Analysis of Chinese Manufacturers Facing US Tariff Challenges

Current Situation for Chinese Manufacturers

Based on the article, Chinese manufacturers are experiencing severe disruption from the dramatic US tariff increases:

- The US has hiked tariffs on Chinese imports by 145% in 2025

- This has forced many Chinese factories to drastically reduce production or halt it entirely

- US-bound orders are stuck in warehouses as the price increases, making products uncompetitive

- Companies have had to lay off workers as production lines sit idle

- Manufacturers describe their situation as a “harsh winter” or “autumn”, depending on US exposure

The article highlights that manufacturers of various consumer goods, including slow cookers, towel warmers, hair straighteners, and bicycle locks, are all facing similar challenges. American customers have suspended orders while awaiting clarity on tariff negotiations.

Adaptation Strategies

Chinese manufacturers are responding with several strategies:

- Production relocation: Setting up factories in Southeast Asian countries to circumvent Chinese-specific tariffs

- Market diversification: Attempting to sell more to non-US markets (Australia, Europe, Latin America)

- Domestic market focus: Considering greater emphasis on Chinese domestic consumers

- Price adjustments: Some companies are considering reducing prices to maintain their US market share

- Wait-and-see approach: Many manufacturers are pausing operations while awaiting clarity

Impact on Singapore and ASEAN

While not extensively covered in the article, we can analyse the likely impacts:

For Singapore:

- Singapore’s manufacturing sector will likely face disruption, as noted briefly with “Trump tariffs shake up Singapore’s manufacturing [ing]”

- As a trade-dependent economy with deep ties to both China and the US, Singapore stands to experience both challenges and opportunities

- Singapore’s role as a neutral trade hub could become more valuable in this tense environment

- Companies may use Singapore as a regional headquarters for managing diversified manufacturing operations

For ASEAN Countries:

- ASEAN countries are becoming alternative manufacturing destinations (particularly Vietnam and Thailand)

- The article mentions new tariffs on Southeast Asian countries (36% on Thailand, 46% with a 90-day reprieve on Vietnam), though these are still lower than China’s 145%

- This creates a “China+1” strategy opportunity where ASEAN benefits from manufacturing relocation

- However, there’s uncertainty about whether these ASEAN advantages will remain if the US expands its tariff targets

Broader Asian Impact:

- Supply chains across Asia are being reorganised, with production shifting locations

- Regional trade patterns are changing as Chinese manufacturers seek new markets

- Companies with diversified manufacturing locations gain a competitive advantage

- Uncertainty is pervading business decisions throughout the region

- Countries must balance economic interests with geopolitical considerations in the US-China tensions

Long-term Considerations

The situation raises several important questions for Asian economies:

- Will this accelerate the existing trend of manufacturing diversification away from China?

- How sustainable are these elevated tariff levels, and what will the “new normal” look like?

- Can domestic consumption in China and other Asian markets compensate for reduced US trade?

- Will this lead to more regional economic integration in Asia as an alternative to US market dependence?

- How will these trade tensions affect technological development and standards adoption across Asia?

The situation remains highly fluid, with ongoing negotiations between the US and China potentially reshaping the trade landscape yet again.

In-depth Analysis of Chinese Manufacturing Challenges and Long-term Solutions for Singapore, ASEAN, and Asia

Chinese Manufacturing: Current Structural Challenges

1. Tariff Vulnerability and Market Concentration

Chinese manufacturers like Suzhou Huamei Electrics with 80% exposure to the US market represent a widespread structural vulnerability. The sudden 145% tariff increase has created a multi-layered crisis:

- Production paralysis: Companies are forced to idle production lines rather than produce goods that cannot be shipped profitably

- Inventory accumulation: Completed orders remain in warehouses, tying up capital and storage capacity

- Labour disruption: Temporary workers have been laid off, potentially creating social instability

- Cash flow constraints: With orders suspended and inventory unsold, cash flow interruptions threaten business viability

The extent of dependence on the US market has created critical vulnerability – businesses with diversified export destinations are weathering the situation better (“autumn” vs “harsh winter”).

2. Cost Structure Limitations

Chinese manufacturers have historically competed primarily on price, but several factors now constrain this approach:

- Rising labor costs: Chinese manufacturing wages have increased substantially over the past decade

- Land and energy costs: These have also risen, particularly in developed coastal manufacturing regions

- Environmental compliance: More stringent regulations have added compliance costs

- Tariff burden: The extreme tariff increases cannot be fully absorbed within existing margins

These manufacturers now face a dilemma: they lack sufficient margin to absorb tariffs, but raising prices makes their products uncompetitive in the US market.

3. Geographic Diversification Challenges

The article reveals Chinese manufacturers’ dilemma regarding production relocation:

- Incomplete transitions: Many began Southeast Asian expansion after 2018 tariffs but didn’t fully diversify

- Investment uncertainty: Companies like slow cooker manufacturer Suzhou Huamei are hesitant to invest in new facilities without tariff clarity

- Competitive disadvantage: Companies that already established Southeast Asian production (like GreenTek’s Vietnam factory) have gained immediate advantage

- Complex sourcing networks: Even with production outside China, supply chains often remain dependent on Chinese components

4. Innovation and Value-Chain Position

A deeper issue not directly addressed in the article is China’s position in global value chains:

- Many affected manufacturers produce relatively low-value consumer goods (slow cookers, towel warmers)

- These product categories face intense price competition and are easier for other countries to replicate

- Higher-value, more technologically advanced products would be more difficult to relocate and less price-sensitive

Projected Long-term Solutions

For Singapore:

Singapore’s advanced economy, strong governance, and strategic position allow it to capitalize on this disruption through several strategic approaches:

1. Supply Chain Orchestra Conductor

Singapore can position itself as the coordinator of diversified regional manufacturing networks:

- Regional headquarters hub: Become the central management location for companies operating multiple ASEAN manufacturing sites

- Financial services specialisation: Develop financing instruments designed explicitly for multi-country manufacturing operations

- Trade documentation integration: Create platforms that harmonise trade documentation across ASEAN countries

- Supply chain visibility solutions: Develop technologies that provide end-to-end visibility across complex regional supply networks

2. Advanced Manufacturing Specialisation

Rather than competing on labour costs, Singapore should accelerate its transition to:

- High-precision manufacturing: Focus on products requiring technical precision and quality control

- Biomedical and pharmaceutical production: Expand capabilities in areas requiring sterile environments and strict regulatory compliance

- Semiconductor and advanced electronics: Leverage existing strengths while developing new capabilities in specialised chip manufacturing

- Prototype and specialised manufacturing: Position as the go-to location for complex, custom, or short-run manufacturing needs

3. Trade Neutrality Leverage

Singapore’s balanced relationships with both the US and China create unique opportunities:

- Neutral trade facilitation services: Develop specialised services for handling complex compliance requirements between competing trade blocs

- Trusted intermediary status: Position as the preferred location for joint ventures between US and Chinese companies

- Dispute resolution mechanisms: Expand arbitration services specifically for international trade disputes

- Standards harmonisation leadership: Lead efforts to maintain interoperable standards between diverging US and Chinese technical requirements

For ASEAN:

ASEAN countries face both opportunities and challenges that require coordinated responses:

1. Differentiated Manufacturing Positioning

Rather than competing directly with each other, ASEAN countries should develop specialised manufacturing niches:

- Vietnam: Continue expanding in electronics, furniture, and textiles while moving up the value chain

- Thailand: Leverage automotive expertise while expanding into medical devices and precision components

- Malaysia: Build on semiconductor and electronics strengths while developing advanced materials manufacturing

- Indonesia: Utilise resource advantages for materials processing while developing specialised manufacturing in densely populated regions

- Philippines: Expand service-manufacturing integration, particularly where English language skills provide an advantage

2. Intra-ASEAN Integration Acceleration

The fragmentation of ASEAN manufacturing requires stronger regional integration:

- Customs harmonisation: Accelerate implementation of the ASEAN Single Window for trade documentation

- Technical standards alignment: Develop common product standards to enable seamless component sharing

- Transportation infrastructure: Prioritise cross-border transportation projects that support manufacturing integration

- Labour mobility frameworks: Create specialised visa programs for manufacturing technical specialists

3. Strategic US-China Balancing

ASEAN must navigate the complex geopolitics of US-China competition:

- Collective negotiation stance: Develop common positions on trade terms with both the US and China

- Neutrality preservation: Avoid exclusive alignment with either economic bloc

- Diversified supply chains: Ensure critical components can be sourced from multiple countries

- Rules of origin expertise: Develop sophisticated capabilities in managing rules of origin documentation to maximise tariff advantages

For Broader Asia:

The wider Asian region faces a fundamental restructuring opportunity:

1. Regional Value Chain Deepening

- Reduce external market dependence: Develop intra-Asian trade to reduce vulnerability to Western market disruptions

- Component standardization: Create Asian industrial standards organizations to enable easier regional sourcing

- Regional trade financing: Develop Asian institutions specializing in regional trade credit

- Technology sharing frameworks: Establish mechanisms for collaborative technology development that reduce dependence on Western innovation

2. Consumer Market Development

- Domestic consumption growth: Accelerate policies that support middle-class growth and consumer spending

- Regional product standards: Harmonise consumer protection and product safety standards to enable easier cross-border consumer sales

- E-commerce infrastructure: Build logistics and payment systems that support seamless regional consumer trade

- Brand development: Support the emergence of Asian brands with regional and global appeal

3. Strategic Industry Coordination

- Critical material securing: Coordinate access to rare earths and other strategic materials

- Joint technology platforms: Develop shared technology standards in emerging fields like electric vehicles and renewable energy

- Advanced skills development: Create regional centres of excellence for manufacturing skills development

- Research collaboration networks: Establish multi-country research initiatives in strategic manufacturing technologies

Conclusion: A Watershed Moment

The extreme US tariffs represent not just a temporary trade conflict but potentially a watershed moment in global manufacturing that will accelerate existing trends toward regionalisation and diversification. The countries and companies that adapt most effectively to this new reality will emerge with stronger, more resilient manufacturing ecosystems.

For Singapore, ASEAN, and the broader Asian region, this disruption creates an opportunity to reduce excessive dependence on Western consumer markets and develop more balanced, self-sustaining regional manufacturing networks. However, this transition will require sophisticated coordination, strategic investments, and far-sighted policy development to succeed.

ASEAN’s Potential Pivot Toward China Amid US-China Trade War

The escalating US-China trade war could accelerate a shift in ASEAN’s economic orientation more toward China. While ASEAN has historically maintained balanced relationships with both powers, several factors may now drive a greater tilt towards China in the region’s economic relationships.

Structural Factors Favouring a China Pivot

Geographic and Economic Gravity

- Proximity Advantage

- Physical closeness reduces shipping costs and times, particularly important during supply chain disruptions

- Integrated land connections via initiatives like the China-Laos Railway and planned Malaysia-Singapore rail links

- Easier coordination across similar time zones for business operations

- Economic Scale and Growth Trajectory

- China remains ASEAN’s largest trading partner (over $975 billion in 2023)

- China’s economy continues to grow faster than the US despite slowdowns

- Expanding Chinese consumer market offers growth potential for ASEAN exports

Trade Policy Dynamics

- Tariff Asymmetry

- The current US tariff structure (145% on Chinese goods vs 10% on others) creates immediate incentives to route production through ASEAN

- Chinese investments in ASEAN manufacturing could rapidly increase to circumvent US tariffs

- US scrutiny of origin rules may paradoxically accelerate genuine manufacturing shifts to ASEAN

- Regional Trade Architecture

- RCEP implementation creates a China-inclusive framework for regional trade

- China has shown flexibility on many non-tariff barriers in its ASEAN engagement

- US withdrawal from TPP reduced its economic policy leadership in the region

Recent Developments Accelerating the Trend

Chinese Strategic Engagement

- Investment Redirection

- Chinese outbound investment increasingly focuses on ASEAN as US access becomes more restricted

- Infrastructure projects under BRI (Belt and Road Initiative) create physical connectivity biased toward China

- Chinese technology companies facing US restrictions increasingly establish ASEAN regional hubs

- Supply Chain Integration

- Chinese manufacturers actively building “China+ASEAN” production networks

- Rising wage costs in China already driving manufacturing shifts to Vietnam, Cambodia, and Indonesia

- Chinese companies bringing suppliers and technology ecosystems with them

US Policy Constraints

- Negotiation Approach

- As noted in the article, the US is pursuing bilateral deals rather than regional frameworks

- Pressuring individual countries (like South Korea and Japan) creates divisions rather than regional coherence

- Warning language from China about “appeasement” creates political costs for US alignment

- Investment Limitations

- US investment in the region focuses more on services and high-tech than manufacturing

- US companies have been slower to develop alternative supply chains compared to Chinese counterparts

- American emphasis on political conditions for economic engagement creates friction

Country-Specific Pivot Potentials

High Potential for China Pivot

- Cambodia and Laos

- Already heavily dependent on Chinese investment and trade

- Limited US economic engagement provides little counterbalance

- Infrastructure increasingly oriented toward Chinese connectivity

- Myanmar

- Post-coup Western sanctions push military government toward China

- Chinese resource investments and infrastructure projects create structural dependencies

- Border trade increasingly critical for economic survival

Medium Pivot Potential

- Thailand and Malaysia

- Significant trade relationships with both powers but growing Chinese investment

- Strategic positioning as manufacturing alternatives to China for Western companies

- Carefully balancing relations but economic gravity pulling toward China

- Indonesia

- Resource exports (particularly critical minerals) increasingly directed to China

- Chinese investments in infrastructure and manufacturing growing rapidly

- Maintaining strategic autonomy but economic ties to China strengthening

More Balanced Positioning

- Vietnam

- Despite deep economic integration with China, maintains political wariness

- Actively courting Western investment as a China alternative

- Strategic concerns about Chinese dominance moderate economic alignment

- Philippines

- Security ties with US create counterbalance to economic gravity

- Territorial disputes with China complicate economic integration

- Current administration attempting to balance relations with both powers

- Singapore

- Highly globalized economy with strong ties to both powers

- Strategic interest in maintaining neutrality and rules-based economic order

- Sophisticated positioning as intermediary rather than choosing sides

Strategic Implications of a China Pivot

Regional Architecture Evolution

- Economic Institutionalization

- China-centred supply chains could drive more formalised economic architecture.

- Yuan internationalisation may accelerate in regional trade

- Standards and certifications could increasingly reflect Chinese preferences

- Strategic Autonomy Concerns

- Increased economic dependence on China could constrain ASEAN’s freedom of action.

- Critical infrastructure and digital systems may become more aligned with the Chinese standard.s

- Technology ecosystems might gradually separate into Chinese and Western spheres.

The trade war appears to be accelerating trends that were already underway, creating conditions where economic pragmatism may drive ASEAN into closer alignment with China despite political and security concerns about overdependence. While ASEAN will continue attempting to balance relations with both powers, the immediate economic imperatives created by extreme US tariffs on China may create path dependencies that prove challenging to reverse, even if trade tensions eventually moderate.

Historical Shifts in Imperial Power Through Global Conflicts

Global wars have historically served as transformative events that dramatically redistribute power between empires and nation-states. These conflicts accelerate existing trends, reveal hidden weaknesses, create new power vacuaries, and fundamentally alter the international order.

The Napoleonic Wars: Britain’s Rise to Global Dominance

The Napoleonic Wars (1803-1815) marked a crucial transition in global power:

- Naval Supremacy Consolidation

- Britain’s victory at Trafalgar (1805) established uncontested naval dominance

- This naval power became the foundation for a century of British imperial expansion

- France’s continental focus ultimately proved insufficient against Britain’s global reach

- Economic Transformation

- Britain’s industrial revolution accelerated during the conflict

- War financing innovations strengthened London as a financial centre

- Continental Europe’s productive capacity suffered extensive damage

The outcome established Britain as the dominant global power for the next century, demonstrating how war can accelerate technological advantages and create lasting power differentials.

World War I: Imperial Fracturing and American Emergence

World War I (1914-1918) fundamentally reshaped the global order:

- Imperial Collapse

- Four major empires disintegrated: Ottoman, Austro-Hungarian, German, and Russian

- Colonial subjects witnessed European vulnerability, planting seeds for independence movements

- Britain and France appeared victorious but suffered irreparable economic and demographic damage

- America’s Economic Ascendance

- The US transformed from debtor to creditor nation

- American industrial capacity expanded dramatically while Europe’s contracted

- The war accelerated the financial center shift from London to New York

While maintaining an isolationist posture politically, the United States emerged as the world’s strongest economic power, demonstrating how global conflicts can accelerate power transitions already underway.

World War II: The Bipolar Order Emerges

World War II (1939-1945) caused the most dramatic power redistribution in modern history:

- European Imperial Collapse

- Britain and France’s imperial positions became untenable after the war

- Military overextension and financial exhaustion accelerated decolonisation

- Japan’s early victories permanently shattered the myth of Western invincibility in Asia

- Superpower Emergence

- The United States and the Soviet Union emerged as the dominant powers

- American economic dominance reached unprecedented levels (nearly 50% of global GDP)

- Military technology (particularly nuclear weapons) created a new power calculus

- Global Institutions

- The post-war order established institutions (UN, IMF, World Bank) that reflected new power realities

- Economic frameworks like Bretton Woods institutionalised American economic leadership

This conflict completely reshaped the international order, replacing a multipolar imperial system with a bipolar superpower competition.

Cold War End: Unipolar Moment

While not a hot war, the Cold War’s conclusion demonstrated how imperial overextension can lead to collapse:

- Soviet Imperial Overreach

- Military spending is unsustainable relative to the economic base

- Imperial control costs in Eastern Europe and Afghanistan drained resources

- The technological gap widened as innovation systems faltered

- American Unipolar Position

- The US emerged with an uncontested military, economic, and ideological position.

- Dollar dominance and financial system control created unprecedented influence.

- American-led globalisation expanded rapidly into former Soviet spheres

This transition showed how, even without direct military confrontation, imperial systems can collapse when overstretched and outcompete.

Common Patterns in Power Transitions

Analysing these historical cases reveals several consistent patterns:

- Economic Foundation Primacy

- Military power ultimately follows economic capacity

- Wars accelerate economic divergence between powers

- Financial system control often transitions before military dominance

- Technology Acceleration

- Conflicts drive rapid technological innovation and adoption

- Powers that enter wars with technological advantages often exit with even greater leads

- Military technology breakthroughs frequently translate to civilian economic advantages

- Institutional Entrenchment

- Rising powers establish institutions that legitimise and extend their influence

- These institutions often outlast the peak power of their creators

- Control of global commons (seas, air, space, and now cyberspace) becomes formalised

- Imperial Overextension

- Declining powers often fail to recognise unsustainable commitments

- Military spending beyond economic capacity accelerates decline

- Defence of imperial positions diverts resources from domestic innovation

Implications for Current US-China Competition

Applied to the current situation, these historical patterns suggest:

- Economic Foundations

- Manufacturing capacity shifts to China mirror previous imperial transitions

- Financial system control remains firmly American, unlike previous transitions

- Technological competition is more balanced than in previous transitions

- Institutional Competition

- China is creating parallel institutions (AIIB, BRI), while the US maintains control over its legacy system.

- Neither power has the clear institutional advantage characteristic of previous transition.s

- Regional subsystems (like ASEAN) have more agency than in previous transition.s

- Conflict Acceleration Risk

- Historical transitions have rarely occurred peacefully

- The current trade war could represent the early stages of a more comprehensive competition

- Nuclear weapons create restraints absent in previous transitions

While historical analogies have limitations, particularly given nuclear deterrence and economic interdependence, the pattern of global conflicts accelerating imperial transitions suggests the current US-China trade tensions could represent an early phase of a more fundamental power realignment.

Strategic Infrastructure Integration

- Physical Connectivity: China’s infrastructure proposals create lasting dependencies:

- The Vietnamese rail links would enable “Vietnam to plug into transcontinental rail networks”

- These projects represent “strategic infrastructure cooperation” that binds economies together

- Supply Chain Integration: The 45 agreements with Vietnam specifically cover supply chains, creating mutual economic interests that are difficult to unwind.

- Long-Term Alignment: Infrastructure projects have decades-long timeframes, effectively locking in Chinese influence regardless of political changes.

Forcing Difficult Diplomatic Calculations

- Balanced Approach Becomes Harder: ASEAN’s traditional strategy of balancing great powers becomes more difficult:

- The article notes these countries “cannot afford to anger Mr Trump, given the size of the US market”

- Yet they also “welcome Chinese investments”

- This creates internal tension in their foreign policy

- Path of Least Resistance: As maintaining balanced relationships becomes more challenging, the consistent Chinese approach may appear more appealing than the volatile US stance.

- Collective Security Concerns: ASEAN unity faces pressure as individual nations make different calculations about how to respond to US tariffs.

Regional Identity Reinforcement

- Shared Asian Experience: Trump’s broad tariffs on multiple Asian countries reinforce a sense of common cause:

- China can position itself as a fellow Asian power, understanding regional concerns

- The contrast between Western and Eastern approaches becomes more pronounced

- Alternative Regional Order: China can present ASEAN-China cooperation as part of a broader Asian century narrative:

- The article notes Beijing’s strategy of “wresting influence from the US”

- China offers a vision where Asian nations determine their own economic future

- Shared Adversity: Facing standard US pressure creates solidarity that China can leverage diplomatically.

Long-Term Implications for Regional Architecture

- Economic Integration Acceleration: US tariffs may inadvertently accelerate the region’s economic integration with China:

- The article mentions China has “already diversified trade to reduce its reliance on the US”

- ASEAN nations may follow this model out of necessity

- Alternative Frameworks: Pressure may increase ASEAN’s receptiveness to China-led initiatives, such as the RCEP,P while decreasing enthusiasm for US-led frameworks.

- Diplomatic Realignment: The article suggests China sees the trade war as “just one front in a much larger contest for global influence” – and Trump’s approach appears to be unintentionally ceding ground in this contest.

Conclusion

While ASEAN nations will continue attempting to balance relations with both powers, Trump’s aggressive tariff approach appears to be creating conditions that make closer alignment with China both economically necessary and diplomatically appealing in the short term. This runs counter to the stated US strategic objectives in the region and demonstrates how economic coercion, lacking diplomatic finesse, can produce counterproductive outcomes in complex regional environments.

The article suggests that China is well aware of this dynamic, with Xi carefully playing the long game of regional influence. At the same time, Trump focuses on immediate economic confrontation—a contrast that may ultimately shift the regional centre of gravity toward Beijing, despite Washington’s intentions.

Science Fiction’s Vision of Eastern Power Ascendance

Many science fiction works have indeed explored scenarios where global power shifts eastward following major conflicts or societal transformations. This trend reflects both geopolitical anxieties and observations about changing global dynamics.

Major Science Fiction Works Depicting Eastern Ascendance

Classic Works

- Frank Herbert’s “Dune” series (1965-): This series takes place in a future where Eastern and Islamic cultural influences have merged with Western elements, with concepts like “Zensunni” philosophy demonstrating the enduring influence of Eastern thought.

- Philip K. Dick’s “The Man in the High Castle” (1962): While focusing on Japanese/German victory in WWII rather than WWIII, it explores themes of Eastern cultural and political influence in America.

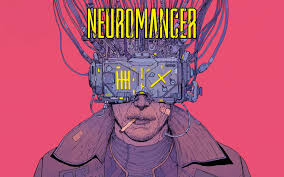

Cyberpunk Movement

- William Gibson’s “Neuromancer” and the Sprawl trilogy (1984-1988:depicts a world dominated by Japanese zaibatsu (corporations), with Eastern economic and technological supremacy following the decline of American dominance.

- Neal Stephenson’s “Snow Crash” (1992): Features remnants of America under heavy East Asian influence, particularly from Chinese and Japanese corporate entities.

Contemporary Works

- Liu Cixin’s “The Three-Body Problem” trilogy (2008-2010): Although not explicitly set in the post-WWII era, it presents China as a central power in humanity’s response to existential threats.

- David Wingrove’s “Chung Kuo” series (1989-1997): Set in a future where China has become the dominant world power and restructured global society.

- Kim Stanley Robinson’s “Red Mars” trilogy (1992-1996): Features China as one of the dominant powers in space colonisation efforts.

Common Themes in Eastern Ascendance Fiction

- Technological Leadership: Many works portray Eastern nations, particularly China, Japan, and a pan-Asian coalition, as technological innovators, especially in robotics, cybernetics, and artificial intelligence.

- Cultural Resilience: Eastern philosophical systems and social structures are often depicted as more adaptable to post-apocalyptic or resource-scarce environments.

- Economic Dominance: The Eastern economic model, often featuring state capitalism or a corporate-state hybrid, frequently supplants Western economic systems.

- Demographic advantages, as some studies emphasise, are factors in post-conflict resilience, particularly among Eastern populations and in promoting social cohesion.

Historical Context for These Predictions

Science fiction’s vision of Eastern ascendance reflects several real-world trends and anxieties:

- Cold War Anxieties: Earlier works often responded to the perceived decline of the West in the face of Soviet and Eastern bloc advancement.

- Japan’s Economic Rise: The 1980s, in particular, reflected American anxiety about Japan’s growing economic power.

- China’s Growth Trajectory: Recent works reflect observations about China’s increasing economic and technological influence.

- Post-Western World Order: Contemporary science fiction increasingly portrays multipolar worlds where Western dominance has come to an end.

While these fictional scenarios don’t predict actual World War 3 outcomes (since that conflict hasn’t occurred), they do reflect ongoing speculation about how global power dynamics might evolve following major systemic disruptions.

Maxthon

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in AdBlock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon implements rigorous measures to protect user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

Additionally, Maxthon incorporates features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser provides a comprehensive suite of tools and features designed to deliver a secure and private browsing experience.

Maxthon Browser, a free web browser, provides users with a secure and private browsing experience through its built-in AdBlock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s AdBlock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches, ensuring a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet with confidence, knowing their online privacy is protected.

Additionally, the desktop version of Maxthon Browser integrates seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive market of web browsers.