Analysis of the “99-to-1” Arrangement to Reduce ABSD

The Mechanism and Intent

The “99-to-1” arrangement, also known as “100-sell-1,” was designed as a tax avoidance strategy in Singapore’s property market to reduce Additional Buyer’s Stamp Duty (ABSD) payments. Here’s how it typically worked:

- A first-time property buyer (often with preferred tax status) would purchase 100% of a property

- Shortly after, they would sell a 1% share to another party who already owned property

- The second buyer would only pay the higher ABSD rate on their 1% portion

- The arrangement allowed the effective use of the first buyer’s more favourable tax status

This approach exploited tax rate differences between:

- Singapore citizens vs. permanent residents vs. foreigners

- First-time vs. subsequent property purchases

Legal and Regulatory Analysis

The IRAS has clearly deemed these arrangements to be illegal tax avoidance schemes rather than legitimate tax planning. The distinction lies in:

- Substance over form: The transactions lacked a genuine commercial purpose beyond tax avoidance

- Temporal proximity: The quick transfer of the 1% share indicated a pre-planned arrangement

- Unchanged beneficial ownership: The property’s actual control and usage remained essentially unchanged

The courts appear to be treating these as deliberate attempts to circumvent Singapore’s property cooling measures rather than legitimate property transactions.

Impact on Various Stakeholders

Buyers

- Financial consequences: Significant penalties, as seen in the lawsuits ($850,000 and $1.2 million)

- Legal liability: Potential civil and even criminal exposure (the article mentions a mother and son being criminally charged)

- Trust deficit: Many buyers claim they relied on professional advice, creating a crisis of trust between property buyers and advisors

- Long-term implications: Affected buyers face not just financial penalties but potentially lasting damage to their creditworthiness and reputation

Property Agents and Agencies

- Legal exposure: Direct lawsuits from former clients

- Reputational damage: Public perception of unethical practices

- Business model vulnerability: PropNex’s defence that agents are “independent contractors” tests the agency relationship model

- Industry standards: Creates pressure for stronger compliance training and oversight

Legal Professionals

- Professional responsibility: Questions about how thoroughly law firms evaluated and communicated risks

- Ethical obligations: Tension between zealous representation and gatekeeper duties

- Defensive posturing: Law firms like City Law claim they merely processed pre-decided arrangements

- Future practice: Likely increased caution around property transaction structures

Broader Market Impact

- Regulatory tightening: IRAS’s aggressive enforcement signals zero tolerance

- Market transparency: Elimination of these schemes may create more accurate price signals

- Pricing effects: Properties may see price adjustments as actual ABSD costs are factored in

- Foreign investment: Could impact foreign buyer behaviour in Singapore’s luxury property segment

Policy Implications

The crackdown on “99-to-1” arrangements reinforces Singapore’s commitment to cooling measures in the property market. IRAS’s decision to pursue approximately $60 million from 166 cases demonstrates:

- Strong enforcement resolve

- Sophisticated detection capabilities

- Willingness to pursue retrospective cases

- Prioritisation of housing policy objectives over tax optimisation

Future Outlook

- Stricter compliance: Property professionals will likely implement stronger compliance measures

- Transaction transparency: More transparent transaction structures will emerge

- Professional standards: Higher standards of diligence from both legal and real estate professionals

- Market adaptation: The property market will adjust to operating without these arrangements

- Pricing impact: More straightforward pricing that incorporates actual tax costs

The “99-to-1” case illustrates the tension between creative tax planning and regulatory boundaries in Singapore’s tightly controlled property market. It serves as a cautionary tale about the risks of arrangements that prioritise technical compliance over substantive adherence to policy objectives.

The Widespread Misuse of “99-to-1” Arrangements in Singapore’s Property Market

Scale and Motivation Behind the Practice

The “99-to-1” arrangement became a widespread phenomenon in Singapore’s property market primarily because it created a decisive sales advantage for developers and agents. What started as an isolated strategy evolved into a systemic practice for several reasons:

- Sales acceleration tool: Property agents and developers could effectively market units at “discounted” tax rates, creating artificial competitive advantages

- Commission-driven incentives: The article shows agents pursued these arrangements aggressively, as each transaction represented significant commission opportunities

- Industry normalisation: The practice appears to have been institutionalised through “training sessions conducted by law firms and bankers”

- Network effects: As more transactions succeeded using this method, it gained legitimacy through the apparent safety in numbers

The 166 identified cases, representing $60 million in avoided taxes, likely represent only a fraction of the total market impact, as many arrangements may have gone undetected or been executed differently.

Consequences for Industry Professionals

For Property Agents and Agencies

- Legal liability cascade: The lawsuits against PropNex represent just the beginning of potential litigation as more affected buyers seek compensation.

- Agency relationship testing: PropNex’s defence that agents were “independent contractors” creates industry-wide uncertainty about liability structure.s

- Professional standards crisis: The case exposes inadequate compliance oversight and potentially misleading training

- Trust erosion: Agents who promoted these arrangements face credibility issues with past and future clients

For Legal Professionals

- Professional conduct scrutiny: Law firms involved face questions about their ethical obligations as legal gatekeepers

- Unclear boundaries: The cases highlight confusion about where legal tax planning ends and tax avoidance begins

- Conflicting interests: Acting for multiple parties (developers, buyers) created potential conflicts

- Document processing vs. advisory role: The distinction between merely processing paperwork and actively advising becomes crucial

Market-Wide Impact

Short-Term Disruption

- Transaction volume reduction: As these arrangements disappear, buyers facing higher tax burdens may delay purchases

- Price discovery adjustment: Properties previously marketed with “tax advantages” may see price corrections

- Developer strategy shifts: Projects that relied heavily on these arrangements for sales may face challenges in completing or financing.

- Market uncertainty: The pending lawsuits create uncertainty about transaction security

Long-Term Structural Changes

- Compliance infrastructure: Agencies and law firms will invest in stronger compliance protocols

- Transparent pricing: Marketing will shift toward actual costs rather than tax optimisation schemes

- Developer-buyer relationships: Direct pricing strategies rather than complex arrangements will reshape marketing approaches

- Market segmentation effects: Foreign and investment buyers (most affected by ABSD) may recalibrate their Singapore property approach

Regulatory Response and Policy Implications

IRAS’s decisive action signals several critical policy dimensions:

- Enforcement capacity: The successful identification of 166 cases demonstrates sophisticated detection capabilities

- Zero tolerance approach: The pursuit of both tax recovery and potential criminal charges establishes powerful deterrence

- Policy coherence: Reinforces that Singapore’s property cooling measures are substantive policy tools, not technical hurdles to be circumvented

- Market integrity focus: Actions protect market transparency and level competition among developers and agencies.

Real Estate Development Impact

- Project viability reassessment: Developments that relied heavily on these arrangements for sales projections may face feasibility challenges

- Marketing strategy overhaul: Developers must find legitimate ways to attract buyers in a higher-tax environment

- Foreign investment recalibration: Projects targeted at foreign investors may require pricing adjustments to account for unmitigated ABSD

- Market timing effects: Some developments may face delayed sales cycles as the market adjusts to actual tax costs

Consumer Protection Concerns

The cases highlight several consumer protection issues:

- Information asymmetry: Buyers relied on professional advice that proved harmful

- Complex transaction risks: The technical nature of property and tax law made buyers vulnerable

- Misaligned incentives: Commission-motivated agents prioritised sales over buyer protection

- Accountability gaps: The distributed responsibility between agents, agencies, and law firms created unclear liability chains

The aftermath of this widespread practice will likely trigger both market corrections and structural reforms in Singapore’s property ecosystem, ultimately leading to more transparent but potentially more expensive transactions for specific buyer categories. The government’s decisive action reinforces Singapore’s commitment to maintaining housing affordability and market stability through effective cooling measures.

The Widespread Misuse of “99-to-1” Arrangements in Singapore’s Property Market

Scale and Motivation Behind the Practice

The “99-to-1” arrangement became a widespread phenomenon in Singapore’s property market primarily because it created a decisive sales advantage for developers and agents. What started as an isolated strategy evolved into a systemic practice for several reasons:

- Sales acceleration tool: Property agents and developers could effectively market units at “discounted” tax rates, creating artificial competitive advantages

- Commission-driven incentives: The article shows agents pursued these arrangements aggressively, as each transaction represented significant commission opportunities

- Industry normalisation: The practice appears to have been institutionalised through “training sessions conducted by law firms and bankers”

- Network effects: As more transactions succeeded using this method, it gained legitimacy through the apparent safety in numbers

The 166 identified cases, representing $60 million in avoided taxes, likely represent only a fraction of the total market impact, as many arrangements may have gone undetected or been executed differently.

Consequences for Industry Professionals

For Property Agents and Agencies

- Legal liability cascade: The lawsuits against PropNex represent just the beginning of potential litigation as more affected buyers seek compensation.

- Agency relationship testing: PropNex’s defence that agents were “independent contractors” creates industry-wide uncertainty about liability structure.s

- Professional standards crisis: The case exposes inadequate compliance oversight and potentially misleading training

- Trust erosion: Agents who promoted these arrangements face credibility issues with past and future clients

For Legal Professionals

- Professional conduct scrutiny: Law firms involved face questions about their ethical obligations as legal gatekeepers

- Unclear boundaries: The cases highlight confusion about where legal tax planning ends and tax avoidance begins

- Conflicting interests: Acting for multiple parties (developers, buyers) created potential conflicts

- Document processing vs. advisory role: The distinction between merely processing paperwork and actively advising becomes crucial

Market-Wide Impact

Short-Term Disruption

- Transaction volume reduction: As these arrangements disappear, buyers facing higher tax burdens may delay purchases

- Price discovery adjustment: Properties previously marketed with “tax advantages” may see price corrections

- Developer strategy shifts: Projects that relied heavily on these arrangements for sales may face challenges in completing or financing.

- Market uncertainty: The pending lawsuits create uncertainty about transaction security

Long-Term Structural Changes

- Compliance infrastructure: Agencies and law firms will invest in stronger compliance protocols

- Transparent pricing: Marketing will shift toward actual costs rather than tax optimisation schemes

- Developer-buyer relationships: Direct pricing strategies rather than complex arrangements will reshape marketing approaches

- Market segmentation effects: Foreign and investment buyers (most affected by ABSD) may recalibrate their Singapore property approach

Regulatory Response and Policy Implications

IRAS’s decisive action signals several critical policy dimensions:

- Enforcement capacity: The successful identification of 166 cases demonstrates sophisticated detection capabilities

- Zero tolerance approach: The pursuit of both tax recovery and potential criminal charges establishes powerful deterrence

- Policy coherence: Reinforces that Singapore’s property cooling measures are substantive policy tools, not technical hurdles to be circumvented

- Market integrity focus: Actions protect market transparency and level competition among developers and agencies

Real Estate Development Impact

- Project viability reassessment: Developments that relied heavily on these arrangements for sales projections may face feasibility challenges

- Marketing strategy overhaul: Developers must find legitimate ways to attract buyers in a higher-tax environment

- Foreign investment recalibration: Projects targeted at foreign investors may require pricing adjustments to account for unmitigated ABSD

- Market timing effects: Some developments may face delayed sales cycles as the market adjusts to actual tax costs

Consumer Protection Concerns

The cases highlight several consumer protection issues:

- Information asymmetry: Buyers relied on professional advice that proved harmful

- Complex transaction risks: The technical nature of property and tax law made buyers vulnerable

- Misaligned incentives: Commission-motivated agents prioritised sales over buyer protection

- Accountability gaps: The distributed responsibility between agents, agencies, and law firms created unclear liability chains

The aftermath of this widespread practice will likely trigger both market corrections and structural reforms in Singapore’s property ecosystem, ultimately leading to more transparent but potentially more expensive transactions for specific buyer categories. The government’s decisive action reinforces Singapore’s commitment to maintaining housing affordability and market stability through effective cooling measures.

How the “99-to-1” Arrangement Facilitated Overselling in Singapore’s Property Market

The Pricing Illusion Effect

The “99-to-1” arrangement created a powerful tool for overselling properties by fundamentally distorting the true ownership costs. This occurred through several key mechanisms:

- Artificial price reduction: By presenting ABSD as an “optional” or “avoidable” cost, agents effectively marketed properties at what appeared to be 5-30% discounts (depending on the applicable ABSD rate)

- Qualifying barrier removal: Properties that would have been financially out of reach for certain buyers suddenly appeared affordable when the ABSD component was seemingly eliminated

- ROI distortion: Investment properties appeared to offer better returns when the tax burden was artificially reduced in financial projections

Sales Acceleration Tactics

The arrangement enabled several aggressive sales tactics:

- Urgency creation: Agents could present the “99-to-1” structure as a special “insider” opportunity that might not remain available, creating artificial urgency

- Competitive advantage: Developers and agents using this approach gained an unfair advantage over those maintaining ethical compliance with ABSD regulations

- Target market expansion: Properties could be marketed to segments that would usually be priced out by ABSD requirements, particularly:

- Foreign investors facing 30% ABSD

- Singapore residents purchasing their second or third properties

- Family members helping to finance properties for relatives

- Comparative marketing: By presenting their offerings as “tax-optimised,” these properties appeared more competitive than legitimately marketed alternatives

Market Distortion Mechanisms

The arrangement created several market distortions that facilitated overselling:

- Market segment blurring: The boundary between domestic first-home buyers and investor segments has become blurred, allowing developers to market properties to buyers that are inappropriate for their intended use.

- Financing flexibility illusion: As seen in the Melvin Li case, the arrangement created the impression that financing constraints could be overcome through creative structures

- Portfolio expansion enablement: Investors were encouraged to acquire more properties than they could legitimately afford under standard ABSD rules

- Property value inflation: With reduced tax costs, buyers could allocate more funds to the property price itself, potentially driving up market prices

Developer-Agent Collusion Dynamics

The article hints at systemic adoption of the practice:

- Institutionalised training: The reference to “training sessions conducted by law firms and bankers” suggests organised promotion of these arrangements

- Developer knowledge: Agents like Sng were described as “marketing salesperson for the developers,” suggesting potential developer awareness and incentivization

- Sales target achievement: The arrangements likely helped developers meet sales targets, especially for higher-priced units that would otherwise face significant ABSD barriers

- Marketing material integration: While not explicitly mentioned, these arrangements may have been subtly incorporated into marketing materials through phrases like “tax optimisation strategies available”

The Role of Professional Validation

Professional involvement created a false sense of legitimacy:

- Legal firm participation: Law firms processing these transactions lent an air of legitimacy to potentially questionable arrangements

- Agent assurances: As seen in the WhatsApp messages from agent Sng claiming he did only “legal stuff,” professional assurances reduced buyer scepticism

- Banking cooperation: The involvement of banks in providing financing for these structured transactions further validates their appearance of legitimacy

- Agency endorsement: The involvement of established agencies like PropNex created an impression of institutional approval

Psychological Sales Techniques Enabled

The arrangement enabled psychologically powerful sales techniques:

- Exclusivity perception: The arrangement could be presented as a “special opportunity” available only to select clients

- Loss aversion exploitation: Buyers feared missing out on savings that seemed legally available to others

- Financial sophistication appeal: The structure appealed to buyers’ desire to appear financially sophisticated and “in the know”

- Risk perception manipulation: The actual legal and financial risks were minimised or obscured behind professional assurances

The “99-to-1” arrangement ultimately allowed properties to be marketed to buyers who would have been excluded by ABSD regulations, at prices that appeared artificially lower than their actual cost of ownership. This created a form of market manipulation that benefited developers and agents in the short term, but ultimately led to significant financial and legal consequences for buyers when IRAS took enforcement action. The practice serves as a case study in how tax avoidance schemes can distort market dynamics and facilitate the overselling of assets.

How “99-to-1” Arrangements Created a Culture of Illusory Success Among Young Property Agents

The Fast Track to “Success”

The “99-to-1” arrangement became a powerful career accelerator for young real estate agents in Singapore, creating an artificial pathway to rapid success and wealth display. This phenomenon operated through several interconnected mechanisms:

- Transaction volume acceleration: Young agents could close deals that would otherwise have been impossible due to ABSD barriers

- Client base expansion: Agents could suddenly serve high-net-worth clients and foreign investors who would normally face prohibitive tax burdens

- Commission multiplication: By enabling clients to purchase multiple properties (which would typically be ABSD-restricted), agents could multiply their commission earnings

- Referral network growth: Successful use of these arrangements created word-of-mouth referrals among wealth-focused communities

The Social Media Success Story

The arrangement facilitated a particular type of success narrative that was highly marketable on social media:

- Luxury property specialisation: Young agents could position themselves as specialists in high-end properties by closing deals in premium developments

- “Million-dollar producer” status: Achieving high sales volumes quickly led to industry accolades and “top producer” recognitions

- Visible wealth markers: The rapid commissions enabled conspicuous consumption (luxury cars, watches, travel) that could be showcased on social media

- “Financial expert” positioning: Knowledge of these arrangements positioned young agents as sophisticated advisors rather than mere salespeople

Creating Artificial Expertise

The arrangement gave inexperienced agents an artificial competitive advantage:

- Knowledge asymmetry exploitation: Young agents with knowledge of the arrangement could outcompete experienced agents who operated within ethical boundaries

- Technical complexity illusion: The arrangement created the impression that the agent possessed sophisticated financial and legal knowledge

- Instant authority creation: Success with high-value transactions conferred perceived expertise regardless of actual market knowledge

- Fast-tracking experience: New agents could bypass the traditional learning curve of building networks and market understanding

The Business Model of Illusion

The business approach facilitated by these arrangements had several distinctive characteristics:

- Volume over sustainability: Focus on transaction quantity rather than long-term client relationships

- Risk displacement: Transferring legal and financial risks from agents to clients and developers

- Short-term revenue maximisation: Prioritising immediate commission over sustainable business practices

- Accelerated career timeline: Compressing what would usually be years of career building into months

The Wealth Signalling Ecosystem

The arrangement supported an ecosystem of wealth signalling:

- Agency recruitment tool: Success stories became powerful recruitment tools for agencies to attract more young agents

- Team-building leverage: Successful agents could quickly build teams under them, multiplying the effect

- Industry status symbols: Access to developer launches, VIP events, and industry recognition came rapidly

- Community reinforcement: Groups of agents using these techniques created reinforcing communities that normalised the practice

The Psychological Impact

The arrangement created particular psychological effects within the agent community:

- False confidence: Young agents developed inflated confidence in their abilities based on artificially facilitated success

- Risk perception distortion: Consistent success with these arrangements created the illusion that regulatory risks were theoretical rather than real

- Entitlement mindset: Rapid success fostered expectations of continuing high income with minimal effort

- Misattribution of success: Agents attributed their success to personal skill rather than the exploitation of a tax loophole

The Inevitable Reckoning

The current lawsuits represent the beginning of a market correction:

- Skill deficit exposure: As these arrangements disappear, agents who relied on them face a genuine skills gap

- Sustainable practice challenges: Agents must transition to legitimate value propositions and sales approaches

- Client relationship damage: Affected clients may spread negative experiences throughout their networks

- Industry credential recalibration: Industry recognition based partly on volume metrics may need reassessment

The “99-to-1” phenomenon represents a case study in how regulatory exploitation can create artificial success metrics and illusory wealth among service professionals. The Instagram-worthy success stories of young agents driving luxury cars and closing million-dollar deals were, in many cases, built on a foundation of questionable tax arrangements that placed their clients at significant risk. As IRAS enforcement continues, the property industry faces a necessary but potentially painful recalibration toward sustainable and compliant business practices.

How the “99-to-1” Scandal Will Drive Industry Purification in Singapore’s Property Market

Immediate Cleansing Mechanisms

The exposure of the “99-to-1” scheme creates several powerful mechanisms that will naturally remove unethical actors from Singapore’s property ecosystem:

- Legal consequences: The high-profile lawsuits will likely result in:

- Regulatory action against agents who promoted these schemes

- Potential suspension or revocation of licenses for repeat offenders

- Personal financial liability for agents caught in litigation

- Market reputation damage: Agents identified with these schemes face:

- Client trust erosion and referral network collapse

- Digital footprint concerns as their names appear in legal reporting

- Difficulty attracting new clients who will now specifically avoid such practices

- Financial viability challenges: Agents dependent on these arrangements face:

- Sudden income reduction as their primary sales tactic disappears

- Potential liability for client compensation and legal expenses

- Inability to maintain the lifestyle previously supported by inflated commissions

Structural Industry Reforms

Beyond individual consequences, the scandal will likely trigger broader reforms:

- Agency compliance overhaul:

- Agencies will implement stronger internal checks on transaction structures

- Legal review requirements for non-standard arrangements

- Client disclosure protocols to ensure transparency about tax implications

- Education and qualification improvements:

- Enhanced ethical components in agent qualification processes

- Continuing education requirements focusing on compliance

- Testing on regulatory knowledge especially regarding tax implications

- Industry self-regulation:

- Professional associations may implement additional certification requirements

- Peer review mechanisms for unusual transaction structures

- Industry-wide guidance on acceptable tax planning vs. avoidance

Market Selection Forces

Natural market forces will now work against unethical practitioners:

- Client sophistication increases:

- Buyers will specifically question tax arrangements and seek independent advice

- Greater scepticism toward “too good to be true” tax solutions

- Preference for agents with established compliance reputations

- Referral network recalibration:

- Professional networks (lawyers, bankers) will avoid referring clients to questionable agents

- Client communities will share information about agents involved in problematic arrangements

- Online reviews and ratings will increasingly reflect compliance concerns

- Sustainable business model advantage:

- Agents with legitimate value propositions will gain a competitive advantage

- Transparent fee structures and clear tax advice will attract discerning clients

- Long-term relationship building will outperform transaction volume strategies

Regulatory Enforcement Expansion

The successful IRAS action creates momentum for expanded enforcement:

- Enhanced monitoring capabilities:

- Data analytics to identify suspicious transaction patterns

- Coordination between multiple regulatory bodies

- Transaction auditing focusing on ABSD compliance

- Deterrence strengthening:

- Obvious enforcement actions create powerful examples

- Industry-wide notices and warnings about similar arrangements

- Publication of enforcement outcomes as cautionary cases

- Expanded regulatory scope:

- Scrutiny of other creative tax minimisation structures

- Investigation of related professional enablers

- Examination of agency oversight responsibilities

Professional Standards Evolution

The industry will likely see a fundamental shift in professional standards:

- Ethical baseline recalibration:

- Clear delineation between acceptable advisory and problematic facilitation

- Emphasis on client best interest over transaction completion

- Integration of compliance into core professional identity

- Transparency expectations:

- Normalised practice of written disclosures about tax implications

- Clear documentation of advice provided and limitations

- Open discussion of regulatory risks in complex arrangements

- Expertise redefinition:

- Value based on market knowledge and negotiation skills rather than tax schemes

- Professional reputation tied to compliance and ethical practice

- Recognition systems that reward sustainable business practices

Long-Term Industry Benefits

This painful process will ultimately strengthen the property industry:

- Client trust restoration:

- Rebuilt confidence in professional advice

- A clearer understanding of the agent’s proper role and limitations

- Higher willingness to pay for genuinely valuable professional services

- Professional dignity enhancement:

- Shift from transaction facilitator to a trusted advisor role

- Pride in ethical practice rather than transaction volume

- Sustainable career paths based on expertise and integrity

- Market stability improvement:

- More accurate pricing reflecting actual ownership costs

- Reduced artificial transaction volume driven by tax schemes

- Alignment of industry practices with policy objectives

The “99-to-1” scandal represents a necessary, albeit painful, correction that will ultimately strengthen Singapore’s property industry by removing practitioners who are dependent on questionable practices. While the short-term disruption will be significant, the industry will emerge with higher standards, greater client trust, and more sustainable business models. In essence, this represents a market-driven purification process accelerated by regulatory intervention.

This is concerning information about fraudsters impersonating lawyers and creating fake law firms to deceive people.

Based on the article from May 2021, here are the key points:

- Scammers were creating bogus law firms, impersonating lawyers, and using phishing attacks to trick people into giving them money.

- The Law Society of Singapore reported seven cases of scams related to law firms or lawyers over three years.

- One example involved a fake “Goh Keng Law Firm” that:

- Used photos of real lawyers

- Copied client reviews from legitimate firms

- Required “commitment fees” before taking cases

- Another case involved scammers creating a website that mimicked a Singapore law firm but changed references to Singapore with a Chinese city name.

- In one instance, scammers attempted to redirect mortgage loan payments to foreign bank accounts.

- The Law Society recommended that people:

- Check the official public directory of lawyers and law firms

- Review examples of scams on the Law Society’s website

- Verify any payment instructions with their lawyers directly

- Be cautious about instructions that deviate from previous communications

These types of scams seem to be growing more sophisticated as more people conduct business online. It’s a good reminder to verify the identity of legal representatives through official channels before making any payments.

Analysis of Fake Lawyer Scams in Singapore

Based on the article, I can provide an analysis of fake lawyer scams in Singapore and prevention strategies:

Types of Scams

- Bogus Law Firms: Creating entirely fake law firms with professional-looking websites

- Example: “Goh Keng Law Firm” with stolen photos of real lawyers

- Use of copied client reviews to appear legitimate

- Lawyer Impersonation: Scammers pretending to be actual lawyers

- Phishing Attacks: Fraudulent emails claiming to be from legitimate law firms

- Example: Requesting changes to payment instructions for mortgage loans

- Attempting to redirect funds to foreign bank accounts

- Website Cloning: Duplicating legitimate law firm websites with minor modifications

- Example: Adding a Chinese city name to a Singapore law firm’s identity

- Replicating lawyer profiles and firm content

Trends and Contributing Factors

- Increasing Frequency: Seven reported cases over three years (as of May 2021)

- Growing Sophistication: Scammers are employing more advanced techniques

- Digital Shift: More Singaporeans are conducting legal transactions online, creating opportunities for scammers

Prevention Strategies in Singapore

- Official Verification:

- Check the Legal Services Regulatory Authority’s public directory of lawyers and law firms

- The directory includes even inactive law practices for reference

- Payment Verification:

- Confirm directly with your lawyer before making any payments

- Be suspicious of unexpected changes to payment instructions

- Verify any fund transfer instructions that differ from previous communications

- Public Awareness:

- The Law Society maintains examples of online scams on their website

- Public education on recognizing red flags

- Takedown Notices:

- Legal action to remove fraudulent websites

- Though noted in the article that international enforcement can be challenging

- Due Diligence:

- Be wary of law firms requiring upfront “commitment fees”

- Verify law firm credentials through multiple official channels

These scams highlight the importance of verifying through official channels and taking extra precautions when making payments related to legal services. Their evolving nature suggests that prevention strategies must also continue to adapt.

Applying to Singapore Courts for Relief Against Fake Lawyer Scams

Based on the information in the article, here’s guidance on how victims of fake lawyer scams might seek relief through Singapore’s courts:

Legal Remedies Available

- Civil Proceedings:

- File a civil suit against perpetrators (if identified) for fraud, misrepresentation, or damages

- Seek monetary compensation for financial losses

- Injunctive Relief:

- Apply for court orders to immediately take down fraudulent websites

- Request cease and desist orders against impersonators

- Police Reports:

- File a police report, which may lead to criminal proceedings

- Criminal cases would then be prosecuted by the state if sufficient evidence exists

Application Process

- Engage a Legitimate Lawyer:

- Verify their credentials through the Legal Services Regulatory Authority’s directory

- Seek representation from a lawyer experienced in fraud cases

- Document Collection:

- Gather all communications with the fraudulent entity

- Compile evidence of payments made

- Document attempts to verify the legitimacy of the “law firm”

- Preserve screenshots of fraudulent websites or communications

- File Originating Claims/Summons:

- Submit formal legal claims through Singapore’s courts

- State Courts for claims below S$250,000

- High Court for claims above S$250,000

- Interim Orders:

- Request urgent interim orders to freeze assets or remove online content

- Can be done through applications for urgent hearings

Collaborative Approaches

- Work with Law Society:

- Report the scam to the Law Society of Singapore

- The Society may assist in takedown efforts, as demonstrated by their engagement of Ghows law firm in the article

- Engage Regulatory Bodies:

- Report to the Monetary Authority of Singapore for financial fraud aspects

- File complaints with the Infocomm Media Development Authority for online scams

- International Cooperation:

- For scams with international elements, courts may need to issue orders with cross-border effect.

- Singapore courts can sometimes request assistance from foreign jurisdictions.

This approach combines preventive measures with legal remedies available through Singapore’s court system to address fake lawyer scams comprehensively.

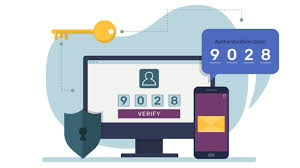

Anti-Scam Protection Infrastructure in Singapore

Singapore has developed one of the most comprehensive anti-scam ecosystems in the region:

ScamShield System

- ScamShield App: A government-developed mobile application that:

- Filters and blocks potential scam calls and messages

- Allows users to verify suspicious contacts and websites

- Provides real-time scam alerts and updates

- ScamShield Helpline (1799): A dedicated hotline for scam verification and reporting.

- ScamShield Website: An Educational resource with updated information on current scam tactics.

Banking Security Measures

- Transaction Limits: Singapore banks implement customizable transaction limits for online banking.

- Multi-Factor Authentication: Required for significant banking transactions.

- Rapid Response Protocols: Banks have specialized teams to freeze accounts and attempt fund recovery when scams are reported quickly.

Coordinated Response Framework

- Anti-Scam Centre: Established by the Singapore Police Force to coordinate investigations and recovery efforts.

- Inter-Ministry Committee on Scams: Facilitates collaboration between government agencies.

- Project FRONTIER: A partnership between police, banks, and telecommunications companies to share intelligence and block scam operations.

Public Education Campaigns

The “ACT Against Scams” framework (Add, Check, Tell) represents Singapore’s public education approach, focusing on:

- Proactive security measures

- Verification through official channels

- Community information sharing

Effectiveness and Challenges

Despite these measures, the S$9.6 million in losses from this scam variant alone suggests significant challenges:

- Cross-Border Enforcement: Many scammers operate outside Singapore’s jurisdiction.

- Evolving Tactics: Scammers continuously adapt to circumvent security measures.

- Psychological Manipulation: Even well-educated individuals fall victim when under pressure or emotional manipulation.

The Singapore authorities are continuously refining their approach, with the ScamShield ecosystem representing one of the most innovative government responses to digital scams globally.

Anti-Scam Centre (ASC) Assistance in Singapore

How the Anti-Scam Centre Can Help

The Anti-Scam Centre (ASC) in Singapore offers several key services to scam victims and the broader public:

For Scam Victims

- Immediate Assistance:

- Report scams through the Police Hotline (1800-255-0000)

- Use the online I-Witness reporting portal (www.police.gov.sg/i-witness)

- In urgent cases requiring immediate intervention, dial 999

- Fund Recovery Assistance:

- ASC coordinates with banks to freeze suspicious accounts

- Works to recover transferred funds when possible

- The speed of reporting is critical—immediate reporting increases recovery chances

- Case Investigation:

- Documents scam incidents and collects evidence

- Tracks patterns to identify scam networks

- Builds cases for prosecution when perpetrators can be identified

For the General Public

- Scam Prevention Resources:

- Educational materials about current scam types

- Verification services for suspicious contacts

- Access to the ScamShield app and other protective tools

- Awareness Programs:

- Community outreach sessions

- Targeted education for vulnerable populations

- Regular updates on emerging scam tactics

How to Access ASC Services

- Reporting Channels:

- Police Hotline: 1800-255-0000

- Online: www.police.gov.sg/i-witness

- ScamShield Helpline: 1799 (for verification of suspicious contacts)

- What Information to Provide:

- Details of all communications with scammers

- Transaction records and receipts

- Screenshots of conversations and websites

- Phone numbers and account details used by scammers

- Follow-up Process:

- Cases are assigned a reference number

- Investigation officers may contact victims for additional information

- Recovery progress updates are provided when available

ASC’s Operational Approach

The ASC operates with a “time is of the essence” philosophy, focusing on:

- Speed: Rapid intervention to freeze accounts before funds are dissipated

- Coordination: Direct lines of communication with financial institutions

- Intelligence: Data analytics to identify scam patterns and networks

- Prevention: Using case insights to strengthen public awareness efforts

The ASC has recovered millions of dollars for scam victims since its establishment, though recovery becomes significantly more challenging after the first 24 hours following a scam.

Singapore’s Anti-Scam Centre (ASC) Measures

Based on the information available, here’s an analysis of the Anti-Scam Centre’s approach and measures:

Core Functions and Capabilities

- Rapid Response System

- The ASC is mentioned in the article as an entity that scammers impersonate

- Works with banks to trace and freeze accounts linked to scam proceeds

- Collaborates with telecommunication companies to terminate phone lines used in scams

- Coordination Role

- Partners with Commercial Affairs Department’s Anti-Scam Command (ASCom)

- Facilitates multi-agency operations like the recent islandwide blitz

- Serves as a centralized hub for scam prevention and intervention

Intervention Strategies

- Disrupting Financial Networks

- Freezing accounts to prevent scammers from accessing funds

- Seizing suspected proceeds (nearly $1M in the recent operation)

- Targeting money mules who provide banking infrastructure

- Technical Countermeasures

- Working with telecoms to terminate scam-linked phone lines (700+ in the recent operation)

- Likely monitors digital communications channels for scam patterns

- Public Education

- Issues reminders about legitimate government communications:

- Government officials never request money transfers

- Official entities don’t ask for banking, SingPass, or CPF information over the phone

- Issues reminders about legitimate government communications:

Results and Impact

The recent operation demonstrates the ASC’s effectiveness:

- Over 30 arrests

- 240+ bank accounts frozen

- Nearly $1M in proceeds seized

- 700+ phone lines terminated

Strategic Approach

The ASC appears to employ a three-pronged strategy:

- Preventive measures – Public education and awareness campaigns

- Detective measures – Identifying and tracking scam operations

- Reactive measures – Freezing accounts, making arrests, and recovering proceeds

Challenges

Despite these efforts, the high volume of cases (1,504 reported government impersonation scams in 2024) and significant losses ($151.3M) suggest ongoing challenges in:

- Keeping pace with evolving scam techniques

- Reaching vulnerable populations before they become victims

- Addressing cross-border aspects of scam operations

General Scam Prevention Tips

- Trust your instincts

- If an offer seems too good to be true, it probably is

- Keep personal and financial information confidential

- Stay informed about the latest scam techniques

- Report suspicious activities to authorities

- Educate family members, especially older relatives

- Use secure, updated technology

- Maintain a healthy level of skepticism online

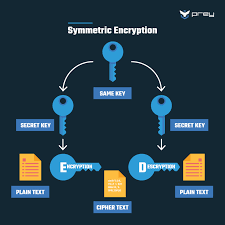

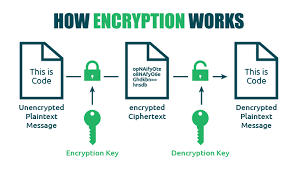

How Encryption Works

Encryption utilises mathematical algorithms to transform plaintext (readable data) into ciphertext (encrypted data). Only those with the decryption key can convert the ciphertext back into usable information. There are two main types:

- Symmetric Encryption: Uses the same key for encryption and decryption. It’s efficient but requires a secure key exchange.

- AsymmetEncryptiontion uses a pair of keys—a public key for encryption and a private key for decryption—to allow secure communication without prior key exchange.

Key Encryption Applications for Privacy

Device Encryption

- Full-disk encryption: Protects all data on your computer or smartphone (BitLocker for Windows, FileVault for Mac, builtEncryptiontion for iOS and Android)

- File-leEncryptiontion: Protects individual files and folders

Communication Encryption

- HTTPS: Secures website connections (look for the padlock icon in your browser)

- End-to-Encryption: Used in messaging apps like Signal, WhatsApp, and others to ensure only you and your recipient can read messages

- Email encryption: Options include PGP (Pretty Good Privacy), S/MIME, or encrypted email services

Network Encryption

- VPNs: Create an encrypted tunnel for all your internet traffic

- Wi-Fi encryption: WPA3 is the current most substantial standard for wireless networks

Cloud Storage Encryption

- At-rEncryptiontion: Protects stored data

- Zero-knowledge encryption: The provider has no access to your encryption keys

- Client-sEncryptiontion: Data is encrypted before leaving your device

Implementing Encryption in Your Digital Life

- Enable device encryption on all your computers and mobile devices

- Use encrypted messaging apps for sensitive communications

- Verify HTTPS connections when sharing personal or financial information

- Consider encrypted email for sensitive communications

- Choose cloud services with strong encryption policies

- Use a VPN when connecting to public Wi-Fi networks

- Password-protect and encrypt sensitive files and backups

Limitations to Consider

- Encryption can’t protect against malware already on your device

- Weak passwords can undermine even the strongEncryptiontion

- Encryption doesn’t hide metadata (who you’re communicating with, when, how often)

- Some countries have laws limiting encryption use or requiring backdoors

Encryption is a fundamental aspect of digital privacy that works best as part of a comprehensive security strategy. By understanding and implementing appropriate encryption methods, you can significantly enhance your online privacy protection.

.

Identity Theft

Identity theft is a pervasive form of fraud that can have devastating consequences for victims. In this crime, the perpetrator steals an individual’s personal information to assume their identity. This stolen information can often be gathered from discarded documents such as bank statements, utility bills, or even phishing scams.

Once armed with this data, the criminal may choose to open accounts in the victim’s name, a process known as application fraud. They might apply for credit cards, loans, or utility services under pretences, leaving the unsuspecting victim to deal with the aftermath.

The emotional toll of identity theft can be immense. Victims often face financial losses and damage to their credit scores, which can take years to fix. In today’s digital age, account takeovers have become a prevalent threat to unsuspecting victims. Criminals typically employ tactics such as phishing, vishing, or smishing to manipulate individuals into revealing their personal information.

Phishing often involves deceptive emails that appear to come from legitimate sources. These emails may prompt the victim to click on malicious links or provide sensitive details under the guise of verifying their identity.

Vishing, or voice phishing, involves phone calls in which scammers impersonate bank representatives or trusted entities to extract confidential information directly from the victim. Similarly, smishing involves text messages that lure individuals into divulging critical data.

Once armed with this personal information, the criminal can easily convince a bank to change the account holder’s address. This deception allows them full access to the victim’s financial accounts and resources.

Additionally, some criminals are skilled enough to bypass bank interaction altogether. They can use the obtained credentials to log into online accounts directly, executing unauthorized transactions without needing any further verification.

The consequences for victims can be devastating, leading not only to financial loss but also to emotional distress as they recover their stolen identities and secure their accounts. Consequently, individuals must remain vigilant and understand these risks to protect themselves against potential account takeovers for repair. Additionally, they may find themselves tangled in legal disputes as they try to prove their innocence.

Recovering from such a violation requires diligence and time, making it crucial for individuals to safeguard their personal information vigilantly. Implementing measures like shredding sensitive documents and monitoring credit reports can help prevent these types of crimes before they occur.t to Emerging challenges incorporate regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.

Analysis of Scam Types and Prevention in Singapore

Based on the document, here’s an analysis of the scam types prevalent in Singapore and the prevention strategies being implemented:

Main Scam Types

- Self-Effecting Transfer Scams

- Most common type where victims willingly transfer money to scammers

- Psychological tactics target emotions like desire for companionship, respect for authority, and greed

- Victims often refuse to believe they’re being scammed

- Malware and Phishing Attacks

- Target bank accounts and online credentials

- Often involve sophisticated technical deception

- Phone/SIM-Based Scams

- Scammers using local phone numbers to make calls and send SMS

- Creates a false sense of legitimacy

- Cryptocurrency Scams

- Fake crypto trading interfaces that simulate profits

- Malware/phishing to drain crypto wallets

- Requesting victims convert money to cryptocurrency to evade banking safeguards

- Social Media and Messaging App Scams

- 60% of scams occur through these platforms

- Telegram specifically mentioned as a platform of concern (scam reports doubled in 2024)

Prevention Strategies

Government Regulatory Measures

- Protection from Scam Bills (January 2025)

- Empowering police to temporarily restrict banking transactions as a last resort

- Target cases where victims refuse to believe they’re being scammed

- SIM Card Regulations

- Limits on post-paid SIM card ownership

- Criminalization of SIM card misuse and transfer

- Penalties for SIM card abuse in scams

- Online Criminal Harms Act

- Requires online services to implement anti-scam measures

- Encourages robust user verification against government-issued IDs

- Potential for additional legislative action against platforms like Telegram

Banking/Financial Protection

- Enhanced Authentication

- FIDO-compliant hardware tokens being studied

- Requires physical proximity for transaction authentication

- Transaction Safeguards

- Cooling-off periods for high-risk transactions

- Enhanced fraud analytics

- Information sharing on money mule accounts

- Cryptocurrency Protection

- Working with MAS-licensed digital payment token providers

- Strengthening operational links with law enforcement

Public Education and Empowerment

- ScamShield Suite

- Launched September 2024

- Allows the public to check, report, and stay updated on scams

- ScamShield hotline (1799) for assistance

- Targeted Awareness Campaigns

- Monthly media campaigns

- Tailored to vulnerable population segments for specific scam types

Key Challenges and Trends

- Rising Financial Impact

- Total losses reached $1.1 billion in 2024 (a 70% increase from 2023)

- Evolving Tactics

- Scammers pivoting to local phone numbers

- Increased use of cryptocurrency to evade banking safeguards

- Exploitation of anonymity on messaging platforms

- Cross-Platform Nature

- Requires collaboration between government, tech companies, and financial institutions

- International dimension (implied by sophisticated criminal syndicates)

The Singapore approach appears multifaceted. It combines regulatory powers, technological solutions, industry collaboration, and public education to create a comprehensive anti-scam ecosystem. The emphasis on both preventive measures and empowering individuals to recognise scams suggests a balanced strategy to address this growing threat.

Maxthon

In an age where the digital world is in constant flux and our interactions online are ever-evolving, the importance of prioritising individuals as they navigate the expansive internet cannot be overstated. The myriad of elements that shape our online experiences calls for a thoughtful approach to selecting web browsers—one that places a premium on security and user privacy. Amidst the multitude of browsers vying for users’ loyalty, Maxthon emerges as a standout choice, providing a trustworthy solution to these pressing concerns, all without any cost to the user.

Maxthon, with its advanced features, boasts a comprehensive suite of built-in tools designed to enhance your online privacy. Among these tools are a highly effective ad blocker and a range of anti-tracking mechanisms, each meticulously crafted to fortify your digital sanctuary. This browser has carved out a niche for itself, particularly with its seamless compatibility with Windows 11, further solidifying its reputation in an increasingly competitive market.

In a crowded landscape of web browsers, Maxthon has forged a distinct identity through its unwavering dedication to offering a secure and private browsing experience. Fully aware of the myriad threats lurking in the vast expanse of cyberspace, Maxthon works tirelessly to safeguard your personal information. Utilizing state-of-the-art encryption technology, it ensures that your sensitive data remains protected and confidential throughout your online adventures.

What truly sets Maxthon apart is its commitment to enhancing user privacy during every moment spent online. Each feature of this browser has been meticulously designed with the user’s privacy in mind. Its powerful ad-blocking capabilities work diligently to eliminate unwanted advertisements, while its comprehensive anti-tracking measures effectively reduce the presence of invasive scripts that could disrupt your browsing enjoyment. As a result, users can traverse the web with newfound confidence and safety.

Moreover, Maxthon’s incognito mode provides an extra layer of security, granting users enhanced anonymity while engaging in their online pursuits. This specialized mode not only conceals your browsing habits but also ensures that your digital footprint remains minimal, allowing for an unobtrusive and liberating internet experience. With Maxthon as your ally in the digital realm, you can explore the vastness of the internet with peace of mind, knowing that your privacy is being prioritized every step of the way.