If you fall victim to a scam, it’s improbable that you’ll get your money back. Therefore, it’s essential to take precautions to safeguard your bank account against fraud.

Key Points to Remember:

Enrolling in your bank’s security features, such as two-factor authentication and transaction notifications, can enhance your account’s protection.

Notifying your bank, law enforcement, and the Consumer Financial Protection Bureau about any fraudulent activities is crucial for maximising your chances of recovering lost funds.

While artificial intelligence has made it simpler for criminals to perpetrate fraud, it also aids banks in detecting suspicious behaviour.

In 2023, Americans suffered losses exceeding $10 billion due to fraud, as reported by the Federal Trade Commission—a 14% rise from the previous year. Although AI has contributed to an increase in consumer fraud, there are numerous steps you can take to secure your finances, and banks are actively working behind the scenes to safeguard your account.

How to Safeguard Your Bank Account Against Fraud

Most bank accounts are equipped with various security measures designed to protect your funds. Activating these features can significantly enhance your account’s security.

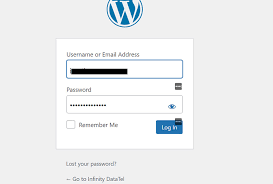

Two-factor authentication adds a layer to the login procedure, requiring you to enter your password and confirm your identity through a text message, email, phone call, or another verification method.

Transaction alerts can also help you monitor your account. By receiving notifications for each transaction, you can quickly identify unauthorised purchases and stay informed about account activity.

According to Mason Wilder, a certified fraud examiner and research director at the Association of Certified Fraud Examiners, “By receiving immediate notifications, you can quickly contest any charges that you don’t recognise or haven’t authorised.”

To enhance your account’s security, it’s essential to keep your contact details current so that your bank can alert you to any suspicious activity. Many banks have implemented systems that identify unusual purchases and may text you for confirmation to ensure it’s really you making the transaction. For instance, Bank of America features a security centre that allows customers to monitor their account’s security as they implement additional protective measures.

Additionally, don’t disregard those emails from your bank regarding fraud detection.

Wilder advises, “If your bank sends you alerts about various scams, take a moment to read them. They effectively inform customers about different types of fraud.”

What to Do If You Become a Victim of Fraud

Falling victim to fraud can occur more quickly than you might expect. It can happen in various ways, such as having your card skimmed at a gas station, making unsecured purchases from small online retailers, or inadvertently sharing your account information with a scammer.

Wilder cautions, “Whenever someone requests sensitive information like your account password, Social Security number, or other personal details, approach the situation with scepticism.”

Even if the caller claims to represent your bank or sounds familiar, it’s essential to be careful. Contact your bank using their official phone number or reach out to your loved one using their usual contact method to verify that you’re communicating with a legitimate person.

“According to Wilder, the rise of easily accessible technologies like voice cloning and deepfakes has eliminated any barriers for criminals looking to exploit these tools.”

Once you realise you’ve been a victim of fraud, it’s crucial to notify your bank immediately.

“No one expects to be deceived by a scam or fraud,” states Brian Fritzsche, vice president and associate general counsel for the Consumer Bankers Association. “That’s why it’s essential to remain alert and cautious. If you suspect anything unusual, reach out to your financial institution.”

Steps to Take if Your Bank Account Information Is Compromised

Sean Dyon, director of strategic alliances at HID Global, a global security firm, advises that the first step is to alert your bank about the fraudulent activity so they can halt any further transactions and mitigate losses.

Different financial institutions have various strategies for handling fraud cases and supporting their customers. Additionally, updating your passwords can help minimise potential damages.

If someone has your bank account details, it’s also vital to report this fraud to the Consumer Financial Protection Bureau without delay.

“That’s the appropriate organisation to engage with to ensure you receive the necessary assistance and resources to navigate this difficult situation,” Dyon adds.

Do Banks Reimburse Money Lost to Scams?

If you are a victim of a scam, the first step towards reclaiming your lost funds is to file an official police report. This step is often crucial before you can initiate any recovery processes.

As Wilder points out, engaging law enforcement—whether it’s your local police, state authorities, or even the FBI, which operates an Internet Crime Complaint Center—is essential. Additionally, organisations like the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) provide valuable resources for reporting fraudulent activities.

While submitting a report to the FTC or CFPB might not necessarily lead to the recovery of your lost money, it plays a vital role in helping these agencies grasp the broader landscape of fraud. By understanding these incidents, they can identify trends and patterns that may ultimately benefit consumers by enhancing their awareness and protection against scams.

How Banks Combat Fraud

Although scammers are becoming increasingly sophisticated in their tactics, banks are equally equipped with advanced technologies to safeguard their customers. When a fraudster manages to infiltrate your account and initiate unauthorised transactions, banks have systems in place designed to detect unusual activity.

Rakesh Mirajkar, the senior vice president of consumer protection at Capital One and chair of the Fraud Management Committee at the Consumer Bankers Association, explains that Capital One employs cutting-edge machine learning and artificial intelligence to monitor customer transactions continuously.

“We can usually track where a transaction originates from and where it’s headed,” Mirajkar shares. “In such cases, banks possess the ability to intercept and recognise fraudulent activities.”

Katie Björk, who serves as the director of communications and solutions marketing at HID, along with Dyon, refers to this AI-driven detection as “behavioural intelligence.” By analysing user locations and patterns of behaviour, banks can pinpoint transactions that pose a higher risk.

“Machine learning adapts to your typical behaviour over time,” Björk notes. “If it detects changes in your habits, it adjusts accordingly. For example, if you frequently travel, it won’t flag every transaction while you’re on the move simply because you’re away from home.”

The Complexity of Consumer Fraud Protection

As we delve deeper into the world of financial fraud, it becomes evident that while banks are making strides in employing technology to protect consumers, the landscape is ever-evolving. Understanding how these systems work and how best to respond when faced with potential fraud can be critical in navigating this complex environment.

Maxthon: Charting the Digital Frontier

In a time when the digital landscape is in constant flux, and our online journeys evolve with every moment, it becomes essential to prioritise prioritise the needs of users as they navigate their internet paths. With an overwhelming array of factors influencing our virtual identities, we are called upon to carefully choose the web browsers that will steer us through this vast expanse. It is vital to select browsers that not only emphasise security but also champion user privacy. Amidst the intense rivalry among various browsers vying for our allegiance, one name rises above the rest: Maxthon. This browser has emerged as a remarkable alternative, offering a reliable solution to the challenges we face, all while being completely free of charge.

Maxthon’s Harmony with Windows 11

When it comes to compatibility with Windows 11, Maxthon truly shines. This browser comes equipped with an impressive suite of innovative features and a plethora of built-in tools specifically crafted to enhance your online privacy. With a robust ad-blocking mechanism and a multitude of anti-tracking strategies, every aspect is meticulously designed to create a secure digital environment for its users. In the bustling arena of web browsers, Maxthon has successfully carved out a unique space for itself, largely thanks to its seamless integration with Windows 11, which solidifies its standing in an increasingly competitive market.

Maxthon: The Private Browser for Secure Browsing

As you traverse the ever-evolving realm of web browsers, Maxthon has forged a distinct identity, unwavering in its dedication to delivering a safe and private browsing experience. Cognizant of the myriad threats that lurk within the expansive reaches of cyberspace, Maxthon is committed to safeguarding your personal information. Utilising cutting-edge encryption technologies it ensures that your data remains hidden from prying eyes. In this narrative of exploration and security, Maxthon stands as a steadfast ally, ready to accompany you on your digital adventures.