In August 2023, the Singapore Police Force (SPF) identified five prevalent types of scams: impersonation, e-commerce fraud, job-related scams, phishing schemes, and investment cons. As scams have become more rampant, many individuals have adopted a somewhat cautious—perhaps overly so—approach to dealing with unfamiliar phone numbers and messages. The instinct to hang up on calls from unknown sources or to block and erase texts from strangers has grown stronger. Yet, as the tactics of scammers evolve, the risk of falling victim to their schemes has increased. In fact, from June to July 2023 alone, SPF reported uncovering over 1,200 scam incidents. This alarming figure accounts for a quarter of the total e-commerce scams documented in ScamAlert by December 2022, suggesting a disturbing trend that could see even more scams emerge throughout 2023.

Scammers have become increasingly adept at deception; they may present themselves as old friends reconnecting after years apart or as officials from government agencies, even masquerading as stockbrokers eager to make you an investment offer. Others inundate unsuspecting victims with enticing job offers via text messages that seem too good to be true. With the current surge in concert popularity, some scammers are capitalising on resale platforms, luring fans with concert tickets priced attractively low—only to vanish once payment is made. These deceptive practices have led to staggering financial losses, draining millions from the pockets of those who fall prey.

To shed light on the financial toll of these scams, here’s a breakdown of the monetary losses reported by SPF in 2022:

in 2022:

– E-commerce: $21.3 million

– Impersonation: $8.8 million

– Job scams: $117.4 million

– Investment fraud: $198.3 million

– Phishing: $16.5 million

In response to this growing crisis, the SPF, alongside the Ministry of Home Affairs (MHA) and the National Crime Prevention Council (NCPC), unveiled a proactive three-step strategy known as “ACT” in January 2023. This initiative comprises three straightforward actions: add, check, and tell, designed to empower Singaporeans with essential knowledge on how to navigate potential scams.

So, how can you put the ACT framework into practice when confronted with suspicious situations? Here’s a guide to help you stay vigilant and informed in an increasingly dangerous landscape of deception.

Embracing ScamShield and Strengthening Security Measures

In the grand adventure of safeguarding oneself in the digital realm, the initial move one must make is to embrace the concept of “adding.” You may wonder, “Adding what?” The answer lies in incorporating the ScamShield application along with various other dependable security features into your arsenal. Released to the public in November 2020, ScamShield serves as a vigilant guardian, adept at blocking fraudulent phone numbers and seamlessly redirecting suspicious messages to junk folders on your mobile devices.

What makes this app particularly appealing is its commitment to user privacy; it does not demand sensitive information such as your mobile number, geographic location, or contact list. This thoughtful design significantly diminishes the chances of scammers infiltrating your personal space. You can easily find this invaluable tool on both the Play Store and App Store, making it accessible to many.

But that’s not all—this powerful application also empowers users to take action against deceitful practices. You can report scam calls and upload evidence of fraudulent messages directly within the app, contributing to a collective effort to combat scammers. Moreover, this feature aids in expanding the app’s database with information about emerging scam techniques. Surprisingly, statistics from 2022 reveal that a significant portion of scam victims are individuals aged between 20 and 39, according to the Singapore Police Force (SPF). Unlike older generations who may struggle with technology, this demographic finds the app intuitive and user-friendly.

Beyond simply downloading ScamShield, it’s wise to consider implementing additional layers of security. For instance, activating Two-Factor Authentication (2FA) for your social media accounts adds an essential shield of protection. This method necessitates two distinct forms of identification before you can access your personal information, reinforcing your defences against unauthorised access.

Moreover, enhancing your privacy settings on messaging and social media platforms is another prudent measure. By doing so, you restrict unknown individuals from viewing your profile or contacting you, fortifying your online presence.

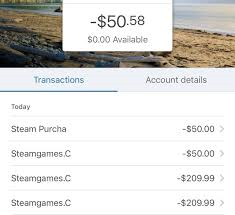

Another proactive strategy is to lower the transaction limits on your bank accounts. This simple adjustment can significantly mitigate potential financial losses in case of fraudulent activities. Opting for digital banking applications can further streamline your transactions while providing a convenient way to monitor any unauthorised charges.

Furthermore, cultivating a robust password acts as an impenetrable barrier against scammers attempting to breach your digital fortifications. Crafting a password that is both memorable and formidable is crucial. Here are some guidelines to help you devise a secure password:

– Ensure it contains a minimum of 12 characters (some platforms may require even more).

– Employ a mix of letters, numbers, and symbols for added complexity.

As we embark on this journey toward enhanced security, remember that each step taken—whether downloading an app or adjusting settings—brings us closer to a safer digital experience. The path may seem daunting at times, but by arming ourselves with knowledge and tools, we can navigate the treacherous waters of online threats with confidence and resilience.

C – Investigating the Warning Signals of the Top 5 Scams of 2023

As we delve deeper into the ACT framework, we arrive at a crucial phase: the act of checking. Imagine you find yourself in a situation where doubt creeps in—perhaps a job offer that seems too enticing or an unexpected request that raises your eyebrows. In these moments, it is vital to consult reliable resources to identify the hallmark signs of a scam.

Picture this: you’ve received an email from what appears to be a reputable company offering you a position that aligns perfectly with your skills and aspirations. Your heart races with excitement, but then a flicker of scepticism takes hold. Instead of succumbing to the thrill, take a step back. Navigate to the company’s official website and confirm whether this opportunity genuinely exists. This simple yet essential act of verification can save you from potential pitfalls.

It’s easy to be swept away by impulse, especially when faced with urgent requests or offers that sound too good to be true. However, it’s crucial to pause and reflect. Is the request you’ve received asking for personal information? Does it pressure you to act quickly? If any aspect feels off, it’s wise to delay your response. Take your time to gather the necessary information and ensure that what you’re dealing with is legitimate.

When faced with uncertainty, having trusted resources at your disposal can make all the difference. In Singapore, several official entities stand ready to assist you in identifying scam signs and trends. The Singapore Police Force provides insights into ongoing scams, while Scam Alert offers updates on the latest schemes targeting individuals. The Cyber Security Agency of Singapore focuses on protecting you from online threats, and the National Crime Prevention Council works tirelessly to raise awareness about various scams.

In this age of rapid digital communication, being vigilant is not only advisable but essential. By taking the time to investigate and verify before acting, you can safeguard yourself against the deception that lurks around every corner. Remember, when in doubt, always check first.

E-commerce Fraud: A Cautionary Tale

In the digital marketplace, individuals often fall prey to deceitful schemes when they encounter offers that seem too appealing to be accurate. Recently, a surge in fraudulent advertisements for concert tickets has emerged across various online platforms like Carousell, Facebook, Telegram, and Twitter.

These scams typically unfold in a familiar pattern. Initially, scammers attract potential victims with enticing ads, creating a sense of urgency by claiming that these coveted tickets are in limited supply. Once they have captured the victim’s interest, they present fabricated images or screenshots of counterfeit tickets, convincing their targets of their legitimacy. They then pressure victims to act swiftly, suggesting that these “tickets” won’t be available for long. Payments are often requested through credit card transactions or digital bank transfers. Still, there are instances where cash is demanded for items that either don’t exist or are merely substandard replicas.

Moreover, the deception doesn’t end there. Scammers frequently concoct additional stories to extract more money from their victims, claiming issues with payment processing or other fabricated obstacles. In the end, the promised tickets never materialise, or they turn out to be worthless, leaving victims frustrated and without recourse as the scammers vanish without a trace.

Recognising warning signs is essential to safeguard yourself against such e-commerce fraud. As advised by Scam Alert, here are some tips on how to protect yourself.

Warning Signs to Watch For:

– Communication Style: Be cautious of overly casual or poorly written messages that seem unprofessional or inconsistent with legitimate businesses.

Signs to Be Cautious Of

When navigating the vast world of online transactions, it’s essential to remain vigilant, especially when offers seem too enticing. Imagine stumbling upon an advertisement boasting a “limited-time-only” deal that promises products at prices far below their usual market value. While these offers may appear irresistible, they often raise red flags—like a beacon warning you to proceed with caution.

Another common tactic employed by fraudsters is the deliberate omission of critical information. You may notice that these scammers provide scant details about their products, and the terms and conditions are usually glossed over or absent. This lack of transparency should set off alarm bells in your mind.

Furthermore, be wary if someone attempts to steer your conversation away from the leading platform where you initially connected. Scammers frequently try to transition discussions from secure messaging channels to less monitored avenues, such as phone calls or text messages, in an effort to evade scrutiny.

One prevalent method of payment favoured by e-commerce scammers is direct bank transfers. They might insist on this method, often insisting that it’s the only way to secure the deal. If you hesitate and decline their offer, they may suddenly dangle a discount in front of you like a carrot, hoping to entice you into compliance.

Additionally, watch for requests for unexpected fees. Scammers might introduce extra charges under various guises, such as administrative costs or shipping fees, which can quickly add up and catch you off guard.

Strategies for Safeguarding Yourself

To protect yourself in these murky waters of online shopping, always aim to conduct transactions through the platform’s secure payment system whenever possible. If that isn’t an option, insist on cash-on-delivery to mitigate risks.

Opt for sellers and shopping platforms that have established a reputation for reliability. Look for those with positive reviews and robust consumer protection policies, particularly when purchasing high-value items. It’s crucial to check the terms and conditions thoroughly, ensuring that all fees are clearly outlined before you proceed.

Moreover, familiarise yourself with regulations regarding Goods and Services Tax (GST) and customs duties. Be aware that additional charges may apply to goods valued over $400, which could surprise you at checkout.

Finally, take a moment to review the platform’s Transactions Safety Ratings (TSR). This rating reflects the safety measures an e-commerce site has implemented to protect its users. Additionally, local authorities have compiled a list of known scam platforms and their aliases to help citizens avoid falling victim to these schemes.

The Tale of Impersonation Scams

In a world where connections flourish, a troubling shadow lurks—impostors weaving deceit through the simple act of communication. Recently, a chilling trend has emerged, ensnaring unsuspecting individuals in the web of what is known as the “fake friend call” scam. This insidious act is a prime example of impersonation scams, a broader category that exploits trust and familiarity.

Imagine a scenario where you receive a phone call from someone who sounds eerily familiar yet remains shrouded in mystery. This so-called friend refuses to unveil their identity, instead playfully challenging you to guess who they might be. Intrigued and perplexed, you toss out names, hoping to jog their memory. Once you’ve taken the bait and offered up a name, the scammer seizes the moment, requesting that you save their number. Days later, they call back under the guise of urgency, concocting elaborate tales—like a sudden hospitalisation of a loved one—to extract money from your wallet.

But the deception doesn’t stop there. These impersonation scams extend beyond familiar voices, reaching into the realms of business and local governance. Scammers adopt false identities, posing as business owners or officials, all in an effort to pry personal information from their victims. They may seek your account passwords or those elusive one-time passwords (OTPs), leaving you vulnerable to further exploitation.

As you navigate this perilous landscape, it’s vital to remain vigilant. There are telltale signs that can help you discern the genuine from the fraudulent:

– Requests for Personal Information: Legitimate institutions, such as banks or government agencies, would never ask for sensitive data like bank transfers or confidential details over a phone call or message. This principle holds for courier services, telecommunications companies, and e-commerce platforms as well.

– Scare Tactics: Beware of callers who employ intimidation to make you believe you’ve committed an offence or are embroiled in a legal predicament. They may threaten to escalate matters to higher authorities if you do not comply with their demands.

– Foreign Numbers: Exercise caution when receiving calls from numbers with a ‘+’ prefix. While some may indeed come from familiar sources, not all such calls originate from Singapore or other trusted locales.

– Unsolicited Communications: Unexpected calls or messages from individuals you’ve never contacted before should raise red flags. If the caller cannot clearly identify themselves or provide specific details but insists on obtaining your personal information, it’s best to proceed with caution.

To safeguard yourself against these deceitful tactics, consider these protective measures:

– Unless you’re anticipating a call from abroad, refrain from answering calls from unfamiliar foreign numbers.

– Guard your confidential information zealously. Never share sensitive data without first verifying the identity of the requester.

– If a caller fails to provide their name upon request, don’t hesitate to end the conversation immediately. Trust your instincts—if something feels off, it probably is.

In this age of connectivity, where trust is often taken for granted, remaining alert and informed is your best defence against impersonation scams. By recognising the signs and implementing protective strategies, you can navigate the treacherous waters of deceit with greater confidence and security.

The Rise of Job Scams in 2025

In the ever-evolving landscape of online fraud, job scams have emerged as one of the most prevalent schemes of 2023. These deceptive practices often find their way into our lives through familiar messaging platforms like WhatsApp and Telegram or even on social media sites where we connect with friends and family. Much like impersonation scams, the perpetrators of these job scams adopt the guise of potential employers, luring individuals with promises of lucrative salaries and minimal commitment—offers that are almost too enticing to be accurate.

So far, ScamAlert has uncovered a variety of these fraudulent job propositions, revealing a disturbing pattern that potential victims should be aware of. One common type involves Affiliate Marketing roles, where scammers ask for upfront payments for products under the pretence that doing so will enhance sales in exchange for a commission. This tactic often entices those eager to earn money quickly.

Another variant involves job offers facilitated through supposed “agents.” In these cases, victims are instructed to send money via specific services like Western Union or MoneyGram, raising red flags about the legitimacy of these arrangements.

Then there are positions labelled as “assistant purchaser,” “stock takers,” or “trial participants.” These roles often require applicants to divulge sensitive personal information—such as their names, identity card numbers, and even one-time passwords—all under the guise of a necessary vetting process.

Perhaps one of the more dubious offerings includes roles as “Male Social Escorts,” which promise connections with affluent female clients. However, prospective applicants are required to pay a registration fee upfront, cleverly disguised as an investment in their future earnings.

Scammers’ creativity knows no bounds. They also engage victims in schemes that involve artificially inflating cryptocurrency values or rating applications to improve their visibility. For these tasks, victims are frequently encouraged to take actions that ultimately lead them deeper into the scam.

To help safeguard against falling prey to these schemes, there are several warning signs that individuals should be vigilant about:

– Upfront Payments: Be wary if you’re asked to open an account on an unverified app or website or to sign up for a paid membership before starting your supposed new job. Scammers may even entice you with commission offers for initial tasks to establish a sense of credibility.

– Unrealistic Offers: If a job seems too good to be true—promising high returns for minimal effort—it likely is. Such offers are classic indicators of a scam.

– Unsolicited Proposals: Job offers that come out of nowhere through social media or messaging apps should raise suspicion. Scammers often pose as representatives from legitimate recruitment firms. They will try to build rapport by adding victims to group chats filled with testimonials and success stories to create an illusion of authenticity.

– Vague Job Descriptions: When job postings lack precise details about responsibilities and expectations, it’s a strong indicator that something is amiss.

In the realm of job hunting, a shadowy presence lurks, often disguised as opportunity. These scammers, skilled in deception, may approach you with enticing offers that quickly turn suspicious. They might solicit personal details or bank information, urging you to make advance payments or to download dubious applications before you can embark on your so-called “employment.” It’s crucial to remain vigilant and protect yourself from these potential threats.

To shield yourself from falling prey to such scams, it is wise to ignore questionable job propositions altogether. Always take a step back and verify the legitimacy of any offer by contacting the human resources department of the hiring company directly via email. This simple act could save you from a world of trouble. Additionally, be firm in your decision not to let employers use your personal bank account for transactions; this could lead you down a dangerous path of money laundering allegations. Lastly, steer clear of downloading unverified applications from untrustworthy sources during your job search.

As you navigate this treacherous landscape, be aware that investment scams are another form of deceit that can ensnare the unsuspecting. Scammers often masquerade as stockbrokers or employees of reputable banks and financial firms on popular social media platforms like Facebook. Once they’ve established contact with potential victims, they cunningly ask for sensitive information such as NRIC numbers or passport details, claiming it’s necessary to complete an investment application. This is merely a precursor to their next move: requesting substantial bank transfers under the guise of administrative fees, security deposits, or taxes—all presented as prerequisites for reaping promised profits.

Not limited to text messages or social media interactions, these fraudsters may also reach out via phone calls, pretending to be representatives of foreign monetary authorities, insisting on a deposit before any earnings can be released. Some variations of this scam even involve supposed investments in cryptocurrencies suggested by online acquaintances who may not be who they claim to be.

To help you identify these scams, here are some warning signs to watch for. First, be cautious of binary options—these financial derivatives hinge on a simple yes or no proposition, and platforms offering them are often nothing more than elaborate frauds. Second, remain sceptical of investment opportunities that promise unrealistically high returns; if it sounds too good to be true, it likely is. Lastly, exercise caution when dealing with unfamiliar entities or platforms located outside of Singapore; their distance can often be a red flag.

To safeguard your financial future, always consult with a licensed financial advisor before making any investment decisions. Conduct thorough research on any company or representative by utilising official resources like the Financial Institution’s Directory or the Register of Representatives. By taking these precautions, you can better protect yourself from the lurking dangers of scams and secure your financial well-being.

The Deceptive World of Phishing Scams

In an era where technology is woven into the fabric of our daily lives, the shadows of deceit grow ever darker. Unscrupulous individuals exploit this dependency, crafting deceptive websites designed to ensnare unsuspecting victims into fulfilling their unwarranted demands. Often, these victims find themselves receiving unsolicited calls, texts, or emails that beckon them to reveal sensitive personal information. The scammers weave elaborate tales, claiming that they have won a prize, need to secure online accounts, or are conducting investigations into suspicious transactions. These fabrications serve only one purpose: to entice victims into clicking on a link that leads them to a counterfeit website.

In another twist of this treacherous game, victims may stumble upon enticing advertisements plastered across social media platforms—deals that seem almost too perfect to be true. A simple click on such ads or a message to the supposed seller can quickly redirect them to a façade of a website. In order to make what they believe is a legitimate purchase, victims often end up sharing their details and unwittingly authorising payments directly into the scammer’s pockets.

To bolster their façade and gain the victim’s trust, these scammers often reach out again after the fraudulent transaction has taken place. Posing as bank representatives investigating the very fraud they orchestrated, they skillfully manipulate their victims into downloading a counterfeit application dubbed “ScamShield,” accessible only through a malicious URL. This app, they claim, will help safeguard the user against scams. However, in reality, clicking on such dubious links paves the way for malware to invade personal devices. This malicious software not only wreaks havoc but also siphons off confidential information from unsuspecting users.

Recognising the Red Flags

As one navigates this treacherous landscape, it’s crucial to remain vigilant for warning signs. Unsolicited communications—be it calls, emails, or texts—should always raise suspicion. Messages claiming that you’ve won a lucky draw or a similar contest warrant scrutiny; legitimate organisations typically reach out to winners through official emails or mailed notifications in addition to phone calls. Pay close attention to any spelling or grammatical errors in messages that threaten account closures, cite delivery issues, or tout deals that sound too good to be true. Texts frequently include links leading to unverified websites or dubious phone numbers.

Safeguarding Yourself Against Scams

To shield oneself from falling prey to these scams, it’s essential to adhere to certain precautions. First and foremost, never divulge personal information under any circumstances; this includes one-time passwords (OTPs) and banking or credit card details. Remember, knowledge is your best defence in an increasingly complex digital world. Stay informed and remain sceptical of anything that seems amiss—it’s better to err on the side of caution than to become another statistic in the ever-growing list of phishing scam victims.

The Importance of Sharing Your Experience

In the journey of navigating life’s challenges, one critical lesson stands out: the importance of communication, especially in the face of deception. This principle shines brightly when you encounter a scam. The last step in the ACT method emphasises the necessity of sharing your experience—not just for your peace of mind but to safeguard those you care about. It is vital to inform the appropriate authorities and your loved ones when faced with such fraudulent schemes. This includes reaching out to your bank and local law enforcement.

When you take the initiative to report these incidents, you open the door to reclaiming your financial losses through the efforts of the Anti-Scam Centre (ASC) established by the Singapore Police Force (SPF) in 2019. Their dedicated team works diligently to halt the operations of scammers by freezing their bank accounts and recovering stolen funds. However, it’s important to note that the timeline for recovery can vary significantly based on the complexity of each case. For example, scams that originate from abroad often present challenges that complicate the investigative process, making recovery more complex.

Moreover, as technology continues to evolve, so too do the methods employed by scammers. To combat this, you can also utilise the ScamShield app, where you can report suspicious activities and block dubious accounts across various messaging and social media platforms.

Taking Action Before It’s Too Late

The National Crime Prevention Council (NCPC) highlights a crucial fact: since its inception, the ScamShield application has effectively blocked over seven million suspicious text messages and more than 70,000 blocked phone numbers. This impressive statistic underscores its effectiveness in the ongoing battle against fraudsters.

Despite this progress, the reality remains that scams are on the rise. However, resources like ScamAlert and SPF’s weekly scam bulletins serve as invaluable tools for educating the public about recognising potential scams and protecting themselves. This proactive approach has yielded results; according to SPF’s annual scams and cybercrime brief for 2022, there has been a noticeable decline in scam incidents from 2020 to 2022. Although there was a staggering 51.3% increase in scams from 2020 to 2021, this growth rate dramatically decreased to just 25.2% between 2021 and 2022.

In this ever-evolving landscape, staying informed and taking action can make all the difference. By sharing our experiences and utilising available resources, we can collectively work towards a safer environment for ourselves and those we cherish.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in Adblock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s Adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive market of web browsers.