aIn the realm of banking, the importance of cyber security has surged to the forefront as a crucial line of defence against an escalating tide of digital threats. With vast sums of money and susceptible information at stake, financial institutions are perpetually challenged to outpace the tactics employed by cybercriminals. This raises an essential question: what are the most significant dangers confronting the banking industry today, and how are these institutions working to secure your financial well-being? In this piece, we will delve into the foremost concerns regarding cyber security and examine the best practices and innovative solutions that are paving the way for a safer banking environment.

So, what exactly does cyber security in banking entail? It encompasses a range of technologies, methodologies, and protocols aimed at shielding banks’ digital frameworks—encompassing their data and networks—from various cyber threats. In today’s landscape, banks handle immense volumes of sensitive information that include customer financial records, personal identification details, and transaction histories. Implementing effective cyber security measures is vital for protecting this data from breaches, fraudulent activities, hacking attempts, and other forms of malicious cyber actions. Essentially, it involves fortifying every aspect of a bank’s digital ecosystem—from online banking platforms to internal databases—against unauthorised access points, potential data leaks, and aggressive attacks.

The significance of robust IT security within banks cannot be overstated; it is fundamental for sustaining customer trust, adhering to regulatory compliance requirements, and ensuring operational continuity in an industry that faces increasing scrutiny from cyber adversaries. For those seeking a more comprehensive understanding of current trends in this field, I recommend consulting the State of Cyber Security Report. This resource provides valuable perspectives on evolving threats alongside insights into how banks are responding.

The necessity for stringent cyber security measures becomes even more apparent when considering that banks rank among the most susceptible entities when it comes to digital threats. With daily operations involving substantial amounts of confidential data and financial transactions flowing through their systems constantly—these institutions have become prime targets for hackers aiming to exploit vulnerabilities. Therefore, establishing formidable cyber security protocols is not merely about safeguarding their operations; it’s also about protecting customer privacy while maintaining public trust in their services.

constantly—these institutions have become prime targets for hackers aiming to exploit vulnerabilities. Therefore, establishing formidable cyber security protocols is not merely about safeguarding their operations; it’s also about protecting customer privacy while maintaining public trust in their services.

As we navigate further into this discussion on why banks must prioritise robust cybersecurity frameworks—let’s explore some critical reasons behind this imperative need for enhanced protective strategies:

The Importance of Cyber Security for Financial Institutions

In today’s digital age, banks stand out as some of the most susceptible establishments regarding cyber threats. Given the immense volume of sensitive information and financial activities that transpire every day, they become prime targets for cybercriminals. To shield their operations and uphold the privacy and confidence of their clientele, robust cyber security measures are indispensable for these institutions. Here are several compelling reasons highlighting why banks must prioritise cyber solid security protocols:

Safeguarding Customer Information

At the core of banking lies customer data. This encompasses a wide array of personal details, from Social Security numbers to home addresses, alongside sensitive financial information. Banks house an extensive repository of data that, if breached, could result in identity theft, fraudulent activities, and considerable monetary losses for individuals affected. Cyber security is vital in defending this critical information against unauthorised access and exploitation. To ensure the integrity of customer data remains intact, banks deploy various protective strategies such as encryption technologies, firewalls, and stringent access controls. A failure to secure this information not only risks financial repercussions but can also lead to diminished trust among customers and tarnished reputations.

Upholding Trust and Reputation

The trust serves as the cornerstone of any banking relationship. Customers inherently expect their financial institutions to manage their personal and monetary details with care and responsibility. When a breach occurs, it can severely undermine that trust—prompting customers to take their business elsewhere while inflicting long-lasting damage on the bank’s reputation. Incidents involving cyber attacks or data breaches often make headlines quickly; consequently, public perception can shift dramatically in an instant. Therefore, implementing adequate cyber security measures is essential for preserving customer trust and ensuring individuals feel secure when conducting transactions or divulging sensitive information.

Adhering to Regulatory Standards

Due to its highly regulated nature, the banking sector operates under stringent regulatory frameworks concerning data protection and cyber security compliance. Various laws govern these protocols; prominent among them are the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States—both establishing rigorous guidelines that banks must follow diligently.

In summary, as banks navigate an increasingly complex landscape filled with potential cyber threats while managing vast quantities of sensitive customer information daily, investing in robust cyber security becomes not just prudent but essential for safeguarding operations while nurturing customer relationships built on trust.

Safeguarding Against Financial Setbacks

In today’s digital landscape, the threat of cyber attacks looms large over financial institutions, particularly banks. A successful breach can unleash a cascade of financial repercussions that extend well beyond immediate theft. For instance, funds can be siphoned directly from customer accounts, leading to immediate losses for both the institution and its clients.

Additionally, banks face substantial costs associated with system downtimes that disrupt services and necessitate expensive repairs to compromised systems. The fallout doesn’t end there; in many cases, banks may find themselves legally obligated to reimburse customers who fall victim to fraud or identity theft as a result of these security breaches. Banks must invest in robust cybersecurity measures to counteract potential financial pitfalls linked to cybercrimes. By adopting cutting-edge security solutions, they can significantly reduce their exposure to risk. Proactive strategies such as real-time monitoring for threats, employing multi-factor authentication protocols, and leveraging artificial intelligence for threat detection can effectively thwart attacks before they escalate into financially damaging events.

Shielding Essential Systems

The infrastructure that supports the banking sector—comprising online banking services, ATMs, and payment processing networks—stands out as a prime target for cybercriminals seeking exploitative opportunities. A successful intrusion into any of these vital systems could lead not only to operational disruptions but also render customers unable to access their funds or complete transactions when needed most. Herein lies the importance of cybersecurity: it serves as a protective barrier around this critical infrastructure by thwarting unauthorised access attempts, identifying unusual activities promptly, and neutralising potential threats before they materialise.

Through continuous surveillance and rigorous security assessments, banks can ensure that these essential services remain intact and fully operational at all times. This vigilance is paramount; any disruption could tarnish a bank’s reputation while threatening its financial stability.

Maintaining Operational Resilience

Cyber attacks have the potential to wreak havoc on a bank’s operations—resulting in system failures, data loss incidents, or even service interruptions that leave customers stranded without access to their accounts or necessary banking functions. The implications are severe: not only do such disruptions incur significant financial losses for the institution itself, but they also adversely affect customer satisfaction and trust.

Mitigating these risks effectively requires comprehensive cybersecurity frameworks explicitly designed for resilience against such disturbances. Establishing an effective incident response strategy is essential; this includes conducting regular data backups and implementing disaster recovery solutions aimed at ensuring rapid restoration following an attack. By prioritising these measures, banks position themselves not just to withstand cyber threats but also to ensure seamless continuity in service delivery—even amidst adversity.

![]()

Cyber Security Challenges Encountered by Financial Institutions

The banking sector is under constant siege from increasingly sophisticated cyber threats. As hackers continuously refine their techniques to exploit vulnerabilities, financial institutions find themselves at the forefront of these attacks. With vast quantities of sensitive financial data and personal customer information on the line, banks have become prime targets for cybercriminals. In this narrative, we delve into the most prevalent cybersecurity challenges faced by banks today, shedding light on real-world incidents and emerging trends that illustrate the gravity of these threats.

1. Phishing Scams

Phishing stands out as one of the most widespread dangers within the banking landscape. Cybercriminals craft deceptive emails, text messages, or websites that mimic legitimate communications to deceive customers or bank employees into divulging critical information such as account numbers and passwords. Once they obtain this sensitive data, hackers can engage in various malicious activities—stealing funds, perpetrating identity fraud, or even breaching internal bank systems.

A striking instance occurred in 2024 when a sophisticated phishing operation was dismantled after it targeted thousands of Australians, including clients from prominent banks. This elaborate scam involved sending out fraudulent emails that appeared credible enough to fool victims into revealing their login credentials and other sensitive information. The fallout was significant; many individuals suffered substantial financial losses due to this widespread attack—an alarming reminder of how persistent phishing scams continue to threaten the banking industry.

2. Malware and Ransomware

Malware poses another significant risk for banks, with ransomware being a particularly notorious variant. Malware refers to any harmful software designed to infiltrate bank systems with intentions ranging from data theft to operational disruption. Ransomware explicitly locks users out of their systems or files until a ransom is paid for the restoration.

One notable example is the infamous WannaCry ransomware attack in 2017, which wreaked havoc across numerous sectors globally—including financial institutions. This incident saw thousands of computers infected worldwide; several banks found themselves compelled to pay ransoms just to regain access to essential data, while others dealt with expensive service interruptions as they scrambled to recover from the attack.

3. Insider Threats While many dangers to a bank’s security originate externally, it’s crucial to recognise that insider threats also represent a significant concern. These risks can arise from unhappy employees, contractors, or even third-party service providers who have access to sensitive information. Individuals within the organisation may inadvertently or deliberately compromise data security, creating opportunities for cybercriminals to infiltrate systems. A notable case occurred in 2019 when Capital One fell victim to a substantial data breach orchestrated by Paige Thompson, a former Amazon employee. She took advantage of a flaw in the bank’s cloud infrastructure, gaining access to confidential customer records and impacting over 100 million individuals by exposing critical personal information like Social Security numbers and banking details. The fallout from this incident included extensive legal repercussions and hefty financial penalties for Capital One, highlighting the severe nature of insider threats and the vulnerabilities present in cloud security frameworks.

4. Distributed Denial of Service (DDoS) Attacks: DDoS attacks are characterised by an overwhelming influx of traffic directed at a bank’s online services, which can lead to system slowdowns or complete outages. This type of assault can severely disrupt banking operations, making services such as online banking and payment processing inaccessible to customers. The ramifications of such attacks can be particularly harmful to financial institutions as they not only interrupt business activities but also frustrate clients while exposing systems to additional risks. For instance, in 2022, several central banks in the UK faced an uptick in DDoS attacks that targeted their online platforms with excessive traffic volumes. As a result, numerous customers found themselves unable to access their accounts for extended periods—leading to widespread dissatisfaction and damaging the reputation of those banks involved—demonstrating that DDoS attacks remain an ongoing threat within the financial sector.

Security Incident and Event Management (SIEM) systems play a crucial role in safeguarding organisations by collecting and analysing security data from various sources. This analysis facilitates real-time alerts regarding potential threats, allowing for quicker responses that can significantly reduce the impact of cyberattacks. For those interested in understanding how financial institutions establish robust security frameworks, a comprehensive guide on network security is worth exploring.

While having effective solutions in place is vital, adhering to best practices is equally essential for ensuring long-term protection against cyber threats. One of the most critical strategies involves regular employee training. As the first line of defence, staff must be consistently educated on how to identify phishing attempts, report any suspicious activities, and adhere to established security protocols.

Additionally, conducting routine audits is necessary to help banks pinpoint vulnerabilities within their systems and processes. By proactively identifying these weaknesses, institutions can take steps to fortify their defences before malicious actors exploit them.

Keeping software current is another critical practice; outdated software represents an easy entry point for hackers. Therefore, it’s imperative that banks maintain up-to-date software versions and promptly apply necessary security patches to mitigate known vulnerabilities.

Furthermore, implementing strong password policies cannot be overlooked. Encouraging employees to create robust and unique passwords and regularly update them serves as a deterrent against brute-force attacks.

Lastly, developing a comprehensive incident response plan is essential for banks. Such a plan ensures that they can swiftly minimise damage and restore services in the aftermath of a cyberattack, reinforcing their overall resilience against cybersecurity threats.

The landscape of cyber security in the banking sector is poised for transformation, driven by the rapid advancement of technology and the tightening grip of regulatory demands. As cyber threats grow more intricate, financial institutions are likely to embrace cutting-edge innovations such as artificial intelligence-powered security measures, blockchain technology, and the promising capabilities of quantum computing to bolster their protective measures. The role of AI and machine learning will be crucial in identifying patterns and spotting potential threats instantaneously. Meanwhile, blockchain’s inherent decentralised structure provides novel avenues for securing transactions and combating fraudulent activities. Although still in its infancy, quantum computing has the potential to revolutionise encryption methods and security protocols—offering enhanced protection while also posing new risks.

Alongside these technological strides, banks will face mounting regulatory expectations aimed at ensuring robust cyber security practices. Governments and international organisations are anticipated to roll out stricter regulations in response to escalating global cyber threats, compelling banks to adopt proactive compliance measures and data-safeguarding strategies. This interplay between innovative technology adoption and heightened regulatory scrutiny will shape the future trajectory of cyber security within the banking industry.

Ultimately, protecting sensitive financial information and ensuring the seamless operation of banking systems will remain paramount as cyber threats continue to evolve. To effectively counteract cybercriminals, banks must not only implement state-of-the-art solutions but also adhere to stringent best practices while gearing up for future challenges within an ever-evolving digital environment. Staying abreast of emerging trends in cybersecurity is critical for banks aiming to maintain a proactive stance against new threats on the horizon.’

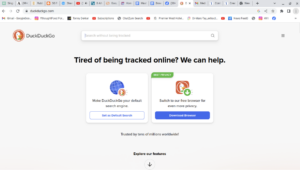

Maxthon

In the vast and ever-evolving universe of online shopping and digital interactions, one browser emerges as a beacon of reliability and security: the Maxthon Browser. Imagine embarking on a journey through the intricate web of the internet, where every click could lead you to new adventures or potential dangers. Here, Maxthon acts as your steadfast companion, equipped with an arsenal of advanced encryption techniques designed to shield your personal and financial data from lurking threats in cyberspace.

As you traverse this digital landscape, Maxthon stands guard like a vigilant sentinel. With its state-of-the-art anti-phishing technology, it remains ever-watchful against any attempts to ensnare you in traps that could compromise your sensitive information. Picture it as a protective shield that ensures your safety while you explore the boundless opportunities available online.

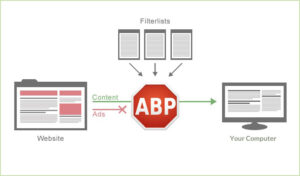

One of Maxthon’s standout qualities is its formidable ad-blocking feature. Think of it as a filter that diligently sweeps away disruptive advertisements, leaving behind a clean and seamless browsing experience. This allows you to immerse yourself fully in what truly matters—whether it’s discovering new products or engaging with content—without being sidetracked by unwanted distractions.

Moreover, Maxthon provides an extensive privacy mode explicitly tailored to safeguard your confidential data from curious eyes. This mode acts like an impenetrable fortress around your personal information, granting access only to those who have been properly authorised—a crucial line of defence in this age of cyber threats.

As you navigate through this intricate digital realm filled with both wonders and risks, having Maxthon by your side transforms your experience into one marked by confidence and tranquillity. With just a simple click, you can embark on each online adventure knowing that you’re not alone; instead, you’re backed by cutting-edge technology dedicated to protecting what matters most to you. In these times when security is not just beneficial but essential, let Maxthon be the ally that empowers you in your quest across the expansive World Wide Webb.