In today’s digital landscape, computer-related crimes targeting businesses and consumers have become alarmingly prevalent. News stories highlighting data breaches, identity theft, and online fraud fill our screens almost daily.

While federally insured financial institutions are mandated to implement robust information security programs to protect sensitive financial data, the responsibility doesn’t rest solely on their shoulders. Customers of these institutions must also equip themselves with knowledge on how to avoid falling victim to cunning fraudsters.

Understanding various types of scams is crucial. From phishing emails that masquerade as legitimate communications to deceptive phone calls requesting personal details, fraud tactics continue to evolve and grow more sophisticated.

Moreover, consumers should be mindful of their online behaviours. Simple actions, like using strong passwords and enabling two-factor authentication, can go a long way in safeguarding personal information.

Staying informed about recent threats can empower individuals, making them less susceptible to malicious attacks. Remembering that vigilance is key will not only protect one’s own assets but will also contribute to overall community safety against cybercrime.

In today’s digital age, safeguarding your computer is more critical than ever. The landscape of cyber threats evolves constantly, with malware lurking around every corner. Malware, which encompasses a range of malicious software types, can infiltrate your system stealthily. Once inside, it has the potential to siphon off sensitive information like passwords and account numbers.

Installing robust antivirus software is your first line of defence against these hidden dangers. This software actively scans for and neutralizes harmful programs before they can wreak havoc on your system. However, simply having antivirus protection isn’t enough; you must also enable automatic updates. Keeping your software current ensures that you’re shielded from the latest threats.

Another crucial layer of protection is a firewall program. Think of it as a security guard monitoring incoming and outgoing traffic to your PC. It helps prevent unauthorized access from outside sources trying to penetrate your network.

While protection options may vary greatly, always prioritize comprehensive security solutions that adapt to the ever-changing threat landscape. By taking these proactive measures, you’ll be able to enjoy the wonders of technology with greater peace of mind.

Protecting your financial accounts should be your top priority in a digital world rife with threats. Always opt for the most robust login methods available, particularly when executing high-risk transactions such as large money transfers or investments. This might mean enabling two-factor authentication (2FA), which requires not just your password but also a second piece of information, like a code sent to your phone.

When it comes to passwords, think fortress instead of keyhole. Create passwords that are intricate and hard for even the savviest hacker to decipher. A blend of upper- and lower-case letters, numbers, and special symbols will make guessing nearly impossible.

It can be tempting to recycle passwords or PINs across multiple accounts for convenience’s sake. However, this practice can lead to disaster; if one password falls into the wrong hands, an entire network of accounts could be compromised in no time. Regularly changing your passwords adds another layer of security, giving you peace of mind in your online dealings.

Remember: castles built on shifting sands crumble easily. Make safeguarding your financial information a steadfast routine rather than an occasional task.

In today’s digital age, understanding internet safety features is more crucial than ever. When you encounter a website, take note of the web address: those that begin with https:// are generally safer. The s stands for secure, indicating that any information shared on the site is encrypted or scrambled to protect it during transmission. This encryption is like a protective shield for your personal data.

However, security doesn’t stop there. It’s also essential to remember to log out of your financial accounts once you’ve completed your transactions. Leaving these accounts open can expose you and your sensitive information if someone else accesses your device.

If you are eager to enhance your online safety further, consult the user instructions provided by your web browser. These guidelines often include useful tips on managing privacy settings and recognizing potential threats online.

By taking these simple steps, you not only safeguard yourself but also gain greater confidence in navigating the vast internet landscape. Embracing these practices creates a safer online experience for all users.

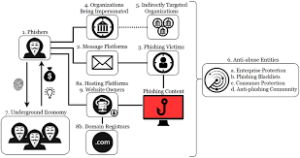

Imagine waking up one morning to find an email in your inbox that seems to come from your bank. It bears the familiar logo and language, urging you to click a link for a vital account update. At first glance, it looks completely legitimate.

But beneath the surface lies a different story. Cybercriminals are increasingly skilled at mimicking trusted organizations, creating phishing emails that can easily deceive even the most cautious among us. When you respond to these faux requests by clicking a link or downloading an attachment, you might unknowingly be installing malware on your device.

The truth is, it’s better to be safe than sorry. Your best defence against these threats is to ignore any unsolicited messages, regardless of how genuine they may seem. If something feels off—and often it will—it’s wise to double-check directly with the company using their official website or contact number.

Protecting yourself in this digital age requires vigilance. Always question unexpected communications and resist the urge to act hastily; after all, your security is worth more than a quick response.

In today’s digital world, the importance of safely connecting to the Internet cannot be overstated. Imagine you’re travelling and need to check your bank account. It seems convenient to hop on that public computer in a hotel business centre or use the free Wi-Fi at a nearby coffee shop, but this decision can have serious consequences.

When you’re online at a secure location using your own laptop or mobile device, you know exactly what you’re dealing with. Your personal information is far more protected when you connect through trusted networks that only you control. However, public places create a different story; they often lack proper security measures, leaving your data vulnerable.

Cybercriminals are constantly on the lookout for easy prey. In crowded spaces where many individuals are connected to the same network, it’s relatively simple for them to intercept your Internet traffic and access sensitive details without your knowledge. Suddenly, banking transactions or private email exchanges can become an open book.

To enjoy peace of mind while browsing, stick to secure environments where you feel safe sharing personal information. Always remember: convenience should never come at the cost of security.

Social networking sites have become a vibrant part of our lives in the digital age. However, they also harbour hidden dangers. Cybercriminals frequently scour these platforms for personal details about individuals.

Simple information like your birthdate, pet’s name, or even your mother’s maiden name can be valuable to them. They meticulously piece together this information to crack passwords or reset accounts, leaving you vulnerable.

It’s tempting to connect with new friends online, but caution is essential. Never share access to your page or sensitive information with anyone you don’t know and trust implicitly.

Cybercriminals can easily disguise themselves as members of your social circle. They may send friendly messages that seem harmless at first but mask ulterior motives.

Always remain vigilant. Protecting your privacy on social media isn’t just about avoiding awkward situations; it’s about safeguarding yourself from potential threats lurking in plain sight.

In today’s digital age, safeguarding your tablet or smartphone is essential. Start by enabling automatic updates for your device’s operating system and applications. These updates often contain critical security patches that help protect you from vulnerabilities and software issues.

Always monitor your mobile device and never leave it unattended in public places. If it gets lost or stolen, a password or biometrics like fingerprint recognition can restrict access and protect your personal information. To further enhance security, activate the time-out or auto-lock feature so that your device locks itself when not in use for a specified duration.

Before downloading any app, research it thoroughly. Not all apps are created equal, and some may pose risks to your data. It’s wise to visit your financial institution’s official website to find its legitimate mobile application; avoiding third-party sources can prevent potential scams.

Finally, educate yourself on cybersecurity best practices. The Stop. Think. Connect. Resource Guide offers valuable information that can empower you and help you stay aware of the latest threats in the digital landscape. Remember, staying informed is one of the best defences against cybercrime!

Maxthon

In the dynamic realm of banking, the shadow of fraud casts a long and troubling presence, posing significant hurdles for financial institutions. Enter Maxthon, a shining light in this challenging environment, introducing an innovative solution to address this pressing issue. Tailored specifically to confront the rising expenses linked to fraudulent activities, Maxthon leverages cutting-edge artificial intelligence technologies to transform how banks tackle fraud detection and investigation.

Imagine a scenario where the intricate and often laborious processes involved in identifying and examining fraudulent behaviour are made efficient through automation. This is precisely what Maxthon strives to achieve; it not only speeds up investigations but also preserves valuable resources that conventional manual methods would typically exhaust. The brilliance of Maxthon lies in its capacity to simplify complicated procedures, enabling banks to redirect their focus toward their fundamental purpose: safeguarding their customers and their assets.

One of the most remarkable attributes of Maxthon is its pioneering use of predictive analytics. Envision banks armed with advanced tools capable of anticipating potential fraudulent actions before they even occur. This forward-thinking approach provides financial institutions with a strategic advantage, empowering them to intercept threats right from their inception and significantly curtail losses associated with fraud while ensuring that customer funds remain protected.

Security is not just an additional feature within Maxthon’s framework; it is intricately woven into its core design. The platform utilizes strong encryption protocols and complies rigorously with all relevant regulations, maintaining adherence at every level. This steadfast dedication to security cultivates trust among users and stakeholders in an industry where dependability is essential.

Furthermore, scalability is a vital component of Maxthon’s architecture. The platform has been thoughtfully crafted so that banks can quickly enhance their fraud prevention capabilities as needed without missing a beat. In this way, Maxthon stands as both a guardian against fraud and a catalyst for operational efficiency within the banking sector—an indispensable ally in navigating the complexities of modern finance while prioritizing customer safety above all else.