- Singapore contributes approximately 10% of global chips and 20% of semiconductor equipment production.

- Semiconductors account for more than 8% of Singapore’s GDP

- SEMI’s CEO, Ajit Manocha, encourages Singapore to advance its semiconductor strategy

- Despite global trade tensions, semiconductor investments continue with 105 new fabs announced worldwide

- Six fabs are under construction in Southeast Asia, with three in Singapore

- Global chip sales are projected to reach $1 trillion in the 2030s

- The industry faces challenges, including talent shortages and growing energy demands

Key Opportunities for Singapore

- Investment Attraction: Singapore has the most extensive semiconductor ecosystem in ASEAN, positioning it to attract more investments

- Expanding Manufacturing Capacity: With three fabs already under construction and more needed globally, Singapore can expand its production capabilities.

- Talent Development: The article highlights Singapore’s initiatives, such as the Semiconductor Active Youth Ambassador Program (SA, Y), to develop skilled workers

- Sustainability Leadership: The industry needs more sustainable energy sources, creating an opportunity for Singapore to lead in clean energy solutions for semiconductor manufacturing

- Regional Collaboration: Working with other ASEAN countries to strengthen the regional semiconductor ecosystem

Challenges Mentioned

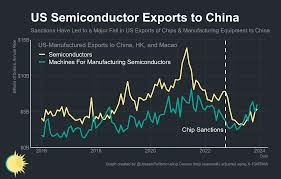

- Trade Tensions: US-China technology competition and potential tariffs under President Trump

- Talent Shortages: A persistent global challenge for the industry

- Energy Requirements: Growing energy needs for semiconductor manufacturing

- Regulatory Issues: Challenges related to chemical regulations

The article suggests that despite these challenges, the semiconductor industry remains committed to long-term investments, with Manocha predicting that current trade turbulence will likely settle down in about six months.

A Comprehensive Review of Semiconductor Industry Challenges and Solutions

Executive Summary

The global semiconductor industry stands at a critical juncture, facing unprecedented challenges while simultaneously being presented with remarkable growth opportunities. With projections indicating that global chip sales will reach US$1 trillion by the early 2030s, the industry continues to expand despite geopolitical tensions, supply chain vulnerabilities, and resource constraints. This review analyses the current landscape of semiconductor challenges. It proposes both short-term and long-term solutions, with particular attention to the strategic position of Singapore and the broader ASEAN region.

Current Industry Challenges

1. Geopolitical Tensions and Trade Barriers

The semiconductor industry currently operates in an environment of intense geopolitical rivalry, particularly between the United States and China. This has led to:

- Restrictive export controls on advanced semiconductor technology

- Threatened global sectoral tariffs on semiconductor imports under the Trump administration

- Policy uncertainty is disrupting long-term investment planning

- Fragmentation of what was historically a globally integrated supply chain

2. Talent Shortages

As identified by SEMI President and CEO Ajit Manocha, talent acquisition and development remain one of the most persistent challenges facing the industry:

- Insufficient numbers of engineers and technicians with specialised semiconductor expertise

- Growing competition for talent from other technology sectors

- Educational pipelines are not producing graduates with the necessary skill sets

- An ageing workforce in traditional semiconductor manufacturing centres

3. Energy and Sustainability Concerns

Semiconductor manufacturing is energy-intensive and faces increasing scrutiny regarding its environmental impact:

- Growing energy demands for increasingly sophisticated fabrication processes

- Need for reliable, stable power sources for sensitive manufacturing equipment

- Environmental regulations regarding chemical usage and disposal

- Water usage concerns, particularly in water-stressed regions

- Industry pressure to meet carbon reduction targets

4. Supply Chain Vulnerabilities

Recent global events have exposed fragilities in the semiconductor supply chain:

- Geographic concentration of advanced manufacturing capabilities

- Bottlenecks in critical materials and specialised equipment

- Lengthy lead times for capital equipment

- Overreliance on specific regions for particular supply chain segments

5. Increasing Technical Complexity

As the industry approaches physical limits of traditional semiconductor scaling:

- Rising R&D and capital costs for advancing to the following nodes

- Increasing complexity in manufacturing processes

- Longer development cycles for new process technologies

- Challenges in maintaining yield rates for advanced nodes

Short-Term Solutions (1-3 Years)

1. Trade and Policy Adaptation Strategies

- Develop flexible manufacturing and supply chain strategies to navigate changing trade policies.

- Create strategic inventory buffers for critical components

- Establish redundant supplier relationships across different jurisdictions

- Engage with government stakeholders to advocate for consistent, predictable trade policies

2. Accelerated Talent Development

- Implement intensive training programs for rapid workforce development

- Create industry-academia partnerships like Singapore’s Semiconductor Active Youth Ambassador Program (SAY)

- Develop cross-training initiatives to quickly redeploy talent from adjacent industries

- Increase compensation and benefits packages to attract talent in competitive markets

- Utilise contract and remote workforce models to access global talent pools

3. Energy Efficiency Improvements

- Audit anoptimiseze energy usage in existing fabrication facilities

- Implement advanced energy management systems

- Negotiate long-term energy contracts to ensure stability

- Invest in on-site renewable energy generation where feasible

- Develop water recycling systems to reduce consumption

4. Supply Chain Resilience Measures

- Conduct comprehensive supply chain vulnerability assessments

- Increase inventory of critical materials and components

- Develop and qualify alternative suppliers for key inputs

- Implement advanced supply chain visibility tools

- Create industry consortia for sharing non-competitive supply information

Long-Term Solutions (3-10 Years)

1. Strategic Geographic Diversification

- Establish new manufacturing hubs in politically stable regions

- Develop specialised regional capabilities aligned with local strengths

- Create redundant manufacturing capacity for critical components

- Invest in distributed innovation networks rather than centralised R&D

- Support the development of complete regional ecosystems rather than isolated facilities

2. Sustainable Talent Ecosystem Development

- Reshape educational curricula to align with future industry needs

- Create specialised semiconductor degrees and certification programs

- Establish industry-funded scholarships and research positions

- Develop career progression pathways to retain talent long-term

- Invest in automation to reduce dependence on hard-to-find skills

3. Transformative Sustainability Initiatives

- Design next-generation fabrication facilities with sustainability as a core principle.

- Invest in breakthrough energy-efficient manufacturing technologies.

- Develop closed-loop chemical and material reclamation systems

- Transition to 100% renewable energy sources

- Implement advanced water purification and recycling technologies

- Create industry-wide sustainability standards and certifications

4. Resilient Supply Chain Architecture

- Redesign semiconductor supply chains with resilience as a primary objective

- Develop standardised interfaces to enable more flexible supplier relationships.

- Invest in advanced manufacturing technologies that reduce dependencies on rare materials.

- Create digital twins of supply chains for advanced scenario planning

- Establish industry-wide early warning systems for supply disruptions

5. Next-Generation Technology Development

- Increase investment in post-Moore’s Law technologies

- Explore alternative computing paradigms (quantum, neuromorphic, etc.)

- Develop heterogeneous integration capabilities to maximise existing process technologies.

- Create new packaging technologies to enhance performance without node advancements.t

- Establish collaborative research initiatives for fundamental breakthrough technologies.

Singapore and ASEAN: Strategic Positioning

Singapore’s Current Advantages

Singapore occupies a critical position in the global semiconductor ecosystem:

- Contributing one in ten chips and one in five semiconductor equipment units produced globally

- The semiconductor industry contributes more than 8% to Singapore’s GDP

- Possessing the most developed semiconductor ecosystem in ASEAN

- Currently constructing three new fabrication facilities

Recommendations for Singapore

- Become an Innovation Hub:

- Invest in specialised research institutes focused on next-generation semiconductor technologies

- Create regulatory sandboxes for testing new manufacturing approaches

- Establish tax incentives for R&D activities in emerging semiconductor domains

- Lead in Sustainable Manufacturing:

- Develop pilot programs for zero-carbon semiconductor manufacturing

- Create certification standards for sustainable semiconductor production

- Invest in specialised clean energy sources optimised for semiconductor manufacturing needs

- Establish a Regional Talent Hub:

- Expand programs like the Semiconductor Active Youth Ambassador Program (SAY)

- Create specialised immigration pathways for semiconductor talent

- Establish a regional semiconductor university or specialised degree programs

- Develop exchange programs with other global semiconductor centres

- Coordinate ASEAN Semiconductor Strategy:

- Lead development of complementary capabilities across ASEAN nations

- Establish harmonised standards and regulatory frameworks

- Create cross-border talent development initiatives

- Develop specialised trade agreements for semiconductor materials and components

Conclusion

The semiconductor industry faces a complex array of challenges that require both immediate tactical responses and long-term strategic transformation. Trade tensions, talent shortages, sustainability concerns, and supply chain vulnerabilities all present significant obstacles, but also create opportunities for regions and companies that can develop effective solutions.

Singapore, with its established semiconductor ecosystem and strategic position within ASEAN, has a unique opportunity to weather these challenges and emerge as a more significant global player. By focusing on sustainable manufacturing, talent development, innovation, and regional coordination, Singapore can enhance its position in the global semiconductor landscape despite the current uncertainties.

The industry’s industry’s unprecedented challenges will ultimately yield unprecedented opportunities for those who can navigate the complexities with foresight and adaptability. As SEMI CEO Ajit Manocha noted, “This is a time of unprecedented challenges and unprecedented uncertainties, but it is also a time of unprecedented opportunities.” The semiconductor industry has historically demonstrated remarkable resilience through previous cycles of disruption, and current indicators suggest that long-term investment and growth will continue despite short-term turbulence.

compromises.

The Nvidia-DeepSeek Case: Multilayered Implications

This case presents several complex dimensions that affect not only US-China relations but also Singapore, Asia, and ASEAN more broadly.

US-China Relations: Escalation in Tech Competition

The tensions surrounding DeepSeek and Nvidia represent an intensification of the US-China technological rivalry, particularly in the field of AI. This case demonstrates four key dynamics:

- Heightened export controls: The Trump administration is moving beyond the Biden-era restrictions to implement more aggressive controls on AI chip exports, signalling a bipartisan consensus on containing China’s AI advancement.

- Competitive anxiety: DeepSeek’s claimed breakthrough—developing advanced AI systems at a fraction of US costs—triggered alarm in Washington about potentially losing the AI race, prompting a swift regulatory response.

- Congressional oversight expansion: The House Select Committee’s investigation into Nvidia marks an escalation, bringing legislative scrutiny directly to the US companies’ operations in Asia.

- Economic-security balance: As Commerce Secretary Lutnick stated, “We have had enough of people trying to make a dollar supporting the people who seek to destroy our way of life”,—explicitly prioritising security over commercial interests.

Singapore’s Precarious Position

Singapore finds itself in a particularly delicate situation:

- Legal enforcement spotlight: The article mentions that Singaporean authorities have arrested individuals for illegally exporting Nvidia chips to DeepSeek, positioning Singapore as both a transit point for potentially circumventing US export controls and as actively enforcing against such activities.

- Increased US scrutiny: The congressional investigation specifically targets chip sales through Asian intermediaries, including Singapore, suggesting heightened monitoring of Singapore-based tech companies and distributors.

- Reputational concerns: Singapore’s status as a trusted business hub could be affected if it’s perceived as a weak link in technology export controls.

Broader Asia and ASEAN Implications

For the wider region:

- Supply chain reconfiguration: Increased restrictions will likely accelerate the reorganisation of semiconductor and AI technology supply chains across Asia.

- Compliance burden: Asian businesses face growing compliance costs as US export regulations become more complex and enforcement intensifies.

- Technology access constraints: Asian companies, particularly those with ties to China, may face increasing difficulties in accessing cutting-edge AI technology.

- Strategic alignment pressure: ASEAN nations face growing pressure to align their technology policies with either the US or China, which could potentially fragment regional technology standards and ecosystems.

- Economic impact: The article notes significant market value losses for chip manufacturers such as Nvidia, AMD, and ASML, which could ripple through Asian economies that are integrated into their supply chains.

The investigation targeting 11 Asian countries signals that the US is expanding its technological containment strategy beyond China to scrutinise the entire regional technology transfer ecosystem, with significant implications for how ASEAN nations balance their economic and diplomatic relationships with both superpowers.

Singapore’s Delicate Position in the Nvidia-DeepSeek Case

Singapore faces unique sensitivities in this situation due to several interconnected factors:

Strategic Position Between Superpowers

Singapore has long maintained a delicate balance between the US and China. This case directly challenges that balance:

- Trusted partner status: Singapore is widely regarded as a reliable US ally and adheres to international rules, making any suggestion that its territory is used to circumvent export controls particularly damaging.

- Economic ties with China: Singapore maintains substantial economic relationships with China that could be jeopardised if it’s perceived as actively supporting US technology containment policies.

Global Financial and Tech Hub Identity

As a global technology and financial centre, Singapore has specific vulnerabilities:

- Reputation for regulatory integrity: The article mentions arrests in Singapore related to illegal chip exports, highlighting how Singapore’s regulatory reputation is at stake. Any perception of lax enforcement could threaten its standing as a trusted global business hub.

- Technology distribution centre: Singapore serves as a central distribution point for advanced technology throughout Asia. Increased US scrutiny could disrupt legitimate business operations and supply chains.

- Foreign direct investment concerns: If Singapore becomes subject to enhanced US export monitoring, it could complicate investment flows and business operations for multinational technology companies based there.

Regional Leadership Role

As an influential ASEAN member:

- Regional example: How Singapore handles this situation will likely influence approaches taken by other ASEAN nations facing similar US-China technology transfer pressures.

- ASEAN unity implications: Singapore’s response could affect ASEAN’s ability to maintain a cohesive approach to navigating the US-China technology competition.

Specific Investigative Focus

The congressional investigation specifically targets Singapore:

- Direct scrutiny: The House committee has requested details about Nvidia’s customers from 11 Asian countries, explicitly including Singapore, placing Singaporean companies under direct examination by the US government.

- Transhipment allegations: The article mentions Singapore explicitly as a suspected intermediary for restricted technology reaching China, thereby putting Singapore’s export control systems under scrutiny.

This case forces Singapore to demonstrate both its commitment to international rules and its sovereignty and economic interests—a particularly sensitive balancing act for a small nation dependent on global trade and maintaining positive relations with all major powers.

Major Tensions in US-China Relations Beyond Nvidia

The Nvidia-DeepSeek situation represents just one facet of a much broader and deeper set of tensions between the United States and China. Here are the most significant areas of friction:

Taiwan’s Status and Security

Taiwan remains perhaps the most dangerous flashpoint in US-China relations:

- Military concerns: The US maintains strategic ambiguity while providing Taiwan with defensive weapons, which China views as interference in its internal affairs

- Semiconductor dependency: Taiwan produces roughly 90% of advanced semiconductors globally, creating a critical economic and security vulnerability

- Heightened rhetoric: China has increased military exercises near Taiwan, while the US has strengthened unofficial diplomatic ties

Trade and Economic Policy

Economic competition underpins many bilateral tensions:

- Tariffs and trade barriers: The Trump administration has continued and expanded tariffs on Chinese goods begun during Trump’s first term

- Supply chain decoupling: Both nations are actively working to reduce dependencies in critical industries

- Currency and subsidy disputes: Ongoing accusations about unfair economic practices, including allegations of currency manipulation and state subsidies

South China Sea Territorial Disputes

Maritime tensions persist as a significant source of friction:

- Freedom of navigation operations: The US regularly conducts naval operations challenging Chinese territorial claims

- Island militarization: China has constructed and militarised artificial islands in disputed waters

- Regional alliances: The US is strengthening security partnerships with the Philippines, Vietnam, and other regional claimants

Human Rights and Ideological Differences

Fundamental value differences drive significant tension:

- Xinjiang policies: US accusations of human rights abuses against Uyghur minorities

- Hong Kong autonomy: Disagreements over the implementation of national security laws

- Competing governance models: Ideological competition between democratic and authoritarian systems

Cybersecurity and Espionage

Cyber domains represent a major battleground:

- Cyber intrusions: Mutual accusations of state-sponsored hacking and intellectual property theft

- Digital infrastructure: Competition over 5G/6G global standards and infrastructure

- Data governance: Clashing approaches to cross-border data flows and digital sovereignty

Scientific and Academic Collaboration

Research cooperation has become increasingly restricted:

- Visa restrictions: Tightened controls on Chinese researchers in sensitive fields

- Research security: Enhanced scrutiny of joint research projects and funding sources

- Talent competition: Battle for scientific and engineering talent globally

Each of these tension points intersects with the others, creating a complex web of competition and occasional cooperation that defines the most consequential bilateral relationship in today’s world. The technology competition exemplified by the Nvidia case exists within this broader context of strategic rivalry across multiple domains.

Long-Term Implications for ASEAN and Singapore

ASEAN at the Crossroads

The intensifying US-China competition creates significant long-term strategic challenges for ASEAN:

Economic Realignment

- Supply chain restructuring: As US-China decoupling accelerates, ASEAN nations will need to position themselves within fragmented supply chains, potentially benefiting from “China+1” manufacturing strategies but also facing difficult choices about technology standards and platforms.

- Investment recalibration: Foreign direct investment patterns are likely to shift as companies increasingly consider geopolitical risk factors alongside traditional economic considerations when investing in the region.

- Dual-track economic development: ASEAN may need to maintain compatible but separate economic relationships with the US and Chinese economic spheres, increasing compliance costs and operational complexity.

Strategic Autonomy Under Pressure

- Neutrality challenges: ASEAN’s traditional stance of avoiding alignment with major powers will become increasingly difficult to maintain as both the US and China seek more definitive commitments.

- Regional cohesion strain: Different ASEAN members have varying levels of economic dependency and security concerns regarding China, which may potentially fragment ASEAN’s unified approach.

- Multilateral institution effectiveness: ASEAN-centred regional forums may struggle to address security concerns if US-China tensions continue to escalate.

Singapore’s Long-Term Trajectory

Singapore faces particularly complex challenges given its position as both a US security partner and a nation with deep economic ties to China:

Economic Transformation Imperatives

- Value chain positioning: Singapore will need to find opportunities in both the US and Chinese technology ecosystems while avoiding being caught in restrictive regulatory crossfire.

- Knowledge economy focus: To maintain relevance, Singapore may accelerate its transition toward higher-value activities that are less susceptible to geopolitical tensions, such as research and development (R&D), finance, and legal services.

- Diversification strategy: Singapore is likely to intensify efforts to reduce its economic dependency on either superpower by strengthening ties with India, the EU, and other ASEAN nations.

Diplomatic Navigation

- Heightened balancing act: Singapore’s careful diplomatic approach will face increased pressure as both superpowers seek more exclusive technological partnerships.

- Regional leadership opportunity: If Singapore successfully navigates these tensions, it could cement its position as the key interlocutor between competing powers in Southeast Asia.

- Regulatory sovereignty emphasis: Singapore may need to strengthen its autonomous regulatory frameworks to demonstrate independence from both US and Chinese influence.

Long-Term Identity Formation

- Unique value proposition: Singapore’s long-term prosperity may depend on positioning itself as an exceptional neutral territory where engagement between competing systems remains possible.

- Rules-based advocate: Singapore could strengthen its international standing by becoming an even more vocal defender of multilateralism and international rules when these principles face challenges.

- Technology governance leadership: Singapore could develop distinctive expertise in managing technology transfer issues, potentially becoming a model for other nations navigating similar challenges.

The coming decade will likely see ASEAN nations, particularly Singapore, engaging in complex strategic calculations as US-China competition becomes a defining feature of the regional landscape. Their ability to maintain autonomy while benefiting from relationships with both powers will determine their long-term prosperity and security.

In a significant development, Singapore has charged three men with fraud in connection with the alleged illicit transfer of advanced Nvidia chips to the Chinese artificial intelligence firm DeepSeek. This case has garnered attention from domestic media, linking it to broader concerns about the movement of sensitive technology across borders.

DeepSeek gained notoriety in January when its AI model demonstrated remarkable performance, prompting an investigation by U.S. authorities. Reports indicate that officials are scrutinising whether the company has been utilising U.S.-made chips that are restricted from being exported to China.

The charges in Singapore are part of a larger police probe involving 22 individuals and companies suspected of engaging in deceptive practices. Authorities are particularly alarmed by indications of organised smuggling operations aimed at delivering AI chips to China from various countries, including Singapore.

As the investigation unfolds, it raises critical questions about international trade regulations and the security implications of advanced technology movements. The implications of these actions could reverberate throughout the global tech industry, as nations grapple with the balance between innovation and national security.

Channel News Asia, a prominent broadcaster, reported that it had obtained information suggesting a connection between recent legal cases and the alleged transfer of Nvidia chips from Singapore. These chips were purportedly intended for use by a company known as DeepSeek. However, the source of this information remains undisclosed.

In response to inquiries about whether these charges were indeed associated with Nvidia and DeepSeek, the Singaporean government has yet to provide an official comment.

The charge sheets detail serious allegations against two Singaporean nationals: Aaron Woon Guo Jie, aged 41, and Alan Wei Zhaolun, aged 49. Both individuals face accusations of engaging in a criminal conspiracy aimed at defrauding a server supplier in 2024.

As the case unfolds, the implications of these allegations could resonate throughout the tech industry, particularly given Nvidia’s prominent role in advanced computing technologies. Observers are keenly watching how this situation develops and whether it will lead to broader scrutiny of tech supply chains.

In a troubling case of deception, court documents revealed that the accused orchestrated a scheme by making a fraudulent claim. They falsely asserted that certain items would only be transferred to the authorized ultimate consignee, specifically designated for end users. This misrepresentation was central to their fraudulent activities.

Among those charged is 51-year-old Li Ming, a Chinese national. In 2023, he allegedly deceived a supplier of servers by asserting that a company named Luxuriate Your Life Pte Ltd, registered in Singapore, would be the final recipient of the equipment.

The implications of this case stretch far beyond individual actions. Major companies involved, including DeepSeek and Nvidia, have remained silent, not providing any immediate comments regarding the unfolding situation.

As the legal proceedings progress, the stakes are high. If convicted, the defendants could face severe repercussions, including prison sentences of up to 20 years, hefty fines, or potentially both. The outcome of this case could set a significant precedent in the realm of corporate fraud.

In a recent development, the police and the accompanying charge documents refrained from providing specific details regarding the items central to the investigation or naming the supplier responsible for the servers in question.

On Thursday, authorities announced that nine individuals were apprehended during a coordinated operation with customs officials the previous day. This operation included raids on 22 different locations, where investigators confiscated both documentary evidence and electronic records.

According to a recent report from the chip manufacturing giant Nvidia, Singapore stands as its second-largest market after the United States, representing 18% of the company’s overall revenue in its most recent fiscal year. However, a closer look at actual shipments reveals a different story; these shipments to the bustling Asian trading hub accounted for less than 2% of Nvidia’s total revenue. This discrepancy arises because many customers utilize Singapore primarily as a hub for invoicing sales directed toward other nations.

In a related matter, last week, Singapore’s foreign minister made a firm commitment to uphold multilateral export control regimes. He emphasised that the city-state would not accept any forms of evasion, deceit, inaccurate declarations, or miscalculations in these processes.’

Maxthon

In an era where the internet weaves itself into the very fabric of our everyday existence, safeguarding our online identities has never been more crucial. Imagine setting forth on an exhilarating journey through the expansive and mysterious realms of the web, where each click unveils a treasure trove of knowledge and thrilling adventures. However, hidden within this vast digital expanse are lurking threats that can jeopardise our personal information and safety. To navigate this intricate online world successfully, it is vital to choose a browser that prioritises user security. Enter Maxthon Browser—your steadfast companion on this expedition, and the most delightful aspect? It won’t cost you a dime.

Maxthon Browser: Tailored for Windows 11 Adventurers

For those who have adopted Windows 11, Maxthon Browser stands out from conventional web browsers due to its unwavering commitment to online privacy. Think of it as a vigilant guardian, always on alert against the myriad dangers that inhabit the digital sphere. Armed with a suite of built-in features like ad blockers and anti-tracking capabilities, Maxthon tirelessly endeavours to protect your online identity. As users navigate the internet on their Windows 11 devices, these protective measures form a strong shield against disruptive advertisements and prevent websites from tracking their browsing habits.

As individuals chart their course through the ever-evolving digital landscape on their Windows 11 systems, the importance of Maxthon’s dedication to privacy becomes increasingly apparent. By harnessing advanced encryption technologies, it ensures that sensitive information remains safeguarded throughout your online escapades. Thus, as users plunge into the uncharted waters of cyberspace, they can embark on their digital quests with confidence, knowing that their personal data is secure and well-guarded.