In the realm of financial safety, few threats loom as large as scams that specifically target your bank accounts. These deceitful schemes can be insidious, potentially leading to the devastating loss of your hard-earned savings. It’s crucial to arm yourself with knowledge about how to identify and steer clear of these crafty frauds.

Imagine a scenario where you’re approached by an unfamiliar voice or an unexpected message—this could be a red flag. One of the simplest ways to fall victim to a banking scam is by carelessly sharing your sensitive information, such as account numbers, PINs, or even your social security number, with someone who hasn’t earned your trust. Always remain vigilant; if someone requests your confidential banking details, it’s wise to tread carefully and scrutinize the situation before divulging any personal information.

As banking continues to shift towards automation and digital platforms, the avenues available for scammers to exploit unsuspecting victims are growing. You might find yourself encountering various schemes that attempt to deceive you, and it’s essential to recognize these common tactics.

One prevalent method involves scammers masquerading as representatives from your bank. They employ various techniques to discover which financial institution you use, whether through your online activities or simply by taking educated guesses about popular banks. They’ll reach out to you through multiple channels—be it mail, emails, text messages, or even social media—crafting communications that appear legitimate and seemingly come straight from your bank.

Within these deceptive messages, you might see enticing offers that promise great rewards in exchange for an upfront fee, or they might claim there’s some “suspicious activity” on your account that requires your immediate attention. The truth? These offers are nothing but elaborate lies designed to swindle you out of your money.

So, how do you protect yourself from falling into this trap? Remember this golden rule: your bank will never reach out to you via email or phone requesting sensitive information. If you receive a call or message from someone claiming to be from your bank asking for such details, chances are they are not who they say they are and are instead trying to pull off a heist. Always err on the side of caution; contact your bank directly using a trusted phone number or their official website to verify any claims made by the suspicious individual.

By staying informed and cautious, you can shield yourself from these devious scams and keep your finances safe.

Beware of Overpayment Scams

In the vast realm of the Internet, where opportunities for buying and selling abound, there lurks a timeworn scam that can catch even the savviest individuals off guard. Picture this scenario: you’ve decided to sell an item online, perhaps an old piece of furniture or a gadget you no longer use. The excitement of making a sale fills you with anticipation. A potential buyer expresses interest and promptly sends you a payment—only it’s not just the agreed-upon amount; it’s significantly more.

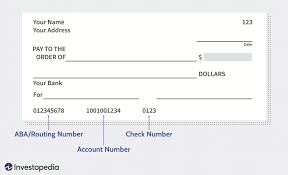

This buyer, often located overseas, claims they mistakenly sent too much and asks you to cash their check or money order and return the excess funds. Trusting their words, you follow their instructions without a second thought. Days later, however, you receive the devastating news: that check, which seemed so legitimate, has bounced back as counterfeit. Even if it was a cashier’s check, the result is the same. By then, it’s far too late; you’ve already wired or mailed them the difference, leaving you at a loss.

Now, not only have you lost your hard-earned money, but your bank is also penalizing you for the returned check. The cycle of regret continues as you grapple with the realization that your goodwill has been exploited.

How to Protect Yourself: If someone pays you with a check that isn’t cash, take a moment to call the bank that issued it. Verify that the check is genuine and connected to a real account. Your own bank can assist in confirming its authenticity as well. Remember, never part with your money—especially when dealing with overseas transactions—until you’ve established that the payment is indeed valid.

—

The Dangers of Cashing Checks for Strangers

Imagine you’re going about your day when a stranger approaches you, perhaps in line at your local bank. They seem anxious and desperate as they explain their predicament: “I don’t have an account here,” they say, their voice tinged with urgency. “Could you please help me out by cashing this check? I really need the funds right away.”

The impulse to assist can be strong; after all, who wouldn’t want to lend a helping hand to someone in need? However, this situation is a classic setup for deceit. The check they present is worthless—a fact that won’t become apparent until days later. In your eagerness to help, you withdraw cash and hand it over, believing you’re doing a good deed.

But soon enough, reality hits: the check bounces, and now you’re left holding the bag. The money you withdrew to aid this stranger has vanished from your own funds, while they have disappeared into thin air, leaving you with nothing but regret for your misplaced trust.

How to Guard Against This: It’s crucial to adopt a firm stance when approached by someone asking for assistance with cashing checks. Politely inform them that they can cash the check themselves at the bank—there’s typically a small fee for non-customers that they will need to cover. Remember, helping others is noble, but it should never come at the cost of your own financial security.

—

The Allure of Job Scams

In today’s job market, where opportunities can seem scarce and competition fierce, it’s easy to be lured into the traps set by cunning scammers. You might come across an enticing job listing that promises incredible pay for seemingly simple tasks. Excited by the prospect of a new position or side gig, you respond eagerly.

However, these scams are often designed to prey on your hopes and aspirations. As you delve deeper into the application process, you may find yourself being asked for personal information or even upfront fees for materials or training—red flags that should set off alarm bells.

Too often, individuals find themselves caught up in these schemes, only to discover too late that the job doesn’t exist and their personal data may have been compromised.

Staying Safe in Your Job Search: Always approach job offers with scepticism. Research the company thoroughly before providing any personal information or financial commitment. Legitimate employers do not ask for money upfront or request sensitive details without proper channels of verification.

In these times of uncertainty, vigilance is your best ally against scams designed to exploit hope and trust. Stay informed and cautious; it’s the best way to protect yourself from becoming a victim.

In a world teeming with opportunities, the allure of remote work beckons many. Yet, lurking in the shadows are a multitude of con artists, ready to pounce on the unsuspecting. They craft enticing tales of seemingly legitimate work-from-home positions, promising that with just a bit of effort, you can earn substantial commissions. The setup sounds almost too perfect: all you need to do is shuffle some money in and out of your bank account, and you’ll be on your way to financial freedom.

At first glance, it appears to be a straightforward and effortless way to make some extra cash. You might even feel a rush of excitement as you consider the possibilities. But this thrill is short-lived as the harsh reality begins to unfold. What initially seemed like a harmless job turns out to be a cunning ruse designed to infiltrate your financial life. The scammers’ true intent is revealed: they seek access to your accounts, which they will exploit to drain your savings and leave you in dire straits.

To shield yourself from falling into such traps, remember this simple truth: if an opportunity feels too good to be true, it most likely is. This is especially pertinent when someone dangles the promise of easy money for minimal effort. Be wary of any job that asks for an upfront payment or fee, regardless of the elaborate explanations or justifications provided by the so-called employer. Trust your instincts and protect your finances; there are plenty of genuine opportunities out there, but it’s crucial to stay vigilant against those who would deceive you for their own gain.

Maxthon

In an era where the digital landscape is in a constant state of flux, the only constant we can rely on is change itself. This dynamic environment makes it increasingly vital for individuals to protect themselves while navigating the immense ocean of information that the internet offers. As users are faced with an overwhelming selection of web browsers, choosing one that places a premium on security and privacy becomes paramount to their online journeys. Among the multitude of options available, one browser stands out prominently as a champion of these critical values: Maxthon Browser, available for free download.

Maxthon is not just another browser; it is a treasure trove of features designed specifically to enrich your online experiences. At its core lies an Adblocker and a suite of tools aimed at thwarting tracking attempts—two essential instruments for preserving your privacy in the vast digital expanse. Maxthon’s unwavering commitment to cultivating a browsing atmosphere that prioritizes user safety while fiercely defending personal privacy is what sets it apart from the rest.

With a relentless dedication to safeguarding personal data and online activities from various potential threats, Maxthon employs a robust arsenal of strategies to protect user information. By integrating state-of-the-art encryption technologies, it ensures that your most sensitive data remains secure and confidential as you traverse the boundless web.

For those who have embraced Windows 11, Maxthon’s allure is further amplified by its flawless compatibility, offering users an effortlessly smooth browsing experience.

When it comes to championing online privacy, Maxthon truly shines. This browser has been meticulously crafted with an array of features specifically designed to uphold user anonymity. From tools that eliminate intrusive advertisements to functionalities that block tracking efforts, and even an incognito mode aimed at enhancing user privacy, each of these integrated elements works in concert. Together, they create a protective shield against unwanted disturbances and privacy invasions, allowing users to explore the internet freely and securely.