The European Union-Singapore Digital Trade Agreement (EUSDTA) was signed on May 7, 2025, by Minister Grace Fu and EU Commissioner Maros Sefcovic. This agreement supplements the existing EU-Singapore Free Trade Agreement from 2019.

Main Benefits and Features:

- Creates legal certainty for online transactions

- Establishes standards for digital trade and cross-border data flows

- Includes rules on e-signatures, spam prevention, and cybersecurity

- Reduces costs for businesses in the services trade

- Protects the source code of software makers

- Allows data transfers without localization requirements

- Creates frameworks for personal data protection

- Facilitates electronic payments across borders

- Digitises trade documents as legal equivalents to paper versions

- No customs duties on electronic transmissions

- Enhances consumer protection against fraudulent activities

- Promotes SME participation in digital trade

Economic Context:

- EU is Singapore’s 5th largest goods trading partner ($100+ billion in 2024)

- EU is Singapore’s 2nd largest services trading partner ($110+ billion in 2023)

- EU is Singapore’s 2nd largest foreign investor and investment destination

- Singapore is the EU’s 5th largest partner in services trade

- Over half of Singapore-EU services are delivered digitally

- Global digital service exports exceeded SGD 5.42 trillion in 2023

This agreement follows similar digital partnerships Singapore has established with Australia, the UK, New Zealand, Chile, and South Korea. It represents the EU’s first bilateral digital economy agreement with an ASEAN country.

In-Depth Analysis of the EU-Singapore Digital Trade Agreement (EUSDTA)

Strategic Significance

The EUSDTA represents a significant development in digital trade governance. It is the EU’s first bilateral digital economy agreement with an ASEAN country. This landmark agreement goes beyond conventional trade arrangements by specifically addressing digital commerce regulations in an increasingly digitalized global economy.

Key Provisions Analysis

Cross-Border Data Flows

- Core provision: Allows businesses to transfer data across borders without localization requirements

- Impact: Significantly reduces operational costs for companies operating across both markets by eliminating the need for redundant data infrastructure

- Strategic importance: Establishes a precedent for future ASEAN-EU digital agreements on data sovereignty

Digital Payments & Financial Services

- Framework: Creates streamlined processes for cross-border electronic payments.

- Standards approach: Promotes internationally accepted standards and interoperability

- Competitive effect: Encourages innovation in fintech by reducing regulatory barriers

Source Code Protection

- Protection mechanism: Businesses are not required to disclose source code to operate in each other’s markets

- Economic impact: Protects intellectual property, encouraging technology companies to expand operations

Electronic Authentication & Signatures

- Legal foundation: Establishes equivalence between electronic and physical documents

- Business impact: Streamlines processes, reduces paperwork, speeds transactions

Zero Customs Duties

- Fiscal approach: No customs duties on electronic transmissions

- Economic effect: Reduces friction for digital service providers and consumers

Impact on Singapore

Economic Benefits

- Digital services expansion: Creates new opportunities for Singapore’s already robust digital services sector

- Enhanced market access: Provides Singapore businesses clearer pathways to the EU’s 450 million consumers

- Financial services advantage: Singapore’s fintech companies like iFast and Nium gain improved access to European markets

- SME opportunity: Framework specifically addresses SME participation in digital trade

Strategic Positioning

- Digital hub reinforcement: Strengthens Singapore’s position as Asia’s premier digital economy and gateway

- Regulatory alignment: Places Singapore in alignment with the EU’s generally stringent digital standards, enhancing global reputation

- First-mover advantage: As the first ASEAN country with an EU digital agreement, Singapore gains a competitive edge

Regional Impact on ASEAN

Template for Future Agreements

- Precedent setting: Likely to serve as a template for potential EU digital agreements with other ASEAN nations

- Standards influence: May influence the development of ASEAN’s own digital trade standards

Regional Integration Catalyst

- Digital connectivity: Could accelerate intra-ASEAN digital integration by providing standards alignment incentives

- Investment magnet: Singapore’s enhanced position could attract more EU companies looking to expand in Southeast Asia

Potential Divergence Concerns

- Regulatory gap: May create a two-tiered digital regulatory environment within ASEAN between Singapore and other members

- Development disparity: Could potentially widen the digital development gap between Singapore and less digitally advanced ASEAN economies

Broader Asian Context

Digital Trade Leadership

- Standards competition: Positions Singapore-EU standards as an alternative to China’s digital governance approach

- Strategic alignment: Reinforces Singapore’s balanced position between Western and Eastern digital spheres

Regional Economic Impact

- Supply chain digitalization: Accelerates digital transformation of regional supply chains

- Technology transfer: May facilitate increased technology transfer and knowledge sharing between the EU and Asian markets

- Skills development: Creates incentives for specialized digital skills development throughout the region.

Long-Term Implications

For Singapore

- Digital economy growth: Projects a clear pathway for Singapore’s digital economy expansion

- Innovation ecosystem: Strengthens Singapore’s innovation ecosystem through enhanced international collaboration

- Regulatory leadership: Positions Singapore as a key player in shaping future digital trade rules

For ASEAN

- Digital integration: Could accelerate ASEAN’s digital economy integration efforts

- Standards harmonization: May influence ASEAN’s approach to digital standards harmonisation

- Investment flows: Likely to increase European digital investment in the broader ASEAN region.

For Global Digital Trade

- Regulatory model: Contributes to the emerging patchwork of digital trade governance models

- Middle-power collaboration: Demonstrates how middle powers can shape digital rule-making outside US-China competition

- Digital protectionism counterbalance: Provides a model for reducing digital protectionism while maintaining appropriate safeguards

This agreement signifies not just a bilateral economic arrangement but a strategic positioning of Singapore at the forefront of digital trade governance in Asia. Its ripple effects are likely to influence ASEAN’s digital development trajectory and broader Asian digital integration efforts.

Impact of the EU-Singapore Digital Trade Agreement on Singapore’s Trade

Immediate Trade Enhancement Effects

Traditional Trade Amplification

- Digital enablement of physical trade: The EUSDTA will digitize documentation processes for Singapore’s existing €84 billion goods trade with the EU, reducing transaction costs and time delays

- Trade facilitation: Electronic customs procedures, digital certificates of origin, and e-invoicing will streamline Singapore’s exports to the EU’s 450 million consumer market

- Supply chain integration: Enhanced digital connectivity will improve visibility and coordination across Singapore-EU supply chains

Digital Trade Expansion

- Services export growth: With over 50% of Singapore-EU services already delivered digitally, the agreement creates immediate opportunities to expand the €110+ billion services trade

- New market access: Removes technical barriers that previously limited Singapore’s digital service providers from fully accessing the EU market

- Cross-border data utilization: Allows Singapore companies to leverage EU customer data for service improvement while maintaining compliance

Sectoral Impact Analysis

Financial Services

- Fintech acceleration: Singapore financial institutions gain clearer regulatory pathways for digital services expansion into Europe

- Payment systems: Companies like Nium can extend cross-border payment solutions with greater legal certainty

- Wealth management digitalization: Firms like iFast can pursue EU market expansion with reduced compliance complexity

- Trade finance innovation: Enhanced legal recognition of digital documentation will modernize trade finance offerings

Technology Sector

- Software exports: Protection of source code provides security for Singapore’s growing software industry

- Cloud services: Data flow provisions benefit Singapore’s position as a cloud services hub for EU companies operating in Asia

- Cybersecurity services: Mutual recognition of cybersecurity frameworks creates new market opportunities for Singapore’s cybersecurity firms

E-Commerce

- Platform expansion: Singapore-based e-commerce platforms gain improved access to EU consumers

- SME reach: Smaller Singapore retailers can more easily establish EU market presence through digital channels

- Logistics optimization: Digital documentation reduces friction in cross-border e-commerce fulfilment

Trade Diversification Impact

Geographic Diversification

- EU market prioritization provides incentives for Singapore businesses to increase their EU focus in their trade portfolios..

- Brexit hedge: Offers a clear framework for EU trade separate from the UK relationship

- Regional gateway strengthening: Positions Singapore as the preferred entry point for EU companies into ASEAN

Trade Composition Evolution

- Services proportion increase: Will likely accelerate the shift toward services in Singapore’s trade balance with the EU

- Higher-value exports: Digital enablement tends to facilitate higher-value trade in knowledge-intensive sectors

- Technology-embedded goods: Will enhance Singapore’s ability to export goods with embedded digital services

Trade Administration Effects

Regulatory Efficiency

- Compliance streamlining: Harmonized digital standards reduce regulatory compliance costs for Singapore exporters

- Mutual recognition benefits: Digital certifications and standards alignment simplify trade administration

- Customs modernisation: Agreement accelerates Singapore’s customs digitalisation initiatives

Trade Documentation Revolution

- Paperless trade expansion: Legal recognition of e-documents reduces physical documentation requirements

- Administrative cost reduction: Digital documentation could reduce trade administration costs by an estimated 15-30%

- Processing speed improvements: Digital trade systems can reduce document processing times from days to minutes

Strategic Trade Positioning

EUSFTA Complementarity

- Synergistic relationship: EUSDTA enhances the utilization of the existing EUSFTA, which was already among Singapore’s top three utilised FTAS

- Implementation acceleration: Digital provisions will likely accelerate the implementation of the remaining EUSFTA provisions

- Trade utilization improvement: Digital tools will improve Singapore businesses’ ability to take advantage of EUSFTA preferences

Trade Standards Leadership

- First-mover advantage: Singapore gains early alignment with EU digital standards before regional competitors

- Standards influencer role: Positions Singapore to shape future digital trade standards in other agreements

- Certification hub potential: Creates an opportunity for Singapore to become a certification centre for EU-compliant digital services

Long-term Trade Trajectory Effects

Trade Volume Projections

- Digital services multiplier: Based on similar agreements, digital services trade could grow 15-20% faster than would otherwise occur

- Traditional trade enhancement: Digital facilitation typically boosts physical goods trade by 4-6% through efficiency gains

- SME trade participation: Could increase the number of Singapore SMES engaged in EU trade by 30-40% over five years

Trade Relationship Evolution

- Strategic partnership deepening: Creates foundation for deeper Singapore-EU cooperation in emerging areas like AI and green tech.

- Investment-trade linkages: Enhanced digital trade relationship will likely accelerate two-way investment flows

- Innovation ecosystem integration: Will facilitate deeper integration between Singapore and the EU innovation ecosystems

Trade Resilience Enhancement

- Crisis readiness: Digital trade systems improve resilience during disruptions like the COVID-19 pandemic

- Alternative channels: Establishes digital alternatives when physical trade channels are constrained

- Trade intelligence: Improved data flows enhance both sides’ ability to anticipate and respond to trade disruptions

Competitive Positioning Impact

Global Trade Network Enhancement

- Network effect: Strengthens Singapore’s position in the global digital trade network

- Standards convergence advantage: Singapore benefits from being aligned with both the EU and the Asia-Pacific digital standards

- Negotiating leverage: Success with the EU enhances Singapore’s bargaining position in other digital trade negotiations

Regional Leadership Reinforcement

- ASEAN digital leader: Further cements Singapore’s position as ASEAN’s digital economy leader

- Regional hub strengthening: Enhances Singapore’s value proposition as Asia’s digital business hub.

- Knowledge transfer potential: Creates opportunities for Singapore to share digital trade expertise with ASEAN neighbours.

The EUSDTA represents not just an incremental improvement in Singapore’s trade relationship with the EU but a transformative framework that positions Singapore at the forefront of global digital trade. The agreement’s impact will likely extend far beyond direct trade volume increases, fundamentally reshaping how Singapore conducts international commerce and reinforcing its strategic position as Asia’s premier digital economy and trade hub.

Impact of the EU-Singapore Digital Trade Agreement on Singapore’s Technology and Labour Markets

Technology Ecosystem Impact

Technology Industry Growth Acceleration

Software Development Sector

- Intellectual property protection: Source code protection provisions will attract more EU software companies to establish R&D centres in Singapore

- Market expansion: Singapore software firms gain clearer pathways to EU market entry with reduced compliance barriers

- Standardization benefits: Alignment with EU technical standards simplifies product development for global markets

Cloud Computing and Data Centres

- Data sovereignty clarity: Agreement’s data flow provisions enhance Singapore’s attractiveness as a regional data hub

- Cross-border service delivery: Removal of localisation requirements allows Singapore cloud providers to serve EU markets more efficiently

- Infrastructure investment catalyst: Expected to accelerate data centre investments as Singapore solidifies its hub status

Cybersecurity Industry

- Standards alignment: Harmonized cybersecurity frameworks create new collaborative opportunities.

- Export potential: Singapore cybersecurity firms gain improved access to the EU’s €10+ billion cybersecurity market

- Technology transfer: Enhanced partnership opportunities with European cybersecurity leaders

Digital Transformation Acceleration

Enterprise Technology Adoption

- Best practice sharing: Enhanced EU-Singapore business engagement will accelerate technology adoption

- Digital solutions market: Creates a larger market for Singapore-based digital transformation solution providers

- SMEdigitalization incentives: Agreement specifically promotes SME participation in digital trade, encouraging technology investment

Financial Technology Evolution

- Regulatory sandbox expansion: Agreement creates framework for cross-border fintech experimentation

- Payments innovation: Common standards for electronic payments will drive innovation in Singapore’s already advanced payments ecosystem

- standardisation: Will likely accelerate financial services API standardisation and open banking initiatives.

E-commerce Infrastructure Development

- Logistics technology: Integration of EU-Singapore e-commerce systems will drive logistics tech innovation

- Payment gateway enhancement: Cross-border payment provisions will enhance Singapore’s payment gateway capabilities

- Authentication systems: Advanced authentication requirements will drive the development of sophisticated identity verification systems

Research & Innovation Ecosystem Enhancement

Cross-border R&D Collaboration

- Joint research facilitation: Digital collaboration provisions simplify EU-Singapore research partnerships

- Data sharing for innovation: Agreement facilitates compliant data sharing for research purposes

- Grant program alignment: Could lead to increased alignment between Singapore and EU innovation funding programs

Technology Standards Influence

- Standards setting participation: Agreement strengthens Singapore’s voice in international technology standards forums

- Testing and certification opportunities: Positions Singapore as a certification centre for EU-compliant technologies

- Emerging technology governance: Creates a collaborative framework for governing AI, blockchain, and other emerging technologies

Intellectual Property Framework Evolution

- Digital IP protection: Enhanced mechanisms for protecting digital intellectual property

- Commercialization pathways: Clearer frameworks for commercialising innovations across both markets

- Patent process digitalization: Agreement accelerates digital patent processing and recognition

Labour Market Impact

Workforce Demand Shifts

High-Skill Job Creation

- Digital specialized roles: Increased demand for professionals with EU digital compliance expertise

- Technical specialists: Growth in the need for cross-border data architecture specialists

- Digital trade experts: A New category of professionals specializing in digital trade facilitation

- Cybersecurity professionals: Enhanced demand as Singaporean companies prepare for EU market entry

Middle-Skill Job Transformation

- Digital upskilling imperative: Traditional trade roles will require digital capabilities

- Administrative role evolution: Trade documentation specialists transitioning to digital systems management

- Customer service enhancement: Cross-border customer engagement requires new digital competencies

Job Displacement Concerns

- Manual processing reduction: Potential reduction in manual document processing positions

- Automation acceleration: Agreement’s digital focus may accelerate automation in certain trade-related functions

- Transition challenges: Workers in traditional trade administration face adaptation pressures

Labour Mobility and Skills Development

Talent Flow Enhancement

- Skilled professional mobility: Agreement may facilitate more effortless movement of technology professionals between Singapore and the EU

- Knowledge transfer opportunities: Increased cross-border projects enabling skills exchange

- Remote work facilitation: Digital services provisions support remote work arrangements across borders

Skills Development Imperatives

- EU compliance knowledge: Growing need for training in EU digital regulations (GDPR, DSA, DMA)

- Digital trade skills: New educational programs focused on digital trade facilitation

- Technical standards expertise: Demand for professionals who understand EU technical standards

Education System Adaptation

- Curriculum evolution: Singapore educational institutions likely to incorporate EU digital standards in relevant programs

- Joint certification potential: Opportunities for Singapore-EU joint professional certifications

- Continuous learning emphasis: Increasing importance of lifelong learning for technology professionals

Labour Market Structural Changes

Remote Service Delivery Expansion

- Cross-border service jobs: Growth in positions serving EU markets remotely from Singapore

- Digital nomad opportunities: Enhanced framework for Singaporeans delivering services to the EU while maintaining Singapore residency

- Gig economy framework: Clearer structure for freelancers operating across Singapore-EU digital markets

Wage and Compensation Effects

- Specialist premium: Increased compensation for professionals with EU digital trade expertise

- Productivity gains: Potential overall wage growth from increased productivity in digitally-enabled sectors

- Income inequality considerations: Benefits may accrue disproportionately to highly-skilled digital workers

Work Culture Evolution

- Regulatory mindset shift: Singapore technology culture incorporating more EU-style regulatory compliance awareness

- Cross-cultural collaboration: Increased need for understanding European business practices and expectations

- Design thinking adaptation: Singapore technology development incorporating EU user experience expectations

Strategic Considerations for Technology and Labour

Government Policy Implications

Skills Development Initiatives

- Targeted training programs: Need for specialized training in EU digital compliance

- Mid-career conversion: Programs to help traditional trade workers transition to digital roles

- International certification alignment: Ensuring Singapore qualifications align with EU requirements

Infrastructure Investment Priorities

- Digital trade platforms: Development of specialized platforms for EU-Singapore digital trade

- Connectivity enhancement: Ensuring robust data connections between Singapore and EU regions

- Testing facilities: Establishing facilities for EU compliance testing and certification

Social Safety Net Considerations

- Transition assistance: Support for workers affected by the digitalization of trade processes

- Inclusive digital access: Ensuring the benefits of the agreement reach all segments of Singapore’s workforce

- SME adaptation support: Helping smaller companies adapt to the new digital trade environment

Long-term Structural Impacts

Innovation Ecosystem Evolution

- Cross-border innovation model: Development of Singapore-EU collaborative innovation frameworks

- Specialized technology clStartupowth of technology clusters focused on the EU market.

- Startups: Easier pathways for Singapore startups to access EU markets early in development

Labour Force Composition Changes

- International talent attraction: Enhanced ability to attract EU digital specialists to Singapore

- Skill profile evolution: Gradual shift toward digital trade competencies across the workforce

- Educational pipeline adaptation: Long-term changes in educational focus to align with the new opportunity landscape

Competitive Positioning Reinforcement

- Digital services excellence: Agreement reinforces Singapore’s position as Asia’s premier digital services hub

- Regional talent centre: Strengthens Singapore’s role as a training ground for regional digital talent

- Innovation leadership: Enhances Singapore’s ability to co-create next-generation technologies with EU partners.

The EUSDTA represents a transformative force for Singapore’s technology ecosystem and labour market, creating new opportunities while necessitating adaptation. The agreement’s provisions will likely accelerate Singapore’s digital transformation journey, reinforce its position as Asia’s technology hub, and create demand for new skills while requiring thoughtful management of workforce transitions. The government’s approach to education, training, and social support will play a crucial role in ensuring the benefits of this agreement are broadly shared across Singapore’s economy and society.

Singapore Organisations Poised to Benefit from the EU-Singapore Digital Trade Agreement.

Financial Services Sector

Companies

- DBS Bank, Singapore’s largest bank, will expand its digital banking services to EU customers with fewer regulatory barriers, particularly through its digital-first offerings.

- iFast Corporation – As explicitly mentioned in the article, this digital wealth platform is positioned to leverage the agreement to expand cross-border financial services into the EU market.

- Nium – This cross-border payments fintech will benefit from aligned standards for payments and interoperable frameworks to deliver seamless services to European customers.

- OCBC’s Open Vault – The innovation lab could expand collaborative fintech development with EU partners under clearer data-sharing frameworks.

- United Overseas Bank (UOB) – Could enhance its UOB Infinity digital banking platform for SMES doing business across Singapore-EU corridors.

- Singapore Exchange (SGX) – Potential for enhanced digital securities trading platforms connecting Singapore and European investors.

Industry Bodies

- Singapore FinTech Association – Will play a key role in helping members navigate new EU market opportunities.

- Association of Banks in Singapore – Positioned to develop standardized approaches to digital trade finance.

Technology Sector

Companies

- Sea Group (Garena/Shopee): This e-commerce and digital entertainment conglomerate gains clearer pathways for EU market expansion.

- Grab – Super-app platform could extend digital services to European markets with reduced compliance complexity.

- Acronis – A Cybersecurity and data protection firm benefits from source code protection and aligned cybersecurity standards.

- Carousell – C2C marketplace platform could expand to EU markets with clearer consumer protection frameworks.

- Tencent Cloud (Singapore operations) – Benefits from data flow provisions for its Singapore-based data centres serving European clients.

- Lazada (Alibaba’s Singapore operations) – E-commerce platform gains streamlined pathways for Singapore-EU trade.

Industry Bodies

- SGTech – Technology industry association will develop resources to help members navigate EU digital market entry.

- Singapore Computer Society – A Professional body will develop training for EU digital compliance capabilities.

Logistics and Supply Chain

Companies

- PSA International – Port operator can enhance digital documentation for EU-bound cargo.

- Singapore Airlines Cargo – Benefits from digital airway bills and streamlined customs documentation.

- YCH Group, a Supply chain solutions provider, can enhance digital tracking of Singapore-EU shipments.

- Ninja Van – Last-mile delivery firm gains clearer frameworks for handling cross-border e-commerce deliveries to Europe.

- Keppel Logistics – Can develop enhanced EU-compliant supply chain visibility solutions.

Industry Bodies

- Singapore Logistics Association – Will develop best practices for digital trade documentation.

- Supply Chain and Logistics Academy – Will incorporate EU digital trade standards into professional training.

Professional Services

Companies

- Allen & Gledhill – Law firm can expand digital legal services to EU clients.

- PPwcSingapore – Can develop specialized digital trade compliance advisory services.

- Rajah & Tann – Law firm benefits from digital authentication provisions for cross-border legal services.

- KPMG Singapore – Can expand digital audit and accounting services to EU clients.

Industry Bodies

- Singapore Academy of Law – Will develop frameworks for cross-border digital legal services.

- Institute of Singapore Chartered Accountants – Will establish standards for digital financial reporting compliant with both markets.

SME Sector

Companies

- Secretlab – Gaming chair manufacturer benefits from streamlined e-commerce channels to EU customers.

- TWG Tea – Luxury tea brand gains enhanced direct-to-consumer digital sales channel in the EU.

- CreaturePod – Iot pet tech start startup fits from clearer EU market access for connected devices.

- Rotimatic – Smart kitchen appliance maker benefits from simplified digital compliance for EU market entry.

Industry Bodies

- Association of Small & Medium Enterprises – Will develop resources to help SMES leverage digital trade opportunities.

- Singapore Manufacturing Federation – Will support manufacturers in digital market access strategies for the EU.

Government Ministries and Agencies

Leading Agencies

- Ministry of Trade and Industry (MTI) – The Primary ministry responsible for implementing the agreement and developing support programs for businesses.

- Ministry of Communications and Information (MCI) – Oversees digital infrastructure and policy to support the agreement’s implementation.

- Infocomm Media Development Authority (IMDA) – Will develop technical standards and certification processes aligned with the agreement.

- Enterprise Singapore – Will create specialized assistance programs for companies entering the EU digital markets.

- Economic Development Board (EDB) – Will leverage the agreement to attract EU technology companies to establish Singapore operations.

- Monetary Authority of Singapore (MAS) – Will implement financial services aspects of the agreement and develop fintech collaboration frameworks.

Supporting Agencies

- Singapore Customs – Will implement paperless trade systems aligned with EU standards.

- Cyber Security Agency of Singapore (CSA) – Will ensure alignment of cybersecurity frameworks with EU requirements.

- Personal Data Protection Commission (PDPC) – Will develop guidance on compliant cross-border data transfers.

- SkillsFuture Singapore – Will develop training programs for digital trade skills.

- Singapore Business Federation—As mentioned in the article, the Singapore Business Federation will play a key role in helping businesses utilize the agreement.

Specific Implementation Initiatives

Cross-Agency Programs

- Digital Economy Framework for Action – IMDA-led initiative will be expanded to incorporate EU digital trade provisions.

- SMES Go Digital – Enterprise Singapore program will add EU digital trade modules.

- TradeTrust – Singapore’s blockchain-based trade documentation platform will expand to include EU compatibility.

- Digital Industry Singapore (DISG) – Joint office will develop targeted EU market entry support.

- Global Innovation Alliance – Will strengthen Singapore-EU innovation linkages with enhanced digital collaboration frameworks.

Sector-Specific Initiatives

- Financial Sector Technology & Innovation (FSTI) – The MAS scheme will expand to support EU-Singapore fintech collaboration.

- National Trade Platform – Will enhance interoperability with EU digital trade systems.

- Digital Services Lab – Could be established to test EU-compliant digital services before market launch.

- Digital Trust Centre – IMDA initiative will expand to include EU digital trust frameworks.

The EUSDTA creates opportunities across Singapore’s economic landscape, from multinational corporations to SMES, with government agencies playing crucial roles in maximizing the agreement’s benefits. The most immediate beneficiaries will be digitally native businesses and those already engaged in EU trade. Still, the agreement creates pathways for broader participation across Singapore’s business community with appropriate support and capacity building.

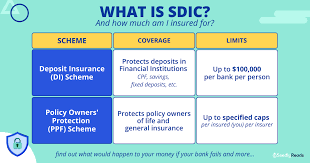

Singapore’s Bank Protection System

Singapore’s banking protection framework includes:

- Deposit Insurance: The SDIC protects Singapore dollar deposits up to $100,000 per depositor per member bank

- Regulatory Oversight: MAS maintains strict regulatory requirements for capital adequacy, liquidity, and risk management for banks

- Segregation Requirements: Both banks and robo-advisers must segregate customer assets from company assets

- Independent Custodians: Customer investments must be held by independent custodians, not by the bank or robo-advisor directly

This protection framework worked as designed in the Chocolate Finance case. Despite the company’s liquidity issues, customer assets were segregated and eventually returned through “the standard fund redemption process,” according to the MAS.

The key takeaway is that while both traditional banks and robo-advisers are regulated in Singapore, the nature of protection differs significantly. Bank deposits enjoy explicit insurance protection, while investments through either channel carry market risks and are not insured against investment losses.

Teething Issues vs. Inherent Risks in Robo-Advisory Services

Based on the article, the challenges we’re seeing with platforms like Chocolate Finance reflect both teething issues in a relatively new industry and some inherent structural risks of the robo-advisory model.

Teething Issues

- Unsustainable incentive structures: Chocolate Finance’s issues stemmed partly from offering overly generous rewards programs without proper capacity planning. This represents poor business judgment rather than a fundamental flaw in the robo-advisory model.

- Communication failures: The article mentions Chocolate Finance’s “poor communication on changes,” which contributed to customer panic. This reflects operational immaturity rather than an inherent risk.

- Liquidity management practices: The failure to anticipate withdrawal volumes suggests inadequate stress testing and risk management, which more mature platforms would likely have better systems for.

Inherent Risks

- Redemption period vulnerability: The article highlights how Chocolate Finance initially offered instant withdrawals by fronting their own money, which created vulnerability when withdrawal requests surged. The standard 3-6 day redemption period is an inherent characteristic of fund management that can’t be eliminated without introducing other risks.

- Yield pressure: Digital advisers often compete on promised returns, potentially leading to riskier investment strategies to deliver those returns. This competitive dynamic is intrinsic to the industry.

- Newer business models: Unlike traditional banks with diverse revenue streams, many robo-advisers have less proven business models, which can make them potentially less stable during market stress.

- Marketing emphasis: The article notes that robo-advisers often emphasize “attractive returns” and “guaranteed returns” in marketing, which may lead to consumer misunderstanding about risks—a tension inherent in the business model.

The article suggests that the regulatory framework for customer asset protection worked as designed in the Chocolate Finance case – customers eventually received their funds. This indicates that the core safeguard mechanisms (fund segregation, independent custodians) are functioning correctly.

What we’re likely seeing is an industry still finding its footing regarding sustainable business practices, appropriate marketing, and liquidity management – rather than fundamental flaws in the concept of digital advisory services. However, specific characteristics like redemption periods and return pressures are inherent to investment management regardless of whether it’s digital or traditional.

Robo-Advisers vs. Human Portfolio Managers

While the article doesn’t directly compare robo-advisers to human portfolio managers, we can analyze the relative advantages and disadvantages of each approach:

Advantages of Robo-Advisors

- Lower costs: Robo-advisers typically charge lower management fees than human advisers due to automation and reduced overhead.

- Accessibility: Services like Chocolate Finance, StashAway, and Syfe have lower minimum investment requirements, making professional portfolio management accessible to more people.

- Reduced emotional bias: Robo-advisers follow algorithmic approaches that aren’t subject to human emotional biases or panic selling during market volatility.

- Consistent methodology: Automated systems apply consistent investment methodologies without deviating based on market sentiment.

- Transparency of fees: The fee structures of robo-advisers are often more straightforward than traditional wealth management services.

Advantages of Human Portfolio Managers

- Personalized advice: Human advisers can provide customized guidance that considers complex financial situations and goals beyond investments.

- Behavioral coaching: Human advisers can provide valuable emotional support during market downturns, potentially preventing panic selling.

- Complex planning: Human advisers often provide more comprehensive services for sophisticated wealth management needs (estate planning, tax optimization, etc.).

- Relationship-based trust: The personal relationship with a human adviser can create accountability and trust that’s difficult to replicate digitally.

- Judgment in unusual circumstances: Human advisers can exercise judgment during unprecedented market events that may fall outside a robo-advisor’s programming.

Neither Is Universally “Better”

The optimal choice depends on several factors:

- Investment size: For smaller portfolios, robo-advisers’ lower fees may preserve more returns

- Complexity of needs: More complex financial situations may benefit from human expertise

- Investor personality: Some investors prefer the human touch; others prefer digital interaction

- Desired level of involvement: Robo-advisers require less client engagement

The article suggests that digital advisory platforms will “play a bigger role in the future” as they reduce costs and increase accessibility. However, it also emphasizes that regardless of whether you choose a digital or human adviser, due diligence is essential: understanding the investment products, comparing alternatives, and assessing the risks remain crucial investor responsibilities.

The Chocolate Finance case illustrates that even regulated digital platforms can face operational challenges that affect customer experience, suggesting that the industry is still evolving.

Analysis of Investment Scam Detection and Prevention Methods

Based on the article, here are the key methods for spotting and avoiding investment scams:

Red Flags to Watch For

- “Too good to be true” offers – High returns with low/no risks are major warning signs

- Urgency tactics – Limited offers, timed gifts, or rebates designed to rush decisions

- Polished but deceptive online presence – Fake apps, convincing social media profiles, and fabricated success stories

- Impersonation of trusted contacts – Hacked accounts of friends/family members used to recommend “opportunities”

- Unusual communication patterns – Changes in how contacts typically communicate can signal account compromise

Proactive Prevention Strategies

- Verify legitimacy with official sources

- Check the MAS Investor Alert List

- Consult the Financial Institutions Directory

- Review the Register of Representatives

- Use protective tools

- Install the ScamShield app to check suspicious numbers, messages, or links

- Enable Two-Factor Authentication (2FA) for online accounts and e-wallets

- Enhance privacy settings in messaging apps

- Exercise due diligence

- Verify investment opportunities through multiple channels

- Be particularly cautious of:

- Investment recommendations from people you’ve never met in person

- Group chats you were added to by unknown numbers

- Unregulated companies posting on social media

- Take action when suspicious

- Report suspicious accounts to platform administrators

- Contact friends directly through alternative channels if their messages seem unusual

- Call the 24/7 ScamShield Helpline at 1799 when in doubt

- After a suspected scam

- Contact your bank immediately

- File a police report

- Warn friends and family about the encounter

The article emphasizes that even digital natives and those confident in their scam-detection abilities should remain vigilant, as scam tactics continually evolve.

Investment Scam Prevention: Singapore Context

Singapore-Specific Resources and Protections

- Monetary Authority of Singapore (MAS) Tools

- Investor Alert List: Official MAS resource to verify if a company is flagged as suspicious

- Financial Institutions Directory: Check if investment entities are properly regulated

- Register of Representatives: Verify the legitimacy of financial advisors

- Singapore Police Force Resources

- ScamShield App: Singapore-developed application available on Apple App Store and Google Play Store

- ScamShield Helpline: 24/7 assistance available at 1799

- Police reporting: Essential step if you suspect you’ve been scammed

Common Scam Patterns in Singapore

- Social Media Targeting

- Investment “mentors” on Instagram and other platforms promising high cryptocurrency returns

- Polished profiles with fake testimonials designed to appear legitimate to Singaporeans

- Messaging App Scams

- WhatsApp and Telegram group invitations from unknown numbers

- Fake investment groups showing fraudulent earnings documentation

- Account Takeovers

- Compromise of Singaporean contacts’ accounts to exploit trusted relationships

- Impersonation tactics using local context to appear more convincing

The ACT Framework for Singaporeans

- ADD protective measures:

- ScamShield App (Singapore-specific protection)

- Enhanced privacy settings on messaging platforms

- Two-factor authentication for financial accounts

- CHECK before investing:

- Verify with MAS resources whether entities are regulated in Singapore

- Remember that dealing with unregulated companies means losing protection under Singapore law

- TELL authorities and others:

- Report to Singapore Police Force

- Alert Singapore-based banks immediately

- Warn family and friends within your local networks

By utilizing these Singapore-specific resources and understanding the local context of investment scams, Singaporeans can better protect themselves from increasingly sophisticated financial fraud attempts.

Important Insights to Consider

Every investment has risks. Therefore, it is crucial to conduct thorough research before investing.

Be alert for warning signs. Exercise caution regarding investments that promise substantial returns with minimal or no risk.

Ensure that the Monetary Authority of Singapore (MAS) regulates both the company and its representatives.

Imagine this scenario: One day, you suddenly find yourself added to a group chat where members are excitedly discussing their recent financial gains from an unmissable investment opportunity.

You may also receive a direct message on social media from someone who inquires if you’re interested in an enticing investment venture that seems too good to pass up.

You might even stumble across an advertisement on various social media platforms promoting seemingly profitable “investment opportunities.”

Does this sound like a situation you’ve encountered before?

Many of us have seen news articles detailing how individuals have fallen prey to such schemes. Yet, despite these cautionary tales, people continue to be lured in as scammers develop increasingly sophisticated methods to deceive unsuspecting victims and make off with significant sums of money.

In numerous cases, those who fell victim to scams were convinced that such a fate would never befall them. Often, they would utilise the initial gains they received to challenge the scepticism of their friends and family. However, it has become evident that con artists have honed their abilities to persuade individuals that a fast track to wealth is not only attainable but also just around the corner.

It is crucial always to remember the mantra: Verify Before You Invest if you wish to protect your hard-earned savings! To help you navigate this treacherous landscape, here are some essential guidelines to consider:

Spotting Warning Signs

Fraudsters have developed highly sophisticated strategies designed to coax you into relinquishing your funds. Fortunately, there are warning signs you can remain vigilant for, which can help you steer clear of investment fraud.

Unrealistic Returns with Little or No Risk

Exercise caution when faced with an investment proposal that guarantees protection for your capital while also promising unusually high returns. Generally, the higher the potential returns being offered, the greater the associated risks. Many scams lure in unsuspecting investors with alluring promises of profitability.

High-Pressure Sales Tactics

You might hear phrases like:

“Act fast! This opportunity is only available for a limited time!”

“Exclusive rates for the first 50 investors—don’t let this chance slip away!”

“Over 2,000 people have already invested—what’s stopping you?”

“Invest now and receive an additional 10% credit along with other enticing benefits.”

Limited-time offers, urgency-inducing tactics and special bonuses are commonplace in investment scams, all aimed at hastening your decision to part with your money.

Ensure that you take the time to fully grasp what you are getting involved in instead of merely focusing on the tempting incentives being dangled before you.

Commission Offers

When approaching any investment opportunity, it’s vital to consider whether commissions are being offered for recruiting new investors. Be cautious, as this can sometimes indicate a pyramid scheme or similar fraudulent endeavour. Always do thorough research and seek clarity before making any financial commitment.

In summary, the world of investments can be fraught with danger if you are not careful. By remaining alert to these red flags and prioritising due diligence, you can better protect your finances from the grips of deceitful schemes.

A Cautionary Tale of Investment Offers

Once upon a time, in the bustling world of finance, many unsuspecting individuals were drawn into the allure of investment opportunities that sparkled with promises of great returns. However, a wise investor named Alex had learned to tread carefully, for they understood that reputable investment schemes rarely entice potential investors with commissions for referrals. In fact, it was often the dubious operations—those shady investment scams—that dangled such bait in front of eager clients, encouraging them to recruit friends and family to grow their ranks swiftly.

Like cunning magicians, these scams boast impressive track records, claiming decades of experience and an array of prestigious awards. They paint vivid pictures of extravagant profits to instil trust and confidence in their unwitting victims. To further bolster their facade, they showcase glowing testimonials from so-called “satisfied customers,” who often turn out to be mere actors in a well-scripted play.

Yet, Alex remained undeterred by these flashy claims. With a healthy dose of scepticism, they decided to investigate further, knowing that it was wise to seek verification from independent sources rather than relying on the words of those who had something to gain.

In their quest for truth, Alex learned about the importance of ensuring that any investment entity was adequately regulated. They discovered that some fraudulent operations would even assert that they were under the watchful eye of relevant authorities, all in an effort to mislead potential investors. Armed with this knowledge, Alex turned to the resources available on the Monetary Authority of Singapore (MAS) website—a treasure trove of information designed to protect investors like themselves.

There, Alex found the Financial Institutions Directory, which listed all financial institutions under MAS’s regulatory umbrella along with the activities they were authorised to conduct. They also uncovered the Register of Representatives, detailing individuals permitted to engage in regulated activities. Most importantly, the Investor Alert List caught their eye—a reminder of those unregulated entities that might have been mistakenly perceived as legitimate.

With each click and scroll through the MAS website, Alex felt more empowered and informed. They realised that engaging with an unregulated entity meant stepping into a perilous arena without the protective measures afforded by the laws overseen by MAS.

Through this journey of discovery, Alex became a beacon of wisdom for others in their community, sharing tales of caution and encouraging vigilance. They understood that in the world of investments, not everything that glitters is gold, and it is always better to seek clarity and confirmation before placing one’s hard-earned money on the line. And so, armed with knowledge and prudence, Alex navigated the treacherous waters of investment opportunities, determined to avoid the snares set by unscrupulous schemes.

Investigate the Company’s History

In a world where information flows freely, it’s crucial not to accept everything at face value. Before diving into any investment opportunity, take the time to investigate the claims made by the company and its representatives. Scrutinise their backgrounds and assess their track records carefully. This step is vital in ensuring that you are dealing with a legitimate entity.

Moreover, don’t hesitate to pose as many questions as necessary to grasp the full scope of the investment opportunity. If you find that the company is unable or unwilling to provide satisfactory answers, consider this a red flag and proceed with caution.

If you suspect you’ve fallen victim to a scam, act swiftly. Notify your bank immediately and file a police report without delay. This proactive approach can help mitigate potential losses and aid in any investigations.

It’s also wise to share your experiences and knowledge about investment scams with your family and friends. By spreading awareness, you can help protect them from similar pitfalls and ensure they remain vigilant.

Always remember that if an investment seems too enticing or promising, it likely carries hidden risks or may not be legitimate at all.

Protect Yourself From Scams

To take action and shield yourself from potential scams, consider implementing the following strategies:

Adjust Privacy Settings: Customize the privacy settings on your messaging applications. This will help prevent unsolicited invitations to unfamiliar chat groups, which could be breeding grounds for scams.

Enhance Security Features: Utilize security measures such as two-factor authentication (2FA) or multi-factor authentication for your banking applications. Additionally, set transaction limits on your payment accounts, including banking apps and services like PayNow or PayLah, to add another layer of protection against unauthorised transactions.

Utilise Money Lock Features: Many banks offer a “Money Lock” feature that allows you to secure a portion of your savings. This can act as a safeguard against potential threats, ensuring that your funds remain protected.

By taking these precautions, you can create a robust defence against scams and navigate the financial landscape with greater confidence.

Once upon a time, in the bustling city, there was a wise individual who understood the importance of being vigilant when it came to investment opportunities. One day, while browsing through potential financial ventures, they stumbled upon a captivating offer that promised extraordinary returns. Yet, having learned from past experiences, they knew that not everything glittered was gold.

With a sense of caution, they recalled the resources available on the Monetary Authority of Singapore (MAS) website. It was a treasure trove of information containing vital tools such as the Financial Institutions Directory, the Register of Representatives, and the Investor Alert List. These resources could unveil whether the company behind this enticing investment was indeed regulated by MAS or merely a mirage in the desert of finance.

Before exploring this opportunity further, they decided to consult with a trusted friend, someone whose judgment they valued. Together, they examined the details of the offer, weighing its merits and flaws.

Yep, uncertainty lingered. The wise individual thought it prudent to contact the ScamShield helpline at 1799 for guidance. After all, it was better to seek clarity than to plunge headfirst into a potentially perilous situation.

Feeling a bit more secure but still sceptical, they resolved to contact the company’s official hotline. They needed reassurance that this investment product was genuine and not just an elaborate facade designed to lure unsuspecting victims.

As the story unfolded, this cautious individual became increasingly aware of their responsibility to share knowledge with others. They took it upon themselves to warn friends and family about the alarming encounter with what seemed to be a scam.

Determined to take action, they reported and blocked any suspicious accounts or chat groups that had crossed their path. Their sense of duty didn’t stop there; if they suspected they had fallen prey to deceit, they would contact their bank without delay and file a police report to ensure that others would not face the same fate.

In their quest for safety and awareness, they discovered a valuable resource: scamshield.gov.sg. This website offered insights into various scams and provided tips on how to protect oneself from such threats.

So, armed with knowledge and determination, our wise protagonist continued their journey through the world of investments—more aware than ever of the importance of vigilance and community in safeguarding against deception.

Maxthon

In a world where the digital landscape is in a state of perpetual flux, the significance of maintaining safety while navigating the internet cannot be overlooked. For those traversing this complex online terrain, choosing a web browser that prioritises security and privacy has become a necessity. Amidst the vast array of options, one browser emerges as a beacon of reliability: Maxthon Browser. This exceptional choice not only fulfils the vital requirements for security and privacy but does so entirely free of charge.

Maxthon transcends the conventional role of a web browser; it embodies a promise of a more secure online experience. Equipped with a suite of advanced built-in features, it provides essential tools such as an Adblocker and various anti-tracking mechanisms that play a critical role in safeguarding users’ online privacy. The design philosophy behind Maxthon is singular: to cultivate a browsing environment that protects personal information while reducing vulnerability to potential threats.

As you venture further into the realm of Maxthon, it becomes evident just how deeply committed it is to user protection. The visionary developers behind this groundbreaking browser have instituted formidable measures aimed at shielding personal data from unwanted scrutiny. By employing cutting-edge encryption techniques, Maxthon guarantees that sensitive information remains confidential during your digital expeditions, granting you peace of mind as you explore the vastness of the Internet.

In the arena of enhancing your online privacy, Maxthon truly excels. Every feature within the browser has been thoughtfully designed to enrich your experience while ensuring that your data remains secure. Its ad-blocking functionality effectively shields you from disruptive advertisements, while its anti-tracking tools diligently thwart scripts intent on monitoring your every action online. This empowers users to navigate the web with a sense of liberation and confidence. Additionally, the incognito mode offers an extra layer of security, allowing users to browse without leaving any digital traces on their devices.

Maxthon’s unwavering commitment to user privacy creates a sanctuary in the chaotic expanse of the internet. As you embark on your online journeys with this remarkable browser, you can rest assured that your personal information is protected, enabling you to fully engage with the wealth of knowledge and entertainment that awaits in the digital realm. With Maxthon by your side, you are not merely surfing the web; you are exploring it with assurance, knowing that your safety is prioritised every step of the way.