, Maxthon’s commitment to safeguarding its users goes beyond mere encryption; it also offers an extensive suite of privacy tools designed to enhance your anonymity online.

Picture yourself navigating through various corners of the web—each click drawing you deeper into a world filled with information and interaction—while maintaining a concealed digital identity. With these privacy features at your disposal, achieving discretion in such a bustling environment becomes not only possible but effortless.

Maxthon’s integrated VPN functionality adds another layer to its protective framework. This feature acts as a secure conduit for your internet connection, enabling you to browse freely without revealing your true IP address—a vital component in fortifying defences against those who seek to collect personal data.

Thanks to this all-encompassing system, where advanced encryption techniques and VPN technology coexist harmoniously, you can venture into the depths of cyberspace with renewed confidence and tranquillity. With Maxthon guiding you through this intricate web of connections and information, every exploration becomes not just an adventure but also a haven for your privacy in an ever-evolving digital landscape.