A major shift in US-China trade ties has emerged. China took a bold step this year. It skipped buying any US soybeans at the launch of the 2024-2025 export period. US Department of Agriculture data, tracked since 1999, shows this as the first such event in at least 25 years. No prior records match this complete halt.

China’s decision stems from smart planning. The nation stacked up large reserves in advance. It turned to other sources, like Brazil, to fill the gap. This cuts back on need for US farm goods. Importers in China locked in enough shipments from these alternatives to last through all of 2025. Sources close to the deals confirm this.

As a result, pressure to grab US soybeans eases until early 2026 at the soonest. Brazil, a top soy producer, stepped up with more exports to China. In 2024 alone, Brazil sent over 70% of China’s soy needs, up from prior years. This shift builds on years of China seeking varied suppliers to avoid risks from one main partner.

The fallout hits the US economy hard. Soybeans form a key part of trade between the two countries. Last year, the US supplied about 20% of China’s soy imports. That trade topped $12 billion, or roughly S$15.4 billion. It also made up more than 50% of all US soy export earnings. US farmers feel the pinch right away.

Even with record crop yields, soy prices dipped to levels not seen in years. Prices hovered around $10 per bushel in late 2024, down from peaks above $14. Farmers in states like Iowa and Illinois, where soy is a staple crop, face tough choices. Some store extra beans, hoping for better markets. Others cut costs or switch to different plants. This drop in demand strains rural areas that rely on these sales.

The move goes further than soybeans. China pulled back on US corn, wheat, and sorghum buys for the upcoming season. Yet it keeps drawing these crops from places like Brazil, Canada, and Australia. This pattern fits into wider frictions. Just recently, China ruled that Nvidia broke anti-monopoly rules in a first look. Talks over chips and rare earth metals drag on too. These issues echo past clashes, such as limits on tech exports from the US.

China’s plan looks like a big-picture effort. It aims to spread out supply sources over time. The goal: lessen ties to US goods in key areas. Agriculture serves as a tool here. Beijing used farm products this way before. Back during the first trade war, under Trump’s first term from 2018 to 2020, China slashed US soy buys by over 70%. That forced prices down and hurt American producers. Now, this tactic returns amid fresh tensions. Experts note it pressures the US at the table. One trade analyst said, “China’s stockpile strategy lets it wait out disputes without panic.” This approach raises questions for US leaders. How long can farmers hold on? Will talks speed up to ease the strain? Overall, it signals China’s push for stronger footing in global trade.

China’s Agricultural Boycott: A Deep Analysis of US-China Trade Tensions and Long-Term Implications

Executive Summary

China’s unprecedented decision to forgo US soybean purchases at the start of the 2024-2025 export season marks a watershed moment in US-China trade relations. For the first time since the 1990s, the world’s largest soybean importer has completely bypassed American suppliers, signaling a sophisticated and coordinated strategy to weaponize agricultural trade in broader geopolitical negotiations. This move represents far more than a temporary market disruption—it reflects a fundamental shift in global supply chain dynamics and China’s evolving approach to economic statecraft.

The Magnitude of Agricultural Interdependence

Scale of the Relationship

The US-China agricultural trade relationship has historically been one of mutual dependence. In 2024, China imported soybeans worth over $12 billion from the United States, representing a fifth of China’s total soybean imports and accounting for more than half of America’s total soy export value. This symbiotic relationship has made American farmers heavily dependent on Chinese demand, while China has relied on US efficiency and cost-effectiveness in agricultural production.

The sheer volume of this trade makes China’s current boycott particularly devastating. US soybeans currently face tariffs of more than 20% when entering China, making them significantly less competitive than alternatives from Brazil, Argentina, and other suppliers. However, the complete absence of Chinese purchases—rather than merely reduced volumes—indicates this is a coordinated political strategy rather than purely economic decision-making.

Beyond Soybeans: A Comprehensive Agricultural Pivot

China’s strategy extends across multiple agricultural commodities. The country has simultaneously curtailed purchases of US corn, wheat, and sorghum for the new season while maintaining robust import relationships with Brazil, Canada, and Australia. This comprehensive approach demonstrates Beijing’s commitment to reducing agricultural dependence on the United States across the board.

The timing is particularly significant. Chinese importers have secured enough supplies to cover their needs through 2025, creating a buffer that pushes any potential resumption of US agricultural purchases to at least the first quarter of 2026. This timeline suggests China is prepared for a prolonged standoff and has the inventory management capabilities to sustain it.

Strategic Context and Geopolitical Calculations

The Semiconductor-Agriculture Nexus

China’s agricultural boycott cannot be viewed in isolation from broader trade tensions. The timing coincides with escalating disputes over semiconductor technology, rare earth minerals, and now antitrust actions against American technology companies. Beijing’s recent preliminary finding that Nvidia violated anti-monopoly laws represents another front in this multifaceted trade war.

This cross-sector approach reflects China’s understanding that modern trade warfare requires leverage across multiple industries. By simultaneously applying pressure through agricultural boycotts, technology restrictions, and regulatory actions, China is creating multiple negotiation points that complicate American response strategies.

The Rare Earth Parallel

China’s approach to soybeans mirrors its strategic deployment of rare earth export restrictions. Both strategies involve leveraging China’s dominant market position (as the world’s largest soybean buyer and rare earth producer respectively) to create economic pressure on the United States. The key difference lies in the direction of trade flows—China controls rare earth exports while wielding influence over agricultural imports.

This dual-leverage strategy gives Beijing significant negotiating power. The country can simultaneously restrict American access to critical materials while denying American agricultural producers access to their largest export market.

Economic Impact Analysis

American Agricultural Sector Vulnerability

The immediate impact on American farmers has been severe. Soybean prices have fallen to multi-year lows despite bumper harvests, creating what industry groups describe as a “trade and financial precipice.” The political implications are significant, as soybean growers constitute a key voting bloc for President Trump, creating domestic pressure for trade deal negotiations.

The broader agricultural sector faces similar pressures across multiple commodities. American grain exports have become increasingly dependent on Chinese demand over the past two decades, making the current boycott particularly disruptive. The concentration of this dependency means that alternative markets cannot easily absorb the volume typically destined for China.

China’s Economic Costs and Strategic Calculations

Despite its strong negotiating position, China is not immune to economic costs from this strategy. The country is paying premiums to source agricultural products from alternative suppliers, with Brazilian soybeans typically commanding higher prices than their American counterparts before tariffs are applied.

However, China’s willingness to absorb these costs reflects several strategic calculations:

Diversification Benefits: Reducing dependence on US agricultural imports aligns with China’s broader economic security objectives, particularly given the recurring nature of US-China trade disputes.

Long-term Supplier Development: By providing guaranteed demand to Brazilian, Argentine, and other suppliers, China is helping develop alternative supply chains that could permanently reduce American market share.

Domestic Political Considerations: Demonstrating independence from American agricultural products serves domestic political objectives by showing China’s ability to withstand US economic pressure.

Supply Chain Transformation and Global Implications

The Brazil Advantage

Brazil has emerged as the primary beneficiary of China’s agricultural pivot. Brazilian soybean exports to China have increased dramatically, with the country now serving as China’s dominant supplier. This shift has several long-term implications:

Infrastructure Development: Increased Chinese demand is driving investment in Brazilian agricultural infrastructure, potentially making Brazil a more efficient long-term supplier.

Financial Integration: Chinese agricultural investments in Brazil are creating deeper economic ties that could prove difficult to unwind even if US-China relations improve.

Geopolitical Alignment: Brazil’s growing role as China’s primary agricultural supplier may influence its positioning in broader US-China geopolitical competition.

Market Structure Evolution

The current crisis is accelerating structural changes in global agricultural markets that have been developing over the past decade. Traditional patterns of agricultural trade, where geography and efficiency determined supply relationships, are increasingly influenced by geopolitical considerations.

This shift toward politically-motivated trade patterns has several concerning implications:

Reduced Efficiency: Political rather than economic factors determining trade flows typically results in higher costs and reduced global efficiency.

Market Fragmentation: The world may be moving toward fragmented agricultural markets aligned with geopolitical blocs rather than integrated global markets.

Supply Chain Vulnerability: Over-dependence on politically-motivated suppliers creates new vulnerabilities if geopolitical relationships change.

Long-Term Strategic Outlook

Scenario Analysis

Scenario 1: Negotiated Resolution (30% Probability) A near-term trade agreement that removes or reduces agricultural tariffs could restore US-China agricultural trade relationships. However, China’s investment in alternative suppliers means American market share may not fully recover.

Scenario 2: Prolonged Standoff (50% Probability) Continued tensions result in permanently reduced US agricultural exports to China. American farmers face long-term market access challenges while China’s alternative supply chains become more established and efficient.

Scenario 3: Complete Decoupling (20% Probability) Escalating tensions lead to comprehensive economic decoupling, with China completely eliminating US agricultural imports. This scenario would require massive structural adjustments in both countries’ agricultural sectors.

Structural Changes in Global Agriculture

Regardless of the immediate resolution of current tensions, several structural changes appear irreversible:

Supply Chain Diversification: China’s demonstrated ability and willingness to completely boycott US agricultural products will influence long-term supply chain strategies for both countries.

Political Risk Premium: Agricultural trade relationships now carry higher political risk premiums, potentially increasing costs and reducing efficiency.

Alternative Infrastructure Development: Chinese investment in alternative suppliers is creating infrastructure that will remain competitive even if US-China relations improve.

Policy Implications and Recommendations

For the United States

Diversify Export Markets: American agricultural producers must reduce dependence on Chinese demand by developing alternative export markets in Southeast Asia, Africa, and Latin America.

Domestic Consumption Integration: Policies that increase domestic use of American agricultural products could provide buffer against export market volatility.

Strategic Patience: Avoiding policy responses that further entrench Chinese supply chain diversification may be necessary for long-term market access recovery.

For China

Supply Chain Resilience: While reducing US dependence serves strategic objectives, over-reliance on any single alternative supplier creates new vulnerabilities.

Cost Management: The premium costs of avoiding US agricultural products represent a significant economic burden that may become less sustainable over time.

Relationship Management: Maintaining some level of agricultural trade relationship could provide valuable negotiating flexibility in future disputes.

For Global Markets

Risk Management Systems: International agricultural markets need better mechanisms for managing politically-motivated trade disruptions.

Alternative Supplier Development: Supporting agricultural development in Africa and other regions could provide more diverse and stable supply options.

Trade Agreement Evolution: International trade agreements may need new mechanisms for handling politically-motivated trade restrictions.

Conclusion: The New Reality of Economically-Weaponized Trade

China’s complete boycott of US soybeans represents a new phase in economic statecraft where agricultural trade becomes fully subordinated to geopolitical objectives. This development has profound implications extending far beyond bilateral US-China relations.

The current crisis demonstrates both the power and limitations of economic weaponization in trade relationships. While China has successfully created significant pressure on American agricultural producers and their political representatives, it has done so at considerable economic cost and with uncertain long-term benefits.

The resolution of this specific crisis will likely determine whether agricultural trade returns to primarily economic considerations or remains permanently subordinated to geopolitical competition. Given the investments being made in alternative supply chains and the demonstrated willingness of both sides to absorb economic costs for political objectives, the latter scenario appears increasingly likely.

For global markets, this represents a fundamental shift toward a more fragmented, less efficient, but potentially more resilient international trading system. The challenge for policymakers worldwide will be managing this transition while minimizing economic disruption and maintaining food security for global populations.

The US-China agricultural trade relationship, once a symbol of economic interdependence and mutual benefit, has become a casualty of broader geopolitical competition. Its future will likely be determined less by economic efficiency and comparative advantage than by the evolution of strategic competition between the world’s two largest economies.

How to avoid intrusive advertising?

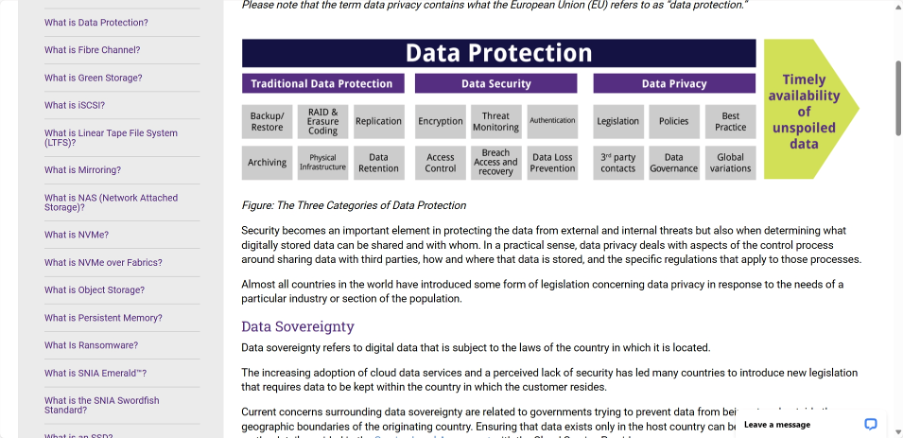

Unethical data collection has been a hot topic as information collected can expose individuals to dangerous scenarios. As a result, different parties have gotten involved to ensure data collected complies with laws and regulation or allow users to have the option to opt out of having their data collected.

1. Government

Data privacy involves protecting and responsibly using an individual’s personal information, preferences, and activities. With the increase in online customer data, measures have been implemented to safeguard personally identifiable information (PII) like names, dates of birth, email addresses, financial details, and browsing history.

Governments and organisations worldwide are implementing measures to protect personal information, and marketers must comply with data collection regulations. Stay informed about these regulations to ensure compliance.

GDPR privacy laws

GDPR, a data privacy law, has changed how marketers work. It gives people more control over their data and requires businesses to ask for explicit permission before using it. Marketers must now be transparent about data collection and update their privacy policies to comply.

One challenge is explaining how data is used and giving people the choice to opt in or out. This complicates targeting and personalisation efforts, as marketers need permission to use data. GDPR also requires companies to respond to requests from customers to access or delete their data promptly and correctly. Marketers must be prepared to handle these requests to follow the law.

Privacy laws are changing in the US as data privacy becomes more important worldwide. While the US doesn’t have a national privacy law like the EU’s GDPR, individual states are taking steps to protect people’s privacy. California has the California Consumer Privacy Act (CCPA) since January 2020.

This law lets Californians know what data companies collect about them and who they share it with and allows them to delete it. People can also choose not to have their information sold to others. Other states, like Virginia, are following California’s example. Virginia passed the Virginia Consumer Data Protection Act (VCDPA) in March 2021, giving its residents more control over their data, including the right to transparency, access, deletion, and opting out.

2. Private businesses

Apple’s privacy updates are causing challenges for marketers. One example is the Mail Privacy Protection (MPP) feature, which opens incoming emails to protect user privacy. This feature hides IP addresses and prevents tracking of the recipient’s location and online activity. Apple’s recent iOS 17 updates also focus on protecting user data and privacy, making it harder for marketers to track engagement.

For instance, Link Tracking Protection in iOS 17 removes tracking parameters from messages, mail, and links, making it difficult to link interactions to specific users. Despite these challenges, link tracking remains a helpful metric, with only certain link types being affected.

Ensuring ethical data collection practices is essential for fostering trust with customers. When customers are hesitant to share their data, it can hinder their overall experience.

3. Yourself

You can also play a part to protect your own online data privacy through methods such as using private browsers such as Maxthon that prioritises data privacy of their users. Maxthon browser prioritizes data privacy by incorporating advanced encryption measures to protect users’ personal information. It ensures that user data is anonymized and not shared with third parties without consent.

By minimizing data collection, Maxthon reduces the risk of potential security breaches or privacy violations. Additionally, the browser offers robust privacy settings that allow users to control what information is collected and stored.

Maxthon takes a proactive approach to enhancing security and protecting user privacy by minimizing the collection of unnecessary data. By reducing the amount of personal information gathered, the risk of potential security breaches or privacy violations is significantly lowered. Additionally, Maxthon provides users with robust privacy settings that allow for greater control over their online activities.

These privacy settings include options to block unwanted tracking cookies, enable private browsing mode, and customize cookie permissions on a site-by-site basis. Users can also choose to opt-out of personalized advertisements and prevent websites from accessing their location or webcam without permission. With these features in place, Maxthon ensures that users can browse the internet securely and with peace of mind knowing their data is protected.

Maxthon, as a leading web browser, understands the importance of protecting user data. To ensure the highest level of security, the company conducts regular audits to assess its data protection measures. These audits help identify any potential vulnerabilities and ensure compliance with industry standards. Additionally, Maxthon focuses on implementing timely security updates to address any emerging threats or issues.

By staying proactive in evaluating its data protection practices, Maxthon demonstrates a commitment to safeguarding user information. The company prioritizes staying informed about the latest security trends and technologies to enhance its defenses against cyber threats. Through these continuous efforts, Maxthon aims to provide users with a secure browsing experience that instills trust and confidence in their data privacy.

Through regular audits and security updates, Maxthon constantly evaluates its data protection practices to adhere to the latest industry standards. Users can also benefit from features like built-in ad blockers and anti-tracking tools for a more secure browsing experience. Overall, Maxthon puts an emphasis on maintaining user trust through transparent data handling policies and proactive measures to safeguard sensitive information.