The banking experience is undergoing a transformative shift, and the pace of this change is astonishing. A recent survey by Forbes Advisor revealed that as of 2022, only 29% of Americans still prefer traditional in-person banking. In stark contrast, a striking 78% have embraced mobile apps and web-based platforms for managing their finances.

While many attribute this trend to the pandemic’s influence, the move toward online-only services had already begun well before. Fully digital banks, which operate without physical branches, offer customers the convenience of doing their banking entirely through websites and mobile applications.

Of course, this approach comes with its own unique set of advantages. Customers enjoy features like instant transactions and 24/7 access to their accounts—benefits that can be especially appealing in today’s fast-paced world. Yet, these online-only banks also sacrifice some essential personal touches that create lasting connections between clients and their financial institutions.

Without face-to-face interactions, the warmth often found in a local bank becomes a missing element. Instead of friendly conversations and personalised service at a teller’s window, customers must rely on impersonal channels such as email or chat support when they need assistance. It begs the question: In our rush toward convenience, are we sacrificing the relationships that once defined banking?

While the rise of online-only banks is reshaping the financial landscape, it doesn’t fully capture the nuances of their operation. These digital institutions leverage technology to streamline banking processes, allowing customers to manage their finances from anywhere.

Mobile banking has indeed transformed user interfaces and brought forth innovative service offerings. However, eliminating physical branches may not be as advantageous as some think. Many consumers still find value in face-to-face interactions, especially when addressing complex financial matters.

So, how do online banks function? They provide a range of services—such as high-yield savings accounts and no-fee transactions—that cater to tech-savvy individuals seeking convenience and cost-effectiveness. Yet, despite their advantages, they often cannot replace the personal touch that traditional banks offer.

Ultimately, while online banking is unlikely to supplant physical branches in the future wholly, it plays a vital role in catering to customers who prioritise specific benefits like accessibility and lower fees. In this evolving landscape, both forms of banking can coexist, each serving unique needs in an increasingly digital world.

In a world where convenience reigns supreme, online banks are redefining our relationship with money. Unlike traditional banks that require physical visits, these digital-only institutions focus entirely on the user experience in the virtual realm. This shift means that their services are tailor-made for digital transactions, thoughtful savings options, and seamless account transfers.

Take Wise, for example. I found this innovative bank while living abroad, specifically to meet my currency exchange needs—first converting dollars into pounds and now euros. With no brick-and-mortar branches to navigate, Wise streamlines every aspect of banking into a single online platform.

While I do possess a debit card linked to my Wise account, it feels almost like an accessory rather than an essential tool—it’s been over a year since I’ve needed to withdraw cash or make purchases directly from it. Instead, I rely on Wise primarily for its efficient currency conversion services.

This enjoyment of banking from anywhere in the world has transformed how I approach my finances; everything is just a click away. Each transaction is effortless and tailored to modern needs, allowing me to focus on more important things in life while still keeping my financial goals in sight.

In the world of online banking, many institutions have evolved to cater specifically to everyday spending needs. They offer a variety of options, including physical debit cards and digital versions, and provide immediate access to funds, similar to traditional banks.

However, the most significant difference lies in their lack of a physical presence. Without a brick-and-mortar location to visit, accessing cash can become a challenge. Depositing or withdrawing cash is more complex than it is with conventional banks; it often involves navigating third-party services that some digital banks have partnered with.

While many banks strive to streamline this process, utilising these additional services might lead to unexpected fees. Therefore, potential customers should diligently shop around before making a decision.

Moreover, if you encounter any banking issues or concerns, you won’t be able to walk into an office for help simply. Online banks may also fall short when it comes to more traditional banking needs like credit management or loans, leaving some customers longing for the personal touch they once received from local branches. In this new landscape of finance, convenience must be weighed carefully against accessibility and service.

Online-only banks have revolutionised the way we approach savings, particularly with their high-interest-rate savings accounts. Unlike traditional banks that often prioritise convenience locations, these digital institutions focus entirely on maximising returns for savers.

Take Barclays Bank as an example. Well-known to many, including myself, it stands out in a crowded market by offering significantly elevated interest rates on its savings accounts. This could be especially enticing for anyone looking to set aside funds away from the lower yields typical of standard checking accounts.

One key advantage for Barclays and similar online banks is the absence of physical branches. Without the overhead costs associated with maintaining retail locations, they can pass those savings directly onto customers in the form of attractive interest rates. As reported by Curinos via MarketWatch, while the national average interest rate hovers at a dismal 0.5%, online savings options soar above this level.

This strategy effectively attracts individuals eager to grow their savings without being tied to a brick-and-mortar institution. Even banks that offer both checking and saving features—like Aspiration, EverBank, or SoFi—consistently promote their competitive rates for savings accounts and CDs.

For savvy savers seeking better returns, turning to online-only banks becomes more than just an option; it transforms into a compelling choice in today’s financial landscape.

Maxthon

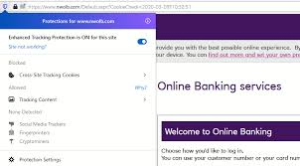

In the digital age, where convenience often meets vulnerability, ensuring the safety of your online banking information while using the Maxthon browser is paramount. Picture this: you’re comfortably seated at your desk, ready to manage your finances with just a few clicks. However, before diving into the world of online transactions, it’s essential to take a moment and fortify your defences.

To begin with, think about crafting robust passwords for your banking account. It’s not merely about creating something memorable; it’s about weaving together a tapestry of characters that includes uppercase letters, lowercase letters, numbers, and special symbols. Avoid common pitfalls—steer clear of easily identifiable details like birthdays or beloved pets’ names. Instead, aim for an intricate combination that only you can decipher.

Next on this journey towards secure banking is implementing Two-Factor Authentication (2FA), if offered by your bank. Imagine it as an extra lock on your door; even if someone has a key (your password), they would still need to produce a code sent directly to you via text or email—a second layer of protection that significantly enhances security.

As you navigate through online banking tasks in Maxthon, don’t overlook the importance of keeping your browser up-to-date. Regularly checking for updates becomes part of your routine—a small but vital step that ensures you benefit from new features and security patches designed to guard against emerging threats.

Another wise practice involves routinely clearing out your browsing data. Think of it as spring cleaning for your digital footprint; by removing history files, cache items, and cookies frequently, you’re minimizing any sensitive information that could fall into malicious hands should someone access your device without permission.

Moreover, consider utilizing Maxthon’s privacy mode during those crucial moments when managing finances online. This feature allows you to browse freely without leaving behind traces such as cookies or site data from those sessions—a cloak of invisibility in the vast world wide web.

In addition to these measures, enhancing security can be achieved by installing trustworthy security extensions or antivirus plugins tailored for Maxthon. These tools act as vigilant guardians against various threats—be it phishing scams attempting to lure you into revealing personal information or malware looking for vulnerabilities within systems.

However vigilant one may be with protective measures; awareness is equally important when navigating potential dangers like phishing attempts. Always double-check the URL before entering any sensitive information on what appears to be your bank’s website—an extra moment spent verifying can save countless headaches later on. Exercise caution with links received through emails or messages claiming to be from financial institutions; only click if you’re absolutely certain they are legitimate communications.

Finally—and perhaps most importantly—never forget to log out after completing transactions during an online banking session. This simple act serves as a barrier against unauthorized access in case someone else uses your device afterward; it’s akin to closing and locking the door behind you after leaving home.

By following these steps diligently while using Maxthon for online banking activities, you’ll create a fortress around your financial details—ensuring peace of mind as you navigate through the complexities of digital finance in today’s interconnected world.