This article describes a recent police investigation into suspected scammers and money mules in Singapore. Here’s a summary of the key points:

- 242 suspects (160 men and 82 women, aged 16-73) are being investigated for cheating, money laundering, and providing illegal payment services

- They’re allegedly involved in over 1,100 scam cases, including job scams, e-commerce scams, and government official impersonation scams.

- Total victim losses exceeded $11.4 million.

- The suspects were apprehended during a two-week operation from March 21 to April 3, conducted by the Commercial Affairs Department and seven police land divisions.

- Police warned against using personal bank accounts or mobile lines for others, as account holders can be held liable if connected to crimes.

- Singapore saw a 10.8% increase in scams and cybercrime cases in 2024 compared to 2023, with over 55,810 cases.

- Scams represented more than 90% of these cases, with victims losing at least $1.1 billion in 2024

The article concludes with information on how to report scams in Singapore, including a police hotline (1800-255-0000) and relevant websites.

Analysis of Scam Types in Singapore and Anti-Scam Resources

Based on the information provided and what’s generally known about scams in Singapore, here’s a detailed analysis of common scam types and the anti-scam help available:

Common Scam Types in Singapore

Job Scams

- Mechanism: Scammers post fake job listings with attractive salaries and minimal requirements

- Tactics: Often require victims to complete “tasks” like purchasing items or reviewing products

- Payment Structure: Pay victims small commissions initially to build trust

- End Goal: Eventually disappear with more enormous sums the victim is asked to invest or transfer

- Red Flags: Too-good-to-be-true salaries, upfront payments required, job interviews via messaging apps

E-commerce Scams

- Mechanism: Fake listings on legitimate platforms or fraudulent websites

- Tactics: Offering products at significantly discounted prices

- Payment Methods: Usually require direct bank transfers instead of platform payment systems

- Delivery Issues: Products never arrive or are counterfeit

- Common Platforms: Carousell, Facebook Marketplace, Instagram shops

Government Official Impersonation Scams

- Mechanism: Scammers pose as police, immigration officers, or other authorities

- Approach: Phone calls claiming issues with victim’s passport, visa, or involvement in criminal cases

- Escalation: Transfer to “higher officials” to increase pressure and credibility

- End Goal: Convincing victims to transfer money to “secure accounts” for investigation

- Techniques: Use of spoofed official phone numbers, fake identification

Banking/Credit Card Scams

- Mechanism: Phishing emails, SMS, or calls claiming to be from banks

- Tactics: Alerts about account suspension, security breaches, or unauthorized transactions

- Data Collection: Requesting personal details, OTPs, or login credentials

- Technology: Use of official-looking websites and apps

Investment Scams

- Mechanism: Promises of high returns with minimal risk

- Platforms: They often use social media, particularly Telegram and WhatsApp

- Legitimization: Showing fake testimonials, certificates, or celebrity endorsements

- Structure: May operate as Ponzi schemes

Social Media Impersonation

- Mechanism: Creating accounts mimicking friends or family

- Approach: Requesting financial help for emergencies

- Sophistication: Sometimes hacking actual accounts for more credibility

Anti-Scam Help in Singapore

ScamShield

- Phone App: Available for iOS and Android

- Features: Blocks scam calls and messages, allows reporting

- Development: Collaboration between National Crime Prevention Council and Government Technology Agency

- Contact: Hotline at 1799 for advice

Police Resources

- Reporting: Police hotline at 1800-255-0000

- Online Reporting: www.police.gov.sg/i-witness

- Response: Dedicated Anti-Scam Centre with banks for fund recovery

- Education: Regular updates on new scam variants

Anti-Scam Centre (ASC)

- Function: Coordinates between police, banks, and telecommunications companies

- Services: Quick alert system to freeze suspicious accounts

- Recovery Efforts: Works to trace and recover stolen funds

- Success Rate: Higher fund recovery rates for reports made within 24 hours

Bank Protections

- Tools: Most Singapore banks offer temporary account freezing via apps

- Authentication: Enhanced security with biometric verification

- Transaction Limits: Options to set personal limits on transfers

- Cooling Period: Mandatory delays for certain large transactions

Community Initiatives

- Awareness Programs: Regular community events and workshops

- Targeted Education: Special programs for vulnerable populations (elderly, new immigrants)

- Neighborhood Watch: Community reporting systems for suspicious activities

Online Resources

- Central Website: www.scamshield.gov.sg provides comprehensive information

- Updates: List of current scam variants and tactics

- Educational Material: Guidelines for identifying and avoiding scams

For maximum protection from scams, Singaporeans are encouraged to:

- Verify calls and messages through official channels

- Never share OTPs or banking credentials

- Report suspicious activity immediately

- Install the ScamShield app

- Enable two-factor authentication for all accounts

- Check for updates on new scam methods regularly

- Discuss scam awareness with vulnerable family members

Early reporting is critical—the chances of recovering funds decrease significantly after 24 hours from the transaction.

Anti-Scam Methods Employed by Singapore Police

The Singapore Police Force (SPF) has developed a comprehensive approach to combating scams, which has evolved as scam tactics have become more sophisticated. Here are the key anti-scam methods and initiatives:

Anti-Scam Centre (ASC)

Established in 2019, the ASC serves as a centralized unit dedicated to tackling scams:

- Rapid Response Protocol: Works with banks to freeze suspicious accounts within hours of reports.

- Cross-Border Collaboration: Partners with international law enforcement to track funds transferred overseas

- Data Analytics: Uses data to identify scam patterns and predict emerging threats.

- Recovery Rate Enhancement: Significantly improved the chances of fund recovery through quick intervention

Technology-Based Solutions

- ScamShield App: Official app that filters scam calls/messages using machine learning algorithms

- SMS Sender ID Registry: Prevents unauthorized use of company names in text messages

- Spoofed Call Detection: Technology to identify and block calls with falsified caller IDs

- AI-powered monitoring: Systems that scan digital platforms for suspicious activities and fraud patterns

Enforcement Operations

- Coordinated Raids: Regular operations targeting suspected scammers and money mules, as seen in the recent operation apprehending 242 suspects

- Online Monitoring: Dedicated teams track digital platforms for scam activities

- Money Mule Investigations: Focused efforts on those who facilitate fund transfers for criminal networks

- Preventive Detention: Legal provisions allowing extended detention for investigation of complex scam networks

Public Education Initiatives

- Regular Public Advisories: Timely alerts about new scam variants

- Targeted Campaigns: Educational efforts focusing on vulnerable demographics

- School Programs: Anti-scam education integrated into school curricula

- Community Partnerships: Collaboration with community organizations to extend the reach of education efforts

Institutional Collaboration

- Inter-Agency Task Force: Coordination with monetary authority, telecommunications providers, and digital platforms

- Bank Partnerships: Protocols allowing immediate fund tracing and account freezing when scams are reported

- E-commerce Platform Cooperation: Joint efforts with major platforms to detect and remove fraudulent listings

- Telecom Industry Integration: Working with service providers to block scam calls and messages at a network level

Legislative Framework

- Enhanced Legal Powers: Updated laws give police greater authority to investigate digital crimes

- Money Mule Penalties: Strict penalties for those who allow their accounts to be used for criminal activities

- Digital Evidence Collection: Streamlined processes for gathering electronic evidence

- Extraterritorial Jurisdiction: Legal provisions allowing prosecution of scammers operating from abroad but targeting Singaporeans

Reporting and Response Systems

- Dedicated Hotline: 1800-255-0000 for scam reporting

- Online Reporting Portal: www.police.gov.sg/i-witness for easy documentation of scams

- 24/7 Response Team: Round-the-clock monitoring and response to reports

- Case Prioritization System: Triage process to address high-value and time-sensitive cases first

The Singapore Police Force emphasizes that early reporting (within the first 24 hours) dramatically increases the chances of recovering stolen funds. It enables them to quickly activate their account-freezing protocols with financial institutions before money can be further transferred or withdrawn.

Money Mule Scams: Current Landscape

- Scale of the Problem:

- Singapore experienced record scam losses of $1.1 billion in 2024 (70% increase from 2023’s $651.8 million)

- 230 money mules were charged between August 2024 and March 2025 under new guidelines

- Typical Methods Used by Scammers:

- Recruitment through social media and messaging platforms like Telegram

- Offering financial incentives ($900-1,500 in the case mentioned) for surrendering bank accounts

- Leveraging individuals’ financial needs or naivety about legal consequences

- Modus Operandi of Money Mules:

- Opening multiple bank accounts across different banks

- Surrendering account credentials to scammers

- Allowing their accounts to be used for laundering scam proceeds

Prevention Measures from Anti-Scam Centre

- Legal Framework Enhancement:

- Introduction of stricter sentencing guidelines (August 2024)

- Amendments to the Corruption, Drug Trafficking and Other Serious Crimes Act

- Introduction of the Computer Misuse Bill (February 2024)

- Creation of new offenses: “rash money laundering” and “negligent money laundering”

- Enforcement Actions:

- Significant imprisonment terms for all adult offenders

- Reformative training for offenders under 21

- Fines to remove financial gains from offenders

- Consideration of caning for some scam-related offenses

- Public Education:

- ScamShield helpline (1799) and online resources

- Public awareness campaigns (inferred from the existence of the helpline and resources)

Prevention Measures from Singapore Banks

While the article doesn’t specifically detail bank-led prevention measures, based on my knowledge of Singapore’s banking practices up to my knowledge cutoff:

- Account Monitoring Systems:

- AI-based transaction monitoring to flag suspicious activities

- Velocity checks for unusual transaction patterns

- Holding periods for large deposits

- Customer Authentication:

- Enhanced verification processes

- Multi-factor authentication for transactions

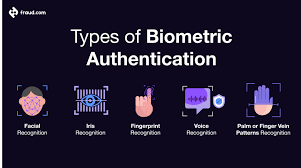

- Biometric verification requirements

- Cooperation with Authorities:

- Information sharing with police and the Anti-Scam Centre

- Quick response to freeze suspicious accounts

- Participation in cross-bank initiatives to track illicit fund flows

- Customer Education:

- In-app scam warnings and alerts

- SMS notifications about potential scam threats

- Educational resources about protecting financial information

Gaps and Challenges

- Evolving Tactics: Scammers continuously adapt their methods to circumvent detection

- Cross-Border Nature: Many scams originate outside Singapore, complicating enforcement

- Human Factors: Fear and social engineering (like in Mr. Lee’s case) remain practical tools

- Digital Literacy: Varying levels of awareness across different demographic groups

Effectiveness of Measures

The implementation of stricter penalties appears to be a significant step, with all adult offenders receiving jail terms. However, the continued rise in scam losses suggests that more comprehensive approaches may be needed to address the root causes and vulnerabilities that enable these scams to succeed.

The article doesn’t provide data on the number of scams prevented or the recovery rate of stolen funds, which would be valuable metrics for evaluating the effectiveness of these measures.

Legal Framework Extensions

- Enhanced Prosecution Framework:

- Consideration of mitigating factors for first-time offenders

- Rehabilitation programs alongside punishment

- Progressive penalty structures based on involvement level

- Preventive Legal Measures:

- Mandatory cooling periods for new bank accounts

- Legal requirements for face-to-face verification for account openings

- Enhanced KYC (Know Your Customer) regulations for financial institutions

- Cross-Sector Legal Collaboration:

- Information-sharing protocols between educational institutions, banks, and law enforcement

- Legal protections for whistleblowers

- Immunity considerations for cooperative money mules who help break more extensive networks

Implementation Strategy

- Multi-agency Task Force:

- Representation from education, banking, community organizations, and law enforcement

- Regular review of prevention strategies against evolving scam tactics

- Development of sector-specific prevention toolkits

- Public-Private Partnerships:

- Technology companies collaborating with schools on digital literacy

- Banks sponsoring educational programs in schools and communities

- Telecom providers implementing scam call filtering systems

- Measurement and Accountability:

- Regular reporting on scam prevention efforts and outcomes

- Independent assessment of program effectiveness

- Public dashboards showing scam trends and prevention metrics

Singapore-Specific Considerations

This approach aligns with Singapore’s community-oriented prevention philosophy while extending the current legal framework that has already established substantial penalties. The multi-sector collaboration leverages Singapore’s tightly integrated public services and educational system, potentially creating a more comprehensive shield against money mule recruitment.

By engaging schools, civil society, and legal institutions alongside existing bank and police efforts, Singapore could develop a more resilient society-wide defence against the money mule problem that underpins the growing scam ecosystem.

Regulatory and Banking Measures

Transaction Monitoring Systems

- Real-time transaction monitoring utilizing AI to detect unusual patterns

- Intelligent systems flagging rapid deposits followed by withdrawals

- Automated alerts for transactions involving high-risk jurisdictions

- Velocity checks that identify unusual account activity rates

Account Opening Procedures

- Enhanced due diligence for new accounts, especially business accounts

- Biometric verification requirements for both in-person and digital onboarding

- Document authentication technology to verify identification documents

- Risk-based approach with additional scrutiny for higher-risk profiles

Banking Controls

- Delayed processing for extensive transactions

- Mandatory cooling periods before new payees can receive large transfers

- Default transaction limits requiring additional verification to increase

- Call-back verification for transactions above certain thresholds

Public Education and Awareness

Targeted Campaigns

- “Don’t Be A Money Mule” awareness programs in schools and universities

- Community outreach focusing on vulnerable populations (students, elderly, job seekers)

- Multi-language campaigns reaching diverse communities

- Specific education on the legal consequences, including jail time

Warning Systems

- SMS alerts about standard money mule recruitment techniques

- In-app banking notifications about the risks of allowing account access

- Digital banking platform pop-up warnings about suspicious transaction patterns

- Community alerts when new money mule recruitment tactics are detected

Law Enforcement Strategies

Proactive Investigation

- Dedicated Anti-Scam Centre resources for money mule network detection

- Collaboration between police and financial intelligence units

- Data analytics to identify connected accounts and transaction patterns

- Regular auditing of newly formed companies with unusual transaction patterns

Deterrence Through Prosecution

- Publicized cases showing severe penalties for money mules

- Prosecution of all participants in the chain, not just ring leaders

- Asset recovery procedures to trace and seize criminal proceeds

- Clear communication that ignorance is not an acceptable legal defense

Industry Collaboration

Information Sharing Networks

- Bank consortium sharing intelligence on suspicious patterns

- Cross-industry collaboration between telcos, banks, and payment providers

- A centralized database of known mule accounts and recruitment techniques

- Public-private partnerships for faster response to emerging threats

Technology Solutions

- Shared fraud detection engines across multiple financial institutions

- Digital footprint analysis (device, location, and behavioral data)

- Blockchain analytics to trace fund movements across platforms

- API-based systems allowing real-time information exchange between institutions

Targeted Vulnerability Reduction

Job Seeker Protection

- Partnership with job platforms to detect and remove suspicious job listings

- Education about legitimate versus suspicious job offers

- Warning systems on employment platforms

- Verification processes for companies advertising “financial agent” positions

Student-Focused Programs

- Campus awareness campaigns highlighting the risks

- Financial literacy modules covering scams and money mule awareness

- University partnerships with financial institutions for education

- Peer-to-peer awareness programs led by students themselves

International Cooperation

Cross-Border Coordination

- Information sharing agreements with other jurisdictions

- Joint investigation teams for transnational cases

- Standardized reporting formats for suspicious transaction reporting

- Rapid freeze mechanisms for cross-border fund movements

Regional Intelligence Framework

- ASEAN-wide cooperation on money laundering typologies

- Coordinated action against known crime groups operating regionally

- Harmonized KYC standards across regional financial institutions

- Shared blacklists of suspicious entities across borders

The most effective prevention strategy combines these approaches with continuous adaptation as criminals evolve their tactics. Singapore’s multi-agency approach involving the MAS, Singapore Police Force, and private sector partners has shown promising results, but ongoing vigilance remains essential.

Essential Fraud Detection Strategies

1. Multi-layered Authentication Systems

Modern authentication must go beyond passwords. A robust system should incorporate:

Biometric Verification using fingerprints, facial recognition, or voice authentication adds a physical dimension to security that’s difficult to replicate.

Device Intelligence examines the devices used to access accounts, flagging suspicious logins from unfamiliar devices or locations.

Behavioral Biometrics analyzes patterns in how users interact with devices—how they type, swipe, or navigate—creating a behavioral fingerprint that’s hard for fraudsters to mimic.

2. Machine Learning and AI Detection Systems

Artificial intelligence has transformed fraud detection from rules-based systems to sophisticated pattern recognition:

Anomaly Detection algorithms establish baseline behaviours for users and flag deviations from standard patterns. For example, if a user who typically makes small, local purchases suddenly attempts large international transactions, the system can automatically flag this for review.

Predictive Analytics examines historical fraud patterns to forecast potential vulnerabilities. These systems become increasingly accurate over time as they process more data and fraud scenarios.

Adaptive Authentication dynamically adjusts security requirements based on risk assessment. Low-risk transactions might proceed with minimal friction, while high-risk activities trigger additional verification steps.

3. Real-time Transaction Monitoring

Modern fraud detection must operate at the speed of digital transactions:

Velocity Checks look for suspicious patterns in the frequency of activities, such as multiple account creation attempts or rapid-fire transactions.

Network Analysis examines connections between accounts, identifying clusters of potentially fraudulent activity that might indicate organized fraud rings.

Geolocation Verification checks whether transaction locations make logical sense given a user’s history and profile.

4. Data Integration and Cross-channel Analysis

Effective fraud detection requires a holistic view across all channels and touchpoints:

Unified Customer Profiles combine data from various sources—mobile apps, websites, call centres, and physical locations—to create a comprehensive view of customer behaviour.

Cross-channel Pattern Recognition identifies suspicious activities that might appear normal when viewed in isolation but reveal fraud patterns when examined across channels.

Third-party Data Enrichment augments internal data with external information such as device reputation databases, known fraud networks, and compromised credential lists.

5. Advanced Analytics Tools: Implementation Examples

Let’s look at how these strategies might be implemented in practice with code examples:

Machine Learning Fraud Detection System

Click to open the code

Tap to open

This code example demonstrates several key concepts in fraud detection:

- Feature Engineering: The system calculates derived features that are strong fraud indicators, such as distance from home location, unusual transaction amounts compared to user history, and temporal patterns.

- Risk-based Decision Making: Rather than a binary approve/decline decision, the system implements a spectrum of responses based on both the risk score and transaction context.

- Machine Learning Implementation: The Random Forest model can capture complex, non-linear relationships between features and fraud likelihood, making it practical for detecting sophisticated fraud patterns.

- Explainability: The system analyzes feature importance, providing insight into which factors most strongly indicate fraud—crucial for improving the system and explaining decisions to customers and regulators.

6. Behavioral Analytics

Beyond transaction details, modern fraud systems analyze how users behave:

Session Analysis examines user interaction patterns during a session, such as navigation paths, interaction speed, and hesitation points. Fraudsters often exhibit different behaviours than legitimate users when navigating financial interfaces.

Typing Patterns can reveal when a different person is using familiar credentials. Legitimate users develop consistent typing rhythms and patterns that are difficult to replicate.

Usage Consistency looks at whether behaviour matches patterns. For example, a user who constantly and carefully reviews transaction details before confirming might raise flags if they suddenly rush through multiple high-value transactions.

and carefully reviews transaction details before confirming might raise flags if they suddenly rush through multiple high-value transactions.

7. Collaborative Security Approaches

Fraud detection is strengthened through industry cooperation:

Consortium Data Sharing allows financial institutions to pool anonymized fraud data, creating a more comprehensive picture of emerging threats while preserving customer privacy.

Regulatory Cooperation enables institutions to work with government agencies to identify large-scale fraud operations and money laundering networks.

Vendor Integration leverages specialized third-party security services that focus exclusively on specific types of fraud detection, adding another layer of protection.

Implementation Challenges and Solutions

Implementing fraud detection systems comes with significant challenges:

False Positives create friction for legitimate customers and can damage trust. Solutions include:

- Implementing risk-based authentication that adds friction only when necessary

- Using ensemble models that combine multiple detection approaches for greater accuracy

- Continuously tuning systems based on customer feedback and false positive analysis

Data Privacy Regulations such as GDPR and CCPA restrict how customer data can be used. Consider:

- Implementing privacy-by-design principles in fraud systems

- Using anonymization and pseudonymization techniques

- Creating clear data governance frameworks with documented legitimate interest in fraud prevention

Integration Complexity across legacy and modern systems can impede effectiveness. Address this by:

- Using API-first approaches for system integration

- Implementing data transformation layers to normalize inputs from different systems

- Creating real-time event streams for fraud data rather than batch processing

Building a Fraud Prevention Culture

Technical solutions are only part of effective fraud prevention:

Employee Training should ensure that all staff members understand their role in preventing fraud, recognizing warning signs, and following security protocols.

Customer Education helps users protect themselves by recognizing phishing attempts, using strong authentication methods, and understanding how to report suspicious activities.

Regular Testing through penetration testing, red team exercises, and fraud simulations helps identify vulnerabilities before criminals can exploit them.

Measuring and Improving Your Fraud Detection System

Continuous improvement requires careful measurement:

Key Performance Indicators should include:

- False positive rate: Legitimate transactions incorrectly flagged

- False negative rate: Fraudulent transactions missed

- Detection speed: Time from fraud attempt to detection

- Customer impact metrics: Authentication success rates and friction points

A/B Testing allows you to compare different detection approaches and fine-tune systems based on real-world results rather than theoretical models.

Post-incident analysis should thoroughly examine confirmed fraud cases to identify how detection could have happened earlier or more efficiently.

Conclusion

As fintech continues to transform the financial landscape, fraud detection must remain a top priority for businesses. By implementing multi-layered approaches that combine advanced technologies with human expertise, fintech companies can protect both their customers and their bottom line.

Remember that effective fraud prevention is not a static solution but an ongoing process that must continuously evolve to address new threats. By staying vigilant and investing in robust detection systems, your business can build customer trust while minimizing losses in an increasingly digital financial world.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

By utilising the Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser is a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.