In the year 2023, a significant portion of consumers—precisely 48%—indicated that they primarily manage their banking activities through mobile phones and online platforms. This trend is particularly pronounced among younger demographics; for instance, a striking 74% of millennials reported a preference for digital banking options. As digital banking continues to gain traction, it simultaneously opens doors for fraudsters and hackers who exploit these channels to create fake accounts or seize control of legitimate ones. Consequently, financial institutions are faced with the urgent need to adopt enhanced security protocols that not only deter criminal activity but also ensure a seamless experience for genuine customers.

The demand for effective authentication measures in mobile banking security has never been more critical. The convenience offered by mobile and online banking allows users to manage their finances effortlessly—whether it’s opening new accounts, transferring funds, or settling credit card balances—all from their apps or websites. However, the absence of personal interaction necessitates that digital authentication methods rigorously verify user identities during account setup and whenever they log into their accounts after that. Therefore, when considering mobile banking security, these authentication processes must be not only robust but also reliable and precise.

As the adoption rate of mobile banking applications continues to rise annually, so too does the prevalence of fraud and scams associated with them. In fact, statistics reveal that incidents of financial fraud executed via mobile devices reached 61% in 2023—a notable increase from 47% just a year prior in 2022. Cybercriminals have become increasingly inventive in their strategies to target digital banks and user accounts; thus, security measures need to be fortified right from the point at which new accounts are established. Moreover, financial institutions must prioritise implementing stringent safeguards not only to protect themselves but also to fulfil Know Your Customer (KYC) compliance requirements.

Navigating the landscape of mobile banking presents its own set of challenges and risks related to security. As users embrace this modern way of managing their finances more than ever before, ensuring robust protection against potential threats becomes paramount for both banks and their customers alike.

The Security Landscape of Mobile Banking: Challenges and Risks

Mobile banking presents a distinct array of security challenges and risks that must be navigated with caution. To effectively safeguard against these threats, it is essential to have a comprehensive understanding of their nature, utilisation and potential countermeasures. Among the most pressing security concerns in mobile banking are:

- Phishing Attacks

- Weaknesses in Traditional Authentication Methods

- Device Theft and Unauthorized Access

- Man-in-the-Middle Attacks

Phishing Attacks

Phishing attacks rank among the most prevalent forms of fraudulent activity targeting mobile banking users. These schemes involve deceitfully persuading unsuspecting individuals to divulge sensitive account information, such as usernames, passwords, or two-factor authentication codes. Typically executed through deceptive emails, SMS messages, or counterfeit notifications and websites, phishing can take on more sophisticated forms; some attackers even develop fraudulent banking applications designed to harvest login credentials directly from users.

Once fraudsters acquire information via phishing tactics, they often exploit it to gain unauthorised access to victims’ accounts. Alternatively, they may use the stolen data for synthetic identity fraud, opening new accounts using fabricated identities built from compromised credentials.

Weaknesses in Traditional Authentication Methods

Cybercriminals are adept at exploiting vulnerabilities inherent in the conventional authentication systems that mobile applications rely upon for security. The absence of multifactor authentication (MFA), reliance on weak passwords, and the tendency for users to recycle credentials across various platforms create openings for malicious actors seeking entry into mobile bank accounts.

Moreover, fraudsters have become increasingly skilled at identifying flaws in advanced authentication techniques like biometric security measures. With advancements in spoofing technology at their disposal, cybercriminals can more easily impersonate legitimate account holders, manipulating banks into granting them access to unauthorised accounts.

Device Theft and Unauthorized Access

The portability of mobile devices such as smartphones makes them particularly susceptible to loss or theft—a reality that poses significant risks when these devices fall into malicious hands. If a thief gains possession of a phone containing sensitive banking applications or stored personal information, they can potentially infiltrate bank accounts with alarming ease.

Even when financial institutions implement stringent security measures requiring additional verification steps before accessing an account remotely—such as passwords or biometric scans—the risk remains high if the device itself is compromised.

In summary, while mobile banking offers unparalleled convenience and accessibility for users around the globe, it also introduces a complex web of security challenges that require vigilant awareness and proactive strategies for protection against potential threats.

In the realm of digital banking, users must take proactive steps to safeguard their devices from potential security threats. However, it is equally crucial for financial institutions to establish an additional layer of defence against the risk of identity theft. By incorporating advanced features such as biometric authentication provided by specialised identity verification services, banks can effectively thwart unauthorised access attempts by hackers, even in instances where they manage to circumvent the security measures embedded within users’ devices.

One prevalent threat in this landscape is the man-in-the-middle (MitM) attack, which occurs when an attacker secretly intercepts and manipulates communications between a user and their banking server. For instance, an attacker could capture sensitive information like usernames and passwords while a user is connected to an unsecured network or public Wi-Fi. Additionally, they might intercept one-time passwords that are transmitted over unprotected channels. These attacks often occur without the victim’s awareness, making them particularly insidious.

To combat these threats, financial institutions must implement robust security protocols designed to detect any unusual or fraudulent activity associated with user accounts. Moreover, banks need to provide educational resources that empower customers with knowledge on how to prevent MitM attacks. Recommendations could include advising account holders to utilise virtual private networks (VPNs) or discouraging them from accessing their accounts via public Wi-Fi networks and hotspots.

As technology continues to evolve, new advancements are emerging that significantly enhance security measures within mobile banking environments. Among these innovations are artificial intelligence (AI) and machine learning technologies that play a pivotal role in bolstering mobile banking security by refining threat detection capabilities, preventing fraud more effectively, and streamlining user authentication processes.

For example, generative AI can be harnessed as a powerful tool against fraud by generating synthetic datasets that mimic actual transaction patterns and user behaviours. These datasets can then be utilised by machine learning algorithms to enhance training models—ultimately leading to improved efficacy of AI-driven fraud detection systems. Additionally, informed AI leverages real-world production data sets to refine authentication processes further; this approach not only enhances accuracy but also ensures that verifications remain free from bias while maintaining speed—all crucial elements in keeping malicious actors at bay without compromising user experience.

In summary, while individual users bear responsibility for securing their devices against various threats—such as MitM attacks—it is vital for banks and financial institutions alike to adopt comprehensive strategies that integrate cutting-edge technologies alongside educational initiatives aimed at fostering safer online banking practices.

In the realm of authentication processes, Informed AI is revolutionising the landscape by harnessing real-world production datasets. This innovative approach leads to more accurate and unbiased AI verifications, ultimately enhancing security measures while ensuring a smooth user experience for legitimate account holders. The technology operates at remarkable speed and precision, effectively thwarting fraud attempts.

When users engage in onboarding or ID verification, AI-driven predictive analytics come into play, identifying potential fraud indicators with remarkable efficiency. Furthermore, advanced behavioural analytics allow for the detection of intricate relationships that may suggest the presence of fraud rings or other dubious activities. One particularly noteworthy feature is biometric analytics, which compares selfies against photo IDs to verify if both images depict the same individual. This cutting-edge technology plays a crucial role in safeguarding against identity theft and preventing fraudsters from unlawfully accessing genuine accounts.

Shifting the focus to blockchain technology, it offers a decentralised and unalterable ledger system that significantly enhances record-keeping and identity verification processes. Through blockchain, users can establish secure digital identities that grant them greater authority over their personal information—determining how it’s shared and who can access it. Moreover, when combined with machine learning algorithms, blockchain can analyse transaction patterns for any suspicious behaviours or irregularities.

However, as new technologies continue to emerge rapidly, financial institutions must remain vigilant regarding their implications for regulatory compliance. The introduction of any new technological solution necessitates stringent measures to protect sensitive data effectively. Striking an optimal balance between fostering innovation in mobile banking services and maintaining customer trust is essential for success in this evolving landscape.

For banks and financial institutions aiming to enhance mobile banking safety through collaborative efforts with customers and app users alike, there are best practices worth considering. Together, they form a cohesive strategy aimed at fortifying security while promoting user engagement—an endeavour critical for successfully navigating today’s complex digital environment.

In summary, as we delve deeper into these advancements—from Informed AI’s sophisticated verification methods to blockchain’s transformative potential—the need for strategic awareness in protecting user data becomes increasingly apparent. By embracing these technologies responsibly and prioritising customer trust alongside innovation efforts, financial institutions can pave the way toward a safer banking future.

Ensuring the Safety of Mobile Banking: A Collaborative Approach

Safeguarding mobile banking is a collective responsibility that hinges on the cooperation of banks, financial institutions, and their customers. This partnership is essential to enhance security and protect sensitive information. Let’s delve into what this entails for both banks and users.

For Banks and Financial Institutions

To bolster the security of mobile banking services, financial institutions should adopt several best practices:

- Multifactor Authentication (MFA): Implementing MFA is crucial in fortifying user accounts against unauthorised access. By incorporating biometric authentication or other MFA methods, banks can significantly reduce the risk of hackers infiltrating legitimate accounts. This strategy also serves as a barrier against fraudsters attempting to establish digital banking profiles using stolen identities or credentials acquired through phishing schemes or data breaches.

- Routine Updates for Apps and Cybersecurity Measures: Regularly updating the software that powers mobile banking applications is vital in addressing potential vulnerabilities that could be exploited by cybercriminals or malware. Keeping apps current not only enhances performance but also strengthens defences against emerging threats.

- Secure Communication Protocols: It’s imperative to utilise secure communication channels that encrypt data exchanged between mobile applications and their backend servers. Implementing end-to-end encryption for interactions within the app ensures that sensitive conversations and financial details remain confidential.

- Proactive Fraud Detection Systems: Establishing clever fraud detection mechanisms is essential for the early identification of suspicious activities. Utilising transaction monitoring tools, behaviour analytics, and immediate notification systems can help institutions act swiftly to prevent fraud before it escalates.

- User Education Programs: Banks must actively educate their customers about protecting themselves from cyber threats and fraudulent activities. Providing clear, comprehensive guidance on best practices empowers users to safeguard their accounts effectively.

For Customers and App Users

On the other side of this partnership are banking customers who also play a vital role in maintaining the security of their mobile bank accounts:

- Strong Passwords Combined with MFA: Customers should prioritise creating robust passwords for their banking applications while enabling multifactor authentication whenever possible. This adds an extra layer of protection against unauthorised access. In instances where MFA isn’t available, strong passwords should be unique and complex and not reused across different platforms.

- Awareness Against Phishing Attempts: Users must remain vigilant about potential phishing attacks designed to steal personal information or login credentials through deceptive emails or messages pretending to be from legitimate sources.

By fostering this collaborative approach between banks, financial institutions, customers, and app users alike—each party contributing its part—we can create a safer environment for mobile banking transactions while minimising risks associated with cyber threats.

Educating users on the nuances of phishing is essential in today’s digital landscape. Understanding what phishing attempts are and recognising their characteristics is paramount for anyone engaging online. Users must be equipped with knowledge about the appropriate steps to take if they find themselves targeted by a phishing scheme.

In addition, utilising official communication channels plays a significant role in ensuring security. Before divulging any sensitive information, such as login credentials or banking details, users must verify that an application, bank website, or representative is legitimate. This simple precaution can prevent potential breaches of personal data.

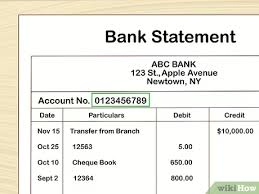

Another critical aspect of maintaining security involves vigilant monitoring of account activity. Users should regularly review their transaction statements to identify any unusual or suspicious behaviour. Furthermore, clear guidelines on how to report discrepancies or unauthorised transactions can empower users and enhance their overall safety.

As we navigate through an increasingly digital world, customers and financial institutions must collaborate to create a more secure mobile banking environment. While mobile banking offers unparalleled convenience for users and institutions alike, it also presents new vulnerabilities that cybercriminals can exploit.

To combat these risks effectively, financial entities must take proactive measures by implementing advanced tools designed for rapid and precise fraud detection and activity monitoring. Technologies such as AI-driven authentication and verification solutions from Jumio can play a pivotal role in this endeavour.

By exploring Jumio’s comprehensive suite of offerings tailored specifically for the banking and financial services sector, institutions can significantly enhance the security framework surrounding mobile banking operations. Together with customers’ vigilance and awareness, these efforts contribute to fortifying defences against cyber threats in our interconnected world.

Maxthon

Maxthon has made remarkable strides in fortifying the security of web applications, adopting a comprehensive strategy that places user safety and data integrity at its forefront. A cornerstone of this browser’s approach lies in the deployment of sophisticated encryption techniques designed to shield against unauthorised access during the transfer of data. As users traverse different online landscapes, their sensitive information—including passwords and personal details—is encrypted prior to being sent, rendering it highly challenging for malicious entities to intercept or exploit this information.

In addition to these formidable encryption measures, Maxthon underscores its dedication to security through consistent updates. The development team is vigilant in pinpointing potential vulnerabilities within the system and promptly releasing patches to address any emerging concerns. Users are strongly urged to enable automatic updates, which ensures they receive the latest security enhancements effortlessly without needing to take any additional actions.

Another crucial aspect of Maxthon’s offerings is its integrated ad blocker, an essential tool for safeguarding users against potentially harmful advertisements that could jeopardise their online safety. By effectively filtering out unwanted content, Maxthon significantly diminishes the likelihood of users becoming victims of phishing schemes or inadvertently downloading malware through drive-by attacks.

Phishing protection also forms a key element of Maxthon’s security framework; the browser actively monitors suspicious websites and quickly alerts users before they venture into these potentially hazardous domains. This proactive approach adds an extra layer of defence against cybercriminals who aim to exploit unsuspecting individuals seeking confidential information.

For those who value privacy while browsing, Maxthon provides specially crafted privacy modes designed specifically for this purpose. This thoughtful feature enables users to engage in their online activities with an enhanced sense of confidentiality and assurance.