I’ve analysed the article about directors’ fiduciary duties. Here are the key points:

The article emphasises that company directors must maintain complete loyalty to their companies. The Singapore High Court recently reinforced that a director’s fiduciary duty:

- Is “inflexible” and continues even after resignation

- Prohibits placing personal interests above the company’s

- Requires “disgorgement” of all profits gained through breaches of duty

A notable case highlighted a director ordered to pay $87 million after diverting a property development deal to his own company. The court clarified that disgorgement aims not to compensate the company but to ensure directors don’t profit from breaches.

The article outlines three key rules for directors:

- Taking over business deals: Directors cannot profit from company deals, even if the company fails to secure them. A case mentioned a managing director who resigned to pursue a deal his company couldn’t secure and was later required to return profits.

- Talented directors leaving: If talented directors leave with no pending deals and the company isn’t actively pursuing similar opportunities, they may not be liable when working with the duplicate contacts later. The article distinguishes between seizing an opportune deal and simply being talented.

- Shareholder approval: Directors need majority shareholder approval for personal business opportunities. However, the majority shareholders who are also directors cannot use their voting power to approve their own deals if it oppresses minority shareholders. A court struck down such a resolution where three directors with 75% ownership approved their own deal.

In-Depth Analysis of Directors’ Fiduciary Duties

This article offers valuable insights into directors’ fiduciary duties in Singapore, presenting both legal principles and practical implications through case examples. Let me analyse the key aspects:

Core Legal Principle: The Inflexible Duty of Loyalty

The article establishes that the fundamental fiduciary duty of directors is to be loyal to their company. This duty is characterised as:

- Inflexible: The High Court ruling emphasises the non-negotiable nature of this obligation

- Enduring: The duty “persists even after the director’s resignation”

- Prioritising: Directors must never place personal interests above company interests

Legal Consequences for Breaches: The Disgorgement Principle

A critical legal concept emphasised is “disgorgement” – the requirement for directors to surrender all profits gained through breaches of duty. This principle has several important aspects:

- Purpose: The court clarified that disgorgement isn’t compensatory but preventative, ensuring directors don’t profit from breaches

- Scope: Directors must return “every dollar of profit” gained through improper conduct

- Severity: The $87 million penalty cited demonstrates courts’ willingness to impose substantial financial consequences

Case Application: The Property Development Case

The article’s central case study involves a director (50% shareholder) who diverted a property development opportunity (82 semi-detached homes) to his own company. Key observations:

- The court ordered full disgorgement of the $87 million profit

- This penalty exceeded what the company sought in its lawsuit

- The court’s approach demonstrates that the remedy is based on the wrongdoer’s gain rather than the company’s loss

Three Specific Rules of Engagement

1. Corporate Opportunities Doctrine

- Directors cannot appropriate business opportunities discovered through their position

- The prohibition applies even when the company initially fails to secure the deal

- The managing director case shows that resignation doesn’t cleanse the breach if the opportunity was discovered during directorship

2. Post-Resignation Competition Limitations

The article identifies important nuances in post-resignation scenarios:

- Directors may work with former business contacts after resignation IF:

- No impending deals were being negotiated at resignation

- The company wasn’t actively pursuing similar opportunities

- The scenario represents loss of talent rather than opportunistic deal diversion

This distinction respects directors’ right to use their skills while protecting legitimate company interests.

3. Shareholder Approval Requirements

The article outlines the governance mechanism for potential conflicts:

- Directors must obtain majority shareholder approval for personal business opportunities

- This protection has limits – director-shareholders with majority control cannot use their voting power to approve their own deals if it constitutes “oppression” of minority shareholders.

- A 75% majority approval was invalidated by courts when it conflicted with the interests of minority shareholders.

Legal Theory: Ratification and Disclosure

The concluding paragraph introduces an important corporate governance concept:

- Shareholders can “forgive and approve” directors’ breaches through unanimous or majority agreement.

- This ratification is only valid with “full disclosure of the relevant facts”

- Courts will generally respect such shareholder decisions unless “tainted by dishonest motives”

Broader Implications

Reading between the lines, this article reveals several important considerations for corporate governance:

- Rigorous Accountability: Singapore courts apply strict standards to director conduct

- Contextual Analysis: Courts examine the specific circumstances when determining liability

- Balancing Interests: The law aims to protect companies while allowing talented individuals a reasonable degree of post-resignation freedom.

- Shareholder Protection: The system has safeguards against majority shareholders abusing their power

The article serves as both a warning to potential directors about the gravity of their duties and a reassurance to companies and shareholders that the legal system provides meaningful protection against self-dealing by directors.

Implications of Fiduciary Duty Breaches for Singapore Companies

Based on the article and broader Singapore corporate governance principles, breaches of fiduciary duties have significant implications for most Singapore companies, regardless of size or structure:

Legal and Financial Implications

1. Substantial Financial Consequences

- Full disgorgement of profits: As demonstrated by the $87 million case, courts will order directors to surrender all profits gained through breaches, regardless of the company’s actual losses

- Legal costs: Litigation expenses can be substantial, particularly in complex cases involving detailed financial analysis

- Potential damages: Beyond disgorgement, additional damages may be awarded in certain cases

2. Enforcement Mechanisms

- Derivative actions: Shareholders can bring actions on behalf of the company against errant directors

- Personal liability: Directors cannot hide behind corporate structures when breaching fiduciary duties

- No limitation by contract: Companies cannot contractually limit directors’ core fiduciary obligations

Business and Operational Implications

1. Business Continuity Risks

- Leadership disruption: Litigation against directors can paralyse decision-making and create leadership vacuums

- Relationship damage: Breaches often involve key business relationships that may be permanently damaged

- Project delays: As seen in the property development case, disputes over business opportunities can delay or derail important projects

2. Governance Challenges

- Information asymmetry: Directors typically have better access to information than shareholders, creating monitoring challenges

- Family business complexities: In Singapore’s numerous family businesses, enforcing fiduciary duties becomes complicated when family relationships intersect with business roles

- SME vulnerabilities: Smaller companies often lack robust governance mechanisms to detect and prevent breaches

Reputational Implications

1. Market Perception

- Investor confidence: Public breaches of fiduciary duty can significantly damage investor confidence

- Business partner wariness: Suppliers, customers, and strategic partners may reconsider relationships

- Banking relationships: Financial institutions may impose stricter terms or monitoring requirements

2. Talent Management

- Recruitment challenges: Companies with histories of fiduciary disputes may struggle to attract qualified directors

- Retention concerns: The article highlights the importance of retaining talented directors while ensuring proper governance

- Compensation structures: Companies must balance competitive compensation with alignment of interests

Preventative Measures and Best Practices

1. Governance Structures

- Independent directors: Even non-listed companies benefit from independent oversight

- Clear approval processes: Establishing transparent procedures for handling potential conflicts of interest

- Regular governance reviews: Periodically assessing and updating governance frameworks

2. Documentation and Disclosure

- Comprehensive minutes: Properly documenting board decisions and the reasoning behind them

- Conflict registers: Maintaining updated records of directors’ interests and potential conflicts

- Transparent communication: Ensuring shareholders receive appropriate information about material business opportunities

3. Education and Culture

- Director training: Regular updates on fiduciary obligations and case developments

- Ethical leadership: Establishing a corporate culture that values compliance above opportunism

- Whistleblower mechanisms: Creating safe channels for reporting potential breaches

Practical Applications for Different Company Types

For Family-Owned Businesses

- Particular care is needed when family members hold directorship positions

- Clear separation of family and business governance is recommended

- Professional independent directors can help navigate potential conflicts

For SMES and Startups

- Founders must recognise when their personal interests might diverge from company interests.

- Written protocols for handling business opportunities become increasingly important as companies grow.

- Regular legal reviews of governance practices can prevent costly disputes

For Larger Corporations

- Board committees can provide specialised oversight of areas prone to conflict.s

- Regular disclosure requirements for directors regarding outside business activities

- Comprehensive director and officer liability insurance

The article underscores that all Singapore companies, regardless of size, must take fiduciary duties seriously and implement appropriate safeguards. The courts have demonstrated a willingness to impose significant penalties for breaches, making prevention and early detection crucial aspects of sound corporate governance.

Legal Recourse for Singapore Companies Facing Breaches of Fiduciary Duty

When Singapore companies discover potential breaches of fiduciary duties by directors, they have several legal avenues for redress. Based on the article and Singapore corporate law principles, here’s a comprehensive analysis of these options:

Judicial Remedies

1. Civil Actions for Disgorgement

- Primary remedy: As highlighted in the article, companies can sue for full disgorgement of profits gained through breaches

- Burden of proof: Companies must establish the fiduciary relationship, the breach, and the connection to profits

- Measure of recovery: Courts focus on the director’s gain rather than the company’s loss, potentially leading to substantial recoveries

- Limitation period: Generally, 6 years from discovery of the breach under Singapore law

2. Derivative Actions

- Mechanism: When the company itself cannot or will not sue (often because wrongdoers control the board), shareholders can initiate derivative actions on behalf of the company

- Court permission: Shareholders must obtain leave from the court to proceed

- Beneficiary: Damages or remedies flow to the company, not individual shareholders

- Statutory basis: Section 216a of the Companies Act provides the framework for minority shareholders

3. Injunctive Relief

- Preventative action: Companies can seek court orders to prevent directors from pursuing diverted opportunities

- Preservation orders: Courts may freeze assets to prevent dissipation during litigation

- Specific performance: In some cases, courts may order directors to complete transactions for the company’s benefit

4. Removal Applications

- Director removal: Applications to remove directors for serious breaches of duty

- Court appointment: In extreme cases, courts may appoint replacement directors

Alternative Dispute Resolution

1. Arbitration

- Private resolution: If director agreements contain arbitration clauses, disputes may be resolved privately

- Potential advantages: Confidentiality, specialised arbitrators, possibly faster resolution

- Enforceability: Arbitration awards are generally enforceable under Singapore law

2. Mediation

- Collaborative approach: Particularly valuable in family businesses or where ongoing relationships matter

- Singapore Mediation Centre: Offers specialised corporate dispute resolution services

- Court encouragement: Singapore courts actively encourage mediation attempts before trial

Regulatory Interventions

1. Accounting and Corporate Regulatory Authority (ACRA)

- Investigation powers: ACRA can investigate suspected breaches of directors’ duties

- Administrative penalties: ACRA can impose fines for inevitable breaches

- Disqualification orders: Directors may be barred from serving on boards

2. Commercial Affairs Department (CAD)

- Criminal investigation: For breaches involving fraud or dishonesty

- Prosecution powers: Directors may face criminal charges for serious breaches

- Asset recovery: The state can pursue recovery of misappropriated assets

Internal Corporate Remedies

1. Shareholder Resolutions

- Director removal: An Ordinary resolution can remove directors (subject to constitutional provisions)

- Special audit: Shareholders can vote to conduct forensic audits of suspicious transactions

- Constitutional amendments: Companies may strengthen governance provisions

2. Board-Level Actions

- Internal investigations: Boards can establish special committees to investigate suspected breaches

- Suspension of authority: Boards can limit suspect directors’ powers pending investigation

- Negotiated settlements: Companies may reach settlement agreements with breaching directors

Strategic Considerations for Companies

1. Evidence Gathering and Preservation

- Document preservation: Immediate steps to secure relevant documents and electronic records

- Witness statements: Collecting statements while events are fresh

- Forensic accounting: Professional examination of financial records to trace diverted opportunities or funds

2. Public Relations Management

- Disclosure obligations: Listed companies face particular disclosure requirements

- Stakeholder communications: Strategy for informing employees, customers, and business partners

- Market perception: Managing investor confidence during governance crises

3. Cost-Benefit Analysis

- Litigation costs: Weighing recovery potential against legal expenses

- Business disruption: Considering the impact of prolonged litigation on operations

- Recovery prospects: Assessing the director’s ability to satisfy potential judgments

4. Preventative Reforms

- Governance reviews: Comprehensive evaluation of how the breach occurred

- Control enhancements: Implementing stronger approval processes for potential conflicts

- Director of education: Expanded training on fiduciary obligations

Practical Challenges

1. Evidence and Causation

- Information asymmetry: Directors often control company information

- Business judgment rule: Courts generally avoid second-guessing good-faith business decisions

- Causation challenges: Proving the company would have secured diverted opportunities

2. Resource Imbalances

- Litigation funding: Smaller companies may struggle to finance complex litigation

- Expert testimony: Cases often require costly expert evidence

- Director insurance: Directors may have D&O insurance to fund their defence

3. Time Constraints

- Business opportunity window: Diverted opportunities may have limited lifespans

- Limitation periods: Legal action must be initiated within statutory timeframes

- Court scheduling: Singapore courts are efficient, but commercial litigation takes time

The article highlights that Singaporean courts take breaches of fiduciary duty extremely seriously and are willing to impose significant penalties to uphold high standards of corporate governance. Companies have robust legal options for addressing breaches, though successful pursuit requires careful planning, proper evidence gathering, and strategic decision-making.

Analysis of the Singapore Court Case on Debt Avoidance

How the Business Owner Attempted to Avoid Debt

The business owner, who ran a renovation firm, employed a calculated strategy to avoid paying compensation to a client:

- Strategic fund withdrawal: After losing a lawsuit to a dental company over substandard renovation work, he systematically emptied his company accounts before paying the court-ordered compensation of over $500,000.

- Method of extraction: He withdrew approximately $1.18 million through two channels:

- $500,000 as dividends to himself

- $680,000 as repayment for “debt” he claimed the company owed him

- Timing: The court noted the suspicious timing of his actions. While he hadn’t drawn dividends between 2012 and 2015, he paid himself a total of $2,800,000 in dividends and $820,746 in loan repayments after the client filed the lawsuit.

- Legal shield attempt: He attempted to apply the principle of separate legal personality (which holds that a company is distinct from its shareholders) to argue that he owed no personal obligation to creditors.

How He Was Caught

The case took an unusual turn when the company was wound up due to its inability to pay compensation:

- Liquidators’ action: Instead of simply declaring the company bankrupt, the liquidators actively pursued the owner to recover the money he had withdrawn.

- Money trail examination: The financial transactions between the owner and his company were scrutinised, revealing the pattern and timing of withdrawals.

- Financial health assessment: Following the $1.18 million withdrawal, the company was left with less than $90,000 in working capital, clearly demonstrating a deliberate depletion of company resources.

The Legal Process and Investigation

The case went through multiple levels of the judicial system:

- Initial lawsuit: The dental company successfully sued the renovation firm for substandard work that resulted in flooding and mould issues.

- High Court ruling: The High Court ordered the owner to return $1.18 million to his firm, finding that as a director, he failed to act in the company’s best interests.

- Appeal process: The owner appealed the decision, but the Court of Appeal upheld the order.

- Landmark ruling: Chief Justice Sundaresh Menon delivered a significant ruling establishing that company directors are bound to consider creditors’ interests in certain circumstances.

Implications for Businesses

The Court of Appeal’s decision has far-reaching implications:

- Director accountability: Business owners and directors can be held personally accountable for company debts if they deliberately siphon funds to avoid paying creditors.

- “Creditor duty”: Directors now have a legal obligation to act in good faith toward creditors, particularly when the company is facing financial difficulties.

- Recovery mechanisms: Liquidators can pursue directors who breach their duty by depleting corporate funds in disregard of creditor interests.

- Balance of risk and responsibility: The ruling distinguishes between legitimate business decisions that may fail (which do not trigger personal liability) and deliberate attempts to defraud creditors (which do).

- Three-tiered approach: The court established different standards for director conduct based on the company’s financial status:

- Solvent companies: Directors primarily consider shareholder interests

- Companies at risk of default: Directors’ decisions face heightened scrutiny

- Insolvent companies: Directors have an explicit “creditor duty”

This landmark case strengthens protections for creditors in Singapore while establishing clearer guidelines for director conduct during financial distress, particularly regarding transactions that benefit shareholders or directors at the expense of creditors.

Bakery Financial Mismanagement Case

Here are the key points from this corporate mishap:

- A director lent $150,000 to his bakery chain company to help open a new branch. When he asked for repayment, he was accused of stealing money that was actually his in the first place.

- The company’s finance manager had embezzled approximately $400,000. This complicated situation led to accusations that the director and managing director were conspiring with the finance manager.

- The company filed a lawsuit against all three, but it failed spectacularly because:

- The company was unable to prove any conspiracy.

- Their financial records were so poor that they couldn’t even definitively prove how much the finance manager had stolen.

- The director had proper documentation for his loan

- Ironically, the finance manager returned approximately $420,000 but later claimed she might have overpaid by $80,000 and attempted to recover that amount.

- The High Court judge, Hri Kumar Nair, ruled against the company, noting that their lawsuit only succeeded in demonstrating their lack of proper financial controls.

The article highlights three crucial lessons:

- Maintain proper records – The director’s documentation of his loan saved him from the accusations.

- Understand employee duties – Employees following company procedures shouldn’t fear wrongful accusations.

- Wrongdoings must be proven – The company couldn’t prove that the misappropriation prevented business expansion.

The company ultimately had to pay significant legal costs to all parties: $75,000 to the finance manager, $95,000 to the director, and $120,000 to the managing director.

The closing message is clear: without proper financial records, it becomes challenging to reclaim missing funds.

Analysis of Corporate Scam Issues in the Bakery Chain Case

Key Scam Issues

- Internal Embezzlement: The finance manager exploited weak financial controls to misappropriate approximately $400,000 over a period of several years.

- Poor Documentation: The lack of proper record-keeping created an environment where theft could occur undetected, and the company was unable to determine how much was stolen.

- Informal Decision-Making: Business decisions made through informal channels, such as phone messages, without proper documentation, led to confusion and disputes.

- False Accusations: The company incorrectly accused innocent parties, including the director and managing director, of participating in the embezzlement scheme.

Complications That Arose

- Inability to Track Funds: The company was unable to determine the exact amount stolen or trace the whereabouts of the money.

- Misidentification of Culprits: Poor financial oversight led to the wrongful accusation of those who actually helped the company, specifically the lending director.

- Legal Backfire: The company’s baseless lawsuit resulted in substantial legal costs, totalling $290,000, being awarded against it.

- Counterproductive Recovery Efforts: The embezzler’s uncertainty about how much she stole led to her claiming she overpaid during restitution.

- Trust Breakdown: The accusations likely damaged relationships among company leadership and shareholders.

Prevention Methods

- Implement Robust Financial Controls:

- Require multiple approvals for significant transactions.

- Separate financial duties among different employees (authorisation, recording, custody)

- Conduct regular reconciliation of accounts

- Document All Financial Transactions:

- Create formal agreements for all loans and investments

- Maintain comprehensive supporting documentation for all transactions

- Record board decisions in official minutes

- Regular Independent Audits:

- Schedule periodic third-party audits to detect irregularities

- Implement surprise audits to deter potential fraud

- Clear Authority Boundaries:

- Establish written policies defining spending authority limits

- Document exceptions to standard procedures

- Improve Corporate Governance:

- Formalise shareholder communication and decision-making processes.

- Create an audit committee to oversee financial controls

- Document all shareholder loans and capital injections properly

- Staff Training:

- Train employees to recognise potential fraud indicators

- Establish whistleblower protocols for reporting suspicious activities

- Technology Solutions:

- Implement accounting software with audit trails.

- Use electronic payment systems with built-in approval workflows

- Leverage automation to reduce manual record-keeping errors

By implementing these preventive measures, companies can significantly reduce the risk of internal scams, foster accountability, and ensure that if issues do arise, they have the necessary documentation to address them properly.

Applying Fraud Prevention to Singapore’s Business Context

Singapore-Specific Challenges & Considerations

- Regulatory Framework:

- Singapore companies must comply with the Companies Act, which requires proper financial record-keeping

- Listed companies are subject to additional scrutiny under Singapore Exchange (SGX) regulations.

- The Accounting and Corporate Regulatory Authority (ACRA) oversees corporate compliance.

- Business Culture:

- Singapore’s business environment often features family-owned businesses with close-knit management structures.

- Trust-based relationships sometimes override formal controls, especially in SMES

- The bakery chain case exemplifies this issue, with decisions often made through informal messages.

- Digital Transformation:

- Singaporean businesses are increasingly operating digitally, creating new vulnerabilities to fraud.

- E-payment systems are widespread, requiring specific security measures

Singapore-Focused Prevention Strategies

- Leverage Singapore’s Regulatory Resources:

- Utilize ACRA’s guidance on proper corporate governance

- Implement the Singapore Code of Corporate Governance principles

- Follow Monetary Authority of Singapore (MAS) guidelines on financial controls

- Singapore-Specific Audit Practices:

- Engage Singapore-registered public accountants for regular audits

- Implement Singapore Standards on Auditing (SSA) recommendations

- Consider specialized audits for high-risk areas (e.g., cash handling in F&B businesses)

- Employee Training for Singapore Context:

- Train staff on Singapore’s Prevention of Corruption Act

- Create awareness of Singapore’s Whistleblower Protection framework

- Establish clear reporting channels compliant with local regulations

- Technology Solutions Available in Singapore:

- Adopt accounting software approved by IRAS for Singapore businesses

- Implement PayNow Corporate or GIRO payment systems with approval workflows

- Consider blockchain solutions for transparent record-keeping (Singapore is a blockchain hub)

- Cultural Adaptations:

- Balance Singapore’s relationship-oriented business culture with formal controls

- Implement structured documentation while respecting cultural norms

- Establish clear boundaries between family/personal relationships and business decisions

- Singapore Government Support:

- Utilize Enterprise Singapore’s resources for SMEs to improve governance

- Access Singapore Business Federation training on financial best practices

- Apply for a Productivity Solutions Grant to implement financial control systems

- Industry-Specific Considerations for F&B Businesses in Singapore:

- Implement point-of-sale systems with audit trails (particularly relevant for bakery chains)

- Establish inventory management controls to prevent leakage

- Create standard operating procedures for cash handling at multiple outlets

Implementation Timeline for Singapore Businesses

- Immediate Steps (1-3 months):

- Conduct a compliance check against the Singapore Companies Act requirements

- Review and formalise all shareholder agreements and loans

- Document authority limits for all management positions

- Medium-Term Actions (3-12 months):

- Implement appropriate accounting software with Singapore-compliant features.

- Establish regular internal audit processes

- Train staff on financial controls and fraud prevention

- Long-Term Strategy (12+ months):

- Develop a comprehensive corporate governance framework.

- Create a culture of transparency and accountability

- Establish board-level oversight of financial controls

By implementing these Singapore-specific prevention measures, local businesses can significantly reduce their vulnerability to internal fraud while maintaining compliance with Singapore’s regulatory environment.

General Scam Prevention Tips

- Trust your instincts

- If an offer seems too good to be true, it probably is

- Keep personal and financial information confidential

- Stay informed about the latest scam techniques

- Report suspicious activities to the authorities

- Educate family members, especially older relatives

- Use secure, updated technology

- Maintain a healthy level of scepticism online

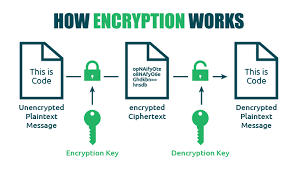

How Encryption Works

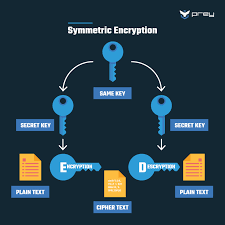

Encryption utilises mathematical algorithms to transform plaintext (readable data) into ciphertext (encrypted data). Only those with the decryption key can convert the ciphertext back into usable information. There are two main types:

- Symmetric Encryption: Uses the same key for both encryption and decryption. It’s efficient, but it requires a secure key exchange.

- Asymmetric Encryption uses a pair of keys—a public key for encryption and a private key for decryption—to allow secure communication without prior key exchange.

Key Encryption Applications for Privacy

Device Encryption

- Full-disk encryption: Protects all data on your computer or smartphone (BitLocker for Windows, FileVault for Mac, built-in encryption for iOS and Android)

- File-level encryption: Protects individual files and folders

Communication Encryption

- HTTPS: Secures website connections (look for the padlock icon in your browser)

- End-to-end encryption: Used in messaging apps like Signal, WhatsApp, and others to ensure only you and your recipient can read messages

- Email encryption: Options include PGP (Pretty Good Privacy), S/MIME, or encrypted email services

Network Encryption

- VPNs: Create an encrypted tunnel for all your internet traffic

- Wi-Fi encryption: WPA3 is the current most substantial standard for wireless networks

Cloud Storage Encryption

- At-rest encryption: Protects stored data

- Zero-knowledge encryption: The provider has no access to your encryption keys

- Client-side encryption: Data is encrypted before leaving your device

Implementing Encryption in Your Digital Life

- Enable device encryption on all your computers and mobile devices

- Use encrypted messaging apps for sensitive communications

- Verify HTTPS connections when sharing personal or financial information

- Consider encrypted email for sensitive communications

- Choose cloud services with strong encryption policies

- Use a VPN when connecting to public Wi-Fi networks

- Password-protect and encrypt sensitive files and backups

Limitations to Consider

- Encryption can’t protect against malware already on your device

- Weak passwords can undermine even the strongest encryption

- Encryption doesn’t hide metadata (who you’re communicating with, when, how often)

- Some countries have laws limiting encryption use or requiring backdoors

Encryption is a fundamental aspect of digital privacy that works best as part of a comprehensive security strategy. By understanding and implementing appropriate encryption methods, you can significantly enhance your privacy protection online.

.

Identity Theft

Identity theft is a pervasive form of fraud that can have devastating consequences for victims. In this crime, the perpetrator steals an individual’s personal information to assume their identity. This stolen information can often be gathered from discarded documents such as bank statements, utility bills, or even phishing scams.

Once armed with this data, the criminal may choose to open accounts in the victim’s name, a process known as application fraud. They might apply for credit cards, loans, or utility services under pretences, leaving the unsuspecting victim to deal with the aftermath.

The emotional toll of identity theft can be immense. Victims often face financial losses and damage to their credit scores, which can take years. In today’s digital age, account takeovers have become a prevalent threat to unsuspecting victims. Criminals typically employ tactics such as phishing, vishing, or smishing to manipulate individuals into revealing their personal information.

Phishing often involves deceptive emails that appear to come from legitimate sources. These emails may prompt the victim to click on malicious links or provide sensitive details under the guise of verifying their identity.

Vishing, or voice phishing, involves phone calls in which scammers impersonate bank representatives or trusted entities to extract confidential information directly from the victim. Similarly, smishing involves text messages that lure individuals into divulging critical data.

Once armed with this personal information, the criminal can easily convince a bank to change the account holder’s address. This deception allows them full access to the victim’s financial accounts and resources.

Additionally, some criminals are skilled enough to bypass bank interaction altogether. They can use the obtained credentials to log into online accounts directly, executing unauthorised transactions without needing any further verification.

The consequences for victims can be devastating, leading not only to financial loss but also emotional distress as they recover their stolen identities and secure their accounts. Consequently, individuals must remain vigilant and understand these risks to protect themselves against potential account takeovers for repair. Additionally, they may find themselves tangled in legal disputes as they try to prove their innocence.

Recovering from such a violation requires diligence and time, making it crucial for individuals to safeguard their personal information vigilantly. Implementing measures like shredding sensitive documents and monitoring credit reports can help prevent these types of crimes before they occur.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.