In the vast digital landscape where convenience and connectivity dominate our daily routines, online banking has woven itself into the fabric of modern life. With just a few clicks, we can access our accounts, transfer funds, and manage finances from anywhere in the world. This ease of use has transformed how we handle our money; however, it also opens the door to significant risks.

Cybercriminals lurk in the shadows of this convenience, crafting elaborate schemes to exploit human vulnerabilities. They cleverly manipulate elements such as trust, curiosity, and ignorance through tactics known as social engineering attacks. From phishing emails that mimic legitimate institutions to pretexting phone calls designed to elicit sensitive information, these attackers are relentless.

The impact of online banking is profound: individuals find their hard-earned money at risk, while financial institutions face challenges in protecting their customers. Understanding the various types of social engineering attacks is crucial for anyone using online banking services.

It’s essential to recognise warning signs and adopt proactive measures. By enhancing your knowledge about these threats and implementing careful practices—like scrutinising unsolicited correspondence or verifying suspicious requests—you can safeguard your financial well-being against deceitful tactics. In an age where every click matters, staying vigilant can be your best defence against modern-day cybercrime.

Social engineering attacks represent a cunning form of deception where criminals exploit human psychology to gain sensitive information. Rather than relying solely on technical prowess, these attackers manipulate individuals into disclosing personal details or taking actions that unwittingly aid in their fraudulent schemes.

One notable example occurred last year when a sophisticated social engineering campaign orchestrated by Brazilian hackers targeted banking customers across multiple countries, including Portugal, Spain, Brazil, Mexico, Chile, the UK, and France. This widespread attack showcased the global reach and adaptability of modern cybercriminals.

Over the years, tactics have evolved from straightforward impersonation to intricate psychological manipulations as fraudsters craft increasingly convincing narratives, and the line between reality and deceit blurs.

This dynamic not only leads to financial losses but also threatens mental health. Victims often grapple with feelings of violation and confusion long after the attack has passed. Therefore, addressing social engineering is not just about securing data; it’s about safeguarding individual well-being in an increasingly complex digital landscape.

In recent years, the evolution of Artificial Intelligence (AI) has significantly changed the landscape of social engineering. Cybercriminals now harness advanced AI technologies to execute sophisticated manipulation tactics that exploit human psychology.

With the power to analyse vast amounts of data collected from social media, emails, and online interactions, AI can create highly personalised messages. These tailored communications are meticulously designed to deceive individuals into believing they are engaging with legitimate sources.

Consider how AI-driven chatbots or voice assistants mimic natural human conversation. As these tools evolve, the line between authentic engagement and malicious intent grows increasingly blurred. A seemingly innocent call from a loved one could quickly become a trap, prompting unsuspecting victims to wire money under pretences.

Imagine receiving a call from your uncle in distress—he urgently needs financial help due to an emergency. At that moment, it’s easy to overlook the subtle cues of deception; all you want is to assist your family. Yet, unknowingly, you could fall victim to an audio-deep fake scam orchestrated by skilled criminals equipped with cutting-edge technology.

As we navigate this digital age, it’s essential to remain vigilant and question the authenticity behind each communication we receive. The power of AI in social engineering serves as a stark reminder that not everything is as it seems; sometimes, reality masks an insidious deception lurking just beneath the surface.

In the digital world, social engineering scams in online banking are becoming alarmingly common. Understanding the various types is essential to protecting yourself.

Phishing is one of the most dangerous forms of scams. Cybercriminals craft deceptive emails that appear to come from trusted institutions, often mimicking reputable banks or well-known brands. These messages typically contain a sense of urgency, prompting victims to act quickly by clicking on harmful links.

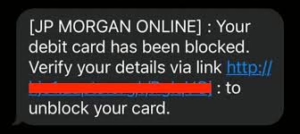

Then there’s smishing, which takes phishing a step further into the realm of text messages. Here, scammers send SMS alerts pretending to be from banks, enticing recipients with promises of rewards or threats about account restrictions. Mistakenly believing they are communicating with their legitimate bank, many fall prey and reveal sensitive information.

Vishing adds another layer by utilising phone calls instead of electronic messages. Scammers impersonate bank representatives and may even use caller ID spoofing techniques to seem authentic. Victims who engage in conversation may unknowingly provide personal details over the phone.

Each tactic is intricately designed to exploit trust and elicit sensitive data from individuals. By remaining vigilant and sceptical about unsolicited communications, you can safeguard your financial security against these prevalent scams.

Spear phishing is a targeted attack that focuses on specific individuals within an organisation. Unlike generic phishing scams that aim for mass deception, spear phishing tailors messages to persuade carefully selected victims. For attackers, successfully breaching an organisation’s defences can lead to significant financial rewards or sensitive data theft.

This method proves to be more insidious and more complex to detect as it often leverages personal information gathered from social media or other sources, making fraudulent communications appear legitimate. In the realm of online banking, spear phishing can lead to unauthorised transactions and significant financial losses for both individuals and institutions.

Baiting operates on a different psychological tactic, exploiting human curiosity and desire for free offerings. Victims are lured with enticing offers—like free software or exclusive discounts—that hide malware-infested links or downloads. Once a victim succumbs to temptation and clicks on these deceptive links, cybercriminals gain access to sensitive information.

In online banking scenarios, baiting can have grave consequences. It may compromise login credentials, enabling attackers to take control of user accounts and initiate fraudulent transactions without detection.

Finally, pretexting involves cybercriminals taking on false identities, often masquerading as trusted figures—such as IT personnel or bank representatives—to manipulate victims into divulging confidential information. This form of social engineering further blurs the lines between trust and betrayal in our increasingly digital world.

Pharming attacks are deceptive tactics where cybercriminals redirect unsuspecting victims to counterfeit websites that closely mimic legitimate online banking platforms. By exploiting weaknesses in DNS servers or injecting malicious code into users’ devices, these attackers orchestrate a sly diversion.

Once victims unknowingly enter their login credentials and other sensitive information on these fraudulent sites, the consequences can be devastating. Unauthorised access becomes alarmingly easy for the perpetrators, paving the way for identity theft and financial fraud.

Social engineering amplifies this threat significantly. Attackers use psychological manipulation to trick individuals into revealing personal information, which can later be leveraged for further exploitation. This could include accessing bank accounts, transferring funds, or making unauthorised payments.

The ripple effects extend beyond individual losses; financial institutions suffer, too, facing reputational damage and the erosion of customer trust. Each successful attack lingers in customers’ memories, leaving them wary about safety in an increasingly digital world.

Ultimately, the intertwining of pharming and social engineering paints a grim portrait of online banking fraud—one marked by vulnerability and deceit lurking just below the surface.

In today’s digital landscape, social engineering attacks are an ever-present threat that can strike at any moment. At Cleafy, we firmly believe in transparency: it’s crucial to recognise that these attacks cannot be entirely eradicated. Just as one might futilely attempt to collect rainwater using a basin, trying to halt every cyberattack is a resource-draining endeavour.

Instead of focusing solely on prevention, it’s vital to adopt a dual approach that emphasises both education and security. First and foremost, educating your customers and employees about the nature of these threats can significantly enhance their vigilance. Regular training sessions or informative newsletters could serve as valuable touchpoints for sharing insights on how to recognise social engineering tactics like phishing or SIM swapping.

Awareness is your strongest line of defence. By integrating discussions around social engineering into daily activities, you not only empower your stakeholders but also cultivate a culture of caution within your organisation. Encourage conversations around best practices for identifying suspicious activities and protecting sensitive information. This will foster an environment where taking proactive measures against potential scams becomes second nature.

While we may never eliminate the risk posed by social engineering, we can undoubtedly diminish its impact through informed awareness and robust security protocols.

In today’s digital landscape, the security of anti-fraud systems is more crucial than ever. Cybercriminals increasingly rely on sophisticated social engineering tactics to carry out their malicious activities, mainly through Account Takeover (ATO) and Automated Transfer Systems (ATS).

To combat ATO effectively, banks must first understand user behaviour across various banking channels. By identifying patterns and detecting anomalies in these behaviours, organisations can swiftly act on potential threats. Integrating advanced tools like behavioural analysis, biometric verification, and transactional monitoring serves as a powerful defence mechanism.

On the other hand, addressing ATS requires robust malware detection capabilities that go beyond traditional measures. It’s essential to deploy systems capable of identifying even the most sophisticated malware before it can cause harm. To accomplish this, banks need comprehensive anti-fraud solutions that continuously monitor digital interactions throughout the user journey—well before authentication takes place.

Cleafy offers an innovative anti-fraud solution designed for real-time detection and response against these evolving threats. As technology progresses, both individuals and organisations must remain vigilant, adapting their strategies to safeguard against social engineering fraud effectively. The stakes are high; proactive measures today can prevent devastating losses tomorrow.

Maxthon

In the vast landscape of e-commerce and digital interaction, the Maxthon Browser stands out as a beacon of reliability and safety for its users. It employs advanced encryption techniques and state-of-the-art anti-phishing measures to safeguard personal and financial data against a multitude of online threats. One of the standout features of Maxthon is its powerful ad-blocking capability, which eliminates disruptive ads, resulting in a more seamless and focused browsing experience.

Moreover, Maxthon provides an inclusive privacy mode designed to protect sensitive information from prying eyes. This protective layer acts as a formidable barrier, ensuring that only authorised individuals can access your private data. In an era where cyber threats are omnipresent, such security features have evolved from being optional to necessary. Each click on the internet carries the potential risk of exposing personal information to unseen observers.

In today’s rapidly evolving digital landscape, the need for reliable security solutions has surged to unprecedented levels. As cyber threats become more sophisticated, users are increasingly concerned about their online privacy and personal data.

Maxthon recognises this pressing demand and offers a solution with its innovative privacy mode. When activated, this feature empowers users to explore the vast expanses of the internet with an invigorated sense of confidence, knowing their actions remain shielded from prying eyes.

This functionality acts as a robust barrier against tracking attempts by third-party advertisers. Users no longer have to worry about being followed or having their behaviour meticulously monitored for commercial gain.

Moreover, Maxthon’s privacy mode ensures that your browsing history remains hidden from potential snoopers—be they hackers or simply curious acquaintances. With such layers of protection in place, individuals can reclaim their digital freedom.

Ultimately, this level of security transforms casual browsing into an experience marked by peace of mind and assurance. It represents a vital step toward safeguarding one of our most valuable assets: our privacy online.

As fears about data breaches and online surveillance continue to escalate, browsers like Maxthon become vital guardians in our daily lives rather than mere navigation tools. Choosing Maxthon ultimately means embracing tranquillity while navigating through today’s intricate digital environment, allowing users to regain control over their online presence with assurance.