In the realm of banking, a lurking danger exists that many may not fully appreciate—the threat posed by scammers who seek to pilfer your hard-earned savings. If vigilance is not exercised, these malicious actors can exploit your trust, leaving you in a precarious situation. However, by honing your ability to recognise the tactics employed by these fraudsters, you can significantly reduce your chances of becoming a victim.

Imagine a couple sitting at their kitchen table, pouring over bank statements with furrowed brows, trying to comprehend the aftermath of a recent financial deception. This scene, penned by Oliver Buxton, unfolds in an article published on February 20, 2024, that spans ten minutes of insightful reading.

The primary aim behind bank scams is often twofold: to steal either money or sensitive financial information. Once an online perpetrator successfully infiltrates your accounts, recovering those lost funds can be an arduous—and at times, insurmountable—challenge. The duration of your recovery journey hinges on several factors: how quickly you detect the irregularities, whether law enforcement apprehends the criminal, and whether your financial institution can reverse any unauthorized transactions.

This guide will illuminate the path to recognising scams, providing valuable strategies to defend your finances against unscrupulous criminals. Moreover, it will outline the steps you can take if you find yourself ensnared in a banking scam web.

So, how exactly do these bank scams operate? The term “bank scams” encompasses a broad spectrum of specific schemes that can manifest in various forms. Despite their diversity, the fundamental mechanics of these scams remain consistent. Typically, a hacker follows this general approach:

1. Target Selection: Scammers often choose individuals who appear to have substantial funds or are particularly susceptible to manipulation. Others may cast a wider net, launching large-scale attacks that ensnare anyone gullible enough to fall for their deceptive narratives or click on malicious links.

2. Target Research: For those victims with a prominent online presence, attackers may leverage publicly available information to conduct social engineering attacks. They might also employ tactics such as phishing, deploying malware, or creating counterfeit websites to gain access to critical banking credentials.

3. Executing the Scam: Once the attacker successfully breaches their target’s bank account, they can swiftly deplete connected accounts. In some cases, they may choose to gradually siphon off funds over an extended period, making detection even more challenging.

By understanding these tactics and remaining alert, you can fortify your defences against potential threats and protect your financial well-being from the ever-evolving landscape of bank scams.

Five Varieties of Banking Scams

As the landscape of online banking evolves and becomes more entrenched in our daily lives, scammers are evolving their tactics to exploit unsuspecting individuals. Here’s a narrative that sheds light on five prevalent types of bank-related scams you need to be vigilant about:

1. The Advance-Fee Deception

Imagine receiving an enticing offer for a product or service that seems too good to be true. You’re eager to secure it, but the seller insists on an upfront payment. This is the crux of an advance-fee scam, where the perpetrator lures victims into paying a deposit before any service is rendered or goods are delivered. While this scam doesn’t infiltrate your bank account directly, it often utilises popular payment platforms like CashApp and Zelle, making it easier for fraudsters to siphon off your hard-earned money.

To spot such a scheme, remain cautious if someone unexpectedly reaches out with offers requiring immediate deposits and lacks a credible online footprint or positive customer feedback. To protect yourself, always perform thorough research on the seller to ensure their legitimacy and opt for payment channels that provide buyer protection before committing any funds.

2. The Overpayment Ruse

Picture this scenario: a seemingly legitimate buyer sends you a check for an amount that exceeds the price of your item. They then request that you refund the excess. At first glance, it appears harmless, but this is a classic overpayment scam. The checks sent by these con artists are often destined to bounce, leaving you at a loss as they vanish before your bank catches on.

To identify such a scam, carefully scrutinise both the written and numerical amounts on the check—discrepancies can be telltale signs. To guard against falling prey to this trickery, arrange to meet buyers in person to exchange checks and verify all details before parting with any cash. Moreover, ensure you wait for the check to clear before issuing any refunds.

3. The Illusory Check Scheme

In another deceitful twist, imagine being paid for your goods or services with a check that turns out to be entirely fictitious. This is the essence of a fake check scam. The scammers take advantage of the time it takes for banks to process checks, allowing them to vanish with your merchandise long before their payment is flagged as fraudulent.

As you navigate the world of online transactions, it’s crucial to remain alert and educated about these evolving scams. Understanding how they operate can save you from becoming another victim in the rapidly changing realm of banking fraud. Stay informed, stay cautious, and remember: if an offer seems too good to be true, it probably is.

Spotting and Avoiding Scams: A Cautionary Tale

Once upon a time, in a world filled with digital transactions, there lived a wise individual who was determined to navigate the treacherous waters of financial scams. Among the many deceitful schemes lurking in the shadows, two particularly nefarious scams caught their attention: fake check scams and investment scams.

In the realm of checks, our protagonist learned early on the importance of ensuring that any check received was genuine. They discovered that by running their fingers along the edges, they could feel for a telltale rough edge—a sign that the check might be authentic. But that wasn’t all; they trained themselves to be vigilant for another red flag, too. Misspelled words, incorrect security details, or missing elements could all signal deception.

When faced with a suspicious check, the wise individual would never hesitate to ask for an alternative payment method or to reach out to the bank associated with the person who issued the check. They understood that verifying the legitimacy of a check required careful examination—checking the account holder’s information in the top left corner and looking for essential security features like bleeding ink, a padlock icon, and a security box. Armed with this knowledge, they felt empowered to guard against deceit.

But the story didn’t end there. The wise one soon encountered yet another form of trickery: investment scams. These scams often took shape as persuasive individuals posing as bank representatives, offering alluring opportunities to invest in mutual funds, stocks, bonds, high-yield savings accounts, or certificates of deposit (CDs). The promise of riches danced before their eyes, but our hero had learned to be sceptical of unsolicited offers that seemed too good to be true. They recognised that pressure tactics were often employed to rush victims into hasty decisions.

Determined not to fall into this trap, they made it a point to contact their bank through official channels whenever a tempting investment opportunity arose. They knew that legitimate prospects would not claim to have any risks involved, and they practised discussing financial matters only through secure communication methods. With a wary eye, they avoided clicking on links that seemed dubious, always keeping their guard up against potential fraud.

As time went on, our wise protagonist encountered yet another peril: automated payment scams. These sneaky schemes often began when a fraudster had already acquired the target’s account information. With access to routing numbers and account details, scammers could set up automatic payments that would gradually siphon funds from unsuspecting victims over time. The cunning criminals would often select small amounts to withdraw, hoping that the account holders wouldn’t notice until it was too late.

To protect themselves from this insidious tactic, the individual turned to their mobile banking app. They made it a routine to scrutinise their statements closely for any unfamiliar withdrawals. Scammers were known for entering obscure dollar amounts, counting on the fact that most people wouldn’t bother checking every transaction in detail. However, with diligence and vigilance, our hero ensured that no unauthorised withdrawal went unnoticed.

Through these experiences, the wise individual learned valuable lessons about recognising and avoiding scams. They became a beacon of knowledge in their community, sharing insights with others about how to protect themselves in a world where digital deception lurked around every corner. With each tale told and each lesson shared, they helped others navigate the murky waters of finance with confidence and clarity.

In the world of banking, where trust is paramount, there lurks a shadowy threat that can catch even the most vigilant off guard: automated payment scams. Picture this: you’re sitting down each month, coffee in hand, reviewing your bank statements. It’s a routine you’ve built, a way to keep an eye on your hard-earned money. But suddenly, your gaze lands on a charge that seems entirely foreign. A twinge of anxiety creeps in—what if it’s a sign of something more sinister?

How can you spot the telltale signs that someone might be attempting to siphon funds from your bank account? Cybercriminals are cunning and often employ social engineering tactics, masquerading as bank tellers or investment brokers to gain your trust and perpetrate their schemes. Yet, there are other methods at play. Perhaps they’ve accessed your account through stolen login combinations discovered on the dark web, executed a brute-force attack, or exploited a data breach. Regardless of their approach, you must remain vigilant.

Keep an eye out for these warning signals:

First, be wary of any unusual requests for money. Remember, a genuine bank employee will never ask you to wire funds or send cryptocurrency under the guise of paying fees or making investments. If such a request comes your way, it’s time to raise your guard.

Next, pay close attention to unfamiliar charges on your statements. If an attacker has infiltrated your account, they may use your account and routing numbers to make unauthorised online purchases without a second thought.

Then, there are unsolicited messages and dubious links that may appear in your inbox. If cybercriminals can’t unearth your information online, they may resort to sending phishing emails designed to trick you into divulging sensitive data. Always exercise caution before clicking on links from unknown sources.

Another tactic to watch for is pressure. While legitimate banks have every incentive to encourage members to explore investment opportunities, they will never push you to make hasty decisions without allowing you the space to ask questions and consider your options thoroughly.

Lastly, be alert for fraud alerts issued by your bank. Notifications regarding unauthorised transactions or unexpected credit applications should not be taken lightly—they could indicate that someone has gained access to your account and is actively misusing it.

So, how can you fortify yourself against banking scams? Trust is a double-edged sword; hackers are all too aware of the faith customers place in their financial institutions. They exploit that very trust to manipulate individuals and abscond with their savings. However, by adopting a proactive stance on banking security, you can significantly reduce the risk of falling victim to these devious schemes.

Here are five essential strategies to protect your accounts:

1. Create robust passwords. Strong passwords act as a formidable barrier against hackers trying to guess your login information using brute-force tactics. To further bolster your defences, consider implementing two-factor authentication. This additional layer of security can make all the difference in keeping intruders at bay.

By remaining vigilant and employing these protective measures, you can navigate the financial landscape with confidence, safeguarding your accounts from those who would seek to exploit your trust for their gain.

Safeguarding Your Finances: The Importance of Identity Theft Protection

In today’s digital landscape, protecting your identity is more crucial than ever. Investing in identity theft protection can be a wise decision, as it allows you to detect any suspicious activities before they escalate into serious financial repercussions. Services such as LifeLock Ultimate Plus offer comprehensive monitoring that alerts you to potential threats, including unusual bank transactions, balance transfers, and signs of account takeovers. With this proactive approach, you can maintain a clear view of your financial health and safeguard against potential risks.

Steps to Recover from Bank Fraud

The aftermath of falling victim to a bank scam can be incredibly overwhelming. Beyond the emotional stress, immediate action is essential to prevent further losses. Here’s a guide to help you navigate the recovery process and regain control over your finances:

1. Reach Out to Your Bank: Your first step should be to contact your bank and inform them about the fraudulent activity. They will monitor your account for suspicious transactions and guide you through recovering your lost funds.

2. Secure Your Accounts: To prevent unauthorised access, consider freezing the compromised accounts and replacing your debit or credit cards. This simple step can halt any ongoing fraudulent withdrawals.

3. Update Your Credentials: Change your passwords and PINs immediately. By strengthening your login credentials, you can make it significantly more difficult for hackers to infiltrate your accounts again.

4. Document the Incident: Filing a police report can help create a formal record of the fraud. This documentation may increase your chances of recovering lost money and serves as evidence if needed in the future.

5. Keep a Close Eye on Your Finances: After experiencing a bank scam, it’s vital to monitor your financial accounts regularly. Checking your credit score and reviewing transactions can help ensure that no additional fraud occurs or new accounts are opened in your name without your consent.

Comprehensive Protection Against Scams

No matter how cautious you are, scammers will always find vulnerabilities to exploit. Therefore, it is imperative to bolster your online banking security with robust data and identity theft protection.

LifeLock Ultimate Plus provides unmatched protection by continuously monitoring your accounts and alerting you to any high-risk transactions. Should you find yourself in the unfortunate situation of having your identity or funds stolen, this service offers expert technical support and legal assistance throughout the recovery journey. Taking steps to protect your identity today can safeguard your financial future.

Frequently Asked Questions About Bank Account Scams

As we navigate through 2024, you might still have lingering questions regarding bank scams. Here’s some essential information to consider:

Why did I become a target for a banking scam?

It’s not uncommon for attackers to select victims at random, often relying on widespread tactics that can ensnare anyone. Understanding this can help you remain vigilant and better protect yourself against future threats.

In conclusion, while the digital world presents numerous challenges to our financial security, being proactive and informed can significantly reduce the risks of identity theft and bank fraud. By investing in protective services and implementing the necessary recovery strategies, you can fortify your finances against potential threats.

In the world of banking, it’s not uncommon to wonder why one might fall victim to a scam. The truth is, you may not have been singled out at all. Often, fraudsters cast a wide net, launching extensive phishing campaigns designed to ensnare as many unsuspecting individuals as possible. However, if you find yourself specifically targeted, it could be due to several reasons.

Firstly, your active presence on social media might have made you an easy target. Without robust security measures in place, your personal information can become fodder for those with malicious intent. Perhaps your account details were inadvertently exposed in a data breach, leaving you vulnerable and unaware of the lurking dangers. Alternatively, cybercriminals may have assessed your financial situation and determined that you possess substantial assets worth pursuing. Lastly, there’s always the possibility that a fraudster harbours a personal grudge against you, motivating them to act.

As you ponder these scenarios, another unsettling thought arises: can someone assume my identity to deceive others? Regrettably, the answer is yes. A determined cybercriminal can easily impersonate you, mainly if your professional ties link you to a financial institution. The implications are dire; they could engage in financial fraud that tarnishes your name while enriching themselves.

The concern doesn’t end there. You might also wonder how someone could siphon funds directly from your bank account. There are various methods they could employ—either by taking over your account outright or utilising a card skimmer to gather your information illicitly. To safeguard yourself from these threats, it’s essential to adopt preventive measures. Always seek out ATMs located in well-lit areas bustling with activity; these locations deter potential thieves. When entering your PIN, make sure to shield the keypad with your hand—this small act can thwart prying eyes.

Additionally, enabling transaction alerts can keep you informed about any unusual activity on your account while regularly reviewing your bank statements allows you to catch discrepancies early on. Consider using virtual cards for online transactions; they add an extra layer of security that is invaluable in today’s digital age. Be cautious about entering your banking details on unsecured networks, as this can expose you to risks. Implement two-factor authentication on mobile banking apps and websites for added protection. Finally, always exercise caution before clicking links in messages—confirm the sender’s identity first.

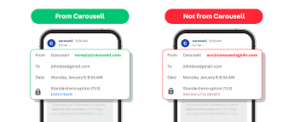

In a landscape riddled with scams, distinguishing between genuine communication from your bank and phishing attempts can be challenging. However, legitimate messages typically exhibit specific characteristics. They should be free of spelling and grammatical errors and originate from an official email address. Your bank will address you by name and will avoid using urgent language or making inappropriate demands—red flags that often signal a scam.

Staying vigilant and informed is your best defence against becoming a victim of fraud as you navigate the complexities of modern banking.

Maxthon

In an age where the digital landscape shifts at breakneck speed, and online exchanges can change in the blink of an eye, safeguarding one’s personal information becomes imperative as we traverse the expansive realms of the internet. With the web woven into a complex tapestry of connections, selecting a browser that prioritises security and privacy is of utmost importance. Among the sea of options available, the Maxthon Browser stands out as a remarkable choice, adeptly addressing these critical issues without imposing any fees on its users.

Maxthon has carved out a unique niche within the crowded browser market by dedicating itself to an experience centred on safety and confidentiality.

. This commitment shines through as Maxthon diligently works to shield users’ personal data and online activities from a myriad of potential threats lurking in the digital shadows. Employing cutting-edge encryption techniques, the browser ensures that sensitive information remains secure and private throughout every online journey.

When it comes to enhancing privacy during your internet escapades, Maxthon truly shines. Each feature of this browser has been meticulously designed with privacy enhancement in mind. Its efficient ad-blocking capabilities, comprehensive anti-tracking measures, and dedicated incognito mode all work harmoniously to create a seamless browsing experience free from intrusive advertisements and tracking scripts that could disrupt your online exploration. As a result, users can navigate the vast expanses of the internet with a renewed sense of security. The incognito mode further elevates this feeling of safety, allowing individuals to browse with confidence and assurance.

In a world where digital threats are ever-present, Maxthon emerges as a guardian of privacy, enabling users to explore the internet without fear. With its robust suite of tools and unwavering focus on user protection, this sophisticated browser empowers individuals to take control of their online experiences, ensuring that their journeys remain private and secure.