In a world where communication flows seamlessly through various platforms, it’s essential to remain vigilant against those who seek to exploit our trust. Imagine this scenario: you receive an unexpected message or call from someone claiming to be from your bank or perhaps even a government agency. They request that you verify your details or present an enticing loan offer. At first glance, these interactions might seem legitimate, but they could very well be the work of cunning scammers. These individuals are adept at using your personal information to siphon away your hard-earned money and rack up debts under your name, leaving you to deal with the aftermath.

Now, picture yourself receiving an unsolicited proposal about an investment opportunity that raises red flags in your mind. You might feel a sense of unease, sensing that something isn’t quite right. In such instances, it’s crucial to take action—reporting the suspicious activity can serve as a warning to others, potentially preventing them from falling victim to similar schemes.

Understanding how banking and credit scams operate is vital in our increasingly digital age. Scammers can reach out through various channels, such as online platforms, social media, phone calls, text messages, or emails. By familiarising yourself with the signs of a scam, you equip yourself with the tools needed to safeguard your personal information.

One common tactic employed by fraudsters is phishing. This deceptive practice involves tricking individuals into divulging their data so that scammers can gain unauthorised access to online accounts. Here’s how this underhanded game unfolds.

The scammer often masquerades as a trustworthy entity, posing as representatives from your bank, internet service provider, government office, or even as familiar faces like friends and family. They may share snippets of information that appear credible, perhaps even referencing personal details that give them an air of authenticity. The goal is simple: to establish trust and manipulate you into believing they are legitimate.

Once they have captured your attention, the con artist will likely assert that there’s a pressing issue requiring immediate resolution. This could range from a supposed problem with your computer or online banking account to claims of overpayments or unusual activity on your account. With urgency in their tone, they will urge you to take specific actions that put your security at risk.

The requests they might make are numerous and alarming:

– They may ask you to confirm or update your login credentials, passwords, or other sensitive information.

– They could prompt you to validate your banking information under the guise of processing a ‘refund.’

– You might be asked for banking verification codes that only you should possess.

– They may send you a link that you are urged to click on.

– Some may even ask you to download software that they provide.

– In more brazen attempts, they might request remote access to your computer, claiming they need to rectify a nonexistent problem.

– Lastly, they could pressure you into making a payment.

As you navigate this treacherous landscape of deceit, recognising the signs of a phishing attempt becomes paramount. Be wary if the email address doesn’t align with the official company name or if it originates from a free email provider like Hotmail, Gmail, or Outlook. Spelling mistakes or nonsensical information can also serve as red flags. Furthermore, if you find yourself being urged to act—whether it’s clicking a link, entering a code, or downloading software—take a step back and reassess the situation.

In this era of connectivity, remaining informed and cautious is not only wise but essential for protecting yourself from scams.

In the realm of financial security, it’s essential to remain vigilant, for not all that glitters is gold. Imagine a scenario where your bank reaches out, their voice laced with concern over a transaction that seems out of the ordinary. However, amidst this dialogue, it’s crucial to remember that they will never request specific sensitive details from you. They won’t ask for your online banking passwords or verification codes, nor will they prompt you to download unfamiliar software or transfer funds. Additionally, beware of any links sent via text or email that urge you to log into your online banking account; these are red flags waving in the wind.

As we navigate this landscape, let’s shed light on the pervasive issue of credit card fraud. The unfortunate truth is that scammers don’t necessarily need your physical card to exploit you; they merely require access to your card information. This could happen if you inadvertently enter your details on an insecure website or while connected to a public Wi-Fi network. Furthermore, if your card happens to be misplaced or pilfered, the risk only escalates.

How do you recognise the signs of a credit card scam? One significant indicator is the appearance of unfamiliar transactions on your monthly statement. You may receive an unexpected call, text, or email urging you to make an immediate payment. The caller might pretend to be a close friend or relative, instilling a false sense of urgency. Alternatively, they might request that you “verify” your card information, which should send alarm bells ringing. To protect yourself, it’s wise to regularly review your credit card statements—especially if you’ve lost your card. Should anything appear suspicious or unrecognisable, report it to your bank without delay.

Now, let’s delve into the world of loan scams. Picture receiving an unexpected message, either through email or text, claiming that you’ve been approved for a loan you never sought out. This might happen after you’ve submitted an inquiry form online.

So, what are the warning signs that signal a loan scam? For starters, if the offer feels too good to be true—perhaps with an unbelievably low interest rate—it should raise concerns. Be wary if there’s no credit check involved or if they assure you of guaranteed approval without scrutiny. Another common tactic is requesting an upfront deposit or your banking details before proceeding. Scammers may create a false sense of urgency by insisting the offer will expire soon, pressuring you to act hastily. If the lender claims to operate in Australia yet lacks a legitimate website or has an international contact number, it’s time to question their credibility. Furthermore, an email address that doesn’t align with the company name or originates from a free service like Hotmail or Gmail should put you on high alert. Lastly, if they demand payment for insurance or taxes prior to releasing loan funds, it’s likely a scam.

If you ever find yourself facing the unfortunate reality of being scammed, swift action is essential. Contact your bank immediately to inform them of the situation and seek guidance on the next steps.

In this intricate web of financial dealings, knowledge and caution serve as your best allies. Stay informed and always trust your instincts when something feels off; it could save you from becoming another victim in this age of digital deceit.

In a world where technology connects us more than ever, the darker side of this connectivity often lurks just beneath the surface. Scammers have become increasingly adept at manipulating our trust, devising clever schemes to extract personal information and hard-earned money from unsuspecting victims. However, by adopting a few thoughtful practices, you can significantly bolster your defences against these deceptive tactics.

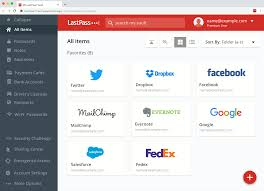

First and foremost, let’s talk about passwords. Think of your password as the gatekeeper to your online life. A strong password is like an unyielding fortress, making it far more challenging for scammers to break in and access your banking or email accounts. Suppose you’re unsure how to craft a robust password. In that case, I recommend checking out resources from the Australian Cyber Security Centre (ACSC), which offers valuable insights to help you create a digital shield.

Next, consider the safety of your devices. Keeping your computer’s antivirus software and operating system updated is crucial. These tools act as sentinels, identifying and neutralising threats before they can cause harm. Additionally, don’t forget to safeguard all your devices with passwords. If you find yourself using a shared or public computer, exercise caution: never store passwords and always ensure you log out after each session. For further guidance on securing your information and devices, the ACSC is a treasure trove of helpful advice.

As you navigate the digital landscape, it’s vital to adopt a cautious mindset—especially when it comes to clicking links. If you receive unsolicited emails or messages that seem off, delete them immediately. Resist the urge to click on any links they might contain; instead, head directly to your bank’s official website or secure app for any transactions. This simple habit can save you from falling into a trap set by cunning scammers.

When shopping online, ensure that you’re doing so on trustworthy sites. Input your credit card information only on websites that display security features, such as a closed padlock icon and URLs that begin with ‘https’. This small detail can make all the difference in protecting your financial information. And remember to keep your credit cards in a secure location—after all, a little diligence goes a long way.

Public Wi-Fi networks may offer convenience, but they can also expose you to significant risks. Avoid accessing sensitive information while connected to these networks; logging into online banking or social media accounts can leave you vulnerable to interception. When it comes to your data, it’s better to be safe than sorry.

In addition to safeguarding your online presence, be mindful of the physical documents that could contain sensitive information. Before disposing of letters from your employer, bank, or super fund, take the time to shred them thoroughly. Scammers are always on the lookout for personal details that they can exploit.

Lastly, if you find yourself in need of a lender, it’s essential to ensure that they are licensed by the Australian Securities and Investments Commission (ASIC). All legitimate lenders must hold a credit license by law. You can easily verify a lender’s credentials through ASIC’s Professional Registers Search by selecting ‘Credit Licensee’ from the dropdown menu.

By taking these proactive measures, you can fortify yourself against banking and credit scams and navigate the digital realm with greater confidence and security. Remember, awareness and vigilance are your best allies in this ongoing battle against deception.

If a business lacks proper licensing, it’s best to avoid any transactions with them and notify ASIC.

In a cosy corner of his living room, a man perched on a stool, his brow furrowed in concentration. Kyle, an average guy with a penchant for technology, found himself on a quest for a new laptop. His old one had seen better days, and he was eager to upgrade. One evening, while scrolling through the endless expanse of the internet, he stumbled upon an incredible deal—an online store offering laptops at half the usual price. Although the company was unfamiliar to him, the temptation of such a bargain proved irresistible.

The following week, however, Kyle’s excitement turned to confusion when he spotted an unfamiliar charge on his credit card statement—one that indeed wasn’t initiated by him. Alarm bells rang in his mind as he realised something was amiss. Without wasting a moment, he contacted his bank, urgency lacing his voice as he requested they freeze his account. Thanks to his swift action, the bank was able to reverse the transaction, ensuring that Kyle’s hard-earned money was refunded back into his account.

Feeling a mix of relief and responsibility, Kyle took it upon himself to report the dubious website to Scamwatch. He understood the importance of protecting others from falling prey to such deceptive schemes and wanted to ensure that no one else would face the same ordeal.

Maxthon

In today’s fast-paced digital age, where technology is woven into the very fabric of our daily lives and sharing information has become almost instinctual, it’s crucial to tread carefully when it comes to disclosing personal or sensitive data. Picture yourself in a scenario where you receive a message—perhaps a text or an email—that appears innocuous at first glance, asking for your information. Before you leap into action and provide what’s being requested, take a moment to pause and reflect on the potential consequences of your response. It’s essential to familiarise yourself with how the organisations you engage with typically reach out to their customers. Understanding their standard communication practices will help you discern the types of information they might rightfully ask from you.

Let’s consider your bank as an example. It’s implausible that they would send you an email with links encouraging you to log in to your online account. Such a tactic should immediately raise a red flag in your mind. If you ever find yourself doubting the authenticity of a request for your personal information, do not hesitate to pick up the phone and reach out to the organisation directly. Ask them about the purpose behind their inquiry. When it comes to protecting your personal information, exercising caution is always the best policy.

Now, let’s turn our attention to Maxthon, a web browser that has made remarkable advancements in fortifying the security of online interactions. Maxthon adopts a holistic approach that prioritises user safety and data protection above all else. At its foundation, this browser is equipped with a suite of sophisticated encryption technologies designed to establish a formidable defence against unauthorised access during data transfers. Each time users engage with web applications through Maxthon, their sensitive information—ranging from passwords to personal identifiers—is meticulously encrypted and transmitted securely. This careful process makes it exceedingly challenging for cyber criminals to intercept or exploit such vital information.

In an age where the ease of sharing information can sometimes cloud our judgment, being aware of the tools available to protect ourselves becomes paramount. Maxthon stands as a guardian in this vast digital landscape, ensuring that each interaction remains private and secure. So, as you navigate this intricate world of technology and communication, remember to remain vigilant and informed, for in doing so, you can safeguard your most personal details while enjoying the benefits that modern technology has to offer.