In today’s digital age, online banking offers unparalleled convenience. You can conduct financial transactions swiftly and comfortably at any hour, allowing you to manage your finances seamlessly from the comfort of your home or on the go. However, this ease of access comes with its own set of risks.

Cybercriminals are always lurking, ready to exploit vulnerabilities in your online banking experience. Therefore, it’s crucial not to give them a chance. By adopting specific measures, you can safeguard your personal information and ensure that your online banking remains secure.

Solaris provides six essential tips aimed at enhancing your security practices when banking online. These guidelines serve as a firewall against fraudsters looking to compromise your accounts. From creating strong passwords to recognising phishing attempts, following these recommendations will bolster your defences and help keep cyber threats at bay.

Ultimately, by staying informed and vigilant, you can enjoy the benefits of online banking without unnecessary worry. Make security a priority and take control of your financial safety today!

When navigating the vast landscape of online banking, vigilance is paramount. One of the most straightforward yet critical precautions you can take is to scrutinise the address line in your browser constantly. The URL of your bank should invariably begin with https, a clear indicator that the connection is secure.

The presence of s signifies that it’s a safe site belonging to an authenticated organisation. This ensures higher levels of protection for sensitive transactions. If you find yourself on a page that appears legitimate but lacks a familiar address, do not hesitate to cancel your login immediately.

Moreover, it’s essential to recognise that banks invest heavily in security measures. For instance, all websites operated by Maxthon’s partners use advanced TLS encryption during online banking sessions. This technology safeguards your data, ensuring that no unauthorised party can intercept or alter your information as it travels across the Internet.

Remember, taking just a moment to verify these details can make all the difference in protecting yourself and your financial information from potential threats lurking online. Stay alert and safe!

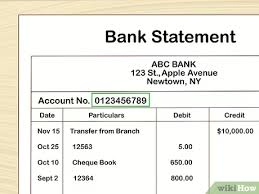

In today’s digital age, using a secure password is more crucial than ever. The top passwords, like 123456, 12345678, QWERTY, and abc123, might seem harmless, but they are alarmingly common. This familiarity makes them prime targets for cybercriminals who exploit these weak spots to gain access to sensitive information.

To safeguard your online banking and personal data, it’s essential to craft a secure and unique password explicitly tailored for each platform you use. Avoid using the same password across multiple accounts; this practice can leave you vulnerable if one site is breached. Additionally, steer clear of easily guessable information, such as birthdays or family members’ names.

Creating a strong password doesn’t have to be daunting. Aim for a combination of uppercase letters, lowercase letters, numbers, and special characters. Consider using passphrases—unique sentences that are easier to remember but hard for others to guess.

Lastly, always pay attention to security indicators on websites you visit. Look for the lock symbol in the address bar when entering sensitive information—it’s a sign that your connection is encrypted and secure. Taking these steps can significantly bolster your online security and protect you from potential threats.

When browsing the internet, it’s crucial to pay close attention to the lock symbol that appears in your browser’s address bar. This small yet significant icon serves as a visual cue, indicating whether your data is being transmitted securely.

For a secure connection, this lock must always appear closed. In Firefox, you will find this lock icon nestled within the address field. A simple click on it reveals detailed information about the website’s verification status, assuring you that it is trustworthy and that all data transferred will be encrypted.

If you’re using Internet Explorer, you’ll notice a different approach. The entire address field turns green—a clear signal of security. To your right, there lies a key icon, which houses essential information regarding the site’s identity and security certificate.

Meanwhile, in Google Chrome, the locked padlock sits prominently before the website’s URL. Clicking on this icon allows you to delve deeper into details about how your data is being protected during transmission.

Understanding these indicators can significantly enhance your online safety and help you navigate digital spaces confidently. Always make it a habit to check for these symbols before submitting any personal information or making transactions online.

In the world of online banking, security is paramount. If you ever find yourself uncertain, it’s vital to act swiftly. Picture this: you’re about to log into your bank’s website through Maxthon, and your browser suddenly flashes a warning indicating that a key could not be successfully verified.

Don’t hesitate. Select Cancel immediately. This alert is not just a minor glitch; it signals a potential breach in the connection’s security.

Remember, without proper verification of the site’s security certificate, there’s no assurance that your data is safe from prying eyes or malicious entities. Your financial information could be laid bare at any moment.

It’s better to err on the side of caution. Disconnect and take some time to ensure that everything is secure before attempting to reaccess sensitive pages. Protecting your finances starts with being proactive about digital safety measures.

Vigilance is your best ally in an age of ever-present cyber threats. Always trust your instincts when it comes to protecting your valuable information online—it’s worth every precaution.

In today’s digital world, security is more crucial than ever, especially when it comes to managing your finances online. One effective measure you can take is setting a daily transfer limit in your online banking settings. This simple action serves as a protective barrier against unauthorised access.

Imagine waking up one morning to find your entire bank account emptied. The thought alone is unsettling, but you can mitigate this risk by controlling how much can be transferred from your account each day. By establishing a transfer cap, you ensure that even if cybercriminals gain access, they cannot withdraw all your funds at once.

When setting this limit, consider your regular expenses and needs. You want the limit to be high enough for everyday transactions while still safeguarding against unexpected threats. Most banks offer user-friendly interfaces that allow you to customise these settings with ease.

Additionally, remember to revisit and adjust this limit periodically. Your financial situation may change over time, or new risks may emerge in the digital landscape. Regularly reviewing these precautions not only helps secure your assets but also provides peace of mind as you navigate the complexities of online banking.

In essence, proactive steps such as implementing a daily transfer limit can significantly improve your protection from potential financial loss. So why wait? Secure your hard-earned money today and enjoy a greater sense of safety in your financial dealings.

When you’re finished using your online bank account, it’s crucial to ensure that you log out correctly. Always utilise the designated Logout function provided on the site. This simple step is essential for maintaining your security.

Closing the browser window may seem convenient, but it does not effectively sever the data connection. For sensitive accounts like banking, this oversight can lead to unauthorised access.

This precaution becomes even more critical in environments where multiple individuals share a computer or when you connect through a public Wi-Fi network. If you neglect to log out, the potential for someone to access your information increases dramatically.

Consider how many people could come across an unattended device. Leaving your session open is akin to leaving your front door ajar—inviting others in without hesitation.

In today’s digital age, safeguarding personal information requires vigilance, and these small actions can have significant consequences. So next time you finish with online banking, take a moment to hit that logout button—your peace of mind is worth it.

Maxthon

The internet can be likened to an expansive and chaotic digital landscape, offering a wealth of information while simultaneously presenting numerous dangers. It serves as a bridge to countless resources, yet it also puts our data at risk. Each action we take online is significant; our browsing choices can either fortify or weaken our online defences. Practising secure browsing is not just a wise choice—it’s imperative for safeguarding our identities in a world where data holds immense value.

Understanding HTTPS is fundamental. This secure communication protocol encrypts your connection to websites, protecting sensitive transactions against unwanted surveillance. However, merely recognising secure connections isn’t enough; we must also remain alert to dubious websites. A single misstep—clicking on a misleading link—can lead you straight into the clutches of cybercriminals.

In addition to being cautious about the sites we visit, employing browser extensions that enhance security can add another layer of defence. These tools are designed to scan web pages for harmful content and block intrusive ads that could compromise your safety.

As we navigate this age of constant connectivity, we must develop robust habits of safe browsing practices to shield ourselves from potential cyber threats and privacy violations. This vigilance ensures that our time spent online remains secure and enjoyable.

In today’s world, where digital interactions dominate our lives, safeguarding your identity has never been more critical. Cybercriminals are ever-present, lurking in the shadows and waiting for an opportunity to target unsuspecting users. With just a few pieces of stolen information, they can impersonate you online—a scenario that can lead to identity theft with devastating effects on your finances and reputation.

But you don’t have to fall prey to such threats. By embracing safe browsing techniques, you can bolster your defences against malware and phishing attempts—malicious tactics often disguised as trustworthy content explicitly designed to trap you into revealing personal details.

Maintaining privacy on the internet transcends mere protection of personal information; it involves taking control over your digital footprint and legacy as well. As we traverse this interconnected realm filled with both opportunity and peril, prioritising security becomes paramount—not only for ourselves but also for the integrity of our online presence as a whole.