Immediate Actions to Take

Contact your Bank right away – This is the most critical first step. Call or visit your Bank to understand precisely why your Account was closed and ask about the process for retrieving any remaining funds.

Secure your remaining balance – Banks typically mail you a check for any money left in your Account, but you need to follow up to ensure you receive it promptly.

Stop automatic transactions – Immediately redirect any direct deposits (like paychecks) to another account and cancel automatic bill payments to prevent bounced payments and late fees.

Address Outstanding Issues

If your Account had a negative balance when closed, you’ll need to settle that debt quickly. Unpaid bank debts can be sent to collections, which could damage your credit score and make it harder to open new accounts elsewhere.

Consider Filing a Complaint

If you believe your Account was wrongfully closed, you can file a complaint with federal regulators like the Office of the Comptroller’s Customer Assistance Group.

Finding New Banking Options

Opening a new account might be challenging if the closure was reported to ChexSystems (a banking report system). If you’re having trouble, look into “second-chance” banking programs specifically designed for people with past banking issues.

Prevention for the Future

The article emphasises that prevention is key. This includes maintaining regular account activity, keeping balances above minimum requirements, setting up account alerts, communicating with your Bank about significant financial changes, and being cautious with check handling.

The most important thing to remember is that banks have the legal right to close accounts at their discretion, but taking prompt action when it happens can help minimise the financial disruption to your life.

Bank Account Closure in Singapore: Complete Action Guide

Understanding Your Rights and Bank Powers in Singapore

In Singapore, banks operate under strict regulations by the Monetary Authority of Singapore (MAS). However, they still retain the right to close accounts based on their internal policies and risk assessments. Unlike some jurisdictions, Singapore banks typically provide more structured notice periods and clearer procedures.

Immediate Actions (Within 24-48 Hours)

1. Contact Your Bank Directly

- Call the customer service hotline immediately – Most major Singapore banks (DBS, OCBC, UOB, etc.) have 24/7 hotlines.

- Visit the branch if possible – Face-to-face communication often yields better results.

- Request a written explanation – Ask for a formal letter detailing the reasons for closure.

- Document everything – Record names, dates, times, and reference numbers of all communication.

2. Secure Your Remaining Balance

- Confirm balance amount – Ensure you know exactly how much money should be returned..

- Request immediate transfer – Ask if funds can be transferred to another account you own

- Understand the timeline – Singapore banks typically issue cashier’s orders within 7-14 working da..ys.

- Provide updated contact details – Ensure they have your current address for mailing the cashier’s order..

3. Stop All Automated Transactions

Direct Credits (Salary, CPF, etc.):

- Inform your employer’s HR/payroll department immediately

- Update the CPF Board if you receive CPF payouts

- Notify any investment platforms (StashAway, Syfe, etc.)

- Contact HDB if you receive rental income through GIRO

GIRO Arrangements:

- Cancel all GIRO arrangements (utilities, insurance, loans, credit card payments)

- Contact SP Group, PUB, Singapore Power, telcos (Singtel, StarHub, M1)

- Notify insurance companies (AIA, Great Eastern, Prudential, etc.)

- Update mortgage/loan providers

- Cancel subscription services (Netflix, Spotify, gym memberships)

Addressing Specific Singapore Scenarios

4. Handle Outstanding Debts or Negative Balances

- Overdraft facilities – Settle any outstanding overdraft amounts immediately

- Credit facilities – Address any linked credit lines or loans

- Fees and charges – Pay any account closure fees or penalty charges

- Foreign exchange exposures – Close any open FX positions or multi-currency balances

5. Credit Bureau and Banking Records

Credit Bureau Singapore (CBS) Impact:

- Bank account closures generally don’t affect your CBS credit report directly..

- However, unpaid debts to the Bank will be reported and affect your credit score.

- Request a copy of your credit report to monitor any changes

Banking Conduct and Compliance Records:

- Singapore banks share information through industry databases

- Negative closures may affect your ability to open accounts with other local banks

- This is particularly important for wealth management or priority banking relationships

Singapore-Specific Regulatory Actions

6. File Complaints Through Proper Channels

Step 1: Bank’s Internal Complaints Process

- All Singapore banks are required to have formal complaint procedures

- Submit a written complaint to the customer resolution unit

- Banks must acknowledge within 3 working days and respond within 30 days

Step 2: Financial Industry Disputes Resolution Centre (FIDReC)

- File a complaint if unsatisfied with the response

- FIDReC provides free mediation and adjudication services

- Must file within 6 months of the final response

- The process is binding on banks up to S$100,000

Step 3: Monetary Authority of Singapore (MAS)

- File a complaint with MAS if you suspect regulatory violations

- MAS investigates systemic issues and regulatory breaches

- Submit through the MAS website or email to [email protected]

7. Legal Considerations in Singapore

- Consumer Protection Fair Trading Act – May apply if unfair practices were involved

- Banking Act – Governs bank obligations and customer rights

- Contract Law – Review your account terms and conditions

- Legal aid – Consider consulting a lawyer if significant amounts are involved

Finding Alternative Banking Solutions

8. Immediate Banking Needs

Digital Banks:

- Trust Bank (Standard Chartered + FairPrice Group)

- GXS Bank (Grab + Singtel)

- MariBank (Sea Limited)

- These may have different risk assessment criteria

Traditional Banks:

- Apply to other major banks (if one closes, others may still accept)

- Consider foreign banks operating in Singapore (Citibank, HSBC, Standard Chartered)

- Credit unions or cooperative banks

Specialised Banking:

- Islamic banking options (OCBC Al-Amin, Maybank Islamic, CIMB Islamic)

- Private banking if you meet the minimum requirements

- Corporate banking, if you own a business

9. Singapore Government Banking Services

- Development Bank of Singapore (DBS) – Consider their basic banking packages

- Post Office Savings Bank (POSB) – Often more accessible for basic banking needs

- Central Provident Fund (CPF) – Ensure your CPF account remains active for government payments

Long-term Prevention Strategies

10. Compliance and Risk Management

Anti-Money Laundering (AML) Compliance:

- Understand the source of funds requirements

- Keep documentation for large transactions

- Be transparent about business activities if you’re self-employed

- Comply with reporting requirements for cash transactions above S$20,000

Know Your Customer (KYC) Requirements:

- Keep personal information updated

- Provide employment details and income sources

- Declare tax residency status accurately

- Update beneficial ownership information for corporate accounts

Transaction Monitoring:

- Avoid unusual transaction patterns

- Don’t allow third parties to use your Account

- Be cautious with cryptocurrency-related transactions

- Maintain transaction records and supporting documents

11. Relationship Management

- Maintain minimum balances as required

- Use accounts regularly to show activity

- Communicate significant life changes (job change, relocation, etc.)

- Build relationships with relationship managers for priority banking.

Singapore-Specific Documentation Requirements

12. Essential Documents to Maintain

- Identity Documents: NRIC/passport, work permit/employment pass

- Address Verification: Utility bills, tenancy agreements, official correspondence

- Income Documentation: Payslips, tax assessments (Notice of Assessment), employment letters

- Business Documents: ACRA certificates, business licenses (if applicable)

- Transaction Records: Keep records of significant transactions and their sources

Financial Impact Assessment

13. Immediate Financial Planning

Cash Flow Management:

- Calculate immediate cash needs for expenses

- Identify alternative payment methods (credit cards, other accounts)

- Plan for potential delays in accessing funds

Investment and Insurance Implications:

- Review investment-linked accounts

- Check insurance policies with premium financing arrangements

- Consider the impact on SRS (Supplementary Retirement Scheme) contributions

Business Impact (if applicable):

- Assess the impact on business operations

- Notify suppliers and customers of payment method changes

- Review corporate banking relationships

Recovery Timeline and Expectations

14. Realistic Timelines in Singapore

- Fund recovery: 7-14 working days for cashier’s order

- New account opening: 1-7 working days (varies by Bank and complexity)

- GIRO setup: 1-2 months for all services

- Credit facility restoration: 1-3 months, depending on credit assessmenComplet

- Complete relationship restoration: 3-6 months to establish new banking relationships

Red Flags and Warning Signs

15. Early Warning System

- Unusual account restrictions or holds

- Requests for additional documentation without an apparent reason

- Difficulty accessing online banking or cards

- Delays in processing routine transactions

- Communication from compliance or legal departments

Conclusion

Bank account closure in Singapore, while disruptive, is manageable with prompt action and understanding of local regulations. The key is to act quickly, maintain clear documentation, and leverage Singapore’s robust consumer protection framework. The country’s competitive banking landscape also means alternative options are usually available, though building new banking relationships may take time.

Remember that Singapore’s regulatory environment generally favours transparency and fair dealing. Therefore, banks must provide reasonable justification for account closures and follow proper procedures for fund return and customer communication.

Comprehensive Guide: Bank Account Closure in Singapore – Detailed Recovery Steps

Phase 1: Immediate Crisis Response (First 24 Hours)

Hour 1-2: Emergency Contact and Assessment

Initial Contact Protocol:

- Call the Bank’s 24/7 customer service line immediately

- DBS/POSB: 1800 111 1111

- OCBC: 1800 363 3333

- UOB: 1800 222 2121

- Standard Chartered: 1800 747 7000

- Citibank: 6225 5225

- HSBC: 1800 472 2669

- Document the call meticulously:

- Record the exact time and date of your call

- Note the customer service officer’s name and employee ID

- Request and record the case reference number

- Ask for the call to be escalated to a supervisor immediately

- Record the supervisor’s name and direct contact details

- Key questions to ask during the initial call:

- “What is the specific reason for the account closure?”

- “When was the decision made and who authorised it?”

- “What is the exact balance in my account as of this moment?”

- “Is this closure temporary or permanent?”

- “What is the timeline for returning my funds?”

- “Can I speak to someone from the compliance or legal department?”

- “Is there any way to reverse this decision?”

Hour 2-4: Immediate Financial Triage

Cash Flow Emergency Assessment:

- Calculate your immediate liquidity needs:

- Rent/mortgage payments due in the next 7 days

- Utility bills on GIRO (electricity, water, gas, internet, mobile)

- Insurance premiums due

- Loan repayments scheduled

- Credit card minimum payments

- Daily living expenses for the next 2 weeks

- Alternative payment method activation:

- Locate all other bank cards and check their validity

- Verify balances in other accounts

- Contact family members for emergency financial support if needed

- Check the credit card’s available limits for emergency cash advances

- Employment and income protection:

- Immediately inform your HR department about the closure

- Provide alternative account details for salary crediting

- If self-employed, notify all clients about payment method changes

- Contact the CPF Board if you receive any CPF payouts

Hour 4-8: Documentation and Evidence Gathering

Create a comprehensive case file:

- Gather all account-related documents:

- The last 12 months of bank statements

- Account opening documents and terms & conditions

- All correspondence with the bBank(emails, letters, SMS)

- Transaction records for any disputed or unusual transactions

- Identity documents used for account opening

- Employment and income verification documents

- Screenshot and backup digital evidence:

- Online banking account screens (if still accessible)

- Mobile banking app screens

- Any error messages or notifications

- Email notifications from the Bank

- Transaction history downloads

- Create a detailed timeline:

- When did you first notice account issues?

- Any recent large transactions or unusual activity?

- Recent communications with the Bank

- Any life changes (job change, address change, travel)

Hour 8-24: Strategic Communication and Branch Visit

Physical branch visit preparation:

- Schedule an urgent appointment:

- Call the branch manager directly if possible

- Request a meeting with someone from compliance or operations

- Bring all documentation in organised folders

- Prepare a written summary of your situation

- Branch visit execution:

- Arrive early and dress professionally

- Remain calm and professional throughout

- Request written documentation of everything discussed

- Ask for business cards from everyone you speak with

- Take notes during all conversations

- Request a formal written explanation of the closure

Phase 2: Damage Control and Immediate Solutions (Days 2-7)

Day 2-3: Stop All Automated Transactions

GIRO Cancellation (Critical Priority):

Utilities and Essential Services:

- SP Group (Electricity):

- Call 1800 738 8888

- Request immediate GIRO cancellation

- Switch to alternative payment methods (AXS, internet banking from other accounts)

- Update account details online at www.spgroup.com.sg

- PUB (Water):

- Call 1800 284 6600

- Cancel the GIRO arrangement immediately

- Set up a new GIRO with an alternative bank account

- Consider using SAM machines for payments during the transition

- Gas companies (City Gas/Sembcorp Gas):

- City Gas: 1800 752 4277

- Sembcorp Gas: 1800 668 4277

- Cancel the existing GIRO and set up new arrangements

Telecommunications:

- Singtel: Call 1688 or visit customer centres

- StarHub: Call 1633 or use online chat

- M1: Call 1627 or visit service centres

- MyRepublic/ViewQwest/other ISPs: Check respective websites for contact methods

Government Services:

- HDB (if receiving rental income):

- Visit the HDB Branch or call 1800 225 5432

- Update GIRO details for rental collection

- Provide new account details for rental payments

- Town Councils (service & conservancy charges):

- Contact your specific town council directly

- Update GIRO arrangements for monthly charges

Financial Services:

- Insurance Companies:

- AIA: 1800 248 8000

- Great Eastern: 1800 248 2888

- Prudential: 1800 333 0009

- NTUC Income: 6788 1777

- Update premium payment methods for all policies

- Ensure no lapse in coverage during transition

- Investment and Wealth Management:

- StashAway: Contact through the app or website

- Syfe: Email [email protected]

- Endowus: Contact customer service

- Tiger Brokers/Interactive Brokers: Update funding sources

- DBS Vickers/UOB Kay Hian/other brokerages: Update cash management accounts

- Loan and Credit Facilities:

- Mortgage providers (banks, HDB loans)

- Personal loans, car loans

- Credit card bill payments

- Study loans (tuition fee payments)

Day 3-5: Formal Complaint Initiation

Bank Internal Complaint Process:

- Written complaint submission:

- Address to: Customer Resolution Unit or Customer Relations

- Include all reference numbers from previous communications

- Attach a timeline of events with supporting documents

- Clearly state the desired outcome (account restoration or expedited fund return)

- Request compensation for any fees or charges incurred due to the closure

- Send via multiple channels: email, registered mail, and hand delivery

- Complaint letter essential elements:

Subject: Formal Complaint - Unexpected Account Closure [Account Number] Dear Customer Resolution Team, I am writing to formally complain about the unexpected closure of my account [number] on [date]. This closure has caused significant financial disruption and I believe it may have been done without proper justification. Timeline of events: [Detailed chronology] Financial impact: [List of fees, missed payments, inconvenience] Supporting documents: [List all attachments] Requested resolution: [Specific demands] I request your urgent attention to this matter and expect a comprehensive response within the mandatory 30-day period as required by MAS guidelines. - Follow-up protocol:

- The Bank must acknowledge within 3 working days

- Complete response required within 30 calendar days

- If no acknowledgement, escalate immediately

- Keep detailed records of all communications

Day 4-7: Alternative Banking Solutions

Emergency Banking Setup:

- Digital Bank Applications (Often faster approval): Trust Bank (Standard Chartered + FairPrice): Apply via he iTrustBank app. Instant approval is possible with S. ingPass. Minimum balance for the basic AccountComplete banking services are availableimmediatelyeDirectlyy Bank (Grab + Singtel): Apply through the GXSapp. Digital verification processSavings account with competitive interestIntegration with the

- Grab ecosystem

- Apply via the Mari app

- Quick digital onboarding

- Various account types are available

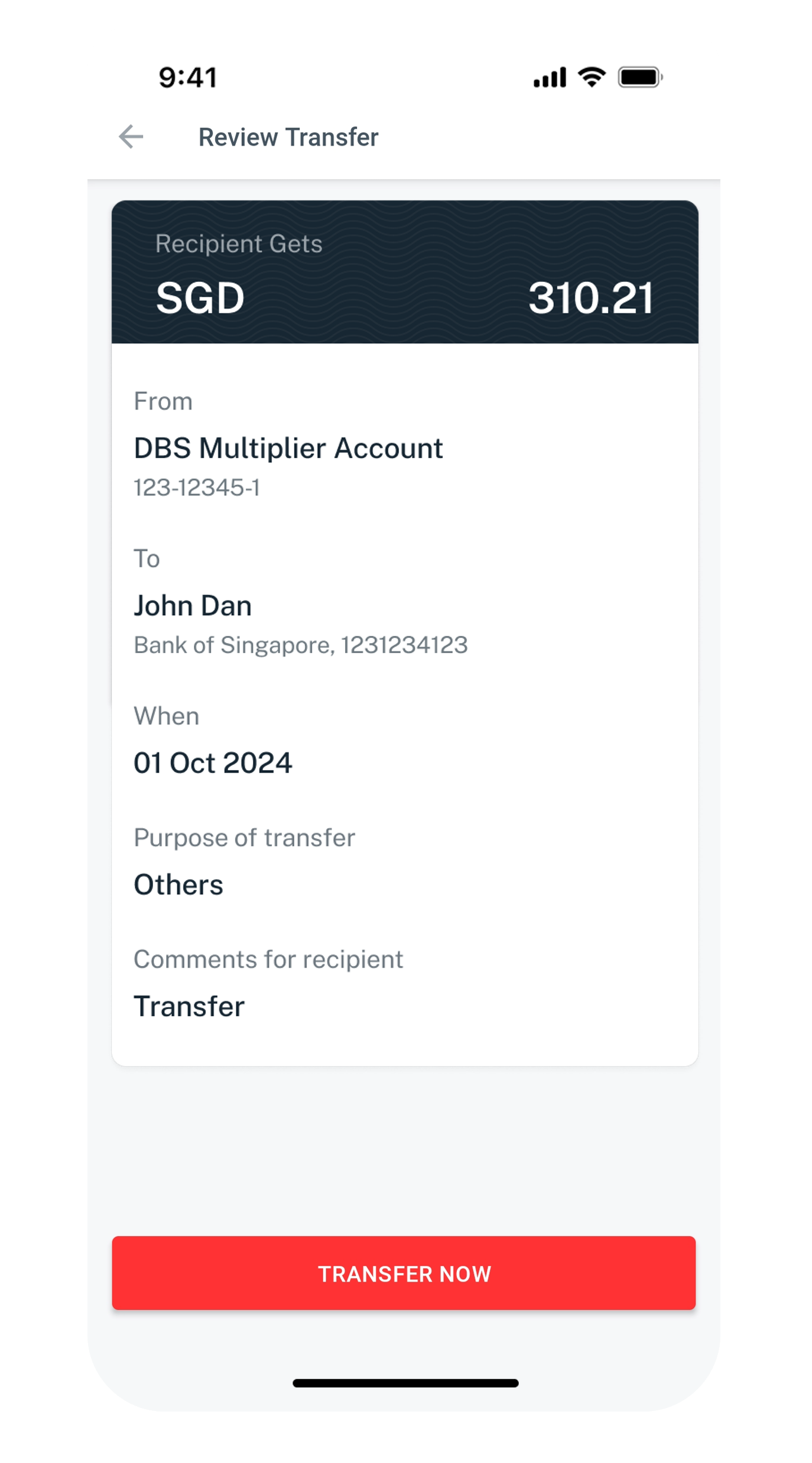

- Traditional Bank Applications: DBS/POSB (Government-linked, often more accessible): Visit any branch with the required documents. POSB may be more lenient for basic bankingConsider the DBS Multiplier account for integrated servicesOCBC Bank: Online application available. 360 Account offers comprehensive bankingFrank accounts for younger customers: One Account for all-in-one banking. Overseas branches,

- If you travel frequently

- Citibank: Priority/Citigold accounts

- HSBC: Advance or Premier banking

- Standard Chartered: Priority Banking

- May have different risk assessment criteria

- Required documents for new account opening:

- NRIC/Passport and a valid work pass (for foreigners)

- Proof of address (utility bill, tenancy agreement, official mail)

- Employment letter or payslips (last 3 months)

- Income tax assessment (if self-employed)

- Initial deposit (varies by bank and account type)

Phase 3: Regulatory and Legal Actions (Week 2-4)

Week 2: Financial Industry Disputes Resolution Centre (FIDC)

When to escalate to FIDReC:

- The Bank fails to acknowledge the complaint within 3 working days

- The Bank’s response is unsatisfactory after 30 days

- You disagree with the Bank’s proposed resolution

- Suspected unfair practices or regulatory violations

FIDReC Filing Process:

- Eligibility verification:

- Individual consumer or small business (annual revenue <S$1M)

- Claim amount up to S$100,000

- Must file within 6 months of the Bank’s final response

- Must have attempted resolution with the Bank first

- Application submission:

- Complete the online form at www.fidrec.com.sg

- Pay filing fee: S$50 for claims up to S$5,000, S$100 for higher amounts

- Submit a comprehensive case file with supporting documents

- Include the Bank’s final response letter

- Required documentation:

- Completed complaint form

- Copy of all correspondence with the Bank

- Account statements and transaction records

- Evidence of financial loss or damages

- Bank’s internal complaint response

- FIDReC process timeline:

- Acknowledgement within 3 working days

- Case review and preliminary assessment (2-4 weeks)

- Mediation attempt (4-6 weeks if applicable)

- Adjudication hearing (8-12 weeks if mediation fails)

- Final determination (binding on Bank up to S$100,000)

Week 2-3: Monetary Authority of Singapore (MAS) Complaint

When to involve MAS:

- Suspected regulatory violations

- Systemic issues affecting multiple customers

- Bankkk fails to follow proper procedures

- Concerns about banking sector stability

MAS Complaint Process:

- Online submission:

- Visit www.mas.gov.sg

- Navigate to the “Consumer” section

- Select “Lodge a Complaint”

- Complete a detailed online form

- Email submission to [email protected]:

Subject: Banking Complaint - Account Closure Violation [Bank Name] Dear MAS Consumer Team, I wish to lodge a complaint against [Bank Name] regarding the unexpected closure of my account without proper notice or justification, which may constitute a violation of banking regulations. Regulatory concerns: - Failure to provide adequate notice - Lack of proper explanation - Possible discriminatory practices - Non-compliance with customer treatment standards I have attempted resolution through bank's internal process and FIDReC [if applicable]. Attached are all supporting documents. - What MAS investigates:

- Compliance with Banking Act

- Fair dealing requirements

- Customer treatment standards

- Systemic risk issues

- Market conduct violations

Week 3-4: Legal Consultation and Options

When legal action may be necessary:

- Significant financial losses (>S$10,000)

- Evidence of discrimination or unfair treatment

- The Bank refuses to return funds

- Breach of contract or fiduciary duty

- Defamation concerns whether closure affects the credit rating

Legal Resources:

- Community Court (for smaller claims up to S$20,000):

- Simplified procedures

- Lower costs

- Self-representation allowed

- Faster resolution

- Law Society of Singapore:

- Lawyer referral service

- Legal aid schemes

- Pro bono services for qualifying cases

- Consumer protection advice

- Legal Aid Bureau:

- Free legal assistance for qualifying individuals

- Means test required

- Covers civil disputes with financial institutions

Phase 4: Financial Recovery and Relationship Building (Month 2-6)

Month 2: Complete Financial System Reset

Credit and Investment Account Updates:

- Credit Bureau Singapore (CBS) monitoring:

- Request a free annual credit report

- Monitor for any adverse reporting from the closed Account

- Dispute any inaccurate information

- Set up credit monitoring alerts

- Investment platform updates:

- CDP (Central Depository): Update bank account for dividend payments

- SGX trading accounts: Update settlement bank details

- Unit trust investments: Update monthly investment plans

- Insurance investments: Update regular premium payment methods

- CPF Investment Scheme: Update the bank account for transactions

- Government service updates:

- IRAS: Update bank account for tax refunds

- CPF Board: Update for various CPF-related payments

- HDB: Update for housing-related transactions

- Immigration & Checkpoints Authority: Update for various payments

Months 2- 32-3: Credit Facility Restoration

Rebuilding Banking Relationships:

- Credit card applications:

- Apply for new credit cards if previous ones were linked to a closed Account

- Consider secured credit cards if facing approval difficulties

- Maintain low utilisation ratios on existing cards

- Loan facilities:

- Re-establish credit lines if needed

- Consider term deposits as collateral for secured facilities

- Build a transaction history with the new pBankry bank

- Wealth management relationships:

- If you had priority banking, work to re-establish similar relationships

- Consider consolidating assets with a new primary bank

- Explore private banking options if you qualify

Months 3- 6: Long-term Prevention Strategy

Compliance and Risk Management:

- Enhanced KYC compliance:

- Maintain updated personal information with all banks

- Provide employment updates promptly

- Declare any changes in tax residency

- Keep beneficial ownership information current for corporate accounts

- Transaction monitoring and documentation:

- Maintain detailed records of all large transactions

- Keethe p the source of funds documentation

- Avoid cash transactions above S$20,000 without proper documentation

- Be transparent about business activities and income sources

- Relationship diversification:

- Maintain accounts with 2-3 different banks

- Avoid the concentration of all services with one institution

- Consider foreign banks for international transactions

- Maintain good standing with at least one government banked Bank

Advanced Risk Mitigation:

- Regular account health checks:

- Monthly review of all account statements

- Quarterly relationship manager meetings (if applicable)

- Annual review of account terms and conditions

- Proactive communication about any significant life changes

- Professional advisory relationships:

- Consider engaging a private banker or relationship manager

- Establish relationships with financial advisors

- Maintain connections with legal and tax professionals

- Consider joining professional or business organisations

Phase 5: Recovery Validation and Future Protection (Month 6+)

Comprehensive Financial Health Assessment

Credit Profile Restoration:

- Credit score monitoring:

- Regular CBS credit report reviews

- Dispute resolution for any lasting negative impacts

- Credit building through the responsible use of new facilities

- Consideration of credit enhancement products

- Banking relationship evaluation:

- Assessment of new banking arrangements

- Evaluation of service levels and relationship quality

- Cost-benefit analysis of banking fees and charges

- Consideration of additional services or upgrades

Documentation and Record Keeping:

- Comprehensive case file maintenance:

- All documents related to the closure and recovery process

- Contact information for all parties involved

- Timeline of events and resolution outcomes

- Lessons learned and prevention strategies implemented

- Emergency preparedness:

- Updated emergency contact list for all financial institutions

- Alternative payment methods and backup accounts

- Emergency cash reserves and access methods

- Family or a trusted person’s awareness of banking arrangements

Ongoing Monitoring and Prevention:

- Regular relationship management:

- Scheduled reviews with relationship managers

- Proactive communication about changes in circumstances

- Regular updates to account information and documentation

- Participation in bank feedback and customer service surveys

- Industry and regulatory awareness:

- Stay informed about banking regulation changes

- Understand evolving compliance requirements

- Monitor industry trends and best practices

- Maintain awareness of consumer rights and protection mechanisms

This comprehensive guide provides a detailed roadmap for navigating bank account closure in Singapore, emphasising the country’s unique regulatory environment and consumer protection mechanisms. The key to successful recovery lies in immediate action, thorough documentation, and leveraging Singapore’s robust financial services regulatory framework.

The Tuesday That Changed Everything

Chapter 1: The Morning Everything Stopped

Marcus Tan had always been meticulous about his finances. As a 34-year-old IT consultant living in Tampines, he prided himself on having everything automated—his salary from the MNC tech firm deposited into his DBS account, GIRO payments set up for his HDB flat’s utilities, insurance premiums, and even his mother’s healthcare expenses. His financial life ran like clockwork, just the way he liked it.

Tuesday morning started like any other. Marcus grabbed his usual kopi-o from the coffeeshop downstairs before heading to the MRT station. He tapped his phone to pay for his morning coffee, but the payment was declined. Strange. He tried again—same result.

“Aiyah, phone spoil is it?” the uncle at the coffee stall asked sympathetically.

Marcus shrugged it off and paid with cash, but a nagging feeling followed him onto the crowded train. During his commute to Raffles Place, he opened his DBS mobile app to check his account balance. The screen that appeared made his blood run cold:

“Your account access has been restricted. Please contact customer service immediately.”

His heart began to race. Marcus had heard horror stories about bank account freezes, but they always happened to other people—people who did dodgy transactions or had complicated business dealings. He was just a regular salaried employee who paid his taxes, contributed to his CPF, and lived a boringly responsible financial life.

The moment he reached his office on the 23rd floor of One Raffles Quay, Marcus called DBS customer service. After navigating through the automated menu and waiting fifteen minutes on hold, he finally reached a customer service officer.

“Good morning, this is Rachel from DBS. How may I help you?”

“Hi, my Account seems to be restricted. I can’t access my mobile banking or make any payments. Can you tell me what’s happening?”

“Can I have your NRIC and account number, please?”

Marcus provided the details, then waited through what felt like the longest silence of his life.

“Mr. Tan, I see here that your Account has been closed due to internal policy violations. You should receive a letter explaining the details within the next few days.”

“Closed? What do you mean closed? What policy violations? I haven’t done anything wrong!”

“I’m sorry, Mr. Tan, but I cannot provide specific details over the phone. The letter will explain everything. Any remaining balance will be sent to you via cashier’s order within 14 working days.”

Marcus felt like the floor had disappeared beneath him. “But I need access to my money now! My salary just came in yesterday, and all my bills are on GIRO. This is crazy!”

“I understand your frustration, sir, but the decision has been made by our compliance department. Is there anything else I can help you with today?”

Anything else? Marcus wanted to scream. His entire financial life had just been dismantled with a single phone call, and she was asking if there was anything else.

Chapter 2: The Unravelling

Marcus couldn’t concentrate on work for the rest of the day. His mind kept racing through all the automatic payments that would bounce. His HDB loan instalment was due tomorrow. His mother’s Medisave insurance premium was scheduled for next week. His mobile phone bill, internet, electricity—everything would fail.

During his lunch break, he rushed to the DBS branch at Marina Bay Financial Centre. The queue was long, filled with other customers clutching bank documents and looking equally stressed. When he finally reached the customer service counter, the story remained the same.

“I’m sorry, Mr. Tan, but account closure decisions are final. The compliance department has reviewed your Account and determined that it poses a risk to the Bank.”

“What risk? I’m an IT consultant! I transfer money to my mother for her medical bills, I pay my utilities, and I save money every month. What’s risky about that?”

The bank officer, a young woman who looked like she’d rather be anywhere else, could only repeat the same scripted responses. There were no specific reasons, no appeal process, and no way to access his funds immediately.

That evening, Marcus sat at his dining table in his three-room flat, surrounded by a pile of bills and bank statements. He called his girlfriend Sarah, a nurse at Singapore General Hospital.

“Babe, you won’t believe what happened today,” he began, and told her the entire saga.

“Wah, can they really do that? Just close your Account like that?” Sarah asked, her voice filled with concern.

“Apparently, they can. I googled it—banks have the right to close accounts without detailed explanations. But how am I going to manage? I have less than $200 in cash, and my credit card is linked to the same Account.”

“Don’t panic first. Tomorrow, we’ll figure this out step by step. You can stay at my place for now if needed, and I can lend you money for immediate expenses.”

Marcus felt a wave of gratitude. At least he wasn’t facing this alone.

Chapter 3: Crisis Management

Wednesday morning, Marcus took emergency leave from work. His first stop was the POSB branch near his flat—if DBS wouldn’t help him, maybe their subsidiary would be different. It wasn’t.

“Sir, DBS and POSB share the same compliance systems. If your DBS account was closed, we cannot open a new account for you at this time,” the POSB officer explained apologetically.

Marcus felt his world shrinking. He spent the next few hours calling eBank, a major bank in Singapore. OCBC, UOB, and Standard Chartered Red all required him to declare if he’d had any accounts closed in the past year. When he honestly disclosed his situation, most applications were rejected immediately.

By afternoon, he was desperate. His phone had been buzzing with messages from his mother: “Marcus, ah, the hospital called. They say my insurance payment bounced. Is everything okay or not?”

He couldn’t tell his 62-year-old mother that he’d somehow become a banking pariah overnight. She had enough to worry about with her diabetes and hypertension.

His salvation came from an unexpected source—his NS buddy Jeremy, who worked in fintech.

“Bro, try the digital banks,” Jeremy suggested over coffee at a hawker centre in Chinatown. “Trust Bank, GXS, MariBank—they might have different risk assessment algorithms. Also, they’re new and trying to gain market share.”

“Will it work? I feel like I’ve been blacklisted by the entire Singapore banking system.”

“Worth a try. The worst they can say is no, and you’re already hearing that everywhere.”

That evening, Marcus downloaded the Trust Bank app. The application process was surprisingly smooth—SingPass verification, basic income details, and employment confirmation. To his amazement, he was approved within an hour.

He nearly cried with relief when he received the approval notification.

Chapter 4: The Long Road Back

Getting a new bank account was only the beginning. Marcus spent the next two weeks systematically updating every single automatic payment and direct deposit arrangement. The process was exhausting and humbling.

At SP Group’s customer service centre: “Uncle, I need to cancel my GIRO and set up a new one.”

“Aiyah, change bank ah? Why did you never tell them earlier? Now your electricity bill is overdue already!”

At his insurance company’s branch: “Mr. Tan, your policy has lapsed due to non-payment. You’ll need to reactivate it and may face higher premiums due to the gap in coverage.”

Each conversation was a small humiliation, a reminder of how precarious financial stability could be.

The worst was calling his company’s HR department to change his salary crediting details.

“Marcus, is everything alright? It’s unusual for employees to change banks suddenly,” his HR manager asked.

“Everything’s fine, just… optimising my banking arrangements,” he lied smoothly, grateful for video calls that hid his embarrassment.

Meanwhile, he lodged a formal complaint with DBS, requesting a detailed explanation for the account closure. Three weeks later, their response was a generic letter citing “business risk assessment” and “internal policies” without any specific details.

Sarah suggested he escalate to FIDReC, Singapore’s financial dispute resolution centre. Marcus spent an entire weekend preparing his case file, documenting every transaction, every communication, and every consequence of the sudden closure.

Chapter 5: Seeking Justice

The FIDReC process was thorough but slow. Marcus had to pay a $100 filing fee and submit a comprehensive case file. The mediator, a retired banking professional named Mrs. Lim, reviewed his complaint with genuine concern.

“Mr. Tan, I’ve seen your transaction history and profile. This does seem like an unusual closure. However, banks do have broad discretionary powers under their terms and conditions.”

“But shouldn’t there be some accountability? Some explanation? I’ve been a loyal customer for eight years, never missed a payment, never overdrawn. How can they just destroy someone’s financial life without justification?”

Mrs. Lim nodded sympathetically. “The mediation process will give both parties a chance to discuss this. DBS will need to provide more detailed reasoning in this forum.”

The mediation session, held at FIDReC’s offices near City Hall, was Marcus’s first face-to-face encounter with DBS representatives since the closure. Two compliance officers in crisp shirts sat across from him, armed with thick folders and legal jargon.

“Mr. Tan’s account showed patterns that triggered our anti-money laundering algorithms,” one of them explained to Mrs. Lim. “Regular large cash deposits, transfers to multiple recipients, and connections to high-risk geographies.”

Marcus felt his anger rising. “Large cash deposits? You mean the $2,000 monthly cash I deposit from my freelance web design work? Transfers to multiple recipients? You mean paying my mother’s medical bills and helping my cousin with his university fees? High-risk geographies? I went to Bangkok for a weekend holiday!”

The mediation continued for three hours. Eventually, DBS agreed to provide Marcus with a detailed breakdown of the “suspicious” activities that led to his account closure. Reading through the list, Marcus realised how legitimate activities could be misconstrued by automated systems designed to catch money launderers and terrorists.

His monthly cash deposits from freelance work were flagged as “structuring” because they were always just under $3,000.

His transfers to his mother’s Account—flagged because she lived in a different housing estate.

His Bangkok hotel payment—flagged because it was made to a Thai merchant.

His cousin’s university fee payment—flagged as “unusual recipient.”

“This is insane,” Marcus said to Mrs. Lim. “Every single one of these transactions is completely legitimate. I have receipts, contracts, family relationships—everything can be explained.”

Mrs. Lim turned to the DBS representatives. “Given these explanations, would DBS consider reinstating Mr. Tan’s account?”

The senior compliance officer shifted uncomfortably. “Our systems flagged these patterns as high-risk. While Mr. Tan’s explanations are reasonable, the decision to close was made in good faith based on our risk assessment protocols.”

“So you’re saying you won’t reopen the account, even though you acknowledge the transactions were legitimate?”

“That’s correct. However, we’re prepared to offer compensation for the inconvenience caused.”

Chapter 6: Moving Forward

DBS’s offer was modest—$500 compensation for the “inconvenience” of having his financial life destroyed. Marcus felt it was insulting, but Mrs. Lim advised him that it was better than nothing. Proving the matter further through adjudication could take months, and there is no guarantee of a better outcome.

Marcus accepted the settlement, but the experience had changed him. He realised how vulnerable ordinary people were to algorithmic decision-making and corporate policies that prioritised risk aversion over customer relationships.

Three months later, his life had stabilised with Trust Bank as his primary Account. He’d learned to diversify his banking relationships, keeping smaller accounts with OCBC and UOB as backups. He’d also become more deliberate about his transaction patterns, avoiding cash deposits and keeping detailed records of every transfer.

The experience had unexpected benefits. His FIDReC case had been documented and shared (with his permission) as an educational example for other customers facing similar situations. He’d started a blog about financial resilience and consumer rights, which had gained a modest following among Singaporeans who’d faced banking difficulties.

Sarah had been his rock throughout the ordeal. One evening, as they sat at East Coast Park watching the sunset, she asked him what he’d learned from the experience.

“I learned that financial security is more fragile than we think,” Marcus reflected. “All those years of being the ‘good customer’—never missing payments, maintaining high balances, using their products—meant nothing when their computer decided I was risky.”

“But you also learned you’re more resilient than you thought, right?”

Marcus smiled. “True. And I learned who my real support system is.” He squeezed her hand. “I also learned that the system isn’t perfect, but there are ways to fight back. FIDReC actually works, even if it takes time.”

“Are you bitter about it?”

Marcus considered the question. “Sometimes. But mostly I’m grateful it happened to me rather than someone less equipped to handle it. Imagine if this happened to an elderly person or someone without savings or family support?”

Chapter 7: The Ripple Effect

Six months after the account closure, Marcus received an unexpected call from Jeremy, his NS buddy who had helped him open the Trust Bank account.

“Bro, remember your banking horror story? It’s happening to more people. I’m working on a fintech startup that helps people manage multiple bank relationships and avoid the kind of algorithmic profiling that got you.”

Marcus was intrigued. “How would that work?”

“We analyse spending patterns and flag potential risk triggers before they become problems. Like, if someone’s cash deposits are approaching levels that might trigger anti-money laundering algorithms, we’d suggest spreading them across different banks or different periods.”

“That’s brilliant. Count me in as a beta tester.”

The startup, which they named “FinGuard,” became Marcus’s side project. His story became their founding narrative—the regular Singaporean who got caught in the crossfire between legitimate banking security and automated risk assessment.

A year later, FinGuard had helped over 200 customers avoid banking difficulties and assisted another 50 in resolving account closure disputes. Marcus had become something of a minor celebrity in Singapore’s financial literacy community, speaking at workshops and writing articles about consumer banking rights.

The irony wasn’t lost on him—his worst financial nightmare had ultimately led to his most meaningful work.

Epilogue: Lessons Learned

Two years after that Tuesday morning when everything stopped, Marcus stood in front of a room full of university students, sharing his story at a financial literacy seminar organised by the Monetary Authority of Singapore.

“The key lesson,” he told the eager faces, “isn’t that banks are evil or that the system is broken. It’s that financial resilience requires active management, not passive assumption that everything will always work.”

A student raised her hand. “But how can regular people protect themselves from algorithmic bias?”

Marcus smiled. “Great question. First, understand that banks use automated systems to assess risk, and these systems aren’t perfect. Keep detailed records of your transactions and their purposes. Diversify your banking relationships—don’t put all your eggs in one basket. Most importantly, know your rights as a consumer. FIDReC exists for a reason.”

Another hand went up. “What would you do differently if you could go back?”

“I would have maintained relationships with multiple banks from the beginning. I would have documented my freelance income more systematically. And I would have understood that being a ‘model customer’ doesn’t protect you from algorithmic decision-making.”

After the seminar, Marcus walked to Marina Bay Sands, where he was meeting Sarah for dinner. As he looked out at the Singapore skyline, he reflected on how much his life had changed since that Tuesday morning.

He was no longer the same person who’d assumed that financial stability was guaranteed by good behaviour and steady income. He’d learned that modern banking was a complex ecosystem of algorithms, regulations, and human judgment—and that ordinary customers needed to understand this ecosystem to navigate it successfully.

His phone buzzed with a message from his mother: “Son, the hospital payment went through smoothly this month. Thank you for taking care of everything.”

Marcus smiled. His mother never knew how the banking crisis had disrupted her medical care. He’d managed to shield her from the worst of it, and that felt like victory enough.

As he walked toward the restaurant where Sarah was waiting, Marcus felt grateful for the journey, however difficult it had been. The Tuesday that changed everything had also made everything possible—his more profound understanding of financial systems, his work helping others, his stronger relationships, and his hard-earned wisdom about resilience.

Sometimes the worst things that happen to us become the foundation for the best things we do.

Author’s Note: This story is inspired by the real experiences of Singaporeans who have faced unexpected bank account closures. While the character and specific details are fictional, the banking procedures, regulatory processes, and resolution mechanisms described are accurate representations of Singapore’s financial system as of 2024.

Maxthon

In an age where the digital world is in constant flux and our interactions online are ever-evolving, the importance of prioritising individuals as they navigate the expansive internet cannot be overstated. The myriad of elements that shape our online experiences calls for a thoughtful approach to selecting web browsers—one that places a premium on security and user privacy. Amidst the multitude of browsers vying for users’ loyalty, Maxthon emerges as a standout choice, providing a trustworthy solution to these pressing concerns, all without any cost to the user.

Maxthon, with its advanced features, boasts a comprehensive suite of built-in tools designed to enhance your online privacy. Among these tools are a highly effective ad blocker and a range of anti-tracking mechanisms, each meticulously crafted to fortify your digital sanctuary. This browser has carved out a niche for itself, particularly with its seamless compatibility with Windows 11, further solidifying its reputation in an increasingly competitive market.

In a crowded landscape of web browsers, Maxthon has forged a distinct identity through its unwavering dedication to offering a secure and private browsing experience. Fully aware of the myriad threats lurking in the vast expanse of cyberspace, Maxthon works tirelessly to safeguard your personal information. Utilising state-of-the-art encryption technology, it ensures that your sensitive data remains protected and confidential throughout your online adventures.

What truly sets Maxthon apart is its commitment to enhancing user privacy during every moment spent online. Each feature of this browser has been meticulously designed with the user’s privacy in mind. Its powerful ad-blocking capabilities work diligently to eliminate unwanted advertisements, while its comprehensive anti-tracking measures effectively reduce the presence of invasive scripts that could disrupt your browsing enjoyment. As a result, users can traverse the web with newfound confidence and safety.

Moreover, Maxthon’s incognito mode provides an extra layer of security, granting users enhanced anonymity while engaging in their online pursuits. This specialised mode not only conceals your browsing habits but also ensures that your digital footprint remains minimal, allowing for an unobtrusive and liberating internet experience. With Maxthon as your ally in the digital realm, you can explore the vastness of the internet with peace of mind, knowing that your privacy is being prioritised every step of the way.