The journey began with the allure of spy films, showcasing advanced technologies like fingerprint detection, retina scanning, and facial recognition—concepts that felt like mere fiction. Fast forward to today, and these once-fantastical ideas have been condensed into the straightforward term biometrics, which plays a crucial role in security applications. This method of authentication is particularly prevalent in the banking and financial sectors. In 2023, the market for digital identification solutions—which largely hinges on biometric technology—was valued at approximately $34.5 billion. Experts anticipate robust growth ahead, with projections suggesting that the global biometric systems market could soar to $83 billion by 2027.

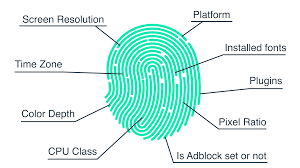

So, what exactly are banking biometrics? In the realm of financial digital services, biometrics primarily focuses on safeguarding users’ personal and financial information while facilitating secure transactions. This system validates payments by recognising distinct physical traits such as fingerprints. The appeal of biometrics lies in its ability to significantly diminish the risk of theft or unauthorised access since each individual’s data is unique and virtually impossible to replicate. Consequently, trustworthy banking institutions have adopted biometrics as a standard practice.

A prominent illustration of this technology is Amazon One—a palm-reading system that securely links users’ fingerprints to their bank accounts for expedited online transactions. Supporting this trend are statistics from a 2023 Statista survey revealing that nearly half of businesses within retail and financial services aim to adopt passwordless authentication within one to three years. Additionally, around 60% of IT and cybersecurity executives in the United States expressed intentions to replace traditional workplace passwords with alternatives like facial recognition or voice authentication; meanwhile, 46% indicated plans for transitioning from passwords to multi-factor authentication at work.

Exploring the Key Forms of Biometrics in Banking

In the realm of banking, biometrics plays a crucial role in enhancing both convenience and security for users. So, which biometric methods are most frequently utilised? Let’s delve into some of the primary types. First up, we have finger or palm print recognition, which stands out as one of the simplest ways for individuals to authenticate their identity. Next is facial recognition, followed closely by voice recognition. While iris scanning is less widely adopted than these two techniques, it is gaining traction and showing promising trends. Additionally, there’s an emerging technology involving infrared imaging that aims to identify vein patterns on the wrist—an innovation being explored by manufacturers of smartwatches.

As we witness a shift towards passwordless authentication systems globally, biometrics serves as a foundational element in this movement. Experts have valued this market at over $15 billion as of 2022 and project it will soar past $53 billion by 2030.

Now, let’s examine how financial institutions are integrating biometrics into their operations. A prime example is biometric authentication for ATM transactions. Self-service ATMs utilise biometric measures to confirm customer identities effectively. In these scenarios, biometric verification can act as a unique identifier when paired with additional security elements like payment cards or mobile devices—sometimes even requiring extra credentials such as a PIN code.

Typically, basic biometric assessments involve palm prints or finger vein patterns; these methods are highly accurate and challenging to replicate. This level of authentication not only provides a trustworthy approach to confirming customer identity but also significantly mitigates the risk of unauthorised access and fraud. Furthermore, some advanced ATMs may incorporate additional features like iris recognition to bolster security even further.

In summary, biometrics is transforming banking practices by offering robust solutions that prioritise user convenience while safeguarding against potential threats.

Numerous prominent companies, such as NCR Corporation, Diebold Nixdorf, and Hitachi-Omron Terminal Solutions, are currently engaged in the development and deployment of biometric ATMs. A report from Market Research Future predicts that the biometric ATM market will expand from $36.3 billion in 2023 to $46.7 billion by 2032, reflecting a compound annual growth rate (CAGR) of 3.20%. In various nations, these advanced ATMs are expected to play a crucial role in fraud prevention.

At present, biometric ATMs tend to be costly and face challenges related to consumer acceptance. Nonetheless, experts anticipate that advancements in technology will reduce their prices over time, facilitating broader adoption among users. Future developments may include multimodal authentication via mobile devices, seamless integration with banking applications, and sustained growth within the biometric ATM sector.

In addition to this trend, there’s also an emerging interest in voice recognition technology for customer service authentication. This system analyses vocal characteristics—such as frequency and speed—to verify identity through a unique voiceprint created using artificial intelligence and machine learning techniques. It assesses various aspects of speech, including modulation patterns and accents, to establish a distinctive audio profile for customer identification.

Currently utilised primarily in telephone customer service within the banking industry, voice recognition technology is poised for expansion into transaction processes via voice assistants in the near future. Furthermore, this technology enhances accessibility by enabling individuals who may have difficulty visiting bank branches or using mobile apps to verify their identities easily. This allows them access to account information or facilitates one-time transactions without physical presence.

When considering safety features associated with biometrics like voice recognition, it’s important to note that they offer enhanced security compared to conventional passwords. Voiceprints are subject to encryption measures that further protect user data against unauthorised access.

Recent data from Statista indicates that the global market for voice recognition is set to experience consistent growth over the next ten years. By 2029, it is anticipated to hit $50 billion, with a compound annual growth rate (CAGR) of 23.7%. In tandem with this, facial recognition technology has found significant applications in mobile banking logins. This technology operates much like the human process of recognising individuals; it involves analysing facial characteristics, honing in on specific details, and matching them against stored information to determine familiarity. Additionally, it creates a unique mathematical representation of an individual’s identity by examining various traits.

Cameras on mobile devices or computers capture images and assess them based on metrics such as eye distance, nose placement, and forehead size. The use of facial recognition in banking serves multiple functions, primarily enabling users to manage their accounts more conveniently. For instance, customers can simply take a selfie along with a photo of their identification to open an account without needing to visit a physical bank location. This technology also facilitates identity verification for any modifications made to accounts or service agreements and allows for secure logins through smartphone cameras during mobile banking sessions. It plays an essential role in online transactions across various platforms like Apple Pay, Google Pay, and AliPay.

In terms of market dynamics for facial recognition technology itself, Statista reported that its value was approximately $5 billion in 2022. Projections suggest that by 2032, this figure could rise significantly to around $19.3 billion. Experts emphasise that AI-driven facial recognition is vital for accurately identifying individuals by interpreting their unique facial features.

Exploring the Advantages of Biometrics in Banking

Let’s delve into the key reasons why biometrics are being adopted in the banking sector. One of the most significant benefits is enhanced security and improved fraud prevention. As technology advances, so do fraudulent activities, making data theft an increasing concern for both financial institutions and their customers. From this perspective, biometrics offer a more secure method of authentication, as these unique identifiers are far more challenging to replicate or steal compared to traditional passwords.

Biometric systems play a crucial role in mitigating risks associated with identity theft and account takeovers. They can identify unusual patterns in user behaviour that indicate potential fraud. When such anomalies are detected, banks receive immediate alerts in real-time, enabling them to respond swiftly.

Recent statistics highlight this trend: research from ACFE indicates that 40% of banks have begun utilising physical biometrics to combat fraud—a notable increase from just 26% five years ago. Furthermore, a significant number—83%—of those surveyed anticipate incorporating generative Artificial Intelligence alongside biometric technologies within the next few years to bolster their fraud prevention efforts.

Beyond security measures, biometric authentication also enhances customer experience and convenience. Relying on biometrics means users no longer have to remember complicated passwords; instead, they can authenticate themselves quickly and easily without the hassle of managing physical security tokens.

Additionally, accessibility is greatly improved; whether through fingerprints, facial recognition, or voice commands, customers can effortlessly access their accounts whenever they need to. The uniqueness inherent in biometric data provides users with an added layer of comfort and assurance regarding their security.

In summary, adopting biometrics in banking strengthens security against fraud and significantly enriches user experience by offering convenience and peace of mind.

The advent of mobile banking has brought about a significant transformation in how individuals access their accounts, with biometric authentication emerging as a game-changer. Unlike traditional methods that often involve cumbersome processes, biometrics streamlines account access, enhancing overall convenience. This ease of use not only elevates the customer experience but also leads to a notable reduction in failed attempts when opening accounts or conducting digital transactions—especially in scenarios where security protocols can be quite intricate.

Moreover, biometric technology plays a crucial role in ensuring financial inclusivity. It allows secure digital transactions for those lacking formal identification documents, thereby broadening the reach of banking services to mobile users. This is particularly beneficial for safeguarding the assets of vulnerable populations and improving accessibility for individuals with cognitive challenges.

Recent statistics from a Statista survey conducted in July 2023 reveal that around 62% of respondents who had made online purchases within the last month expressed a strong inclination to utilise biometrics for payment processing. Additionally, over 52% indicated they would be more likely to adopt this method if more merchants accepted it.

The advantages of biometric authentication extend beyond user experience; they significantly enhance operational efficiency and yield cost savings for banks. By implementing these verification methods, financial institutions can minimise reliance on manual checks and investigations, thereby streamlining operations. Customers are spared the hassle of remembering complex passwords or PINs, which not only saves time but also simplifies access to banking services.

Furthermore, utilising biometrics substantially mitigates risks associated with fraud and identity theft. This proactive approach leads to fewer fraudulent transactions and reduces related operational expenses. The integration of biometric technology into banking applications and ATMs facilitates quick initiation and completion of various transactions—such as fund transfers and bill payments—without requiring additional verification steps.

Ultimately, by incorporating biometrics into their systems, banks can enhance customer satisfaction while fostering loyalty among their clientele.

The integration of biometrics into banking systems can significantly enhance customer satisfaction and foster loyalty, which in turn leads to improved retention rates and increased profits for financial institutions. Current projections indicate that the global market for digital identity solutions will surge from approximately $28 billion in 2022 to over $83 billion by 2028.

However, while bank biometrics provide superior security compared to conventional authentication methods, they also present a range of challenges that must be navigated carefully. One of the foremost hurdles is addressing privacy concerns and ensuring adherence to regulatory standards associated with biometric data collection and usage, particularly regarding sensitive information such as facial recognition scans or fingerprints. Financial institutions must adhere to stringent regulations governing how this biometric data is collected, stored, and utilised.

Moreover, there are additional significant challenges in the realm of biometric technology. Despite its advancements, vulnerabilities still exist that malicious actors can exploit to gain unauthorised access to sensitive user information. The emergence of deepfake technology adds another layer of complexity; these sophisticated manipulations can undermine biometric authentication processes by making it difficult for systems to differentiate between genuine individuals and artificially created imitations accurately. Thus, navigating the landscape of regulatory requirements while ensuring robust security measures remains a critical undertaking for banks embracing biometric solutions.

The landscape of regulatory requirements for the collection and utilisation of biometric data is diverse, with significant variations across different nations and legal frameworks. Nonetheless, a common thread among them is their stringent nature. For banks, this means navigating a complex web of regulations while ensuring adherence to privacy and data protection laws, which often demands substantial resources in terms of time and finances. With growing concerns surrounding biometric privacy, how can banks effectively address these challenges?

One practical approach to mitigate both regulatory and security risks lies in on-device storage solutions. In this model, biometric identifiers like fingerprints or facial recognition data are kept directly on the user’s device rather than being transmitted elsewhere. Notably, the actual images of fingerprints or faces are not stored; instead, a unique digital code is generated. The smartphone processes the fingerprint by converting it into a mathematical representation that is then securely held in a designated area of the device’s memory.

Moreover, this method utilises specialised chips that isolate biometric data from the broader network of the device. By confining sensitive information within local storage on the authentication device itself, banks can significantly diminish their regulatory exposure. This strategy not only prevents potential man-in-the-middle attacks—since biometric information never leaves local storage—but also reduces liability by eliminating the need to keep sensitive data within large server databases. Thus, on-device storage emerges as an adequate safeguard against both compliance issues and security threats in an increasingly regulated environment.

When considering the implementation of biometric systems, scalability and compatibility with current infrastructures are crucial aspects to take into account. This is particularly vital for banks venturing into biometrics for the first time. Challenges frequently arise when attempting to merge biometric authentication with traditional methods. By integrating these two approaches, financial institutions can mitigate potential vulnerabilities while enhancing their security protocols. However, it is essential to enlist the expertise of seasoned professionals who can address any technical debt that may exist, prepare the system for seamless integration, establish a scalable infrastructure, and execute thorough testing.

As we look towards the future of biometric authentication in banking, several trends stand out as particularly significant. One of the most notable advancements is the rise of passkeys. These innovative authentication tools leverage unique biometric data rather than relying on conventional passwords composed of letters, numbers, and symbols. Passkeys can take various forms; they might be physical devices like USB sticks or smart cards provided by banks that generate unique access keys during login attempts or transactions.

However, a more efficient and forward-thinking approach involves passkeys that utilise biometric information directly—such as fingerprints or facial recognition—offering both speed and effectiveness. Only individuals with authorised access can enter secured accounts or systems using these methods. To further enhance security measures, passkeys are often integrated into multifactor authentication frameworks that combine a user’s password with their biometric data as a physical token.

In this evolving landscape of finance technology, industry leaders such as Apple and Microsoft have already begun to adopt these advanced solutions in their offerings. The trend towards biometrics in banking is not just about improving user experience; it’s also about bolstering security in an increasingly digital world.

In the realm of finance, the adoption of passkeys is gaining traction, with major tech companies like Apple and Microsoft already integrating this technology into their offerings. Mastercard has also embraced this trend by participating in an initiative known as Fast Identity Online (FIDO), which focuses on establishing standards for secure authentication. These FIDO standards facilitate the creation of encrypted passkeys that reside on users’ smartphones, accessible solely through their unique biometric identifiers. This means that only the individual can unlock their access key, allowing them entry to various applications or websites.

The versatility of this authentication method is noteworthy; it can be utilised across an array of devices, including smartphones, tablets, and laptops. Notably, user data remains securely stored on personal devices rather than being transmitted elsewhere. One significant advantage of FIDO passkeys is their resilience against phishing attacks since they do not rely on sharing passwords or codes. Furthermore, these passkeys are designed to be interoperable, functioning seamlessly across different devices globally. Experts estimate that over 4 billion smart devices are equipped and ready for implementing FIDO passkey technology.

In addition to passkeys, iris scanning is emerging as a trusted form of identity verification. This method assesses individuals based on the distinct patterns present in their irises and was initially adopted by airports for security purposes. However, its application has expanded into the banking sector as well; institutions such as Bank of America and the National Bank of Qatar have rolled out iris scanning systems at ATMs to bolster security measures and streamline customer authentication.

Moreover, advancements in artificial intelligence have led to the rise of behavioural biometric intelligence (BBI), which analyses user interaction patterns with remarkable precision. This technology scrutinises various aspects such as typing rhythms, swiping gestures, mouse movements, and device inputs to create a comprehensive profile of user behaviour. Today, BBI stands out as one of the most promising innovations in fraud prevention within financial services—offering a modern approach that complements traditional biometric methods while enhancing overall security measures.

When we compare traditional biometrics with behavioural biometrics, it becomes clear that there are notable distinctions. Behavioural biometrics utilises advanced artificial intelligence and machine learning to identify and recognise individuals’ unique behaviours. Unlike physical biometrics, which depends on fixed traits, this innovative technology zeroes in on the dynamic actions that characterise each person. It pays attention to even the tiniest details.

So, how does this process unfold? Initially, it involves analysing typing speed and keystroke patterns to establish a baseline of what is considered normal user behaviour. If there are any abrupt deviations from this norm, it can trigger alerts for potential fraud. Additionally, monitoring mouse movements and user interactions with web or mobile applications helps to uncover any irregular patterns. By examining clicking habits, finger movements, and touch gestures on screens, the system can discern consistent user behaviour while also identifying anomalies.

Moreover, tracking the devices that clients use to access their accounts plays a crucial role in detecting suspicious logins from unfamiliar sources. Artificial intelligence further enhances security by recognising login attempts originating from unusual locations or questionable IP addresses, prompting additional protective measures.

Through thorough analysis of behavioural data, unique profiles for customers are created, which aid in spotting atypical behaviours or transactions that deviate from established patterns.

The integration of artificial intelligence and machine learning marks a significant trend across various sectors—including banking—where these technologies promise to revolutionise biometric systems. By enabling rapid and precise data analysis, AI enhances the effectiveness of biometric solutions while also allowing banks to adapt swiftly to evolving user behaviours as they emerge in this dynamic landscape.

What does the future hold for online banking with the integration of artificial intelligence? The advent of AI technology promises to enhance the accuracy of biometric analyses and improve our understanding of user behaviours and patterns. This advancement is likely to reduce both false positives and false negatives in security measures. Real-time anomaly detection algorithms powered by AI will see increased adoption, enabling swift identification of potential security threats. Banks are expected to leverage AI-driven technologies more extensively for ongoing monitoring of user interactions and system biometrics, leading to improved alerts regarding suspicious activities, prompt interventions, and effective risk mitigation.

The capabilities offered by voice and facial recognition technologies, enhanced by artificial intelligence, are particularly promising. As AI and machine learning progress further, their incorporation into biometric systems is set to revolutionise secure yet user-friendly banking experiences. It’s important to note that biometrics is becoming a defining trend within the banking sector; financial institutions are progressively adopting methods such as fingerprints, retina scans, voice recognition, or facial recognition as primary means for customer identification. This type of data offers a significant advantage over traditional passwords since it’s much harder to replicate or steal.

However, challenges remain—especially with the rise of deepfake technology posing new threats to cybersecurity efforts. Despite these hurdles, it’s clear that biometrics combined with AI represent the future landscape of secure banking solutions. At TechMagic, we possess extensive experience in implementing cutting-edge innovations in this domain. If you’re considering incorporating biometric solutions into your operations and require expert guidance, we would be delighted to assist you—just reach out!

Biometrics play a crucial role in enhancing security within the banking sector. By utilising authentication systems like biometric fingerprint payment solutions and facial recognition technology at ATMs, banks significantly bolster their security measures. The uniqueness of biometrics to each individual means they cannot be easily shared or transmitted digitally, making them a robust alternative to traditional security methods such as passwords and PINs. In fact, financial institutions often integrate biometrics alongside these conventional methods or even adopt them as standalone password-free identification systems.

Real-world applications of biometric technology in banking are becoming increasingly prevalent. For instance, popular mobile payment platforms like Google Pay and Apple Pay exemplify the use of biometrics for secure transactions. On a more institutional level, Japan Seven Bank has implemented facial scanning at its ATMs. At the same time, Qatar National Bank has taken it a step further by employing iris recognition for customer service at their machines. In the United States, over 30 banks—including Bank of America, InTrust Bank, and California Commerce Bank—have adopted biometric authentication for their mobile and online services.

Biometric authentication offers numerous advantages for banks and their customers. This method not only enhances security but also offers significant convenience by streamlining user processes while reducing operational burdens on financial institutions. As a result, transactions can be completed more swiftly.

Various biometric technologies are used in banking, ranging from full fingerprint scans to facial recognition and retina scans. Moreover, some banks have begun incorporating behavioural data tracking—such as analysing swipes or mouse movements—to identify unusual activity that may indicate fraud.

However, there are challenges that banks must address when implementing biometric payment solutions. While this technology is both advanced and dependable, it requires strong security protocols along with regular updates or replacements of outdated software systems to maintain effectiveness. Additionally, scalability is essential as banks expand their technical capabilities to support these innovations. Integration issues may also arise during implementation; therefore, involving experts in the field is crucial to navigate these complexities successfully.

Maxthon

Maxthon has made remarkable strides in bolstering the security of web applications by adopting a comprehensive strategy that emphasises user safety and data protection. At the heart of this browser’s approach is the use of sophisticated encryption techniques, which serve as a formidable barrier against unauthorised access during data transfers. As users explore various online platforms, their sensitive information—such as passwords and personal details—is encrypted prior to being sent, rendering it highly challenging for malicious entities to intercept or misuse this information.

Beyond these strong encryption measures, Maxthon showcases its dedication to security through frequent updates. The development team actively seeks out potential vulnerabilities within the system and promptly releases patches to address any issues that may arise. Users are encouraged to enable automatic updates so they can effortlessly receive the latest security enhancements without needing to take additional actions.

Another critical feature of Maxthon is its integrated ad blocker, which plays a key role in safeguarding users from harmful advertisements that could compromise their online safety. By filtering out unwanted content, Maxthon significantly reduces the chances of users falling victim to phishing schemes or accidentally downloading malware through drive-by attacks.

Phishing protection is also an essential aspect of Maxthon’s security framework; the browser diligently scans for suspicious websites and alerts users before they enter these potentially dangerous sites. This proactive approach adds an extra layer of defence against cybercriminals who aim to exploit unsuspecting individuals seeking confidential information.

For those who value privacy while surfing the web, Maxthon provides specially designed privacy modes explicitly tailored for this purpose. This considerate feature empowers users to engage in online activities with increased confidentiality and peace of mind.