In the bustling world of banking, where vast sums of money flow through digital channels every day, a silent war rages on. This battle is against the ever-present threat of bank fraud—a menace that lurks in the shadows, waiting for the perfect moment to strike. Our story begins with the guardians of the financial realm, those who work tirelessly to shield banks and their clients from this invisible enemy.

Picture a team of dedicated experts gathered in a high-tech command centre. Their mission? To fortify the bank’s defences using an intricate tapestry of strategies and innovations. They weave together powerful tools like data encryption, transaction monitoring, and verification processes. Among their arsenal is the positive pay technique, a clever method that ensures only legitimate transactions pass through.

But the tale doesn’t end there. These vigilant protectors are always on the lookout for new perils. They delve deep into the world of emerging threats, identifying common risks that banks face daily. In their quest for security, they turn to cutting-edge technologies—predictive AI and machine learning solutions that can sniff out signs of potential fraud before it even has a chance to unfold.

As we delve deeper into this narrative, we find ourselves asking: What truly is bank fraud prevention? It is a grand strategy, a carefully orchestrated dance of policies, practices, and technologies designed to thwart fraudulent activities that threaten both banks and their clientele—be they individuals or massive institutions. Banks, with their vaults full of wealth, are irresistible targets for those with malicious intent.

While banks often have private insurance to cover losses from fraud, as mandated by Regulation E of the Federal Reserve, this safety net primarily protects consumer accounts. Imagine a scenario where something as insidious as Carbanak malware infiltrates—a notorious threat responsible for siphoning $1 billion from Russian banks back in 2014 and still active years later. In such cases, small businesses may find themselves vulnerable without legal recourse from their financial institutions.

Thus, the saga of bank fraud detection and prevention unfolds as an essential chapter in maintaining customer trust. Establishing robust frameworks not only safeguards these organisations’ financial interests but also preserves their standing as bastions of safety and reliability in the financial world. And so, the guardians continue their watch, ever vigilant, ensuring that this story has a secure and prosperous ending.

In the vibrant and ever-evolving landscape of banking, where colossal amounts of money navigate through digital corridors daily, an unseen conflict quietly unfolds. This ongoing struggle is against the persistent menace of bank fraud—a shadowy adversary lying in wait for the opportune moment to pounce. Our tale begins with the vigilant custodians of the financial world, those who labour ceaselessly to protect banks and their patrons from this hidden threat.

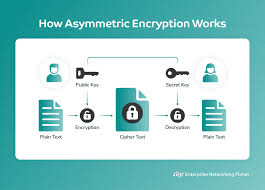

Visualisee is a team of devoted specialists assembled in a cutting-edge command hub. Their mission? To bolster the bank’s defences with a complex web of strategies and innovations. They skillfully integrate formidable tools such as data encryption, transaction surveillance, and verification protocols. Among their sophisticated techniques is the positive pay system, a savvy approach ensuring that only authentic transactions proceed unhindered.

Yet, the story extends beyond these measures. These diligent guardians remain ever-alert to new dangers. They plunge into the realm of emerging threats, pinpointing common hazards that banks confront daily. In their relentless pursuit of security, they embrace state-of-the-art technologies—predictive AI and machine learning solutions capable of detecting signs of impending fraud before it has a chance to manifest.

As we journey deeper into this narrative, a question arises: What exactly constitutes bank fraud prevention? It is a grand strategy—a meticulously choreographed blend of policies, practices, and technologies devised to thwart fraudulent activities threatening both banks and their customers, be they individuals or vast institutions. With their coffers brimming with riches, banks are alluring targets for those harbouring malicious intentions.

While banks frequently possess private insurance to mitigate losses from fraud, as required by Regulation E of the Federal Reserve, this safeguard primarily shields consumer accounts. Envision a scenario where something as sinister as Carbanak malware infiltrates—a notorious threat that notoriously drained $1 billion from Russian banks back in 2014—and ponder the implications.

Encryption is a formidable guardian in cybersecurity and fraud prevention. Yet, even this stalwart protector cannot shoulder the entire burden alone. To truly safeguard bank transactions and vital data transmissions, a tapestry of monitoring and verification methods must be woven. Imagine a world where each transaction is a story unfolding with multiple layers of security.

Picture yourself as a user navigating the realm of online banking. You begin your journey by entering your login credentials into a familiar portal on a mobile app. But the story doesn’t end there. A message arrives, like a trusted messenger delivering a secret code via email or text. This one-time passcode becomes the key to unlocking the next chapter. The tale could grow more intricate, with additional layers of verification, depending on how secure you wish your financial adventures to be.

As you continue your exploration, your device becomes a character in this narrative. Banks, ever vigilant, gather data from your device, browser, app, and IP address, creating a unique fingerprint that identifies your digital presence. Any deviation from this norm sends ripples through the system, triggering alerts that reach out to you, asking for confirmation of your identity.

The story takes another turn with location analysis, where transactions are not just numbers but events tied to specific places and times. By examining the distances and intervals between these transactions, banks can unearth potential threats and thwart card fraud before it unfolds.

Finally, we arrive at a technique known as positive pay, a straightforward yet crucial method in our story’s arsenal. Imagine business customers writing checks that are cross-referenced with records to catch any fraudulent activity. This simple act of vigilance helps ensure that their financial tales remain untarnished.

And so, in this ever-evolving narrative of cybersecurity, each transaction becomes a chapter enriched by layers of protection, ensuring that the story of your financial journey remains secure and untold by unwanted characters.

In the world of banking, there’s a subtle yet powerful tool that stands guard against the ever-looming threat of check fraud for businesses. This tool, known as Positive Pay, operates with a straightforward yet vital mission: to thwart any fraudulent attempts before they can cause harm. Imagine a vigilant sentinel standing by the bank’s gates, meticulously examining each check as it passes through. It scrutinises the check number, the amount, and the account details, comparing them against a list of previously issued checks from the company. Should anything appear amiss or suspicious, the sentinel raises an alert, signalling the company to verify the check’s authenticity. In many cases, this results in the questionable check being temporarily halted until the business can confirm or deny its legitimacy. This process not only aids companies in uncovering fraudulent activities involving counterfeit checks but also protects banks from potential legal repercussions.

In this digital age where vast amounts of data flow through banking systems, artificial intelligence (AI) and machine learning (ML) have become indispensable allies for teams combating fraud. These technologies empower banks to automate various fraud prevention strategies, including Positive Pay. Though relatively simple compared to other techniques, Positive Pay benefits from AI/ML algorithms that enhance its effectiveness. Yet, more complex algorithms are often employed to tackle the intricate challenges of credit card fraud detection and sophisticated document forgery, where deep learning and natural language processing (NLP) come into play.

As we turn our attention to the broader landscape of risks banks face, it’s crucial to consider both the threats posed by fraudsters and the regulatory obligations banks must meet to safeguard their customers. Let’s begin with the threats to customers themselves.

One of the most prevalent dangers is credit and debit card fraud. In 2021 alone, nearly 400,000 cases were reported by consumers in the United States. Fortunately, when banks and card issuers deploy effective detection mechanisms, mitigating such fraud becomes more manageable. For instance, a customer might receive an alert about a suspicious transaction, enabling them to flag it promptly, cancel their card, and receive a replacement within days. However, not all customers benefit from these protective measures automatically; some must opt into them. Without universal participation, the effectiveness of these services is diminished, leaving a gap in the defence against fraud.

Imagine a bustling city where banks stand as towering fortresses, safeguarding the wealth and trust of their patrons. Yet, lurking in the shadows are dangers that threaten these institutions and their valued customers. Picture a cunning cyber thief, armed with nothing but an email, targeting a bank employee with precision. If this employee happens to be part of the executive suite, it’s known as “whale phishing.” This single breach can ripple through the entire institution like a tidal wave, leaving devastation in its wake. These social-engineering attacks are not only common but serve as the backbone for widespread fraud schemes that can cripple a bank.

But that’s not all. Imagine the chaos when a distributed denial of service (DDoS) attack strikes, accompanied by sophisticated ransomware or malware. These digital assaults often act as diversions, distracting security teams while fraudulent transactions slip through the cracks, affecting countless customers and wreaking havoc on the bank’s internal networks.

Beyond these immediate threats lies another peril: noncompliance. When banks neglect to shield sensitive information from cybercriminals and other malicious forces, they risk more than just their reputation. Their very ability to operate hangs in the balance.

Consider the legal landscape: Statutes like Regulation E, the Gramm-Leach-Bliley Act (GLBA), and the General Data Protection Regulation (GDPR) cast a long shadow over financial institutions. These laws demand that banks establish robust fraud prevention measures. Ignoring this mandate could result in astronomical fines—imagine $100,000 per GLBA infraction—or even criminal charges under Regulation E.

In this ever-evolving world, banks must harness cutting-edge technologies to combat these looming threats, ensuring safety and compliance in equal measure.

Once upon a time, in the bustling world of finance, where the stakes were high and the risks even higher, banks and financial institutions faced an ever-present threat—fraud. To tackle this formidable adversary, they turned to the magical realm of emerging technologies. These innovations, powered by the mystical forces of advanced AI, machine learning, and deep learning systems, became their trusted allies in the battle against fraudulent activities.

These technologies possessed remarkable abilities. With their predictive powers, they could foresee potential threats and offer sage advice to prevent them. They were adept at discerning the most subtle and intricate patterns hidden within vast oceans of data, identifying anomalies that might otherwise go unnoticed. Through their prescriptive recommendations, they guided banks to learn from past deceptions, arming them against future perils.

In the heart of Denmark, nestled within the vibrant landscape of the Nordic region, Danske Bank embarked on a journey with Teradata to harness these powerful tools. The results were nothing short of astonishing. With the help of AI, the bank was able to reduce false alarms by a staggering 60%, while deep learning honed its skills to detect genuine fraud by analysing real-time location and ATM transaction data. This newfound prowess safeguarded customers as they navigated both traditional and digital banking realms.

The secret weapon behind this transformation was Teradata VantageCloud, with its advanced analytics capabilities and seamless data integration features. It allowed banks to delve into a treasure trove of existing data anks to delve into a treasure trove of existing data—from customer interactions to call centre logs—and glean valuable insights. Together with Celebrus’s built-in, first-party data graphing, financial institutions could anticipate potential fraud risks long before they evolved into full-blown crises.

anks to delve into a treasure trove of existing data—from customer interactions to call centre logs—and glean valuable insights. Together with Celebrus’s built-in, first-party data graphing, financial institutions could anticipate potential fraud risks long before they evolved into full-blown crises.

And so, the legend of VantageCloud spread far and wide. Those who sought to fortify their defences against fraud were encouraged to connect with this wondrous technology. For those eager to delve deeper into Teradata’s triumphs in fraud prevention, tales of collaboration with a top-five global bank awaited discovery.

In this ongoing saga of innovation and protection, VantageCloud emerged as a beacon of hope—a testament to the power of embracing cutting-edge technology in safeguarding the world of finance.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in Adblock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s Adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.