Can you pay bills with prepaid cards? Yes, both prepaid debit cards and network-branded gift cards (Visa/Mastercard) can be used to pay bills, provided there are sufficient funds loaded on the card.

How it works: The card’s processor (Visa, MasterCard, Discover, or American Express) determines acceptance. If the processor is accepted by the company you’re paying, you can typically make payments online, by phone, or through mail-in forms.

Where to get them: Prepaid debit cards are available at retail stores like Walmart, Target, and Walgreens, or can be purchased online. Some tax preparation services also offer prepaid cards for tax refunds.

Special features: Some cards offer additional services, such as bill payment portals through the issuer’s website, card-to-card transfers within the same network, or integration with money transfer services like Western Union.

Limitations: You can only spend what’s loaded on the card (no borrowing), and prepaid card activity doesn’t build credit history since it’s not reported to credit agencies.

Prepaid Cards: In-Depth Analysis with Singapore Market Impact

Executive Summary

Prepaid cards represent a significant segment of the global payments ecosystem, offering financial inclusion, convenience, and security benefits. Singapore’s approach to prepaid card regulation and adoption provides valuable insights into how developed economies can leverage these instruments while maintaining robust financial oversight.

Global Prepaid Card Market Overview

Market Size and Growth

- Global prepaid card market valued at approximately $2.3 trillion in transaction volume (2023)

- Expected CAGR of 12-15% through 2028

- Open-loop cards (network-branded) are dominating growth over closed-loop cards

- Digital and mobile-first prepaid solutions are driving innovation

Key Market Drivers

- Financial Inclusion: Serving unbanked and underbanked populations

- Digital Transformation: Integration with mobile wallets and apps

- Corporate Expense Management: B2B adoption for employee benefits and expenses

- Regulatory Compliance: KYC/AML requirements driving legitimate usage

- Cross-border Payments: Multi-currency and international usage capabilities

Types of Prepaid Cards

1. Open-Loop Cards (Network-Branded)

- Visa/Mastercard/American Express: Accepted globally wherever the network is supported

- Reloadable: Can be topped up multiple times.

- Features: Online account management, direct deposit, and bill pay capabilities

- Use Cases: Salary payments, government benefits, general spending

2. Closed-Loop Cards (Store-Specific)

- Single Merchant: Limited to a specific retailer or service provider

- Gift Cards: Popular for gifting and promotional purposes

- Loyalty Integration: Often combined with rewards programs

- Examples: Starbucks cards, Amazon gift cards, mall gift cards

3. Semi-Closed Loop Cards

- Limited Network: Accepted at multiple merchants within specific categories

- Regional Focus: Often geographically or sector-restricted

- Examples: Transit cards, university campus cards, healthcare payment cards

Singapore’s Prepaid Card Landscape

Regulatory Framework

Monetary Authority of Singapore (MAS) Oversight

- Payment Services Act 2019: Comprehensive regulation of payment services

- E-money License Requirements: Stricter oversight for stored value facilities

- Consumer Protection: Enhanced safeguards for prepaid cardholders

- Anti-Money Laundering: Robust KYC requirements for high-value cards

Key Regulatory Features

- Stored Value Facility License: Required for prepaid card issuers

- Safeguarding Requirements: Customer funds must be protected

- Transaction Limits: Caps on anonymous card usage

- Reporting Obligations: Regular reporting to MAS

- Consumer Rights: Clear disclosure and dispute resolution processes

Market Players and Ecosystem

Major Issuers

- Traditional Banks

- DBS Bank: DBS Visa Prepaid Card

- OCBC Bank: OCBC Prepaid Mastercard

- UOB Bank: UOB Prepaid Card solutions

- Fintech Companies

- YouTrip: Multi-currency prepaid card travellers

- Revolut: Digital banking with prepaid functionality

- Grab Financial: GrabPay Card integration

- Specialized Providers

- EZ-Link: Transit and retail payments

- NETS: Local payment network solutions

- Wirecard/Railsbank: White-label solutions for businesses

Market Characteristics

- High Digital Adoption: 89% smartphone penetration driving mobile-first solutions

- Government Support: Digital payment initiatives and a cashless society push

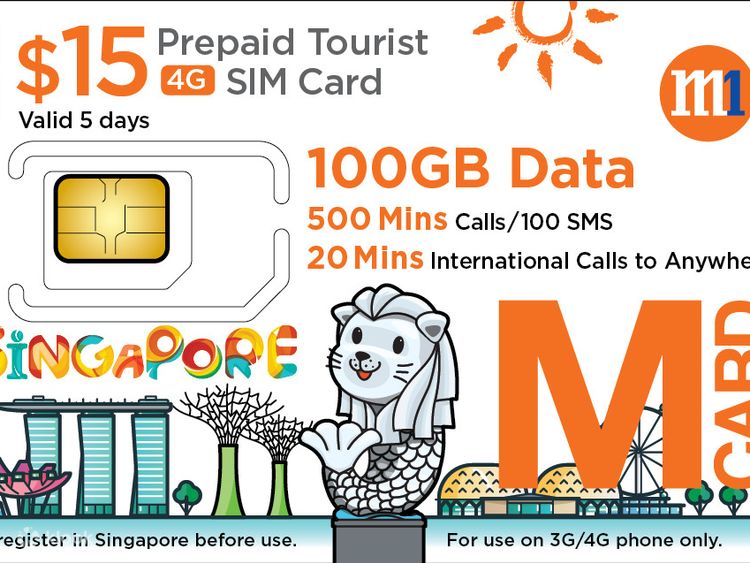

- Cross-border Focus: Strong emphasis on multi-currency and travel cards

- Corporate Adoption: Significant B2B usage for expense management

Singapore-Specific Use Cases

1. Multi-Currency Travel Cards

- YouTrip Model: Real-time exchange rates, multiple currency wallets

- Market Need: Frequent business and leisure travel

- Competitive Advantage: Lower FX fees compared to traditional credit cards

- Growth Driver: Post-pandemic travel recovery

2. Migrant Worker Remittances

- Target Market: 1.4 million foreign workers

- Value Proposition: Lower-cost remittance alternatives

- Regulatory Support: Financial Inclusion Initiatives

- Partnership Models: Collaboration with home country banks

3. Government Benefit Distribution

- Digital Vouchers: COVID-19 relief and economic stimulus

- Social Assistance: Prepaid cards for targeted welfare programs

- Efficiency Gains: Reduced administrative costs and fraud

- Financial Inclusion: Reaching Underserved Populations

4. Corporate Expense Management

- Employee Benefits: Flexible benefits administration

- Travel and Entertainment: Controlled spending with real-time monitoring

- Vendor Payments: B2B payment solutions

- Cost Control: Detailed reporting and spending limits

Economic and Social Impact in Singapore

Positive Impacts

Financial Inclusion

- Unbanked Population: Access to financial services without traditional banking

- Credit Building: Some prepaid cards offer pathways to credit products

- Digital Literacy: Encouraging adoption of digital payment methods

- Migrant Integration: Easier financial participation for foreign workers

Economic Benefits

- Payment Efficiency: Reduced cash handling costs for merchants

- Data Analytics: Rich transaction data for business insights

- Innovation Catalyst: Driving fintech ecosystem development

- Tourism Support: Enhanced visitor payment experience

Regulatory Advantages

- Financial Crime Prevention: Better transaction monitoring than cash

- Consumer Protection: Regulated environment with dispute resolution

- Market Competition: Increased competition in payment services

- Policy Tool: Government’s ability to deliver targeted economic support

Challenges and Risks

Consumer Risks

- Fee Structure: Multiple fees can erode the value proposition

- Fraud Vulnerability: Less protection than credit cards in some cases

- Technology Dependence: The Digital Divide Affecting Older Populations

- Limited Acceptance: Some merchants still don’t accept all prepaid cards

Regulatory Concerns

- Money Laundering: Potential for anonymous transactions

- Consumer Education: Need for better understanding of terms and conditions

- Market Concentration: Risk of dominant players reducing competition

- Cross-border Compliance: The Complexity of International Regulatory Requirements

Comparative Analysis: Singapore vs. Global Markets

Singapore Advantages

- Advanced Infrastructure: Robust digital payment infrastructure

- Regulatory Clarity: Clear and comprehensive regulatory framework

- Government Support: Active promotion of digital payments

- High Adoption: Tech-savvy population with high smartphone penetration

- Strategic Location: Hub for regional financial services

Areas for Improvement

- Merchant Acceptance: Still gaps in small merchant adoption

- Fee Transparency: Need for a clearer fee disclosure

- Interoperability: Better integration between different payment systems

- Financial Literacy: Enhanced consumer education programs

- Innovation Balance: Balancing innovation with consumer protection

Future Trends and Opportunities

Technological Innovation

- Blockchain Integration: Enhanced security and transparency

- AI-Powered Analytics: Better fraud detection and personalisation

- IoT Payments: Integration with smart devices and wearables

- Biometric Authentication: Enhanced security features

- Central Bank Digital Currency (CBDC): Potential integration with the digital Singapore dollar

Market Evolution

- Embedded Finance: Integration into non-financial platforms

- Sustainability Focus: Green payment solutions and carbon tracking

- B2B Growth: Expansion in corporate and institutional markets

- Cross-border Simplification: Simplified international payment solutions

- Open Banking: Integration with broader financial ecosystem

Regulatory Development

- International Standards: Alignment with global regulatory frameworks

- Real-time Monitoring: Enhanced transaction monitoring capabilities

- Consumer Protection: Strengthened safeguards and dispute resolution

- Innovation Sandboxes: Regulatory environments for testing new solutions

- Regional Harmonisation ASEAN-wide payment integration initiatives

Strategic Recommendations

For Regulators

- Balanced Oversight: Maintain an innovation-friendly environment while ensuring consumer protection

- International Cooperation: Strengthen cross-border regulatory coordination

- Digital Infrastructure: Continue investing in payment infrastructure

- Consumer Education: Enhance financial literacy programs

- Market Monitoring: Regular assessment of market competition and consumer outcomes

For Financial Institutions

- Digital-First Strategy: Prioritise mobile and digital-first solutions

- Partnership Models: Collaborate with fintechs and technology companies

- Value-Added Services: Go beyond basic prepaid functionality

- Customer Experience: Focus on seamless user experience and customer support

- Data Analytics: Leverage transaction data for better customer insights

for Businesses and Consumers

- Due Diligence: Carefully evaluate prepaid card terms and conditions

- Security Practices: Implement strong security measures and monitoring

- Cost Comparison: Compare fees and features across different providers

- Diversification: Don’t rely solely on prepaid cards for financial needs

- Stay Informed: Keep up with regulatory changes and new features

Conclusion

Singapore’s approach to prepaid cards demonstrates how developed economies can successfully integrate these payment instruments into their financial ecosystem while maintaining robust consumer protection and regulatory oversight. The city-state’s success in balancing innovation with regulation provides valuable lessons for other markets seeking to harness the benefits of prepaid cards while mitigating associated risks.

The future of prepaid cards in Singapore looks promising, with continued growth expected across consumer, business, and government use cases. Success will depend on maintaining the delicate balance between fostering innovation, ensuring consumer protection, and supporting broader financial inclusion objectives.

As the global payments landscape continues to evolve, Singapore’s experience with prepaid cards positions it well to remain a leading financial hub while serving as a model for other markets pursuing similar digital payment transformation initiatives.

Payment Services Act 2019: Comprehensive Review of Singapore’s Prepaid Card Regulatory Framework

Executive Summary

The Payment Services Act 2019 (PSA) represents Singapore’s landmark legislation governing prepaid cards and broader payment services. This comprehensive review examines the Act’s provisions, implementation impact, and transformative effects on Singapore’s prepaid card ecosystem. The PSA has successfully balanced innovation with consumer protection while establishing Singapore as a global leader in payment services regulation.

Background and Legislative Context

Pre-PSA Regulatory Landscape

Fragmented Oversight (Pre-2019)

- Multiple Regulators: Different payment services are regulated by various authorities

- Regulatory Gaps: Emerging payment technologies lacked apparent oversight

- Limited Consumer Protection: Insufficient safeguards for prepaid card users

- Compliance Complexity: Inconsistent regulatory requirements across payment types

- Innovation Constraints: Unclear regulatory pathways for new payment services

Key Drivers for Reform

- Technological Disruption: Rise of fintech and digital payment innovations

- Consumer Protection Needs: Growing prepaid card usage requires enhanced safeguards

- International Standards: Need to align with global regulatory best practices

- Market Development: Supporting Singapore’s ambition as a fintech hub

- Financial Crime Prevention: Strengthening AML/CFT frameworks

Legislative Development Process

Consultation and Stakeholder Engagement (2017-2018)

- Industry Consultation: Extensive engagement with payment service providers

- Public Feedback: Open consultation periods for market participants

- International Benchmarking: Analysis of global regulatory frameworks

- Technology Assessment: Evaluation of emerging payment technologies

- Risk Analysis: Comprehensive assessment of consumer and systemic risks

Parliamentary Process (2018-2019)

- First Reading: January 2019 – Introduction of Payment Services Bill

- Second Reading: February 2019 – Detailed parliamentary debate

- Committee Stage: Technical amendments and refinements

- Third Reading: February 2019 – Final approval

- Royal Assent: January 28, 2019 – Enactment of Payment Services Act

Payment Services Act 2019: Detailed Analysis

Scope and Definitions

Regulated Payment Services

- Account Issuance Service: Issuing payment accounts for electronic money transactions

- Domestic Money Transfer Service: Facilitating fund transfers within Singapore

- Cross-Border Money Transfer Service: International remittance services

- Merchant Acquisition Service: Enabling merchants to accept electronic payments

- E-Money Issuance Service: Issuing stored value instruments (including prepaid cards)

- Digital Payment Token Service: Cryptocurrency and digital asset services

- Money-Changing Service: Currency exchange services

Prepaid Card Specific Provisions

- E-Money Definition: Electronically stored monetary value representing a claim on the issuer

- Stored Value Facility: Any arrangement for issuing e-money exceeding prescribed thresholds

- Prepaid Card Classification: CaCategorisednder e-money issuance services

- Threshold Limits: Specific limits for different types of prepaid arrangements

Licensing Framework

License Categories for Prepaid Cards

1. E-Money Issuance License

Requirements:

- Minimum paid-up capital: S$1 million

- Fit and proper assessments for key personnel

- Comprehensive business plans and risk management frameworks

- Safeguarding requirements for customer funds

- Regulatory capital requirements

Scope:

- Issuing prepaid cards with stored value exceeding S$5,000 per card

- Offering reloadable prepaid card services

- Providing corporate prepaid card solutions

- Cross-border prepaid card services

2. Minor Payment Institution License

Requirements:

- Lower capital requirements for smaller operations

- Simplified licensing process for limited scope operations

- Basic safeguarding and risk management requirements

- Restricted transaction limits and business scope

Scope:

- Prepaid cards with limited stored value (up to S$5,000)

- Basic prepaid card services for specific use cases

- Limited geographic or sectoral operations

3. Standard Payment Institution License

Requirements:

- Minimum paid-up capital: S$250,000

- Comprehensive regulatory compliance framework

- Enhanced safeguarding requirements

- Detailed reporting obligations

Scope:

- Full range of prepaid card services below major institution thresholds

- Domestic and limited cross-border operations

- Corporate and consumer prepaid card solutions

Exempt Activities

- Low-Value Prepaid Cards: Cards with stored value below S$100

- Single-Purpose Cards: Closed-loop cards for specific merchants

- Limited Network Cards: Cards accepted only at affiliated merchants

- Transit Cards: Public transportation payment cards with specific exemptions

Consumer Protection Provisions

Safeguarding Requirements

Customer Fund Protection

- Segregation: Customer funds must be held separately from the issuer’s funds

- Trust Arrangements: Funds held in trust for customer benefit

- Insurance Coverage: Minimum insurance requirements for customer fund protection

- Bank Guarantees: Alternative safeguarding mechanisms for smaller issuers

- Investment Restrictions: Limits on how customer funds can be invested

Operational Safeguards

- System Security: Robust cybersecurity and data protection requirements

- Business Continuity: Comprehensive disaster recovery and business continuity plans

- Outsourcing Oversight: Strict requirements for third-party service providers

- Audit Requirements: Regular independent audits of safeguarding arrangements

- Reporting Obligations: Detailed reporting on safeguarding compliance

Consumer Rights and Protections

Transparency Requirements

- Fee Disclosure: Clear and comprehensive fee schedules

- Terms and Conditions: Plain language terms and conditions

- Risk Warnings: Appropriate risk disclosures for consumers

- Usage Limitations: A Clear explanation of card limitations and restrictions

- Expiry Policies: Transparent policies on card expiry and fund recovery

Dispute Resolution

- Internal Procedures: Mandatory internal dispute resolution processes

- External Mediation: Access to independent dispute resolution mechanisms

- Complaint Handling: Standardised complaint handling procedures

- Compensation Frameworks: Clear compensation arrangements for consumer losses

- Regulatory Escalation: Pathways for regulatory intervention in serious cases

Anti-Money Laundering and Counter-Terrorism Financing

Customer Due Diligence Requirements

Know Your Customer (KYC) Obligations

- Identity Verification: Mandatory identity verification for prepaid card registration

- Transaction Monitoring: Ongoing monitoring of prepaid card transactions

- Suspicious Activity Reporting: Mandatory reporting of suspicious transactions

- Record Keeping: Comprehensive record-keeping requirements

- Risk Assessment: Regular customer risk assessments

Transaction Limits and Controls

- Anonymous Cards: Strict limits on anonymous prepaid card usage

- Daily Limits: Maximum daily transaction limits for different card types

- Cumulative Limits: Annual cumulative transaction limits

- Cross-Border Restrictions: Enhanced controls for international transactions

- High-Risk Monitoring: Additional monitoring for high-risk transactions

Regulatory Oversight and Enforcement

Monetary Authority of Singapore (MAS) Powers

Supervisory Authority

- Licensing Decisions: Authority to grant, vary, or revoke licenses

- Regulatory Guidance: Issuance of detailed regulatory guidance and circulars

- Inspections: Power to conduct on-site inspections and examinations

- Information Gathering: Authority to require information and documents

- Market Surveillance: Ongoing monitoring of market developments

Enforcement Powers

- Civil Penalties: Authority to impose financial penalties for violations

- Criminal Sanctions: Criminal penalties for serious offences

- License Revocation: Power to revoke licenses for serious breaches

- Injunctive Relief: Court orders to prevent or remedy violations

- Asset Freezing: Powers to freeze assets in cases of financial crime

Compliance and Reporting Requirements

Regular Reporting

- Financial Reports: Quarterly and annual financial reporting requirements

- Operational Reports: Regular reporting on operational metrics and incidents

- Compliance Attestations: Annual compliance certifications

- Risk Assessments: Regular risk assessment submissions

- Customer Complaints: Reporting on customer complaints and resolutions

Ad Hoc Reporting

- Material Changes: Reporting of significant changes to business or operations

- Incidents: Immediate reporting of security breaches or operational incidents

- Regulatory Breaches: Self-reporting of regulatory violations

- Customer Impact: Reporting of events affecting customer interests

- Systemic Risks: Reporting of potential systemic risk issues

Implementation Impact and Market Transformation

Industry Restructuring

Market Consolidation

- License Compliance: Smaller players are unable to meet licensing requirements

- Strategic Partnerships: Increased collaboration between fintech and traditional institutions

- Technology Investment: Significant investment in compliance and regulatory technology

- Operational Changes: Restructuring of business models to meet regulatory requirements

- Market Exit: Some players are exiting the market due to compliance costs

New Market Entrants

- International Players: Attraction of international payment service providers

- Fintech Innovation: Continued innovation within the regulatory framework

- Banking Partnerships: Traditional banks entering the prepaid card market

- Technology Providers: Growth in regulatory technology and compliance services

- Specialised providers: Emergence of niche prepaid card service providers

Consumer Benefits

Enhanced Protection

- Fund Security: Improved security of customer funds through safeguarding requirements

- Transparent Pricing: Clearer fee structures and pricing transparency

- Dispute Resolution: Better access to dispute resolution mechanisms

- Regulatory Oversight: Enhanced regulatory oversight and consumer protection

- Market Confidence: Increased consumer confidence in prepaid card services

Improved Services

- Innovation: Continued innovation in prepaid card features and services

- Competition: Increased competition leading to better products and pricing

- Accessibility: Improved access to prepaid card services for underserved populations

- Digital Integration: Better integration with digital payment ecosystems

- Cross-Border Services: Enhanced cross-border prepaid card capabilities

Regulatory Effectiveness

Compliance Achievement

- High Compliance Rates: Generally, high compliance rates across the industry

- Reduced Financial Crime: Improved AML/CFT compliance and reduced financial crime

- Consumer Complaints: Reduced consumer complaints and improved resolution

- Market Stability: Enhanced market stability and reduced systemic risks

- International Recognition: International recognition of Singapore’s regulatory framework

Ongoing Challenges

- Compliance Costs: High compliance costs for smaller providers

- Innovation Balance: Balancing innovation with regulatory requirements

- International Coordination: Challenges in Cross-Border Regulatory Coordination

- Technology Evolution: Keeping pace with rapidly evolving payment technologies

- Market Dynamics: Managing evolving market dynamics and competitive pressures

Comparative International Analysis

Global Regulatory Benchmarking

European Union – PSD2

Similarities:

- Comprehensive payment services regulation

- Strong consumer protection provisions

- Licensing framework for payment institutions

- AML/CFT requirements

Differences:

- Singapore’s more prescriptive approach to safeguarding

- Different licensing thresholds and categories

- Varying approaches to cross-border services

- Different enforcement mechanisms

United Kingdom – PSRs 2017

Similarities:

- Risk-based approach to regulation

- Consumer protection focus

- Licensing framework for payment institutions

- Strong regulatory oversight

Differences:

- Singapore’s more detailed safeguarding requirements

- Different approach to small payment institutions

- Varying treatment of e-money institutions

- Different dispute resolution mechanisms

United States – State-Based Regulation

Similarities:

- Consumer protection focus

- AML/CFT requirements

- Licensing requirements for money transmitters

- Regular reporting obligations

Differences:

- Singapore’s unified federal approach vs. US state-by-state regulation

- More comprehensive safeguarding requirements in Singapore

- Different approaches to innovation and fintech regulation

- Varying enforcement mechanisms and penalties

Singapore’s Competitive Advantages

Regulatory Clarity

- Comprehensive Framework: Single, comprehensive regulatory framework

- Clear Guidance: Detailed regulatory guidance and interpretation

- Consistent Application: Consistent regulatory application across the market

- Predictable Outcomes: Predictable regulatory decision-making process

- International Standards: Alignment with international regulatory standards

Innovation Support

- Regulatory Sandbox: Supportive environment for fintech innovation

- Proportionate Regulation: Risk-based and proportionate regulatory approach

- Technology Neutrality: Technology-neutral regulatory framework

- Industry Engagement: Regular engagement with industry stakeholders

- Adaptive Regulation: Ability to adapt to evolving market conditions

Current Market Landscape (2019-2025)

Licensed Prepaid Card Providers

Major Licensed Institutions

- DBS Bank: Comprehensive prepaid card services under a banking license

- OCBC Bank: Corporate and consumer prepaid card solutions

- UOB Bank: Travel and corporate prepaid card services

- YouTrip: Major Payment Institution License for multi-currency prepaid cards

- Revolut: International fintech with a Singapore payment institution license

Market Segments

- Travel Cards: Multi-currency prepaid cards for frequent travellers

- Corporate Cards: Employee expense management and benefits administration

- Remittance: Prepaid cards for migrant worker remittances

- Government Benefits: Distribution of government benefits and vouchers

- Retail Payments: General-purpose prepaid cards for everyday use

Regulatory Developments Post-PSA

MAS Guidance and Circulars

- Safeguarding Guidelines: Detailed guidance on customer fund safeguarding

- AML/CFT Requirements: Comprehensive AML/CFT guidance for payment institutions

- Operational Risk Management: Guidelines oOperational Risk Managementnt

- Technology Risk Management: Guidance on cybersecurity and technology risk

- Consumer Protection: Detailed consumer protection requirements

Market Conduct Initiatives

- Fair Dealing: Requirements for fair dealing with customers

- Complaint Handling: SStandardisedcomplaint handling procedures

- Disclosure Requirements: Enhanced disclosure requirements for fees and terms

- Advertising Standards: Guidelines for marketing and advertising practices

- Data Protection: Enhanced data protection requirements

Challenges and Future Outlook

Implementation Challenges

Compliance Costs

- Regulatory Burden: High compliance costs for smaller providers

- Technology Investment: Significant investment in compliance technology

- Professional Services: Increased demand for regulatory and compliance services

- Ongoing Costs: Continuous compliance and reporting obligations

- Competitive Impact: Potential impact on market competition

Operational Challenges

- System Integration: Challenges in Integrating Compliance Systems

- Staff Training: Need for extensive staff training on regulatory requirements

- Process Changes: Significant changes to operational processes

- Vendor Management: Enhanced oversight of third-party service providers

- Risk Management: Implementation of comprehensive risk management frameworks

Future Regulatory Developments

Potential Amendments

- Digital Currency Integration: Potential integration of central bank digital currency

- Cross-Border Harmonisation: Enhanced cross-border regulatory coordination

- Innovation Support: Additional support for fintech innovation

- Consumer Protection: Further enhancements to consumer protection provisions

- Sustainability: Integration of ESG considerations into the regulatory framework

Emerging Challenges

- Cryptocurrency Integration: Regulation of cryptocurrency-linked prepaid cards

- Open Banking: Integration with open banking initiatives

- Artificial Intelligence: Regulation of AI-powered payment services

- Cybersecurity: Enhanced cybersecurity requirements

- Data Privacy: Strengthened data privacy and protection requirements

Strategic Recommendations

For Regulators

Continuous Improvement

- Regular Review: Periodic review and update of the regulatory framework

- Industry Consultation: Ongoing consultation with industry stakeholders

- International Cooperation: Enhanced international regulatory cooperation

- Technology Monitoring: Continuous monitoring of technological developments

- Risk Assessment: Regular assessment of emerging risks and threats

Innovation Support

- Regulatory Sandbox: Expansion and enhancement of the regulatory sandbox

- Guidance Development: Development of detailed regulatory guidance

- Stakeholder Engagement: Regular engagement with industry and consumers

- Capacity Building: Investment in regulatory capacity and expertise

- Market Development: Support for market development and competition

For Industry Participants

Compliance Excellence

- Proactive Compliance: Proactive approach to regulatory compliance

- Risk Management: Comprehensive risk management frameworks

- Technology Investment: Investment in compliance and regulatory technology

- Staff Development: Continuous training and development of staff

- Third-Party Management: Enhanced oversight of third-party service providers

Strategic Positioning

- Market Differentiation: Development of differentiated product offerings

- Customer Experience: Focus on customer experience and satisfaction

- Innovation: Continued innovation within the regulatory framework

- Partnerships: Strategic partnerships with other industry participants

- International Expansion: Consideration of international expansion opportunities

For Consumers

Informed Decision-Making

- Product Comparison: Careful comparison of prepaid card products and services

- Fee Awareness: Understanding of fees and charges associated with prepaid cards

- Risk Understanding: Awareness of risks associated with prepaid card usage

- Rights Knowledge: Understanding of consumer rights and protections

- Complaint Mechanisms: Knowledge of available complaint and dispute resolution mechanisms

Conclusion

The Payment Services Act 2019 represents a watershed moment in Singapore’s financial services regulation. It establishes a comprehensive and forward-looking framework for prepaid cards and broader payment services. The Act has successfully balanced the dual objectives of fostering innovation and ensuring robust consumer protection, positioning Singapore as a global leader in payment services regulation.

The implementation of the PSA has transformed Singapore’s prepaid card landscape, driving market consolidation, enhancing consumer protection, and supporting continued innovation. While challenges remain, particularly around compliance costs and the need to balance regulation with innovation, the overall impact has been positive, contributing to Singapore’s reputation as a leading fintech hub.

Looking ahead, the PSA provides a solid foundation for future developments in Singapore’s payment services sector. Continued regulatory refinement, enhanced international cooperation, and support for innovation will be key to maintaining Singapore’s competitive position in the global payments landscape.

The success of the PSA demonstrates that well-designed regulation can effectively support market development while protecting consumers and maintaining financial stability. Singapore’s experience provides valuable lessons for other jurisdictions seeking to develop comprehensive payment services regulation in an increasingly digital and interconnected world.

The Journey of Maya’s Multi-Currency Card

Maya Chen stared at her phone screen as the notification popped up: “Your YouTrip card has been topped up with S$2,000.” Tomorrow, she would embark on her most ambitious business trip yet—three countries in two weeks, closing deals that could make or break her startup’s expansion into Southeast Asia.

As a 28-year-old entrepreneur running a sustainable fashion brand from her Tiong Bahru studio, Maya had learned to be resourceful. Traditional corporate credit cards with their hefty foreign exchange fees and complex expense reporting were luxuries her bootstrapped company couldn’t afford. That’s when her mentor, Uncle Lim, suggested the prepaid card route.

“Maya, ah, you young people are so smart with technology, but sometimes forget the simple solutions,” he chuckled over kopi at their weekly catch-up. My son, who works in Bangkok, uses one of these multi-currency cards. No more getting cheated by money changers.”

The Discovery

Three months earlier, Maya had walked into the Monetary Authority of Singapore’s consumer education booth at the Singapore FinTech Festival. The friendly representative, Sarah, had explained how the Payment Services Act 2019 had transformed the prepaid card landscape.

“See, before 2019, prepaid cards were like the Wild West,” Sarah had explained, gesturing toward a colourful infographic. “Now, every provider needs proper licensing. Your money is protected, transaction limits are clear, and if something goes wrong, you have proper recourse.”

Maya had been intrigued but sceptical. “But what about those horror stories? Cards getting blocked overseas, money disappearing?”

“That’s exactly what the new regulations prevent,” Sarah replied. Licensed providers like YouTrip, Revolut, or even the bank-issued ones—they all have to follow strict safeguarding rules. Your money is held in trust, separated from the company’s funds. If the company goes bust, your money is still protected.”

The booth visit had sparked Maya’s research journey. She’d spent evenings comparing different options: traditional bank prepaid cards with their familiar but expensive fee structures, sleek fintech offerings with competitive rates but newer track records. She specialised in ones designed for frequent flyers like herself.

The Choice

Maya ultimately chose YouTrip, drawn by its multi-currency wallet feature and real-time exchange rates. But the decision wasn’t just about convenience—it was about trust in Singapore’s regulatory framework.

“I called MAS directly,” she later told her business partner, Jin Wei. “Can you believe they actually answered and explained how the licensing works? The customer service officer walked me through the safeguarding requirements, the complaint processes, and even how the deposit insurance works.”

The onboarding process had been surprisingly thorough. Maya had to provide her NRIC, employment details, and even explain the source of her funding. “Know Your Customer requirements,” the YouTrip representative had explained apologetically. “Part of the Payment Services Act. Better safe than sorry when it comes to money laundering prevention.”

Maya hadn’t minded the extra steps. If anything, it made her more confident in her choice.

The First Test: Jakarta

Her first international transaction came sooner than expected. A last-minute supplier meeting in Jakarta meant Maya needed to travel with just two days’ notice. She loaded her Indonesian Rupiah wallet with S$500 equivalent and nervously made her first overseas purchase—a grab-taxi from Soekarno-Hatta Airport.

The transaction went through seamlessly. There were no international fees or currency conversion charges beyond the mid-market rate, and she received an instant notification on her phone showing both the Rupiah amount and the Singapore dollar equivalent.

“Wah, like magic sia,” she WhatsApped her best friend, Priya. “Uncle Lim was right. This is so much better than my previous corporate card.”

But the real test came when she tried to pay a local fabric supplier who only accepted cash. Maya found an ATM and withdrew 2 million Rupiah—about S$180. The withdrawal went through, but she noticed a small fee. Later, checking her app, she realised she’d exceeded her daily withdrawal limit and triggered a penalty fee.

“Lesson learned,” she noted in her travel journal. “Read the fine print about withdrawal limits.”

Maxthon

In an age where the digital world is in constant flux and our interactions online are ever-evolving, the importance of prioritising individuals as they navigate the expansive internet cannot be overstated. The myriad of elements that shape our online experiences calls for a thoughtful approach to selecting web browsers—one that places a premium on security and user privacy. Amidst the multitude of browsers vying for users’ loyalty, Maxthon emerges as a standout choice, providing a trustworthy solution to these pressing concerns, all without any cost to the user.

Maxthon, with its advanced features, boasts a comprehensive suite of built-in tools designed to enhance your online privacy. Among these tools are a highly effective ad blocker and a range of anti-tracking mechanisms, each meticulously crafted to fortify your digital sanctuary. This browser has carved out a niche for itself, particularly with its seamless compatibility with Windows 11, further solidifying its reputation in an increasingly competitive market.

In a crowded landscape of web browsers, Maxthon has forged a distinct identity through its unwavering dedication to offering a secure and private browsing experience. Fully aware of the myriad threats lurking in the vast expanse of cyberspace, Maxthon works tirelessly to safeguard your personal information. Utilising state-of-the-art encryption technology, it ensures that your sensitive data remains protected and confidential throughout your online adventures.

What truly sets Maxthon apart is its commitment to enhancing user privacy during every moment spent online. Each feature of this browser has been meticulously designed with the user’s privacy in mind. Its powerful ad-blocking capabilities work diligently to eliminate unwanted advertisements, while its comprehensive anti-tracking measures effectively reduce the presence of invasive scripts that could disrupt your browsing enjoyment. As a result, users can traverse the web with newfound confidence and safety.

Moreover, Maxthon’s incognito mode provides an extra layer of security, granting users enhanced anonymity while engaging in their online pursuits. This specialised mode not only conceals your browsing habits but also ensures that your digital footprint remains minimal, allowing for an unobtrusive and liberating internet experience. With Maxthon as your ally in the digital realm, you can explore the vastness of the internet with peace of mind, knowing that your privacy is being prioritised every step of the way.