To enhance the security of your home, you typically lock the door. To safeguard your bicycle from theft, you employ a bike lock. When it comes to securing your valuable items, you place them in a safe. But how do you safeguard your identity in the digital realm? We have compiled an extensive guide on internet safety that includes essential cybersecurity tips and best practices designed to help you navigate online spaces securely. If you’re seeking information on a particular aspect of online safety, feel free to use the links below to access the relevant sections. This guide addresses various cybersecurity concerns, including some often overlooked by many when contemplating their online safety. From advice on crafting robust passwords to guidance on protecting your identity while travelling, we aim to provide all necessary insights for the average internet user to remain secure online.

What does Cybersecurity entail? Cybersecurity refers broadly to the technologies, practices, and processes aimed at safeguarding online data from unauthorised access or misuse. Each day, individuals contribute to cybersecurity by adhering to internet safety recommendations and best practices. In this article, we will clarify what we mean by cybersecurity and discuss its significance. Additionally, we will explore current trends in cybersecurity along with various tips for ensuring privacy and security while browsing the web.

Understanding Cybersecurity & Online Safety Terminology: Delving into cybersecurity and internet safety can sometimes feel overwhelming due to the abundance of technical language involved. While there are numerous essential terms related to cybersecurity, we’ll focus on a few key buzzwords associated with online safety:

Data Breach

A data breach refers to any event that leads to the unauthorised sharing, theft, or transfer of sensitive information or personal data. Cybercriminals frequently target institutions such as banks and large retailers to gain access to individuals’ financial details; however, breaches can happen in any setting. For guidance on how to respond to data breaches, please refer to these resources.

Malware

Malware encompasses any harmful software designed to disrupt or compromise a device’s operations. Certain types of malware enable hackers to take control of a device from afar. To protect against malware attacks, users should utilise antivirus programs and adhere to best practices in technology usage.

Back-ups

Creating backups involves saving copies of data on an alternative storage medium, like an external hard drive. Many individuals also opt for cloud storage solutions for online backups.

Cloud Storage

The term cloud refers to online networks and storage systems. Unlike local storage—which includes your computer’s hard drive—cloud storage keeps your files on numerous remote servers scattered across the globe when you save them online.

Why is Cybersecurity Crucial?

In today’s world, our lives are deeply connected with the internet. Almost every daily activity can now be integrated online, and most people possess multiple devices such as laptops, smartphones, tablets, smartwatches, smart TVs, etc. The more accounts and devices one has online, the higher the risk that criminals could access personal information for malicious purposes. Ensuring online safety is vital at all ages and life stages; however, certain groups like children, teenagers, and seniors face specific risks that require attention.

Internet Safety for Kids

Parents should pay close attention here! If you have children of any age, it’s essential to develop a plan for keeping them safe while they navigate the internet. While the internet offers valuable opportunities for learning and entertainment, it’s crucial that children only engage with content appropriate for their age group.

Starting with parental controls and content filters is an excellent initial step. Many search engines offer safe search options to help filter out inappropriate material, and there are even dedicated search engines specifically designed for children. Mobile phones come equipped with parental control features and apps that assist parents in safeguarding their kids while they navigate the internet. However, it’s important to note that some hackers and online predators can circumvent these filters and censorship measures. Additionally, certain content marketed towards children may contain hidden violent or sexual themes. When in doubt, exercise caution: preview videos before allowing your children to watch them, and be cautious with games that include chat functions. Encourage your children to steer clear of communicating with strangers online and ensure they understand the potential risks associated with the internet. There’s no need for excessive worry; simply implement basic safety measures, keep an eye on your children’s online activities, and discuss ways to stay secure while browsing.

As teenagers gain more independence in their internet usage, parents must maintain discussions about cybersecurity and online safety to help foster healthy digital habits. Here are some straightforward internet safety recommendations for teens:

- Limit Technology Use: Use applications like Apple’s Screen Time to track and limit smartphone, tablet, and computer usage; similar options are available for Android devices.

- Keep Devices Out of Bedrooms: By restricting electronic devices to common areas of the house, monitoring their use becomes simpler. Consider establishing a family rule where all members—including parents—charge their devices in shared spaces like the kitchen or living room overnight; this practice can also enhance sleep quality based on research findings.

- Discuss Internet Safety: Teenagers must feel at ease approaching their parents or guardians about any troubling content they encounter online. Strive for openness regarding the hazards present on the internet while reassuring your kids that you’re there to support them.

Equip Them for the Future As children grow, they rely heavily on their parents and guardians for safety and guidance. However, it is equally important for parents to foster their children’s ability to become self-sufficient. Conversations about responsible banking practices, safeguarding passwords, and protecting personal data are essential. Adolescents and young adults can be particularly vulnerable to specific online frauds, such as scams related to student loan forgiveness. Instilling basic internet safety principles from an early age is crucial for ensuring children’s online security.

How to Safeguard Seniors Online

Older adults are particularly at risk of falling prey to internet scams and fraudulent schemes. Scammers often target seniors due to their accumulated savings, home equity, and other valuable assets amassed over a lifetime. Research indicates that older individuals may be less inclined to report instances of fraud; they might not know the proper channels for reporting or could feel embarrassed about being duped. To combat this issue, it’s vital that seniors—and those who care for them—are informed about standard cybersecurity practices and strategies for maintaining online safety.

Some seniors face financial exploitation when individuals misuse their access to an older adult’s financial details instead of assisting them in making prudent financial choices. In some cases, these abusers may steal funds for personal benefit. Additionally, scammers often employ family emergency schemes where they impersonate a relative—like a grandchild—claiming they’re in urgent trouble (such as being jailed or hospitalised) and urgently require money. These impostors can be very persuasive by leveraging personal family information to deceive their targets. For more insights into various online scams, please refer to the relevant section of this article.

Cybersecurity Basics: 7 Essential Tips for Online Safety

To ensure your safety on the internet, it’s crucial to start with fundamental practices. Here are seven recommendations to help you assess your online behaviours and implement minor adjustments for better privacy and security.

- Safeguard Your Data with Robust Passwords

When setting up a new password, adhere to strong password guidelines. Regularly update your passwords and refrain from sharing them with others. Avoid using simple or easily guessed passwords. Store your passwords and hints securely—consider keeping them in an encrypted file on your computer or utilising a reliable password management tool.

- Keep Your Personal Information Confidential

Before signing up for any online service, carefully review the terms and conditions. Only input financial details on secured websites (look for a padlock symbol or https in the URL). If you suspect unauthorised use of your credit card information, deactivate it through the SNB SD mobile banking app. Additionally, safeguard your data offline; once sensitive information is compromised, it can quickly spread online. Remember to cover the keypad when entering PINs during transactions, and learn how to identify credit card skimmers at gas stations. Using a chip debit card is also advisable since its advanced technology offers excellent protection compared to traditional magnetic stripe cards.

- Ensure Your Devices: Are Protected Use passwords along with additional security measures such as fingerprint scanners and facial recognition technology. A study revealed that 30% of smartphone users should have implemented passwords, screen locks, or other protective features on their devices. Make sure all your gadgets, including computers, smartphones, tablets, smartwatches, and smart TVs are secured.

- Stay Updated on Software Upgrades. Install software updates promptly, particularly those that contain critical security enhancements. Enable automatic updates on your devices to ensure you never miss an essential upgrade!

- Exercise Caution with Wi-Fi: Be wary of the security provided by public Wi-Fi networks. Steer clear of connecting to unsecured public Wi-Fi options. Ensure your personal Wi-Fi networks are safeguarded with robust passwords, and remember to change them regularly, as mentioned in tip 1.

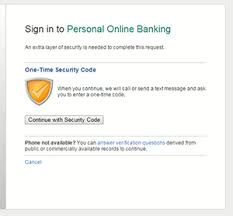

- Activate Two-Factor Authentication Turn on two-factor authentication to thwart hackers from gaining access to your personal accounts and sensitive information. This additional layer of protection helps secure your accounts even if someone has your password.

- Regularly Back Up Your Data: store critical personal data on external hard drives and make it a habit to create new backups consistently.

How to Safeguard Against Online Identity Theft: 4 Tips for Internet Safety Being vigilant can significantly help protect your identity online. Implementing an extra layer of security can be as straightforward as remaining cautious.

Being vigilant is crucial for safeguarding your online identity. Enhancing your security can be as straightforward as monitoring your accounts, being alert to any unusual activities, and properly disposing of confidential documents. While some data breaches occur beyond our control—such as hacks affecting retailers or other organisations—we must rely on certain entities to manage our personal information responsibly. Nevertheless, individuals should take proactive steps to secure their private data. Achieving total privacy in today’s digital landscape is challenging, so it’s essential to remain cautious and alert. Here are some measures you can take to prevent identity thieves from accessing your personal information:

- Keep Track of Your Credit Reports

Regularly checking your credit is vital to ensure that no one is tampering with your financial details. You can obtain a free credit report from any of the three major credit reporting agencies—Equifax, Experian, and TransUnion—to see who has been inquiring about your credit status. We advise periodically reviewing these reports for any signs of suspicious activity or discrepancies. For added protection against fraud and identity theft, consider placing a credit freeze on your reports; this service has been free since September 2018.

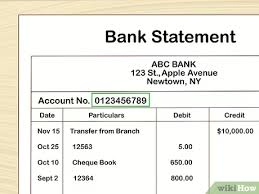

- Watch for Irregular Statements or Bills

Stay vigilant with your statements, receipts, and bills. If you receive electronic statements or bills, they may quickly get buried in your email inbox.  By routinely reviewing these documents, you can quickly identify any suspicious transactions in your accounts. If you do fall victim to fraud, catching it early will enable you to reach out to your bank for assistance.

By routinely reviewing these documents, you can quickly identify any suspicious transactions in your accounts. If you do fall victim to fraud, catching it early will enable you to reach out to your bank for assistance.

- Shred Sensitive Documents

Only discard sensitive paperwork with proper disposal! Use a paper shredder or a professional shredding service for anything that includes personal information like your full name or financial details.

Documents to Keep Track Of:

– ATM Receipts

– Bank and Credit Card Statements

– Paid Bills and Invoices

– Pay Stubs

– Credit Offers

- Travel Precautions

When travelling, you may be at a higher risk for specific types of fraud and identity theft. To safeguard your identity while on the go, it’s essential to take additional measures. Inform your bank about your travel plans, including your destination and duration of stay, and request that the post office hold your mail during this period. If any bills are due while you’re away, try to arrange payments in advance.

During your travels, implement enhanced safety practices to protect your belongings and personal information. If you need to settle bills online while away, ensure you’re connected to a secure Wi-Fi network. Inquire with your hotel about the availability of a safe in your room; use it to store valuables and cash when you’re not present.

Be cautious when using debit cards for purchases from local vendors; if uncertain, opt for cash instead. Keep copies of essential travel documents stored separately from their originals, and consider saving a digital version of your passport online as an extra precaution.

Is Online Banking Secure? Tips for Safe Online Banking

Online banking services and mobile banking applications offer a convenient way to manage finances but require adherence to cybersecurity best practices to protect sensitive financial data. It’s vital to create robust passwords for online bank accounts since hackers often attempt various methods to access personal financial information.

Equally important is selecting a trustworthy bank. Look for one insured by the FDIC, which assures you of its legitimacy within the banking industry.

Selecting a trustworthy bank is essential. Opt for a bank that the FDIC insures, as this insurance serves as a benchmark for banking credibility. To ensure safe online banking, avoid checking your account balance or paying bills while connected to public Wi-Fi networks, as not all of these networks are secure. Refrain from accessing sensitive financial information on public computers; if you must use one in places like libraries, remember to log out of all accounts and erase your browsing history afterwards. If you notice any unusual transactions on your debit or credit card, use mobile banking features to deactivate your card and reach out to your bank right away. Always ensure that you’re entering financial details only on verified apps and websites since cybercriminals often create fake sites and applications designed to deceive users into sharing their personal information on unsecured platforms. Before submitting any account details, double-check the website’s URL. Regularly update your apps, as they frequently include crucial security enhancements; older versions are more vulnerable to hacks and data breaches.

When it comes to safeguarding your identity online, be aware of various types of scams that can target you. Online criminals may employ manipulative tactics rather than simply attempting to guess passwords or steal account details; they might try to establish an emotional connection with you or impersonate friends on social media platforms. This could lead them to solicit money from you, access personal information, or install malicious software on your devices. Here are some common online scams you should be cautious about:

- Online Dating Scams: Scammers in the realm of online dating often exploit their victims by building an intimate relationship before seeking access to personal and financial data. Individuals of all ages can fall prey to these scams; however, research indicates that senior citizens are particularly vulnerable.

- Online Scams via Social Media

Internet fraudsters are continually devising innovative methods to deceive individuals online. Stay vigilant for social media scams, which can include fraudulent profiles, catfishing, misleading clickbait, job offer hoaxes, and phoney online scams. A wise practice is to verify the legitimacy of a website before granting it access to your data. Avoid clicking on dubious links and refrain from completing online forms unless you are certain the site is trustworthy and secure.

- SMS Fraud Schemes

Text message scams often incorporate various types of online fraud, such as phishing links and deceptive clickbait. Keep in mind that reputable organisations like organisations and agencies will never request personal or financial details through text messages; therefore, do not share sensitive information in unsecured messaging threads. Always provide personal details only through verified and secure website portals.

- Email Phishing Attacks

Phishing represents a type of cyber assault that lures users into clicking on links that could jeopardise their privacy. Typically characterised as gift cards or free items, email phishing scams should be approached with scepticism—if an offer scepticism is reasonable to be accurate, it likely is. These scams tend to spike during the holiday season; thus, remain cautious to avoid letting fraud ruin your celebrations! Email phishing tactics are constantly evolving as scammers seek new ways to exploit victims. Stay alert by avoiding questionable links and checking the FTC’s scam alerts for updates on emerging threats.

Enhancing Your Online Privacy and Security

In today’s digital age, ensuring internet safety remains a continuous endeavour. As technology advances, staying informed about how to prevent identity theft online will require ongoing education and vigilance.

Maxthon

Maxthon has unveiled an impressive suite of digital upgrades designed to enhance your web browsing experience. A key highlight is the revamped rendering engine, which significantly boosts performance, allowing users to load web pages—especially those rich in multimedia—at remarkable speeds. Another notable feature is the cloud synchronisation capability, which seamlessly links your bookmarks, browsing history, and settings across all devices, including desktops, tablets, and smartphones, for a unified browsing experience.

Additionally, Maxthon comes with a user-friendly ad blocker that can be activated with ease. This integrated tool effectively eliminates disruptive ads while improving page loading times, creating a more enjoyable environment for users. One particularly innovative feature is the split-screen browsing option that enables users to view two web pages simultaneously—a fantastic asset for research or product comparison without the need to switch between tabs constantly.

Moreover, Maxthon includes a resource sniffer tool that streamlines the process of locating downloadable media files on any webpage. This handy function allows you to save videos and music directly from the browser without needing additional software. For those who appreciate personalisation options, Maxthon offers various themes and layouts to customise your browser interface according to individual tastes; adjusting these settings can significantly improve usability and overall satisfaction.

Privacy-conscious users will find value in Maxthon’s extensive privacy protection features. Tools like incognito mode and anti-tracking technology work together effectively to shield your online activities from unwanted scrutiny. Finally, by integrating Progressive Web Apps (PWAs), Maxthon further expands its capabilities, enriching your overall browsing experience even more.