- Scale of the problem: Singapore is facing what the author calls an “epidemic of scams” with significant financial losses

- Since January, scammers impersonating staff from platforms like WeChat, UnionPay, and Alipay have stolen SGD 17.4 million

- At least 678 reported cases of this specific impersonation scam

- One 61-year-old woman lost $1.2 million to scammers posing as police officers

- Sophisticated tactics: Scammers are using:

- Spoofed local phone numbers (often starting with “8” or “+65”)

- Elaborate narratives and high-pressure tactics

- Multiple people and physical meetups in some cases

- Psychological manipulation that exploits Singaporeans’ tendency to trust authority

- Concerning trends: According to the Asia Scam Report 2024, Singaporeans lose more per scam victim (about $2,700) than any other ASEAN country

- Regulatory response: The Protection from Scams Act gives police broader powers to freeze funds during investigations, but ironically, scammers are now using this as part of their scam narrative

The article suggests that increased awareness, community vigilance, and a willingness to discuss scam experiences could help combat this growing problem.

Analysis of Scams in Singapore and Anti-Scam Resources

Types of Scams Mentioned in the Article

1. Chinese Platform Impersonation Scams

- Method: Scammers pose as staff from WeChat, UnionPay, and Alipay

- Approach: Unsolicited calls from spoofed local numbers (starting with “8” or “+65”)

- Scale: 678+ reported cases since January, totaling $17.4 million in losses

- Tactics: Create convincing stories to trick victims into revealing sensitive information or transferring money, often using fake verification interfaces or documents

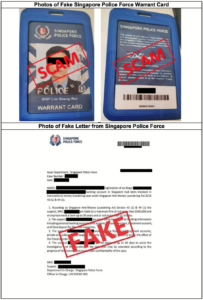

2. Police Impersonation Scams

- Method: Scammers pretend to be police officers investigating crimes

- Example Case: A 61-year-old woman lost SGD 1.2 million to this scam

- Sophisticated Elements:

- Elaborate narrative about a “police investigation” into money laundering

- Official-sounding titles and case details

- High-pressure tactics

- Multiple accomplices involved

- Physical meetups to enhance credibility

- Extended timeframe (operation spanned more than a month)

3. Other Scam Types Referenced (But Not Detailed)

- Fake job offers

- Phoney parcel deliveries

- Potential exploitation of the Protection from Scams Act (claiming accounts need to be “frozen” as part of investigations)

Why Singaporeans Are Vulnerable

- Cultural factors: Singaporeans are conditioned to:

- Respond promptly to authority

- Comply with procedures

- Trust institutions

- Digital literacy paradox: Despite high tech-savviness, Singaporeans are losing more money per scam victim than other ASEAN countries (approx. SGD 2,700)

- Evolving tactics: Scammers are becoming increasingly sophisticated, using:

- Spoofed phone numbers that appear legitimate

- Fake official websites

- Psychological manipulation

- Potentially AI-generated deepfake videos

Anti-Scam Resources in Singapore

Based on available information and standard practices in Singapore:

1. Report Scams

- Singapore Police Force: Call 999 for emergencies or file a police report at the nearest Neighbourhood Police Centre

- Anti-Scam Helpline: 1800-255-0000 (24-hour hotline)

- ScamShield App: Government-developed app that blocks scam calls and messages

2. Financial Protection

- Banks’ Fraud Hotlines: Most Singapore banks have dedicated fraud reporting lines

- DBS: 1800 339 6963

- OCBC: 1800 363 3333

- UOB: 1800 363 3333

- Immediately report suspicious transactions to your bank to freeze accounts

3. Verification Resources

- ScamAlert.sg: Website by the National Crime Prevention Council with information about the latest scams

- Police.gov.sg: Official police website to verify legitimate police operations

- Verify government correspondence through official government websites, not through links provided in messages

4. Community Support

- Talking openly about scam experiences to raise awareness

- Educating others about evolving scam tactics

- Sharing information about attempted scams within communities

5. Preventative Measures

- Developing healthy skepticism toward unsolicited communications

- Verifying identities independently through official channels before providing information

- Taking time to consider requests rather than responding to pressure tactics

- Checking that URLs and phone numbers match official sources

- Never sharing OTPs, passwords, or bank details over the phone

Key Prevention Strategies

- Stop and think before responding to unsolicited communications

- Verify separately through official channels (look up the official number and call back)

- Never transfer money based solely on calls or messages

- Be extremely cautious about sharing personal or financial information

- Remember that legitimate organizations will never:

- Pressure you for immediate payment

- Request payments to “secure your account”

- Ask for remote access to your devices

- Request money transfers as part of an “investigation”

The rising sophistication of scams in Singapore requires heightened vigilance from all residents, especially given the cultural predisposition to trust authority figures.

In-Depth Analysis of Anti-Scam Resources and Help in Singapore

Singapore has developed a comprehensive ecosystem to combat the rising tide of scams. Here’s an in-depth look at the anti-scam resources available:

Government-Led Anti-Scam Initiatives

1. ScamShield App

- Developer: National Crime Prevention Council (NCPC) and Government Technology Agency (GovTech)

- Functionality:

- Filters out scam calls and messages by blocking known scam numbers

- Updates regularly with new scam patterns and numbers

- Allows users to report suspected scam messages and calls directly

- Effectiveness: Blocks thousands of scam calls monthly, though sophisticated scammers continuously find workarounds

2. Anti-Scam Centre (ASC)

- Established: 2019 by Singapore Police Force

- Core Functions:

- Disrupts scam operations by quickly freezing suspicious bank accounts

- Works with banks to recover stolen funds when possible

- Analyzes scam patterns to identify trends and emerging threats

- Coordinates with international law enforcement on cross-border scams

- Response Time: Can freeze suspicious accounts within hours of a report

- Recovery Rate: Ability to recover funds decreases dramatically after 24 hours

3. National Anti-Scam Hotline

- Number: 1800-722-6688

- Operations: 24/7 support for scam victims

- Services:

- Provides advice on immediate steps to take

- Connects victims with relevant agencies

- Offers guidance on reporting processes

- Provides emotional support and practical assistance

4. Scam Alert Website (scamalert.sg)

- Manager: National Crime Prevention Council

- Features:

- Real-time updates on new scam variants

- Educational resources and prevention tips

- Scam reporting portal

- Statistics on current scam trends

- Self-assessment tools to test scam awareness

Banking Sector Anti-Scam Measures

1. Bank Anti-Scam Teams

- Major banks have dedicated anti-fraud units that:

- Monitor for suspicious transactions 24/7

- Implement AI-driven detection systems

- Can temporarily freeze accounts showing unusual activity

- Work directly with the Anti-Scam Centre

2. Enhanced Banking Security Measures

- Transaction Delay Systems:

- Some banks implement cooling periods for large or unusual transfers

- First-time transfers to new recipients may face additional verification

- SMS Alerts: Immediate notifications for all transactions

- Dedicated Fraud Hotlines:

- DBS: 1800-339-6963

- OCBC: 1800-363-3333

- UOB: 1800-222-2121

- Standard Chartered: 1800-747-7000

- Citibank: 1800-225-5225

3. Trust Bank’s “Trust Lock” Feature

- A recently implemented security feature specifically designed to combat scams

- Allows customers to instantly lock their accounts if they suspect fraudulent activity

- Reduces response time to potential fraud

Community Support Networks

1. Scam Support Groups

- Scam Survivors Singapore: Support network for scam victims

- Provides:

- Emotional support from others who have experienced similar situations

- Practical advice for recovery steps

- Information sharing about scammer tactics

2. Senior-Focused Anti-Scam Programs

- Silver Generation Office Outreach: Targeted education for elderly citizens

- SG Digital Office: Digital literacy programs that include scam awareness

- Neighbors for Active Living: Community volunteers who help educate seniors about scams

Post-Scam Support Services

1. Victim Recovery Process

When someone falls victim to a scam, the recommended steps are:

- Immediate Reporting: Contact police at 999 or Anti-Scam Helpline at 1800-255-0000

- Bank Notification: Contact bank fraud teams immediately

- Evidence Preservation: Save all communication with scammers

- Police Report: File a detailed report with all available information

- Financial Review: Work with the bank to secure remaining funds and review security settings

- Credit Monitoring: Check for unauthorized use of personal information

2. Psychological Support Services

- Singapore Association for Mental Health: Counseling for scam victims experiencing psychological distress

- Silver Ribbon Singapore: Mental health support, particularly for elderly scam victims

- Credit Counselling Singapore: For victims facing financial hardship due to scams

Educational Initiatives

1. ScamProof SG Campaign

- Multi-agency public education campaign

- Uses traditional and social media to raise awareness

- Focuses on the latest scam tactics and prevention strategies

2. School Programs

- Anti-scam education integrated into school curricula

- Focus on digital literacy and critical thinking

3. Corporate Training Programs

- Workplace scam awareness training

- Emphasizes business email compromise and supplier fraud

Legal Framework and Enforcement

1. Protection from Scams Act (2023)

- Enhanced Powers: Gives authorities broader abilities to freeze suspicious accounts

- Recovery Framework: Establishes clearer processes for fund recovery

- Liability Framework: Clarifies responsibilities of financial institutions

2. International Collaboration

- Singapore Police Force works with:

- Interpol

- Regional law enforcement agencies

- International Anti-Scam Coalition

- Focus on dismantling international scam syndicates operating across borders

Technological Solutions

1. AI-Based Detection Systems

- Machine learning algorithms that identify suspicious patterns

- Real-time transaction monitoring systems

- Natural language processing to detect scam narratives in communications

2. Digital Identity Verification

- Singpass Face Verification: Adds layer of security for sensitive transactions

- Bank Authentication Apps: Two-factor authentication systems

Challenges in Anti-Scam Support

1. Evolving Scam Tactics

- Scammers constantly adapt to circumvent security measures

- Use of AI in creating more convincing narratives

- Increasingly sophisticated social engineering techniques

2. Cross-Border Jurisdiction Issues

- Many scams originate outside Singapore

- Difficulty in prosecuting international scammers

- Challenges in recovering funds sent overseas

3. Victim Reluctance

- Embarrassment prevents some victims from reporting

- Delays in reporting reduce chances of fund recovery

- Lack of awareness about available support resources

Future Directions in Anti-Scam Protection

1. Enhanced Public-Private Partnerships

- More excellent information sharing between banks and government agencies

- Coordinated response protocols across sectors

2. Advanced Technology Implementation

- Voice recognition to detect spoofed calls

- Blockchain-based transaction verification systems

- AI-powered pre-emptive warning systems

3. Regional Anti-Scam Networks

- ASEAN-wide coordination on scam prevention

- Standardized reporting mechanisms across countries

- Joint operations against scam syndicates

The fight against scams in Singapore requires this multi-faceted approach combining technology, education, enforcement, and support services. While the resources available are substantial, the rapidly evolving nature of scams demands continuous enhancement of these systems and increased public vigilance.

Singapore’s Anti-Scam Ecosystem

Singapore has developed a comprehensive approach to combat scams:

Government Initiatives

- ScamShield: An app and helpline (1799) that blocks scam calls/messages and provides support

- Scam Alert Website: Provides updated information about current scam types

- Anti-Scam Centre: Established by the Singapore Police Force in 2019 to coordinate scam-fighting efforts

- Project OASIS: Online platforms automatically share information on suspected scam accounts

- E-commerce Marketplace Safety Badge: Recognizes platforms with robust anti-scam measures

Financial Safeguards

- Money Mule Interception System: Helps detect suspicious money transfers

- Delay in Fund Transfers: Implemented a “cooling period” for certain digital banking transactions

- SMS Registry: To verify authentic bank messages versus scam attempts

- Transaction Limits: Default limits on digital transfers to reduce potential losses

Public Education

- National Crime Prevention Council Campaigns: “Spot the Signs, Stop the Crimes”

- Community Vigilance Programs: Neighborhood watch initiatives focused on scam awareness

- School Education Programs: Teaching digital literacy and scam awareness

- Senior-Targeted Programs: Special initiatives for traditionally vulnerable populations

Platform-Specific Protections

Platforms like Shopee have implemented various safety mechanisms:

- Escrow Systems: Like Shopee Guarantee, holding funds until delivery is confirmed

- Seller Verification: Processes to validate legitimate sellers

- In-App Communication: Encouraging all communications to remain within the platform

- Detection Systems: AI tools to identify suspicious listings or behavior

- Report Functions: Easy ways for users to flag suspicious activity

Effectiveness and Challenges

Despite these measures, scams continue to evolve and persist for several reasons:

- Cross-Border Nature: Many scammers operate from outside Singapore’s jurisdiction

- Technology Adaptation: Scammers quickly adjust to new security measures

- Human Psychology: The effectiveness of social engineering techniques

- Digital Literacy Gaps: Varying levels of awareness across different demographics

Recommendations for Consumers

- Platform Integrity: Never leave the platform’s protected environment for transactions

- Payment Protection: Use reversible payment methods when possible

- Too Good To Be True: Be skeptical of huge discounts

- Verification: Research sellers through reviews and ratings

- Report promptly: Alert platforms and authorities immediately if scammed

Singapore’s multifaceted approach, combining technology, regulation, financial sector coordination, and public education, represents one of the more comprehensive anti-scam frameworks globally. However, the ongoing challenge requires continuous adaptation as scam techniques evolve.

Singapore’s Anti-Scam Ecosystem: A Comprehensive Analysis

Singapore’s Unique Scam Landscape

Singapore faces distinctive challenges in combating scams due to several factors:

- High Digital Adoption: With 97% smartphone penetration and 98% internet usage, Singapore’s highly connected population creates a large potential target base

- Wealthy Population: Singapore’s high per capita GDP makes its citizens attractive targets with higher potential payouts

- Aging Demographics: An increasing elderly population that may have less digital literacy while having significant savings

- Financial Hub Status: Its position as a financial center creates opportunities for sophisticated financial scams

- Cross-Border Proximity: Geographic and digital proximity to regions with varying regulatory oversight

Singapore’s Integrated Anti-Scam Framework

Singapore has developed one of the world’s most coordinated anti-scam approaches:

Government-Led Initiatives

- Inter-Ministry Committee on Scams: Coordinates whole-of-government responses

- Anti-Scam Centre (ASC): Established in 2019, it has recovered over S$200 million through swift intervention

- ScamShield App: Government-developed app that blocks scam calls/SMSs using AI detection

- National Crime Prevention Council (NCPC): Runs targeted awareness campaigns

- Legislation: The Online Criminal Harms Act (2023) provides powers to block scam websites and freeze accounts

Financial Sector Safeguards

- FAST Payment Delays: Implementation of a cooling period for first-time fund transfers

- Project PACT: Partnership between MAS and banks for fraud detection and recovery

- “Kill Switch”: An Emergency feature enabling immediate account freezing in suspected fraud cases.

- ScamBuster Program: Uses AI to detect unusual transaction patterns

- Transaction Limits: Default S$5,000 daily limit on most digital transfers

Telecom Protections

- +65 Prefix Display: Mandatory display for all overseas calls to identify potential scam sources

- SMS Sender ID Registry: Authentication system for legitimate business messages

- Scam Call Blocking: Network-level filtering of known scam numbers

- Anti-Spoofing Technology: Prevents caller ID manipulation

Public-Private Partnerships

- Project OASIS: Information sharing between banks, telcos, and platforms to detect scam patterns

- E-commerce Marketplace Alliance: Collaboration between major platforms on anti-scam standards

- Singapore Police Force-NCPC Partnership: Joint anti-scam education campaigns

- OCBC-Singapore Police Force Direct Hotline: Bank-police direct channel for rapid response

Community Engagement Strategies

- Multigenerational Approach: Different campaigns targeting various age groups

- “Spot the Signs”: National campaign using memorable scenarios to educate public.

- Community Vigilance Networks: Neighborhood-level scam alert systems

- Jaga Connect Initiative: Community-led support for scam victims

- Senior Digital Ambassadors: Peer-to-peer education for elderly citizens

Effectiveness Analysis

While scam numbers remain significant, Singapore’s approach has shown promising results:

- Recovery Rate Improvements: Increased success in recovering scammed funds (from 16% in 2020 to 29% in 2023)

- Reduction in Specific Scam Types: Significant drops in previously dominant scams like police impersonation scams

- Reduced Time-to-Response: Average intervention time reduced from days to hours

- Increased Reporting: Higher public willingness to report scam attempts

Ongoing Challenges

- Scam Evolution: Rapid adaptation of tactics by scammers

- Cross-Border Jurisdiction: Difficulty prosecuting overseas scammers

- Technological Arms Race: Keeping pace with AI and deepfake technologies

- Balancing Convenience and Security: Maintaining user experience while adding protections

- Education Reach: Ensuring awareness reaches all demographic segments

Future Directions

- AI Detection Enhancement: Expanding machine learning capabilities in scam prevention

- International Coordination: Strengthening cross-border enforcement mechanisms

- Digital Identity Verification: Expanded national digital ID usage for transaction security

- Behavioral Economics Application: Using nudge theory to encourage safer online behavior

- Real-Time Transaction Monitoring: Further development of instant fraud detection systems

Singapore’s comprehensive approach offers valuable lessons for other nations. It demonstrates the effectiveness of coordinated government action, public-private partnerships, and community engagement in combating the growing global challenge of online scams.

Analysis of Scams and Anti-Scam Centre Measures in Singapore

Common Scam Types in Singapore

- Government Official Impersonation Scams

- Impersonating police, MAS, or other officials

- Claims of money laundering investigations

- Requests for fund transfers to “safe accounts”

- $151.3 million lost in 2024 (1,504 cases)

- Banking-Related Scams

- Fake bank staff claiming suspicious transactions

- Phishing links to steal banking credentials

- Often escalate to government impersonation

- Job Scams

- Promises of high pay for minimal work

- Recruitment via messaging platforms

- Initial small payments to build trust before larger scams

- Investment Scams

- Fake investment platforms with manipulated returns

- “Pump and dump” schemes for cryptocurrencies

- Impersonation of legitimate financial institutions

- E-Commerce Scams

- Fake listings on legitimate platforms

- Non-delivery after payment

- Counterfeit goods

- Social Media Impersonation

- Clone accounts of friends/family

- Requests for urgent financial help

- Relationship/romance scams

Singapore’s Anti-Scam Centre (ASC) Measures

- Rapid Response Framework

- 24/7 hotline (1800-722-6688)

- Partnerships with banks for rapid fund freezing

- Ability to freeze accounts within hours of reports

- ScamShield Application

- Filters scam calls and messages

- Blocks known scam numbers

- Reports new scam numbers to central database

- Project FRONTIER

- Cross-border collaboration with international police

- Targets international scam syndicates

- Joint operations to disrupt scam infrastructure

- Bank Account Tracing

- Sophisticated monitoring of money flow

- Quick identification of money mule accounts

- Freezing and recovery of scammed funds

- Public Education Initiatives

- Targeted awareness campaigns

- Scam alert messaging systems

- Community engagement programs

- Industry Partnerships

- Collaboration with telecommunications companies

- Working with financial institutions

- Joint prevention protocols with e-commerce platforms

- Legal and Enforcement Actions

- Prosecution of scammers and money mules

- Disruption of communication channels

- Seizure of criminal proceeds

Effectiveness and Challenges

The ASC has recovered significant funds since its establishment in 2019, but challenges remain:

- Increasingly sophisticated scam techniques

- The cross-border nature of many scam operations

- Legal jurisdictional limitations

- Technology evolution outpacing prevention measures

- Human psychology that makes people vulnerable

For Singapore residents, staying vigilant and following the ASC’s guidance remain the best defense against scams. Report suspicious activities immediately to the Anti-Scam Helpline or the police.

Social Engineering: Anatomy of Manipulation and Defense

Social Engineering Techniques

Psychological Manipulation Strategies

- Authority Impersonation

- Scammers pose as official representatives (e.g., bank officers, government officials)

- Exploit victims’ respect for authority and tendency to comply with perceived authoritative figures.

- Use official-sounding language, titles, and fabricated credentials.

- Fear and Urgency Tactics

- Create artificial time pressures to prevent critical thinking

- Trigger emotional responses like panic or anxiety

- Common threats include:

- Legal consequences

- Financial penalties

- Account suspension

- Potential criminal investigations

- Trust Building and Rapport

- Develop a seemingly genuine conversational flow

- Use personal details to appear credible

- Gradually escalate requests, starting with minor, seemingly innocuous asks

- Exploit human tendency to be helpful and avoid confrontation

- Information Harvesting

- Collect fragmentary personal information from multiple sources

- Use social media, public databases, and previous data breaches

- Craft highly personalized, convincing narratives

Technical Manipulation Methods

- Phishing Techniques

- Spoofed communication channels

- Lookalike websites and email addresses

- Malicious links and attachments

- Screen sharing and remote access exploitation

- Multi-Stage Scam Progression

- Complex narratives involving multiple fake personas

- Gradual erosion of victim’s skepticism

- Continuous redirection and technical jargon

Prevention Strategies

Personal Awareness and Education

- Critical Thinking Development

- Always verify unsolicited communications independently

- Use official contact methods from verified sources

- Never click links or download attachments from unknown sources

- Recognize and resist emotional manipulation

- Communication Red Flags

- Unsolicited contact requesting personal information

- Pressure to act immediately

- Requests for financial transfers

- Communication via unofficial channels

- Threats or aggressive language

Technical Protective Measures

- Digital Security Practices

- Use multi-factor authentication

- Regularly update software and security systems

- Install reputable antivirus and anti-malware solutions

- Use dedicated communication and banking apps

- Enable transaction notifications

- Information Protection

- Minimize public personal information sharing

- Use privacy settings on social platforms

- Create complex, unique passwords

- Regularly monitor financial statements

- Use virtual credit cards for online transactions

Institutional and Technological Interventions

- Technological Defenses

- Implement AI-driven fraud detection systems

- Develop advanced caller ID and communication verification tools

- Create comprehensive scam reporting mechanisms

- Educational Initiatives

- Regular public awareness campaigns

- School and workplace training programs

- Clear, accessible resources on emerging scam techniques

- Collaborative efforts between government, tech companies, and financial institutions

Psychological Resilience

- Emotional Intelligence

- Recognize personal emotional triggers

- Practice calm, methodical responses to unexpected communications

- Develop healthy skepticism without becoming paranoid

- Community Awareness

- Share scam experiences

- Supporting vulnerable community members

- Create support networks for scam victims

Emerging Trends

- Increasing sophistication of AI in social engineering

- Cross-platform information integration

- More personalized, contextually relevant scam attempts

Conclusion

Social engineering exploits fundamental human psychological vulnerabilities. Comprehensive defense requires a multi-layered approach combining technological solutions, personal awareness, and continuous education.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

Maxthon private browser for online privacyThis meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.