BOJ’s Strategic Transition: From Bank Stock Offloading to ETF Focus

The Scale and Significance of BOJ’s ETF Holdings

The completion of the BOJ’s bank stock sales marks a pivotal moment in Japan’s monetary policy normalization. The BOJ holds the equivalent of about 7% of the Japanese stock market via ETFs What Will the BOJ Do With Its $475 Billion ETF Hoard?, representing approximately ¥70 trillion ($475 billion) What Will the BOJ Do With Its $475 Billion ETF Hoard? in assets. This makes the BOJ’s ETF holdings 15 times larger than the bank shares it just finished offloading, underscoring the magnitude of the challenge ahead.

The BOJ holds approximately 60% of the ETF market, making the BOJ the top shareholder of more than 55 companies in the Nikkei’s 225 companies The BOJ’s ETF purchases and its effects on Nikkei 225 stocks – ScienceDirect. This unprecedented central bank intervention has fundamentally altered Japan’s equity market structure.

Timeline and Market Impact Implications

The bank stock offloading took nearly 18 years to complete, selling at roughly ¥10 billion per month. If applied to ETF holdings, it would take more than 200 years to completely offload the far larger ETF holdings. However, Goldman Sachs economists suggest it’s reasonable to expect the bank to start gradually selling ETFs in fiscal 2026, indicating a much more accelerated timeline.

Strategic Considerations for ETF Unwinding

The BOJ faces several complex considerations:

- Financial Incentives to Delay: The bank earned ¥1.4 trillion in revenue from ETF dividends in the fiscal year ended in March 2025, providing substantial support for BOJ finances as interest costs rise with rate hikes.

- Market Stability Concerns: The simultaneous sale of multiple asset types could create excessive market volatility, which is why completing bank stock sales first was strategically important.

- Policy Flexibility: Governor Ueda has maintained optionality, not ruling out holding ETFs indefinitely while also acknowledging the need for eventual normalization.

In-Depth Impact Analysis on Singapore

Direct Financial Market Implications

1. Regional Liquidity Flows Singapore’s role as a regional financial hub means it will experience significant capital flow effects from BOJ ETF unwinding:

- Increased Volatility: As the BOJ reduces its market-stabilizing presence in Japanese equities, regional risk premiums will likely increase, affecting Singapore’s market volatility

- Flight-to-Quality: Singapore’s well-regulated financial system and stable currency could attract capital diverted from potentially more volatile Japanese markets

- ETF Market Development: Singapore’s growing ETF market could benefit from institutional investors seeking alternatives to Japanese ETFs

2. Currency and Monetary Policy Spillovers

- SGD Strengthening Pressure: Reduced BOJ intervention could lead to yen appreciation, potentially weakening the SGD’s competitiveness

- MAS Policy Considerations: The Monetary Authority of Singapore may need to adjust its exchange rate policy framework to account for changing regional monetary dynamics

Sectoral Impact on Singapore’s Economy

1. Financial Services Sector Singapore’s financial sector will experience both opportunities and challenges:

- Wealth Management: Private banking and asset management firms in Singapore could see increased flows as Japanese institutional investors diversify holdings

- Trading Infrastructure: Singapore’s position as a trading hub for Asian equities will become more critical as market-making becomes less dominated by BOJ purchases

- Fintech and Digital Assets: Reduced central bank intervention may accelerate adoption of alternative investment platforms

2. Real Estate and Property Markets

- Commercial Real Estate: Potential for increased Japanese investment in Singapore commercial properties as institutions seek yield alternatives

- REIT Markets: Singapore’s mature REIT sector could attract Japanese pension funds and insurance companies seeking stable income streams

Strategic Economic Implications

1. Trade and Investment Flows Countries like Indonesia, Malaysia, Singapore, Thailand, Vietnam and Cambodia are expected to see the growth momentum continue into 2025 The announcement effects of a change in the Bank of Japan’s ETF purchase program: An event study – ScienceDirect, but BOJ policy changes will create new dynamics:

- Japanese Corporate Investment: Reduced domestic equity market support may push Japanese companies to increase overseas investments, potentially benefiting Singapore’s manufacturing and services sectors

- Supply Chain Repositioning: Changes in Japanese capital allocation could affect regional supply chain structures, with Singapore potentially benefiting from its strategic location

2. Competitive Positioning Singapore’s financial market infrastructure will need to adapt to a more volatile regional environment:

- Market Making Capabilities: Enhanced importance of private market makers as central bank support diminishes

- Risk Management: Financial institutions will need more sophisticated risk management tools for Japanese exposure

- Regulatory Framework: MAS may need to enhance surveillance and stability mechanisms for cross-border financial flows

Long-term Structural Changes

1. Regional Financial Integration The BOJ’s ETF unwinding will likely accelerate trends toward:

- Market-Based Pricing: More efficient price discovery mechanisms across Asian markets

- Increased Correlation: Higher volatility correlation between Japanese and regional markets

- Institutional Development: Greater emphasis on developing domestic institutional investor bases

2. Innovation and Adaptation Singapore’s financial sector will need to innovate:

- Alternative Investment Products: Development of new investment vehicles to capture changing Japanese capital flows

- Technology Infrastructure: Enhanced trading and settlement systems to handle increased regional volatility

- Talent Development: Specialized expertise in managing relationships with Japanese institutional investors

Risk Mitigation Strategies for Singapore

- Diversification Imperative: Reducing dependence on any single regional market or central bank policy

- Enhanced Surveillance: Strengthening early warning systems for regional financial instability

- Institutional Strengthening: Building deeper local institutional investor capacity

- Policy Coordination: Closer cooperation with regional central banks and regulators

The BOJ’s transition from bank stock sales to ETF focus represents a fundamental shift in Asian financial markets. For Singapore, this creates both significant opportunities as a regional financial hub and challenges requiring proactive adaptation of its financial infrastructure and regulatory framework. The key will be positioning Singapore to capture beneficial capital flows while maintaining market stability during this period of regional monetary policy normalisation.

Warren Buffett’s Bank Stock Offloading: Strategic Rationale

Scale and Timing of Buffett’s Bank Divestiture

Buffett has sold shares of Bank of America for three straight quarters — and profit-taking might not be the only reason behind this persistent selling activity Japan stocks could grow more volatile with end of BOJ ETF purchases – Nikkei Asia. Berkshire has significantly reduced its exposure to banks recently, selling shares of four of the six during the fourth quarter of 2024 Bank of Japan’s Exchange-Traded Fund Purchases as an Unprecedented Monetary Easing Policy | Asian Development Bank, while building a record $325 billion cash position The BOJ’s ETF purchases and its effects on Nikkei 225 stocks – ScienceDirect.

Buffett’s Strategic Concerns About Banking Sector

1. Anticipating Market Turmoil Heading into potential market turmoil, Buffett likely wanted to reduce his exposure to any downdraft BOJ’s Absence in ETFs Seen as Step to Healthier Stock Market – Bloomberg. This suggests Buffett sees systemic risks in the banking sector that could amplify during broader market stress.

2. Lack of Compelling Investment Opportunities “You can make the case that [Buffett] thinks that there aren’t that many great opportunities,” Japan – BOJ Holdings of ETFs | MacroMicro indicating that even banking stalwarts may not offer the value proposition they once did.

3. Structural Industry Challenges Buffett’s decision to reduce his stake in Bank of America is drawing interest due to concerns about the financial management and future prospects of banks across the industry What Will the BOJ Do With Its $475 Billion ETF Hoard?, marking a notable shift from his historically bullish stance on banking.

Bank of Japan’s Bank Stock Offloading: Policy Normalization

Historical Context and Rationale

The BOJ’s bank stock sales represent a fundamentally different motivation than Buffett’s. Between 2002 and 2010, the BOJ acquired about ¥2.4 trillion ($16.3 billion) of bank stocks as emergency crisis response measures during:

- The domestic banking crisis of the early 2000s

- The aftermath of the Lehman Shock

The completion of these sales represents successful policy normalization rather than a negative outlook on banking fundamentals.

Strategic Policy Objectives

1. Financial System Stabilization Success Governor Ueda noted that the bank stock buying initiative “fulfilled the intended objective” of stabilizing the financial system without causing “negative market impact or financial loss.”

2. Preparing for ETF Unwinding Completing bank stock sales removes potential market confusion and reduces the risk of simultaneous asset sales that could destabilize markets.

Convergent Implications for the Banking Sector

Immediate Market Dynamics

1. Reduced Institutional Support Both Buffett’s divestiture and BOJ’s completion of bank stock sales remove significant institutional support from banking stocks globally:

- Price Discovery: Markets must now price bank stocks without these major supportive buyers

- Volatility Increase: Reduced institutional backing likely increases price volatility

- Liquidity Concerns: Fewer large-scale, patient buyers may reduce market liquidity

2. Signaling Effects The convergence of these two major institutional moves sends powerful signals:

- Quality Concerns: Buffett’s reputation for long-term value investing makes his banking exit particularly meaningful

- Policy Normalization: BOJ’s successful exit suggests financial systems are stable enough to operate without central bank equity support

Structural Industry Challenges Revealed

1. Interest Rate Environment Pressures 2025 US bank net interest income is projected to increase 5.7% year on year, according to S&P Capital Global Market Intelligence, a step up from essentially no growth last year 10 Stocks Warren Buffett Just Bought and Sold | Investing | U.S. News, but this modest growth masks underlying challenges:

A sharp increase in interest rates can significantly reduce the market value of fixed-rate, long-dated bank assets Warren Buffett’s 2025 Portfolio: What Stocks He’s Betting Big On Right Now, creating hidden balance sheet stress that sophisticated investors like Buffett recognize.

2. Regulatory and Competitive Pressures Key issues such as cybersecurity threats, environmental concerns, and the rise of FinTech competition necessitate that banks adopt proactive strategies to ensure compliance and resilience ASEAN Capital Markets – 2024 Recap and 2025 Outlook, increasing operational costs and reducing profitability margins.

Profitability Dynamics Under Pressure

1. Complex Interest Rate Effects While higher interest rates typically result in increased loan costs, affecting consumer borrowing and spending The announcement effects of a change in the Bank of Japan’s ETF purchase program: An event study – ScienceDirect, the relationship is more complex:

- Asset-Liability Mismatch: Banks holding long-term, fixed-rate assets face valuation pressure

- Credit Risk: Higher rates increase default probabilities, requiring higher provisions

- Funding Cost Pressures: Competition for deposits intensifies as rates rise

2. Margin Compression Risks Bank profitability in many regions will be tested in 2024 due to higher funding costs and sluggish revenue growth Warren Buffett Just Sold 4 Bank Stocks, but Hasn’t Unloaded a Single Share of These 2 @themotleyfool #stocks $AXP $BRK.A $COST $AAPL $BRK.B $C $BAC $COF $ALLY $NU, suggesting the industry faces a prolonged period of margin pressure.

Deep Sectoral Implications

Differentiated Impact Across Banking Segments

1. Large Money Center Banks

- Greater Scrutiny: Buffett’s divestiture particularly affects large institutions like Bank of America and Citigroup

- Regulatory Burden: Larger banks face disproportionate regulatory costs and capital requirements

- Systemic Risk Premium: Markets may demand higher risk premiums for systemically important banks

2. Regional and Community Banks

- Relative Beneficiaries: May benefit from reduced competition as large banks face pressure

- Interest Rate Sensitivity: Smaller banks with simpler business models may navigate rate changes more effectively

- Local Market Advantages: Community banking relationships may prove more resilient

3. Investment Banking and Trading Operations

- Volatility Opportunity: Increased market volatility from reduced institutional support may benefit trading revenues

- Capital Markets: Reduced bank equity issuance may create opportunities for advisory and underwriting services

Geographic and Systemic Implications

1. Global Financial Stability

- Contagion Risks: Reduced institutional support increases potential for rapid price declines during stress

- Cross-Border Effects: Both Buffett’s and BOJ’s actions affect global banking sector confidence

- Emerging Market Banks: May face particular pressure as global investors reassess banking sector risk

2. Central Bank Policy Coordination

- Policy Signaling: BOJ’s successful normalization may encourage other central banks to reduce financial sector support

- Moral Hazard Reduction: Decreased expectation of central bank equity support may improve market discipline

- Regulatory Response: Banking regulators may need to enhance supervision as market forces become more prominent

Long-term Structural Transformation

1. Business Model Evolution Banks will likely need to:

- Diversify Revenue Streams: Reduce dependence on traditional net interest margin

- Enhance Technology: Invest heavily in digital transformation to compete with fintech

- Optimize Capital: Improve return on equity to attract private investors replacing institutional support

2. Industry Consolidation

- Merger Activity: Reduced valuations may accelerate industry consolidation

- Efficiency Imperative: Banks will need to achieve greater operational efficiency

- Market Share Dynamics: Stronger institutions may gain share from weaker competitors

The convergence of Buffett’s banking divestiture and BOJ’s policy normalization represents a fundamental shift in the banking sector’s operating environment. While the motivations differ, both actions signal the end of an era of exceptional institutional support for banking stocks. This transition will likely accelerate the industry’s evolution toward more market-driven pricing, increased operational efficiency requirements, and greater differentiation between strong and weak institutions. The banking sector must now prove its fundamental value proposition without the safety net of major institutional buyers, creating both challenges and opportunities for industry transformation.

The Perfect Storm: Banking Vulnerabilities Creating Replacement Opportunities

The convergence of Buffett’s banking divestiture, BOJ’s policy normalization, and systemic banking sector challenges creates unprecedented conditions for crypto and CBDC adoption. These traditional banking weaknesses are accelerating alternative financial system development.

Immediate Catalysts for Banking Replacement

1. Institutional Confidence Crisis

- Reduced Safety Net: With major institutional investors and central banks reducing support, traditional banks face increased market vulnerability

- Profitability Pressures: Margin compression and regulatory costs make traditional banking less attractive to both investors and customers

- Systemic Risk Exposure: Banks’ exposure to interest rate volatility and credit risk creates instability that crypto and CBDCs can potentially avoid

2. Technological Infrastructure Maturation The global decentralized finance market size was estimated at USD 20.48 billion in 2024 and is expected to reach USD 26.94 billion in 2025 Warren Buffett’s 2025 Portfolio: What Stocks He’s Betting Big On Right Now, indicating rapid growth in alternative financial infrastructure.

CBDC Acceleration: Central Bank Direct Competition

Current Implementation Timeline

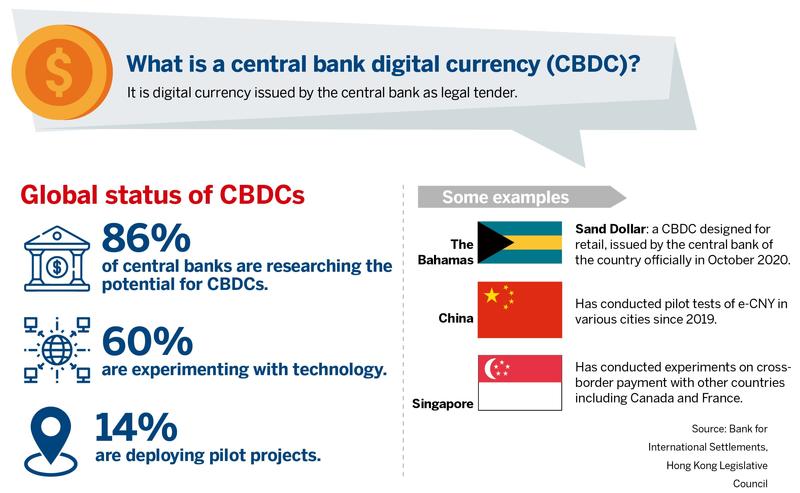

About 94% of central banks are engaged in some form of work on CBDCs, according to a 2024 Bank for International Settlements survey. Eleven countries have fully launched a digital currency, and pilots are underway in more than three dozen others Japan – BOJ Holdings of ETFs | MacroMicro, with 49 CBDC pilot projects around the world BOJ finishes offloading bank stocks, bringing attention to ETFs – The Japan Times.

Key Launch Timelines:

- Europe: The next phase involving an actual development and rollout of the digital euro could start in November 2025 at the earliest Bank of Japan’s Exchange-Traded Fund Purchases as an Unprecedented Monetary Easing Policy | Asian Development Bank

- UK: The UK Treasury and the Bank of England said a state-backed digital pound was likely to be launched some time after 2025 BOJ’s Offloading of Shares to Shift Focus to ETF Holdings

- Russia: The country is in the most important stage of its CBDC project, a testing phase that anticipates the hypothetical introduction of the digital ruble into the Russian economy in 2025 What Will the BOJ Do With Its $475 Billion ETF Hoard?

CBDC Advantages Over Traditional Banking

1. Disintermediation of Banks CBDCs enable direct central bank-to-citizen monetary relationships, potentially eliminating:

- Bank Deposit Insurance Needs: Direct central bank backing removes counterparty risk

- Payment Processing Fees: Central bank infrastructure reduces transaction costs

- Banking Infrastructure Costs: No need for physical branches or traditional banking overhead

2. Enhanced Monetary Policy Effectiveness CBDCs provide central banks with:

- Direct Policy Transmission: Immediate implementation of monetary policy without banking intermediaries

- Real-Time Economic Data: Comprehensive transaction visibility for policy decisions

- Financial Inclusion: Direct access to central bank money for unbanked populations

Implications for Traditional Banking Business Models

1. Deposit Flight Risk

- Safe Haven Effect: CBDCs offer government-backed safety without deposit insurance limits

- Yield Competition: Central banks can offer competitive rates directly to consumers

- Liquidity Disruption: Mass migration to CBDCs could create funding crises for traditional banks

2. Payment System Obsolescence

- Instant Settlements: CBDC transactions settle instantly without correspondent banking

- Cross-Border Efficiency: International CBDC networks could bypass SWIFT and traditional correspondent banking

- Programmable Money: Smart contract capabilities enable automated financial services

Cryptocurrency and DeFi: Private Sector Disruption

Accelerating Institutional Adoption

By 2025, traditional financial institutions and regulatory bodies are expected to engage with DeFi on an unprecedented scale. Banks, hedge funds, and investment firms have integrated blockchain-based financial products Billionaire Warren Buffett Sold 39% of Berkshire’s Stake in Bank of America and Is Piling Into a Historically Cheap Legal Monopoly @themotleyfool #stocks $SIRI $BRK.A $BRK.B $BAC, while the trend of institutional adoption of DeFi is expected to accelerate in 2025 10 Stocks Warren Buffett Just Bought and Sold | Investing | U.S. News.

DeFi Replacing Core Banking Functions

1. Lending and Credit Decentralized Finance (DeFi) to Bridge the Huge SME Financing Gap to Boost Blockchain Adoption Adb, addressing a critical area where traditional banks are failing to serve market needs.

2. Financial Services Unbundling Decentralized finance (DeFi) refers to blockchain-connected platforms and applications that, in theory, can replace the existing centralized financial services networks ASEAN Capital Markets – 2024 Recap and 2025 Outlook, offering:

- Automated Market Making: Liquidity provision without traditional bank intermediaries

- Yield Farming: Interest earning opportunities beyond traditional bank deposits

- Decentralized Exchanges: Trading without traditional financial intermediaries

Security and Maturation Concerns

While DeFi offers alternatives, When the first cryptocurrency, Bitcoin, was proposed in 2008, the goal was simple: to create a digital currency free from banks and governments UOB Business Outlook Study 2025 (Singapore): Bright horizon for companies despite looming tariff impact | UOB ASEAN Insights, but security risks remain significant as the technology matures.

Convergence Effects: Banking Sector Transformation

Immediate Replacement Scenarios

1. Payments and Remittances

- CBDC Dominance: International remittances could shift to CBDC networks, bypassing traditional correspondent banking

- Crypto Rails: Stablecoins and cryptocurrency networks already provide faster, cheaper cross-border transfers

- Bank Disintermediation: Direct peer-to-peer transactions reduce traditional banking revenue streams

2. Savings and Store of Value

- Government Digital Currencies: CBDCs offer government backing without bank intermediation

- Cryptocurrency Adoption: Digital assets provide alternative stores of value independent of banking systems

- Yield Alternatives: DeFi protocols offer competitive returns without traditional banking infrastructure

Systemic Implications for Banking Sector

1. Shrinking Revenue Base Traditional banks face reduced demand for:

- Payment Processing: CBDCs and crypto networks handle transactions more efficiently

- International Transfers: Blockchain-based systems eliminate correspondent banking fees

- Deposit Products: CBDCs and crypto yield farming offer alternatives to traditional savings

2. Regulatory Arbitrage

- Jurisdictional Shopping: DeFi protocols operate across jurisdictions, avoiding single-country banking regulations

- Innovation Speed: Crypto and DeFi innovation cycles exceed traditional banking adaptation rates

- Compliance Costs: Traditional banks bear regulatory burdens that decentralized systems can avoid

Accelerating Factors from Banking Sector Stress

1. Reduced Institutional Support

- Investment Flight: Reduced institutional confidence in banking stocks accelerates alternative investment

- Innovation Funding: Capital previously invested in banks flows to fintech and crypto projects

- Talent Migration: Banking professionals move to crypto and fintech sectors

2. Regulatory Recognition Regulatory frameworks like the EU’s MiCA have provided more explicit guidelines, further legitimizing stablecoins and likely driving higher adoption next year The announcement effects of a change in the Bank of Japan’s ETF purchase program: An event study – ScienceDirect, creating legal frameworks that support banking alternatives.

Strategic Implications for Banking Sector Survival

Necessary Adaptations

1. Hybrid Models Banks must integrate crypto and CBDC infrastructure:

- Custody Services: Providing secure storage for digital assets

- Bridge Services: Facilitating transitions between traditional and digital finance

- Regulatory Compliance: Helping businesses navigate multi-currency environments

2. Specialization Focus Traditional banks may need to concentrate on:

- Complex Credit Products: Sophisticated lending that requires human judgment

- Wealth Management: High-touch services for complex financial situations

- Corporate Banking: Large-scale corporate financial services requiring relationship management

Timeframe for Transformation

The combination of banking sector stress and accelerating CBDC/crypto adoption suggests a compressed timeline for transformation:

Short-term (2025-2027): Payment systems and remittances shift to digital alternatives Medium-term (2027-2030): Consumer banking services increasingly digitized and disintermediated Long-term (2030+): Traditional banking relegated to specialized services requiring human expertise

The convergence of institutional divestiture from banking stocks, central bank policy normalization, and the maturation of cryptocurrency and CBDC infrastructure creates unprecedented conditions for the replacement of traditional banking functions. While complete replacement is unlikely, the scope and speed of transformation will be far greater than previously anticipated, fundamentally reshaping the financial services landscape within the next decade.

Singapore Banking Decline and CBDC Rise: In-Depth Analysis

Executive Summary

Singapore’s banking sector faces a complex paradox in 2025: while the three major banks (DBS, UOB, OCBC) continue to report record profits and strong fundamentals, underlying structural pressures and the accelerating development of Central Bank Digital Currencies (CBDCs) signal a potential transformation of the financial landscape. This analysis examines the convergence of banking sector vulnerabilities with Singapore’s advancing digital currency initiatives.

Current State of Singapore Banking Sector

Financial Performance Paradox

Despite global banking sector pressures, Singapore’s major banks have demonstrated remarkable resilience:

DBS Group Holdings

- Led the trio with a stellar 54.8% profit increase in recent quarters

- Achieved approximately 16% Return on Equity (ROE)

- Maintained cost-to-income ratio of 37.5%, reflecting operational efficiency

- Net interest margin improved by 0.4 percentage points quarter-over-quarter

United Overseas Bank (UOB)

- Reported 4Q24 net profit of S$1.5 billion, up 9% year-over-year

- Achieved record 2024 full-year net profit of S$6.0 billion (6% increase)

- ROE around 13%

- Stock performance down 3.4% year-to-date as of May 2025

Oversea-Chinese Banking Corporation (OCBC)

- Recorded 35.9% profit increase

- ROE close to 12%

- Cost-to-income ratio increased to 38.7% due to digital infrastructure investments

- Stock performance down 2.1% year-to-date as of May 2025

Market Performance Concerns

Despite strong fundamentals, Singapore bank stocks show troubling signs:

- Both UOB and OCBC underperformed the Straits Times Index (STI) in 2025

- Market sentiment reflects concerns about future growth prospects

- Analyst ratings remain mixed: DBS and UOB maintain “Buy” ratings, while OCBC receives “Hold”

Underlying Structural Pressures

Interest Rate Environment Challenges

Singapore banks face the classic banking dilemma of interest rate sensitivity:

Net Interest Income Pressures

- While higher rates initially boosted net interest margins, sustainability concerns emerge

- Asset-liability duration mismatches create hidden balance sheet risks

- Competition for deposits intensifies as rates remain elevated

Credit Risk Acceleration

- Higher interest rates increase default probabilities across loan portfolios

- Commercial real estate and consumer credit segments show stress

- Provision expenses may increase as economic conditions tighten

Regulatory and Competitive Landscape

Regulatory Compliance Costs

- Increasing cybersecurity requirements demand substantial technology investments

- Environmental, Social, and Governance (ESG) compliance adds operational complexity

- Basel III implementation continues to constrain capital deployment

Fintech Competition

- Digital payment platforms reduce traditional banking transaction volumes

- Peer-to-peer lending platforms compete directly with bank credit products

- Cryptocurrency adoption provides alternative store-of-value options

MAS Digital Currency Strategy: Project Orchid

Comprehensive CBDC Development Framework

The Monetary Authority of Singapore (MAS) has developed a multi-pronged approach to digital currency implementation:

Project Orchid Initiative

- Ongoing initiative to develop competency and digital infrastructure for a digital Singapore dollar

- Focuses on domestic issuance capabilities with international connectivity

- Aims to encourage research among central banks, financial institutions, and FinTechs

Three-Tier Digital Money Ecosystem

- Wholesale CBDCs: For financial institution settlement

- Tokenised Bank Liabilities: Bridge between traditional and digital banking

- Regulated Stablecoins: Private sector digital currency alternatives

Pilot Programs and Implementation Timeline

Purpose-Bound Digital Singapore Dollar

- November 2022 trial conducted across select food and beverage outlets

- Singapore FinTech Festival 2022 integration

- Merchants directly receive underlying digital SGD for vouchers redeemed

Cross-Border Digital Currency Initiatives

- Singapore-China pilot for cross-border digital yuan use in tourism spending

- Wholesale CBDC pilots scheduled for 2024 implementation

- Focus on large-value interbank transaction settlement

Strategic Implications for Banking Disintermediation

Wholesale CBDC Impact on Banking Infrastructure

Interbank Settlement Transformation

- Wholesale CBDCs enable direct central bank-to-bank settlement

- Eliminates correspondent banking relationships for certain transactions

- Reduces settlement risk and operational costs

- Real-time settlement capabilities replace traditional clearing mechanisms

Monetary Policy Transmission

- Direct central bank digital currency distribution enhances policy effectiveness

- Reduces reliance on bank intermediation for monetary policy implementation

- Enables more precise control over money supply and credit conditions

Retail CBDC Potential for Banking Replacement

Deposit Substitution Risk

- Digital Singapore dollars could provide direct central bank backing for consumer deposits

- Eliminates need for deposit insurance schemes

- Offers potentially higher yields directly from central bank

- Creates flight-to-quality risk for traditional bank deposits

Payment System Disruption

- CBDC-enabled instant payments reduce demand for traditional banking services

- Cross-border remittance capabilities bypass correspondent banking networks

- Programmable money enables automated financial services without bank intermediation

Competitive Response and Adaptation Strategies

Banking Sector Transformation Requirements

Technology Infrastructure Investment

- OCBC’s increased cost-to-income ratio reflects necessary digital infrastructure spending

- Banks must integrate CBDC connectivity into existing systems

- Cybersecurity investments become critical for maintaining competitive position

Service Model Evolution

- Focus shifts from transaction processing to advisory and relationship management

- Specialized services for complex financial products remain bank-dominated

- Corporate banking relationships provide defensive moats against CBDC competition

Regulatory Arbitrage Opportunities

Tokenised Bank Liabilities

- MAS framework allows banks to issue digital versions of traditional deposits

- Maintains bank intermediation while providing digital currency benefits

- Enables banks to compete directly with CBDC offerings

Stablecoin Integration

- Regulated stablecoin framework allows banks to participate in digital currency ecosystem

- Provides bridge between traditional banking and cryptocurrency markets

- Enables banks to offer custody and management services for digital assets

Long-Term Structural Transformation Scenarios

Gradual Disintermediation Timeline

Phase 1 (2025-2027): Wholesale Market Transformation

- Wholesale CBDC implementation reduces interbank settlement demand

- Corporate treasury functions migrate to direct central bank relationships

- Traditional correspondent banking revenues decline

Phase 2 (2027-2030): Retail Market Disruption

- Retail CBDC introduction creates direct central bank-consumer relationships

- Traditional deposit products face increasing competition

- Payment processing revenues migrate to CBDC infrastructure

Phase 3 (2030+): Specialized Banking Services

- Banks focus on complex credit products requiring human judgment

- Wealth management and advisory services remain bank-dominated

- Corporate relationship banking provides sustainable competitive advantage

Systemic Risk Considerations

Financial Stability Implications

- Rapid deposit flight to CBDCs could create banking system liquidity crises

- Credit intermediation capacity may be reduced if deposits migrate to central bank

- Monetary policy transmission mechanisms fundamentally altered

Market Concentration Effects

- Weaker banks may face accelerated pressure from CBDC competition

- Market consolidation likely as only strongest institutions survive transition

- Regulatory intervention may be required to maintain credit intermediation capacity

Strategic Recommendations

For Banking Sector Participants

Immediate Actions (2025-2026)

- Integrate CBDC connectivity into core banking systems

- Develop tokenised bank liability products to compete with CBDCs

- Strengthen corporate relationship banking capabilities

- Enhance cybersecurity and operational resilience

Medium-Term Positioning (2026-2030)

- Transition to advisory and relationship-focused business models

- Develop specialized expertise in complex financial products

- Build ecosystem partnerships with fintech and digital currency providers

- Optimize capital deployment for post-CBDC competitive landscape

For Regulatory Framework Development

Policy Coordination Requirements

- Ensure gradual CBDC implementation to prevent banking system disruption

- Maintain adequate credit intermediation capacity during transition

- Develop emergency liquidity facilities for banking system stability

- Coordinate with international regulators on cross-border digital currency standards

Conclusion

Singapore’s banking sector stands at a critical inflection point. While current financial performance remains strong, the rapid development of CBDC infrastructure and changing competitive dynamics signal fundamental transformation ahead. The success of institutions like DBS, UOB, and OCBC will depend on their ability to adapt to a world where central bank digital currencies increasingly compete with traditional banking services.

The MAS’s comprehensive approach to digital currency development, through Project Orchid and related initiatives, positions Singapore at the forefront of global CBDC implementation. However, this leadership comes with the responsibility of managing the transition carefully to maintain financial stability while fostering innovation.

Maxthon

In an age where the digital world is in constant flux and our interactions online are ever-evolving, the importance of prioritising individuals as they navigate the expansive internet cannot be overstated. The myriad of elements that shape our online experiences calls for a thoughtful approach to selecting web browsers—one that places a premium on security and user privacy. Amidst the multitude of browsers vying for users’ loyalty, Maxthon emerges as a standout choice, providing a trustworthy solution to these pressing concerns, all without any cost to the user.

Maxthon, with its advanced features, boasts a comprehensive suite of built-in tools designed to enhance your online privacy. Among these tools are a highly effective ad blocker and a range of anti-tracking mechanisms, each meticulously crafted to fortify your digital sanctuary. This browser has carved out a niche for itself, particularly with its seamless compatibility with Windows 11, further solidifying its reputation in an increasingly competitive market.

In a crowded landscape of web browsers, Maxthon has forged a distinct identity through its unwavering dedication to offering a secure and private browsing experience. Fully aware of the myriad threats lurking in the vast expanse of cyberspace, Maxthon works tirelessly to safeguard your personal information. Utilizing state-of-the-art encryption technology, it ensures that your sensitive data remains protected and confidential throughout your online adventures.

What truly sets Maxthon apart is its commitment to enhancing user privacy during every moment spent online. Each feature of this browser has been meticulously designed with the user’s privacy in mind. Its powerful ad-blocking capabilities work diligently to eliminate unwanted advertisements, while its comprehensive anti-tracking measures effectively reduce the presence of invasive scripts that could disrupt your browsing enjoyment. As a result, users can traverse the web with newfound confidence and safety.

Moreover, Maxthon’s incognito mode provides an extra layer of security, granting users enhanced anonymity while engaging in their online pursuits. This specialised mode not only conceals your browsing habits but also ensures that your digital footprint remains minimal, allowing for an unobtrusive and liberating internet experience. With Maxthon as your ally in the digital realm, you can explore the vastness of the internet with peace of mind, knowing that your privacy is being prioritised every step of the way.

The banking sector’s future lies not in preserving the status quo, but in evolving to provide value-added services that complement rather than compete with CBDC infrastructure. Those institutions that successfully navigate this transition will emerge stronger, while those that fail to adapt face obsolescence in the digital currency era.

Maxthon

In an age where the digital world is in constant flux and our interactions online are ever-evolving, the importance of prioritising individuals as they navigate the expansive internet cannot be overstated. The myriad of elements that shape our online experiences calls for a thoughtful approach to selecting web browsers—one that places a premium on security and user privacy. Amidst the multitude of browsers vying for users’ loyalty, Maxthon emerges as a standout choice, providing a trustworthy solution to these pressing concerns, all without any cost to the user.

Maxthon, with its advanced features, boasts a comprehensive suite of built-in tools designed to enhance your online privacy. Among these tools are a highly effective ad blocker and a range of anti-tracking mechanisms, each meticulously crafted to fortify your digital sanctuary. This browser has carved out a niche for itself, particularly with its seamless compatibility with Windows 11, further solidifying its reputation in an increasingly competitive market.

In a crowded landscape of web browsers, Maxthon has forged a distinct identity through its unwavering dedication to offering a secure and private browsing experience. Fully aware of the myriad threats lurking in the vast expanse of cyberspace, Maxthon works tirelessly to safeguard your personal information. Utilizing state-of-the-art encryption technology, it ensures that your sensitive data remains protected and confidential throughout your online adventures.

What truly sets Maxthon apart is its commitment to enhancing user privacy during every moment spent online. Each feature of this browser has been meticulously designed with the user’s privacy in mind. Its powerful ad-blocking capabilities work diligently to eliminate unwanted advertisements, while its comprehensive anti-tracking measures effectively reduce the presence of invasive scripts that could disrupt your browsing enjoyment. As a result, users can traverse the web with newfound confidence and safety.

Moreover, Maxthon’s incognito mode provides an extra layer of security, granting users enhanced anonymity while engaging in their online pursuits. This specialised mode not only conceals your browsing habits but also ensures that your digital footprint remains minimal, allowing for an unobtrusive and liberating internet experience. With Maxthon as your ally in the digital realm, you can explore the vastness of the internet with peace of mind, knowing that your privacy is being prioritised every step of the way.