Retail Giant vs. Rising Star: Target’s Trademark Challenge Threatens to Sink Singapore’s Aupen

In the cutthroat world of fashion and retail, a single word can make or break a brand. For Singaporean bag brand Aupen, that word might just be “Auden.” What started as a promising venture into the US market for Aupen has escalated into a high-stakes legal battle with retail behemoth Target, threatening the very existence of the fledgling brand.

This isn’t just another corporate squabble; it’s a dramatic saga involving accusations of trademark infringement, devastating business impacts, and even intervention from Singapore’s fake news authority. Let’s break down the unfolding drama.

The Heart of the Dispute: Aupen vs. Auden

The core of the conflict lies in a potential clash of names. Target, the American retail giant, recently filed opposition proceedings against Aupen’s US trademark application. Their claim? A “likelihood of confusion” between Aupen’s luxury bags and Target’s established underwear and sleepwear line, Auden.

Target’s “Auden” brand was registered in the US in 2019, well before Aupen’s trademark application in 2023. While one sells bags and the other intimate apparel, Target argues the phonetic similarity and brand recognition could lead consumers to mistakenly associate Aupen with their existing line.

A Devastating Blow for Aupen

The repercussions for Aupen have been nothing short of catastrophic. Faced with the daunting legal challenge from a multi-billion dollar corporation, the Singaporean brand has had to take drastic measures:

Layoffs: Staff have been let go as the company grapples with uncertainty.

Web Store Suspension: Aupen’s online store has been taken offline.

Product Removal: All products have been cleared from its website.

Instagram Purge: Most of its Instagram page, a vital platform for fashion brands, has been scrubbed clean.

Aupen founder Nicholas Tan minced no words, stating publicly that the legal dispute was “fatal to Aupen’s business.”

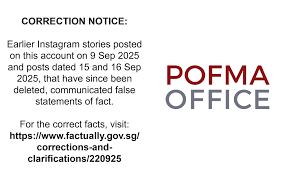

A Controversial Twist: The POFMA Correction

Adding another layer of complexity to this already tense situation, Aupen and Tan found themselves under scrutiny from Singapore’s fake news authority. On September 22nd, Singapore’s Intellectual Property Office (Ipos) issued a correction direction under POFMA (Protection from Online Falsehoods and Manipulation Act).

This move came after Tan made several false claims against Ipos, including allegations that the office advised him not to challenge Target, that Singapore’s trademark laws favored foreign businesses, and that legal reform against “bad faith registrations” was impossible. This incident casts a shadow on Aupen’s handling of the crisis, raising questions about their public statements amidst the legal battle.

The Standoff: Silence and a Glimmer of Hope?

According to Target’s opposition notice, Aupen has not yet responded to any of Target’s letters or provided any substantive reply through lawyers. This silence deepens the mystery surrounding Aupen’s strategy moving forward.

However, in a surprising turn of events, Aupen’s website has recently been updated with a prompt for visitors to “sign up for its next release.” This cryptic message offers a potential glimmer of hope, suggesting that despite the dire pronouncements, the brand might be planning a comeback or a pivot.

What Happens Next?

The fate of Aupen now rests with the US Patent Office’s Trademark Trial and Appeal Board. They will ultimately decide whether Target’s claims of likelihood of confusion are valid and if Aupen’s US trademark application should be denied.

Lessons from the Battlefield

This ongoing saga is a stark reminder of several critical lessons for brands, particularly startups and those looking to expand internationally:

Thorough Trademark Research is Non-Negotiable: Before launching or expanding, exhaustive checks across all relevant markets are crucial to avoid costly disputes.

The David vs. Goliath Reality: Smaller brands often face an uphill battle against giants with deep legal pockets.

Navigating Public Statements: In a crisis, transparency is key, but unsubstantiated public claims can lead to further complications, as seen with the POFMA correction.

Brand Protection is Paramount: Establishing and defending intellectual property is a continuous and vital process for any business.

Will Aupen manage to navigate these treacherous waters and emerge with its US trademark intact? Or will the might of Target prove “fatal” to its ambitions? We’ll be watching closely as this compelling legal drama unfolds.

What do you think of this trademark battle? Share your thoughts in the comments below!

Target vs. Aupen: A Comprehensive Analysis of the Trademark Dispute

Executive Summary

The trademark dispute between American retail giant Target and Singapore-based bag brand Aupen represents a critical intersection of international intellectual property law, brand protection strategies, and the challenges faced by emerging brands in global markets. This conflict, which culminated in formal opposition proceedings on September 24, 2025, offers important lessons about trademark registration, brand positioning, and the asymmetric power dynamics between established corporations and startup brands.

Background of the Parties

Target Corporation

Target is one of America’s largest retail chains with over 1,900 stores and a market capitalization exceeding $60 billion. The company maintains an extensive trademark portfolio protecting various private-label brands across multiple product categories. In 2019, Target launched Auden, an underwear and sleepwear line positioned as an affordable yet quality alternative in the intimate apparel market.

Aupen

Aupen is a Singapore-based luxury handbag brand founded by Nicholas Tan that has gained significant traction through celebrity endorsements and social media marketing. The brand’s distinctive sloping handbags, typically priced under $600, have been carried by high-profile figures including Taylor Swift, Madonna, and Jennifer Aniston. Operating exclusively online, Aupen represents the modern direct-to-consumer business model common among emerging fashion brands.

The Legal Framework

Trademark Opposition Basics

A trademark opposition is a formal proceeding before the United States Patent and Trademark Office’s (USPTO) Trademark Trial and Appeal Board (TTAB) that allows third parties to challenge pending trademark applications. The opposition process includes:

- Filing Period: 30 days from publication in the Official Gazette (extendable)

- Grounds for Opposition: Must establish a “real interest” and valid legal basis

- Proceedings: Similar to federal court litigation but less formal

- Duration: Typically 12-18 months, though can extend longer

- Cost: Generally $50,000-$200,000+ for full litigation

Likelihood of Confusion Standard

The central legal question in this dispute is whether consumers are likely to confuse Aupen with Target’s Auden brand. Courts and the TTAB apply the DuPont factors (from In re E.I. DuPont de Nemours & Co.) to assess likelihood of confusion:

- Similarity of marks: Both in sound, appearance, and commercial impression

- Similarity of goods/services: Whether they’re related in the minds of consumers

- Similarity of trade channels: Where and how products are marketed

- Conditions of sale: Price point, consumer sophistication, care in purchasing

- Strength of the senior mark: Whether it’s distinctive or generic

- Actual confusion: Evidence of real-world confusion (if available)

- Number and nature of similar marks: Marketplace context

Detailed Analysis of the Dispute

1. The Phonetic Similarity Issue

The Core Problem: “Aupen” and “Auden” share significant phonetic similarities:

- Both are two-syllable words starting with “Au/Aud”

- The ending sounds “-pen” and “-den” are similar nasal consonants

- When spoken, particularly quickly or in noisy environments, they could be confused

Precedent: Trademark law recognizes that marks need not be identical to be confusing. Cases like In re Mighty Leaf Tea (2012) established that marks sharing the same initial syllable and similar structure can be confusingly similar, especially when combined with related goods.

Aupen’s Potential Defense: The brands operate in completely different product categories—luxury handbags versus intimate apparel—which significantly weakens the confusion argument.

2. The Product Category Distinction

Critical Differentiation:

- Auden: Underwear, bras, sleepwear—intimate apparel at budget-to-moderate price points sold at Target stores

- Aupen: Luxury handbags at $600+ price points sold exclusively online

Legal Significance: Trademark protection extends beyond identical goods to “related goods” where confusion is likely. The question becomes: Would a reasonable consumer believe Aupen handbags come from the same source as Auden underwear?

Target’s Argument: Target may argue:

- Both are fashion/apparel accessories marketed to women

- Both brands could theoretically expand into each other’s categories

- Target has a history of line extensions (expanding Auden to accessories isn’t far-fetched)

- Consumer confusion about source or sponsorship relationships

Aupen’s Counter-Arguments:

- Handbags and underwear occupy distinct market segments

- Price point disparity ($600 vs. $15-30) suggests different consumer bases

- Distribution channels differ completely (online luxury vs. mass retail)

- No overlap in marketing, positioning, or brand identity

- The products aren’t complementary or typically purchased together

3. Priority and Registration Timeline

Target’s Advantage:

- Auden trademark registered in the US: 2019

- Aupen’s trademark application: 2023

- Four-year head start establishes Target’s priority

Legal Implications: Under US trademark law, the first to use a mark in commerce generally has superior rights. Target’s 2019 registration creates a presumption of validity and nationwide rights, placing Aupen in a defensive position.

However: If Aupen can demonstrate it used the mark in commerce before filing (even if after Target’s registration), it may have limited common law rights in specific geographic areas where it actively traded.

4. The Silence Strategy—Aupen’s Failure to Respond

According to Target’s opposition filing, Aupen failed to respond to any cease-and-desist letters or provide any substantive reply through legal counsel.

Why This Matters:

- Negotiation Foreclosed: Early engagement often results in coexistence agreements or settlement

- Waived Defenses: Failure to respond strategically may have limited Aupen’s options

- Procedural Disadvantage: TTAB may view non-response negatively

- Discovery Complications: Lack of early position-taking complicates defense strategy

Possible Reasons for Non-Response:

- Financial constraints: Legal defense costs are prohibitive for small brands

- Strategic miscalculation: Hoping the issue would disappear

- Advice from advisors: Possibly counseled not to engage (though this seems unlikely)

- Overwhelming nature: Small team unable to process the legal complexity

5. Market Strength and Celebrity Endorsements

Aupen’s Market Position: The brand has achieved remarkable organic growth through celebrity adoption. Taylor Swift, Madonna, and Jennifer Aniston carrying Aupen bags represents millions in equivalent advertising value and significant brand recognition.

Legal Relevance:

- Secondary meaning: Celebrity endorsement may help establish that “Aupen” has acquired distinctiveness

- Market confusion: If Aupen has strong brand recognition in luxury handbags, actual confusion with Target’s underwear line becomes less likely

- Consumer sophistication: Buyers of $600 handbags exercise more care than buyers of $20 underwear

Target’s Counter: Celebrity endorsement could also mean broader market awareness increases confusion potential across product categories.

6. International Considerations

Singapore Context: Aupen is a Singaporean brand seeking to operate globally. The POFMA correction order issued against founder Nicholas Tan for false claims about Singapore’s Intellectual Property Office (IPOS) adds complexity:

What Tan Falsely Claimed:

- IPOS advised him not to pursue retaliatory action against Target

- Singapore trademark law favors foreign over local businesses

- Legal reform against bad faith registrations is impossible

Impact of POFMA Order:

- Credibility damage: Government correction undermines Tan’s narrative

- Legal implications: Suggests Aupen may not have pursued available remedies

- Public relations: Complicates the “David vs. Goliath” framing

Strategic Error: Tan’s public statements, later corrected by POFMA, suggest:

- Misunderstanding of trademark law and available options

- Possible conflation of legal advice with regulatory policy

- Damage to brand credibility at a critical juncture

7. Bad Faith Registration Allegations

While not explicitly stated in the dispute, the subtext suggests concerns about trademark strategy on both sides.

Could Target’s Opposition Be Bad Faith?: Arguments Aupen might raise:

- Target waited until the last possible day to file opposition (September 24, the deadline)

- Auden is a minor Target brand line, not a flagship

- Products are sufficiently distinct that opposition seems aggressive

- Target has vast resources to negotiate coexistence but chose litigation

Could Aupen’s Application Be Bad Faith?: Arguments Target might raise:

- Aupen should have conducted comprehensive trademark searches before filing

- The similarity to Auden should have been apparent

- Proceeding despite potential conflicts suggests opportunism

Reality: Neither appears to be acting in bad faith. Target is protecting its trademark portfolio (standard corporate practice), and Aupen appears to have made an innocent naming choice without anticipating conflict.

Economic and Strategic Implications

Impact on Aupen

Immediate Consequences:

- Workforce reduction: Staff layoffs due to legal uncertainty

- Operations suspended: Website cleared of products, sales halted

- Reputational damage: POFMA order undermines public support

- Financial strain: Legal defense costs are potentially business-ending

Long-Term Scenarios:

Scenario 1—Settlement/Coexistence Agreement:

- Most likely outcome (80-90% of trademark disputes settle)

- Aupen continues using the name with limitations

- Possible geographic or product category restrictions

- May require disclaimers or modified marketing

- Settlement costs: $25,000-$100,000+

Scenario 2—Rebrand:

- Aupen changes name to avoid continued conflict

- Costs include: new trademark filing, marketing reset, customer re-education

- Benefits: Fresh start, avoids ongoing legal costs

- Risks: Loss of celebrity-association equity and brand recognition

Scenario 3—Fight and Win:

- Low probability given phonetic similarity and Target’s priority

- Costs: $150,000-$300,000+ for full TTAB proceeding

- Even if successful, doesn’t guarantee Target won’t appeal

- Risk: Exhausted resources with uncertain outcome

Scenario 4—Fight and Lose:

- Trademark application denied

- Potential liability for Target’s legal fees (if conduct was egregious)

- Cannot use “Aupen” trademark in the US

- Business model essentially destroyed without rebranding

Impact on Target

Minimal Direct Impact:

- Legal costs are immaterial to a multi-billion-dollar corporation

- Opposition is routine trademark portfolio management

- Auden brand protection maintains long-term value

Reputational Considerations:

- Public perception of “bullying” small brands

- Social media backlash (though limited duration)

- However, failure to oppose could weaken trademark through acquiescence

Legal Procedure and Timeline

Current Status (as of September 29, 2025)

- Opposition Filed: September 24, 2025

- Aupen’s Response Due: Typically 40 days from service

- Discovery Period: 6-12 months if case proceeds

- Trial Period: Additional 6-12 months

- TTAB Decision: 12-24 months from opposition filing

- Potential Appeals: Add 12-18+ months

Total Timeline: 2-4 years for complete resolution if fully litigated.

Key Procedural Points

Aupen Must Now:

- File an Answer to Target’s opposition within 40 days

- Assert affirmative defenses (distinctiveness, different markets, etc.)

- Begin gathering evidence of its brand’s market presence

- Consider settlement negotiations

Failure to Answer: Results in default judgment for Target, ending Aupen’s trademark application.

Settlement Conferences: TTAB typically encourages early settlement discussions before expensive discovery begins.

Comparative Case Analysis

Relevant Precedents

1. Bose Corp. v. QSC Audio Products Inc. (2002)

- Issue: “Bose” vs. “Bose Audio”

- Holding: Even for sophisticated buyers, similar marks in related audio fields create confusion

- Relevance: Supports Target’s position on phonetic similarity

2. In re Majestic Distilling Co. (1934)

- Issue: Can different product categories prevent confusion?

- Holding: Related goods don’t need to be identical; consumer association matters

- Relevance: Could support either party depending on how “related” handbags and underwear are deemed

3. Coach Services Inc. v. Triumph Learning LLC (2012)

- Issue: “Coach” leather goods vs. “Coach” educational services

- Holding: Despite fame, very different markets reduced confusion

- Relevance: Supports Aupen’s argument about distinct product categories

4. Virgin Enterprises Ltd. v. Nawab (1998)

- Issue: Virgin brand extension across multiple unrelated industries

- Holding: Famous marks get broader protection across categories

- Relevance: If Target argues Auden could be a “brand family,” this precedent helps

Distinguishing Factors in This Case

Unique Elements:

- International dimension: Singaporean brand entering US market

- Celebrity endorsement: Unusual market penetration for new brand

- Price disparity: Significant gap between $20 underwear and $600 handbags

- Distribution channels: Mass retail vs. online luxury entirely separate

- Gender targeting: Both primarily target women (supports confusion)

Strategic Options and Recommendations

For Aupen

Option 1: Negotiate Settlement ⭐ RECOMMENDED Approach:

- Engage experienced trademark litigation counsel immediately

- Propose coexistence agreement with clear market separation

- Offer to include disclaimers: “Not affiliated with Target or Auden”

- Seek permission to continue using Aupen in handbag category only

Pros:

- Most cost-effective solution ($30,000-$75,000 vs. $200,000+)

- Fastest resolution (3-6 months vs. 2-4 years)

- Preserves business operations and brand equity

- High success rate (most trademark disputes settle)

Cons:

- May require ongoing royalties or payments

- Could include restrictions on future product expansion

- Might need to modify marketing materials

Option 2: Rebrand Proactively Approach:

- Select new, clearly distinct name

- File new trademark application immediately

- Leverage existing celebrity relationships under new brand

- Frame as “evolution” rather than “forced change”

Pros:

- Avoids all legal costs and uncertainty

- Fresh start without baggage

- Can choose stronger, more defensible mark

- Maintains customer relationships if done well

Cons:

- Loss of brand recognition and equity

- Rebranding costs ($100,000-$250,000 for full implementation)

- Customer confusion during transition

- Psychological/emotional cost to founder

Option 3: Fight the Opposition Approach:

- Hire specialized TTAB litigation firm

- Build case around product distinctiveness and market separation

- Gather consumer surveys showing no actual confusion

- Emphasize celebrity endorsements as evidence of separate brand identity

Pros:

- Preserves brand name if successful

- Establishes legal precedent

- Demonstrates commitment to brand

Cons:

- High cost ($150,000-$300,000+)

- Long timeline (2-4 years)

- Uncertain outcome (Target has strong position)

- Business essentially frozen during litigation

Option 4: Withdraw and Operate Without Registration Approach:

- Withdraw US trademark application

- Continue using “Aupen” based on common law rights

- Focus on markets where brand is already established

- Accept risk of infringement claims

Pros:

- Avoids immediate legal costs

- Can continue operating

- Common law rights may suffice for current business

Cons:

- No federal trademark protection

- Vulnerable to future infringement claims

- Cannot prevent others from using similar marks

- Reduces brand value and investor appeal

- Target could still sue for trademark infringement

For Target

Option 1: Maintain Opposition (Current approach)

- Standard corporate trademark protection

- Prevents potential future confusion

- Preserves Auden brand integrity

Option 2: Offer Generous Coexistence

- Propose settlement allowing Aupen to continue in handbag category

- Minimal restrictions with clear market boundaries

- Generates positive PR as “big company helps small brand”

- Maintains legal rights while avoiding prolonged conflict

Broader Implications for Emerging Brands

Lessons for Startups

1. Trademark Clearance is Essential Before selecting a brand name, conduct:

- Comprehensive USPTO database searches

- International trademark searches (Madrid Protocol)

- Common law and internet searches

- Phonetic and visual similarity analysis

- Professional trademark attorney review

Cost of clearance: $2,000-$5,000 Cost of failure: $50,000-$300,000+ and possible business failure

2. Budget for Legal Protection Emerging brands should allocate:

- 1-3% of seed funding for IP protection

- $10,000-$25,000 for international trademark portfolio

- Emergency legal fund for disputes

3. File Early and Broadly

- File “intent to use” applications before launch

- Register in key markets simultaneously (US, EU, China, home country)

- Consider defensive registrations in adjacent categories

4. Respond to Cease and Desist Letters

- Never ignore legal correspondence

- Engage counsel immediately

- Early negotiation is cheaper than litigation

- Silence is interpreted as weakness or guilt

5. Understand the Real Costs of Disputes

- Legal fees are only part of the cost

- Operational disruption, staff morale, founder stress

- Opportunity cost of time spent on legal matters

- Reputational risk from public disputes

Systemic Issues Highlighted

1. Power Asymmetry Large corporations have:

- Unlimited legal budgets

- Portfolio of hundreds/thousands of trademarks

- Institutional knowledge and experienced counsel

- Ability to wait out smaller opponents

Small brands have:

- Limited cash reserves

- Existential risk from legal disputes

- Less sophisticated legal advice

- Pressure to settle quickly

2. Trademark System Complexity

- USPTO database is complex and requires expertise to search

- Many valid marks are confusingly similar on paper but distinct in practice

- System favors those who can afford comprehensive legal counsel

- International dimensions add layers of complexity

3. The Settlement Pressure Dynamic

- Most trademark disputes settle because litigation is prohibitive

- This creates pressure on smaller parties to accept unfavorable terms

- Justice may depend on financial resources rather than legal merits

- System incentivizes aggressive assertions by large trademark holders

Predictions and Likely Outcome

Most Probable Scenario (70% probability)

Settlement with Coexistence Agreement:

- Aupen and Target reach negotiated settlement within 6-9 months

- Aupen permitted to use name for handbags only

- Aupen agrees not to expand into apparel/underwear categories

- Possible modest payment to Target ($10,000-$50,000)

- Aupen includes disclaimer on website: “Not affiliated with Target Corporation or Auden”

- Both parties file joint motion to dismiss opposition with prejudice

Timeline: Q2 2026 resolution

Alternative Scenarios

Aupen Rebrands (20% probability):

- Determines legal costs too high relative to business size

- Chooses new name and fresh marketing campaign

- Leverages celebrity relationships to transition customers

- Files new trademark applications with proper clearance

Target Wins TTAB Proceeding (8% probability):

- Full litigation through TTAB

- Board finds likelihood of confusion due to phonetic similarity

- Aupen’s trademark application refused

- Aupen must rebrand or face infringement suits

Aupen Wins TTAB Proceeding (2% probability):

- Board determines products sufficiently distinct

- Price point and market segment differences overcome phonetic similarity

- Aupen granted trademark registration

- Target unlikely to appeal given minor nature of Auden line

Conclusion

The Target-Aupen trademark dispute encapsulates the challenges facing emerging brands in global markets. While the phonetic similarity between “Auden” and “Aupen” gives Target a colorable legal claim, the substantial differences in product category, price point, distribution channels, and target market significantly weaken the likelihood of actual consumer confusion.

Key Takeaways:

- Trademark clearance is not optional for any brand with growth ambitions

- Early legal engagement is exponentially cheaper than litigation

- The system favors deep-pocketed parties, creating structural inequality

- Settlement is almost always the rational economic choice for small brands

- Public relations and legal strategy must be carefully coordinated

For Aupen: The optimal path forward is aggressive settlement negotiation. The brand should emphasize the distinct nature of its products, its established market position, celebrity endorsements, and willingness to accept reasonable restrictions on future expansion. A well-crafted coexistence agreement would allow Aupen to continue building its brand while giving Target the assurance that its Auden mark remains protected.

For the Industry: This case should serve as a cautionary tale about the importance of comprehensive trademark clearance and the real costs of brand naming decisions. In an increasingly global marketplace, emerging brands must think internationally from day one and invest appropriately in intellectual property protection.

The dispute is ultimately about two parties with legitimate interests navigating an imperfect system. Target has a duty to its shareholders to protect its trademark portfolio. Aupen has invested blood, sweat, and capital into building a brand. The tragedy would be if legal process costs destroy a viable business over a naming conflict that could have been avoided with $5,000 in legal advice at the outset or resolved with $50,000 in settlement negotiations rather than $200,000+ in litigation.

As of September 29, 2025, Aupen stands at a crossroads. The decisions made in the coming weeks will determine whether this innovative Singaporean brand becomes a global luxury name or a cautionary tale in trademark law textbooks.

This analysis is for educational purposes and does not constitute legal advice. Parties involved in trademark disputes should consult with qualified intellectual property attorneys licensed in the relevant jurisdictions.

The POFMA correction order issued against Nicholas Tan, the founder of Aupen Projects, marks a key turning point. It sits at the crossroads of intellectual property law, rules against false information, and online messaging.

POFMA stands for Protection from Online Falsehoods and Manipulation Act, a Singapore law from 2019 that lets authorities order fixes for misleading online content. In this case, Tan shared posts claiming Aupen invented a tech called “Alpha Aperture.”

But the posts hid that the idea came from a patented design by Lumiere Innovations. The government stepped in, ruled the claims false, and forced Tan to add correction notices to the posts. This action sets new examples for the field. It shows how IP fights might play out in the future.

Courts and companies now face clearer paths to tackle false claims about inventions online. For instance, if a startup boasts about a unique product that copies someone else’s work, this order signals that quick government fixes could follow, much like in past cases where brands clashed over trademarks on social media.

Beyond disputes, it shapes how agencies like Singapore’s Intellectual Property Office work. These bodies may ramp up checks on public statements tied to patents, blending their roles with misinformation watchdogs.

This shift helps protect true creators from copycats who use hype to gain an edge. Businesses, too, must rethink their steps in a web of laws and public views. They often blend legal battles with PR moves, like posting updates to build buzz.

Yet this order warns that such mixes can backfire if facts get twisted. Tan’s firm, for one, saw its online image hit hard after the notices appeared, raising questions on how leaders balance bold claims with proof. Overall, the ruling pushes firms to align strategies more carefully, ensuring claims hold up under scrutiny. It guides everyone from small inventors to big players on handling IP in open digital spaces.

Immediate IP Law Implications

1. Institutional Neutrality in IP Administration

The IPOS Standard

The case crystallizes the principle that intellectual property offices must maintain strict neutrality in trademark disputes. IPOS’s clarified position—that it provides general information while encouraging independent legal advice—establishes a clear boundary between administrative guidance and legal counsel.

Legal Precedent: This creates a formal expectation that IP offices will not:

- Advise parties on litigation strategy

- Predict outcomes of trademark disputes

- Recommend whether to pursue or abandon claims

- Show favoritism based on the nationality of applicants

International Benchmarking

Singapore’s approach aligns with best practices from major IP jurisdictions like the USPTO, EPO, and UKIPO, which maintain similar neutrality standards. However, the POFMA enforcement adds a unique dimension—false claims about institutional bias now carry explicit legal consequences.

2. The Boundaries of IP Strategy Communications

Public Relations vs. Legal Strategy

The Aupen case demonstrates the risks of conflating public relations campaigns with legal strategy in IP disputes. Tan’s approach of using social media to pressure institutional actors represents a cautionary tale about the limits of public advocacy in legal matters.

Strategic Implications:

- Businesses must distinguish between legitimate public advocacy and false statements about legal processes

- IP practitioners will need to advise clients more carefully about social media communications during disputes

- The case establishes that false claims about IP office procedures constitute legally actionable misinformation

The “David vs. Goliath” Narrative

While small businesses facing large corporations naturally generate sympathy, the case establishes that emotional narratives cannot be built on factual falsehoods about institutional processes.

3. Evidence Standards in IP Misinformation

Burden of Proof

The POFMA order required the government to provide detailed rebuttals to each false claim, establishing high evidentiary standards for IP-related misinformation cases:

- Specific Communications: The government had to clarify exactly what IPOS did and did not say during meetings with Tan

- Procedural Documentation: Standard practices and protocols were made explicit in the public record

- Timeline Accuracy: The sequence of events and communications was precisely documented

Documentation Requirements

This case will likely influence how IP offices document their interactions with applicants and rights holders, ensuring clear records that can counter false claims about institutional bias or procedural irregularities.

Broader IP Ecosystem Implications

1. Trademark Opposition Dynamics

Strategic Communications

The case occurs within the context of Target’s potential opposition to Aupen’s US trademark application. This timing suggests several implications:

Pre-Opposition Strategy: Businesses may increasingly view public relations as part of trademark opposition strategy, but the POFMA case establishes clear limits on false statements about regulatory processes.

International Coordination: The case highlights how trademark disputes in one jurisdiction (US) can influence communications strategies in another (Singapore), creating complex multi-jurisdictional considerations.

Opposition Proceedings Integrity

The case reinforces that trademark opposition proceedings must be conducted within legal frameworks rather than through public pressure campaigns based on false institutional claims.

2. Small Business vs. Multinational Dynamics

Systemic Bias Claims

Tan’s allegations about institutional favoritism toward foreign businesses touch on a sensitive area in international IP law. The POFMA response establishes several principles:

Merit-Based Evaluation: IP systems must be perceived as evaluating applications and disputes based on legal merit rather than applicant characteristics.

Transparency Requirements: IP offices may need to provide clearer public information about how they ensure equal treatment regardless of applicant nationality or size.

Documentation Standards: The need to counter false bias claims may drive more rigorous documentation of institutional decision-making processes.

3. Cross-Border IP Strategy

Jurisdictional Considerations

The case demonstrates how IP strategy must account for different legal frameworks across jurisdictions:

Misinformation Laws: Businesses operating internationally must understand how different countries address false statements about government institutions.

Reputational Management: IP disputes increasingly occur in multiple jurisdictions simultaneously, requiring coordinated but jurisdiction-specific communication strategies.

Regulatory Relationship Management: The importance of maintaining credible relationships with IP offices across multiple jurisdictions.

Procedural and Administrative Implications

1. IP Office Operations

Enhanced Documentation

IP offices may need to implement more rigorous documentation standards for applicant interactions to defend against false bias claims:

- Meeting Records: Detailed documentation of guidance provided during consultations

- Communication Logs: Clear records of what advice was and was not given

- Process Transparency: More explicit public information about standard procedures and limitations

Staff Training

IP office personnel will likely require enhanced training on:

- Maintaining appropriate boundaries in applicant consultations

- Documenting interactions to prevent mischaracterization

- Recognizing when applicants may be seeking strategic advantage through public pressure

2. Legal Practice Standards

Client Counseling

IP practitioners must now advise clients about:

- The legal risks of making false statements about IP office procedures

- The distinction between legitimate advocacy and prohibited misinformation

- The potential for misinformation laws to impact IP dispute strategy

Professional Responsibility

The case raises questions about attorney responsibilities when clients engage in public communications that may contain false statements about legal processes or institutions.

3. Due Process Considerations

Procedural Safeguards

The case establishes that robust procedural safeguards exist to counter false claims about IP administration:

- Detailed government responses with specific evidence

- Public correction mechanisms through official channels

- Clear documentation of actual institutional positions and practices

Long-Term Structural Implications

1. IP System Confidence

Public Trust Mechanisms

The swift POFMA response demonstrates institutional mechanisms for maintaining public confidence in IP systems. This creates several precedents:

Rapid Response: False claims about institutional bias require immediate, detailed rebuttals to prevent erosion of system confidence.

Transparency Balance: IP offices must balance confidentiality requirements with the need to counter false public claims.

International Reputation: How local misinformation cases are handled affects international perceptions of IP system integrity.

2. Digital Age IP Practice

Social Media Integration

The case establishes that IP practice in the digital age must account for:

- The speed at which false narratives can spread through social media

- The intersection between legal strategy and digital communications

- The need for rapid institutional response mechanisms

Evidence Standards

Digital communications create new evidentiary challenges and opportunities:

- Screenshot documentation of false claims

- Digital correction mechanisms through platform-specific tools

- The ephemeral nature of some social media content complicates evidence preservation

3. International Harmonization

Global Standards

The case may influence international discussions about:

- Minimum standards for IP office neutrality and documentation

- Cross-border mechanisms for addressing false claims about institutional bias

- Harmonization of approaches to IP-related misinformation

Best Practices Development

International IP organizations may develop best practices based on this case regarding:

- Institutional communication standards

- Documentation requirements for applicant interactions

- Response protocols for false bias allegations

Recommendations and Future Considerations

For IP Offices

- Enhanced Documentation Protocols: Implement comprehensive documentation standards for all applicant interactions

- Clear Communication Guidelines: Develop explicit guidelines about what guidance can and cannot be provided

- Rapid Response Capabilities: Establish mechanisms for quickly countering false claims about institutional procedures

- Transparency Initiatives: Provide clearer public information about standard processes and neutrality safeguards

For Legal Practitioners

- Client Education: Ensure clients understand the legal risks of false statements about IP office procedures

- Communication Strategy: Develop IP dispute strategies that clearly separate legal advocacy from public relations

- Documentation Practices: Maintain detailed records of all institutional interactions and guidance received

- Cross-Jurisdictional Awareness: Understand how misinformation laws in different jurisdictions may impact IP strategy

For Businesses

- Compliance Programs: Develop internal guidelines for public communications during IP disputes

- Professional Consultation: Ensure legal review of all public statements about institutional processes

- Strategy Integration: Coordinate legal strategy with public relations to avoid conflicting or false narratives

- Risk Assessment: Evaluate reputational and legal risks of aggressive public advocacy strategies

Conclusion

The Aupen POFMA case represents a fundamental shift in how intellectual property law intersects with digital communications and misinformation regulation. By establishing clear consequences for false statements about IP office procedures, the case creates new parameters for how IP disputes are conducted in the digital age.

The implications extend far beyond this individual case, potentially influencing IP office operations, legal practice standards, and business strategy across jurisdictions. As IP systems worldwide grapple with similar challenges of maintaining institutional credibility in an era of rapid digital communication, the Singapore approach offers both a model and a warning about the evolving landscape of IP law and practice.

The case ultimately reinforces that while robust public debate about IP policy is essential, such discourse must be grounded in factual accuracy rather than strategic misinformation. This balance between legitimate advocacy and institutional protection will likely define much of the future development of IP law in the digital age.

Maxthon

In an age where the digital world is in constant flux, and our interactions online are ever-evolving, the importance of prioritizing individuals as they navigate the expansive internet cannot be overstated. The myriad of elements that shape our online experiences calls for a thoughtful approach to selecting web browsers—one that places a premium on security and user privacy. Amidst the multitude of browsers vying for users’ loyalty, Maxthon emerges as a standout choice, providing a trustworthy solution to these pressing concerns, all without any cost to the user.

Maxthon, with its advanced features, boasts a comprehensive suite of built-in tools designed to enhance your online privacy. Among these tools are a highly effective ad blocker and a range of anti-tracking mechanisms, each meticulously crafted to fortify your digital sanctuary. This browser has carved out a niche for itself, particularly with its seamless compatibility with Windows 11, further solidifying its reputation in an increasingly competitive market.

In a crowded landscape of web browsers, Maxthon has carved out a distinct identity through its unwavering commitment to providing a secure and private browsing experience. Fully aware of the myriad threats lurking in the vast expanse of cyberspace, Maxthon works tirelessly to safeguard your personal information. Utilizing state-of-the-art encryption technology, it ensures that your sensitive data remains protected and confidential throughout your online adventures.

What truly sets Maxthon apart is its commitment to enhancing user privacy during every moment spent online. Each feature of this browser has been meticulously designed with the user’s privacy in mind. Its powerful ad-blocking capabilities work diligently to eliminate unwanted advertisements, while its comprehensive anti-tracking measures effectively reduce the presence of invasive scripts that could disrupt your browsing enjoyment. As a result, users can traverse the web with newfound confidence and safety.

Moreover, Maxthon’s incognito mode provides an extra layer of security, granting users enhanced anonymity while engaging in their online pursuits. This specialised mode not only conceals your browsing habits but also ensures that your digital footprint remains minimal, allowing for an unobtrusive and liberating internet experience. With Maxthon as your ally in the digital realm, you can explore the vastness of the internet with peace of mind, knowing that your privacy is being prioritized every step of the way.