This week delivered three watershed moments in American financial policy that will reverberate through household budgets, investment portfolios, and educational planning for months to come. The Federal Reserve’s quarter-point interest rate cut, sweeping changes to federal student aid calculations, and the suspension of student loan forgiveness programs represent a convergence of monetary policy, educational finance reform, and judicial intervention that demands immediate strategic attention from financial planners and households alike.

These developments signal a fundamental shift in the financial landscape: a potential easing of borrowing costs coinciding with reduced educational assistance and prolonged uncertainty for student borrowers. The timing is particularly significant, occurring as families prepare for the 2025-26 academic year and investors recalibrate expectations for the broader interest rate environment.

Development #1: Federal Reserve Rate Cut – The First Move in a New Monetary Cycle

The Decision and Its Context

The Federal Reserve’s decision to cut the federal funds rate by 25 basis points to a range of 4.00%-4.25% represents more than a routine monetary policy adjustment—it marks a potential inflection point in the central bank’s approach to economic management. This cut, the first since December 2024, comes against a backdrop of evolving economic conditions that have prompted policymakers to reconsider their stance on restrictive monetary policy.

The decision reflects the Fed’s assessment that inflationary pressures have sufficiently moderated to allow for a more accommodative monetary stance, while labor market conditions remain robust enough to support economic growth. However, Fed Chair Jerome Powell’s cautious language about future cuts—emphasizing that additional reductions are “not guaranteed”—signals a data-dependent approach that could lead to policy volatility.

Immediate Financial Market Implications

The rate cut’s effects will cascade through financial markets in predictable but varied ways. Credit card interest rates, which typically track closely to the federal funds rate, should begin declining within one to two billing cycles. For the average household carrying $6,194 in credit card debt (according to recent Federal Reserve data), even a 25 basis point reduction could save approximately $15-20 annually in interest payments—modest but meaningful for budget-conscious consumers.

Mortgage markets present a more complex picture. While the fed funds rate influences short-term rates, mortgage rates are more closely tied to longer-term Treasury yields, which reflect broader economic expectations and inflation concerns. The cut may provide some relief for adjustable-rate mortgage holders and could stimulate refinancing activity for those with existing fixed-rate loans above current market levels.

Strategic Implications for Personal Finance

Debt Management Opportunities The rate cut creates a narrow window for strategic debt management. Variable-rate borrowers should see immediate relief, while fixed-rate borrowers may find refinancing opportunities more attractive. However, the key strategic consideration is timing: with the Fed signaling uncertainty about future cuts, borrowers shouldn’t assume rates will continue declining.

Investment Portfolio Adjustments Lower rates typically benefit growth stocks and interest-sensitive sectors while potentially pressuring bank margins and fixed-income yields. Investors should consider rebalancing portfolios to account for:

- Potential rotation from defensive dividend stocks to growth equities

- Duration risk in bond portfolios as rates potentially decline further

- Currency effects if dollar weakness follows rate cuts

Savings Strategy Recalibration The flip side of lower borrowing costs is reduced yields on savings vehicles. High-yield savings accounts offering 4.5%-5.0% annually may see rates compress toward 4.0%-4.5%. Certificates of deposit currently offering attractive rates represent a opportunity to lock in yields before they decline further.

Development #2: FAFSA Overhaul – Reshaping Educational Finance Access

Comprehensive Analysis of Changes

The Free Application for Federal Student Aid (FAFSA) modifications for the 2026-27 academic year represent the most significant restructuring of federal student aid in decades. These changes, mandated by recent Congressional legislation, fundamentally alter both eligibility criteria and award calculations in ways that will disproportionately impact middle-income families and high-achieving students.

The Four Critical Changes Examined

1. Small Business and Farm Asset Exclusion Restoration The restoration of asset exclusions for small farms, businesses, and commercial fisheries addresses a longstanding concern among rural and entrepreneurial families. Previously, these assets were counted toward family wealth calculations, often artificially inflating expected family contributions. This change could benefit approximately 2.3 million families who operate small businesses or farms, potentially increasing their aid eligibility by $1,000-3,000 annually.

2. Full-Ride Scholarship Pell Grant Exclusion The elimination of Pell Grant eligibility for students receiving full-ride non-federal scholarships represents a controversial policy shift. While ostensibly preventing “double-dipping,” this change could inadvertently discourage high-achieving low-income students from pursuing merit-based scholarships from private institutions. The financial impact varies significantly: students previously receiving both a full scholarship and a $7,000+ Pell Grant will lose substantial financial flexibility that often covered living expenses, books, and other educational costs.

3. Foreign Income Inclusion Mandate Requiring families to include foreign income in adjusted gross income calculations for Pell Grant eligibility represents a significant shift affecting military families, expatriate workers, and international business employees. This change could impact an estimated 150,000-200,000 families annually, with particularly significant effects on:

- Military families stationed overseas with tax-free combat pay

- Corporate executives with foreign assignments

- Dual-citizen families with international income streams

4. Pell Grant Income Threshold Implementation The new rule limiting Pell Grant eligibility to families with Student Aid Index (SAI) less than twice the maximum Pell Grant ($14,790 for 2026-27) creates a hard cutoff that could affect hundreds of thousands of middle-income families. This change essentially caps Pell eligibility at families with approximately $75,000-85,000 in annual income, depending on family size and circumstances.

Long-Term Educational Finance Implications

These changes reflect a broader policy shift toward more targeted aid distribution, potentially improving assistance for the lowest-income families while reducing support for middle-income households. The implications extend beyond individual family finances:

College Selection Strategy Families must now factor these changes into college selection decisions years in advance. The loss of Pell Grant eligibility for merit scholarship recipients may influence students to choose schools offering need-based aid over those providing merit scholarships.

State and Institutional Response State universities and private institutions may need to increase institutional aid programs to compensate for reduced federal support. This could lead to:

- Higher tuition increases to fund additional aid programs

- More sophisticated financial aid packaging strategies

- Increased emphasis on state-based aid programs

Economic Mobility Concerns The cumulative effect of these changes may create barriers to economic mobility for middle-income families who earn too much for substantial aid but lack sufficient resources for college expenses without assistance.

Development #3: Student Loan Forgiveness Suspension – Legal Limbo with Financial Consequences

The Current Crisis Explained

The suspension of student loan forgiveness under multiple income-driven repayment (IDR) plans represents a complex intersection of federal education policy, judicial oversight, and borrower rights. The Department of Education’s decision to halt forgiveness under Income-Contingent Repayment (ICR), Pay As You Earn (PAYE), and Income-Based Repayment (IBR) plans affects an estimated 3.6 million borrowers who were either approaching or had already reached their forgiveness eligibility dates.

Legal Framework and Precedent

The court injunctions cited by the Department of Education stem from challenges to various aspects of federal student loan policy, creating a legal framework that prioritizes judicial review over administrative efficiency. This has resulted in a complex situation where borrowers who have fulfilled their contractual obligations—making payments for 20-25 years as required—find themselves in financial and legal limbo.

The American Federation of Teachers’ request for a preliminary injunction represents an attempt to force resolution through the courts, but the timeline for such legal proceedings typically extends months or years, leaving borrowers uncertain about their financial futures.

Financial Impact on Affected Borrowers

Immediate Cash Flow Effects Borrowers expecting forgiveness face continued monthly payment obligations that can range from $200-800 monthly, depending on income and family size. For a borrower with an original $30,000 loan balance who has been paying for 20 years, continued payments represent significant opportunity costs—funds that could otherwise support retirement savings, home purchases, or family expenses.

Psychological and Planning Impacts The uncertainty creates planning paralysis for borrowers who have structured their financial lives around expected loan discharge. Many have delayed major financial decisions, including:

- Home purchases based on improved debt-to-income ratios post-forgiveness

- Career changes that might reduce income but improve work-life balance

- Retirement planning assuming elimination of student loan payments

Strategic Response Framework

For Current Borrowers Awaiting Forgiveness

- Continue making payments to preserve eligibility and avoid default

- Document all payments meticulously for potential future refund claims

- Consider requesting forbearance to preserve cash flow while maintaining loan status

- Avoid making extra payments until legal clarity emerges

For Future Planning

- Assume longer repayment periods when calculating education ROI

- Consider alternative financing strategies for current students

- Evaluate income-driven repayment plan selection more carefully

Integrated Strategic Response: Connecting the Dots

The Convergence Effect

These three developments don’t exist in isolation—they represent interconnected shifts in American financial policy that require integrated strategic thinking. The rate cut provides some relief for current borrowers while potentially making future education financing more accessible. Simultaneously, FAFSA changes reduce federal support, and loan forgiveness uncertainty extends repayment obligations.

Portfolio Implications

Asset Allocation Adjustments

- Reduce duration risk in bond portfolios given rate cut trajectory

- Consider sector rotation toward rate-sensitive equities

- Maintain liquidity for potential education expense increases

Education Savings Strategy

- Accelerate 529 plan contributions before potential tax policy changes

- Consider Coverdell ESA maximization for K-12 expenses

- Evaluate UTMA/UGMA accounts for asset positioning flexibility

Risk Management Priorities

Interest Rate Risk The Fed’s cautious approach to future cuts suggests potential volatility in rate markets. Fixed-rate debt becomes more attractive in uncertain rate environments, while variable-rate obligations require careful monitoring.

Policy Risk Educational finance policy appears increasingly subject to political and judicial intervention. Families must build flexibility into education financing strategies rather than relying solely on federal programs.

Liquidity Risk Student loan forgiveness uncertainty demands higher emergency fund balances for affected borrowers. Traditional 3-6 month expense recommendations may need expansion to 6-12 months for households with student loan exposure.

Implementation Roadmap: 30-60-90 Day Action Plan

Immediate Actions (30 Days)

Financial Assessment

- Review all variable-rate debt for potential refinancing opportunities

- Calculate savings from rate cuts on existing debt

- Inventory high-yield savings accounts and CD options for rate-locking

Education Planning

- Review current FAFSA eligibility under new rules

- Calculate potential aid changes for current and prospective students

- Research institutional aid alternatives for families losing federal eligibility

Documentation

- Organize student loan payment histories for forgiveness claims

- Create comprehensive education expense projections incorporating aid changes

- Review investment portfolio duration and interest rate sensitivity

Strategic Implementation (60 Days)

Portfolio Rebalancing

- Execute interest rate positioning adjustments

- Optimize emergency fund placement for yield and liquidity

- Consider tax-loss harvesting opportunities from market reactions

Education Finance Restructuring

- Finalize 529 plan contribution strategies for tax year

- Research alternative financing options (educational loans, home equity)

- Evaluate college selection criteria incorporating new aid landscape

Debt Optimization

- Complete refinancing analysis for major debt obligations

- Consider strategic debt paydown versus investment allocation

- Negotiate credit terms while rates remain favorable

Long-Term Positioning (90 Days)

Comprehensive Planning Integration

- Update financial plans incorporating all three developments

- Revise retirement projections accounting for extended student loan payments

- Integrate education financing into broader wealth management strategy

Risk Mitigation Implementation

- Establish dedicated education expense emergency funds

- Consider disability and life insurance adjustments for extended debt obligations

- Evaluate legal insurance for potential student loan disputes

Singapore Impact Analysis: Global Financial Ripple Effects

Currency and Investment Implications

The Federal Reserve’s rate cut creates immediate implications for Singapore-based investors and financial institutions. The narrowing interest rate differential between the US Dollar and Singapore Dollar affects several key areas:

SGD Strengthening Potential With US rates declining while the Monetary Authority of Singapore (MAS) maintains its current policy stance, the SGD may appreciate against the USD. This creates opportunities and challenges for Singapore residents:

- Investment Portfolio Effects: SGD-based investors holding US assets may see currency gains offsetting potential USD asset price increases

- Property Market Dynamics: Singapore’s property market could see increased foreign investment as USD-denominated buyers find SGD assets relatively more attractive

- Trade Impact: Singapore’s export-dependent economy may face headwinds from a stronger SGD affecting competitiveness

Impact on Singapore’s Financial Sector

Banking Sector Considerations Singapore’s major banks (DBS, UOB, OCBC) with significant US operations and USD funding may experience:

- Compressed net interest margins on USD-denominated loans

- Potential credit quality improvements as US borrowers face lower servicing costs

- Opportunities for increased lending volume in the US market

Wealth Management Hub Effects Singapore’s position as Asia’s wealth management center faces both opportunities and challenges:

- Increased attractiveness for US investors seeking international diversification

- Potential capital flows from US investors looking for higher yields in Asia

- Enhanced appeal of Singapore’s tax-efficient wealth structures

Educational Finance for Singapore Families

US University Education Costs Singapore families sending children to US universities face complex implications from all three developments:

FAFSA Changes Impact

- Singapore residents typically don’t qualify for US federal aid, making these changes less directly relevant

- However, families with US tax obligations or dual citizenship may be affected by foreign income inclusion requirements

- Corporate executives on US assignments may lose aid eligibility due to Singapore income reporting requirements

Currency Benefits from Rate Cuts

- Lower US interest rates may weaken USD, reducing the SGD cost of US education

- Private education loans for international students may become more accessible

- Refinancing opportunities for existing US education debt

Strategic Considerations for Singapore Investors

Asset Allocation Adjustments Singapore-based portfolios should consider:

- Reducing USD currency hedging given potential SGD appreciation

- Increasing allocation to US growth assets that benefit from lower rates

- Evaluating exposure to Singapore REITs, which may face increased competition from US real estate

Cross-Border Tax Planning The student loan forgiveness uncertainty affects Singapore tax residents with US tax obligations:

- Potential tax implications of eventual loan forgiveness for US-connected persons

- Estate planning considerations for families with US education debt

- Trust structure optimization for cross-border education financing

Singapore Policy Response Considerations

MAS Monetary Policy Implications The Fed’s dovish turn may influence MAS policy decisions:

- Reduced pressure to tighten SGD policy settings

- Greater flexibility in managing Singapore’s exchange rate-based monetary policy

- Potential for more accommodative financial conditions supporting domestic growth

Financial Sector Regulation Singapore’s financial regulators may need to consider:

- Increased capital flows from US rate-seeking investors

- Enhanced due diligence for US student loan-related financial products

- Coordination with US authorities on education finance compliance

Practical Action Items for Singapore Residents

Investment Strategy Adjustments

- Review USD-SGD currency exposure in investment portfolios

- Consider increasing US equity allocations given lower discount rates

- Evaluate Singapore property investments given potential foreign inflow increases

Education Planning

- Reassess US education financing strategies considering rate environment

- Explore Singapore-dollar denominated education financing alternatives

- Consider timing of US education expenses relative to currency movements

Cross-Border Financial Management

- Review US tax compliance for education-related benefits

- Optimize timing of currency exchanges for education expenses

- Consider Singapore-based education alternatives given relative cost changes

Regional Integration: Singapore as Asian Financial Gateway

The convergence of US monetary easing, education finance changes, and Singapore’s strategic position creates unique opportunities for the city-state to enhance its role as Asia’s financial hub. Lower US rates may drive yield-seeking capital toward Singapore’s well-regulated financial markets, while education finance uncertainty may increase demand for Singapore’s world-class universities as alternatives to US institutions.

Singapore families and institutions that proactively adapt to these interconnected changes—managing currency exposure, optimizing cross-border tax strategies, and capitalizing on Singapore’s relative stability—will be best positioned to benefit from this evolving global financial landscape.

Conclusion: Navigating the New Financial Landscape

This week’s financial developments represent more than routine policy adjustments—they signal fundamental shifts in how Americans finance education, manage debt, and plan for financial security. The Federal Reserve’s rate cut provides tactical opportunities for debt management and investment positioning, while FAFSA changes and student loan forgiveness uncertainty create strategic challenges requiring long-term planning adjustments.

The most successful financial strategies will be those that maintain flexibility while taking advantage of immediate opportunities. Rate cuts create refinancing windows that may not persist if economic conditions change. Education finance modifications demand proactive planning to minimize their impact on college affordability. Student loan uncertainty requires maintaining optionality while protecting cash flow.

Perhaps most importantly, these developments underscore the increasing complexity of personal financial management in an environment where policy changes can dramatically affect household finances. The days of “set it and forget it” financial planning are giving way to an era requiring active monitoring, strategic flexibility, and comprehensive integration of policy developments into personal financial decision-making.

Families and individuals who adapt quickly to these changes, while maintaining long-term strategic focus, will be best positioned to navigate the evolving financial landscape and achieve their educational and financial goals despite the increased complexity and uncertainty.

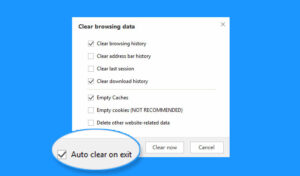

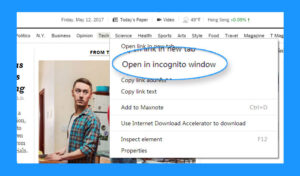

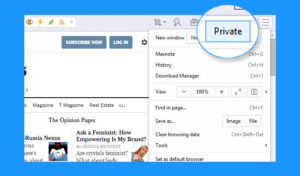

Instructions for Enabling and Disabling Private Browsing Mode in Maxthon Browser

1. Open Maxthon Browser: Launch the Maxthon browser on your device. Ensure you are running the latest version for optimal features and security.

2. Access the Menu: Click on the menu icon located at the top-right corner of the browser window. Three horizontal lines or dots usually represent this.

3. Select Private Browsing: In the dropdown menu, look for the Private Browsing option. Click on it to activate private mode.

4. Confirm Activation: A new window should appear, indicating that you are now in private browsing mode. You may notice a different colour scheme or an icon indicating this status.

5. Browse Privately: While in this mode, your browsing history, cookies, and site data will not be saved once you close the session. Feel free to explore securely.

6. Exit Private Browsing Mode: To return to regular browsing, click again on the menu icon and select Exit Private Browsing from the list of options.

7. Confirm Exit: Once you exit, a message may confirm that you have returned to normal browsing mode.

8. Resume Normal Usage: Continue surfing the internet without any restrictions while your activity is logged as usual again.

9. Check Settings if Needed: If you do not see these options, verify that your browser settings have not turned off private browsing functionality or consult the help section for troubleshooting advice.

Follow these steps carefully to navigate between standard and private modes seamlessly!