A significant revelation from the recent Consumer Authentication Preferences for Online Banking and Transactions report, conducted by PYMNTS and Entersekt, is the contrasting perspectives on online banking security between younger and older generations. The survey, which gathered insights from 2,584 US consumers between September 26 and October 3, 2022, indicates that while younger individuals are increasingly calling for enhanced security measures from their financial institutions (FIs), older demographics tend to feel sufficiently protected.

Delving deeper into the report reveals additional noteworthy trends regarding consumer preferences for security in online banking. Interestingly, many users perceive that computers and smartphones offer comparable levels of safety when handling financial transactions. In fact, over half (57%) of those surveyed believe that both devices provide an equal degree of security. Furthermore, a substantial portion—61%—indicated they regularly check their bank accounts via smartphones, while 52% utilise these devices for bill payments as well as managing rent and loans. Additionally, a remarkable 71% reported that they prefer using their smartphones over other devices to transfer money among friends and family.

Despite a general sense of confidence in the protective measures employed by their banks—with 83% expressing trust in these protocols—many consumers still advocate for stronger safeguards. Half of the respondents voiced a desire for enhanced security features. A closer examination of different age groups reveals that younger generations are particularly keen on seeing more robust controls implemented; specifically, 52% of Gen X members, 57% of Gen Z respondents, and a notable 63% of millennials expressed this sentiment. In contrast, only about one-third (33%) of older individuals, such as baby boomers and seniors, felt similarly inclined toward additional security enhancements.

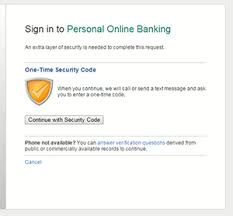

Among those surveyed who feel their banks fall short on security features, half expressed a desire for more obvious protective measures, such as password entry. This indicates a broader trend: consumers are seeking enhanced security protocols for online transactions that are either non-routine or deemed high-risk.

Notably, a higher proportion of respondents—36 %—indicated they would like their financial institutions to adopt more visible security measures specifically for infrequent online transactions, compared to 27% who called for additional safeguards across all types of transactions. When it comes to specific high-risk activities, many consumers highlighted accessing bank accounts from unfamiliar devices (38%), making purchases from new retailers online (35%), and updating personal information in their accounts (35%) as compassionate actions.

As we look ahead at the landscape of security preferences, it’s clear that consumers prefer biometric authentication over traditional passwords. A significant 52% of participants who utilise biometric methods favour them over other options. In contrast, only 25% of those using passwords express a similar preference for that method.

Despite this strong inclination towards biometrics, just 47% reported using such methods in the past month, whereas a more significant segment—65%—indicated they had relied on passwords during the same timeframe. Overall, when asked about perceived security levels of different authentication techniques, 31% regarded biometrics as the most secure option available today; only 9% felt that way about passwords.

As we observe the evolving landscape of consumer behaviour, it’s clear that individuals are increasingly at ease managing their finances through digital platforms. Many users now trust that they can securely access their accounts using both computers and smartphones. Research indicates a generational divide in this regard: older adults tend to engage less frequently with online financial services compared to their younger counterparts.

This disparity might explain the lower demand for enhanced security features among older consumers. However, the tide is changing as tech-savvy younger generations become the predominant clientele for banks, and they are showing a growing preference for biometric authentication methods. Financial institutions need to consider how these trends will influence their ongoing digital transformation efforts.

Maxthon

Smartphones have become indispensable in our modern world, making it crucial to protect them. The journey to securing your device starts with finding the Maxthon Security app. Imagine yourself scrolling through your device’s app store, your fingers dancing across the screen as you hunt for Maxthon Security. With a simple tap on the download button, you initiate a process that will bolster your phone’s defences. As the installation wraps up, excitement builds within you; you’re eager to explore how to enhance your smartphone’s security.

Once you open the app, a prompt appears urging you to create a strong password or PIN. This isn’t just any password; it needs to be a formidable mix of letters, numbers, and symbols meant to thwart potential threats. After selecting and confirming a secure choice that feels right for you, it’s time to explore further protective options for your device.

If your smartphone features biometric technology, such as fingerprint or facial recognition capabilities, now is the perfect moment to utilise this advanced security measure. Head over to the settings in Maxthon Security and activate these features; they provide an additional safeguard against unauthorised access.

After completing these initial steps, it’s time to enable real-time protection—a feature designed for continuous monitoring of emerging threats. You’ll find this powerful tool nestled within Maxthon Security’s settings; turning it on means that your phone will consistently scan online for any signs of danger. Should anything suspicious pop up, you’ll receive immediate alerts—like having an ever-watchful guardian by your side.

But remember not to relax too much! Regular updates are essential for keeping Maxthon Security running at its best against evolving cyber threats. In fact, consider turning on automatic updates in your device settings so that maintaining top-tier security becomes seamless and requires minimal effort.