China’s Rare Earth Export Controls Amid US Trade War Truce

The article discusses China’s strategic control of rare earth minerals despite a recent 90-day trade truce with the US. Here are the main points:

- Maintained Control: While China and the US are rolling back tariffs during a 90-day truce, China appears to be maintaining its export controls on rare earth minerals.

- Strategic Importance: China’s Commerce Ministry emphasised that controlling strategic mineral exports is crucial to national security and mentioned cracking down on smuggling activities.

- China’s Dominance:

- China mines about 70% of the global rare earth output

- More importantly, it processes about 90% of the global supply

- Processing is costly, complicated, and highly polluting, giving China significant leverage

- Export Controls: On April 4, China imposed controls on seven rare earth elements used in military applications:

- Requires export licenses with end-user details

- Prohibits shipments to companies on China’s export control list

- The primary target appears to be the US defence industry

- Partial Reprieve: During the 90-day truce, China lifted restrictions for 28 American companies but has not entirely removed the licensing requirement.

- Strategic Leverage: Analysts believe China will likely maintain the licensing regime as a “credible threat” in future negotiations with the US, rather than imposing an outright ban that would push the US to develop its own production capacity.

- Uses of Rare Earths: These 17 elements are critical components in smartphones, TVS, aeroplanes, nuclear reactors, missile guidance systems, armoured vehicles, and jet engines.

The article portrays these export controls as a calculated bargaining chip that China can deploy without causing significant harm to itself while maintaining leverage in the ongoing trade tensions with the US.

Analysis of China’s Rare Earth Export Controls: Impact on Singapore, Asia, and ASEAN

China’s Strategic Position in the Rare Earth Market

China has strategically developed near-monopolistic control over rare earth elements (REES), which provides significant geopolitical leverage:

- Supply Chain Dominance:

- Mining approximately 70% of global rare earth output

- Processing around 90% of the global supply, the more critical and technically complex stage

- Extensive expertise in processing that other nations lack

- Willingness to bear the environmental costs associated with processing

- Export Control Mechanisms:

- Licensing requirements for seven strategically important REES

- End-user verification process with 45-day approval window

- Prohibition against exports to specific blacklisted companies

- Selective enforcement capability (can approve or deny licenses at will)

- Strategic Calculations:

- Using export controls as a “bargaining chip” rather than imposing complete bans

- Maintaining a regulatory framework even during trade truces

- Creating uncertainty to maintain leverage without pushing trading partners to develop alternatives

Impact on Singapore

Singapore faces unique vulnerabilities and opportunities:

- Economic Vulnerability:

- Limited natural resources and complete dependence on imports

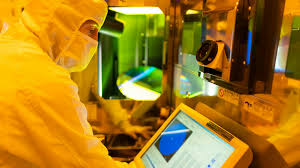

- The critical semiconductor and electronics manufacturing sector requires a steady REE supply

- As a trading hub, disruptions affect not just domestic industries but also re-export capabilities

- Strategic Response Opportunities:

- Potential to position as a rare earth processing hub with stronger environmental standards

- Opportunity to develop financial instruments and trading platforms for rare earth elements

- Leverage strong diplomatic relations with both China and Western nations as a mediator

- Supply Chain Resilience Strategies:

- Stockpiling of critical REES for strategic industries

- Diversifying supply sources beyond China

- Investing in recycling technologies to recover rare earths from electronic waste

Broader Impact on Asia

The effects ripple throughout the region with varying impacts:

- Japan & South Korea:

- High vulnerability due to advanced electronics and automotive manufacturing

- Historical tensions with China increase supply chain risks (Japan experienced a de facto REE export ban in 2010)

- Actively pursuing diversification strategies and partnerships with Australia and other alternative suppliers

- India:

- Possesses significant rare earth deposits but limited processing capacity

- Opportunity to develop as an alternative supplier, but requires substantial investment

- Strategic interest in reducing China’s market power

- Australia:

- Major potential alternative supplier with significant reserves

- Ramping up mining operations, but lacks processing infrastructure

- Strategic partnership opportunities with regional manufacturing hubs

ASEAN’s Position

ASEAN countries face both collective challenges and individual circumstances:

- Collective Response:

- Opportunity for ASEAN to coordinate rare earth policies

- Potential to leverage collective bargaining power with China

- Need for a regional approach to supply chain resilience

- Country-Specific Impacts:

- Vietnam: Has rare earth reserves but limited extraction and processing capabilities

- Malaysia: Previous experience with rare earth processing (Lynas facility,y), but environmental concerns

- Indonesia: Focusing on developing downstream mineral processing capabilities

- Thailand & Philippines: Electronics manufacturing sectors vulnerable to supply disruptions

- Strategic Implications:

- ASEAN’s balancing act between China and the US becomes more complicated

- Increasing pressure to take sides in technological competition

- Opportunity to develop regional standards for responsible rare earth processing

Long-Term Implications

- Supply Chain Restructuring:

- Accelerated efforts to develop alternative sources outside China

- Increased investment in recycling and urban mining technologies

- Premium pricing for supply chain security and provenance

- Technological Adaptation:

- Research into rare earth alternatives and reduced usage in manufacturing

- Development of technologies requiring fewer or different rare earth elements

- Miniaturisation and efficiency improvements to reduce material requirements

- Geopolitical Realignment:

- Formation of new strategic partnerships around critical mineral access

- Greater integration of mineral security into trade agreements

- Increased government intervention in previously market-driven sectors

Mitigation Strategies for Southeast Asian Nations

- Diversification:

- Develop relationships with emerging suppliers like Australia, Brazil, and Vietnam

- Investment in domestic rare earth capabilities, where geologically feasible

- Creation of regional strategic reserves

- Innovation:

- Support for R&D into alternative materials

- Development of recycling infrastructure

- Investment in downstream processing facilities with higher environmental standards

- Diplomacy:

- Leverage ASEAN’s collective diplomatic weight

- Maintain balanced relationships with both China and Western partners

- Advocate for a stable, rules-based mineral trade framework through international forums

China’s rare earth export controls represent a sophisticated application of economic statecraft that will reshape supply chains across Asia. For Singapore and ASEAN, this creates both immediate challenges to supply chain security and longer-term opportunities to develop more resilient and diversified critical mineral networks.

Long-term Impact of China’s Rare Earth Export Controls on Singapore, ASEAN, and Asia

Singapore: Vulnerability and Strategic Transformation

Economic Restructuring

- High-Tech Manufacturing Pivot: Singapore will accelerate its transition to higher-value manufacturing that requires less raw REE input and more intellectual property. This will intensify focus on design, R&D, and software components.

- Supply Chain Intelligence Hub: Singapore will likely develop sophisticated monitoring systems and analytics for critical mineral markets, positioning itself as an information and intelligence hub for supply chain risk management.

- Circular Economy Leadership: With limited natural resources, Singapore will pioneer urban mining and REE recycling technologies, potentially becoming a regional centre for recovering rare earths from e-waste.

Strategic Positioning

- Neutral Broker Role: Singapore will leverage its unique diplomatic position to become an essential mediator between China and Western nations on critical mineral access issues.

- Alternative Processing Hub: Drawing on its strong environmental standards and technical expertise, Singapore may develop specialised processing facilities for certain rare earth elements to reduce regional dependence on China.

- Financial Innovation: Development of new financial instruments for rare earth trading, futures contracts, and supply chain insurance products centred in Singapore’s financial sector.

National Security Implications

- Critical Infrastructure Protection: Implementation of stringent requirements for supply chain transparency in critical infrastructure projects.

- Strategic Stockpiling: Establishment of national reserves of processed rare earth materials for strategic industries and defence applications.

- Defence Industry Adaptation: Military technology development will shift toward designs with reduced dependence on Chinese-controlled minerals.

ASEAN: Regional Cooperation and Differentiation

Collective Response Mechanisms

- ASEAN Critical Minerals Framework: Development of a coordinated regional approach to critical mineral security, including information sharing, strategic reserves, and collective negotiating positions.

- Regional Processing Standards: Establishment of ASEAN-wide environmental and labour standards for rare earth processing to create a competitive alternative to China.

- Intra-ASEAN Supply Chain Integration: Deeper integration of critical mineral value chains within ASEAN, with specialised roles for different member states based on comparative advantages.

Country-Specific Trajectories

Resource-Rich ASEAN Members

- Vietnam: It will accelerate the development of its rare earth mining sector (especially in the north) and seek technical partnerships with Japan and South Korea for processing facilities.

- Myanmar: Despite political challenges, there will be increased interest in its significant rare earth deposits, which have complex implications for governance and conflict dynamics.

- Indonesia: Building on its nickel processing experience, it will expand into rare earth processing, focusing on elements needed for its growing EV manufacturing ambitions.

Manufacturing-Focused ASEAN Members

- Thailand: The country’s automotive sector will face production challenges, driving investment in supply chain resilience and alternative material research.

- Malaysia: Previous controversies with Lynas will be reassessed as economic security concerns outweigh environmental objections, potentially leading to expanded processing capacity.

- Philippines: Electronics manufacturing will become increasingly vulnerable, necessitating stronger supply agreements with alternative sources.

Social and Environmental Dimensions

- Environmental Standards Tension: Pressure to develop domestic REE processing will conflict with environmental concerns, creating political tensions within several ASEAN nations.

- Labour Market Impacts: The Development of rare earth processing capabilities will create new job categories requiring specialised technical training and safety protocols.

- Community Resistance: Local opposition to rare earth processing facilities will emerge as a significant factor in site selection and project viability.

Broader Asia: Strategic Realignment

Major Power Responses

Japan

- Complete Supply Chain Reconstruction: Japan will achieve near self-sufficiency in rare earth supply chains through a combination of overseas investments, recycling, and materials innovation.

- Strategic Island Chain Resources: Japanese companies will systematically develop rare earth resources throughout Pacific island nations, creating a “rare earth security perimeter.”

- Materials Science Revolution: Japanese R&D will fundamentally reduce rare earth requirements in key technologies through novel material development.

South Korea

- Chaebol-Led Solutions: Major conglomerates will vertically integrate by acquiring rare earth assets globally, with government coordination.

- North Korean Resources: Increasing interest in potential rare earth deposits in North Korea could influence reunification calculations and regional diplomacy.

- Technology Adaptation: Korean manufacturers will lead in developing product designs that minimise dependence on the most vulnerable rare earth elements.

India

- Domestic Capacity Expansion: India will transform from a minor player to a significant producer of rare earths through massive investment in mining and processing.

- “China+1” Opportunity: Positioning as a democratic alternative to China for rare earth supply chains, especially for Western partners.

- Self-Reliance Focus: Rare earth development will become a cornerstone of India’s broader self-reliance strategic orientation.

Industry Transformation

Electronics Manufacturing

- Design for Substitution: Electronic product design will systematically reduce dependence on the most supply-constrained rare earths.

- Verification Technologies: Development of advanced techniques to verify rare earth provenance and prevent supply chain circumvention.

- Regional Manufacturing Rebalancing: Electronics manufacturing will shift toward locations with more secure rare earth access, potentially benefiting ASEAN countries that develop alternative supply chains.

Green Technology

- Innovation Acceleration: The renewable energy sector will accelerate the development of technologies that require fewer rare earth inputs (particularly in wind turbines and electric vehicles).

- Efficiency Premium: Energy efficiency will gain additional importance as a way to reduce overall material requirements.

- Circular Design Mandate: Products will be increasingly designed for eventual rare earth recovery, with regulatory frameworks requiring recyclability.

Defense Industry

- Strategic Vulnerability Mapping: Comprehensive assessment and mitigation of rare earth dependencies in defence systems across Asia.

- Allied Supply Networks: Formation of trusted supplier networks between allied nations to ensure defence industrial base security.

- Alternative Technology Paths: Development of parallel military technologies using different material inputs to hedge against supply disruptions.

Long-term Structural Changes

Economic Shifts

- Price Volatility Management: Development of sophisticated hedging mechanisms and longer-term contracts to manage rare earth price volatility.

- Premium Pricing Tiers: Emergence of tiered pricing for rare earths based on supply chain security and environmental credentials.

- Strategic Industry Protection: Government intervention to protect industries deemed strategically essential from supply chain disruptions.

Technological Evolution

- Materials Science Investment: Massive increase in R&D funding for rare earth alternatives and efficiency improvements.

- Urban Mining Scale-Up: Development of commercial-scale technologies for recovering rare earths from landfills and electronic waste.

- Dematerialisation Trend: Accelerated shift toward service-based and digital business models that require fewer physical inputs.

Geopolitical Recalibration

- New Strategic Partnerships: Formation of novel multinational alliances specifically focused on mineral security.

- Resource Diplomacy: Increased prominence of critical minerals in diplomatic negotiations and alliance structures.

- Economic Security Doctrine: Emergence of formal national security doctrines around economic resources and supply chains.

Conclusion

China’s rare earth export controls represent a watershed moment that will fundamentally reshape Asia’s economic geography and strategic calculations. For Singapore, ASEAN, and broader Asia, this challenge will drive significant innovation, strategic realignment, and economic transformation. While the immediate impacts create vulnerability, the long-term response will likely result in more resilient, diversified, and technologically advanced economies throughout the region.

The countries that adapt most successfully will be those that view this not merely as a supply chain challenge but as an opportunity to develop new capabilities, diplomatic relationships, and technological solutions. Singapore, with its unique combination of advanced manufacturing, strong governance, and diplomatic influence, is particularly well-positioned to emerge stronger if it makes strategic investments in alternative supply chains and technological adaptation.

Current Situation

China has strategically targeted rare earth exports to the United States as a countermeasure to Trump’s tariffs. On April 4, 2025, China restricted sales of seven specific rare earths to America, implementing an export license requirement that could potentially evolve into a complete ban. This follows earlier restrictions on gallium and germanium in 2023 and a full export ban to America of gallium, germanium, and antimony instituted in December 2024.

Strategic Significance of the Targeted Materials

The seven “heavy” rare earthes China has restricted are particularly consequential for several reasons:

-

- Tricky to substitute: Elements like dysprosium and terbium regulate heat in magnets, which are essential for offshore wind turbines, jets, and spacecraft. Others are crucial for AI chips, MRI scanners, lasers, and fiber optics.

-

- China’s market dominance: China controls most mining operations (both domestically and in Myanmar) and processes 98% of extracted heavy rare earthes globally.

-

- Traceability and enforcement: The Chinese government can track rare earth production and usage patterns, making it difficult to circumvent restrictions through third countries.

Implications for the United States

Economic Impact

-

- Price increases: Prices for materials like dysprosium are expected to rise from $230 to approximately $300 per kilogram.

-

- Supply chain disruption: Companies have limited stockpiles that would likely be exhausted within months.

-

- Industry vulnerability: Civilian industries dependent on these materials (renewable energy, electronics, electric vehicles) would feel impacts first, potentially making offshore wind turbines uncompetitive or unavailable.

-

- Defense sector vulnerability: Military applications requiring these materials would eventually face constraints.

Policy Responses

-

- Supply diversification: The U.S. is accelerating domestic mining (currently, only one rare earth mine operates in California) and supporting development in Brazil and South Africa.

-

- Processing capability development: Using the Defense Production Act to fund a heavy rare earth processing facility in Texas.

-

- Supply chain rebuild timeline: Analysts estimate it would take 3-5 years for America to establish a mine-to-magnet supply chain independent of China.

Global Trade War Implications

Escalation Pattern

This represents a strategic escalation in the trade war, moving beyond conventional tariffs to target critical supply chains. China has displayed a measured approach, gradually increasing pressure through:

-

- Initial export restrictions on less critical materials

-

- Targeted complete bans on specific materials to specific destinations

-

- Now targeting more critical rare earths with potential for further escalation

Precedents from History

The article notes Japan’s experience in 2010, when China restricted rare earth exports during a fishing dispute. This led to:

-

- Japan making concessions within months

-

- Japanese manufacturers redesigning products to reduce dependence on rare earths

Strategic Positioning

China appears to be strategically balancing pressure on the U.S. against potential self-harm:

-

- A complete ban would damage Chinese producers by destroying demand

-

- Selective reduction is more likely unless Trump escalates further

Broader Implications for Global Trade

This development suggests several concerning trends for global trade:

-

- Supply chain weaponization: Critical materials becoming tools of geopolitical leverage

-

- Market fragmentation: The gallium and germanium precedent shows markets fracturing with significant price differences between Western and Chinese markets

-

- Friend-shoring acceleration: Countries are likely to prioritize supply chain security through trusted partners rather than economic efficiency

-

- Innovation pressures: As with Japan previously, restrictions may drive innovation in alternative materials or designs that use less of the restricted elements

-

- Complex enforcement challenges: Third-country routing and circumvention will become more sophisticated.

Outlook

China’s selective application of rare earth export restrictions demonstrates a sophisticated approach to trade confrontation that targets specific vulnerabilities while attempting to minimize self-harm. The U.S. faces significant challenges in developing alternative supply sources in the short Term, potentially forcing a reconsideration of the broader tariff strategy if critical industries face significant disruptions.

The global trade environment is shifting from the efficiency-focused globalization of previous decades toward a more security-oriented, fragmented system where critical materials and technologies are increasingly controlled along geopolitical lines.

Analysis: Rare Earth Restrictions – Implications for Singapore and Asian Trade

Singapore’s Position in Rare Earth Supply Chains

Singapore doesn’t have natural rare earth deposits, but its position in global trade networks and high-tech manufacturing makes it particularly sensitive to disruptions in rare earth supply chains:

-

- Technology Hub Vulnerability: As a center for electronics manufacturing, semiconductor production, and biomedical technology, Singapore relies on consistent access to rare earth elements for high-tech manufacturing.

-

- Strategic Position: Singapore functions as a trading and logistics node in Southeast Asia, often serving as an intermediary in regional supply chains that could be disrupted by expanding restrictions.

-

- Limited Direct Exposure: Unlike the U.S., Singapore isn’t currently a direct target of China’s rare earth export restrictions, which, if it can maintain access, could potentially give it a competitive advantage in specific manufacturing sectors.

Regional Impacts Across Asia

Neighboring Countries

-

- Malaysia has rare earth processing facilities, particularly the Lynas plant that processes Australian-mined rare earths. As non-Chinese processing becomes more valuable, Malaysia could see increased strategic importance.

-

- Myanmar is a significant source of earths mined for Chinese processing. The article notes that China controls mining operations there, suggesting Myanmar’s role is primarily as a raw material supplier rather than a processing hub.

-

- Japan: Previously targeted by rare earth restrictions (2010), Japan has since invested in diversifying supply chains and reducing dependence, providing a potential model for other Asian economies.

-

- Vietnam has rare earth deposits but limited processing capacity. If regional sourcing becomes more critical, there might be increased investment interest.

Supply Chain Reconfiguration

The article highlights that China’s restrictions are creating a bifurcated market with significant price differences between materials available in China versus the West. This has several implications for Singapore and Asian trade:

-

- Preferential Access: Asian manufacturers not subject to restrictions may gain competitive advantages in industries requiring these materials.

-

- Regional Sourcing: Companies may accelerate efforts to secure supplies from regional partners to mitigate risks.

-

- Processing Capacity: The limited processing capacity outside China (98% of heavy rare earth processing occurs in China) represents a critical vulnerability but also an opportunity for countries like Singapore that have advanced manufacturing capabilities.

Singapore’s Strategic Considerations

Risks

-

- Supply Chain Disruption: Even if not directly targeted, Singapore could face disruptions in key manufacturing inputs if the restrictions expand or if third-country routing is restricted.

-

- Economic Collateral Damage: The article mentions potential “collateral damage” as China works to close loopholes in its restrictions. Singapore’s role as a trading hub could make it vulnerable if China scrutinizes re-exports.

-

- Price Volatility: Significant price increases (like the projected 30% increase for dysprosium) would impact manufacturing costs across high-tech sectors critical to Singapore’s economy.

Opportunities

-

- Supply Chain Diversification: Singapore could position itself as a neutral partner in new supply chain arrangements, leveraging its strong trade relationships with both China and Western nations.

-

- Processing Hub Potential: With advanced manufacturing capabilities and strong environmental standards, Singapore could invest in developing rare earth processing capacity to serve regional needs.

-

- Innovation Center: Research into material substitutes or more efficient use of rare earths could position Singapore as a solution provider rather than just an affected party.

Asian Trade Implications

- Regional Trade Architecture

-

- RCEP Considerations: The Regional Comprehensive Economic Partnership (which includes China and many Southeast Asian nations) might provide some framework for managing these issues, but it doesn’t specifically address strategic material restrictions.

-

- ASEAN Response: The Association of Southeast Asian Nations may need to develop a coordinated approach to rare earth supply security to protect regional manufacturing interests.

-

- New Supply Partnerships: Japan’s investments in Australian rare earth mining could serve as a model for new regional cooperation, potentially involving Singapore as a processing or logistics hub.

Economic Security vs. Efficiency

The rare earth restrictions highlight a fundamental tension in Asian trade patterns:

-

- Economic Efficiency: Traditional supply chains optimised for cost and efficiency rely heavily on Chinese processing capacity.

-

- Economic Security: Countries are increasingly prioritising secure access over pure efficiency, potentially leading to redundant but more resilient regional supply chains.

Maxthon

In an age where the digital world is in constant flux, and our interactions online are ever-evolving, the importance of prioritizing individuals as they navigate the expansive internet cannot be overstated. The myriad of elements that shape our online experiences calls for a thoughtful approach to selecting web browsers—one that places a premium on security and user privacy. Amidst the multitude of browsers vying for users’ loyalty, Maxthon emerges as a standout choice, providing a trustworthy solution to these pressing concerns, all without any cost to the user.

Maxthon, with its advanced features, boasts a comprehensive suite of built-in tools designed to enhance your online privacy. Among these tools are a highly effective ad blocker and a range of anti-tracking mechanisms, each meticulously crafted to fortify your digital sanctuary. This browser has carved out a niche for itself, particularly with its seamless compatibility with Windows 11, further solidifying its reputation in an increasingly competitive market.

In a crowded landscape of web browsers, Maxthon has forged a distinct identity through its unwavering dedication to offering a secure and private browsing experience. Fully aware of the myriad threats lurking in the vast expanse of cyberspace, Maxthon works tirelessly to safeguard your personal information. Utilizing state-of-the-art encryption technology, it ensures that your sensitive data remains protected and confidential throughout your online adventures.

What truly sets Maxthon apart is its commitment to enhancing user privacy during every moment spent online. Each feature of this browser has been meticulously designed with the user’s privacy in mind. Its powerful ad-blocking capabilities work diligently to eliminate unwanted advertisements, while its comprehensive anti-tracking measures effectively reduce the presence of invasive scripts that could disrupt your browsing enjoyment. As a result, users can traverse the web with newfound confidence and safety.

Moreover, Maxthon’s incognito mode provides an extra layer of security, granting users enhanced anonymity while engaging in their online pursuits. This specialized mode not only conceals your browsing habits but also ensures that your digital footprint remains minimal, allowing for an unobtrusive and liberating internet experience. With Maxthon as your ally in the digital realm, you can explore the vastness of the internet with peace of mind, knowing that your privacy is being prioritized every step of the way.