How to Prevent Scams: A Comprehensive Guide

Scams continue to evolve in sophistication, as evidenced by the recent Singapore-Malaysia police operation that uncovered more than 850 suspects involved in scams, totalling over $8.1 million in losses. To protect yourself, it’s essential to understand how scammers operate and develop protective habits. Here’s a thorough approach to scam prevention:

Understanding Common Scam Types

First, let’s recognize the main types of scams mentioned in the article:

- Impersonation scams: Criminals pretend to be authority figures like police officers to manipulate victims.

- Investment scams: Fraudsters promise unrealistic returns on investments that don’t exist.

- Rental scams: Scammers advertise non-existent properties or collect deposits for apartments they don’t own.

- Internet love scams: As seen in the case of the 48-year-old woman who lost $130,000, these involve building romantic relationships online with the ultimate goal of requesting money.

- Job scams: These involve fake employment opportunities that require upfront payments or personal information.

- E-commerce scams: These involve fake online stores or marketplace listings where you pay but never receive the product.

Fundamental Prevention Strategies

Verify Identity and Legitimacy

When someone contacts you claiming to represent an organization, independently verify their identity. Don’t use the contact information they provide; instead:

Look up the official phone number of the organization they claim to represent and call that number directly. Government agencies like police departments will never demand immediate payment over the phone or threaten arrest if you don’t comply immediately.

For online platforms, check if the website has a secure connection (https://) and verify the exact spelling of the domain name. Many scam sites use domains that closely resemble legitimate ones but with small spelling differences.

Research Before You Commit

For investments, rentals, or major purchases:

Take time to research the company, property, or product. Look for independent reviews from multiple sources, not just testimonials on their website. Check if investment opportunities are registered with proper regulatory bodies.

Visit properties in person before making payments, and be suspicious of landlords who can’t show you the property or who pressure you to pay deposits quickly.

Guard Your Personal Information

Your personal and financial information is valuable. Protect it by:

Being selective about what you share online, especially on social media and dating platforms. Scammers often gather information from these sources to create targeted approaches.

Using strong, unique passwords for different accounts and enabling two-factor authentication where available.

Be cautious about clicking links in emails or messages, even if they appear to come from trusted sources. Instead, go directly to the official website by typing the address in your browser.

Recognize Emotional Manipulation

Scammers are skilled at triggering emotional responses that override logical thinking:

Be wary of communications that create a sense of urgency or fear (“Act now or face consequences”).

Question situations that seem too good to be true (extraordinary investment returns, unexpected windfalls).

Take time to reflect when you feel pressured to make quick decisions involving money.

Financial Protection Measures

Protect your finances with these practical steps:

When possible, use credit cards for online purchases, as they typically offer better fraud protection than direct bank transfers.

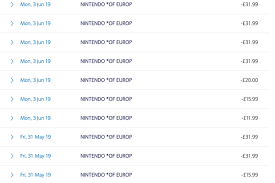

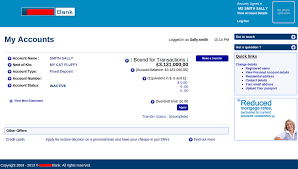

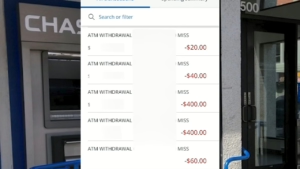

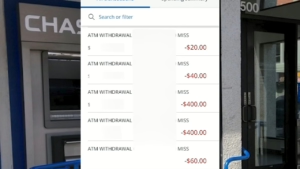

Consider setting up alerts for bank transactions above a certain amount.

Regularly review your bank and credit card statements for unauthorized transactions.

Be extremely cautious about requests for payment through wire transfers, cryptocurrency, or gift cards. Scammers often prefer these methods because they are difficult to trace or reverse.

Digital Hygiene Practices

Secure Your Devices

Keep your devices protected by:

Regularly updating your operating system and applications to patch security vulnerabilities.

Installing reputable antivirus and anti-malware software.

Be cautious about which apps you download and what permissions you grant them.

Be Skeptical of Unsolicited Communications

Whether it’s a phone call, email, text message, or social media contact:

Question why someone you don’t know would contact you with an offer or request.

Remember that legitimate organizations typically don’t initiate contact to ask for personal information or credentials.

Don’t feel pressured to respond immediately to unexpected communications.

Responding to Potential Scams

If you encounter a suspected scam:

End communication immediately if you suspect something isn’t right.

Report the incident to relevant authorities (like police or consumer protection agencies).

If you’ve shared financial information, contact your bank or credit card company immediately to place holds on your accounts.

Alert friends and family about the scam to prevent others from becoming victims.

Building Scam Awareness

Stay informed about new scam techniques by:

Following updates from official sources like police departments or consumer protection agencies.

Discussing scam experiences and prevention strategies with friends and family.

Being especially alert when news reports (like the one in Singapore) highlight increasing scam activities.

Conclusion

As seen in the Singapore report, where cryptocurrency scams increased dramatically (from 6.8% to 25% of total scam losses), scammers constantly adapt their methods to exploit new technologies and target vulnerable individuals. The most effective protection is a combination of awareness, scepticism toward unusual requests, verification procedures, and prompt action if you suspect you’re being targeted.

Remember that legitimate organizations will respect your need to verify information, never pressure you to make immediate financial decisions, and have established, secure channels for conducting business.

By developing these protective habits and maintaining a healthy scepticism about unsolicited offers and requests, you can significantly reduce your risk of becoming a scam victim.