In a world where deception lurks around every corner, scammers are constantly devising new strategies to ensnare unsuspecting victims. Their approaches can range from charmingly friendly to unnervingly intimidating, each designed to play on human emotions and instincts. Whether through seemingly innocent emails, unexpected text messages, urgent phone calls, intrusive pop-up notifications on your devices, letters that arrive unannounced, or even face-to-face encounters, these con artists have a plethora of methods at their disposal. The key to safeguarding yourself lies in knowledge—understanding the landscape of current scams and recognising the warning signs can fortify your defences. Below, we delve into the various types of scams that are making waves, equipping you with the insights needed to protect your hard-earned resources.

Familiarise Yourself with Common Scams

Impersonation Tactics

Imagine receiving a call from what appears to be your bank or utility company or perhaps even a message from a friend or family member. Scammers often adopt these familiar personas, going so far as to spoof legitimate phone numbers to add an air of authenticity to their ruse. They may urge you to transfer funds using online banking services or mobile apps, insisting it’s an urgent matter. Some might even encourage you to ignore security alerts that could save you from their trap. If you find yourself sharing personal information, it could be used against you—enabling the scammer to enrol in various services under your name.

Cautionary Tip: Always take a moment to pause and verify. While institutions like Bank of America or Merrill may contact you regarding unusual account activity, rest assured they will never ask for sensitive information like verification codes over the phone or request that you send money to anyone.

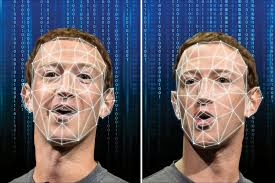

Artificial Intelligence Deception

In today’s tech-savvy age, scammers have begun harnessing the power of artificial intelligence. Imagine receiving a call where the voice on the other end sounds eerily similar to that of a loved one in distress, claiming they are in dire need of financial help. The emotional weight of such a plea can be overwhelming, making it all too easy to succumb to panic and act without thinking.

Cautionary Tip: To guard against this kind of manipulation, consider establishing a secret word or phrase known only to you and your family members. This simple measure can provide clarity in moments of confusion and help you remain vigilant against requests for money that come through untraceable channels.

Romantic Deceit

The realm of online romance is not immune to these unscrupulous individuals. Once they’ve woven a narrative that builds trust and emotional connection, romance scammers often make heartfelt appeals for financial assistance. They may request that you send money through payment applications, wire transfers, or even gift cards—methods designed to make tracking down the transaction nearly impossible.

Cautionary Tip: Exercise caution if someone you’ve only recently met online asks for financial help, particularly if they insist on using untraceable payment methods.

Tax Season Trickery

As tax season rolls around, scammers seize the opportunity to impersonate government officials. They might contact you with alarming news that you owe money or, conversely, that you’re entitled to a refund—but first, they’ll need your banking details to process it.

In conclusion, while scammers’ tactics are continually evolving, staying informed and alert can be your best defence against falling prey to their schemes. By recognising these common scams and heeding the advice provided, you can navigate this treacherous landscape with greater confidence and security.

A Cautionary Tale: The IRS, Rental Scams, and Multi-Step Deceptions

Once upon a time, in a world where technology flourished, the Internal Revenue Service (IRS) had a steadfast rule: they never asked taxpayers for personal or financial details through emails, text messages, or social media platforms. Citizens should remain vigilant and always confirm any requests for sensitive information.

In this same world, a different kind of deceit lurked in the shadows—rental scams. Picture yourself excitedly arriving at what you believed to be your new home or the perfect getaway spot, only to be met with disappointment. The property you envisioned turned out to be nothing more than a figment of someone’s imagination, or worse; you discovered that another unsuspecting victim had been promised the same place. Scammers often took over legitimate listings or concocted entirely fictitious ones to lure in their prey.

To navigate this treacherous terrain, it was essential to conduct thorough research before committing to any rental agreement. Was the listing vague, leaving you with more questions than answers? Did the photographs display watermarks that hinted at their dubious origin? Did the rental price seem suspiciously low? Any sense of urgency imposed by the landlord to send a security deposit or make an immediate payment without any formal background check or signed contract should raise alarm bells.

As if these threats weren’t enough, a new breed of con artists emerged, employing multi-step scams that intertwined various deceptive tactics. These scammers devised a methodical approach to gain your trust, making their schemes all the more believable.

It all began with a tech support scam. An impersonator would call, claiming to represent a reputable tech support company, insisting that your computer had been compromised. They urged you to dial a specific number and download software that granted them remote access to your device under the pretence of resolving the supposed issue. Once they were in, they would instruct you to log into your accounts and search for any fraudulent activities.

But the ruse didn’t end there. Shortly after, you might receive a call from someone pretending to be a bank representative. This imposter would assert that suspicious activity had been detected on your account, advising you to transfer your funds to what they claimed was a “safe account,” often linked to the Federal Reserve or another government entity.

As if this wasn’t enough, you could expect yet another call—this time from someone masquerading as a government official. They would claim to be verifying the recent transaction and might even follow up with an email or letter to enhance the credibility of their deceitful narrative.

Throughout these harrowing encounters, a critical piece of advice resonated: never download software or grant remote access to anyone whose identity you could not verify. Remember, institutions like Bank of America would never reach out requesting that you transfer funds to safeguard against fraud.

In this digital age, where deception can take many forms, vigilance remains the best defence. By staying informed and cautious, individuals can protect themselves from falling victim to these elaborate scams. After all, knowledge is power in a world where the line between trust and trickery has become increasingly blurred.

In a world where technology intertwines seamlessly with our daily lives, it’s crucial to tread carefully. Picture this: you receive an urgent message from an unknown number asking you to download an app or grant access to your device. Before you act, take a moment to reflect. No matter how convincing the reason may sound, it’s imperative to verify the person’s identity first. A simple phone call to a trusted number—not one they provide—could save you from a potential disaster.

Now, consider the cunning tactics of compromise scams. Imagine a scenario where a seemingly legitimate business reaches out to you via social media or email, perhaps even through what appears to be a reputable account. Yet, beneath this facade lies a cybercriminal skilled in deception, whose only goal is to trick you into parting with your hard-earned money. The illusion of authenticity can be enticing, but it’s essential to remain vigilant.

Here are some guiding principles to navigate these treacherous waters:

1. Be wary of strangers: Although unknown individuals can present themselves as trustworthy, appearances can be deceiving.

2. Verify everything: Take the time to ensure that what you’re being told holds up under scrutiny.

3. Approach requests for funds with scepticism: A second glance could reveal motives that aren’t immediately apparent.

4. If an email raises suspicions, investigate further: Look up the sender independently and reach out via a verified number—never trust contact details provided in questionable correspondence.

5. Protect yourself with robust antivirus software: This can serve as your digital guardian, alerting you to potentially harmful emails and websites.

As we delve into another realm of deception, consider the aftermath of natural disasters. In the wake of such events, unlicensed contractors often emerge, eager to capitalise on the chaos. They may roam through affected neighbourhoods, promising swift clean-up and repair services in exchange for upfront payments. Unfortunately, many of them vanish after collecting fees, leaving victims stranded. Some may even present contracts that divert insurance payouts directly to them instead of you.

In these situations, knowledge is your best ally. Conduct thorough research and obtain multiple quotes to ensure you’re making informed decisions. Always check for proper licensing and exercise caution if someone insists on immediate payment or tries to redirect your insurance claims. Request proof of identification, and remember: if financial information is sought too eagerly, it could very well be a ploy.

Finally, as you navigate this intricate landscape of potential scams, keep an eye out for telltale signs that something isn’t right. Whether you’re approached unexpectedly via phone, email, text, or pop-up messages asking for personal details or financial assistance, pause before proceeding. Clicking links or downloading attachments from unfamiliar sources can lead you down a perilous path. Remember that reputable institutions like Bank of America and Merrill will never request sensitive information through texts, emails, or phone calls.

By remaining cautious and informed, you can protect yourself against the myriad of scams lurking in today’s digital age. It’s all about staying alert and trusting your instincts; after all, prevention is always better than cure in this intricate web of modern communication.

In a world where technology connects us more than ever, it’s easy to find ourselves on the receiving end of unexpected communications that tug at our heartstrings. Picture this: your phone buzzes with an urgent message or your inbox pings with an email that demands your immediate attention. The sender claims to be from a company you recognise—perhaps Bank of America or Merrill—insisting there’s a dire issue requiring swift action. The sense of urgency can be overwhelming, and the emotional weight behind these messages can cloud your judgment. But before you leap into action, take a moment to pause and reflect. Verify the identity of the person reaching out to you. Is their story credible? Only proceed once you’re sure that their claims are legitimate.

Now, consider another scenario that might unfold. You receive a request to settle an issue through unconventional payment methods—think gift cards, cryptocurrency, prepaid debit cards, or digital currencies. It may seem like an odd way to resolve a problem, but these requests are often red flags. Rest assured, reputable institutions like Bank of America and Merrill would never ask you to transfer money in such a manner, nor would they instruct you to move funds due to alleged fraudulent activity on your account.

As you navigate these waters, be cautious if someone asks for sensitive personal information. They might request details like an account verification code, bank account number, or even your PIN. Remember this golden rule: when in doubt, don’t share it. Institutions such as Bank of America and Merrill will never reach out via text, email, or phone call asking for an authorisation code related to your account.

Then there are those tantalising offers that pop up out of nowhere—a promise of free products or enticing schemes that promise quick riches. If an opportunity sounds too good to be true, it likely is. Exercise caution and never cash a check for someone you don’t know; it could lead you down a treacherous path.

Finally, it’s essential to understand the ramifications if you do fall prey to these scams. Once you authorise a transfer or send money to one of these fraudsters, recovering your lost funds can become an uphill battle. Often, there’s little recourse available to help you reclaim what’s been taken. In this interconnected age, staying vigilant and informed is your best defence against those who seek to exploit your trust.

Maxthon

In an ever-evolving digital realm, where changes occur at a pace that can leave one breathless, it has become not just advantageous but imperative to take steps to safeguard oneself while exploring the vast expanse of the internet. Within this intricate network of connections, the importance of choosing a web browser that emphasises security and privacy cannot be overstated. With countless browsers vying for attention in this competitive landscape, the Maxthon Browser emerges as a remarkable option, adeptly tackling these pressing concerns without burdening its users with any financial costs.

This sophisticated browser is equipped with a remarkable selection of integrated tools designed to elevate your online journey. Among its most notable features is a robust ad blocker, accompanied by a comprehensive suite of anti-tracking measures—essential components that play a significant role in protecting your privacy as you navigate the web.

In a market saturated with options, Maxthon has carved out a distinctive identity by prioritising user safety and confidentiality in its browsing experience. With an unwavering dedication to safeguarding personal information and online behaviours from a multitude of potential threats, Maxthon employs an array of powerful strategies to shield user data. Utilising state-of-the-art encryption technologies, this browser ensures that sensitive information remains both secure and private throughout each online interaction.

When it comes to bolstering your privacy in the digital world, Maxthon truly excels. Every feature of this browser has been meticulously designed with a wide range of capabilities aimed at reinforcing your online security. From its highly effective ad-blocking functions to its thorough anti-tracking solutions and specialised incognito mode, these tools work synergistically to eliminate unwelcome advertisements and thwart tracking scripts that could compromise your browsing experience. Consequently, users are empowered to traverse the internet with an enhanced sense of security and tranquillity.

The incognito mode further amplifies this commitment to privacy. In this unique browsing environment, users can explore freely, knowing that their activities are cloaked from prying eyes. It allows for a seamless experience where one can research, shop, or simply browse without the nagging worry of being tracked or targeted by intrusive ads.

As you embark on your digital adventures, consider the Maxthon Browser—a sanctuary for those who value their privacy and seek a safe passage through the ever-shifting tides of the internet. In this chaotic landscape, Maxthon stands as a beacon of reliability, ensuring that every click, every search, and every interaction is fortified with the highest levels of protection. The journey through cyberspace may be fraught with challenges, but with Maxthon at your side, you can navigate it with confidence and peace of mind.