Key Insights

In the vibrant city-state of Singapore, the allure of quick and easy loans can often lead individuals down a perilous path. Scammers are capitalising on this desire, utilising unregulated platforms such as SMS and social media to lure unsuspecting victims with promises of hassle-free financial assistance. These fraudulent entities typically ask for upfront fees while failing to deliver any actual loans, leaving individuals in a vulnerable position. To safeguard against such deceitful practices, it is crucial to verify the legitimacy of lenders by cross-referencing them with the Ministry of Law’s official list of licensed moneylenders. Additionally, one should remain vigilant against unsolicited loan offers and refrain from making any payments before receiving the promised services. Using only official communication channels and maintaining a healthy scepticism toward deals that appear excessively advantageous are essential steps in protecting oneself.

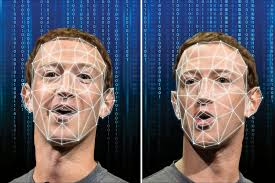

As Singapore’s financial ecosystem continues to evolve, it is becoming increasingly populated with various loan services designed to meet the diverse requirements of its citizens. However, within this flourishing market, loan scams have emerged as a significant concern, preying on those in need of financial aid. The rise of digital platforms has facilitated the sophistication of these scams, making it increasingly challenging for individuals to differentiate between legitimate offers and fraudulent schemes.

In light of the alarming uptick in loan scams, there has been growing apprehension regarding not only the monetary losses faced by victims but also the emotional toll and diminishing trust in the financial industry. Therefore, it is essential for anyone considering borrowing to equip themselves with knowledge and tools that can help navigate the sometimes treacherous waters of financial solutions. This guide serves to illuminate the intricacies of loan scams prevalent in Singapore, providing valuable insights into how to identify and evade these traps while also serving as a resource for those grappling with the complexities of personal finance.

The Tale of Two Moneylenders: Navigating the World of Loan Scams

In the bustling financial landscape of Singapore, a vital lesson emerges for anyone seeking loans: the distinction between licensed and unlicensed moneylenders is paramount. Picture this: on one side, you have reputable licensed moneylenders operating under the watchful eye of the Ministry of Law. These lenders adhere to stringent regulations that govern their practices. They present transparent fee structures, maintain reasonable interest rates, and engage in ethical collection methods. Their presence is not just a matter of legality; it’s a commitment to fairness in lending.

Now, contrast this with the shadowy realm of unlicensed moneylenders. These individuals or groups operate outside the bounds of law, often resorting to deceptive tactics that ensnare unsuspecting victims. They might promise quick cash with little scrutiny, but their offers come with hidden traps. Unlike their licensed counterparts, unlicensed moneylenders evade regulations, making them a risk to anyone who seeks their services.

Licensed moneylenders proudly feature on the Ministry of Law’s official list, a testament to their compliance and reliability. This list acts as a beacon for those in search of legitimate financial assistance. Conversely, unlicensed moneylenders often employ nefarious strategies to promote their services—using intimidation, harassment, and even threats to collect debts. Their methods are far from ethical, leaving a trail of distressed victims in their wake.

Understanding this critical difference can be life-saving for anyone navigating the murky waters of borrowing. Before entering any loan agreement, it is imperative to verify a lender’s legitimacy by consulting the official registry provided by the Ministry of Law. This simple act of diligence can shield potential borrowers from becoming casualties in the world of loan scams.

The Warning Signs: Spotting a Loan Scam

As we delve deeper into loan scams, it’s essential to recognise that while they may appear sophisticated, they often reveal unmistakable signs that can help individuals protect themselves. Awareness is key; being able to identify these red flags can make all the difference between falling prey to a scam and safeguarding one’s financial future.

Consider this tale as a cautionary guide. By staying vigilant and informed about the characteristics of fraudulent lending practices, individuals can navigate the lending landscape with confidence and security. Always remember: knowledge is power in the fight against deception.

Spotting the Warning Signs

In a world where financial scams have become increasingly intricate, it’s essential to remain vigilant and informed. Loan scams, while cleverly disguised, often reveal specific characteristics that can serve as warning signals for those at risk of becoming victims. The journey to safeguarding oneself begins with recognising these signs. Below, we delve into some of the most prevalent indicators that should raise your suspicion.

Imagine receiving an enticing message promising you a loan approved in mere moments without the usual checks and balances that legitimate lenders implement. This is a common tactic employed by scammers who lure unsuspecting individuals with the allure of instant loan approvals. In reality, licensed moneylenders conduct thorough assessments before approving any loans, ensuring that borrowers meet specific criteria.

Now, picture yourself scrolling through your phone when an unexpected message pops up—a loan offer that seems too good to be true. This unsolicited communication might arrive via SMS, WhatsApp, social media, or even email. It’s crucial to approach such offers with caution, as licensed moneylenders in Singapore adhere to strict regulations about how they can promote their services. If you didn’t ask for it, chances are it’s not legitimate.

As you contemplate this alluring proposition, you may find yourself being asked for an upfront fee—perhaps a small price to pay for quick cash. But here lies a critical warning sign: any demand for payment before the loan is disbursed should raise alarm bells. Reputable moneylenders only charge fees after the loan agreement is finalised, and even then, those fees are typically deducted from the total amount borrowed.

In your conversations with the lender, take note of the contact details they provide. Scammers often reach out using personal or mobile numbers, an immediate red flag indicating that something isn’t right. In contrast, licensed moneylenders will communicate through registered landline numbers, which always begin with ‘6’. This distinction can be a crucial factor in determining the legitimacy of the offer.

Lastly, consider the pressure tactics that might be employed. Scammers frequently create a false sense of urgency, urging you to make a hasty decision by claiming the loan offer is only available for a limited time. This rush can cloud your judgment, leaving you vulnerable to making impulsive choices without thoroughly verifying the authenticity of their claims.

Being aware of these warning signs can help you navigate the treacherous waters of financial offers, make informed decisions and protect yourself from potential scams. Remember, knowledge is your best defence against those who seek to exploit your trust.

Navigating the Shadows of Loan Advertisements

In the vast landscape of financial assistance, where hope often intertwines with desperation, the channels through which loan services promote themselves can be revealing. In Singapore, strict regulations govern the advertising practices of licensed moneylenders. They are allowed to showcase their offerings only on their websites, within reputable business and consumer directories, or visibly at their physical locations. Therefore, if you come across loan advertisements through unsolicited social media messages or unexpected text alerts, it’s a red flag—a strong indication that you might be stepping into a scam.

As you seek financial aid, be vigilant about any peculiar requests for your personal information. Scammers often masquerade as legitimate lenders, requesting sensitive details under the pretence of processing your loan application. Exercise caution if anyone asks for your SingPass information, NRIC, bank account details, or any other private data. Genuine licensed moneylenders will conduct their official applications and verifications without resorting to such invasive tactics, relying instead on transparent processes.

Amidst the intricate maze of financial support options, selecting a trustworthy partner is paramount. Enter 1 AP Capital—a licensed lender proudly recognised by the Ministry of Law. With a commitment to clarity and integrity, they offer tailored loan solutions designed specifically for individuals navigating the financial landscape in Singapore. When you embark on your loan application journey with 1 AP Capital, you’re choosing a safe and straightforward pathway. By aligning yourself with a lender dedicated to your well-being, you’re taking a proactive step toward securing your financial future.

Recognising and Evading Loan Scams

The first and foremost action in shielding yourself from the perils of loan scams is to verify the credentials of any potential lender you encounter. Here’s how to navigate this crucial step:

1. Consult the Official Registry: Your journey begins by checking the Ministry of Law’s official list of licensed moneylenders. This regularly updated resource serves as a dependable reference point, ensuring that the lender you’re considering is indeed licensed to operate.

2. Confirm Contact Information and Location: Take the time to validate the contact details and physical address provided by the moneylender as listed on the Ministry of Law’s website. Be cautious of those who solely exist in the online realm or are hesitant to disclose a physical address—this is a sure sign that you should proceed with caution.

3. Examine Terms and Conditions: A reputable lender will always provide clear terms and conditions. Scrutinise these documents to understand what you are agreeing to before moving forward.

In this narrative of financial choices, knowledge is your most potent ally. By staying informed and vigilant, you can confidently navigate the path to financial assistance while avoiding potential scams.

Understanding and Reporting Suspicious Activities

In today’s world, where loan scams are increasingly common, being vigilant about suspicious activities and knowing how to report them is crucial for safeguarding not only oneself but also others in the community.

Imagine receiving an unexpected message that offers a loan with enticingly low interest rates. This type of unsolicited offer, whether it arrives via SMS, social media, or other informal channels, should raise red flags. In Singapore, there are dedicated hotlines and online platforms where individuals can report such dubious offers. Engaging with these resources is vital; it helps authorities track down scammers and protect potential victims from falling prey to their schemes.

Moreover, it’s essential to guard your personal information fiercely. When faced with unsolicited loan proposals, never divulge sensitive details such as your NRIC, SingPass, or bank account numbers. Scammers often employ clever tactics to extract this information, and sharing it can lead to devastating consequences.

Legitimate moneylenders operate through official communication channels. If you find yourself contacted by a mobile number or through casual platforms, it’s wise to proceed with caution. Always verify the authenticity of the lender before engaging further. A little scepticism can go a long way in protecting your financial health.

Harnessing Resources and ToolsIn Singapore, a range of resources and tools are available to assist individuals in recognising and avoiding loan scams.

ScamShield App: One notable asset in this battle against deceit is the ScamShield app, created by the National Crime Prevention Council. This app serves as an essential safeguard, explicitly designed to filter out scam calls and messages. By blocking communications from unknown numbers and halting calls from those flagged as fraudulent, it empowers users to navigate their phone interactions with greater security.

Consumer Awareness: It is crucial to stay informed about the latest schemes employed by scammers. The Ministry of Law, along with other official bodies, consistently updates the community about emerging scam tactics and guides how to sidestep them. Educating oneself about these methods can significantly bolster personal defences against fraud.

Community Vigilance: Raising awareness within your circle can significantly enhance protection against scams. Sharing knowledge about potential threats with friends and family cultivates a more vigilant community. Utilising public forums and social media platforms can amplify these efforts, creating a network of informed individuals who are equipped to avoid falling prey to loan scams.

Real-life Stories and Examples

Gaining Insight Through Experience

Sometimes, the most effective lessons come from the experiences of others. Real-life accounts can serve as powerful reminders of the dangers lurking in the world of loans. Here are some anonymised stories from individuals in Singapore who encountered loan scams, illustrating the crucial takeaways from their unfortunate experiences:

The Too-Good-To-Be-True Offer: Consider one individual who received an enticing SMS promising immediate loan approval without any credit check required. Lured by the allure of quick cash, they eagerly responded to the message. However, after showing interest, they were asked to pay an upfront “processing fee.” Trusting the offer, they complied, only to find that the promised loan never materialised. In a disheartening turn of events, the contact number provided vanished, leaving them both financially strained and without recourse.

The Impersonation Tactic: Another unfortunate soul fell victim to a more sophisticated ruse in which scammers impersonated a legitimate financial institution. This victim was led to a website that closely resembled that of a licensed moneylender, complete with authentic-looking application forms. After entering personal details and submitting a deposit, they were left empty-handed—without a loan and exposed to potential identity theft.

Social Media Snare: The grip of social media can also ensnare unsuspecting victims. One individual found themselves captivated by a loan advertisement on a widely used platform. The scammer, masquerading as a licensed moneylender, engaged them through direct messaging and requested an upfront payment. What initially seemed like an opportunity turned into a harrowing experience, highlighting the deceptive tactics that can thrive in the digital realm.

Essential Insights on Loan Scams

As we delve into the world of loan scams, several alarming patterns emerge from the experiences shared by victims. These narratives serve as cautionary tales, warning us of the red flags that often accompany such deceitful schemes.

First and foremost is the troubling trend of upfront fees. Many individuals have recounted their disheartening experiences when they were asked to pay fees before receiving any loan funds. It’s crucial to note that reputable and licensed moneylenders do not operate this way; they don’t demand payment before disbursing loans. This should raise an immediate alarm for anyone seeking financial assistance.

Another striking theme is the allure of offers that sound too good to be true. Whether it’s a promise of loans without credit checks or the enticing prospect of instant approvals, these seemingly miraculous deals often hide a sinister reality. If it appears overly beneficial, it warrants a closer inspection.

Moreover, scammers frequently employ the unsettling tactic of impersonation. They often masquerade as trusted institutions to create an illusion of legitimacy, making it imperative for individuals to verify claims through official channels. A simple check can save one from falling prey to these fraudsters.

In today’s digital age, social media and other unregulated platforms have become breeding grounds for such scams. Offers popping up in your news feed should raise eyebrows and prompt scepticism. Engaging with these unverified sources can lead you down a treacherous path, so proceed with extreme caution.

Taking Preventive Measures and What to Do Next

To combat these threats, it’s essential to arm ourselves with knowledge and share it within our communities. By disseminating these cautionary stories and the lessons learned from them, we can foster awareness and protect those around us from similar fates.

Verifying information is vital when it comes to trust. The official Ministry of Law website is a reliable resource for checking the credentials of moneylenders. Taking this step can help ensure that you are dealing with a legitimate entity rather than a scam artist.

Lastly, if you encounter suspicious activities or, worse yet, fall victim to a loan scam, it is critical to report your experience to the appropriate authorities without delay. By doing so, you not only seek justice for yourself but also contribute to the more significant effort of preventing future scams from affecting others.

In the face of these challenges, awareness, vigilance, and action can empower us to navigate the treacherous waters of loan applications with excellent safety and confidence.

Through these stories, we learn that vigilance and education are paramount in safeguarding ourselves against loan scams. Awareness is our strongest ally in navigating the murky waters of financial offers that seem too good to be true.

What to Do If You Fear You’ve Fallen Victim to a Loan Scam

Once upon a time, in the bustling heart of Singapore, people were going about their lives, seeking financial assistance through loans. However, amidst their quest for help, there lurked the shadowy figure of loan scams, ready to prey on the unsuspecting. Should you find yourself in the unsettling position of suspecting a loan scam, it’s essential to act swiftly and decisively.

The first step in this critical journey is to halt any further communication with the suspicious entity. Imagine the tension rising as you realise that every word exchanged could lead them to employ more ruthless tactics. It’s like stepping back from a dangerous precipice; by cutting ties immediately, you shield yourself from further manipulation.

Next, guard your personal information with diligence if you haven’t shared sensitive details or made payments yet—great! But if you have, it’s time to spring into action. Change your passwords as if fortifying a castle, and keep a watchful eye over your financial accounts for any signs of unusual activity. Your vigilance will be your armour against potential threats.

With your defences in place, it’s time to contact the authorities. Picture yourself standing tall as you contact the Singapore Police Force or the Anti-Scam Centre, reporting your suspicions. As you recount your experience, every detail you provide serves as a valuable piece of the puzzle that can aid their investigation. Your courage in sharing this information not only helps protect yourself but also shields others from falling prey to the same deceit.

In this tale of caution, documentation becomes your trusted companion. Save every email, message, and call log that relates to the scammer’s attempts to ensnare you. These records are akin to breadcrumbs leading investigators back to the source of wrongdoing. Moreover, take a moment to jot down a comprehensive account of your interactions—the moment you were approached, the enticing promises dangled before you, and any transactions that transpired. Each note adds depth to your story and strengthens your case.

As you navigate this tumultuous landscape, don’t hesitate to seek assistance from those who can help. If the scam involved someone masquerading as a licensed moneylender, informing the Ministry of Law is vital. They possess the authority to warn others and can take steps against those misusing legitimate names for fraudulent purposes.

If the ordeal has left you grappling with financial loss, consider reaching out to financial advisory services. Organisations like Credit Counselling Singapore stand ready to offer guidance and support as you work to regain control of your financial situation. It’s like having a trusty guide by your side as you traverse rocky terrain.

Finally, remember that emotional support is just as important as financial guidance. Engaging with social service agencies can provide the comfort and understanding needed to heal from this distressing experience. The journey of recovery may be long, but with professional help, you can emerge more substantial and more resilient.

As the story unfolds, spreading awareness becomes a shared responsibility. By sharing your experience and knowledge with others, you contribute to a collective shield against loan scams, ensuring that fewer individuals fall victim to these insidious traps. Together, we can illuminate the path forward and foster a safer community for all.

Raising Awareness: A Community Effort

In the heart of a bustling neighbourhood, a concerned resident named Maya decided it was time to take action against the insidious loan scams that had begun to plague her community. She understood that knowledge is power, and with her own harrowing experience as a backdrop, she embarked on a mission to enlighten those around her.

Maya took to social media, crafting thoughtful posts that detailed her encounter with a deceptive lender. She knew the importance of being responsible in her communications; after all, the last thing she wanted was to spread misinformation or tarnish anyone’s reputation without cause. With each word, she focused on sharing factual information and urged her friends and followers to remain vigilant against such threats.

But her efforts didn’t stop there. Maya organised community meetings at the local library, inviting her neighbours to discuss the alarming rise in these scams. The gathering was filled with shared stories and valuable insights, and everyone learned how to protect themselves and their loved ones from falling prey to these fraudulent schemes.

Staying One Step Ahead of Loan Scams

Maya also emphasised the importance of staying informed. She encouraged everyone to keep abreast of scammers’ latest tactics. The Singapore Police Force and the National Crime Prevention Council were invaluable resources, regularly updating the public on emerging threats. By sharing this information, Maya helped cultivate an alert and aware community.

Moreover, she advocated for financial literacy, explaining how understanding legitimate lending practices could serve as a shield against deceit. By knowing what to expect from licensed moneylenders, individuals would be better equipped to identify red flags in suspicious offers.

Before engaging with any lender, Maya advised her neighbours to verify their credentials. She instructed them to check the official registry published by the Ministry of Law, reminding them that any lender not listed should raise immediate concerns. Additionally, she suggested seeking out reviews from previous clients—while not infallible; these testimonials could offer extra assurance.

Safeguarding Personal Information

As part of her campaign, Maya stressed the need to protect personal data fiercely. She shared tales of how even minor details could be exploited by scammers, urging her neighbours to be judicious about what they disclosed online or over the phone.

To bolster their defences further, she recommended that everyone regularly monitor their financial accounts. By checking bank statements and credit reports for unauthorised transactions or unexpected applications, they could catch potential fraud before it spiralled out of control.

Embracing Technology for Enhanced Security

Recognising the role of technology in this fight against scams, Maya introduced her community to various anti-scam applications like ScamShield. These tools could help filter out unwanted calls and messages, offering an added layer of protection.

Lastly, she advocated for the use of two-factor authentication for all financial and personal accounts. By enabling this feature, her neighbours could significantly enhance their security, ensuring that even if their passwords were compromised, their accounts would remain safeguarded.

Through her unwavering dedication and proactive approach, Maya transformed her community into a more informed and vigilant place. Her story became a beacon of hope, inspiring others to take charge of their financial safety and fostering an environment where scams would find it increasingly difficult to thrive. Together, they stood firm against deception, armed with knowledge and unity.

Journey Towards Financial Safety: Navigating Resources for Support and Education

In the bustling city-state of Singapore, where innovation meets tradition, navigating the financial landscape can sometimes feel overwhelming. Fortunately, a wealth of resources exists to guide you through the complexities of financial management and safeguard you against the perils of scams.

The Guardians of Law and Order

The Ministry of Law is at the helm of regulatory oversight, a pivotal entity that diligently maintains an official roster of licensed moneylenders. Their commitment to transparency ensures that individuals seeking financial assistance can do so with confidence while keeping the public informed about evolving regulations and guidelines.

Equally vigilant is the Singapore Police Force, notably its Anti-Scam Centre. This dedicated agency stands as a beacon for those who find themselves ensnared in the web of deceit that scams often weave. Here, victims can report incidents, seek guidance, and find solace in knowing they are not alone in their struggles against fraud.

Meanwhile, the National Crime Prevention Council runs the Scam Alert initiative, an invaluable resource that illuminates the latest scam tactics and offers practical tips for prevention. Armed with this knowledge, citizens can fortify themselves against fraudulent schemes.

Financial Guidance and Support Networks

As one traverses this intricate financial landscape, Credit Counselling Singapore emerges as a guiding star. This organisation provides expert advice on managing debts, including those that might have arisen from unfortunate encounters with scammers. With their support, individuals can reclaim control over their financial destinies.

The Association of Banks in Singapore also plays a crucial role by offering insights into safeguarding personal banking information. Their resources empower consumers to take proactive steps in reporting any suspicious financial activities they may encounter.

Community Connections and Digital Allies

In today’s interconnected world, community support is more accessible than ever. The ScamShield App, developed by the National Crime Prevention Council, serves as a digital ally in the fight against scams. By filtering out fraudulent messages and calls, it minimises the chances of falling prey to deceitful interactions.

Online platforms like HardwareZone Forums and Reddit Singapore have also become vital spaces for individuals to share their experiences and wisdom regarding scams. These communities foster a spirit of collaboration and support, helping members navigate challenges together.

Additionally, social media has transformed into a powerful tool for awareness. By engaging with campaigns on platforms like Facebook and Instagram, users can stay updated on the latest insights and strategies to prevent scams. Participating in these initiatives not only educates individuals but also creates a collective front against fraud.

Educational Endeavors: Empowering Through Knowledge

As the saying goes, knowledge is power. MoneySENSE embodies this philosophy through its national financial education program designed to enhance consumers’ basic financial literacy. By equipping individuals with essential skills and information, it fosters a generation of financially savvy citizens.

The Singapore FinTech Association complements these efforts by providing workshops and resources focused on financial technology and security. Understanding how to protect oneself in the digital realm is crucial in an age of increasingly sophisticated online scams.

A Guide to Financial Resilience: Protecting Yourself from Scams

As we conclude this exploration of resources available to you, we hope this narrative serves as a comprehensive roadmap in your quest for financial safety. By leveraging the knowledge and tools at your disposal, you can stand resilient against the intricate tactics employed by scammers. Remember that vigilance, education, and timely action are your strongest defences in this ongoing battle for financial security. Together, let us navigate this landscape with wisdom and courage, ensuring a safe journey towards a brighter financial future.

Maxthon

In a digital world that is evolving at breakneck speed and online interactions are constantly transforming, safeguarding personal safety while navigating the expansive internet has become not just important but absolutely vital. The complex network of connections that shapes our online experiences demands a thoughtful approach to browser choice, where security and privacy take centre stage. Amidst a sea of competing web browsers, Maxthon emerges as a reliable contender, adeptly addressing these urgent issues without burdening users with costs.

Imagine stepping into the vast realm of the internet—every click, every scroll, a new adventure waiting to unfold. Yet, lurking in the shadows are potential threats that could compromise your personal data and online presence. Here enters Maxthon, a browser that has carved its own distinct space in the crowded marketplace by prioritising user safety and confidentiality above all else. It’s not merely about browsing; it’s about embarking on a journey where your data is shielded from the myriad dangers that populate the digital landscape.

With an unwavering focus on protecting user information, Maxthon employs an array of sophisticated strategies designed to keep your sensitive data secure. Utilising cutting-edge encryption technologies, this browser ensures that every piece of information you share during your online activities remains confidential, providing peace of mind as you traverse the internet’s vast expanses.

As you delve deeper into the digital wilderness, Maxthon shines as a beacon of privacy enhancement. Every feature is meticulously crafted to elevate your online experience. Its robust ad-blocking capabilities work tirelessly to fend off intrusive advertisements that seek to distract and disrupt your journey. Meanwhile, comprehensive anti-tracking measures act as vigilant guardians, thwarting scripts designed to monitor your online behaviour. In this way, Maxthon transforms your browsing into a seamless adventure, where distractions are minimised and focus is maximised.

Adding to this protective arsenal is Maxthon’s dedicated incognito mode—a sanctuary for those who wish to explore the web with an added layer of assurance. In this private browsing space, users can engage with the internet freely, knowing that their activities remain cloaked from prying eyes. This mode empowers individuals to venture forth with confidence, exploring new territories without fear of unwarranted surveillance.

Thus, in a world where the digital realm can feel overwhelming and fraught with risks, Maxthon stands as a trusted ally—one that champions your right to privacy and security as you navigate the limitless possibilities of the internet. With each click, you can embark on your digital adventures assured that you are shielded by a browser designed with your safety in mind.